Introduction

Greece is a capitalist economy, which is comprised of different economic sectors. The public sector accounts for approximately 40% of the country’s Gross Domestic Product (GDP). Moreover, the country’s per capita GDP is approximately 75% of the leading economies in the Eurozone.

The tourism sector accounts for 18% of the country’s GDP. The country’s annual growth rate between 2003 and 2007 was estimated to be 3.3% of the total GDP. Despite the positive economic performance, the country was adversely affected by the 2008 global economic recession.

Consequently, the country experienced tight credit conditions. Greece is a major recipient of the European Union aid. The total annual aid is estimated to be 3.3% of the country’s GDP (“The Heritage Foundation” par. 8).

In spite of the negative economic performance experienced over the past few years, Greece ranks 130th amongst the freest economies according to the 2015 index. The country’s economic freedom score declined by 1.7 to 54.0 by the end of 2014. The decline arose from lapse in government control on public expenditure.

Moreover, the negative economic performance is also associated with the decline in the level of labor, fiscal, and business freedom. The country ranks 40th amongst the 43 European countries with reference to economic freedom, which places it below the regional and world average (“The Heritage Foundation” par. 9).

This research paper seeks to undertake an extensive analysis of the Greece economy and financial environment.

Analysis

Internal and external economies of scale

The existence of market fragmentation is a major hindrance in countries’ quest to achieve economic growth. Kollias affirms that market fragmentation mainly arises from socio-political atomization (88).

Therefore, in order to be competitive in the global market, it is imperative for governments to focus on developing external and internal economies of scale.

Kollias further asserts that internal “economies of scale are attained when industrial firms have a sufficient size and production level that guarantees that resources are combined efficiently and therefore output has a competitive price” (92).

In order for industries established in different economic sectors to derive the benefits associated with large-scale economies of scale, it is imperative to adopt the concept of expanding their geographical market. Therefore, trade should not be limited within the national borders.

On the contrary, firms should seek larger markets by entering the international market.

In a bid to stimulate economic growth, firms should adopt the concept of external economies of scale by establishing strong inter-firm relations with reference to diverse aspects such as labor force training, research and development programs, and subcontracting joint supplies.

Additionally, firms should integrate the concept of backward and forward relations.

Kollias further affirms that in order for a “firm to benefit from external economies of scale, the national productive base must be rich in productive activities” (92).

However, it is considerably difficult for small economies to attain external economies of scale on their own unless they are open to economic cooperation with the neighboring countries. Therefore, most small economies have adopted an open economy regime in an effort to increase their geographical market.

The neighboring countries constitute an important trade partner that governments should consider in formulating foreign trade policies. Kollias affirms that neighboring countries present economies with an opportunity to access a relatively large market due to high product preference amongst the involved countries (97).

Furthermore, establishing trade relations with neighboring countries leads to the emergence of regional multiplier. The regional multiplier arises from lower transportation costs and similar product preference.

Past studies show that the adoption of the concept of external economies of scale has played a fundamental role in improving countries’ export capacity. For example, investment in external economies has considerably enhanced India’s emergence as a major exporter of information services (Kollias 101).

Moreover, Kollias asserts that growth in one country can be transferred to the neighboring countries due to the established export relations (106).

International trade

Greece understands the contribution of international trade to its economic growth. In an effort to improve its economic growth through trade, Greece has appreciated the gravity model, which underscores the importance of establishing bilateral trade relations between countries.

The model underscores the importance of taking into account distance, borders, barriers, and other trade impediments in establishing trade relationships with other countries (Mann and Otsuki 83).

Greece has entered bilateral trade agreement with different countries in the European region. The trade relations mainly relate to the importation and exportation of different products.

Greece’s adoption of international trade is based on fact that no country is self-sufficient by producing all commodities required to meet the population’s needs.

Furthermore, Heckscher-Ohlin Model, which postulates that trade between countries occurs due to the existence of different in factors of production such as capital and labor, further supports the occurrence of trade between countries.

Onkvisit and Shaw affirm that governments should evaluate their production possibility curve in order to determine the extent to which engagement in international trade can lead to attainment of relative and absolute advantages (84).

Consideration of the PPP provides governments with insights on the most optimal trade options to take into consideration. In order to benefit from the PPP, a particular economy must have sufficient resources, viz. labor and capital.

By the end of 2013, Greece total exports were estimated to be 27,556 million Euros, which accounted for 15.1% of the country’s total GDP. The country has continued to increase the volume of its exports despite the adverse effects of the recent global economic recession.

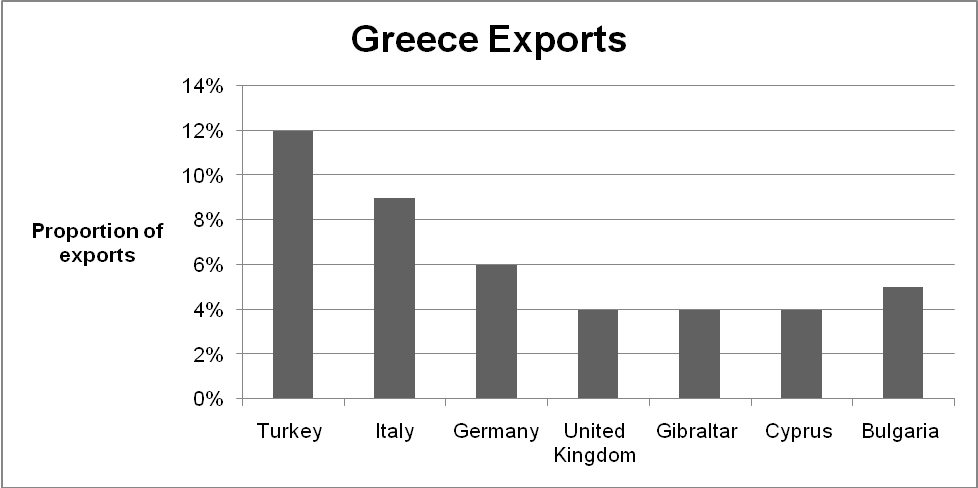

Its total exports into the European Union countries in 2013 were estimated to be 46% of the country’s total exports. The bilateral trade agreement between Greece and the EU underscores the extent to which the country is committed to implementing the gravity model. Table 1 and graph 1 below illustrates Greece main export partners by 2013.

The construction of the production possibility curve enables an economy to determine the range of goods and services to produce for export coupled with what to import. This goal is achieved by the determination of the opportunity cost.

The production possibility curve affirms that a country’s optimal production point occurs at the point whereby the value of production is maximised. Onkvisit and Shaw further contend that countries have unique production possibility curves due to the unique set of their products (24).

The core export commodities include chemicals, petroleum products, industrial products, food, and beverages.

Table 1

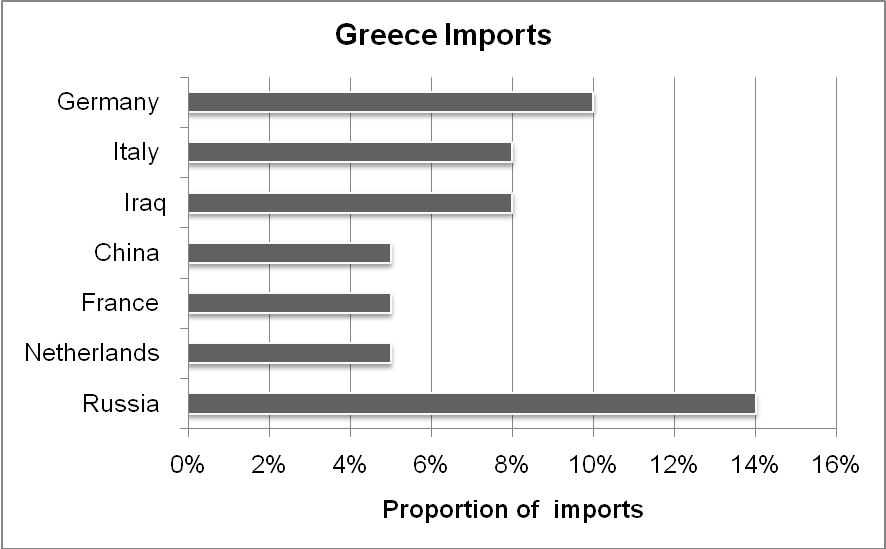

The country’s trade imports include food, fuel, chemical products, vehicles, and machinery. Greece mainly imports from Iraq, Russia, the Netherlands, China, France, and Italy. The graph below illustrates the proportion of imports from the respective countries.

Table 2

In an effort to stimulate trade relations with other countries, Greece has integrated the concept of preferential trade agreement [PTAs]. The European Union is a well established PTA, which has faciliated trade relations amongst different countries in the European region.

Since its foundation, the EU PTAs has faciliated growth in trade exports by 70%. Greece joined the EU in 1981. Over the past years, Greece has been extensively engaged in entrenching its trade relations with the EU.

One of the aspects that underscores the country’s commitment to the EU entails the incorproation of the foreign policy. The country has adopted the Southern Dimension, which is a critical component of the the European Neighbourhood Policy [ENP].

The objective of the Southern Dimension is to develop a strong bilateral relathoship with the Mediterranean countires in order to foster social-economic developments.

Since its accession to the EU, Greece has reduced its tarrifs significantly. The European Union has adopted a harmonsed system across the member countries. The member countries including Greece have integrated preferential tariffs.

The average tarriff rate in the EU is estimated to be 1%. Furthermore, Greece ascended to the World Trade Organisation (WTO) by accepting to comply with the trade regulations. The country has eliminated tarrifs with reference to IT products.

Free Trade Zones

Greece economic performance over the past few years has further been enhanced by the adoption of the concpet of special economic zones [SEZs]. Through this approach, Green has considerably improved the volume of international trade in addition to attracting foreign direct investment (FDI).

Moreover, the concept of Free Zones has enabled Greece to maintain protective barriers to unfair international trade (Tiefernbrun 2010). Tarriffs are a major barrier to international trade because they increase the cost of trade. Tarrifs increase the price of product in the local market, hence reducing the demand of the product.

Therefore, the consumers are affected adversely. Greece has established three SEZs located at Heraklion, Piraeus, and Thessaloniki (“Australian Trade Commission” par.7). By adopting the concept of FTZs, Greece allows imports into the free trade zones without incurring any taxes or custom duties.

Moreover, goods imported into the SEZs are free of any duties even if they are re-exported. The adoption of the FTZs has played a fundamental role in improving the country’s attractiveness to international trade.

Non-tarrif barriers

In line with its commitment to promoting international trade, Greece has made incredible steps in eliminating non-tarrif barriers. Tiefernbrun (2010) cites non-tarrif barriers as one of the main strategies currently used by different countries in an effort to protect the economy.

As a member of the WTO, Greece is committed to adjusting non-tarriff barriers in order to facilitate international trade. This aspect explains why the country is characterised by a comparatively high trade freedom index.

According to “The Heritage Foundation”, trade freedom index includes “a composite measure of the absence of tariff and non-tarriff barriers that affect imports and imports of goos services” (par.1). Over the past few years, Greece has maintained a considerably high trade freedom index.

Table 3 below illustrates the trend in Greece’s trade freedom between 2007 and 2014.

Table 2

One of the non-tarrif barriers that the Greece government has implemented relates to the regulatory restrictions, which are comprised of issues such as domestic content and licensing. Greece has adopted import licences as one of its non-tarrif barriers. However, the import license is only applicable to some products.

Katsimi, Pagoulatos, and Sotiropoulos assert that import licences “are required for some products including a number that have restricted licensing” (12). Greece has integrated special licenses in order to allow some imports into the country. The special licenses mainly apply to imports from low-cost countries.

The EU has integrated quotas with reference to such imports. In addition to the above issues, Greece has mainly maintained nationality restrictions with reference to a number of professions. Some of the professions that have been affected by the restrictions include the legal and business service profession.

Furthermore, Greece has restricted foreign investment in some economic sectors.

The evolution in the country’s macroeconomic developments has arisen from the adoption of effective models. One of the issues that Greece has focused on relates to the improvement of the labour makret. Between 1970 and 2000, real compensation amongst employees in Greece increased by 58.7% (“OECD” par. 4).

Furthermore, the growth in real compensation between 2000 and 2009 increased by an additional 18.5% (“OECD” par. 4). The table below illustrates the trade in the volume of investment in the EU from 2008 to 2014.

Table 3

Table 3 above shows that the Greece’s rate of investment declined considerably between 2008 and 2009 due to the negative effects of the global economic recession.

However, the rate of investment has experienced considerable improvement between 2010 and 2015. It is projected that the country will experience positive economic growth between 2015 and 2016. The growth will rise from the increase in the volume of exports and the rate of investment.

This aspect will play a fundamental role in improving the country’s copetitiveness. Furthermore, the country’s level of unemployment is projected to decline in 2016 (“OECD” par. 7)

Financial crisis

In addition to the adverse economic effects caused by the 2008 global recession, the Greece economic climate has been very turbulent due to the debt crisis. The crisis arose from the lack of effective control mechanisms.

Some of the major causes of the Greek debt crisis include massive tax evasion, corruption, high government spending, and lack of adequate financial control measures. Greece joined the European Union by agreeing to the specification outlined in the Maastricht Criteria.

The criteria outlines the conditions that countries are required to adhere to inorder to integrate the single currency, viz. the Euro, succesfully.

First, the EU member states were required to maintain a rate of inflation that is not greater by 1.5% of the average rate of inflation of 3 European Union countries with the lowest rate of inflation over the past fiscal year.

Secondly, the national budget deficit should be less than 3% of the country’s GDP while the national public debt should not be over 60% of the country’s GDP (“BBC” par. 9).

In its ascession to the European Union, Greece did not meet the Maastricht Criteria. In spite of this aspect, it joined the European Union, which led to extensive economic inconviniencies. Thus, the country was affected adversely by the global financial crisis. The level of revenue in the two sectors declined by 15% in 2009.

In an effort to meet the high public sector wage bill, Greece extensively relied on borrowing from international capital markets. Greece has been characterised by a higher government expenditure as compared to revenue, hence creating budget deficit.

Moreover, the country’s ability to generate revenue has been hindered by tax evasion, which has been increased by political clientelism.

The governments’ reliance on external borrowing to finance trade and budget deficits have led to a reduction in the level of investor confidence. Subsequently, the government is unable to raise revenue from the public.

The government’s heavy reliance of borrowing plunged Greece into a 300 billion Euro debt crisis in 2009. However, the government has undertaken a series of austerity measures over the years in an effort to restore confidence in the ecoomy.

In 2010, the Euro Zone countries approved a $145 billion rescue package for Greece. Additionally, the government integrated tough austerity measures. Some of the measures included high tax rates. In 2011, the EU further approved an additional 109 billion Euros to the rescue package.

Due to the prevailing financial crisis, Greece’s credit rating was downgraded. A new bailout plan involving a debt-swap with private-sector was adopted in 2012. Between 2012 and 2013, Greece recieved bailout loan amounting to 13.5 billion Euros from the International Monetary Fund (IMF) and the European Union.

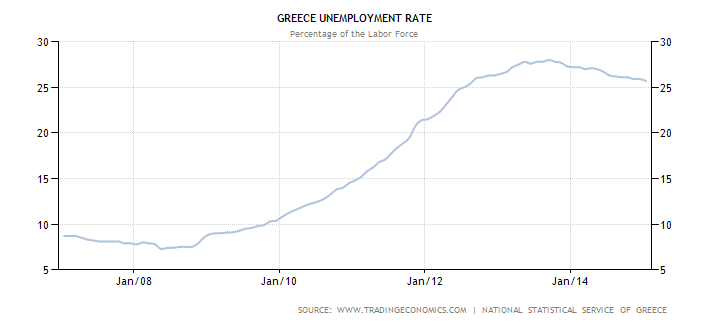

Moreover, the government suspended the operations of the state broadcaster in an effort to reduce public spending. The economic changes experienced in Greece have led to a fluctuation in the rate of unemployment. Graph 3 below shows that the rate of unemployment in Greece has increased steadily from 2008.

The highest rate of unemployment was recorded in 2014 at 28%.

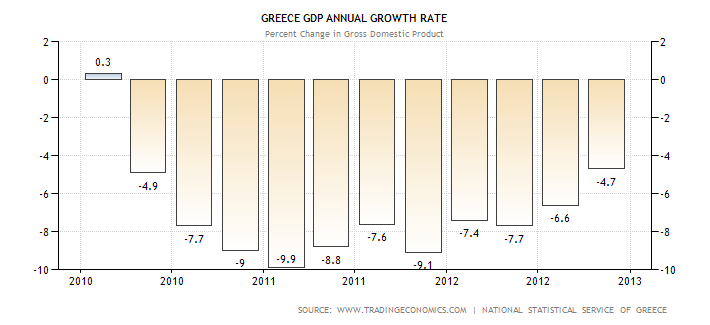

The financial crisis in Greece has affected the country’s economic growth significantly. From 2010, the country’s GDP annual growth rate has been negative as illustrated by the graph below.

However, the austerity measures implemented by the government are steering the country towards economic recovery as illustrated by the trend in the GDP annual growth rate.

Conclusion

Despite the fact that countries’ economic performances are affected by macroeconomic changes such as recession, it is imperative for governments to appreciate the importance of integrating effective economic policies. One of the areas that governments should focus on in their quest to stimulate economic growth entails international trade.

Small countries such as Greece should consider partnering with neighboring countries in order to benefit from external economies of scale. Such economic cooperation will play a fundamental role in promoting growth in different economic sectors.

The adoption of the open trade policy in Greece by signing the European Union preferential trade agreement has played an essential role in its economic growth over the past decades. Joining the EU has improved the country’s geographical market, hence leading to a high GDP.

Furthermore, the adoption of the free trade zones has further improved the Greece’s attractiveness to foreign direct investors, hence increasing the volume of its exports. Despite the open trade policy, Greece has protected some of its economic sectors by integrating non-tariff barriers.

Moreover, the country’s economic performance over the past few years has further been affected by the financial crisis that mainly arose from ineffective fiscal and monetary policies such as overreliance on borrowing to finance public expenditure.

Therefore, in order for the country to benefit from the bailout plan that is being implemented currently, the Greece government should consider restructuring its fiscal and monetary policies in order to safeguard the economy from contagion effects, which are mainly associated with economic crisis.

Works Cited

Australian Trade Commission: Tariffs and regulations; Greece 2012. Web.

BBC: Greece profile; timeline 2015. Web.

Enterprise Greece: Trade 2013. Web.

Katsimi, Margarita, Thomas Pagoulatos, and Dimitri Sotiropoulos. Growing inequalities and their impacts in Greece; country report for Greece 2013. Web.

Kollias, Chrestos. Greece and Turkey in the 21st century; conflict or cooperation; a political economy perspective, New York: Nova Science, 2003. Print.

Mann, Catherine, and Tsunehiro Otsuki. Assessing the potential benefits of trade facilitation; a global perspective, New York: World Trade Publications, 2003. Print.

OECD: Greece; economic forecast summary 2014. Web.

Onkvisit, Sak, and John Shaw. International marketing: Analysis and strategy, London: Psychology Press, 2004. Print.

The Heritage Foundation: Greece 2015. Web.

Tiefernbrun, Susan. Tax free trade zones of the world and in the United States, Cheltenham: Edward Elgar, 2010. Print.

Trading Economics: Greece GDP annual growth rate 2015. Web.