Abstract

Ever since its inception, the European Union has gone through several changes. Originally, the founders’ motivation was to free Europe from the plaguing wars that devastated lives and properties. Nations geographically located within Europe and even those questionably considered European, aspire to become members.

This paper focuses the discussion on the ten European countries, which entered the EU in 2004. These countries had just freed themselves from the clutches of communism and were now aiming for membership to gain economic support from the Union.

Each of these candidate countries had its own problems when it came to fulfilling the requirements of accession. But their goals and motivation were to have a positive effect on their respective economies. How they worked out and fulfilled those requirements as embodied in the acquis is a great topic for discussion in this paper.

The history, the problems, the advantages and disadvantages of EU accession for these ten countries are thoroughly discussed in this dissertation.

Introduction

The European Union is a regional grouping of countries in Europe, which is not an ordinary organization of nation states. It has a ‘supra-national’ government whose legislation and governmental policies pertain to commerce and trade and are binding on the member states.

The history of this unique unification of the countries of Europe can be traced back during the time of the two great world wars. The inhabitants of Europe were becoming traumatized of the plaguing wars that they wanted an ultimate and final solution. The initial solution might have first been playing in the minds of a few great men whose ideas blossomed into a unique medication for a cancerous growth.

A united Europe would be an instrument to oppose wars between countries. The idea went through an evolution but the pioneers succeeded in unifying Europe. At first it was known as the European Economic Community, later it came to be called the European Community; and now it is simply called the European Union. It is synonymous to the first idea of a United States of Europe, which connotes a political grouping, or a unified country.

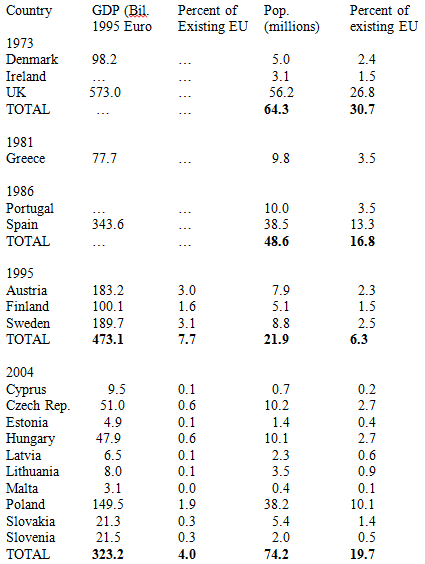

Many historical developments happened in 2004 for the European Union expansion project. The Union expanded to 25 (Miles, 2005). In 2004, there were eight central and east European countries (CEEC) and two Mediterranean islands added into the Union. The eight CEEC accession countries were the Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Slovenia and Slovakia, and the two Mediterranean islands were Cyprus and Malta.

The first group of countries was formerly communist-oriented and so they had to cope with a new system and get away from a centralized structure of governance. How the economies of these accession countries and the old member countries were affected in the process of accession is the subject of discussion for this paper.

Objectives

The objective of this paper is to analyze the economic effects of the ten countries’ membership to the European Union. We will further determine the advantages and disadvantages in the ten countries’ entry into the Union and how these countries dealt with factors that affect their identity as a nation.

Methodology

The methodology applied is a study of the literature, focusing on the particular countries, which finally entered the Union in 2004. A review of the literature will be the primary method of study, emphasizing on researches and studies conducted on the subject of the EU accession and the economic repercussions during the countries’ entry into the EU. This paper will also examine relevant and empirical data on the effects of enlargement to prior members and to the new member countries.

This research will help to form a conclusion where a personal judgement can be presented. Based on the evidences and facts on hand – whether accession had great effects, more importantly, economic benefits, on the 2004 accession countries – we can presume how the European Union and its further development and expansion will affect future states.

Literature Review

The European Union has evolved and expanded not only in substance but also in geographical context. This has happened since the signing of the Treaty of Paris in 1951 creating the European Coal and Steel Community. This was later to be changed to the treaty of Rome (1956), which led to the creation of the European Economic Community. The later came to be EU after undergoing transformation.

Many years after, the EU has undergone several geographic expansion and expansions of scope. (May, 2009, p. 1) The treaty of Paris (1951) committed six nations to form a common market where goods, services, capital, and labor could flow freely, without trade barriers. (Nakos, 2006, p. 598) The European Union is one of the most successful regional groupings in the world today in terms of low unemployment rate and a high per capita income.

It is not only an organization for the purpose of increasing economic development on the part of the member states, but has become a union of states, a political power by itself, a vision implored by Jacques Delos in 1988 that the European Community would by 1998 “be the source of 80 per cent of economic and perhaps even fiscal and social legislation governing EU member states” (Jenny and Müller, 2010, p. 36).

The effects of the EU enlargement – economically and politically – have been continuously speculated in terms of performance and success. This has made it a point of reference to the new-formed unions in the world. It is continuously enlarging, whilst enlargement is considered the most successful foreign policy to be emulated in other nations (Schimmelfennig, 2008, p. 918).

Europeanization is a “policy harmonization through European law” (Jenny and Müller, 2010); and there has been no way out, meaning since its inception there is no record of ‘de-unionizing regulation’ (Jenny and Müller, p. 36).

It has caused a problem of more complexities and the question of how Europe could affect the democratic space and other problems of legitimacy still looms (Scharpf, 1999; Hix, 2002, Moravcshik and Vachudova, 2003 cited in Lecheler, 2008, p. 444), that is the accession of these countries enlarges the geographical area rendering it hard to properly manage. The different countries also have different levels of GDP per capita.

After the official accession of the ten countries, the European elections took place with 342 million eligible voters voting for members of the European parliament (Machill et al., 2006, p. 58). With the entry of the ten countries, EU’s GDP rose to €850 billion, which is translated into £565 billion or US$850 billion (Islam, 2004 cited in Coles and Hall, 2005, p. 51).

Background of the European Union

The European Union started when peoples of the world were obsessed with conquest and wars. As it is said, “It is all about property.” Acquiring property and also trying to improve the state of the countries economies is one key factor that led to the formation of the EU.

Nations and men who wanted to be great aimed for wars. In the sixteenth to the seventeenth centuries, Europe and its leaders thought they were at the center of the world. Everything that pertained to the world pertained to Europe. And here’s a story about Europe and the world.

The main objective in the minds of those trying to set up a united Europe was to end the bloody wars that had been plaguing Europe. One war after another produced destructions and no development. The people of these European countries shared the same destiny and aspiration. One strategy they had envisioned was to unite the European Coal and Steel Community and make it the basis for uniting the European countries both economically and politically. (Europa, 2011a)

Six countries formed the original Member States of the European Union. These were: Belgium, France, the Netherlands, Germany, Italy, and Luxembourg. They were formed during the time of the Cold War when eastern and western countries were positioning against each other (Europa, 2011b).

More historical events on the establishment of the EU can be traced back to the 1920s. In 1922, Count Richard Coudenhove Kalergi published his book Pan Europa and launched a movement to maintain peace and unite the German coal and French steel industries. This was the original idea of the French industrialist Louis Loucheur who argued that the merging of the two industries and putting it away from the hands of national governments would be a way of preserving peace.

Wars at that time depended much on manufacturing of war materials (guns, canyons, etc.). If manufacturing could be controlled, there was no way for countries to wage war since guns and bullets would be out of governments’ hands. The merging of the two industries was to be the basis of a ‘United States of Europe’.

From the outset, the founders of the EU wanted that the real workings, nature and purpose of a government to rule hundreds of millions of people in Europe would not be brought too obvious to the world. The idea of a United States of Europe started in the minds of a few people back in the 1920s.

Jean Monnet, a French salesman who once held an important position in the French Ministry of Commerce and Industry, along with his friend, English civil servant Arthur Salter, had originally crystallized the idea of a United States of Europe. They wanted to put up a supra-national government, and to unite the coal and steel industries (Booker and North, 2005, p. 1)

The original idea was to take control of the coal production of the Germans and put it in the hands of the French government. This was known as the Monnet Plan, which was later applied by Prime Minister Charles de Gaulle. When Monnet became a man of influence or in a position to put their idea into fruition, he realized that the true purpose of fulfilling that idea was to make it not too explicit.

They had to put it in place step by step for a period of time until the machinery of government was installed. That would be the time that its real purpose could be put into the open. Another EU pioneer, the Italian communist Altiero Spinelli, also had in mind a united Europe. He was languishing in jail in the 1940s but had a significant role to play in the final stage of bringing the concept into a reality.

Another important personality who made an important contribution in putting in place a United States of Europe was Paul-Henri Spaak, the prime minister of Belgium at that time, who convinced Monnet that the only way the idea to be successful was to conceal it in the pretense that it was only for economic cooperation and not to put up a supra-national government that would be superior to all the other governments in Europe. (Booker and North, 2005, p. 2)

This compacted idea became a very important agenda and thus on 26 February 2002, which brought together delegates from 25 countries who had to come to convene in Brussels. Their prime objective was to draft the constitution of a United Europe, and not just a paper for a common market.

Some observed that what the founders did was tantamount to a slow-motion coup d’etatagainst the governments of Europe. Be that as it may, the European Union is now a powerful regional grouping that is not only controlling the affairs of governments of the many countries of Europe, but benefitting the countries and the people economically. Like other regional groupings, the EU went through an evolutionary state.

It was first known as the European Community and then the European Economic Community. The first six members attained some sort of success in trade and commerce, their respective economies improved, thus it attracted other states in the region. (Gaisford, J. et al., 2003, p. 1)

The 2004 EU Accession and the Nineteenth Century Civilization

A thesis was developed by Hartmut Behr (2007), which states that the 2004 enlargement had strong commonalities with the EU ‘standards of civilization’ developed for the 19th century Europe. World development has its roots in the 16th century when colonial powers like Portugal, Spain, the Netherlands and Great Britain extended their power beyond Europe.

Non-European states became subject to European rule and thus entered the international society under international law, which was in truth European law. Most commentators argue that equality was formalized with UN Resolution 1514 of the UN General Assembly, which erased political, economic and social inequality among nations. International standards of rule became popular and accepted by people around the world.

Thomas E. Holland popularized the notion that ‘civilization’ was associated with ‘well-organized states’ (Holland, 1933, p. 117, cited in Behr, 2007, p. 244). In reference to the universal law of nations, Henry Wheaton (1785-1848) argued that ‘the public law has always been, and still is, limited to the civilized and Christian people of Europe or those of European origin’ (Wheaton, 1936, pp. 19-20, cited in Behr, 2007, p. 245).

The European ‘standards of civilization’ became a way of admitting new members, while membership was laid down in the Maastricht Treaty (1992), Title VIII, Article 49 which states that any European state can apply as a member in the European Union as long as that state can guarantee ‘freedom, democracy, human rights, and rule of law’ and the basic political rights as embodied in the Rome Convention of Human Rights and Basic Freedoms. This was the basis of the Copenhagen Criteria for admission of accession countries. (Behr, 2007, p. 242)

Why countries aspire for EU membership

The biggest sign that the EU expansion project has been successful is the eagerness of countries to join the EU. The ten Central and Eastern European Countries (CEEC) had been eager to join the union; this was as a result of the previous collapse of communism. (Nakos, 2006, p. 598)

Accession to the EU seems like a magnet for the non-member states. This is true even with any regional trade organizations because of the many benefits they tend to offer when it comes to economy and the free flow of commerce and trade. The larger the market the regional grouping offers, the greater the attraction it offers to non-members.

Regional trade organizations follow a policy of trading among themselves with lesser barriers to market access than trade conducted by members and non-members (Yeung et al., 1999 cited in Gaisford et al., 2003). From the original six member states, the EU then grew into 15 members. In 2004, the EU enlarged considerably with the coming in of 10 countries namely, the Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Slovenia and Slovakia.

This would soon be followed by Cyprus and Malta, with Bulgaria, Romania and Turkey as candidate countries. (Europa, 2011a) The entry of these countries meant an addition of 77 million people and over 700,000 square kilometers of land to the EU. (Murphy, 2006, p. 635)

Moreover, the effects of EU membership have not been all advantageous for the accession countries; rather there were some that were disadvantageous. Upon joining the EU, a member country experiences access to a very large market, consisting of more than 450 million Europeans many of whom are earning high income. The competition is increasing as time goes by.

This single market provides competition amongst member countries, but along with the accession is the challenge among accession countries to modernize their products and services, and increase efficiency. Accession countries experience a change in trade patterns, the absence of barriers, and many more. EU members have to trade with fellow member states, thereby creating new patterns or trade diversions.

Trade diversions occur when the pattern of trade is diverted from a non-member to a new member. The outcome of this is that the cost of the products brought in by the accession country is reduced considering that these products are now brought in with common external tariff (CET).

Then, coming in are more investments from other countries. Developed and rich countries like the United States and Japan are attracted to set up new investments in the EU because of the large market. EU members are also encouraged to invest in the new lower-cost accession countries.

Accession countries also had access to funds from the EU to cope with new challenges and problems. Aid is coming in and so accession countries have enough time for progress and development. Macro-economic policies of the accession countries were reduced for they had to give up some of their power to the EU government.

They had to adapt to a new currency, the euro, only few of the CEEC countries currently the euro and they did not have power over it. They could not devalue anymore their currency, and their central banks had to adjust their policies and regulations to the new policies of the EU. (Grant et al., 2005, p. 23)

Europe’s economic and political environment changed dramatically due to economic integration to the Single European Market, the Economic and Monetary Union and the expansion of the European Union. Along with these phenomena was the market transition of the countries belonging to the Central and Eastern European countries (CEECs). Inside these countries, there were pressures for economic and institutional reforms. (Resmini and Traistaru, 2003, p. 3)

Admission Criteria

The conditions for accession countries to meet in order to be admitted into the EU were provided in the criteria set by the Copenhagen European Council of 1993. The criteria were:

- A market economy that is said to be functioning

- The accession country has to accept EU legislation

- The political system has to be western in orientation (Grant et al., 2005, p. 22).

The Council introduced broad political and economic criteria (Kenjegalieva et al., 2009, p. 1531), further empowering the EU to ‘monitor, control, and guide policy-making in the accession countries’ (Brusis, 2002, p. 534).

The accession country should have a functioning market economy, and the mechanism and expertise to deal with market forces. The competition policy was translated into three criteria by the EU which were:

- A legislative framework regarding anti-trust and state aid;

- An administrative capacity to handle competition (a competition authority should be in place);

- An acquis enforcement record regarding competition policy. (Hölscher and Stephan, 2004, p. 323)

The EU also adopted the Accession Partnerships which established “priorities for the accession preparation that transcend the obligations deriving from the acquiscommunautaire and the envisage sanctions in case of noncompliance” (Grabbe, 1999 cited in Brusis, 2002, p. 534). The acquiscommunautaire refers to the total body of EU law, which has to be complied with in the course of accession and as a member of the EU.

The EU acquis consisted of 31 accession procedures or chapters, which had to be followed by the accession countries. Some issues pertain to migration and movement of people, which were contained in two chapters. They were about justice and home affairs (JHA), such as visa, asylum, immigration, and so forth. There are still some provisions, which are considered developing acquis, and had to be adopted by the accession countries. (Jileva, 2002, p. 683)

The 2004 accession countries went through a transition period. They had to comply with the EU model of legislation based on the German tradition of competition policy. This was a transition from communism to capitalism, although there was a problem of implementation. The transition period was peculiar for each accession country, and thus each country was assessed through the principle of differentiation, which means each country was assessed whether it could meet EU requirements according to everyone’s capacity to comply. (Hölscher and Stephan, 2004, p. 322)

With the required standards of accession, the accession countries had to be able to show economic progress, along with underlying policies related to economy, and also through political reforms. They had to adjust their laws in conformity with the EU competition rules (Hansen et al., 2003).

An example is Poland. It had to show that sulphur emissions had been minimized. Hungary, on the other hand, had to spend €15 million to improve its existing infrastructure. But the EU also provided financial aid to help the accession countries meet the standards. Added to this is the transition period before the standards had to be checked whether they were being followed. (Grant et al., 2005, p. 22)

Poland and Hungary were aided by the so-called EU’s Phare (Poland and Hungary: Aid for Economic Restructuring). This was a support mechanism for candidate countries (CCs) while in the process of fulfilling the requirements, and in order to receive Structural Funding. EU’s Phare played a crucial role in the enlargement process, particularly in solving problems of the EU regional policy, considering that accession countries were having problems of low GDP per capita and their administrative structures were very much centralized. (Bailey and De Propris, 2004, p. 778)

The European Structural Funds were the basis for rural development planning policy and extended up to assistance programs of the CEEC countries (Vanhove, 1999 cited in Kancs, 2001, p. 32). The programs sought to enhance rural development and in a way influenced competitiveness of rural economies in Europe, and also altered economic performance of those economies.

The negotiation for the acquiscommunautaire comes right after the pronouncement on the state of the country’s economy. The Commission explains the chapters on the acquis to an accession country after which the latter explain how they are so prepared to comply with the requirements. The domestic legislation and the EU’s laws should coincide with each other.

The EU and the accession country must agree on the terms of the chapters in the negotiation, after which that chapter is now considered closed. The acquis is more of a technical procedure being implemented by members of the Commission whose job is to help in the expansion processes of the Commission. (Gray, 2009, p. 935)

Economic Arguments on EU Accession

Any country seeking membership to the EU is called an accession country. The EU can expand to as many countries within the territorial boundaries of Europe (or it is understood that it can expand beyond Europe’s geographical boundaries), the purpose of which is to broaden free trade. There is great advantage for member countries on the economies of scale. Cost of production is reduced and consumers have the opportunity to choose from a greater variety of products. (Papazoglou et al., 2006, p. 1077)

In the study conducted by Papazoglou (2006) and associates, Member States enjoy free trade between themselves. This is a result of the elimination of tariff barriers and an increase in gross trade. Accession countries enjoy a large rise in exports.

Papazoglou et al. (2005) differentiate the accession countries in integration into the EU trading pattern. They explained that an accession country has greater export growth where its economy is less well integrated with the EU. For example, when Lithuania entered the EU, it experienced a substantial growth in exports. Compared this to Hungary, which has a closely integrated economy with the EU, had a small increase in exports.

Moreover, all transition accession economies experienced a level of growth of both exports and imports, which allowed these economies to be more integrated to the world trading system. The EU 15 member states also benefitted in the rise of their exports, however, their trade with world trading partners decreased substantially. The rise in imports was greater than the rise in exports, and thus accession created a trade imbalance among the accession countries. (Papazoglou et al., 2006, p. 1088)

Fears of regime competition loomed. Regime competition arises when economic and social integration is not balanced within the countries of the EU. This situation appears when European markets become integrated member states, and thus they increasingly compete with each other. The competition increases as more states come in. The May enlargement increased the gap in labour costs and incomes and increased the competition. (Marginson, 2006, p. 98)

There was also the fear of Europeanization of labour market regulation but which did not materialize because of the rejection in the referenda in France and the Netherlands in 2005. The fear of Europeanization was caused by the adoption of the EU’s first constitutional treaty. The constitutional treaty adopts the Charter of Fundamental Rights and provides legal basis for the rights to association, to conduct collective bargaining and take industrial action, among others. (Hall/Marginson, 2004 cited in Marginson, 2006, p. 98)

Regime competition could also result in the lowering of wages, deteriorate working conditions and employment protection; these are collectively termed as social dumping wherein labor standards and wages, including labor conditions, are sacrificed to gain competitive advantage (Marginson, 2006, p. 99). These conditions however were viewed by Anna Diamantopolou, former Employment and Social Affairs Commissioner of the EU, as extremes.

Europeanization can co-exist with regime competition, but they do interact with each other (Marginson, 2006, p. 99). At macro-level, regime competition is said to have been further exacerbated by the Economic and Monetary Union. This required economic adjustment by bringing the inflation rates down and minimize public sector deficits.

At the entry of the ten countries, part of the solution was to bring to agreement employers and trade unions, facilitated by the national governments (Fajertag/Pochet 2000 cited in Marginson, 2006, p. 99). Further, authorities instituted measures such as EU-level regulatory intervention. (Marginson, p. 114)

Economic Convergence

Economic convergence is significant in this study in that it can be used to measure the economic development for each member state and the accession countries. Convergence has been used in analyzing transition economies particularly the accession countries.

Economic convergence is determined from the period of pre-accession to the accession period. In a study of the economic convergence of transition countries, Varblane and Vahter (2005) addressed the role of the European integration in the economic convergence of new member states.

Convergence is defined in several aspects. Real convergence pertains to the convergence of income levels; nominal convergence may refer to the price level of goods within the EU; institutional convergence is all about legislation of the EU that the member countries have to comply. Other terms that connote convergence include convergence of business cycles, or another that connotes consumer behaviour and social stratification.(Varblane and Vahter, 2005, p. 4)

“There are two lines of thought on the question of convergence: a theory which was known as the Solow-Swan exogenous growth model” (Varblane and Vahter, 2005), the neoclassical model which states that countries are similar in many ways despite the difference in their per capita income. The framework suggests that the economy may converge and maintain steadily with the existence of diminishing returns to investment.

The countries are assumed to “be equal in all aspects but their initial levels of capital per capita (physical and human) and poor countries have higher marginal capital productivity than rich countries” (Varblane and Vahter, 2005, p. 9). Additionally, poor countries have the tendency to grow much more rapidly than rich countries. It ends when the per capita outputs of both rich and poor countries are equalized. The process has reached absolute convergence.

Effects of Globalization on the EU

Globalization has affected the accession countries and the European Union itself. It has continuously played a role in the formation of a more stable EU. Generally, globalization is economic in nature although there are other aspects of disciplines that globalization has had an impact with. The start of economic globalization was in the early 19th century until the beginning of World War I in 1914.

After the war, economic changes and upheavals started to emerge. Globalization faced more challenges and changes with the advent of technology, computers and the Internet.The numerous challenges include protectionism, neo-liberalism, and complaints by groups against exploitation of human and natural resources of transnational corporations.

Present remarkable innovations are the establishment of multilateral organizations such as the World Trade Organization (WTO), the International Monetary Fund (IMF), the World Bank group, and the rise of regional trade agreements. Economically, proponents of globalization expect it to increase growth, decrease inequality and poverty across people and countries.

Politically, socially and culturally, they hope that it will decrease differences, reduce xenophobia and lead to a global consciousness where the nation state is no longer the main unit of identity for individuals. (Kurzer, 2006, p. 19) The question is whether the EU has imposed upon its Member States globalization measures such as implementation of neo-liberal policies, thus reinforcing or helping globalization’s economic demands.

Another question is whether the EU has protected its Member States from globalization measures, allowing them to issue economic policies, which do not coincide with globalization. As the size of the EU grew considerably, its economic policies have become more neo-liberal and have promoted free trade in the common market (Pollack, 2000 cited in Kurzer, 2006, p. 20). Thus, it is safe to say that the EU has been enforcing globalization measures to help its Member States.

In as much as globalization has affected the EU, the latter also has explicitly shaped globalization. The EU has allowed its Member States to set market standards, instead of globalization to set the standards. Thus the EU helped shape globalization. (Kurzer, 2006, p. 30) The EU member countries have to cope with globalization aside from the many challenges created by the integration procedures.

EU Immigration

Because of the EU enlargement and the growing economic activities in the region, migration flows grew from the eastern to the western countries. Concerns then were raised on the rise of unemployment and a threat to the western welfare states (Layard et al., 1992 cited in Kraus and Schwager, 2003).

A theoretical approach was formulated by Hicks (1932) and Harris and Todaro (1970) which states that migration decisions are influenced by income gains, the various costs of migration which are done during the movement from one country to the country of destination. At the beginning of the accession of the ten CEEC and two Mediterranean countries, there was a trend of east-west migration encouragement because of the European enlargement. (Kraus and Schwager, 2003, p. 165)

Social and political factors determine the migration behaviour of countries (Faist, 1997; Hammar and Tam-as, 1997; Massey et al., 1993; Kraus and Schwager, 2003, p. 166). But in the case of the EU enlargement, migration was determined by the reduction of migration costs. The EU therefore was not only enlarged geographically but with migration, people and manpower became concentrated on the east to west centers and cities.

Unique Composition of the EU

The European Union is not an ordinary organization where governments join as in any other organization. Professor Alan Milward and Vibeke Sorensen (cited in Dedman, 2010, p. 7) made a distinction, saying that organizations like the Organization for Economic Cooperation and Development (OECD), the General Agreement on Tariffs and Trade (GATT), the NATO and other similar organizations, operate as interdependent organizations, and their governments work on mutual cooperation.

These organizations do not interfere with government policies or affairs of each government. The European Union, on the other hand, is an integration of member states, which requires a ‘supranational organization’ as the basis for the integration. In the case of the EU, the supranational organization is the European Coal and Steel Community in 1951, and the European Economic Community (EEC) in 1957.

Dedman (2010) argues that in this set-up the member states empower the organization to formulate policies. The decisions formulated by the organization are binding on all member states and therefore must be followed. In reality, the member states transfer some of their authority and power to the organization. (Dedman, 2010, p. 7)

Five of the ten accession countries were Central European countries – the Czech Republic, Estonia, Hungary, Poland, and Slovenia; they were known as the CE5. A study by Nabli (1999) on these five countries revealed that in some of these countries (not all), vulnerabilities to financial crisis would occur similar to the vulnerabilities experienced by the five East Asian countries namely, Indonesia, Korea, Malaysia, the Philippines, and Thailand, which comprised the EA5 countries.

The so-called vulnerabilities could increase due to some factors, for example, in its run up to the EU accession, there would be expected a large volume of inflows and those countries might experience difficulty in managing the macroeconomic outcomes, and stability could not possibly be attained.

Other circumstances could create problems for the accession countries. As they prepared for EU membership, they already experienced more capital inflows and opening of their respective economies. This was due to some factors like transition, special EU agreements, and an international environment on commerce and trade.

The study however commented that because of their strong reform programs, the CE5 would be able to avoid a collapse and might continue to attract more capital inflows in their entry into the EU. The CE5 would have to make sure that they could effectively handle the capital inflows and that their benefits should not be outweighed by the vulnerability risks.

The study commented on the financial systems of the CE5, which were considered nascent, and the ability of the countries concerned to handle large volumes of capital. The CE5 was compared to the EA5 in that there was a similarity in the time the Asian financial crisis occurred. The banking system was also of primary concern, and other problems of corporate governance.

Another is the macroeconomic management that should be handled by the CE5. Large capital flows would create a problem if handled inexpertly. Then there was also the volatile international environment in which the CE5 should be able to handle with much needed reforms. The risks of financial instability were in the offing for the CE5 in their run up for the EU accession. The study concluded that the countries’ intermediation mechanism and strategies were of paramount importance. (Nabli, 1999, p. 2)

The EU Regional Policy

During the process of accession of the ten countries, the EU had currently two distinct regional policies – the active and the reactive processes. This time a dilemma was in the offing in that the EU had to shift from active to reactive regional policy because this was needed by the eastern enlargement. (Van der Beek and Neal, 2004, p. 587)

Without shifting to reactive policies, the existing Member States would jeopardize the expansion project by not financing the big amount of expenditures required for the active regional policy. And by shifting to reactive policy, this big amount of expenditures would be shouldered by the accession countries.

The dilemma here is that during the enlargement, an active regional policy made the enlargement project unattractive to the already Member States, and by switching to reactive policy, the unattractiveness of the enlargement would likewise switch to the accession countries. (Van der Beek and Neal, 2004, p. 587)

At the founding of the EU, regional policy was more important to the Union. It was second priority to EU total expenditures; the first one was the Common Agricultural Policy (CAP). The regional policy had a 3.8 per cent share of EU expenditure in 1980, it became 18 per cent in 1989, and rose again to 30 per cent in 1993, and in 2004 it became 36 per cent, which was equivalent to nearly 30 billion euro.

The regional and structural policies of the EU became more significant in the succeeding years because of the challenge posed by the entry of the ten countries. Regional policy would include structural policy for the EU. This was linked to the regional objectives of convergence. This is stated in the EC Treaty, particularly the Preamble, Articles 2 and 3, and Article 130a-e, which provide that the structural and regional policy was created for the purpose of having cohesion in the European integration process by minimizing the economic differences and disparities among Member States.

The structural and the so-called social policies would just have to mean regional policy of the EU. Active EU regional policies are those carried out with expenditures. But there is another regional policy, which does not touch on the budget; this is the state aid control, associated with competition policy of the EU, which is being handled by the Directorate for the Competition Policy.

It aims for good and fair competition within the EU. To control state aid, the EU has the power to oversee and control subsidies, which are aimed for structural and regional purposes. The EU has to react to regional policies; that is why it is called the ‘reactive regional policy’ of the EU. The EU therefore has to react to the regional and structural policies of the Member States, and not just on EU expenditure on structural funds.

To deal with the dilemmas, Van der Beek and Neal (2004, p. 603) proposed five solutions which are hypothetical. The first option suggests a policy of re-nationalisation. This should be accompanied by a process of intergovernmental fiscal relation wherein richer member states grant aid to poorer states. The block grant system would be aided with a budget from the EU.

The accession countries could use the block grants according to the ways they wanted. The second option would be that the EU be given the power to increase revenues. This would mean providing the EU finances more resources, own taxes and issue bonds.

The third option would be to cut expenditures on all expenses about regional policy. Another option was for the new member states to forgo of their structural funds. Finally, the last suggestion was to cap regional policy expenditure and to implement active and reactive policies very slowly. (Van der Beek and Neal, 2004, p. 604)

Eight CEECs and Two Mediterranean Islands

The eight Central and East European Countries and two Mediterranean countries, Cyprus and Malta, became very busy with their preparations. These countries shared some common characteristics in that they were poor and agricultural countries. They also had some internal political and economic problems at that time of their accession. Most of these countries were socialist or communist countries.

At the time of their accession, communism had just collapsed. But generally, they had different economic, political and social backgrounds, making them distinct from past EU enlargement. This is said to be the largest EU enlargement considering the number of countries all seeking EU admission all at the same time. (Lee, 2006, p. 1)

The new member states added just about four percent to Union-wide GDP. The standard of living of these countries prior to accession was far below the previous EU standard of living. (May, 2009, p. 1)

The countless economic mechanisms were now laid open before the eyes of the accession countries, and they were: increased specialization which includes vertical fragmentation of production, wider scale economies in a larger market, enhanced and more effective supply chain, stiffer competition for businesses inside the CEEC countries, and so forth. (Brülhart et al., 2004, p. 853)

Upon admission of the ten accession countries, there was a wide difference in the per capita income including location of the NMS-10, A-2, C-3, and PC-5 on the eastern location of the previous EU-15 which allowed observers and commentators to predict or comment on significant changes to trade and migration in the years ahead. (May, 2009, p. 4)

In their run up for EU accession, the EU-10 had to rebuild their regional levels of public administration. The reforms were aimed to create administrative capacities to accept and implement EU legislation. (Brusis, 2001, p. 531) The activities included preparatory process for the CEEC governments to have their regional administrative bodies the expertise in the handling and management of the EU Structural Funds, which became an instrument for EU economic assistance once a country was accepted into the EU.

The arrangement of the administrative bodies was a crucial part in the EU accession, considering that these countries would be in the process of Europeanization. It was also necessary to establish a new intermediate level of administration that would link the accession country’s government with the central government levels, which needed reforms during the political transitions in the nineties. Most CEECs were once communist countries.

Post-Communist decentralization was one of the major activities, while many of the CCs lacked regional development strategies (Commission, 1999 cited in Bailey and De Propris, 2010, p. 77). At the time of the 2004 enlargement, the accession countries represented less than five percent of EU’s GDP, providing the accession countries greater benefits. They acquired more economic benefits than the older ones.

A EU study revealed that integration resulted in stronger economic growth for the accession countries (EU-10), and smaller economic growth on the EU-15. It did not however inflict economic harm on the EU-15. (Murphy, 2006, p. 636) The 2004 integration, which is the greatest enlargement in its history so far, helped to modernize the economies of the ten countries, with more economic stability and new opportunities for business.

The EU-10’s economies grew at an average rate of 3.75 per cent in 1997-2005. But the EU-15 had a lower annual growth rate at 2.5 per cent. Other benefits the EU-10 acquired were the growth of foreign direct investment (FDI), the rise in employment, and the decline of trade deficits. (Bureau of European Policy Advisors, 2006, pp. 2-7, cited in Murphy, 2006, p. 636)

From the European Commission’s study, they found that there was only a modest increase in migration during the 2004 enlargement. Poland, which once was considered the largest exporter of labor, sent 200,000 Poles to work in the United Kingdom, 76,000 to work in Ireland, and 8,000 in Sweden around the enlargement period (Iglicka, 2006 cited in Murphy, 2006, p. 637).

It was not as big an increase as expected in the export of labor because the workers found the distance between their country and the EU countries, to include the language and cultural barriers, as working against their desire to work in a foreign country. Added to this is the fact that working conditions in the Central and Eastern European countries were improving at that time. (Murphy, 2006, p. 637)

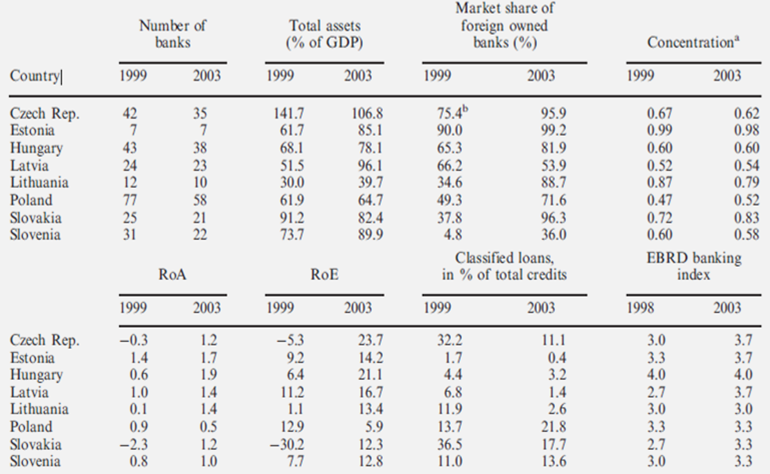

Slovenia was the first Eastern European country to penetrate the Eurozone, followed by the Mediterranean islands of Malta and Cyprus in 2008. These countries were reported to have a healthy banking environment, which helped in their respective candidacies. Most of the accession countries went through a rapid transition, i.e. from being a centrally planned to a market economy system.

Slovenia became a model for the other accession countries because of the instituted economic and structural reforms. One of the effective reforms followed by the accession countries was the alteration of the efficiency profiles of the banking industries. (Kenjegalieva et al., 2009, p. 1532)

The banking system reforms of the CEEC during the transition period involved the liberalization of the licensing policies for most kinds of bank business, and the lifting of sectoral restrictions on specialized banks. This liberalization of the licensing policies however created some problem because of the increase of the number of banks as a result, and the malpractices committed by new banks.

Another reform instituted by the Eastern countries was the introduction of a new central bank and new banking laws, which was started in the 1990s. (Kenjegalieva et al., 2009, p. 1532) On the other hand, the Baltic countries (Estonia and Latvia) increased their total assets managed by banks. The Czech Republic and Slovakia had an awkward experience through a contraction of banking industries through bank insolvency, and the changes in bank operating mechanisms.

But as a whole, the position of foreign owners was provided strength in the East European countries. This is shown in Table 2.

The ‘concentration’ in Table 2 refers to the ratio of the assets of the three largest banks to the assets of the entire banking sector. The information on the market share of foreign-owned banks for Czech Republic pertains to the period around 2000. As pertain price level, the Czech Republic had a lower price level compared to the EU average; its per capita income was lower according to international comparisons. (Janáčková, 2000, p. 73)

Foreign participation in banking business enhanced competition, helped transfer knowledge and expertise in banking, improved technical and managerial skills among the employees. The banking industries in Eastern Europe was considered highly concentrated with the market share of the three largest banks totaled around 52 and 98% during 2003. (Kenjegalieva et al., 2009, p. 1534)

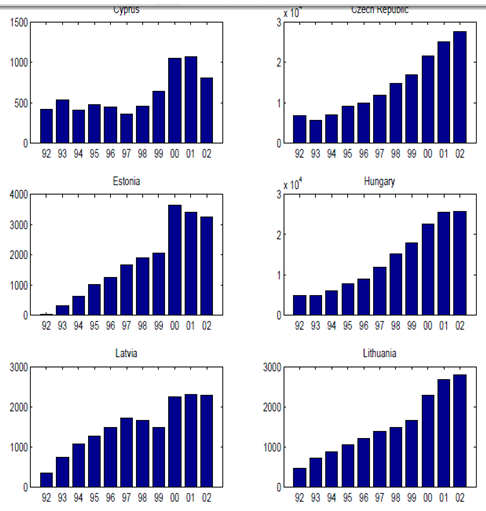

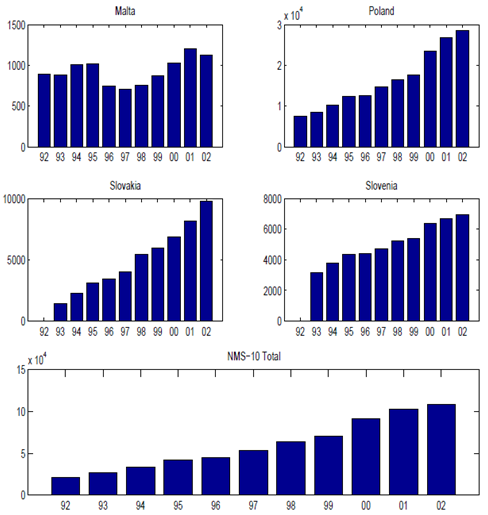

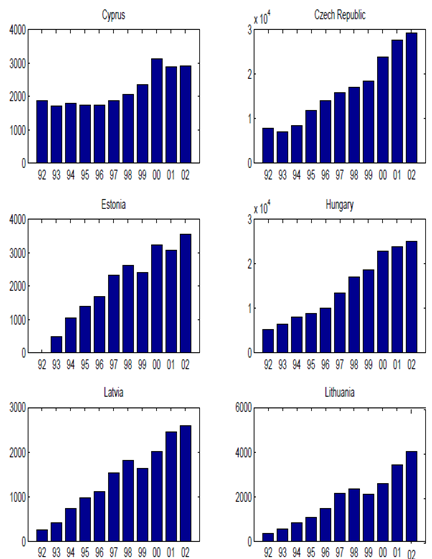

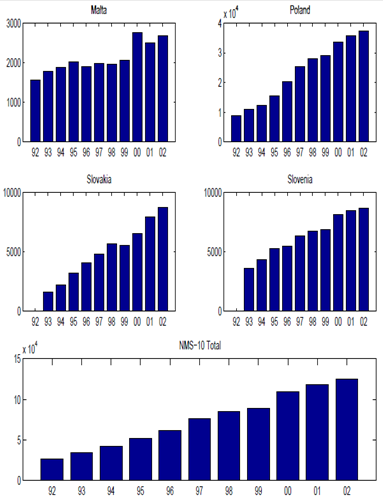

During the years before their official integration into the EU, trade between the EU-10 and the EU-15 was unhampered for several years. From the following figures (Figure 1 and 2), we can see exports of the EU-10 and the EU-10 aggregate to the EU-15 in the years prior to accession, and Figures 3 and 4 show imports of the EU10 and EU-10 aggregate from the EU-15 for the same period. There was an increase in trade flows upon the adoption of the acquiscommunautaire. (May, 2009, p. 4)

Other Economic Benefits/Activities

Outsourcing is a force in business transformation that continues to dominate business functions all throughout the world. (Springsteel et al. (2004, p. 58) With globalization and the continuing changes in technological advances, tremendous development is going on in business and organizations. Each passing day these organizations have to catch up with technological advancement and adjust with countless changes all throughout their existence.

If they don’t do so, they will be lagged behind, and they have to give way to others who are as smart and competitive as they are. As an outcome of outsourcing, many organizations have tremendously improved their operations and have soared to new heights in business due to improvement of quality and reduced cost.

But with the present recession as a result of the global economic crisis, the chaotic start initiated by Wall Street companies, and the collapse of big insurance and investment companies, outsourcing has been affected but not in the process of outsourcing per se. Some countries may have been affected because their respective businesses have done outsourcing even before the outbreak of the present recession. (Springsteel et al. (2004, p. 58)

Additionally, the advancement made in communication and the Internet makes it very easy to connect with people in the other side of the globe. The global age is here and will continue to dominate man’s activities – businesses for that matter – for many years ahead, centuries perhaps, with more and more industries emerging everyday as a result of new tools, innovations, and inventions made by man.

Because of these advances, changes, innovations, or development, new industries are formed. Outsourcing maybe new to some but it has been here for decades. It’s only now when it has been used and applied globally and by many organizations that we very much feel its presence. Moreover, there are mergers and acquisitions and formations of new alliances that outsourcing tends to become a necessity rather than a simple business function.

There are advantages and disadvantages of outsourcing. Companies can outsource to countries, especially the developing ones, for lower costs but with effective and positive results. (Eltschinger, 2007, p. 1) Since the 1960s, the Europe has been using outsourcing. Car manufacturers, European and American carmakers use this to be more competitive with Japanese car manufacturers.

They would source non-vital parts, for example carburetors, from specialty sub-contractors. Japanese counterparts also used the same method. Toyota and other car manufacturers outsourced their car parts from outside sources as an operational strategy to lower the cost of manufacturing. These companies have been successful in outsourcing that their finished products are mostly composed of outsourced products or components from their own valued suppliers. (Lynch, 2008, p. 765-767)

Cobb and Stueck (2005) state that production costs force companies to go abroad. “Because U.S. compensation costs are higher than in low-income countries, factor-price equalization theory suggests that many service jobs not tied to location may move overseas.” (Cobb and Stueck, 2005, p. 58)

Outsourcing is not limited to one or a few countries. Many countries, especially the developing ones, are “implementing proactive strategies to attract jobs and industries. U.S. Companies are encouraged to move work offshore because of the direct incentives these governments offer as part of their national industry strategy.” (Hira et al., 2008, p. 167)

Information Technology and the Internet have totally revolutionized the processes of businesses. There are many functions now that can be outsourced or serviced by employees not organic in the company or organization. For example, call centers. Businesses in the United States use call center agents manning the many call centers from Asian countries and other developing countries to answer to their clients’ queries about product warranties or anything about their products. (Springsteel et al. (2004, p. 59)

Outsourcing is an umbrella term, which involves ‘the transfer of manufacturing or service-related activities to providers outside the firm,’ (Stefanova, 2006, p. 5). A derivative of outsourcing is business process outsourcing wherein a firm hires another firm to provide non-core functions for the company. Contemporary outsourcing combines information technology, foreign direct investment, including the effects of ‘trade liberalization, and labor cost differentials’ (European Policy Center, 2004 cited in Stefanova, 2006, p. 6)

The 2004 enlargement offered opportunities for outsourcing. Stefanova (2006, p. 1) argues that outsourcing has positive relational effects on the objectives of the European integration. Outsourcing is compatible with regional integration in that it facilitates more investment within the EU, develop linkages in the production of various products, particularly new products, and also stimulate competition. (Stefanova, 2006, p. 4)

Analysis/Findings

This paper seeks to understand how EU membership has affected the 2004 accession countries. For this, data from the IMF collected between 1995 and 2010 will be used. Graphs and simple regressions will be used to highlight the effects of accession.

Gross Domestic Product (per capita in US dollars)

Table 3 (see Appendix A) summarizes the GDP per capita for the 10 countries. This table gives the index of GDP per capita and will give a clear view of the growth rates between these countries. The units are in dollars.

A graph developed from STATA will give the data a good view of the GDP per capita growth. This is shown in the graph below.

From the graph, it is evident that the there was a sharp increase in GDP after 2004 when the countries became members of the EU. The GDP before the country was integrated to the EU membership was low and stable but has experienced an upward trend since. This could be attributed to factors within the EU community.

Actually from the graph, all the countries recorded an increase in GDP even before the 2004. Estonia has the highest and a steeper growth as seen from the graph. Poland had the lowest among the ten countries but it was a rising GDP at a slower rate compared to the other countries in the same period.

Lithuania, Estonia and Malta recorded the highest growth as seen from the graph above. Poland and Cyprus recorded relatively lower GDP among the 10 countries.

Unemployment rate for the 10 countries

Table 4 (see Appendix B) shows the summary of the unemployment in the 10 countries from 1995 to 2010.

Graph2 below was generated from the summary above to be able to get a clear view of the trend.

Graph 2 Unemployment rate

There is a decrease in unemployment between 2004 and 2009 signaling a positive trend in the economy as evident from the graph above, before it started to rise afterwards. These are indicators of economic of growth and the changes are attributed to change in factors within and outside the EU market. This might indicate there could have been free flow of good and factors of production especially labor and other related factors.

Inflation Rate for the 10 countries

Table 5 (see Appendix C) gives a summary of the data on inflation in all the 10 countries under the study.

Graph was generated by STATA and gave an insight and clear view of how inflation rates have changed since 2005.

Graph 3 Inflation rate

It appears that the inflation rate has substantially decreased in many of the accession countries from 1995 to 2004 then started to balance off at around 5% maintaining it. It starts to rise again between 2008 and 2010.

Current Account Balance (as a % of GDP) for the 10 countries

The table 6 (see Appendix D) shows a summary of the data said above.

The graph below shows clearly what trends can be observed, most countries operated on a negative balance of trade before joining the EU as evident from the graph below. It then reduces and some went positive meaning it stated gaining from the other EU markets which is a positive note.

Malta recorded the lowest current account balancing 2002 and shot put to 50% in 2003. It also showed a lot of fluctuation in it. Estonia also recorded a lower current account balance compared to the other countries and showed fluctuation within the years. Cyprus, Czech Republic, Hungary and Poland have a relatively stable current account balance just fluctuating slightly above and below zero.

A consolidated data given as a range shows clearly the rate of growth of GDP as shown on table 7 below. It is easy to see the trends and try to take care of outliers when the data is presented as a range.

Cyprus growth rate declined between 2004-2007 and recorded a higher growth within the period 1995-2003. Czech Republic recorded, Hungary, Latvia had their highest growth recorded in the period 2004-2007. This is clear from the table below.

Table 7. GDP Growth in per capita index (before and after 2004)

A summary of unemployment also is clearer on consolidated data as show in table 8 below.

Table 8. Unemployment rate (before and after 2004)

Table 8 above Czech Republic, Malta and cypress saw their unemployment rates soar up between 2004-2010 compared to the period of 1995-2003. Poland and Slovak republic had the biggest drop in unemployment rate between the period 2004-210 compared to the period.

Table 9. Inflation rate (before and after 2004)

Inflation also is clearer when seen in a consolidated form when the data set is larger. The table above gives the inflation rate in a range of time scale. Hungary and Czech Republic recorded the most significant drop in inflation rate in the period 2004-2010.

All the countries actually saw their inflation rate reduce in the period 2004-2010 compared to period 1995-2003. Latvia, Slovak republic and Slovenia recorded an increase in the period 2004-2007. The table below gives the balance of trade figures with an interval year to gain a keener look on the rate and where there is a significant change.

Table 10. Balance of trade (before and after 2004)

Most of it is negative showing that most of the countries were importing more than what they exporting. But most of the countries saw the balance of trade increased due to increased output and thus increased exports. Malta recorded the most significant change compared to other countries.

Conclusions

There have been effects noted on the 2004 accession to the Union as a whole as seen from the changes in GDP, inflation and unemployment. Nevertheless, as a whole, it can be concluded here that the 2004 enlargement created changes in macroeconomic impact. But as to the whole view of enlargement, whether it is a success, remains to be seen.

The statistical analysis done shows clearly the trends especially on GDP of which whole the countries in did have changes positive and negative in some countries showing an effect as a result of the accession. Most of the countries doubled in the between 2004 and 2010. This shows how joining the EU has helped these countries. There has been a significant decrease in unemployment in these countries.

A lot of people from these countries have got jobs within the region since the job market has been expanded significantly. Social and political successes do not quite match with the economic successes. Eurobarometer surveys conducted on the EU enlargement found that majority of Europeans view the EU as a mechanism for peace and stability.

That is why the EU was founded on the basis of eliminating wars between the countries in Europe and the world. The west European countries have an obligation to help their neighbors in the east who have just gone through a recent transformation from communism/socialism to the democratic form.

References

Bailey, D. and De Propris, L., 2004. A bridge too phare? EU pre-accession aid and capacity-building in the candidate countries. JCMS 2004 Volume 42. Number 1.Pp. 77-98, [e-journal], Available through: Business Source Complete .

Behr, H., 2007. The European Union in the legacies of imperial rule? EU accession politics viewed from a historical comparative perspective. European Journal of International Relations 2007, SAGE Publications and ECPR-European Consortium for Political Research, Vol. 13(2): 239-262. DOI: 101177/1354066107076956. [e-journal], Available through: Business Source Complete .

Booker, C. and North, R., 2005. The great deception: the secret history of the European Union. London; New York: Continuum Books.

Brusis, M., 2002. Between EU requirements, competitive politics, and national traditions: re-creating regions in the accession countries of Central and Eastern Europe. Governance: An International Journal of Policy, Administration, and Institutions, Vol. 15, No. 4,October 2002 (pp. 531–559)

Brülhart, M., 2004. Enlargement and the EU periphery: the impact of changing market potential. Blackwell Publishing Ltd. [e-journal], Available through: Business Source Complete .

Bureau of European Policy Advisors and the Directorate-General for Economic and Financial Affairs, 2006.“Enlargement Two Years After: An Economic Evaluation,” European Economy–European Commission Directorate-General for Economic and Financial Affairs—OccasionalPapers, no. 2006. Web.

Cited in Murphy, A., The May 2004 enlargement of the European Union: view from two years out, Eurasian Geography and Economics, 2006, 47, No. 6, pp. 635–646, Bellwether Publishing, Ltd.[e-journal], Available through: Business Source Complete .

Cobb, J. and Stueck, W., 2005. Globalization and the American South. United States of America: University of Georgia Press.

Coles, T. and Hall, D., 2005. Tourism and European Union enlargement. Plus ça change? International Journal of Tourism Research, 7, 51–61 (2005), [e-journal], Available through: Business Source Complete .

Commission of the European Communities, 1999. ‘Sixth Periodic Report on theSocial and Economic Situation and Development of the Regions of the EuropeanUnion’ (Luxembourg: CEC). Cited in Bailey,D. and De Propris, L., 2004, A bridge too phare? EU pre-accession aid and capacity-building in the candidate countries. JCMS 2004 Volume 42. Number 1.Pp. 77-98, [e-journal], Available through: Business Source Complete .

Dedman, M., 2010. The origins and development of the European Union, 1945-2008: a history of European integration. Abingdon, Oxon; New York, USA: Routledge.

Eltschinger, C., 2007. Source Code China: The New Global Hub of IT (Information Technology) Outsourcing. New Jersey: John Wiley & Sons. Inc.

Europa: Gateway to the European Union, 2011a. Countries. Web.

Europa: Gateway to the European Union, 2011b. 2000 – today: a decade of further expansion. Web.

European Policy Centre. 2004. “Ten Do’s and Don’t-s for Sustainable Growth inEurope,” Issue Paper 18 (27 October). Brussels: EPC. Cited in: Stefanova, B., 2006, The political economy of outsourcing in the European Union and the East-European enlargement, The Berkely Electronic Press, [e-journal], Available through: Business Source Complete.

Faist, T. (1997) ‘From Common Questions to Common Concepts’. In Hammar, T. etal. (eds). Cited in: Kraus, M. and Schwager, R., 2003, EU enlargement and immigration. JCMS 2003 Volume 42. Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete .

Fajertag, G. Pochet, P. (2000): A New Era for Social Pacts in Europe. In: Fajertag, G./Pochet, P. (eds.):Social Pacts in Europe – New Dynamics. Brussels: ETUI: 9-40. Cited in: Marginson, P., 2006, Europeanisation and regime competition: industrial relations and EU enlargement. Industrielle Beziehungen, 13(2): 97-117 [e-journal], Available through: Business Source Complete .

Gaisford, J. et al., 2003. Economic analysis for EU accession negotiations. UK; USA: Edward Elgar Publishing, Inc.

Grabbe, H. 1999. The transfer of policy models from the EU to Central andEastern Europe: Europeanisation by design? Paper prepared for the 1999 annual meeting of the American Political Science Association, 2–5 September, Atlanta, GA. Cited in: M. Brusis, Between EU requirements, competitive politics, and national traditions: re-creating regions in the accession countries of Central and Eastern Europe. Governance: An International Journal of Policy, Administration, and Institutions, Vol. 15, No. 4,October 2002 (pp. 531–559).

Grant, S., et al., 2005. Heinemann economics A2. Oxford: Heinemann Educational Publishers.

Gray, J., 2009. International organization as a seal of approval: European Union accession and investor risk. American Journal of Political Science, Vol. 53, No. 4, October 2009, Pp. 931–949 [e-journal], Available through: Business Source Complete.

Hall, M./Marginson, P. (2004): Developments in European Works Councils. In: European IndustrialRelations Observatory. On-line Ref: TN0411101S. Cited in: Marginson, P., 2006, Europeanisation and regime competition: industrial relations and EU enlargement. Industrielle Beziehungen, 13(2): 97-117 [e-journal], Available through: Business Source Complete .

Hammar, T. and Tamas, K. (1997) ‘Why Do People Go or Stay?’. In Hammar, T. etal. (eds). Cited in: Kraus, M. and Schwager, R., 2003, EU enlargement and immigration, JCMS 2003 Volume 42. Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete.

Hansen, M. et al., 2003. EU enlargement and competition law – practical implications for business activities in the 10 future EU member states. Web. AM [e-journal], Available through: Business Source Complete.

Harris, J. and Todaro, M. P. (1970) ‘Migration, Unemployment and Development: ATwo-Sector Analysis’. American Economic Review, No. 60, pp. 126–42. Cited in: Kraus, M. and Schwager, R., 2003, EU enlargement and immigration. JCMS 2003 Volume 42. Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete .

Hicks, J. R. (1932) The Theory of Wages (London: Macmillan). Cited in: Kraus, M. and Schwager, R., 2003, EU enlargement and immigration. JCMS 2003 Volume 42. Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete.

Hira, R., Hira, A., and Dobbs, L., 2008. Outsourcing America: What’s Behind Our National Crisis and How We Can Reclaim American Jobs. United States of America: AMACOM Division American Management Association.

Hix, Simon (2002) Linking National Politics to Europe. London: Foreign Policy Centre. Cited in: Lecheler, S., 2008, EU membership and the press: an analysis of the Brussels correspondents from the new member states, Journalism (Los Angeles, London, New Delhi and Singapore) Vol. 9(4): 443–464. DOI: 10.1177/1464884908091294 [e-journal], Available through: Business Source Complete.

Holland, T., 1933.Lectures on International Law, ed. by Thomas A.Walker and Wyndham L. Walker. London: Sweet & Maxwell. Cited in Behr, H., 2007, The European Union in the legacies of imperial rule? EU accession politics viewed from a historical comparative perspective, European Journal of International Relations 2007, SAGE Publications and ECPR-European Consortium for Political Research, Vol. 13(2): 239-262. DOI: 101177/1354066107076956. [e-journal], Available through: Business Source Complete .

House of Lords, 2006. The further enlargement of the EU: threat or opportunity? Great Britain: The Stationery Office.

Hölscher, J. and Stephan, J., 2004. Competition policy in Central Eastern Europe in the light of EU accession. JCMS 2004 Volume 42. Number 2. pp. 321–45. Available through: Business Source Complete.

Iglicka, K., 2006.“Free Movement of Workers Two Years after the Enlargement: Myths and Reality,”Centrum Stosunków Międzynarodowych, Reports & Analyses, 11/06, 2006. Cited in: Murphy, A., The May 2004 enlargement of the European Union: view from two years out. Eurasian Geography and Economics, 2006, 47, No. 6, pp. 635–646. Copyright © 2006 by Bellwether Publishing, Ltd.[e-journal], Available through: Business Source Complete .

Islam F. 2004. May Day or mayday for the EU? TheObserver 25 April. Cited in: Coles, T. and Hall, D., 2005, Tourism and European Union enlargement. Plus ça change? International Journal of Tourism Research, 7, 51–61 (2005), [e-journal], Available through: Business Source Complete.

Janáčková, S., 2000. Price convergence and the readiness of the Czech economy for accession to the European Union. Eastern European Economics, vol. 38, no. 4, July-August 2000, pp. 73-91. ISSN 0012-8775/2000, [e-journal], Available through: Business Source Complete.

Jenny, M. and Müller, W., 2010. From the Europeanization of lawmaking to the Europeanization of national legal orders: the case of Austria. Public Administration Vol. 88, No. 1, 2010 (36–56). doi: 10.1111/j.1467-9299.2010.01815.x [e-journal], Available through: Business Source Complete.

Jileva, E., 2002. Visa and free movement of labour: the uneven imposition of the EU acquis on the accession states. Journal of Ethnic and Migration Studies Vol. 28, No. 4: 683± 700 October 2002 [e-journal], Available through: Business Source Complete.

Kancs, A., 2001.Predicting European enlargement impacts. Eastern European Economics, vol. 39, no. 5, September-October 2001, pp. 31-63, [e-journal], Available through: Business Source Complete.

Kenjegalieva, K. et al., 2009. Efficiency of transition banks: inter-country banking industry trends. Applied Financial Economics, 2009, 19, 1531-1546 [e-journal], Available through: Business Source Complete.

Kraus, M. and Schwager, R., 2003. EU enlargement and immigration. JCMS 2003 Volume 42. Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete.

Kurzer, P., 2006. Who steers the field of consumer protection and environmental regulations? An American-European comparison. Cited in Laible, J. and Barkey, H., European responses to globalization: resistance, adaptation and alternatives. San Diego, California: Elsevier Ltd.

Lecheler, S., 2008. EU membership and the press: an analysis of the Brussels correspondents from the new member states. Journalism (Los Angeles, London, New Delhi and Singapore) Vol. 9(4): 443–464. DOI: 10.1177/1464884908091294 [e-journal], Available through: Business Source Complete.

Lee, M., 2006. How do small states affect the future development of the E.U. New York: Nova Science Publishers, Inc.

Lynch, R., 2008. Global Automotive Vehicle – Strategy in a Mature Market and Toyota: What is its Strategy for World Leadership. In Strategic Management, 5th edition. London:Financial Times, Prentice Hall.

Machill, M. et al., 2006. Europe – Topics in Europe’s media: the debate about the European public sphere: a meta-analysis of media content analyses. European Journal of Communication 2006 21: 57. DOI: 10.1177/0267323106060989, [e-journal], Available through: Business Source Complete.

Marginson, P., 2006. Europeanisation and regime competition: industrial relations and EU enlargement. Industrielle Beziehungen, 13(2): 97-117 [e-journal], Available through: Business Source Complete.

Massey, D. S., Arango, J., Hugo, G., Kouaouci, A., Pellegrino, A. and Taylor, E.(1993) ‘Theories of International Migration: A Review and Appraisal’. Populationand Development Review, No. 19, pp. 431–66. Cited in: Kraus, M. and Schwager, R., 2003, EU enlargement and immigration, JCMS 2003 Volume 42, Number 2. pp. 165–81 [e-journal], Available through: Business Source Complete.

May, J., 2009. Trade and migration in an enlarged European Union: a spatial analysis. Global Economy Journal, Volume 9, Issue 4, [e-journal], Available through: Business Source Complete.

Miles, L., 2005. Chronology: the European Union in 2004. JCMS 2005 Volume 43. Annual Review pp. 215–18 [e-journal], Available through: City University London (Blackwell Publishing).

Moravcsik, Andrew and Milada A. Vachudova (2003) ‘National Interests, State Powerand EU Enlargement’, East European Politics and Societies 17(1): 42–57. Cited in: Lecheler, S., 2008, EU membership and the press: an analysis of the Brussels correspondents from the new member states, Journalism (Los Angeles, London, New Delhi and Singapore) Vol. 9(4): 443–464. DOI: 10.1177/1464884908091294 [e-journal], Available through: Business Source Complete.

Murphy, A., 2006. The May 2004 enlargement of the European Union: view from two yours out. Eurasian Geography and Economics, 2006, 47, No. 6, pp. 635–646. Copyright © 2006 by Bellwether Publishing, Ltd. [e-journal], Available through: Business Source Complete.

Nabli, M., 1999. Financial integration, vulnerabilities to crisis, and EU accession in five Central European Countries. United States of America: The International Bank for Reconstruction and Development/The World Bank.

Nakos, G., 2006. The European project: growing pains (A Review). Thundirbird International Business Review, Vol. 48(4) 597-603. Published online in Wiley InterScience, [e-journal], Available through: Business Source Complete.

Papazoglou, C., Pentecost, E., and Marques, H., 2006. A gravity model forecast of the potential trade effects of EU enlargement: lessons from 2004 and path-dependency in integration. The World Economy (2006). Doi: 10.1111/j.1467-9701.2006.00834.x

Resmini, L. and Traistaru, I., 2003. Spatial implications of economic integration in EU accession countries. In: I. Traistaru, P. Nijkamp, and L. Resmini, (eds). The emerging economic geography in EU accession countries. England; USA: Ashgate Publishing Limited.

Scharpf, Fritz W. (1999) Governing in Europe: Effective and Democratic? Oxford: OUP. Cited in: Lecheler, S., 2008, EU membership and the press: an analysis of the Brussels correspondents from the new member states, Journalism (Los Angeles, London, New Delhi and Singapore) Vol. 9(4): 443–464. DOI: 10.1177/1464884908091294 [e-journal], Available through: Business Source Complete.

Schimmelfennig, F., 2008. EU political accession conditionality after the 2004 enlargement: consistency and effectiveness. Journal of European Public Policy 15:6 September 2008: 918-937. DOI: 10.1080/13501760802196861. Available through: Business Source Complete.

Springsteel, I., Kuan, J. S., and World Trade Executive, Inc., 2004. Offshore Business Sourcing Special Report on Law & Strategy. USA: WorldTrade Executive, Inc.

Stefanova, B., 2006. The political economy of outsourcing in the European Union and the East-European enlargement. The Berkely Electronic Press, [e-journal], Available through: Business Source Complete.

Van der Beek, G. and Neal, L., 2004. The dilemma of enlargement for the European Union’s regional policy. Blackwell Publishing, [e-journal], Available through: Business Source Complete.

Vanhove, N. 1999. Regional policy: a European approach. Aldershot, Hants, UK: Ashgate.

Varblane, U. and Vahter, P., 2005. An analysis of the economic convergence process in the transition countries, [e-journal]. Web.

Wheaton, Henry (1936) Elements of International Law, with a Sketch of the Historyof the Science, Literal reproduction of the edition of 1866 by Richard Henry DanaJr; ed. with notes by George Grafton Wilson. Oxford: The Clarendon Press;London: H. Milford. Cited in: Behr, H., 2007, The European Union in the legacies of imperial rule? EU accession politics viewed from a historical comparative perspective, European Journal of International Relations 2007, SAGE Publications and ECPR-European Consortium for Political Research, Vol. 13(2): 239-262. DOI: 101177/1354066107076956. [e-journal], Available through: Business Source Complete.

Appendices

Appendix A: Gross Domestic Product. (Per capita in us dollars)

Table 3. Gross Domestic Product (real GDP per capita in US dollars)

Data source: Web.

In order to compare growth rates, it would be useful also to have a graph with GDP per capita with an index=100 for each country in 1995. The table below gives the GDP per capita index of the 10 countries.

Appendix B: Unemployment rate for the 10 countries

Table 4. Unemployment rate

Appendix C: Inflation Rate for the 10 countries

Table 5. Inflation rate

Appendix D: Current Account Balance (as a % of GDP) for the 10 countries

Table 6. Current Account Balance