Introduction

In the past decade, China housing sector has experienced rapid growth. The growth in the housing market has been adjunct to the increased housing prices. The Chinese government has put in place various policies as well as strategies that are geared towards supporting home ownership.

Despite these policies and programs, owning a home in Chinese major towns has become expensive particularly for the ordinary citizens (Deng et al 11). However, the growth in this sector started to slow down after 2010.

The slow growth is due to the government intervention in the fast-rising prices of residential and other housing properties. There has been concerns whether China’s housing sector is about to bubble particularly in major cities that are spread throughout the country (Han 413).

In fact, the rise in housing prices has put China under economic growth scrutiny. The issue is how to deal with the rise of the housing prices and make residential homes affordable to the ordinary citizens.

Housing bubble is being experienced in China and the response of the Chinese government to the housing bubble will be the major discussion.

The expansion of the housing sector and the increase in prices

Over the past years, there has been an immense expansion in the housing sector in China. Despite all these growth experienced in the sector, there has been escalating increases in the prices of houses (Green and Lan 214). As a result, it has become harder for the population to purchase personal residential properties.

Through the government’s intrusion to direct the prices of residential houses, the housing sector has shown signs of decelerating trend in the prices of properties. In addition, due to the economic restructuring in the housing sector, China has achieved massive developments in the sale of homes (Duda et al 918).

Through economic restructuring that lowered the cost of homes, many citizens have been able to purchase inexpensive residential houses. Further, many households are able to rent houses at affordable costs.

Through the government’s intervention, successful privatization policy that encouraged private home ownership has been achieved (Duda et al 918).

In the contrary, the disparity in the accessibility as well as allocation of houses is very common.

Therefore, the responsibility of the government in its housing policies to maintain fairness in the allocation of residential properties is highly necessary (Gao 120). Further, it is also important that the authorities undertake the duty of maintaining the property costs at relatively low prices.

The action would benefit a larger percentage of the public. Currently, China has two significant programs on housing policy portfolio that include the provision of affordable houses.

Additionally, the government has initiated the house provident fund that has made it easy and economical for the citizens to attain private property (Huang and William 7). However, several studies point out several flaws in the program. For instance, the affordable houses are priced lower than the market rates.

As a result, the perceived affordable houses continue to remain expensive for a big number of households. In addition, program incoherence contributes to many exceptions in terms of property ownership requirements.

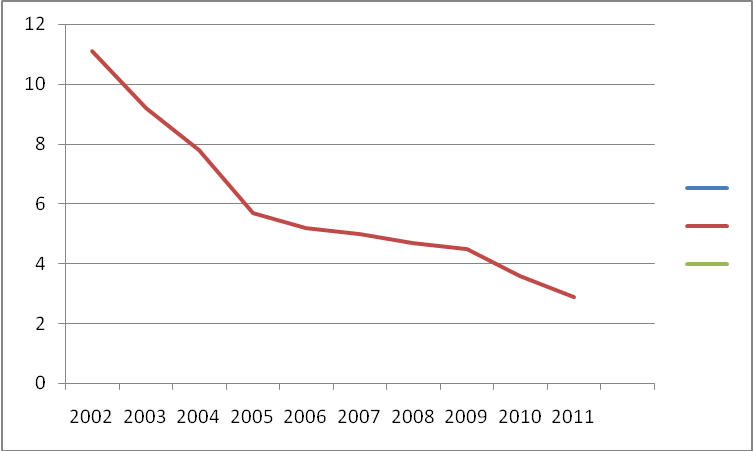

Consequently, there is reduced number of affordable houses because the heavily subsidized residential houses developed into commodity houses (Crowe et al 216). For instance in the last five years, affordable homes have declined considerably as indicated.

Figure 1: Market share of affordable houses in the last five years

Moreover, a large number of households in China depend on their savings in purchasing the houses. The savings enables the households purchase homes through mortgage loans provided by housing provident fund.

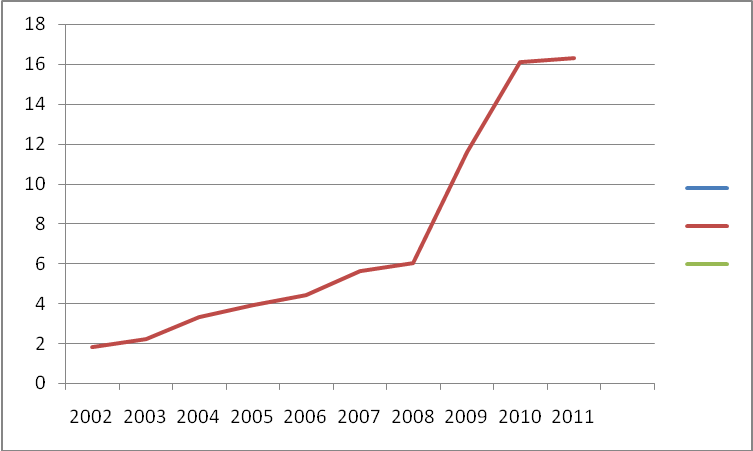

Nevertheless, due to the underdeveloped nature of the China’s bond market, issuance of mortgage bonds is offered without collateral (Zenou 554). As a result, the purchases of homes through mortgages have increased over the last ten years.

Figure 3: Growth in home mortgage loans in the last five years.

The housing bubble

A bubble refers to a sharp increase in the prices of assets such as real estate as well as continuous growth of interests in owning assets among the public (Huang 45). Studies show that there exist housing bubbles in China’s major cities for instance in Beijing and Shanghai.

Recent studies indicate an upward trend in home prices. For example, a new record high of approximately 24% change in home prices was observed in 2009 followed by 7% decrease in 2010 (Wu et al 620).

Since 2002, the upward trend in home prices is consistent. However, the trend changed in 2010 showing a sharp decline and stabilized.

The emergence of the housing bubbles in major cities was partly because of government policies on the housing sector. Recent studies have shown that the monetary policies pursued by the government increases the growth of home prices.

In addition, many researchers find existence of overpricing of houses in major cities. However, the government interventions through the provision of affordable home policies have stabilized the home prices in the last two years.

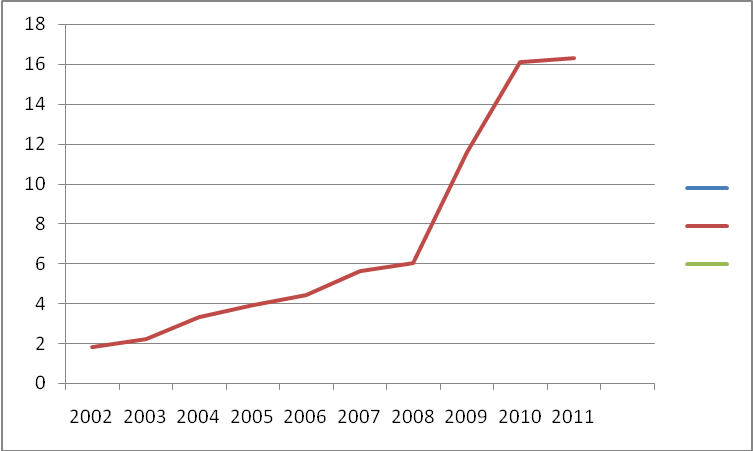

Further, the increase in home prices have been exacerbated by unprecedented increase in value of lands especially in the mega cities. In Beijing for instance, there is a big difference between the prices of houses in the city centre and the suburban areas (Gao 121).

In 2010, the medium price of owning a home per square meter in the city was approximately 35,000 Yuan while in the suburban areas it was 11,500 Yuan.

Similar trends is also observed with average home prices in 2010 of a ninety square meter house in the city center that was 3,142,500 Yuan while in the suburban area it was 1,030,000 Yuan.

Figure 6: land prices per square meter in Beijing.

The growth of home prices have been partly attributed to the municipal governments’ sale and lease of state owned land to generate revenue (Huang and William 7).

Municipal governments restraints the use of land for residential purposes to enable high returns in terms of income. The consequence is the low flexibility in property prices, which in turn leads to the soaring house prices.

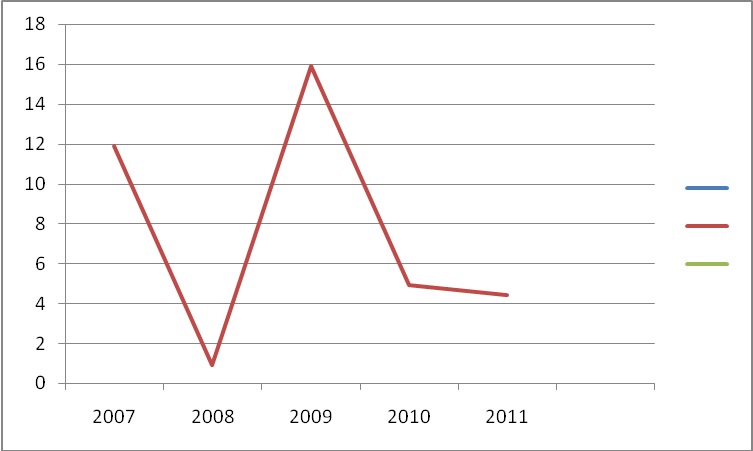

Moreover, the prices of properties are driven by increased demand. For instance in the last five years the demand for houses have grown tremendously driving home prices at a higher rate.

The data indicates corresponding home prices with relative demand for houses. However, the housing demands have been fluctuating primarily due to fluctuating disposable income of the households.

Figure 7: demand of residential houses relative to percentage change in prices.

Conclusions

It is clearly observed that in the recent years, China has experienced numerous changes in its housing sector. Many of its citizens have been able to acquire homes due to the privatization of the housing sector as well as the implementation of policies to correct the unsustainable increase in prices of residential properties.

However, the government still faces great challenges on the growth of housing bubbles in most of its major cities. The government has also achieved extraordinary developments in the housing sector.

The government has achieved these through increasing bank required reserve ratios as well as expansion of measures that cushion banks against housing-related losses. In addition, in a bid to restrain the demand for mortgage loans, the government has tripled the interest rates.

Further, the government has employed administrative measures aimed at restricting the speculative motives together with investment acquisitions. The policies have seen a downward trend in the prices of houses. Due to these guidelines, the Chinese government has been very successful in restricting the increase of home prices.

Moreover, researchers have also emphasized on the importance of higher rates of property taxes in curtailing housing booms as well as the upward inclination of prices.

It is also essential to identify the fact that property prices pursue dissimilar paths in diverse locations of the country. Therefore, it is essential for the government to shape different policies in different regions.

References

Crowe, Christopher, Giovanni Dell’Ariccia, Deniz Igan and Paul Rabanal.“How to Deal With Real Estate Booms: Lessons From Country Experiences.” Financial Innovation and Economic Growth, 16.6 (2009), 215-223. Print.

Deng, Lan, Qingyun Shen and Lin Wang. “Housing Policy and Finance in China: A Literature Review” Department of Housing and Urban Development, 4.2 (2009), 8-19. Print.

Duda, Mark, Xiulan Zhang and Mingzhu Dong. “China’s Homeownership-Oriented Housing Policy: An Examination of Two Programs Using Survey Data from Beijing.” Joint Center for Housing Studies, 6.2 (2005), 918-933. Print.

Gao, Lu. “Achievements and Challenges: 30 Years of Housing Reforms in the People’s Republic of China” Asian Development Bank Economic Review, 19.4 (2010), 119-123. Print.

Green, Stephen and Lan Shen. “China — Housing Inventories: Today, Tomorrow and Ever After” Standard Chartered Global Research, 16.6 (2012), 214-219. Print.

Han, Porter. “Are House Prices Rising Too Fast in China?” Hong Kong Monetary Authority, 23.4 (2010), 413-419. Print.

Huang, Youqin and William Clark. “Housing Tenure Choice in Transitional Urban China: A Multilevel Analysis.” Urban Studies, 39.1 (2002), 7-32. Print.

Huang, Youqin. “Housing Markets, Government Behaviors, and Housing Choice: A Case Study of Three Cities in China.” Environment and Planning, 36.4 (2004), 45-68. Print.

Wu, Jing, Joseph Gyourko and Yongheng Deng. “Evaluating Conditions in Major Chinese Housing Markets.” Urban Affairs Review, 36.5 (2011), 620-645. Print.

Zenou, Yves. “Housing Policy in China: Issues and Options.” Research Institute of Industrial Economics, 32.4 (2010), 554-561. Print.