Introduction

Macroeconomic theories are important in understanding trade between countries and economies. In the case of Australia and the United Arab Emirates, there are different characteristics and features that define the economies of these republics with marked diversity in resources and sources of revenue.

There are few published studies giving comparison between countries in the northern hemisphere and those in the southern hemisphere (McTaggart et al 2003, p. 10: Slavin 1996, p. 13).

There is also no study done to compare the economies of the countries in the Middle East, which are dependent on oil for revenue, and Australia, which relies on agricultural services and manufacturing sectors.

The two countries are a good of example of economies in the south and northern hemisphere that are in the process of re-inventing themselves. Australia is a number of times larger than UAE in size, people, and resources.

This revelation makes comparison between the two economies appropriate. This paper therefore compares the two economies based on various economic indicators for the past decade (mainly from 2002 to 2012), and how they handled the economic crisis.

United Arab Emirates

The United Arab Emirates consists of seven emirates, which united shortly after their independence from Britain in the year 1971 (Naceur & Labidi n.d., p. 2). The seven-member states consisting of Dubai, Abu Dhabi, Fajairh, Ajman Ras al Khaimah, Umm al Qaiwan, and Sharjah maintain their independence with the leadership consisting of a prime minister and his cabinet.

The seven emirs representing the states (Naceur & Labidi n.d., p. 2) choose the cabinet. With the discovery of oil in 1950s, the economy has been transformed from being heavily reliant on fishing and the industry of pearls (Doing Business in the UAE 1991, p.12).

After the discovery of oil in the first state of Abu Dhabi and its export in 1962, the fortunes for this tiny nation changed with many immigrants settling there with the intention of making money in the industry. Other states have since followed suit with the confederation growing in trade and tourism.

With the amount of money earned from the export of oil, the nations have set up a way of promoting tourism and trade. The building industry has attracted professionals from all over the world. This realisation is a result of the policy on immigrants that is in existence.

The construction boom has also been fuelled by the growth in the tourism sector with the states boasting of one of the highest numbers of visitors in a year (Sadik 2012, p.12). The government has invested in a number of projects that are aimed at shifting the balance of trade to their side.

Of the seven states, Abu Dhabi is the largest covering approximately 80% of the land in the confederation. As a coincidence, it also holds the largest number of oil reserves in addition to gas reserves (Naceur & Labidi n.d., p. 2). According to global rankings, UAE has the third largest conventional oil reserves in the world. It ranks fifth in natural gas reserves (Naceur & Labidi n.d., p. 2).

The Abu Dhabi government has the largest control over the resources of UAE. It therefore sets up most of the policies on trade and investment. The strategic vision for the state is set in the document of goals, which the country has set to achieve by the year 2030.

In the next 20 years, the state has set as a priority to develop other sectors of the economy to be more vibrant than the oil industry in a bid to sail away from dependence on oil export. The private sector here is in the process of gaining independence from the government, which now is the main provider of services.

Focus is being made in the sectors of tourism, education, training, and health, which the government considers as an alternative source of revenue with a varied degree of competition globally.

After the worldwide financial crisis of 2008, “the government and the central bank adopted an accommodative monetary policy to support the economy” (Naceur & Labidi n.d., p. 2).

Dubai is well known of the seven states. It serves as the market and regional trade centre. With significant oil and gas deposits of its own, it has also embarked on transforming its economy from dependence on oil to other areas of the economy for future reliance.

The construction industry here is also experiencing a boom with projects of considerable magnitude coming up. It is reported that Dubai has the largest number of construction cranes in operation now due to the projects.

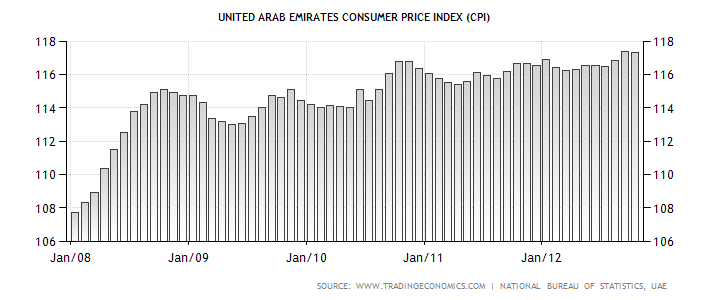

The consumer price index for the UAE has significantly changed, as shown in the graph below. The data is as provided since the year 2008.

Australia

Australia is a relatively large country compared to the small land of UAE. The language used here is English since the country is formerly a British territory and a member of the commonwealth (Bychkov 2003, p. 12: Vaisutis 2007, p. 1).

The population here is currently at 22.6 million, which is a relatively small population compared to its size (Australia 2020 2008, p. 26). The country is not a major oil producer compared to UAE. It imports more of the crude oil than it exports.

Its main exports however are iron ores, coal, gold, and natural gas. The export destinations are mainly China, Japan, Korea, India, and the United States. With the addition of Germany and Singapore, these countries form the main import centres for Australia.

The Australian economy has remained robust and resistant to external forces such as the international markets. It adapts international changes easily. With a GDP of approximately 1.23 trillion US dollars, it ranked 13th by nominal GDP (CIA World Fact Book).

It represents about 1.7 % of the world’s economy, and was ranked 19th in the size of import and export in the world (Country n.d., p. 2). The wealth of the citizens as represented by the Australians per capita is over 300, 000 Australian dollars thus making the country one of the richest in the world.

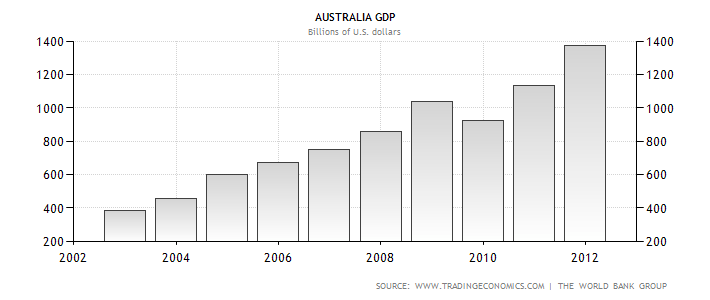

The Australian GDP was 1371.76 US dollars in the year 2011. With the ANZCERTA agreement with New Zealand, the country targets to establish a single market of Australasia (Country n.d., p. 2). The service sector carries the largest share of the economy thus contributing to over 60% of the GDP.

In contrast to UAE, the mining sector only contributes less than 10% of the GDP. When combined with the contribution made by agriculture, they make up only 10% of the GDP.

In contrast to UAE, which has over 80% of the export-earning coming from oil trade, the country imports most of the oil it needs to power her economy. It is dependent on these imports for survival.

The Australian dollar is used in most of the state islands in the region “including Christmas islands, Norfolk Island, Kiribati, Nauru, and Tuvalu” (Country n.d., p. 2). The Australian Security exchange is the largest stock exchange in the country that boasts of listing big firms and companies (Country n.d., p. 2).

The country also has a higher Per-capita GDP than most other nations including Germany, France, and the UK in terms of purchasing power (Country n.d., p. 2). The United Nations ranked it second in its 2010 Human Development Index.

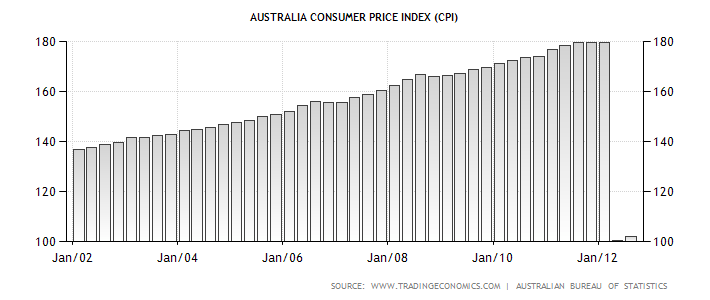

It also ranked sixth in The Economist worldwide quality of life index (Country n.d., p. 2). The country boasts of the highest asset-population ratio in the world. Its debt as a function of the GDP is the lowest among the OECD members (Australian economy).The consumer price index for the last decade is as shown in the graph below.

Economic Comparisons

With the two counties discussed above in brief, a comparison in the economies is necessary. The comparison will mainly focus on the GDP and performance of the economies as recorded in various surveys for the year 2010 after the global economic crisis, which saw many countries affected with some being affected more in relation to others.

The Gross Domestic Product

The gross domestic product of a country is the measure of the county’s economic production of services and goods over a given period. The other related term of per-capita GDP is a measure of the production per person in the same country (Branson 1972, p. 32: Dornbusch & Fischer 1978, p.17: Mankiw 2007, p. 27: Macroeconomic Theory p. 15).

In economic considerations, the GDP is important to consider especially when comparisons between two countries and economies are to be made.

The relevance of GDP is that it is a measure of how much a country is producing in terms of basic commodities such as food, clothing, and shelter and other products such as machinery. Countries producing a large number of these are considered wealthier.

Those countries producing little of the commodities are said to be poorer. The population here enjoys little of the resource. The income approach Y=C+I+G+(X-M) was used to calculate the GDPs of the countries. This is by the use of variables such as government spending, imports, and exports.

In the wake of uprisings in the Middle East and Arabic countries, UAE has experienced stability compared with her neighbours. The poverty index in the UAE is not as high as that of her neighbours. Unemployment is not as high since only a few people have reliable employment.

According to the IMF report published in 2011, the country’s economy grew by 3.2% in the year 2010 (Country n.d., p. 2). This growth was driven by the high international demand for crude oil especially by the neighbours who traditionally make up a large traditional market (Country n.d., p. 2).

In the same year, Dubai recovered after receiving 20 million dollars in grant from the state of Abu Dhabi. Oil production and prices increased in the same year, according to the consumer price index for the year ending December 2010, the rate of inflation was subdued at 1.7%. This followed a -0.3% value for the year 2009 (Country n.d., p. 2).

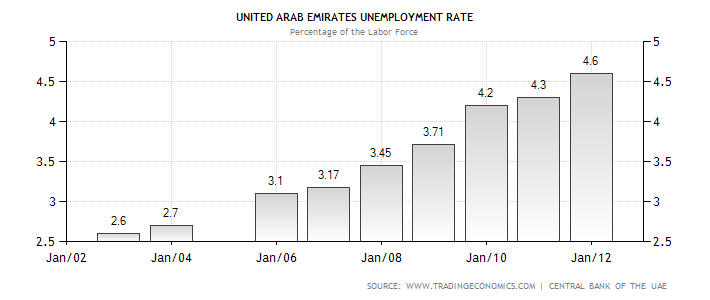

In the year 2010, the GDP growth for the year was 3.25% according to IMF estimates. The per-capita GDP was also estimated at 49,600 US dollars, the CPI being at 2.2 while the FDI was at 76.38 billion US Dollars (Sadik 2012, p.12).The rate of unemployment stood at 2.4%, which was back in 2001.

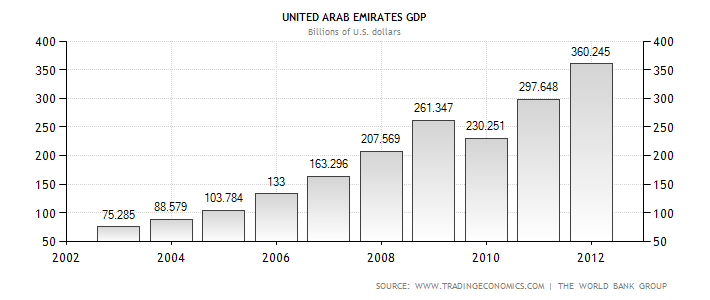

The estimated population was 5,144,648 according to July 2011 estimates (Sadik 2012, p.12).On the other hand, the GDP for Australia in the year 2010 was at 1,242.1 billion US dollars and this has steadily increased over the last two years and stands at 1,542.1 billion US dollars in the year 2012 (Sadik 2012, p.12).

The GDP per capita stood at 55,993 US dollars. This finding steadily rose to stand currently at 67,983 dollars in the current year ending December 2012 (Peevers 2010, p.12). The growth in GDPPP was 2.4% with inflation being as 2.7(Sadik 2012, p.12).

The above information can be represented graphically as below for ease interpretation

Table comparing growth in GDP (in US $ Billions)

For the last decade, the economies of the two countries have been on an upward trend as indicated by their growth in GDP. As shown in the graph, the GDP slightly dipped for both countries in the wake of the economic crisis. This however appears to have had more effect on the economy of UAE compared to that of Australia.

Graphically, the above information will appear as

Employment

The living standards of a population can also be measured from the proportion of the population that is employed in the various sectors of the economy. A higher unemployment in a country implies lower average living standards. The reverse is true. Unemployment is therefore a measure of living standards.

The more a population is unemployed, the lower the living standards. In the case of UAE and Australia, the unemployment levels are critical in determining the stronger economy for the purpose of comparison.

The statistics used are those published by the respective bureaus of statistics and the international factsheets over the countries.

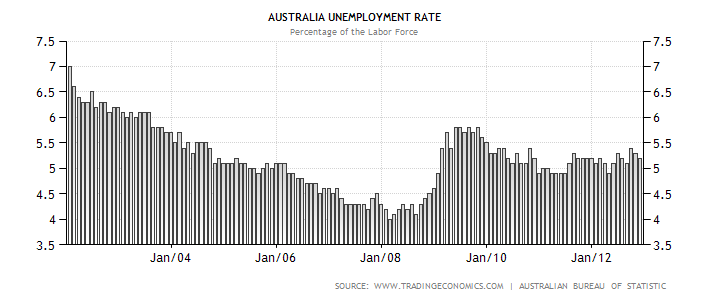

As of December 2009, the population employed stood at 10,844,000 with the rate of unemployment standing at 5.5 for the country of Australia (Country n.d., p. 2). UAE on the other hand had 3.5 million people employed in 2009. This figure was an increase from 3.3 million in the year 2008.

The rate of unemployment as stated by the UAE bureau of Statistics was 4.2% in 2009 with this being an increase from the unemployment rate in the year 2008, which stood at 4%. The unemployment rates in the emirates vary with Dubai having the lowest and Fujairah having the highest unemployment rates.

As shown by the graphs below, the unemployment rate for UAE has been increasing over the decade. This may be explained by the high immigration rates. For Australia, the unemployment rates have reduced over the decade. They only started rising in the year 2008. However, the rates have plateaued since 2010 to present.

In the labour force, a comparison would reveal that the largest percentage of workers work in the oil and mining industry in the UAE with the number being relatively lower in Australia. In UAE, trade and repair services had the highest number of people employed as of the year 2009.

This was followed by domestic services that accounted for 13.1% of all the people employed. The findings represent a slowing construction boom with the construction and maintenance serves accounting for the largest number of employees in the previous year of 2008.

As opposed to UAE, the GDP of Australia has tourism, financial services, and education making up over 60%. It is not dependent on a single sector for income or foreign exchange (Davidson 2009, p. 23). It also exports agricultural produce, minerals, and oil to markets such as China, the USA, India, Japan, and South Korea.

The country also experienced growth in the areas of mining, services sector, and property sector in the year 2010. This was at the expense of the manufacturing sector, which stagnated and remained unchanged.

The manufacturing sector has traditionally been the source of capital and a big contributor to the GDP though the trend has been steadily decreasing over the years.

Despite the rapid increases that UAE has had in the past decades, the issue of unemployment remains a significant one. There is no comparison between unemployment and economic wealth.

On the other hand, Australia enjoys high standards as more people are employed while fewer of them are unemployed. For those not in the formal employment in the country, the informal sector is also a source of employment though this is mainly not represented in the national statistics.

The unemployment rate is therefore lower for Australia than stated. Education standards compared to those in the UAE are higher. In fact, the economy is reaping the benefits due to its investment in technical subjects and its focus on innovation in schools.

The UAE has had challenges in streamlining the education sector. As such, it is in the process of investing in it to ensure there is continuity and innovation even after the oil deposits are exhausted.

Standards of Living

The living standards of a population are influenced by a variety of factors, which are also products of a variety of other factors. The standards of living in a country are also dependent on many factors in a region within the same country.

For the UAE, the living standards are different. They depend on the state in which an individual dwells. Abu Dhabi that has the largest economy has some of the highest living standards in the region with this being represented by the high per-capita in the state.

The state of Dubai also has a high standard of living with the other smaller states having comparatively lower living standards.

In general the living standards in the UAE are higher than most of the Middle East countries. In fact, it is the second after Saudi Arabia. The bulk of citizens are high-income earners with most of them being employed in the mining and the hospitality industry.

In Australia, the largest employment is in the agricultural and service industry. The standards of living are uniform compared to those in the UAE. Living standards here are also higher with the prices of basic commodities being relatively lower.

Education is readily available. A citizen can be employed more easily in the manufacturing industry. The Australian RGDI can be used as an indicator of living standards. Calculation shows that the standards of living are acceptable for an economy of its magnitude (Gregory 2011, p. 4).

By using the GDP of the respective countries, one would automatically assume that the standards of living are higher in Australia compared to the UAE. This is the case between the two countries. If a comparison through survey were made, it would emerge that the average citizen in Australia earns more in relation to the same person in the UAE.

The research used is therefore a true representation of the situation in the two countries.

Taxation

The governments of most countries in the world get their revenues through taxation. The countries of Australia and UAE are not different though they both have different taxation measures.

In the UAE, revenue is collected through taxable and non-taxable revenues, which include customs that are mainly trade and port operations, and incomes often from oil companies and foreign banks (Naceur &Labidi n.d., p. 2).

Non-taxable revenues are generated from the profits made by public enterprises and other sources (Naceur & Labidi n.d., p. 2). The country reported an increase in revenue for the year 2010. This was not equivalent to other expenditure, which was highly inflated mainly consisting of recurrent expenditures.

For the economy of Australia, taxation is done at the federal, state, and local government levels. The levels are dependent on the degree of need at each stage (Country n.d., p. 2).

The republic raises revenue from personal income and business taxes as a member of the commonwealth in addition to the excise, custom duties, and goods and services tax (GST) (Country n.d., p. 2).

In both countries, the collection of tax is efficient with measures set in place to ensure that the citizens abide. The average collection of tax is reported to be over 95% with the countries enjoying positive population growths.

However, the utilisation of the revenues collected in both countries varies with the UAE having a larger budget for recurrent expenditure. Compared to Australia therefore, the confederation has a lower utility for the tax collected.

Conclusion

Comparison between two economies is important, as it allows for application of the macroeconomic theories. In the example above, the comparison between the countries of the UAE and Australia reveals differences and similarities. In the case of the GDP, the two countries are almost at par.

Though Australia has a larger GDP, its growth has been slower compared to that of UAE. There is also a marked comparison in the per-capita GDP for both countries with Australia having one that is among the highest in the world.

In terms of the labour force, the Australian economy boasts of a larger workforce and a lower unemployment rate compared to the UAE. The inflation rates are also approximately equal appearing to have improved for both countries over the resent years.

The two economies are dependent of different sectors for survival. The Australian economy is however more diversified and not dependent on only one area but on different areas such as agriculture, manufacturing, processing, education, and the service industry.

On the contrary, the UAE economy is heavily dependent on oil exports, which form a large percentage of the revenue earned. The country however is focussed on changing this to accommodate more sectors of the economy to ease reliance on crude oil and petroleum products trade.

Taxation was also used to compare the two economies with the realisation that different taxation measures exist for the countries. Australia uses the commonwealth taxation measures at different levels of the economy. The federal government makes the largest tax collections with the states and local authorities getting the rest.

This comparison of the two economies is appropriate, as it entails two countries of different sizes that in different parts of the world having different populations and different sources of revenue. Australia emerges as the country with the higher standards of living of the two besides having a more stable and diverse economy.

References

Australia 2020 2008, Barton, Dept. of the Prime Minister and Cabinet, A.C.T.

Branson, W 1972, Macroeconomic Theory and Policy, Harper & Rowm New York.

Bychkov, T 2003, Australia, Chelsea House Publishers, Philadelphia.

Country n.d., Australia | Data.Data | The World Bank. Web.

Davidson, M 2009, Abu Dhabi: Oil and Beyond, Columbia University Press, New York.

Doing Business in the UAE 1991, Abu Dhabi, Motivate Pub.UAE.

Dornbusch, R & Fischer, S 1978, Macroeconomics, McGraw-Hill, New York.

Gregory, R 2011, Then and Now: Reflections on two Australian Mining Booms, CSES Working Paper No. 50, October, Centre for Strategic Economic Studies, Victoria University, Melbourne.

Mankiw, N 2007, Macroeconomics, Worth Publishers, New York.

McTaggart, D, Parkin, M, & Findlay, C 2003, Macroeconomics, N.S.W.: Addison-Wesley, Frenchs Forest.

Naceur, S & Labidi, C n.d, United Arab Emirates – Economy and Trade of United Arab Emirates – QFINANCE Financial resources, articles, concepts and opinions from QFINANCE – QFINANCE. Web.

Peevers, A 2010, Dubai, Lonely Planet, Footscray, Vic.

Sadik, A 2012, The global economic crisis and consequences for development strategy in Dubai, Palgrave Macmillan, Basingstoke.

Slavin, S 1996, Economics, Irwin, Chicago, Ill.

Vaisutis, J 2007, Australia, Lonely Planet, Footscray, Vic.