The policy makers who are faced with the dilemma of increasing output but maintain interest rates at the current state need to take into account both the fiscal policy and the monetary policy. The fiscal policy uses the government resources to influence demand thus, leading to effects in output of the economy (Arnold 2010). To increase output, the government will need to implement expansionary fiscal policy.

This means that the government can either choose to increase it purchases, increase its level of transfers or reduces the amount of tax for the citizens. Effects of increase in purchases and increase in transfers are more direct since they affect demand more directly.

When the government increases its level of purchases then, the level of planned expenditure in the whole country increases thus, demand for goods and services increases. Due to increase in demand there will be a deficit of goods and services in the economy and therefore firms will employ more inputs to increase supply.

On the other hand, if the government chooses to reduce the amount of taxes that are levied on the citizens then people will have more disposable income and they are likely to increase their spending. When people increase their spending demand will increase therefore increasing supply, which will in turn increase the average levels of income. As supply increases, income levels of people also increases thus pushing demand even higher.

It should therefore be noted that the increase in output is always more than the increase in government spending due to government multiplier. Due to expansionary fiscal policy the IS curve will shift to the right because of increase in aggregate demand thus increasing output (Mankiw 2011).

However, as the IS curve shifts to the right it is not the output only that increases but also interest rates and if the policymakers do not want any effect in the interest rates then LM curve should be induced to shift to the right. Expansionary monetary policy can make the LM curve to increase to the right.

The policy makers will therefore have to increase the amount of money in the economy (Froyen 2008). When the amount of money in circulation increases, the supply of money exceeds its demand and to boost the demand for money, banks have to reduce the interest rates thus making it cheaper to borrow.

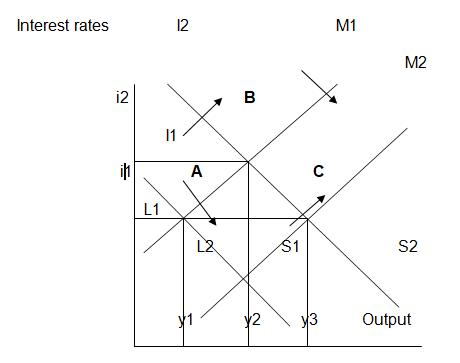

The graph above shows the effects of expansionary monetary and fiscal policy on the IS LM curve. Assuming the economy is in equilibrium at point A with interest rates i1 and output y1. An expansionary fiscal policy will cause a shift of the IS curve from I1S1 to I2S2 therefore, changing the equilibrium to point B where interest rate is i2 and the level of output is y2.

Though the level of output has increased, the interest rates have also increased. An expansionary monetary policy shifts the LM curve rightwards from L1M1 to L2M2 increasing output to y3 but reducing interest rates back to i1 and setting the new equilibrium at point C. with this set of policy mix, the policy makers will have achieved increased output with no change in interest rates.

It should be noted that, increase in money supply should take into consideration the inflation rates of the economy because price levels determine real money supply (Gordon 2008).

Demand for money is affected by various factors among them, the income level of people and the interest rates which are the prices of acquiring money. It should be noted that the quantity change in the demand for money is influenced by the elasticity of demand for money in relation to the factors that affect the demand for money.

Income elasticity of money demand is the percentage change in the quantity of money demanded due to unit change in income levels. Generally, people who have higher income levels have tend to spend more and thus demand more money for their transactions. However, it has been noted that the increase in real money demand is less proportional to increase in real income levels.

On the other hand, interest elasticity of money demand is the quantity change of demand in money due to unit change in interest rates. Interest rates are defined as, the opportunity cost of holding money and as they increase it becomes expensive to hold money.

Therefore, as the interest rates increases rate of return on securities increases and people are better off if they do not hold money. Consequently, an increase in interest rates leads to decrease in nominal demand for money because people prefer to hold non-monetary assets.

Expansionary fiscal policy increases output and therefore, income of the people while at the same time it leads to increase in interest rates. It will therefore be more effective if the income elasticity of money demand is higher than interest elasticity of money demand (Keynes 2006).

This is because the increase in demand for money to be spent will be higher than the decrease in demand for money to be invested and thus the overall effect will be increase in output. It should be noted that, the quantity of increase in aggregate demand and therefore the increase in output highly depends on the quantity decrease in investments due to the increase in interest rates and thus the cost of investing.

The increase in output that is a result of expansionary monetary policy causes an increase in interest rates which is the cost of investments (Harford 2012). This in turn leads to decrease in the amount of investments thus, reducing the quantity change in aggregate demand due to expansionary fiscal policy a process referred to as crowding out effect.

In cases where the income elasticity of money demand is less than the interest elasticity of money demand, the crowding out effect is huge to the extent that it sometimes completely eliminates the increase in output due to expansionary fiscal policy (Baumol & Blinder 2011).

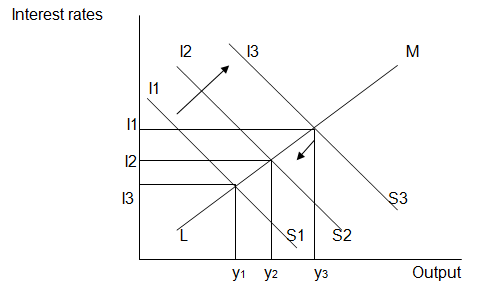

The graph above shows IS LM curve of an economy. Expansionary fiscal policy shifts the I1S1 curve to I3S3 increasing both output and interest rates. The increase in interest rates makes investment expensive while non monetary assets become cheap.

This leads to decrease in the level of private consumption and specifically investments thus causing the IS curve to shift leftwards from I3S3 to I2S2 thus reducing the actual output from y3 to y2.

It should be noted that, the leftward shift due to increase in interest rates is high when the interest elasticity of money demand is higher than the income elasticity of money demand, and in such a case it reduces the multiplier effect of fiscal policy. Therefore, the crowding out effect determines the quantity change in output due to expansionary fiscal policy and the higher it is the lower the quantity increase.

A government that operates a fixed exchange rate system is ready to increase the money supply or reduce it to maintain exchange rate at the fixed amount. The central bank dedicates monetary policy to maintaining exchange rates at the announced rate.

When an expansionary fiscal policy is pursued in an economy where exchange rate is fixed, it leads to different results compared to a situation where the interest rates are floating for example closed economy (Tucker 2008). Let us begin with a situation where the economy uses fixed exchange rates and assume perfect mobility of capital.

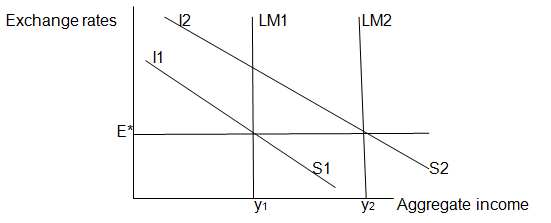

Expansionary fiscal policy will lead to increased aggregate demand hence, shifting the IS curve to the right from I1S1 to I2S2 as shown in the graph above. This will cause pressure on exchange rates to increase but since the central bank is determined to maintain exchange rate at the current level E* it buys all the foreign currency in the market resulting to increased money supply.

Increase in money supply causes the LM curve to shift to the right from LM1 to LM2 thus increasing aggregate incomes from y1 to y2. The perfect mobility of capital ensures that capital can easily be transferred to production of commodities whose demand is high.

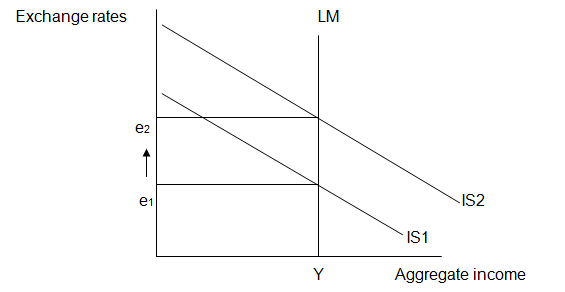

The graph above shows the effects of expansionary policy under floating exchange rate. Expansionary fiscal policy shifts the IS curve rightwards from IS1 to IS2. As a result, there is capital inflow that increases demand for local currency thus, increasing exchange rates from e1 to e2 while the aggregate income remains the same.

It is therefore depicted that in fixed exchange rate system expansionary fiscal policy has greater effects because it triggers expansionary monetary policy thus, increasing aggregate income even further. On the same note, since exchange rate is maintained constant, the problem of crowding out effect is eliminated.

References

Arnold, RA 2010, Macroeconomics, Cengage Learning, Stanford.

Baumol, WJ & Blinder, AS 2011, Macroeconomics: Principles and Policy, Cengage Learning, Stanford.

Froyen, RT 2008, Macroeconomics: Theories and Policies, Prentice Hall, Upper Saddle River.

Gordon, RJ 2008, Macroeconomics, Addison-Wesley, Boston.

Harford, T 2012, The Undercover Economist, Oxford University Press, Oxford.

Keynes, JM 2006, The General Theory of Employment, Interest and Money, Atlantic Publishers, New Delhi.

Mankiw, NG 2011, Essentials of Economics, Cengage Learning, Stanford.

Tucker, I 2008, Economics for Today. Cengage Learning, Stanford.