Introduction

United Arab Emirates (UAE) is a federal state located in the Middle East region. It is precisely found in the southeast of the Arabian Peninsula in Western Asia on the Persian Gulf and it borders Oman and Saudi Arabia (USA International Publications, 2007).

Moreover, the federal neighbors Iraq, Kuwait, Bahrain, Qatar, and Iran. UAE became a federal in 1971, and the states that make up UAE federal state include Abu Dhabi, Ajman, Dubai, Furairah, Ras al-Khaimah, Sharjah, and Umm al-Quwain (USA International Publications, 2007). Today, UAE has its capital in Abu Dhabi, which also acts as the political, economic, and social administrative center of the federal state.

The official language of the federal is Arabic, while Islam is the official religion. The form of government is a constitutional monarchy, where the current president is Khalifa bin Zayed Al Nahayan, while the prime minister is known as Mohammed bin Rashid Al Maktoum (USA International Publications, 2007).

UAE’s per capita GDP is estimated to be at par with those of leading West European nations, while the growth of economy has largely been associated with oil revenue and increasing service sector economy.

Socio-Economic Background

Before the formation of the federal states and the discovery of oil within the UAE federal, the country’s economy depended largely on subsistence agriculture, nomadic animal husbandry, extraction of pearls and the trade in pearls, fishing, and seafaring (Al-Abed and Hellyer, 2001).

During this period, the country was ‘unaware’ of oil resources and therefore, what was witnessed was limited exploitation of natural resources in the country, which later resulted into emergence and continued exercise of simple subsistence economy (Al-Abed and Hellyer, 2001).

Economic development for the country is traced to the formulation of The UAE First Development Decade, which was formulated in 1970, prior to the formation of the federal states on 2 December 1971 (Al-Abed and Hellyer, 2001).

This was the moment the federal established roadmap for the development of its formal economic, social, and political institutions and coincided with massive increase in extraction and production of oil resources. The economic growth of the country was to be boosted in 1973 when the world witnessed massive increase in oil prices, a situation that led to increased oil export by the federal state (Al-Abed and Hellyer, 2001).

Since its formation, UAE has enjoyed relative political stability, where political structures in the country appear to resonate well among the different ethnic groups in the country.

Moreover, the country’s political class has constantly tried to enhance equitable distribution of oil resources and this has led to development and high performance of social and economic infrastructure, high salaries for workers, and high standard of social services such as health and education (Al-Abed and Hellyer, 2001).

This has raised living standards in the country and effectively reducing the likelihood of internal political and social unrest. Moreover, the government of the federal since its formation has continuously promoted aspects of human rights, and this, in essence, has led to promotion and maintenance of political and social stability (Al-Abed and Hellyer, 2001).

Since its formation, UAE Federal State has been trying to promote and develop key economic sectors in the country. However, the dominant economic sector, from which the federal continues to generate high revenues, is oil, gas and mineral economy (Al-Abed and Hellyer, 2001). The country is perceived to contain vast reserves of oil, both offshore and onshore.

At the moment, UAE is believed to be drilling and producing about 2 million barrels of oil daily, although with enhanced technology, the country can produced up to 3 million barrels of oil a day (Al-Abed and Hellyer, 2001).

According to 2000 estimates, it was established that UAE has in possession around 98.8 billion barrels of oil which makes the country as the third largest oil reserves in the world after Saudi Arabia and Iraq (Al-Abed and Hellyer, 2001).

At the same time, UAE’s oil reserves are estimated to constitute 10% of overall global oil reserves as per 2000 estimates (Al-Abed and Hellyer, 2001). Given its daily production of oil, UAE’s oil reserves have been estimated to have a lifespan of around 123 years before they can be depleted.

Natural gases constitute another resource that UAE economy depends on. For example, in 2000, it was estimated that UAE has an approximately 6 trillion cubic meters of proven gas (Al-Abed and Hellyer, 2001). At the same time, it was established that the country possess about 4% of total gas reserves. As a result, UAE is ranked at position four in the entire world as far as gas production and reserves are concerned.

Daily production of gas in the country is estimated to be about 2940 million cubic feet, where if the current daily gas production is maintained, the reserves of gas the country holds will last for around 60 years (Al-Abed and Hellyer, 2001).

Other natural minerals that are vital to the economy of the country can be subdivided into three categories: rocks, sand and soils, and metals. Rocks and sand have been exploited where they are widely used in the construction industry.

Although still poorly performing, agriculture constitutes another sector to the economy, which contributes about 4% to the GDO (Al-Abed and Hellyer, 2001).

Agriculture development in the country has largely been limited with scarcity of land, harsh environmental conditions, and limited water resources (Al-Abed and Hellyer, 2001). However, the government for the last 30 years has been increasing efforts to develop agriculture sector through numerous incentives and support programmes.

Service sector is also growing as one avenue contributing to the growth of UAE economy.

Today, the country GDP has been boosted by service sector economy elements like: commerce; hospitality industry, comprising restaurants and hotels; transport sector; storage sector; communications; finance and insurance; real estates and related government services (Al-Abed and Hellyer, 2001). At the moment, it is estimated that the service sector contribute about 40% to the GDP of the country.

Oil and Gas in the UAE

In 1981, there was the establishment of the Gulf Cooperation Council (GCC), which brought together six countries of Middle East involved in the production of hydrocarbons resources (Fasano-Filho and Schaechter, 2003). The six countries that make up the GCC block include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (Fasano-Filho and Schaechter, 2003).

The countries came together with the aim of helping each other grow and progress economically. In order to achieve these economic goals, the GCC Block aimed at coordinating country members’ financial, monetary, and banking policies that was aimed at establishing a common monetary union (Fasano-Filho and Schaechter, 2003).

The countries came together largely given their commonality in aspects of politics, cultural, language, economic background, and religious aspects. Involved countries entered into agreement that aimed at cooperating in matters of economy.

One of the major achievements of the GCC Block has been realized through introduction of single currency in the GCC member states based on the commonality aspects member countries share.

The major objective for this initiative is to see member countries build on a considerable degree of monetary convergence in about ten years to come that is characterized by high degree of exchange rate stability, general low inflation rates, and co-moving interest rates (Fasano-Filho and Schaechter, 2003).

At the same time, GCC Countries as part of their cooperation set plans to integrate their stock markets, where already some attempts have been made towards this goal.

Initially, two plans were available for implementation and they included merging all the stock markets into a regional bourse and also connecting them and establishing common unified rules and regulations.

Member countries were to operate within the regulations in their individual stock exchange and this in turn was to make it possible for the citizens of the member countries to trade in stocks under similar rules (Fasano-Filho and Schaechter, 2003).

The role of this regional block to member countries can be perceived within the purviews the countries have made as far as economic integration is concerned. The preoccupations among member countries have been premised on the need to achieve economic and financial integration.

Numerous efforts have been made by member countries and such efforts include lifting formal impediments that earlier restricted free movement of national goods, labor, and capital across the countries. Subsequently, the countries have been able to develop similar policy preferences in key areas of concern.

For example, the countries have been successful in maintaining price and nominal exchange rate stability, together with an open trade regime and liberal capital flows. Moreover, the countries of GCC have been able to initiate in place an open-border foreign labor policy that aims to ensure there is sufficient supply of labor across the countries.

It should be remembered that, activities carried out by GCC countries has not just concentrated at seeing growth in hydrocarbons sector but has also accelerated efforts at initiating structural and institutional reforms aimed at encouraging diversification, enhancing non-oil growth, and also developing human capital (Fasano-Filho and Schaechter, 2003).

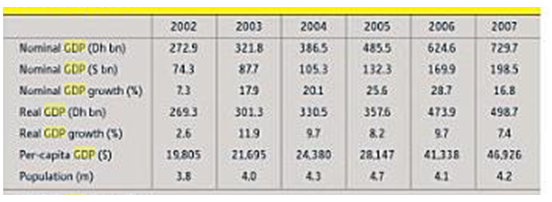

As a result of these efforts to promote common economic goals among the GCC Countries, the member countries have been able to increase their GDP per capita by about 32% especially from 2002-2007 (Saif, 2009).

Oil producing countries across the world have for a long time operated under the umbrella of the Organization of the Petroleum Exporting Countries (OPEC), which in its entity is a permanent, intergovernmental organization (OPEC, N.d).

It was established in 1960 at conference held in Baghdad where the pioneer countries of the organization included: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela (OPEC, N.d).

Later on, these countries were joined by other oil producing countries such as Libya, United Arab Emirates (UAE), Algeria, Nigeria, Ecuador, Angola, and Gabon (OPEC, N.d). Each of these countries joined at its own specific year with the earliest being Libya in 1962 while the latest to join being Angola in 2007 (OPEC, N.d).

Furthermore, countries like Indonesia and Gabon have since suspended their membership in the organization. OPEC mission is integrated in its broad objective, which is aimed at; co-coordinating and unifying petroleum policies among the member countries with sole goal of enabling the members secure fair and stable prices for their petroleum products (OPEC, N.d).

Moreover, the organization works to enhance members achieve an efficient, economic, and regular supply of petroleum to the consuming nations through the established policies to enhance efficient oil production. The policies adopted are largely aimed at ensuring the countries receive fair return on capital they have invested in the industry (OPEC, N.d).

OPEC operations and mandate in the wider environment of ‘petro-politics’ and ‘petro-economies’ has been to see oil producing countries receive benefit is for their hydrocarbons resources. In this way, OPEC has been at the forefront in advocating and leading the pace in setting oil prices at international level aimed at benefiting member countries.

Moreover, the organization is actively involved in regulating oil production among member countries through quotas and this is precisely aimed at ensuring members reap maximum benefits from their oil resources.

OPEC activities in the wider perspective have been viewed to constitute those of cartel tendencies, where the organization has actively participated in activities such as initiating pricing system for crude oil in the global market, introducing group production ceiling, initiating reference basket pricing, enhancing dialogue and cooperation between OPEC and non-OPEC countries, and ensuring oil market stability is realized (OPEC, N.d).

UAE being one of the members of OPEC has operated under the regulation of OPEC whereby the organization sets quotas for the member countries as far as oil production is concerned. Oil quotas operate as limits within which member states have to produce oil and not exceed the level or amount accepted.

Every year, OPEC reviews the oil quotas for each member state and as a regulation, each member is supposed to adhere to the set regulations.

The OPEC quotas aim at regulating oil production among member states with strength of ensuring fair competition prevail and that, members are able to receive benefits for the oil they produce. Nevertheless, in recent times, there have been concerns especially in UAE with regard to OPEC quotas where UAE believe that OPEC quota for the country has failed to reflect the size of its resources (Ayalon, 1992).

Moreover, the country believes that, concessions to other producers within the cartel were being made at its expense.

Advantages of OPEC quotas have been largely reflected in the manner member countries like UAE have been able to realize genuine revenue generated through oil production and international price stabilization but disadvantages on the other hand have effectively been manifested through limit countries have been made to operate within (Ayalon, 1992).

Non-Oil Sectors

Economic diversification in the UAE started in 1970s, specifically after the discovery that Dubai had no enough oil resources. The government therefore set in motion to diversify the economy of the federation from over-dependence on oil.

Today, UAE diversified economy is booming to an extent that average annual non-oil growth rates in the country witnessed progress from initial 3.6% between 1981 and 1990 to 7.3% between 1991 to 2000 (USA International Publications, 2007).

Much of this growth has been stimulated by a surge in trade and manufacturing as well as the evolution of the UAE finance and insurance sectors (USA International Publications, 2007).

For instance, UAE government continue to promote liberalized trade regime which is further coupled by the country’s favorable geographical location and the country has in turn evolved into a powerful financial center among the GCC Countries (USA International Publications, 2007). At the same time, the backbone of the financial system is the banking sector, which is the second largest in the GCC in terms of total assets.

Apart from the financial sector, the tourism sector in the country is booming and it plays a significant economic role in the country, especially in Dubai. Investment from the government in the last number of years has seen growth and progress of tourism sector in the country and specifically in Dubai.

Investment in the sector has been directed at developing infrastructure and enhancing advertisement and marketing of the sector, and today Dubai is one of growing centers in the world visited by large number of visitors every year.

The developments in this sector and the related sectors have continued to play positive role to the country’s GDP whereby, the overall share of non-oil GDP rose from 35% in 1980 to over 70% in 2002 (USA International Publications, 2007).

Manufacturing industries have also emerged largely sprouting from the hydrocarbon sector. For example, in Abu Dhabi and Dubai, there has been massive establishment of manufacturing industries, which specialize in the production of fertilizers and cement. Furthermore, gas products have been promoted through establishment of various industries.

Market for these products has been both at local and international market where demand has forced the concerned industries to increase and enhance their production capacity. Other areas of specialization with regard to manufacturing industry has been in the limestone and marble mining and processing which again plays critical role to the country’s economy.

Agriculture has also become another area UAE has constantly injected resources and these efforts have bore fruits. For instance, the agricultural although affected largely by poor climatic conditions in the country continue to experience remarkable results where production has continued to increase.

Furthermore, immediately the country gained independence and the first ten years saw an increase of about 200% in food production in the country where also land under cultivation increased by about 500%.

The federal government commitment to the promotion of the national agriculture of the country can be evident through increased annual budget allotment, which is estimated to be about $ 100 million every year (Peck, 1986). Further, every Emirate has been increasing its budgetary allocation to the agriculture sector a situation that has seen greater expansion and growth of agriculture.

Transport has become the key area the federal state of UAE has tried to open up its economy to local and outsider players. The country’s conviction is that presence of vibrant trade and commerce activities are the key to economic development and growth of the country.

In order to maintain contact and continued interaction with outside and local markets, the country continues to invest heavily in transport sector, which in turn has accelerated the country’s economic base.

For example, UAE has been involved in developing key transportation infrastructure projects that include Port Khalifa and industrial zone at Taweelah. In addition, there has been initiation of a mega-project (Union Railway project) which has an estimate cost of $ 8 billion (Anonymous, 2011).

The Abu Dhabi International Airport is another key project the country has heavily invested in where the cost of this project amounts to about $ 6.7 billion. More transport infrastructure that the country has heavily invested includes the expansion of the Dubai metro and construction of the Abu Dhabi metro and light rail (Anonymous, 2011).

The essence of all these transport projects is to see development of UAE economy especially through increased bilateral and multilateral trade relations. The country envision growth of economy specifically through presence of new systems construction that are largely related to multi-modal freight and intelligent supply chain management which in totality possess the ability to increase trade opportunities.

Current and future of UAE

UAE economy as it appears for now seems to be largely diversified and oil economy no longer remains the sole backbone of the country’s economy. Nevertheless, the oil revenues remain the key resources to stimulate economies of other sectors. Together with the oil economy, service economy in UAE has been thriving at a promising rate a situation that has led to growth of UAE economy (Oxford Business Group, 2008).

As more effort remains centered on improving and accelerating the non-oil sector, it can be seen that economic development of the federal is likely to continue on an upward trend. For example, in 2003 and the subsequent four year-periods, the economy of the country oscillated around 10% and Abu Dhabi was the key contributing emirate (Oxford Business Group, 2008).

Oil remains the single-most contributor to the GDP of the country, accounting for about 35% of the GDP (Oxford Business Group, 2008). Following the oil sector is the manufacturing sector, which account for about 13% to the GDP of the country.

Trade and repair is at position three where it is perceived to account for about 11% of the GDP to the economy and thereafter, real estate sector contribute about 8% to the country’s GDP (Oxford Business Group, 2008). Predicted economic growth and progress for the country remain live despite impacts of financial crises that took place recently.

The advantage the country has can be exhibited in its strong economic fundamentals, which appear to be solid and steadfast despite the financial challenges. Because of these, in 2008, it was predicted that UAE real GDP growth would accelerate by about 6.5% with potentials of reaching 7% over the next five years despite the impacts of global economic slowdown (Oxford Business Group, 2008).

Inflation remains worry- factor in the federation and in the larger GCC Countries block. This aspect has become serious to extend that there was delayed GCC monetary union. The inflation in the region can be explained by the windfall gains from high oil prices, which gave GCC Countries more cash than many of their domestic markets could handle.

As a result, inflation has gradually become the bugbear that follows the successes of every economy in the region. In 2007, UAE surpassed the psychological inflation barrier of 10%, which further translated to an increase of 11.1% rise in the price of goods and services (Oxford Business Group, 2008).

Furthermore, in 2008, report by Samba Financial Group indicated that, inflation in the UAE went into double figures that reached 11.1% while it was 11.3% in Dubai and 11.7% in Abu Dhabi, which meant that consumer price index growth could be to something closer to 20% (Oxford Business Group, 2008).

Conclusion

UAE since it got its independence has become an economic hub and its influence within the GCC region countries continue to increase. Today, UAE is one of the leading countries in the world as far as matters of GDP and per capita growth are concerned. Moreover, the country has one of the satisfied citizenry populations in the world and this can be associated to increased equitable distribution of resources in the country.

Oil and gas resources are the key aspects upon which the economy of the country is founded and for a long time, revenues from the hydrocarbons remain the backbone of GDP for the country. Nevertheless, some emirates like Dubai have been found to be less blessed with these vast natural resources and the country has in return increased efforts to diversify its economy.

As a result, today the country has diversified its economy to numerous sectors such as construction and real estate, transport, financing, agriculture, tourism, and the entire service sector. The fruits from these diversifications are numerous, with results being reflected in the continued growth of the country’s GDP.

Furthermore, it has to be noted that, growth and economic progress in the country has come about due to political stability and transparency in the distribution of resources, which in turn has enabled the government to initiate more economic strategic plans and policies.

Therefore, as much as oil and gas resources remain key to economy of UAE, it should be remembered that non-oil sector at the same time is promising and remain quite viable hence numerous investments should be directed at these sectors.

References

Al-Abed, I., & Hellyer, P. (2001). United Arab Emirates: A new perspective. London: Trident Press Ltd. Web.

Anonymous. (2011). Mission Statement: Transportation infrastructure/multimodal products and services trade mission, Doha, Qatar, and Abu Dhabi and Dubai, United Arab Emirates. Web.

Ayalon, A. (1992). Middle East contemporary survey. UAE: The Moshe Dayan Center. Web.

Fasano-Filho, U., & Schaechter, A. (2003). Monetary union among member countries of the Gulf Cooperation Council. NY: International Monetary Fund. Web.

Organization of the Petroleum Exporting Countries (OPEC). Brief History. Web.

Oxford Business Group. (2008). The Report: Dubai 2008. London: Oxford Business Group.

Peck, M. C. (1986). The United Arab Emirates: a venture in unity. NY: Taylor & Francis.

Saif, I. (2009). The oil boom in the GCC Countries, 2002-2008: Old Challenges, Changing Dynamics. Web.

USA International Publications. (2007). Doing Business and Investing in United Arab Emirates Guide. NY: International Business Publications.