Depository institutions in the United States, the European countries, and in developing countries use the electronic payment systems. Clients of depository institutions have opportunities to use electronic payment systems for electronic fund transfers with the help of CHIPS, SWIFT, and Eurogiro systems; to use different types of cards; to perform online transactions; to withdraw the e-currency from electronic wallets and accounts; to pay bills; and to use the ATM. In spite of the popularity of electronic payment systems among customers and bankers, it is important to analyze them in terms of proposed benefits and possible weaknesses. Benefits or positive outcomes include the cost-efficiency, time-efficiency, the increased customer satisfaction, the increased industry competitiveness, the diversity of services, and possibilities for using e-currency and online banking. Weaknesses are associated with the work of non-reputable systems and issues of privacy and security.

There is a tendency of increasing the scope of using electronic payment systems in the national and international depository institutions markets because listed benefits. Paper-based systems are discussed today as expensive, slow, inflexible, and requiring many resources. On the contrary, electronic payment systems can provide clients with many services and improve the functioning of depository institutions. Therefore, it is possible to state that the used electronic payment systems have the significant impact on the depository institutions markets, and their progress depends on the systems’ effectiveness and further enhancements.

Case Overview and Problem Statement

Electronic payment systems are actively used for money transferring and other transactions because they allow completing financial operations without the actual involvement of the paper documents exchange in the process. Modern electronic payment systems are presented in numerous forms, and it is possible to discuss debit, credit, and smart cards; electronic fund transfers; e-currency; and online banking as the most typical forms of these systems (Chin and Ahmad 4; Stinneford, Brown, and Davis 632). Depository institutions in the Unites States and globally are primary users of electronic payment systems of the listed types because they provide banks with opportunities to conduct instantaneous operations and transactions among accounts and other banks. As a result, more new electronic payment systems appear, proposing the wider opportunities to the clients of depository institutions (Aduda and Kingoo 109). The case is that the modern national and international depository institutions markets become more dependent on electronic payments, and this tendency is typical not only for the United States and developed European countries but also for a range of developing countries, where the banking systems begin to apply actively electronic payment approaches.

From this point, it is almost impossible to discuss the development of the depository institutions markets without analyzing the impact of electronic payment systems on them. Researchers and practitioners determine many advantages of such systems for implementing innovative strategies in banks. However, they also refer to limitations associated with the high security risks. The problem is in the fact that the exploitation of electronic payment systems tends to increase because banks refer to them as cost-effective and time-efficient methods for financial operations, and it is necessary to evaluate the actual impact of these systems on the scope of depository institutions markets. The purpose of this paper is to examine the existing literature on the problem, analyze the electronic payment systems’ benefits and limitations, and evaluate the overall impact of the systems’ integration on the development of depository institutions markets.

Methodology and Analysis of the Data

The review of the existing literature on the discussed problem is one of the typical approaches that can be used within the qualitative research methodology. In this context, the critical literature review method is effective to analyze the previous researchers’ findings in the area and determine tendencies in discussing the issue (Chin and Ahmad 4). This method of the critical literature review is selected for the current project as the most appropriate one because it provides the opportunity to overview many secondary sources and to compare the researchers’ findings regarding the electronic payment systems’ effects on the depository institutions as well as on the systems’ advantages and disadvantages. Journal articles for reviewing were searched for in such online libraries and databases as ProQuest, EBSCOHost, Science Direct, and Elsevier. The keywords used for the search were the following ones: ‘electronic payment systems’, ‘e-payment systems’, ‘electronic banking’, ‘electronic financial services’, and their synonyms. The articles were reviewed with the focus on searching and identifying factors that are important for evaluating the impact of the electronic payment systems on banks. In addition, the articles discussing the use of systems in the United States, the European countries, and the developing countries were selected.

The review of the literature demonstrates that there are factors having the positive impact on the scope of depository institutions, such as cost-efficiency; time-efficiency; the increased competitiveness; diversity of services; online banking; and e-currency. However, there are also factors that are characterized by rather negative effects on the banking systems’ development, and they include the privacy and security issues. The detailed analysis of these factors is important for conducting the overall evaluation of the systems’ impact on the depository institutions market in the United States and globally.

Cost-Efficiency

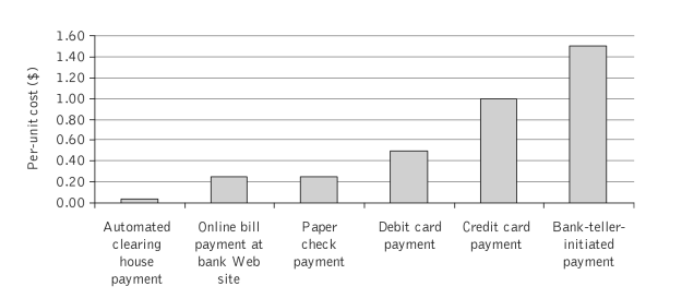

Electronic payment systems operated in banks are based on online transactions that can be discussed as rather cost-efficient for depository institutions. Hasan, Schmiedel, and Song state that banks spend less money for online transactions in contrast to paper transactions (Hasan, Schmiedel, and Song 165). In their turn, Aduda and Kingoo also accentuate the cost-efficiency of online operations noting that banks need to handle and transport the large amounts of paper documents daily in order to address the needs of individual and corporate clients, and these procedures are rather expensive (Aduda and Kingoo 110). In this context, the less expensive transaction is the automated clearing house payment and the most expensive transaction is the bank-teller-initiated payment that is almost equal in costs to the paper-based operations (VanHoose 423; see fig. 1).

Time-Efficiency and Benefits for Clients

Electronic payment systems provide depository institutors with the possibility to serve their customers quickly and in the most efficient manner while proposing online banking services and immediate transfers. According to Hasan, Schmiedel, and Song, both bankers and clients prefer electronic payment systems for their time-efficiency and possibilities to complete operations within few minutes, hours, and only few days (Hasan, Schmiedel, and Song 166). Users of banking services note that the most convenient procedures include operations with debit and credit cards provided by MasterCard and VisaCard; online banking operations; and operations with automated teller machines (ATM) actively used in the United States of America (Wali, Wright, and Reynolds 19).

The Increased Competitiveness

Nowadays, the most popular electronic payment systems utilized by depository institutions are Clearing House Interbank Payment System (CHIPS), Society for Worldwide Interbank Financial Telecommunications (SWIFT), and Eurogiro (including the European, Asian, and African countries) among others. Harris, Guru, and Avvari note that in spite of the active development of these systems, focuses on innovations, and their integration in depository institutions, the limited number of organizations and banks take the leading positions in this sphere (Harris, Guru, and Avvari 230). The reputation of banks significantly depends on the number and quality of electronic payment systems they use, and this factor influences the competitiveness (Chin and Ahmad 8).

Diversity of Provided Services

The integration of new electronic payment systems in the sphere of banking allows depository institutions to diversify the proposed services in order to attract more clients and make their experiences positive. According to AL-Adwan, AL-Zyood, and Ishfaq, today it is possible to check the accounts status online, to pay bills electronically, to make operations with the clients’ accounts online, to buy and sell stocks, to conduct operations associated with electronic transfer funds, and to use credit, debit, and smart cards among other services (AL-Adwan, AL-Zyood, and Ishfaq 16). In addition, Hasan, Schmiedel, and Song state that such diversified services as the electronic transfer funds are most important for improving the process of transferring money between depository institutions, and the opportunity for online banking and using credit and debit cards are most attractive options for clients (Hasan, Schmiedel, and Song 164).

Distant and Online Banking

Electronic funds transfers are usually used by businessmen and employees who need to receive the access to their accounts in different countries. These persons usually use the electronic data interchange services and the electronic terminals and automated teller machines (ATM) for making payments electronically or for receiving the paper currency (Chin and Ahmad 8). Other clients of depository institutions prefer the online banking when it is possible to make all such daily banking operations as paying bills online without visiting the office of the depository institution (VanHoose 424).

The Use of E-Currency

E-currency is a comparably new phenomenon in the sphere of electronic payment systems. On the one hand, as it is noted by Wali, Wright, and Reynolds, the use of e-currency can be discussed as an alternative variant to the use of traditional bank accounts because clients have electronic wallets like Skrill and such systems as PayPal (Wali, Wright, and Reynolds 18). On the other hand, the security of such operations is often guaranteed only with references to the banks that support these organizations and allow the withdrawal of money (Aduda and Kingoo 110).

The Issues of Security and Privacy

Although the use of electronic payment systems provides a lot of benefits for clients of depository institutions, they often ignore opportunities to use these methods because of the frequent cases of violating the clients’ confidentiality, privacy, and security of accounts. Omariba, Masese, and Wanyembi note that depository institutions need to resolve many cases of violation the confidentiality of personal and financial data of clients because of using electronic payment systems (Omariba, Masese, and Wanyembi 435). As a result, the level of trust for these services decreases, and customers can choose traditional banking operations or other depository institution, with the higher level of control regarding the unauthorized access to the private data (AL-Adwan, AL-Zyood, and Ishfaq 16). Another problem is the appearance of more regulations to control the privacy and security issues that are oriented to protect clients of depository institutions, but they can limit the functioning of these organizations (Harris, Guru, and Avvari 228).

Discussion of the Results

The citizens of the United States and European countries can be discussed as the first bank clients who valued the use of electronic payment systems, and today these systems become actively integrated in depository institutions markets of developing countries. In spite of the fact that there is the evidence to state that electronic payment systems are appropriate to be used for the immediate online financial exchange and that such systems influence the progress of the depository institutions markets, there are still issues that can have the negative impact on the market scope. On the one hand, electronic payment systems are effective alternatives to the traditional banking procedures, and they allow clients sent and receive money easily, for instance, with the help of SWIFT transfers (Wali, Wright, and Reynolds 19). These systems also allow the time-efficient online banking or the active use of cards and terminals for non-cash operations. Moreover, such operations as cross-border payments are mostly performed with the help of electronic payment systems. Such approaches are followed in large national and international depository institutions like Bank of America (VanHoose 420). Thus, there is a tendency of widening the scope of using electronic payment systems in depository institutions, and the main focus is on developing innovative tools that can attract more customers and decrease the level of their resistance to the use of electronic resources for banking.

On the other hand, such issues as privacy and security still remain influential to prevent many bank clients from using the advantages of electronic payment systems. While comparing the situations in the United States, in the European countries, and in developing countries, it is possible to state that these issues are more taken into account by customers in developing countries, and they prefer to choose the traditional ways to work with their accounts (Stinneford, Brown, and Davis 631). In addition, the level of the customers’ trust regarding the depository institutions’ operations decreased significantly after the financial crisis of 2008, and clients of banks in the developed countries began to use the electronic money and proposed financial services rarer (Chin and Ahmad 6; Harris, Guru, and Avvari 228). However, the situation tends to change with the focus on new alternative and time-efficient operations proposed in depository institutions.

Thus, the impact of electronic payment systems on the development of the depository institutions market can be discussed as significant because the other paper-based systems are viewed as expensive, rather slow, inflexible, and requiring significant human resources. The majority of researchers and practitioners are inclined to determine more positive effects of using the electronic systems on banks (AL-Adwan, AL-Zyood, and Ishfaq 15; Harris, Guru, and Avvari 228; Omariba, Masese, and Wanyembi 433). The reason is that such systems are necessary to provide clients with more services and improve the functioning of depository institutions while enhancing the development of the national and international banking industries and markets. The only problem is in the inefficiency of certain systems to protect their customers from violating their privacy and security rights. In order to increase the customers’ trust for depository institutions that use the electronic payment systems actively, it is necessary to integrate the most reputable systems that focus on securing the electronic or online banking transactions.

Summary and Conclusions

The majority of depository institutions in the United States and the European countries use the electronic payment systems. Clients usually use these systems to complete electronic fund transfers with the help of such systems as CHIPS, SWIFT, and Eurogiro; to complete online transactions; to use debit, credit, and smart cards; to withdraw the e-currency from the electronic wallet; to pay bills electronically; and to use the ATM and terminals. In developing countries, the integration of electronic payment systems as alternative ones to the paper-based systems is only in the process of development. However, it is possible to observe the tendency of increasing the scope for using electronic payment systems in the national and international depository institutions markets because of a range of benefits proposed with these systems. Summarizing the benefits of integrating innovative electronic payment systems, it is important to pay attention to the cost-efficiency, time-efficiency, customer satisfaction, successful competitiveness within the market, diversity of services, possibilities for online banking and work with e-currency. Nevertheless, the development of these systems can also affect the depository institutions negatively because there are many cases when customers’ accounts and transactions cannot be secured as well as their private or confidential information.

As a result, only a few organizations like PayPal, CHIPS, SWIFT, and other similar companies dominate the international depository institutions market in terms of providing services associated with the electronic payment transactions. In this case, the market can develop further mostly in relation to proposing more services and secure environments for customers. The progress of leading electronic payment systems is important to increase the financial flows in depository institutions and serve a larger number of clients. Therefore, it is possible to state that the currently used electronic payment systems have the significant impact on the banking industry, and the progress of depository institutions depends on how effectively these systems will develop to address security and privacy issues and to serve more customers’ needs.

References

Aduda, Josiah, and Nancy Kingoo. “The Relationship between Electronic Banking and Financial Performance among Commercial Banks in Kenya.” Journal of Finance and Investment Analysis 1.3 (2012): 99-118. Print.

AL-Adwan, Minwer, Mahmoud AL-Zyood, and Mohammad Ishfaq. “The Impact of Electronic Payment on Saudi Banks Profitability: Case Study of SADAD Payment System.” International Journal of Research and Reviews in Applied Science 1.2 (2013): 14-21. Print.

Chin, Lai Poey and Zainal Arffin Ahmad. “Consumers’ Intention to use a Single Platform E-Payment System: A Study among Malaysian Internet and Mobile Banking Users.” Journal of Internet Banking and Commerce 20.1 (2015): 1-15. Print.

Harris, Hezlin, Balachander Krishnan Guru, and Mohan Avvari. “Evidence of Firms’ Perceptions toward Electronic Payment Systems (EPS) in Malaysia.” International Journal of Business and Information 6.2 (2011): 226-245. Print.

Hasan, Iftekhar, Heiko Schmiedel, and Liang Song. “Returns to Retail Banking and Payments.” Journal of Financial Services Research 41.3 (2012): 163-195. Print.

Omariba, Zachary, Nelson Masese, and Gail Wanyembi. “Security and Privacy of Electronic Banking.” International Journal of Computer Science Issues 9.4 (2012): 432-446. Print.

Stinneford, Ryan, Laura Hobson Brown, and Candace Modlin Davis. “Current Developments in Bank Deposits and Payment Systems.” The Business Lawyer 65.2 (2010): 629-643. Print.

VanHoose, David. E-Commerce Economics. New York: Taylor & Francis, 2011. Print.

Wali, Andy Fred, Len Tiu Wright, and Paul Reynolds. “Cashless System, Users’ Perception and Retail Marketing Performance.” International Journal of Sales, Retailing and Marketing 3.4 (2014): 17-32. Print.