Emirates NBD Bank’s Description

Emirates NBD Bank was formed in 2007 when the National Bank of Dubai and the Emirates Bank International merged. The bank’s website is www.emiratesnbd.com. The website is a convenient portal from where the bank’s customers from diverse countries (i.e. the United Arab Emirates, Saudi Arabia, Egypt, Singapore, Qatar, the United Kingdom, Indonesia, China and India) contact the bank and inquire more about the services that Emirate NBD offers. (Emirates NBD 2014a).

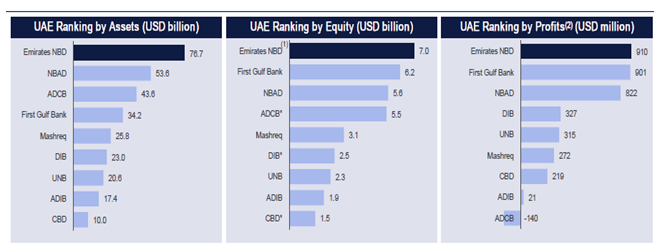

Notably, Emirates NBD has more than 9,000 employees from 70 nations across the world (Emirates NBD 2014a). Emirates NBD ranks first among other UAE banks by assets, equity and profits. Its competitors include First Gulf Bank, the National Bank of Abu Dhabi (NBAD), Abu Dhabi Commercial Bank (ADCB) and Mashreq among others (see figure 1 below). By 2008, it had 20 percent market share in the UAE (Ajman 2014)

At the apex of Emirate NBD’s management is the Group CEO. Middle and lower managers include the Group Chief Operating Officer (COO), the General Manager (GM) Human Resource, GM Risk, GM Retail Banking and Wealth Management, GM International, Chief Financial Officer (CFO), GM Internal Audit, CEO Tanfeeth, Group Treasurer and Group Secretary, in that order.

Innovation Policies and strategies at the company

The Business Dictionary (2014, para. 1) defines an innovation strategy as the “plan made by an organisation to encourage advancements in technology or services”. An innovation policy is however not specifically defined in literature. From the word policy, however, one can infer the meaning of innovation policy as the course of action that an organisation takes in relation to the use of innovations.

From Emirate NBD’s website, it is clear that the bank has a course of action to take and plans to follow in the adoption and utilisation of innovations. The bank, for example, indicates its commitment to give “customers innovative services” through the provision of cutting-edge technology (Emirates NBD 2014b, para. 3).

An example of one such innovative service was the electronic initial public offering (eIPO), which Emirates NBD offered during the recent Emaar Malls IPO which took place on September 14, 2014 (Emirates NBD 2014b; Gulf News 2014).

Another innovation by the bank was the interactive automated teller machine (ITM) (see appendix A), which was praised as a ‘game changing innovation’, (Cabral 2013, p.1). The ITM is also fraud-proof since it verifies the customer’s identity before processing any transaction, and can also take 30 cheque deposits from one customer at a time (Cabral 2013). The ITM is of specific interest to this paper because it arguably combines product and process innovations to provide bank customers with an experience that is not only satisfactory, but effective too.

Product innovation is defined as “a good or service that is significantly improved”, while a process innovation is defined as a “new or significantly improved production or delivery method” (Organisation for Economic Co-operation and Development (OECD) 2014, para. 1-2).

Arguably, the new ITM provides an innovative product and process to consumers because the interactive component means that it is a better product, through which customers are able to access better services. The process innovation is evident from the enhanced user experience that customers have on the new machine. Specifically, customers can now get help when they need it from online customer attendants.

While the ATM is not an entirely new technology, interactive ATM’s are a relatively new concept especially in the UAE and other parts of the developing world (Cabral 2013). As Campbell, Stonehouse and Houston (2002) indicate, innovation can take the form of modifying a product in order to make it more effective or efficient to the people it serves.

Emirate NBD has used the open innovation model described by Chesborough and Crowther (2006), Scotchmer (2005) and Smith (2010) as the use of external and internal ideas for purposes of enhancing technology. According to Cabral (2013), Emirate NBD partnered with the NCR Corporation to develop the ITM, hence suggesting that both internal and external ideas were used. Interestingly, when it was first launched, the ITM was the first of its kind in the UAE and the bank had installed it for trial purposes. Cabral (2013) indicates that many more such ITMs will be rolled out if users respond positively.

Recommendations

Among the most impressive qualities of Emirates NBD is its recognition that there are different sources of innovative ideas. As such, the bank does not limit itself to ideas generated in its internal work environment; rather, it partners with external stakeholders who have non-competing business interests, and through such partnerships, makes its innovative strategies a success.

Another of Emirate NBD’s impressive qualities is its willingness to follow the innovation stages to the full. For example, it would have been tempting for the bank to skip the pilot testing stage of the ITM by engaging in full scale manufacturing and launch. The bank would have done that especially since initial responses indicated that the ITM would be a success.

However, soberness in the bank prevailed and it made the reasonable choice of testing the ITM first. The bank even indicated that installing similar machines would depend on how consumers would respond to the pilot test. The foregoing position is indicative that Emirates NBD understands that all its innovations must be accepted by the customer first, because they (innovations) are meant to enhance the customers’ experience.

The central place that the consumer occupies in innovation is discussed in numerous literature sources which include Berkun (2010), Narayanan and O’Connor (2010), Ziamou and Veryzer (2005) and Ziamou and Ratneshwar (2003) among others.

As a recommendation, Emirates NBD bank should consider partnering with external stakeholders in future, but should also not ignore the innovative potential that is held by its culturally diverse workforce. As Berkun (2010) indicates, people (and especially employees) can be more innovative if they are given the right motivators, tools and environment to be creative and innovative.

References

Ajman, A 2014, ‘Emirates NBD bank Dubai’. Web.

Berkun, S 2010, The myths of innovation, O’Reilly Media, Newton, MA.

Business Dictionary 2014, ‘Innovation strategy’. Web.

Cabral, A 2013, ‘Emirates NBD’s ITM seem to be a game-changing innovation’, Khaleej Times. Web.

Campbell, D, Stonehouse, G & Houston, B 2002 Business strategy: an introduction, 2nd edn, Butterworth Heinemann, Oxford.

Chesborough, H & Crowther, A 2006, ‘Beyond high tech: early adopters of open innovation in other industries’, R&D Management, vol. 36, no.3, pp. 229-236.

Emirates NBD 2014a, ‘About Emirates NBD. Web.

Emirates NBD 2014b, ‘Emirates NBD enables UAE’s first eIPO on ATM and online banking channels’.Web.

Gulf News 2014, ‘Emirates NBD to allow Emaar Malls IPO subscription via ATM’. Web.

Narayanan, V & O’Connor, G 2010, Encyclopaedia of technology and innovation management, Wiley-Blackwell, London.

Organisation for Economic Co-operation and Development (OECD) 2014, ‘Defining innovation’. Web.

Scotchmer, S 2005, Innovation and incentives, MIT Press, Cambridge.

Smith, D 2010, Exploring innovation, 2nd edn, McGraw-Hill Education, Columbus, OH.

Ziamou, P & Ratneshwar, S 2003, ‘Innovations in product functionality: when and why are explicit comparisons effective?’ Journal of Marketing, vol. 67, no.2, pp. 49-61.

Ziamou, P & Veryzer, R 2005, ‘The influence of temporal distance on consumer preferences for technology-based innovations’, Journal of Product Innovation Management, vol. 22, no.4, pp. 336-346.