Introduction

Company background

- Enron was established in 1985 in the US energy industry.

- The firm was formed out of a merger between InterNorth and Houston Natural Gas .

- The firm owned an extensive network of pipeline.

- Enron invested in a rapid expansion strategy during the 1980s and 1990s.

- Areas of operation; risk management, financial services, hedging services, weather products.

- Energy businesses; rude oil, liquefied petroleum gas, physical natural gas, crude oil and electricity.

- The firm also diversified in internet-based systems and bandwidth.

- The firm positioned itself as the leading employer and innovator.

- Enron’s success during the 1980s and 1990s can be linked to its creation of a diverse energy related products.

- Enron Corporation achieved an optimal market position in the US energy sector.

- The firm controlled over 25% of the total US energy market.

- Its growth led to significant improvement in its total market capitalisation from $2 billion to $70 billion between the 1980s and 2001.

- The firm’s consolidated revenue increased to $101 in 2000.

- Enron was ranked 7th amongst the Fortune 500 companies.

- Despite its success, Enron filed for bankruptcy in 2001 and laid off over 4,000 employees.

- The firm’s failure is associated with accounting irregularities.

- Its share price declined by $95 to less than $1 in 2002.

Enron Corporation was company from the United States of America that was established in 1985 in the US energy industry. The company was formed through a merger between InterNorth and Houston Natural Gas. Its headquarters were located in Houston, Texas. Initially, the company operated a network of oil pipelines across different states in the US. It is estimated that the company’s oil pipeline network covered 37,000 miles.

The company invested in a major diversification strategy during the 1980s and 1990s, which led to its establishment in different energy markets. One of the markets in which the firm traded in include risk management and financial services market by offering different services such as foreign exchange risk management, hedging services on energy prices and weather patterns. Its energy business entailed trade on diverse energy commodities and products such as crude oil, liquefied petroleum gas, physical natural gas, crude oil and electricity.

On the other hand, its electronic commerce business entailed provision of internet-based transactions systems and bandwidth. Moreover, the firm also expanded its operations into other non-energy sectors such as trading in water resources and metals. The firm’s expansion arose from its focus in taking advantage of the prevailing market opportunities especially in energy markets, which were increasingly being privatized and deregulated (Allan et al., 2002).During the 1980s, the company was considered as the leading employer and innovator. The company became a role model with regard to showing other firms how they can benefit from restructuring their operations 25% of the US gas business.

Its success in the energy sector motivated the firm’s management to start creating a myriad of energy-related products. In the 1990s, Enron positioned itself as a key player in the US energy industry. The firm controlled over 25% of the industry. The firm’s market capitalisation increased significantly from $2 billion to $70 billion between the mid-1980s and early 2001. Its consolidated revenues in 2000 were estimated to be $101 billion, which made the firm to be ranked number 7 amongst the Fortune 500 companies. By December 2000, Enron Corporation total shareholders’ amounted to 58,920. Enron was considered to be America’s biggest company. Many investors had considered purchasing the company’s shares. For example, the company’s share price increased remarkably hence making it to be an attractive investment option. Enron also ventured into the UK market and positioned itself as the first foreign company in the energy sector (Enron, 2002).

Despite its success during the 1980s and 1990s, Enron Corporation filed for bankruptcy on 2nd December 2001. Subsequently, the firm laid-off 4,000 of its employees through voice mail. Enron’s failure is considered as one of the biggest corporate failures in the American history.

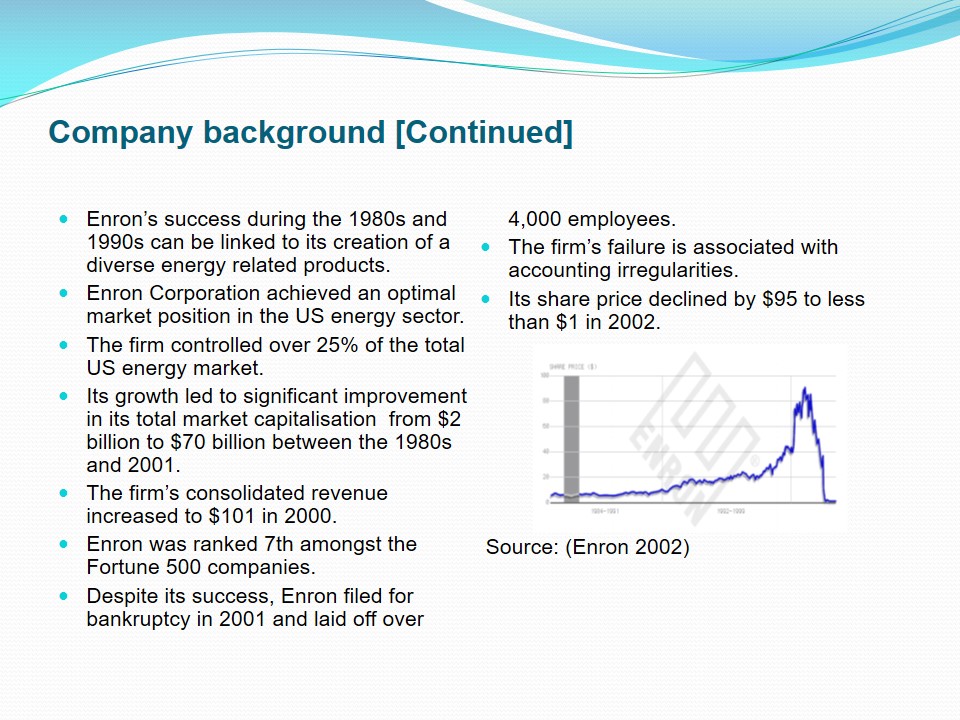

The firm’s top executives Clifford Baxter and Jeff Skilling resigned under controversial circumstances. In August 2001, Sherron Watkins revealed the accounting irregularities in Enron, which led to a $ 4 drop in the company’s share price. More irregularities in the company’s operations were revealed, which made investors to panic hence selling their shares. Furthermore, the company’s decision to file for bankruptcy, led to a $ 95 decline in the company’s share price to less than $ 1. The chart below illustrates the trend in the company’s share price since its inception (Enron, 2002).

Unethical behaviour in Enron

- Enron’s unethical behaviour illustrates the firm’s failure in corporate governance.

- Some of the unethical behaviours in the company include;

- Formation of Special Purpose Entities [SPEs];

- Manipulative accounting practices;

- Enron entered over 3,000 SPEs in an effort to achieve economic benefit.

- The SPEs enabled the firm to obtain finance, share risks, undertake research and development, and collateralise its assets.

- Enron began using the SPEs illegally and concealing material information to shareholders.

- The firm started investing in unusual hedging schemes.

- Enron engaged in off-balance sheet trading:

- The firm did not report all its liabilities in its financial reporting.

- The top management rewarded themselves large sums of money.

- Enron also used the SPEs to by-pass losses to its partners and record the amount received as profit despite the fact that some investments were not operational.

- The firm colluded with some investment banks such as JP Morgan Chase, and Credit Suisse First Boston in concealing its debts.

- Enron adopted sophisticated accounting practices such as Aggressive Earning Management method to conceal its true financial position.

- Collusion with Arthur Andersen:

- Enron collapse can also be associated with its dealings with Arthur Andersen, its external auditor.

- Enron corrupted external auditors by paying them large amounts of money in order to conceal its true financial position (approximately $52 million).

- Subsequently, Enron tampered with the independent reporting of external auditors.

- Arthur Andersen destroyed available evidence by shredding accounting papers after the revelation of Enron’s scandal.

- Collusion with authorities:

- Enron colluded with politicians in order to influence the regulatory agencies.

- The firm made handsome contributions to certain members in the Congress; For example, Enron made political donations amounting to $97,350 to Senator Phil Gramm, a member of the United State Congress

- The firm’s management team also made contributions to support political campaigns especially during the Bush Administration; Kenneth Lay, Enron’s Chief Executive Officer, Board Member and Enron’s Chairman contributed $500,000 to support the Bush campaign.

- Involvement with authorities led to political influence in regulatory agencies ability to undertake their duties.

Enron’s failure is associated with lack of adherence to corporate governance concepts as stipulated in law. Allan et al. (2006) argue that corporate governance is a critical aspect in strengthening an organisation’s long-term survival. First, effective implementation of corporate governance minimises the likelihood of various white-collar crimes such as fraud among others. Furthermore, implementing effective corporate governance policies aids in strengthening organisational culture by promoting development of honesty and high ethical standards among employees.

Formation of SPEs and manipulative accounting practices

Enron’s failure is associated with proliferation of unethical practices amongst the organisation’s executive (Thomas, 2002). The firm invested in a comprehensive expansion program during the 1990s, which led to its establishment in different economic sectors. Additionally, the firm entered into over 3,000 Special Purpose Entities [SPEs] with the intention of undertaking various projects for example research and development. According to Arnold and Lange (2004), SPEs are legal instruments, which are developed with the purpose of assisting an organisation attain economic benefit.

Arnold and Lange (2004) assert that SPEs “enable an organisation to collateralise its assets, share risks and obtain more favourable financing” (p.754). Integrating SPEs in its operation enables an organisation to increase its return on assets and leverage without reporting its debt on the financial statement. Arnold and Lange (2004) assert that Enron started using SPEs illegally to avoid risks in such a way that stakeholders could not note. In 1999, Enron started developing its own SPEs, which were associated with unusual hedging schemes.

Furthermore, the company started engaging in off-balance sheet trading by failing to report all its liabilities in its financial records. Moreover, the firm used SPEs in its off-balance sheet financing process, which has become a common practice amongst businesses. The firm’s top management who were involved in arranging the SPEs would reward themselves hefty investment returns.

McLean (2001) asserts that the “partnerships established by the SPEs enabled Enron to by-pass the losses incurred to in forms of ‘assets’ to the small organisations” (p.3). Subsequently, Enron would record the money received out of the partnerships, as profits in its financial records despite the fact that some of the investments were not operational. Therefore, the SPEs were used in enhancing manipulative accounting practices.

Enron also undertook partnerships with various investment banks such as JP Morgan Chase and Credit Suisse First Boston (CSFB). CSFB played a significant role in enhancing Enron’s ability to establish controversial partnerships. Enron in partnership with CSFB formed a team referred to as ‘Structured Products Group’, which was charged with the responsibility of engineering the partnerships. Enron included Andrew Fastow [Enron’s ex-Chief Financial Officer] as one of the team members with the sole intention of assisting the company in concealing its unprofitable assets.

In addition to the above, Enron ensured that stakeholders did not reveal the firm’s true financial position. This was achieved by adopting various sophisticated accounting techniques. An example of such techniques includes the Aggressive Earning Management [AEM]. The firm’s decision to adopt this method was to ensure that its stock price remained high.

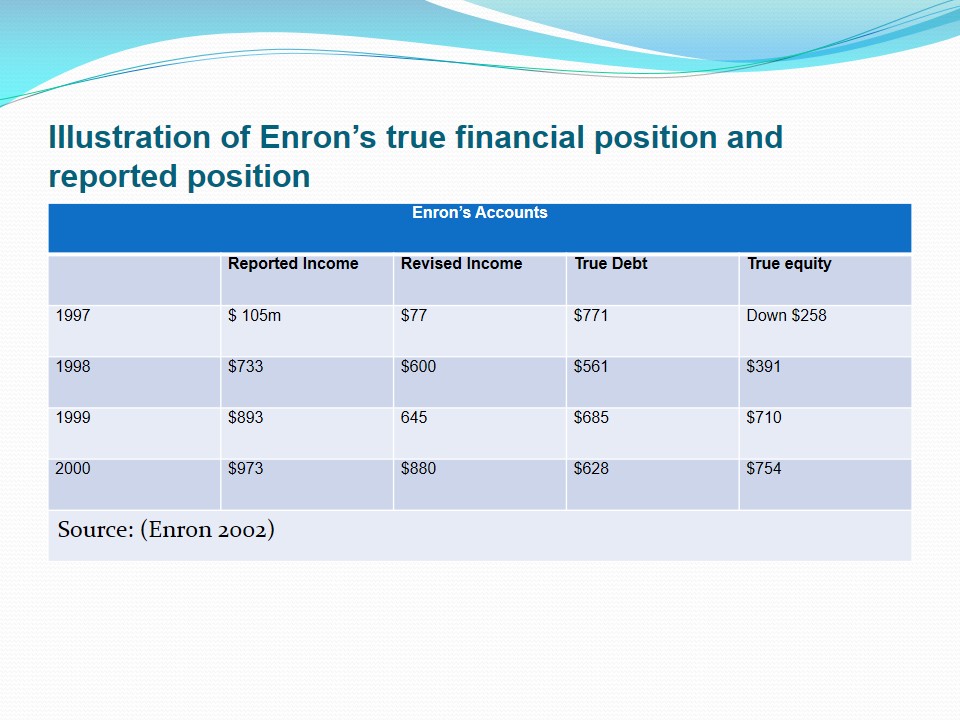

Additionally, Copeland (2003) argues that this technique was also used in order to assist Enron “raise investment against its own assets” (p.9). Adopting the aggressive earning management technique made it difficult for Enron to undertake full disclosure of its financial accounts because of the complexity involved. The process involves complicated procedures and protocols and given that the involved parties wanted to engage in disclosure irregularities, they deemed it unnecessary to carry out the procedure. The chart below illustrates a sample of the degree to which Enron engaged in financial disclosure irregularities for four years.

Enron’s manipulative accounting practices led to significant improvement in its credit rating. Unfortunately, these ratings were faulty, but the involved parties wanted them to be so by design. The major rating agencies such as Fitch IBCA, Standard & Poor’s, and Moody’s did not identify any irregularities in the firm’s accounting practices. Subsequently, the firm was in a position to keep off debts from its financial statements. Investors continued to consider Enron as a perfect investment vehicle.

The company’s high growth rate during the 1990s through its investment in different sectors required the firm to have a strong financial base. In an effort to meet its financial requirement, Enron continued borrowing from banks in order to meet its financial requirements. However, the firm did not report the amount borrowed in its financial reports. Subsequently, the company created the perception of being a highly successful company. Arnold and Lange (2004) assert the company’s overdependence on credit finance made Enron to be highly leveraged.

Enron’s collapse can also be traced back to its association with Arthur Andersen, its main auditor and collusion with some of Wall Street’s staff. Arthur Andersen is ranked amongst the leading accounting firms in the world. Allan et al. (2002) emphasise that external “auditors are charged with the responsibility of ensuring that an organisation’s financial reports adhere to the set accounting standards” (p. 34). Thus, their report should present the true financial picture of an organisation hence providing the relevant stakeholders with insight on an organisation’s performance.

Moreover, external auditors should be independent in executing their duties. Independence is the only reason that justifies the existence of external auditors. Moore et al. (2004) assert that assurance of independence is critical in improving the credibility of financial reports hence their relevance to the various stakeholders. Despite the fact that organisational managers have powerful incentives that can lead to an organisation’s failure to report the actual financial position, external auditors should protect organisation’s financial statements from such vices (Moore et al., 2004). Arthur Andersen did not undertake a free and free auditing of the firm.

The auditor’s failure to present Enron’s true financial position was necessitated by the existence of poor organisational culture, which did not advocate adherence to ethical code of conduct. In an effort to conceal the organisation’s true financial position, Enron paid Arthur Andersen a large amount of money (approximately $52 million). After the revelation of the prevailing scandal in Enron by the US government, the Securities Exchange Commission announced its intention to investigate the company’s involvement in speculative activities. In an effort to conceal the truth, David Duncan, Arthur’s chief auditor issued an order for thousands of financial documents to be destroyed.

Enron’s commitment to exploit the prevailing market opportunities motivated the firm to seek expert advice from Wall Street, a renowned financial services company in order to improve its effectiveness in making decision. Wall Streets’ financial advisors were required to conduct a comprehensive financial analysis of Enron in order to illustrate its true financial position (Allan et al., 2002).

In an effort to propel its unethical accounting practices, Enron made hefty contributions to politicians in an effort to influence the authorities from revealing the actual financial position of the firm. For example, between 1989 and 2001, Enron made political donations amounting to $97,350 to Senator Phil Gramm, a member of the United State Congress. Furthermore the firm made political contributions to various organisations and groups, which its directors were affiliated to.

A report released by the United State Centre for Public Integrity shows that Kenneth Lay, Enron’s Chief Executive Officer, Board Member and Enron’s Chairman contributed $500,000 to support the Bush campaign. This contribution was considered to be the largest single contribution, which made Enron a patron in the Bush Administration. The firm also established strong affiliations with individuals in the Bush Administration.

Allan et al. (2002) assert that Enron’s officials had established close links personal, political, financial and social links with various levels of the Bush Administration. It is reported that over 35 officials within the Bush Administration had invested in Enron’s shares. Additionally, Enron had hired some of the government’s officials as consultants. The strong association with the government authorities favoured Enron Corporation oil exploration and drilling despite the resistance from various environmentalists. Subsequently, one can assert that both the directors and the regulatory authorities were not able to undertake their duties because of existence of conflict of interest.

Reflection on ethical standards

- Firms management teams have an obligation to foster ethical standards in the organisation.

- Enron’s management team should have adhered to the set ethical codes of conduct.

- The company’s top management team violated the ethical code of conduct by hindering the independence of external auditors.

- Furthermore, the top managers propagated conflict of interest by concealing material information, through failure to disclose the firm’s true financial position.

- Enron’s top management enhanced corporate fraud through lack of total disclosure.

- Enron should have incorporated a comprehensive internal and external communication strategy.

- The company’s failure to disclose material facts can affect investors who rely on financial reports in making their decision.

- The agency relationship between Enron’s top managers and shareholders required Enron managers to act in the best interest.

- Enron’s executives acted unethically by concealing material information.

Organisations’ management team have an obligation to foster compliance of ethical standards in firms operation. One of the ways through which this can be achieved is by implementing ethical code of conduct, which should define how the organisation should operate and deal with external stakeholders. Implementing ethical standards plays a critical role in enhancing corporate governance in an organisation. Arnold and Lange (2002) assert that an organisation can ensure ethical operations by implementing a number of ethical values.

In the course of its operation, Enron had implemented a comprehensive code of ethics, which include excellence, effective communication, integrity and respect. However, the company’s top management violated these ethical values, which illustrates significant failure in its corporate governance structure. First, the company’s interference with Arthur Andersen hindered the external auditors’ ability to report objectively. Arnold and Lange (2004) are of the opinion that firms’ management teams should avoid engaging in activities that can lead to conflict of interest either perceived or real in order to maintain objectivity. Engaging in conflict of interest can create an environment, which can stimulate occurrence of corporate fraud.

Additionally, perceived conflict of interest can adversely affect the reputation of stakeholders’ charged with the responsibility of fostering corporate governance.

As a public company, Enron was required to ensure full disclosure of its financial situation through financial reports. One of the ways through which the firm can achieve this is by integrating an effective communication strategy. Arnold and Lange (2002) are of the opinion that it is imperative for organisation’s management teams to ensure that all material information is revealed to the relevant authorities.

Failure to disclose all material facts can affect the consumers of financial reports especially in cases where rumors of misappropriation or malpractices are rife. For example, investors mainly rely on financial reports in making their investment decision. In the course of its operation, Enron misled the public by inflating the price of its share. Consequently, most investors relied on the ‘attractive’ financial report in purchasing the company’s shares and bonds. Additionally, external financiers such as investment banks relied on the financial reports in making advancing loan to Enron. Thus, the company’s collapse adversely affected these companies. Enron’s failure to disclose its true financial position illustrates a classic case of decadence in the company’s commitment to ethical standards. The company’s failure to comply with the generally accepted accounting principles further illustrates the company’s ethical failure.

The agency relationship between the Enron’s managers and shareholders required the top management team to act in the shareholders’ best interests as companies work towards fulfilling the shareholders’ needs. However, the top management team involvements in dishonest dealings shows lack of concern for others well-being. The firm’s executives put the shareholders and employees in harms-way despite their knowledge. In order to minimize such instance, Enron should have ensured that stakeholders were adequately informed of the firm’s operations. One of the ways through which the firm should have achieved this is by ensuring constant communication to stakeholders such as shareholders on the firm’s activities. Thus, investors would have made their decision on the basis of the firm’s material information.

Influence of leadership

- Leadership is critical in the long-term success of an organisation.

- The prevailing agency relationship between organisational managers and shareholders requires managers to integrate effective leadership in order to protect the shareholders interests.

- Enron leaders engaged in poor leadership by engaging in conflict of interest.

- Leaders influenced Enron’s failure by fostering information asymmetry.

- The company’s leaders undertook major strategic shift in the company’s operations during the 1990s without making the necessary adjustments in the Enron’s organisational culture.

- The organisational leaders did not enhance a culture of truthfulness amongst employees.

- Poor leadership enhanced bureaucratic tendencies and conflict of interest amongst organisational leaders.

- The leaders also corrupted external auditors by bribing them to conceal the firm’s true financial position.

Organisational leadership is a fundamental element in the long-term success of an organisation. Subsequently, organisational managers should be focused towards integrating effective leadership strategies. The need to ensure effective leadership arises from the existence of agency relationship between the shareholders and the managers. This means that the shareholders do not have say in the day-to-day operation of the company. Subsequently, managers have an obligation to act in the best interest of shareholders. One of the ways through which this can be achieved is by maximising the shareholders’ wealth, which can be attained by increasing the organisation’s share price. Furthermore, organisational leaders should not engage in activities that amount to conflict of interest, which amounts to agency problem.

Li (2010) asserts that organisational leaders should focus on fostering effective corporate governance. Enron’s collapse illustrates failure in the company’s effort to implement effective corporate governance strategies. Organisational managers engaged in corporate fraud by investing in projects that were aimed at increasing their earnings at the expense of the shareholders. For examples, Enron’s managers ensured that the company’s profits were over-stated in order to increase their earnings. Consequently, the organisation’s leaders influenced the company’s operations by creating asymmetric information problem within the company.

Arnold and Lange (2004) assert that information “asymmetry occurs where management (agents) have competitive advantage of information within the company over that of the owners (principals)” (p. 754). Subsequently, the company principals [shareholders] do not have the capacity to control the activities of the agent in order to achieve the desired outcome.

During the 1990s, Enron undertook major strategic shifts in its operations by investing in different sectors of the economy. The company intended to establish itself as a fast-moving, innovative firm. The company succeeded in becoming an entrepreneurial and risk-taker. Moreover, the company managed to position itself as a global company. However, the company’s management team did not make any adjustment on the organisation’s culture in order to support the company’s new strategic goals. Its leadership structure was characterised by bureaucratic tendencies, which limited formation of an efficient organisational culture.

Enron’s leaders did not promote truthfulness as one of the key elements in promoting corporate governance. Arnold and Lange (2004) are of the opinion that the existence of opportunistic culture in Enron led to development of a culture of minimal information disclosure and secrecy. Enron’s leaders created an environment whereby the various internal and external stakeholders could not understand underlying economic situation of the company. This led to lack of full disclosure in the company’s financial reporting. For example, the organisations CEO informed the employees that the company’s share price would rise significantly. However, he did not reveal his intention to dispose his shares.

Enron’s leaders had significant influence on the company’s failure, which is evidenced by the prevailing conflict of interest. Li (2010) asserts that lack of “independent oversight of management by Enron’s board contributed to the firm’s collapse” (p.38). Furthermore, the organisation’s leaders propagated conflict of interest in the company’s financial reporting process. For example, Arthur Andersen Company doubled as Enron’s external auditor and a consultant. Furthermore, organisational leaders paid Arthur Andersen handsomely in order to conceal the unethical practices in the firm. Subsequently, the leaders tampered with the auditor’s independence (Li, 2010).

Impact on stakeholders

- Enron’s scandal affected various stakeholders such as regulators and investigators, employees, shareholders , creditors.

- The scandal damaged the reputation of various regulatory agencies and investigators such as the

- Securities Exchange Commission,

- The Commodities Futures Trading Commission [CFTC].

- Federal Energy Regulatory Commission [FERC].

Employees and shareholders:

- Over 4,000 employees lost their job.

- Thousands of employees had purchased shares in Enron through the firm’s pension plan.

- The employees were restricted from disposing their shares.

- The decline in the firm’s share price made employees to lose substantial amount of their investment in the company’s pension plan.

- The firm’s collapse also affected Arthur Andersen’s employees, which laid-off a number of its employees.

- It is estimated that Enron’s shareholders lost over $60 billion.

Regulators and investigators

The Securities Exchange Commission

SEC is charged with the responsibility of maintaining stability of the US financial market. SEC intends to position itself as the best market regulator in the world by ensuring strict adherence to accounting standards such as disclosure in order to protect the investors. Enron (2002) asserts that SEC’s “main role is to ensure that investors have accurate information about companies and that companies do not deceive investors or manipulate the market price of their shares” (p.15).

Despite SEC’s knowledge of Enron’s unethical practices such as mismanagement and potential fraud, the commission did not do much to avert the potential crisis. SEC was criticised of failing to investigate Enron’s operations from 1997.

Subsequently, SEC’s credibility as the leading market regulator amongst investors and the public was adversely affected. In its defence, SEC argued, “Enron’s accounts were impenetrable to regulators, since its core business, energy trading, was only lightly regulated by another set of government agencies, which exempted it from many reporting requirements” (Enron, 2002, p.15). However, the US government has given SEC powers to punish companies that violate the accounting standards.

The Commodities Futures Trading Commission [CFTC]

The CFTC was charged with the responsibility of regulating the derivative and futures markets in the US. The firm was supposed to monitor Enron’s derivatives. CFTC adopted ‘light-touch’ in its regulatory process.

Federal Energy Regulatory Commission [FERC]

Enron’s scandal affected FERC’s reputation. FERC was required to oversee the operation of firms in the US energy sector by ensuring that the price paid on energy products such as electricity, gas and oil were fair. The adoption of the deregulation policy in the US energy sector increased the mandate of FERC. However, the FERC failed by not taking an in-depth analysis on the operations of Enron.

Employees – During the 1990s, Enron Corporation was considered as the top employer in the United States, which was a recommendable thing. During the period ranging between 1985 and 2002, Enron’s total human resource base had increased from 15,076 to over 20,000 employees (Enron, 2002). Enron’s collapse had significant impact on employees. Thousands of employees lost their jobs through the massive job-cuts that the firm undertook after the revelation of the scandal. The scandal adversely affected the employees’ financial wellbeing. First, the laid- off employees were not paid any severance pay Most of the employees had purchased Enron’s shares, which constituted their personal pension fund. Enron Corporation had encouraged its employees to join the pension fund. Moreover, the company restricted the employees from disposing their shares even if the price of the share declined.

However, the top executives were able to dispose their shares after the revelation of the company’s unethical behaviour. Subsequently, over 20,000 lower level employees in Enron lost billions of dollars of their investment through the company’s pension plan after the sudden plunge in the company’s share price (Enron, 2002). The collapse of Enron also affected over 28,000 Arthur Andersen employees, who were not involved in the Enron’s auditing process. The scandal threatened Arthur Andersen jobs. Additionally, over 1,750 partners faced the threat of losing their business deals with the firm. Shareholders and creditors; in addition to internal shareholders, the company’s collapse also affected a number of external shareholders. It is estimated that shareholders lost over $60 billion (Barret, 2005).

Social responsibility

- Despite its failure, Enron is recognised for its commitment in corporate social responsibility.

- The firm invested in comprehensive environmental protection programs.

- Some of the programs undertaken by the firm include climate change programs by investing in green energy.

- The firm’s social responsibility is also illustrated by its energy sustainability program.

- The firm worked closely with legislators in ensuring that the environment was adequately protected by minimising emission of greenhouse gases.

Corporate Social Responsibility [CSR] is a fundamental element in an organisation’s ability to succeed in the long-term. Subsequently, it is imperative for organisational leaders to formulate and implement effective CSR policies. Copeland (2003) emphasises that companies that integrate effective CSR are able to increase enhance their profitability. Despite its unethical practices, Enron had integrated a comprehensive CSR policy. One of the areas in which the firm emphasised on relates to climate change. Subsequently, the firm was focused on achieving sustainable development in its operation. For example, the firm was at the forefront in informing the US government of the prevailing manmade greenhouse gas emission in the US. Subsequently, the organisation was awarded by the Environmental Protection Agency [EPA] for its corporate-consciousness (Brandley, 2008).

Moreover, Enron is greatly remembered over its energy sustainability commitment, which has become a key pillar in corporate social responsibility movement. Enron had adopted energy sustainability as one of its vision and strategy. In an effort to minimise its greenhouse gas emission, Enron undertook a major energy change, which made the firm to become a fully-fledged ‘green company’. This was achieved by investing in alternative forms of energy such as wind and solar energy. Thus, Enron can be ranked amongst the ‘green’ companies in the world. The company’s leaders such as Kennedy Lay worked closely with legislators in an effort to push the government to implement a carbon dioxide regulation. Some of the energy issues that the company advocated include natural gas production, natural gas-fired electric generation, carbon dioxide trading, natural gas transmission and environmental services (Enron, 2002).

Fairness of punishment, legal, cultural, environmental implications and outcome of the event

- The crisis highlighted the prevailing legal gap in the US regulatory agencies such as the SEC, and the FASB.

- The SEC reacted by imposing strict regulations as advocated by the Sarbanes-Oxley Act of 2002.

- Other regulatory and investigative agencies such as the FASB and the FBI gained insight on how to deal with corporate fraud.

- The regulatory agencies and investigators advocated recognised the importance of full disclosure in organisations securitisation activities.

- The scandal highlights the significance of developing a strong organisational culture in fighting corporate fraud.

- Enron was taken over by Dynergy while some of the firm’s directors such as Kennedy Lay were sentenced to serve 165 years in jail.

The occurrence of Enron scandal had significant legal and cultural implications in the United States and beyond. First, the crisis highlighted the legal gaps amongst various legal entities in the United States. For example, the Securities Exchange Commission reacted by advocating strict adherence to the Sarbanes-Oxley Act in order to deter organisational managers from engaging in accounting malpractices and conflict of interest. Furthermore, other regulatory and investigative agencies such as the FASB and the FBI gained insight on how to deal with corporate fraud. The FASB emphasised on the significance of adhering to the Generally Accepted Accounting Principles [GAAP] in an organisation’s financial reporting process. Furthermore, the regulatory agencies and investigators advocated for full disclosure of an organisation’s securitisation activities. This move was advocated in order to minimise the likelihood of top managers engaging in sophisticated accounting practices or any other malpractice for that matter.

Furthermore, the scandal highlights the significance of developing a strong organisational culture. One of the ways through which firms can achieve this is by ensuring that organisational managers adhere to the set code of ethics. Additionally, organisations should be focused on nurturing effective leadership in order to eliminate the likelihood of conflict of interest. The event also highlights the importance of a high degree of independence amongst external auditors in order to prevent collapse of firms. Following the scandal, Enron was taken over by Dynery, which was its rival. Furthermore, Kennedy Lay, the firm’s CEO was sentenced to 165 years in jail even though he later committed suicide.

Recommendations

To prevent such organisational scandals, it is imperative for organisational leaders to consider the following.

- Organisational managers should observe a high degree of transparency and integrity in executing their duties. This will foster the prevailing agency relationship.

- Firms’ leaders should create an environment whereby external auditors, accountants, and regulators are able to undertake their duties without interference.

- Firm’s management teams should adhere to ethical standards advocated by the companies code of ethics in order to eliminate off-balance sheet reporting.

- Organisational leaders should desist from engaging in activities that can amount to conflict of interest.

The Enron scandal was a revelation of how institutions can be mismanaged for the benefit of a few individuals at the top. The scandal sought to enrich a group of selected individuals at the expense of the public by presenting wrongful information. This aspect calls for strict measures in a bid to cushion the public from such greedy individuals. Therefore, in a bid to prevent such organisational scandals, it is imperative for organisational leaders to consider the following suggestions. First, organisational leaders should observe a high degree of transparency and integrity in executing their duties. One of the ways through which this goal can be achieved is by fostering a strong organisational culture that considers employees, shareholders, and other external shareholders as a key component in achieving long-term survival.

Secondly, organisational leaders should create an environment whereby external auditors, accountants, and regulators are in a position to undertake their duties without interference. This move will enhance the effectiveness with which an organisation achieves full disclosure in its financial reporting. Furthermore, organisational leaders should adhere to the ethical standards advocated by the companies’ code of ethics in order to eliminate accounting malpractices such as off-balance sheet reporting. Moreover, organisational leaders should desist from engaging in activities that can amount to conflict of interest. The government and financial institutions’ regulators have a central role to play in ensuring the right measures are put in place to counter such occurrences. Legislations are needed in a bid to deter and punish those that involve in scandalous practices.

Reference List

Allan, S., Carol, R., Keith, N., Jennifer, O., & Judy, G. (2006). Laying Enron to rest. Newsweek, 147 (23), 24-30.

Allan, S., Keith, N., Kevin, P., Temma, E., Donna, F., & Jammie, R. (2002). Who killed Enron. Newsweek, 139 (3), 18-20.

Arnold, B., & Lange, P. (2004). Enron; an examination of agency problems. Critical Perspectives on Accounting, 15 (2), 751-765.

Barret, M. (2005). Enron and Andersen- what went wrong and why similar audit failures could happen again. New York, NY: Notre Dame Law School.

Brandley, R. (2008). Corporate social responsibility, and energy lessons from Enron. New York, NY: Lindenwood University.

Copeland, J. (2003). Post Enron challenges for the auditing profession. Vital Speeches of The Day, 69 (12), 360-367.

Enron : The fall from Enron grace; the world’s biggest fraud. (2002). Web.

Li, Y. (2010). The case analysis of the scandal of Enron. International Journal of Business Management, 5 (10), 37-43.

McLean, B. (2001). Is Enron overpriced? It’s in a bunch of complex businesses. Its financial statements are nearly impenetrable. So why is Enron trading such as huge multiple. Factiva, 143 (5), 1-3.

Thomas, W. (2002). The rise and fall of Enron. Journal of Accountancy, 18(6), 68-76.