Real estate prices have been steadily going up for the last five years. Additionally, analysts prospect that the prices will continue to escalate if the issue is not addressed on time. There are a number of factors that have contributed to the gradual escalation of real estate prices. Strict inventory rules are one of the key factors that have contributed to the increase in real estate prices. For instance, most of the countries have regulated the number of real estate to be registered.

This implies that few real estate are going to be constructed hence the prices will increase due to an increased demand. Additionally, tough rules imposed on mortgages by a number of nations across the world have also significantly contributed to the increase. Increase in mortgage rates has made the construction of real estate expensive hence investors increase the prices to cater for the expenses incurred during construction.

Increase in price of the existing homes also leads to the rise in the real estate prices. For instance, investors buying existing homes at higher prices will have to increase the price of their rental house. Population increase implies that the prices of the real estate will escalate due to increased demand.

This problem is majorly common in the urban areas where the population is high hence the demand is also high. Higher demand for land and other properties in a number of geographical areas tend to escalation the value of real estate.

Increase in value of properties in certain areas is another factor that has significantly contributed to the increase in the real estate prices. The value of properties always increases when certain areas start to expand speedily. Besides, the increase in properties may be as a result of the construction of industries in those regions.

When the earning population in certain areas is too high, the demand will automatically rise. Consequently, real estate prices will go up due to the increased demand from the earning population. Considerable financial empowerment or the provision of certain facilities makes the real estate prices go up drastically. Increase in the economy of a certain country can also result into a rise in value of real estate.

Impact of escalation of real estate prices on the society

Increase in the price of real estate has a number of impacts, both positive and negative, on the local people and the society at large. An increase in the value of real estate implies that the demand for children will also go down. For instance, a family with many children will have to go for a bigger house compared to that with few children.

This implies that larger families will have to spend a lot of money on paying rent compared to smaller families. It will also create some disparities within the society as most of the expensive houses will only be occupied by rich people. High real estate prices imply that a number of people in the society will have little to save. Consequently, individuals and the society at large will be developing at a slow pace.

Most people in the society prefer staying in the apartments situated outside the city since their prices are lower compared to those located within the city centre. Consequently, they will have to spend a lot of money, which can otherwise be saved for other purposes. People who want to purchase an apartment will prefer the ones situated outside the city center. This is because they are cheaper compared to those located within the city centre.

Prices of real estate or housing properties in Saudi Arabia

Prices of real estate in Saudi Arabia vary depending on the size of the apartment and areas of its location. Within the city centre, the price of one bedroom apartment ranges from 700 to 2, 062 riyals. Additionally, one bedroom apartment building located far away from the main city centers ranges from 500 to 1500 riyals.

The other difference in the rates within the city is that an apartment with three bedrooms ranges from 1, 312 to 2000 riyals. On the other hand, a three bed roomed apartment located outside the city centre of Saudi Arabia has a value ranging between 1,800 to 1,875 riyals. To purchase an apartment measuring one square meter within the city centre, an individual has to pay 3, 750 riyals (Lalaine, para. 1). Moreover, an apartment with the same measurements located outside the city centre goes for approximately 2, 250 riyals.

The price of properties in Saudi Arabia has gone high due to the presence of oil. For instance, the oil kingdom is bringing in a lot of money hence there is a property boom. The expansion of Saudi Arabian economy has also led to the escalation of the real estate prices and property values.

With the new financing market and laws, local and international investors in Saudi Arabian real estate market are making a lot of money because of the increased prices (Richard, para. 1). Since the law allows foreign investors to invest in real estates, they have come up with their new housing prices dictated by the currencies of their mother country. Therefore, this leads to the high prices of real estate or housing properties in Saudi Arabia.

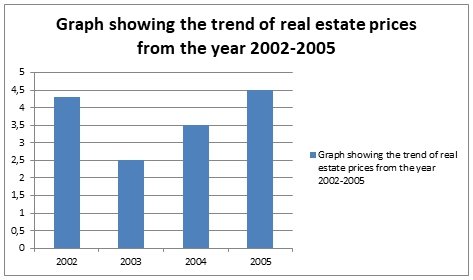

In Jeddah, the value of one bedroom apartment in each square meter had increased by 19 percent by the year 2001. Additionally, the one for a two bedroom house had also increased by 14 percent. Statistics from National Commercial Bank Capital revealed that the prices of real estates and properties had increased by 13.9 percent yearly from the year 2002 to 2005.

Rich people from Saudi Arabia are using money obtained from the sale of petrol to invest in the real estate business. Besides, they are willing to pay substantial amounts of money for the purchase of the estates. As a result, the prices of properties have been steadily going up. Records from Colliers International indicate that the average amount of money, paid for rent by Saudi Arabians, has significantly increased over the last years by 17 percent.

In Riyadh, people experienced a 10 percent increase in the average value of one bedroom apartment to 3, 150 riyal per square meter. In addition, there is an 8 percent increment for a two bedroom apartment located within the town center.

Records from Colliers International also show that the average amount of money that Saudi Arabians pay for their rent has significantly increased over the last years by 17 percent. In the eastern province, the value of real estate has previously been higher than that of Dhahran. In addition, the gap has been steadily increasing over the past years. With the increase in value of the real estate, rental price in the province has increased and has a value of approximately 45,000 riyals.

The impact of Prices of real estate or housing properties on the mind and emotions of Saudi Arabians when coping with it

The increased price of real estate or housing properties has both positive and negative impact on the minds of the Saudi Arabians. To the rich Saudi Arabians and foreign investors, this presented a viable opportunity for them to make extra money from their investments. Additionally, they are using their substantial amount of cash, obtained from the sale of oil, to purchase more apartments. Conversely, this has brought a negative impact on the middle class and poor people.

They pay a lot of money for the apartments. Most of them are feeling the pain of incurring extra costs that could have used in carrying out other duties. A number of people in Saudi Arabia decided to go and stay in apartments located outside the towns as they are cheap compared to those located within the city center.

Statistics indicate that many Saudi Arabians (approximately 70 percent) are not able to own the expensive apartments. This is because they are not able to obtain the available mortgage finance. They are not able to attain the minimum salary needed for the acquisition of a mortgage, due to their low salaries. The Saudi Arabians have a relaxed mind and emotion as they are coping with the increased prices.

This is because their government is currently spending approximately $ 70 billion for the construction of 400,000 apartments within and outside the city. Furthermore, the nation’s housing authority has changed into a full operational ministry. Consequently, the above steps taken by the Saudi Arabian government will solve the housing problem.

Additionally, the government has introduced a mortgage law hence Saudi Arabian people will be able to obtain finances at lower rates. As a result, most of them will be able to purchase an apartment to stay thereby reducing the current problem experienced.

Saudi Arabians have a reason to remain patient as a number of property-owners progressively consider the necessity of offering incentives to their tenants. Currently, landlords are planning to offer free period rent to their tenants. As a result, Saudi Arabian people are enthusiastic as their problem has been given much thought.

Conclusion

There has been a steady increase in the real estate prices because of the increased Saudi Arabian economy and availability of rich oil. Rich people trading in oil have taken advantage of the situation by purchasing numerous apartments within and outside town. As a result, they have dictated their prices by steadily increasing their rent. The price of the apartments varies depending on its location. For instance, apartments located within the city centre have higher prices compared to those outside the city centre.

Despite the challenges, Saudi Arabians are enthusiastic when coping with the situation as the government has introduced favorable mortgage law. Saudi Arabians will receive finances at lower rates hence they will be able to purchase their own apartments. Moreover, they have positive hopes since tenants are planning to offer free rent periods to their tenants. This problem is not only experienced in Saudi Arabia, but all over the world hence adequate solutions should be put in place.

Table showing real estate prices

Works Cited

Delmendo, Lalaine. Saudi Arabia’s property market – hot, hot, hot. 12 Mar. 2010. Web.

Ellis, Richard. “Property Prices in Saudi Arabia up by 60% in H1 of 2011: CBRE”. Zawya. 3 Aug. 2011. zawya.com. Web.