Organizations that wish to respond effectively to variations in their business environments cannot avoid change. Etihad Airways is among companies that need to embrace transformations to remain competitive in the market. Starting its operations in 2003, Etihad Airways operates from Abu Dhabi where its headquarters are located in Khalifa City. By February 2018, the company had a fleet of 117 planes consisting of Boeing and Airbuses that delivered cargo and passengers to destinations in Africa, the U.S., the Middle East, Europe, Asia, and Australia. From 2003, Etihad has experienced growth in terms of the number of passengers carried per year, employees, and cargo volumes. However, it reported losses in 2016 and 2017.

Etihad needs to respond to changes in the business environment characterized by a shrinking fleet. Due to this problem, Etihad reported a loss of $1.5 billion in 2017 (Howells, 2018). This challenging situation has emerged at a time when competitor airlines in the UAE are struggling to combat the problem of pilot shortages following their increasing demand. This report emphasizes the need for Etihad to undergo restructuring as a way of responding fully to this critical historical problem.

Benchmarking from organizations such as Brussels Airlines, Etihad should be prepared to face some pertinent issues and constraints. For example, when Brussels Airlines underwent restructuring, it was badly hit by changing market trends. Any effort to downsize was met with great resistance. Hence, Etihad stands to face the constraints of reduced motivation and organizational commitment among the remaining employees during its restructuring process.

This paper also considers appropriate theoretical concepts, including Lewin’s framework and Nadler and Tushman’s model, applicable to the change process. It recommends the adoption of Nadler and Tushman’s theory, which has been proven effective in guiding the process change implementation at Etihad Airways. Lastly, this paper synthesizes the presented ideas into a clear and coherent discussion that recaps all pertinent aspects of the identified problem, including its solutions.

Identification of the Change

A Major Change

All organizations strive to realize long-term success. Therefore, they are compelled to reform their ways of executing business. The most appropriate changes ensure that organizations become more profitable in a changing business environment (Baddah, 2016). This outcome is important for Etihad, which has been in operation for close to 15 years. According to Howells (2018), although earlier financial information was not published, this company is reported to have started making profits from 2011. It recorded positive net profits from 2011 to 2015 before reporting losses of 1873 million US dollars and 1520 million US dollars in 2016 and 2017 respectively (Howells, 2018).

These losses were attributable to failed strategic alliances with European air carriers, especially Alitalia coupled with Air Berlin. The significantly changing demand in Etihad’s line of business has not had any gain to the company, despite other airlines in the UAE facing shortages of pilots. Upon recognizing these dynamics, Etihad initiated changes in its management with the hope of turning losses to profits in the coming fiscal years.

Nevertheless, considering its current state of profitability, these changes have been inadequate and hence the reason why organizational restructuring is inevitable to help in reducing operating expenses in an environment of declining fleet numbers. Consequently, to effectively deal with the problem of reduced profitability levels, this company needs to consider changes in its human resources, strategic alliances, and corporate sponsorships.

The Significance of the Problem

The significance of any problem determines the extent of reforms that an organization should undergo regarding its business and leadership approaches. Since Etihad operates in an industry where success is determined by the effectiveness of prevailing strategic growth and operational initiatives, the current problem of negative profitability in this company is significant. Failing to implement appropriate measures in time may compromise Etihad’s survival in its line of operation.

Geopolitical, demographic, and technological variations and even intense pressure on the physical environment trigger the need for organizational change. As Baddah (2016) asserts, many organizations, including Etihad, adopt change following experiences in particular events or due to shifts in external business settings. However, internal environmental changes may trigger reforms. For example, new management, leaders, fluctuations in an organization’s performance levels, the adoption of innovative ideas and growth strategies makes change inevitable for Etihad.

How the Current Situation Is Effected by the Absence of Change

Challenges that Etihad Airways has been undergoing have forced it to adopt various strategies for dealing with the current situation. For example, in the effort to boost its profitability, it agreed in 2014 to buy a stake of 560 million Euros from Alitalia (Howells, 2018). Specifically, “On January 1, 2015, Alitalia-CAI formally passed its operations to Alitalia-SAI, a new entity owned 49% by Etihad and 51% by the Alitalia-CAI shareholders” (Howells, 2018, para. 2).

Although the company reported positive profits in 2015, it went ahead to make changes in its managerial structure. For example, it reshuffled its administration where James Hogan took over as Etihad Group’s CEO while Peter Baumgartner assumed the position of the business leader of the airline (Ball, 2016). In May 2017, Alitalia had trouble with the company’s administration. Etihad Airways responded by announcing that its CFO and CEO would be sent home. These arguments suggest that Etihad has been struggling to resolve its external and internal problems through a restructuring strategy.

The Proposed Change

From the above arguments, the problem of negative profitability arises from the changing external market dynamics such as competition. Rivalry compels organizations to implement strategic initiatives, which include the formation of alliances (Ball, 2016). In the current context, Etihad needs to review its partnership with Alitalia and Air Berlin. The idea of increasing economies of scale has failed to work as anticipated. Hence, Etihad should adopt change that assures it of breaking even in the short term. Restructuring its human resources and financial expenditures in corporate sponsorships become inevitable. According to Al-Ameri (2013), these proposed changes require the company to be prepared to deal with outcomes such as the turnover of employees who remain in the company and Etihad’s reduced role in corporate citizenship.

Significance of the Change

In 2017, amid recording negative profits, Etihad had a workforce of 24,558 employees (Howells, 2018). This number was lower compared to what the company had in 2015 when it realized revenue growth after employing 26,566 people. This outcome suggested that the problem with Etihad was not linked to its high number of workers. Nonetheless, the reported decreased profits were attributable to the declining fleet size. Therefore, restructuring human resources and expenditures on corporate sponsorships to match its income flows is a significant move that determines Etihad’s survival and competitiveness in the airline sector. Reducing the organization’s recurrent expenses is critical for its continuity. The overall outcome of this change entails a downsized organization.

Reasons for Change

Downsizing is an important strategy that helps to reduce operations costs. According to Al Jerjawi (2015), after a period of successful operations, situations occur when organizations need to reduce their operational costs to remain profitable. Downsizing entails reducing the size of a business, including its workforce and the number of cities in which it operates (Walker, 2016). In a highly competitive market that is characterized by changing demand trends, firms are under intense pressure to cut costs of operations as a way of improving their efficiency, productivity, and competitiveness. Organizations downsize to ensure they continue operating even during financially trying moments.

As Bin Taher, Krotov, and Silva (2015) observe, such a move helps to prevent bankruptcy while at the same time acting as a proactive measure for increasing productivity. Etihad’s proposed idea of downsizing will be a response to the challenges witnessed in its mergers and acquisitions plan, reduced market share, and declining revenue levels (Al-Ameri, 2013). Technological changes also signal the need for this company to undergo restructuring. Businesses that have embraced technology have reported increased outputs while operating with few human resources (Eggers & Bellman, 2016). Overall, Etihad’s downsizing emerges from the need to reduce its recurrent expenditure and abandoning non-profitable strategic alliances with other airlines.

Applying Theories and Theoretical Concepts

Any change within an organization is implemented through an evidence-based theoretical approach. Kurt Lewin’s framework and Nadler and Tushman’s theory of change are important in the analysis of the proposed reforms in Etihad Airways.

Nadler and Tushman’s Theory

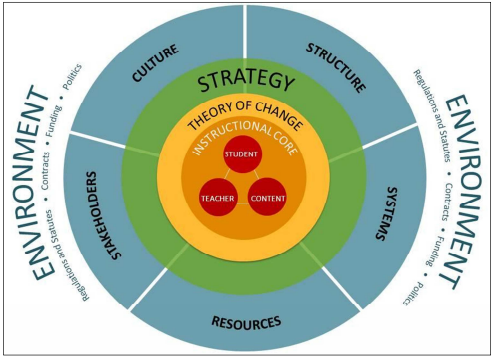

Nadler and Tushman’s theory of organizational change presents companies as a set of systems with different inputs from internal and external sources. Etihad has people in the form of employees and managers. It also has cargo and passenger aircraft. These two categories of resources are converted into outputs as air travel services. Nadler and Tushman’s theory suggests that an organization transforms its inputs into outputs using four main components or subsystems, namely, work, people, a casual organization, and a formal business (Alasadi & Askary, 2014). Therefore, this theory of organizational change conceptualizes an organization as entailing an open system.

Internal and external environments affect its operations to the extent that inputs drawn from them are converted into profitable outputs in the form of improved performance levels. Consequently, if this process fails to yield the anticipated results, the leadership needs to consider adopting change that responds adequately to internal and external environments with the goal of increasing a company’s competitiveness as a strategy, which influences its long-term survival.

Nadler and Tushman’s theory explains the mechanisms under which change can occur at Etihad Airways. The first condition requires it to have the capacity for transforming inputs into outputs via interactions of different subsystems such as work, employees, and leadership. Work refers to any activity executed by employees. In Etihad Airways, such activities should contribute to a fraction of the overall profitability.

Therefore, if this expectation is not met, it becomes necessary to eliminate less productive workers until the organization breaks even and starts operating in the positive profit margin region. As Al Jerjawi (2015) asserts, restructuring human resources involves retaining people who have skills and abilities, which are appropriate to accomplish an organization’s purpose geared towards profitability. However, according to Nadler and Tushman’s theory, for change to be effective, companies should have formal subsystems, for instance, policies, organizational structure, culture, resources, investors, and standards that guide business operations. Figure 1 below shows the above components.

Ensuring the availability of the above aspects requires Etihad to have a transformational leader who can alter the existing counterproductive norms and systems. Therefore, changing this company’s organizational leadership structure and ethical norms is necessary. According to Ball (2016), Etihad Airways recognized this need when it restructured its leadership by announcing James Hogan as Etihad Group’s CEO while Peter Baumgartner took the responsibility of being the airline’s business leader.

Lewin’s Model of Organizational Change

Upon identifying the necessary change, which has the capacity to alter an organization’s current problem characterized by operational and performance challenges, the next step involves its implementation. Change execution frameworks help in this process. Etihad Airways can deploy Kurt Lewin’s model to implement the proposed change. This theoretical system has three key stages, namely, unfreezing, moving, and refreezing (Bin Taher et al., 2015).

In the unfreezing stage, Etihad should find out whether its current business practices are appropriate in helping to respond to the dream of becoming profitable in the changing market environment that has led to a significant decline in the company’s number of carriers. Etihad’s business conditions imply that it does not require this step. Hence, it should proceed to the next phase of Lewin’s model of change implementation. This stage involves redesigning and reorganizing tasks coupled with the roles of different stakeholders.

Etihad’s HR department and the top management team should play the critical role of determining the optimal size of the workforce after resizing, specific unprofitable strategic alliances it needs to abandon, and corporate sponsorships that yield the best results in terms of representing the organization as a good corporate citizen. Otherwise, all non-core activities that do not contribute to this company’s profitability, despite consuming organizational resources, should be frozen. Nonetheless, there should be clear and concise communication of the changes, including their value to all parties, which are interested in the operation of Etihad Airways.

As argued in the discussion section, after executing the restructuring process, Etihad should have a detailed mechanism for addressing the underlying impacts of these reforms. Such a plan determines the airline’s capacity to deal with the refreezing phase following the implementation of change in line with Lewin’s model.

Discussion

Analyzing the implications of the proposed change for Etihad Airways requires one to understand its primary function and purpose. According to Bin Taher et al. (2015), organizations are established to achieve specific goals, missions, aims, and objectives. Etihad aims at ensuring that the world becomes a habitable place where people can travel conveniently to any country of their choice. Achieving this slogan demands this organization to meet all its operational obligations and vision.

This goal may be impractical if no profits are reported to facilitate its realization. Nadler and Tushman’s theoretical model is recommended because it can help the company to convert inputs efficiently into profitable outputs through its organizational processes (Sabir, 2018). Outputs entail the services and products it sells to customers. The most effective outcome occurs when it can deliver these products and services to clients using the required number of workers and financial resources.

Variations in the service demand rate and a decline in the size of Etihad’s fleet can render some employees redundant. This company has experienced such unnecessary human resources and avoidable expenses following fluctuations in the demand for air transport services and non-working strategic alliances. According to Baddah (2016), the capacity to establish coherency, congruence, and integrated inputs that act as autonomous variables to influence the required output is an important factor that affects the ability of firms to realize their objectives. Hence, when Etihad Airways experiences problems in meeting its projected outputs, it becomes foreseeable that it will make losses.

The low demand for airline services requires it to adjust the size of the organization. In addition to lowering the amount of resources necessary to generate outputs, it needs to discard partnerships, which do not deliver any value in terms of profitability. As earlier mentioned, Etihad can abandon its joint venture with Air Berlin and Alitalia. Decreasing the size of redundant organizations should also be accompanied by a reduction of financial resources allocated to corporate activities such as sponsorships.

When implementing the proposed change of downsizing, Etihad Airways should benchmark from experiences of other organizations in or outside of the airline industry. For example, Westpac Corporation and St. George Bank engaged in a delicate downsizing strategy upon forming a strategic partnership. The two companies’ management teams had to make intelligent decisions at a time when superiority battles raged between employees (Al Jerjawi, 2015).

These experiences arise, especially when a merger is accompanied by layoffs. In each company, retained employees believe they escaped layoff because they are superior to those who are fired (Iverson & Zatzick, 2011). Therefore, Etihad Airways should be careful in the downsizing process since some employees may feel intimidated. Etihad has requested some of its pilots to join other airlines in the UAE. Other air carriers can view Etihad’s pilots as a threat or inferior since they come from a loss-making company.

One of the pertinent issues that need to be considered entails the overall impact of downsizing. From the perspective of performance, productivity and efficiency may not increase after downsizing. According to Iverson and Zatzick (2011), a downsized organization may be unprofitable, unproductive, and non-efficient in some cases. Such a change interferes with product development processes. It also increases turnover rates due to employees’ reduced organizational commitment after downsizing. Etihad should be aware of these possible outcomes.

Conclusion

After its establishment in 2003, Etihad began reporting profits in 2011. It recorded massive losses in 2016 and 2017. It attributed these losses to shifts in the demand for airline services. Etihad attempted to make managerial changes, although this strategy failed to yield any improvements. Efforts to form strategic alliances with Alitalia and Air Berlin did not result in positive outcomes. Consequently, this paper has emphasized the need for Etihad to undergo restructuring in its human resources and administration while at the same time reducing its commitment to corporate affairs such as sponsorships.

Nonetheless, it needs to consider the cons of these changes in terms of productivity, efficiency, and its image as a good corporate citizen. The primary objective of the proposed change entails reducing Etihad’s workforce with the intention of increasing productivity and lowering operational costs. Kurt Lewin and Nadler-Tushman’s models have been found to be effective in helping this company to execute this change.

Nevertheless, this paper has recognized the inability to achieve the anticipated outcomes in all situations. The survival syndrome upon downsizing translates into reduced work commitment and motivation among the remaining employees. Hence, it is equally important for Etihad to consider the ripple effects arising from the proposed change.

References

Al-Ameri, M. (2013). Assessing resistance to technological change for improved job performance in the UAE (public sectors). Web.

Alasadi, R., & Askary, S. (2014). Employee involvement and the barriers to organizational change. International Journal of Information, Business and Management, 6(1), 29-51.

Al Jerjawi, K. (2015). The role of human resource executives in mergers: A comparative case study of two bank mergers, the merger of Westpac Corporation and St. George Bank (Australia) and the merger of Emirates Bank International and the National Bank of Dubai (UAE). Web.

Baddah, A. (2016). The direction of change management in the United Arab Emirates. International Journal of Business Management, 11(9), 126-133. Web.

Ball, L. (2016). Etihad came out swinging in 2015. Air Cargo World, 19(1), 17-17.

Bin Taher, N. A., Krotov, V., & Silva, L. (2015). A framework for leading change in the UAE public sector. International Journal of Organizational Analysis, 23(3), 348-363. Web.

Eggers, W. D., & Bellman, J. (2016). The Journey to government’s digital transformation. Santa Clara, CA: Deloitte University Press.

Howells, T. (2018). Etihad airways to change organizational structure. Web.

Iverson, R. D., & Zatzick, C. D. (2011). The effects of downsizing on labor productivity: The value of showing consideration for employees’ morale and welfare in high-performance work systems. Human Resource Management, 50(1), 29-44. Web.

Sabir, A. (2018). The congruence management -A diagnostic tool to identify problem areas in a company. Journal of Political Science and International Relations, 1(2), 34-38. Web.

Walker, K. (2016). The partner. Air Transport World, 53(2), 55-56.