Introduction

Samsung is a consumer electronics firm based in South Korea with a wide product range that includes computers and smartphones. Founded in 1938, as a grocery store, the company has since grown from a small family-owned enterprise to one of the largest in the world (Regan, 2018). This paper evaluates how the firm applies Enterprise Risk Management (ERM) in its corporate practices to manage risks and business decisions when operating internationally.

A Critical Reflection Based On ERM

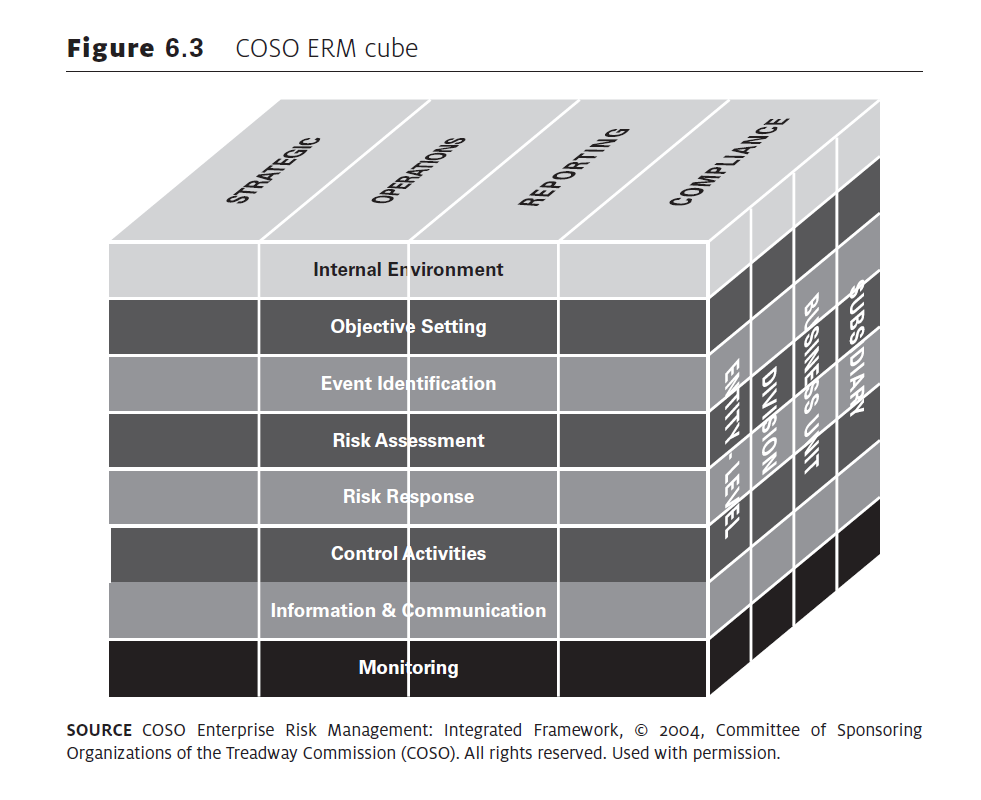

The application of ERM policies depends on a myriad of factors. Three main frameworks for conducting reviews include Integrated Risk Management (IRM), IS031000, and COSO-ERM standards (Hessami, 2019). IRM standards seek to evaluate risk management processes based on four main criteria that evaluate financial, strategic, operational, and hazard risks affecting an organization (Coleman, 2018). Comparatively, IS031000 focuses on three main areas of evaluation – principles, frameworks, and processes (Rael, 2017). Comparatively, the COSO-ERM cube focuses on strategic, operational, reporting, and compliance risks as highlighted in figure 1 below.

As highlighted in figure 1 above, the COSO-ERM model highlighted above evaluates a company’s internal environment through objective setting, event identification, risk assessment, risk response, control activities, information assessment, and monitoring. In the context of Samsung’s risk management plan, the COSO-ERM framework will be used to analyze the firm’s risks and decisions.

Internal Environment

For purposes of this review, Samsung’s internal environment is evaluated based on the efficacy of its management and leadership styles. Relative to its competitiveness in the global market, the South Korean firm has adopted a combination of western and Asian leadership styles to be successful (Samsung Inc., 2021). For example, its bold risk-taking appetite stems from the assimilation of western ideals in the company’s management framework. Alternatively, its treatment of workers is based on the Asian philosophy of fairness, equity, and hard work (Regan, 2018; Biberhofer et al., 2019). Broadly, the hybrid management and leadership philosophy adopted by Samsung is responsive to its risk management objectives.

Objective Setting

A company’s objectives influence the design of its key processes and activities. Samsung’s objective is to develop superior products and services that enhance societal value (Samsung Inc., 2021). Using the COSO-ERM framework to analyze this objective, quality emerges as a core consideration for the firm’s success in achieving this goal (Ensign, Fast and Hentsch, 2016; Grunert, 2017). The company also complies with existing laws and guidelines to make sure that its business processes are consistent with the global code of conduct for conducting multinational operations.

Event Identification

There are various sources of risk in the consumer electronics industry. Top of the list is the COVID-19 pandemic, which has disrupted supply chain patterns and created shortfalls in demand for goods that were hitherto non-essential. Trade wars pitting western and Asian companies are also significant sources of risk for Samsung (Baack, Czarnecka and Baack, 2018). Therefore, the COVID-19 pandemic and ongoing trade wars between western and Asian nations emerge as significant sources of risk for Samsung Electronics.

Risk Assessment

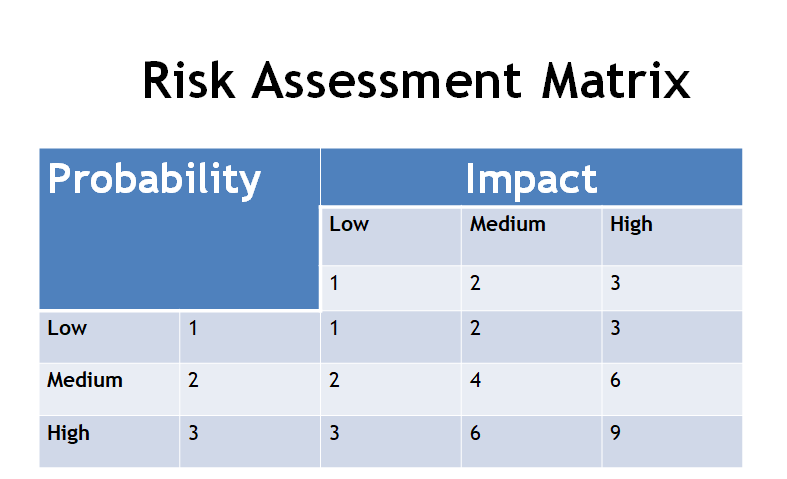

A comprehensive assessment of Samsung’s risk profile is provided in Table 1 below.

Table 1. Samsung’s risk assessment

According to the risk events highlighted in Table 1 above, two risk categories affect Samsung’s operations – COVID-19 and trade wars. The above risks have been ranked according to the risk profile matrix highlighted in figure 2 below and trade wars is the most impactful

A company’s risk management attitude defines the kind of strategies it is likely to adopt in a risk management scenario. Relative to this statement, Samsung can initiate four major types of responses: tolerate, treat, transfer, or terminate a risk (Kumar, Rahman and Kazmi, 2016). Appropriate risk responses will be to treat and transfer the risks, respectively. Trade wars are transferable because they are initiated at an intergovernmental level and Samsung has little control over associated processes. Comparatively, risks associated with the COVID-19 pandemic should be “treated” because they can be mitigated through the deployment of robust health-based and prevention-oriented strategies (Archetti, 2021; Hutchins, 2018). Modalities for implementing these strategies are highlighted below.

Control Activities

According to the proposed strategies highlighted above, the appropriate risk response for managing risks caused by the COVID-19 pandemic is “treatment.” This is because the firm can develop health safeguards to protect its customers and employees from infections (Adhikari, 2018). Comparatively, risks associated with trade wars can be “transferred” because third-party actors, such as insurance companies, can develop products that protect the firm against this type of risk.

Information and Communication

Most companies use Information and Communication Technology (ICT) tools to carry out various functions, including risk management. Such is the case of Samsung because it uses ICT to carry out sustainable business operations by diversifying its risks across different portfolios (Samsung Securities, 2020; Makrides, Vrontis and Christofi, 2020). At the same time, the company uses ICT in risk identification and assessment because it provides a relatively accurate assessment of the same, relative to other evaluative models (Chopra, Avhad and Jaju, 2021). The risk posed by the adoption of this technology includes system breakdowns and the failure of some employees to understand how to use the company’s risk management software (Pesch et al., 2017). Nonetheless, this risk profile is low and the company has successfully used its ICT infrastructure to manage its risk management activities.

Risk Monitoring

In this paper, the main sources of risk for Samsung have been identified to be trade wars and the COVID-19 pandemic. These risks have implications on the organization if not effectively monitored (Regan, 2018). The two levels of risks should be evaluated weekly to understand their implications on the organization (Rael, 2017). The chief risk manager should collaborate with the Chief Executive Officer (CEO) to understand the implications of these risks on various aspects of the firm’s corporate and industry performance.

Role and Impact of Governance, Technology, and Resilience

Role of Governance

Companies have varied ways of managing their risk categories. Two major strategies are adopted by firms when managing risks is to (i) explain why they have not been addressed as stipulated in corporate governance reports or (ii) to comply with rules and guidelines stipulated in the corporate governance report (Rael, 2017). Samsung’s risk management approach should follow the second approach of explaining situations where corporate governance rules and policies have been followed, or not. This is because the two risk events identified in this document – COVID-19 and trade wars – change periodically, while the company’s corporate management rules are rigid (Grunert, 2017). Explaining the responses may be a useful way of navigating these changes.

Samsung’s CEO should take responsibility for the above actions by making sure that the company’s corporate management guidelines are followed. Alternatively, the firm’s Board of Directors should review the performance of the CEO by reviewing how the company’s overall risk management plan helps in the realization of its goals (Köbis, Soraperra and Shalvi, 2021). The process should be open and transparent to ensure there is sustainability of business process outcomes (Adhikari, 2018). By doing so, the process will be fair and receptive to all parties involved.

Impact of Governance

The impact of Samsung’s corporate governance policies on its risk management processes is vast because of their outreach and influence on various aspects of business performance. In the context of Samsung’s operations, corporate governance plays a critical role in moderating the relationship between managers and employees by defining the expectations and roles of each party (Haenlein et al., 2020; Köbis, Soraperra and Shalvi, 2021). From an organizational standpoint, the company’s corporate governance policies will play a critical role in standardizing operational procedures across various product divisions – especially in the way it manages risk (Rael, 2017). Apple Inc. and Huawei are Samsung’s competitors in the consumer electronics industry, which have developed and implemented similar corporate management policies with varied levels of success (Apple Inc. 2021; Adoko, 2017). From their experience, the failure to implement good corporate governance policies in managing a company’s risk events may result in increased inefficiency and unresponsiveness to the changing nature of a firm’s risk events (Adoko, 2017). Therefore, it is important to make sure that such policies are developed by consulting relevant parties.

Role of Technology

As highlighted in this document, ICT plays a critical role in determining how Samsung makes decisions regarding its risk management processes. Relative to this statement, some researchers suggest that ICT is the foundation for the development of innovation policies for use in the corporate setting (Dimic, Orlov and Äijö, 2019; Köbis, Soraperra and Shalvi, 2021). Nonetheless, given the sporadic nature of Samsung’s risk events – COVID-19 and trade wars – technology will play a critical role in formulating, implementing, and monitoring its risks (Adoko, 2017). Particularly, it will help to track risk events in real time, thereby allowing managers to be informed of their impact on organizations. Some technology tools, such as Skype and Zoom, will also be used to communicate appropriate risk management strategies to respective teams based on data collected from the above-mentioned risk tracking processes.

Impact of Technology

The use of ICT tools to undertake Samsung’s risk management processes will have financial and operational implications on the multinational. From a financial perspective, technology may lead to reductions in operational costs because of its inexpensive nature (Kumar, Rahman and Kazmi, 2016; Archetti, 2021; Hutchins, 2018). The firm may also need to automate some of its risk management processes, such as risk monitoring, to accommodate these changes (Kumar, Rahman and Kazmi, 2016; Archetti, 2021; Hutchins, 2018). Some companies have successfully adopted this strategy to manage their risks (Kemp, 2018; Palmatier and Sridhar, 2017). For example, Google and Apple have used machine-learning techniques to minimize their risk exposures because they provide an effective way of improving their overall risk management plans (Apple Inc., 2021; Kelleher, 2019). Overall, technology will have a positive impact on Samsung’s performance by improving its risk tracking and monitoring processes.

Role of Resilience

As highlighted in this document, risk events may have far-reaching implications on a company’s overall performance. Its resilience determines the effects that these events will have on its overall performance (Lewis, Ricard and Klijn, 2018). In this regard, resilience determines the ability of a company to adapt to the changing dynamics affecting its internal and external operations (Hernaus, Juras and Matic, 2021; Management Association, Information Resources, 2018). Samsung has demonstrated market resilience in the manner it manages its risk exposures (Regan, 2018). For example, by being resilient, the company has addressed its market and product challenges by recalibrating its business processes to mitigate known risks (Regan, 2018). In this regard, its resilience has played a critical role in affirming its position as a dominant company in the consumer electronics business.

Impact of Resilience

As highlighted above, Samsung’s resilience has had a positive effect on its overall business performance. For example, it has been able to address customer concerns in problematic product segments, such as the Samsung Galaxy Note, which caught fire when charging (Regan, 2018). Its resilience in the wake of such missteps has given competitors little room to exaggerate the company’s weaknesses (Bérard and Teyssier, 2018). Therefore, its resilience has helped it to maintain market dominance by countering negative information and experiences from customers and competitors. Based on the above examples, Samsung’s resilience is unmatched in the technology industry.

Summary

The insights highlighted in this paper have highlighted the role that ERM and corporate governance play in supporting Samsung’s risk management plan. Two strategies have been proposed for each risk category with the “treatment” option being associated with COVID-19 risks, while the “transfer” option is linked with risks associated with trade wars. It is proposed that the adoption of sound corporate governance policies and the implementation of a robust risk identification criterion will play a critical role in maintaining Samsung’s resilience in the competitive consumer electronics market.

Reference List

Adhikari, A. (ed.). (2018), Strategic Marketing Issues in Emerging Markets. New York, NY: Springer.

Adoko, O. P. (2017), Risk Management Strategies in Public-Private Partnerships. New York, NY: IGI Global.

Apple Inc. (2021). About us. Web.

Archetti, C. (2021), ‘When public relations can heal: an embodied theory of silence for public communication’, Public Relations Inquiry, Vol. 5, No. 1, pp. 1-13.

Baack, D. W., Czarnecka, B. and Baack, D. (2018), International Marketing. London: SAGE.

Bérard, C. and Teyssier, C. (eds.). (2018), Risk Management: A Lever for SME Development and Stakeholder Value Creation. London: John Wiley and Sons.

Biberhofer, P. et al. (2019), ‘Facilitating work performance of sustainability-driven entrepreneurs through higher education: the relevance of competencies, values, worldviews, and opportunities’, The International Journal of Entrepreneurship and Innovation, Vol. 20, No. 1, pp. 21–38.

Chopra, A., Avhad, V. and Jaju, S. (2021), ‘Influencer marketing: an exploratory study to identify antecedents of consumer behavior of millennial’, Business Perspectives and Research, Vol. 9, No. 1, pp. 77–91.

Coleman, L. B. (2018), Managing Organizational Risk Using the Supplier Audit Program: An Auditor’s Guide along The International Audit Trail. London: Quality Press.

Dimic, N., Orlov, V. and Äijö, J. (2019), ‘Bond–equity yield ratio market timing in emerging markets’, Journal of Emerging Market Finance, Vol. 18, No. 1, pp. 52–79.

Ensign, P. C., Fast, J. and Hentsch, S. (2016), ‘Can a technology enterprise transition from niche to wider market appeal in the turbulent digital media industry?’, Vikalpa, Vol. 41, No. 3, pp. 247–260.

Grunert, K. G. (ed.). (2017), Consumer Trends and New Product Opportunities in the Food Sector. Wageningen: Wageningen Academic Publishers.

Haenlein, M. et al. (2020), ‘Navigating the new era of influencer marketing: how to be successful on Instagram, TikTok, and Co.’, California Management Review, Vol. 63, No. 1, pp. 5–25.

Hernaus, T., Juras, A. and Matic, I. (2021), ‘Cross-echelon managerial design competencies: relational coordination in organizational learning and growth performance’, Business Research Quarterly, Vol. 6, No. 1, pp. 445-467.

Hessami, A. G. (eds.). (2019), Perspectives on Risk, Assessment and Management Paradigms. London: Books on Demand.

Hutchins, G. (2018), Supply Chain Risk Management: Completing In the Age of Disruption. London: Greg Hutchins.

Hutchins, G. (2019), Project Risk Management. London: CERM Academy for Enterprise Risk Management.

Kelleher, J. D. (2019), Deep Learning. Massachusetts: MIT Press.

Kemp, K. (2018), Misuse of Market Power: Rationale and Reform. Cambridge, MA: Cambridge University Press.

Köbis, C., Soraperra, I. and Shalvi, S. (2021), ‘The consequences of participating in the sharing economy: a transparency-based sharing framework’, Journal of Management, Vol. 47, No. 1, pp. 317–343.

Kumar, V., Rahman, Z. and Kazmi, A. A. (2016), ‘Assessing the influence of stakeholders on sustainability marketing strategy of Indian companies’, SAGE Open, Vol. 6, No. 2, pp. 987-1109.

Lewis, J. M., Ricard, L. M. and Klijn, E. H. (2018), ‘How innovation drivers, networking and leadership shape public sector innovation capacity’, International Review of Administrative Sciences, Vol. 84, No. 2, pp. 288–307.

Makrides, A., Vrontis, D. and Christofi, M. (2020), ‘The gold rush of digital marketing: assessing prospects of building brand awareness overseas’, Business Perspectives and Research, Vol. 8, No. 1, pp. 4–20.

Management Association, Information Resources. (ed.). (2018), Social Media Marketing: Breakthroughs in Research and Practice: Breakthroughs in Research and Practice. New York, NY: IGI Global.

Palmatier, R. W. and Sridhar, S. (2017), Marketing Strategy: Based on First Principles and Data Analytics. London: Macmillan International Higher Education.

Pesch, U. et al. (2017), ‘Niche entrepreneurs in urban systems integration: on the role of individuals in niche formation’, Environment and Planning A: Economy and Space, Vol. 49, No. 8, pp. 1922–1942.

Rael, R. (2017), Smart Risk Management: A Guide to Identifying and Calibrating Business Risks. London: John Wiley & Sons.

Regan, M. (2018), Samsung. New York, NY: ABDO.

Samsung Inc. (2021), Our mission and values. Web.

Samsung Securities. (2020), Strengthening risk management. Web.