Central, local government, provincial and municipal governments use taxation policies to mobilize revenue and control some activities that are likely to harm the society. Domestic taxes forms governments largest percentage of governments’ collections; excise tax is an indirect behavior control strategy, applied on sale, or production for sale of specific goods and services. Some taxation scholars refer excise tax as duty of excise special tax or sin tax; it is an inland/domestic taxes and differs from border taxes on tax point areas. In all product and services that attract excise duty, it is levied over and above other tax heads like commodity taxes or/and sales taxes as an indirect tax. The imposition of excise duty aims at fulfilling more than one objective from the government point of view; there is the revenue attribute and as a remedy to an unacceptable behaviour prevailing in an economy (Arye, 2003). This paper takes an analysis on the operation, administration, and control of excise tax on Canadian beauty industry; it will concentrate on its impact on consumers, business, government revenues, administration costs, and compliance activities.

According to Canadian taxation laws, the federal and provisional government impose excise taxes on some products that can be classified as inelastic products. Some of these products include cigarettes, vehicle air conditioners, alcohol, and gasoline. In the territory, the tax has been nicknamed sin taxes; a survey conducted in 2010 on the prices of cigarettes and alcohol showed that the greatest position of the commodities in exercise taxes that account for approximately 51% of the cost; the report further indicated that Canadian excise duties/taxes are the highest in the world an indication that the country is concerned with the welfare of its people (BlancaNand Wodon, 2006).

In 2011, the taxes imposed on vehicles air conditioners are at a flat rate of $100 per air conditioning unit; other than excise taxes, some other Canadian taxes heads include payroll taxes, Health and prescription insurance taxes, and estates. When determining the products that the country will impose excise taxes, the government consider the impact that the tax will have on consumption of the product, in the event that a commodity is highly required by the citizens of the country, then the government has no business in injuring the people with high taxes, or the additional tax. Those products that are currently attracting excise duty taxes are those that someone can live without or they have a negative effect on the user or the general public (Bastable, 2003).

The issue of elasticity is another consideration that the government puts when determining the products that will “suffer” the excise duty; smokers and drinkers are less likely to change their habits despite the high taxation rate, these are products of luxury thus the government can comfortably impose taxes on them and still the people would consume the products. When it comes to vehicle air conditioners, the government is conscious that people who use the conditioners are looking for certain luxury that they can live without. The notion that the government holds for excisable good is that they are human wants and not human needs. In some day to day common goods like cooking oil or flour, the Canadian government does not have excise level upon them , the reason is that they affect the living standard of the people thus they need to be kept at the lowest price practical.

People using excisable commodities have similar characteristics in that they would not mind spending an extra coin to get the satisfaction from the product; with this notion, the government understands that the elasticity of demand for the product is low. When commodities have low elasticity, it means that a change in price does not necessarily affect the demand in a way that the industry or the economy can be adversely affected. For example an addict of smoking or alcohol can hardly leave the behavior for price reasons, he is likely to spend an extra coin but get the satisfaction that comes with the drink or cigarette. With commodities of low elasticity, the government is able to make extra revenue as the people are willing to use the products even at high costs (Dalton, 2003).

Excise duty works well with commodities with “abnormal demand,” commodities with abnormal demand means that when the prices of the commodities are high, their demand increases. The commodities do not follow the normal demand curve but always seem to be going against the demand. For example in commodities like perfume, the Canadian government has noted that they follow abnormal demand curve; when their prices are increased, the demand is unlikely to reduce and in some instances the demand increases. The essence of having an excise duty is to ensure that the government can control what sociologists and psychologists call social evils in the community. They are products or services that prevail in the community but causes some pain to the environment or the people.

The Canadian government finances most of its products through monies in the form of taxes collected from the people within the jurisdiction. There are different systems which the government consider when determining the tax head they are likely to increase to get extra revenue; one area that has been adjusted almost yearly is the excise duty rate. In financial years, the government when looking for extra revenue adjusts the rate. The constant adjustment has made the country to have one of the highest rates of taxation in the world (Cnossen, 2005).

With the increased pollution of the environment, the Canadian government should think of using excise taxes to discourage the production and consumption of products that can harm the environment. Despite there being some failures on international talks to protect the environment, like failed negations of Doha round of talks in 2008 and Copenhagen environmental talks in 2010; governments should take individual responsibilities to protect the environment. International trade is sustainable through the forces of absolute and comparative advantage; it has lead to an improved efficiency in use of available resource in different parts of the world. One Canadian sector that pollutes the environment is the beauty industry. The sector of the economy has numerous players who have products that emit products that pollute the environment. Although the sector may have little contribution to the damage of the environment, recommendations from environmentalists is that even the slightest pollution need to be controlled if the right to clean and sustainable development is to be attained:

The industry: the beauty industry

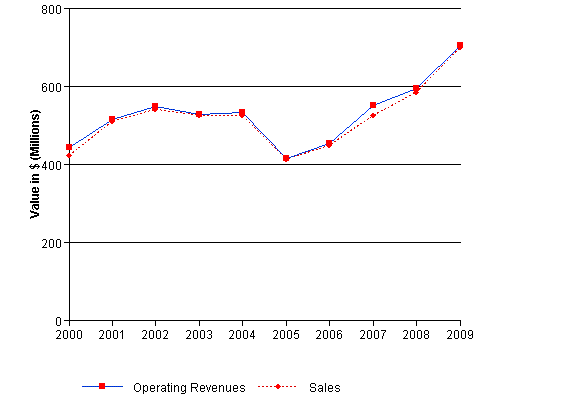

Beauty industry can be classified as home use (toiletries) as wells as the products that people use to make them look and feel beautiful. In 2009, the Canadian beauty industry recorded revenue of $707.6 million which was higher than the amount recorded in 2008 of %596.2 Million; the above is a representation of an 18.7%. The above industry has the potential of polluting the environment and the Canadian government can capitalize on the increase to gain some revenue from excise duty for the benefit of the economy. The graph below shows the growth of Canadian beauty industry:

The beauty industry is growing at relatively high rate; the youthful Canadian population has continued to create business to the industry. When the people use these products, there are some chemicals that find their way to the environment and pollute the environment. These are some of the areas that the government should intervene and charge some excise duty on the commodities. It is from this reasoning that the government should think of having an excise duty for the industry. The basis of rating and charging excise tax at this point is not on the basis that the service and the products are luxury but on the basis that the county has the responsibility of protecting the environment.

The case of locally manufactured excisable products

The Canadian economy has a number of domestic companies that manufacture commodities that are excisable according to the law. The commodities include alcohol, jewelries, beauty products, make-ups, and Cigarettes. When computing the excise duty payable on the product, the government uses the cost of manufacture of the production cost of a commodity. For instance when levying excise tax on alcohol, the government considers the following:

- Manufacturing cost: this is the cost of direct and indirect materials that have been consumed in the production of the commodity. They include the costs that can be attributed to the products in costs like labor, energy, administration and the like

- Any other cost that can be justified to have come because of the manufacture of the product.

- There are some commodities that attract sales or commodity taxes, before levying excise, the taxes are first levied to arrive at the cost that will be used to levy excise. The following illustration demonstrate the operation of excise taxes on domestic products:

- Cost of manufacture xxxxxx

- Add other related costs xxxxxx

- Commodity/product/sales tax xxxxxx

- Total cost of the product zzzzzz

The amount zzzzz will be the amount that will be used to levy excise duty on the commodity. For example if the rate of excise duty on the commodity is 23% then the excise duty payable will be calculated as follows:

- Excise duty = 0.23*zzzzz

In the new companies that have been made to make beauty products, the government should be levying on the cost of the buildings. when determining the cost at which excise duty will be applied, the government should consider the cost of the factory its value added taxes paid:

For example if the cost of the factory was $500 million, the government should use the following formulae to calculate the cost to levy the following format should be adopted:

- Estimated cost of the factory; this is the cost that a licensed quantity surveyors or an architect will give the factory; the basis of valuation of building is on the market value of the products (it should however be noted that when using the professional values method, it should not be lower than the actual cost that was incurred in manufacturing the factory.

It should be at this rate that the excise duty payable should be calculated, however it should be noted that there are some products that have been used for the manufacture of the building but by themselves they had some excise duty paid o them thus the final excise duty payable is:

- Excise duty calculated from above (rate of excise duty* professional values method or cost of making the building cost whichever is high

- Less excise duties paid on inputs used in the manufacture; during manufacture, there may have some products that have been charged some excise duty, they include make-ups, and other products of luxury. When determining the cost of professional values method or cost of making the factory, it is by law that the cost of value added taxes not to be added. Thus no need to adjust for V.A.T.

Despite the above formulae seeming to be straight forward, there is need for the government and tax authority to seek expertise opinions and guidance as it is vulnerable to abuse and understatements (Preece, 2008).

The case of imported excisable products

When dealing with other nations whose are exporting into the country some excisable commodities, the Canadian customs department is given the mandate of collecting the tax on behalf of the government. The tax is imposed after the customs duty has been paid. According to the country’s taxation policy, the method of charging various duties on imported products has to follow the HS Code (harmonized code if classification); “Subsection 123(1) of the Excise Tax Act (the “Act”) contains definitions used in Part IX of the Act relating to the goods and services tax and the harmonized sales tax (GST/HST)” (Preece, 2008). Despite the following of harmonized code if classification, the country has its own rules, procedures, and legislations that it implements to come up with the right tax over and above the provisions of harmonized code if classification (United Nations, 1997). Let’s take a hypothetical example of an imported beauty product; the amount to be excisable will be calculated as follows:

- Cost of the product (this is the cost that the product has been bought from the exporting country, it involves elements like the cost of production, the sellers profit margin, government levies, and other costs that can be attributed to the products

- Add, transportation cost of the product; transportation cost is the freight cost of the product from the country of manufacture to the destination country, in this case the country of destination is United States in specific Canada. There are different manners through which the product can get into the country, they include, through rail, road, air, sea among other. Care should be taken that the cost incurred here on transport covers only cost from the country of origin to the port of importation, costs incurred to transport the commodity to the owner’s premises are not considered.

- Add insurance; when transporting commodities from abroad, there are some insurance costs that have to be incurred by the sender or the receiver, as the deal might have been crafted. The cost should be included when reaching at the excisable value. Again care should be taken that the cost incurred here on insurance covers only cost from the country of origin to the port of importation, costs incurred to insure the commodity to the owners’ premises are not considered (Wanless, 2004).

The above three costs are related to the cost of importing an excisable commodity in the Canadian market, at the point the cost is referred to as the CIF (Cost, Freight, and Insurance) cost. It is upon this cost that customs duty will be levied (note that all excisable commodities attract customs duty at a prescribed rate by the Hs code or Canadian taxation laws. In our case let’s assume that the commodities attract s customs duty at the rate of 25% of the customs value, then:

- Customs duty= 0.25* CIF (Cost, Freight, and Insurance) cost

It is from the total of CIF (Cost, Freight, and Insurance) cost and customs duty that excises duty is levied. Again let’s assume that the product will attract excise duty at the rate of 30%, and then the excise duty will be:

- 0.3*(Customs duty + CIF (Cost, Freight, and Insurance) cost)

- But customs duty = Customs duty= 0.25* CIF (Cost, Freight, and Insurance) cost

- Then Excise duty = 0.3* [(0.25* CIF (Cost, Freight, and Insurance) + CIF (Cost, Freight, and Insurance) cost]

Thus:

Excise duty = 0.3*1.25*CIF (Cost, Freight, and Insurance)

= 3.75 CIF, (Cost, Freight, and Insurance)

The above system operates for those products whose excise duty can be expressed in the form of a percentage. In the event that the excise duty is a fixed rate, the government will have to count the pieces and attribute them to the respective amount of tax they are expected to pay.

The operation of the Canadian excise law has that the tax can only be levied before value added tax has been added or the profit margin of the trader. The final cost of either imported or domestic product is always the costs plus taxes and the traders’ profit margin. When accounting for the excise duty that has been levied, the government should enact guidelines on how and when the exercise should take place. The date and the timing should be well determined to ensure that compliance rate is boosted. There is always some controversy and misinformation when a new law has been made, the government should take the responsibility and train people on the operation of the system for the good of the country. In the past, collection of taxes has been challenged to have high costs (they have been seen not to be economical especially when the compliance rate is low, the government should thus invest highly in boosting understanding and compliance levels in the economy. Occasional trainings need to be conducted and views of people from different sectors considered (ULav, 2002).

What considerations are required in setting the rates?

When setting the rate of excise duty to charge on the proposed products, the government should look at the net effect if the actions to the environment, the revenue collection, and the effect that it will have on the economy. The beauty products are likely not to stop to be used because of the price; this will be good for the economy as it will get some extra revenue as a result. With intervention and addition of excise duty the industries will be marginally affected by the new rule. Although there have been no research that quantify the level of pollution that comes from either of the two proposed industries, environment gurus have agreed that the industries have a negative effect on the environment (Gstoettner and Jensen, 2010).

When high taxes have been levied, the government will get money need to make-up or compensate for the environmental damage that the industry has created. Another area that the government should consider is the effect that the law will have on the living standards of the people, ideally excise taxes are levied on those products that have low elasticity or products that alternatives can be used. The effect of the law is that people will still continue engaging with the industries but will have to pay an extra cost for the same or change to other products that can give the same level of satisfaction but maintain the environment.

Through this method the government will be directly be promoting products that does not pollute the environment; for example with technology, there have come some beauty products that are not polluting the environment (green make-ups), when such make-ups are not levied excise taxes, their production will be promoted (Edward, McCaffery and Joel 2006).

Would there be exceptions and why

The new excise law would have some exceptions to promote some sanity and adherence to the law; for instance with the make-ups, there are some make-ups that do not emit environmental pollutants, they have been nicknamed green-make-ups. Green make-ups should not be subjected to excise duty as they are compliant with the need that the Canadian government which to have. When green make-ups are not subjected to excise taxes, then they are cheaper than those make-ups that have been subjected, the end result will be promotion of their use to the benefit of the economy and the environment (Dietmar, 2000)

Ttechnology has come to develop some structures that are sensitive to the environment, a recent innovation is the innovation of “green-factories,” these are factories that are made in such a way that they can use renewable energy from the atmosphere like wind, solar, and nuclear energy. Other than “producing their own energy, the factories have high tech recycling system where they can recycle waste products like water. In the event that a factory has been made in such a method, then the law should be sensitive enough to exclude it from the payment of excise duty. Beauty products come in different forms, there are products that have medicinal elements and other that do not pollute the environment. Such products should not be subjected to excise duty. However, before a product has been described to have some medicinal assistance to the user, it should be specifically be defined that it will be offered with the guidance of a skin specialist or a medical practitioner in the sector (Dalton, 2003).

Recommendation

Taxation has been an area of controversy in different nations; the reason for the controversy is because the laws defining the system may not always be simple and straight forward. However when drafting the beauty excise law, the government should involve experts in the three sectors (beauty and taxation); on their parts, the experts should draft the law to cover all areas where loopholes can prevail in the economy and hinder the operation of the economy. The rate of excise should be higher enough to shy off people from using such products and when they use them the rate should offer the government enough funds to manage the damage caused.

Taxation law like the society keeps changing with changes in business situations: after the enactment of the law, the government should ensure there is close monitoring and makes any necessary improvement to the system. New emergences and adjustments should be made when necessary but care should be taken not to injure the economy (Gabriele, 2009). Other than environmental issues/ conservations, with beauty products that do not pollute the environment, they are also less harmful to the users; thus the benefits are two ways; by enacting excise on beauty products the government will be looking into the welfare of the environment and its people.

Conclusion

The Canadian excise tax laws can be traced from the ratification of the United States Constitution in 1789; the constitution gives guidelines on how to levy and collect the taxes. Some of the excisable commodities in the Canadian markets include cigarettes, cigars, alcohol, and gasoline. As a move to protect the environment, the Canadian government should consider imposing an excise duty on beauty. The taxes should be after computation of sales and/or products costs but before value added taxes have been calculated. When excise tax law has been administered in the beauty, the government will get extra revenue to address environmental matters; the end result is sustainable development.

References

Arye, L. ,2003. Public finance and public policy: responsibilities and limitations of government. Cambridge: Cambridge University Press.

Bastable, F., 2003. Public Finance. San Diego: Simon Publications LLC.

Blanca, M. and Wodon, Q., 2006. Public finance for poverty reduction: concepts and case studies from Africa and Latin America. Washington: World Bank Publications.

Cnossen, S., 2005. The role and rationale of excise taxes in the ASEAN countries. Maastricht: University of Maastricht.

Dalton, H., 2003. Principles of Public Finance, Volume 1.London: Routledge.

Dietmar, W., 2000. Theory of public finance in a federal state. Cambridge: Cambridge University Press.

Edward ,J. McCaffery, K. and Joel S.,2006. Behavioral public finance. New York: Russell Sage Foundation.

Gabriele, A.,2009. The Enhanced Role Of The State In China’s Industrial Development. Economics, Management & Financial Markets, 4(3), 44-80.

Gstoettner, M. and Jensen, A., 2010. Aid and Public Finance: A Missing Link?. Atlantic Economic Journal, 38(2), 217.

Preece, S., 2008. Key Controls in the Administration of Excise. World Customs Journal, (1)2, pp. 1-45.

United Nations., 1997. Kyoto Protocol to the United Nations Framework Convention on Climate Change. New York: Wiley.

Wanless, D., 2004, Government levers. Securing good health for the whole population report to HM Treasury, United Kingdom, (8) 2, pp. 177-178.

ULav, J., 2002. Cigarette tax increases: cautions and considerations, Center on Budget and Policy Priorities. Washington: Cengage