Introduction

The United Kingdom, like many other industrialized countries has witnessed a rise in tax as a share of GDP as of 1978. In 2006 for example, the percentage of the national income absorbed by tax in the UK averaged those of the developed countries. It was significantly higher than those of the new European Union members of Eastern Europe, the United States, Australia and Japan. However, it is lower than of those of the EU 15 countries, for instance, Italy, France and Scandinavian countries. Major developments in the UK tax structure over the last three decades have been much in line with those witnessed globally:

First, revenue contributions from V.A.T have significantly increased, while at the same time, the contribution by taxes levied on specific goods has declined by a similar, margin. Second, the basic and higher rates of income taxes have been slashed and the number of rates reduced. Third there has been a shift towards taxing members of couples separately. Equally, statutory corporation tax rates have been cut and the tax base widened by minimizing the value of allowances made on capital investments. Furthermore, the use of tax credits has brought relief for low-income workers within the tax structure. The taxation of the shareholders has equally been reformed to extend less credit for companies already paid on profits. Finally, there has been extensive adoption of new environmental taxes.

However, the U.K tax structure has some unique characteristics: a large percentage of the U.K tax revenue comes from business rates and council tax (recurrent taxes) while an insignificant share of the tax revenue comes from social security contributions. Compared to other countries, the UK zero rates value-added tax (VAT) on many goods. In addition, the UK is unique in that it abolished all tax relief for mortgage interest. Finally, the UKs tax raising is uniquely centralized with 95 percent of the total revenue centrally while only 5 percent is raised locally. Overall, the U.K tax system taken as a whole tends to redistribute incomes significantly from the rich to the poor (Clark & Dilnot 2002, p. 32).

Discussion Income and Corporation Tax

Income Tax

Scope and what is Taxable

In the fiscal year 2011/2012, revenue from income tax in the United Kingdom is projected to hit £ 157.6 billion. However, it is important to note that not all income revenues in the UK are subject to taxation. The basic forms of taxable income in the UK include incomes from self-employment, earnings from employment, an allowance given to job seekers, retirement pensions, and incomes from unincorporated businesses, incomes from bank, property and building society interests In addition to dividends on shares(Clark & Dilnot 2002a, p,26). Incomes exempted from taxation include those incomes that come from means tested social security benefits. A number of the non-means tested social security benefits are taxable, for example, the basic state pension. Certain savings products are equally exempted from taxation, for example, Individual Savings Accounts (ISA) and National Savings Certificates (NSC). Furthermore, any gifts extended to a registered charitable organization are deducted from income for the purposes of taxation (Adam &Brown 2011, p. 6)

Residency Rules and Taxable Periods

For tax purposes, an individual is considered a resident in the UK if he has been in the UK for a total of 183 or more days in a given tax year and no exceptions apply to this rule. Generally, in the UK tax is levied on all incomes originating within the United Kingdom and it does not matter whether the individual to whom the income belongs resides in the UK or not. Equally taxable is all the incomes coming outside the geographical border of the UK but belongs to people who reside in the United Kingdom. Furthermore, all gains connected to the disposal of assets anywhere in the globe that belongs to either a person or people who reside in the UK is equally taxable. The amounts paid by individuals as income tax will vary depending on whether they are ordinary citizens or residents in the UK. From April 6th 2008 henceforth, if an individual is in the UK at the end of a day (midnight) then that day counts as a day of his presence in the UK for residence purposes. However, passengers who are on transit are exempt from this rule (that is where they arrive in the UK for one day and they are expected to continue with their journey he next day). This exemption will be applied as long as the passenger in question does not involve himself in any activity that has no relation with his passing through the UK (IR20 2009, p. 6).

Tax Bands

Income tax bands table 2010-11 period

The UK income tax system operates through a system of income bands. Every person has a personal allowance that is deducted from his income before taxation to give the taxable income. All taxpayers below the age of 65 receive a personal allowance worth £ 7,475, senior citizens (65 years and above) are entitled to a much higher personal allowance. Previously, married couples were equally were equally entitled to the married couples allowance, however, this rule was abolished in 2000. Presently, the MCA does not serve to increase the total personal allowance but instead serves to ease the final tax liability by £ 729.50 in 2011/2012 (HM Revenue and Customs 2012, p. 2).

The tax rate subjected to taxable income depends on the band within which the income falls. For the initial £ 35,000 of the taxable income (income that exceeds the personal allowance), the basic rate of taxation is 20 percent, any income between £35,001 and £150, 000 incurs a higher income tax of 40 percent. For all incomes above £150,000, an additional income tax rate of 50 percent is charged. As a result, a higher income tax rate is charged on all incomes above £42, 475 (which is the basic rate limit plus the personal allowance). All individuals who earn an income exceeding £150,000 incur an additional tax rate, for this band, they do not benefit from personal allowance and therefore, all their income is taxed.

Dividends and savings income is subject to a different tax rate. All incomes arising from savings is charged 20 percent if it belongs to the basic rate band, 40 percent if it falls under the higher rate band and 50 percent for all incomes exceeding £150,000. Apart from savings, all incomes falling within the first £2,560 of taxable income is charged at a lower rate of 10 percent. Equally, all dividend income is taxed at 10 percent up to the basic rate limit. A further 32.5 percent is charged on dividend income that fall between the basic rate and additional rate limit. Any dividend rate above is taxed at 42.5 percent. The following table summarizes the individual and age related allowances available under income tax for the 2010/2011 fiscal year;

The personal allowance is decreased by 50 pence for every extra pound of income over and above the threshold of £ 24,000. All personal allowances are reduced by 50 pence regardless of age for every extra pound of income over and above £ 100,000. The personal allowance is gradually reduced up to the point where it reaches zero for those individuals with incomes above £ 114,950.

Corporation Tax

Definition of residence and Scope

Generally, under the UK tax system a company is defined as a resident for the purposes of taxation if it is incorporated / registered in the United Kingdom, similarly, when a company is not incorporated in the united kingdom but its central management and control, are centered in the united kingdom, then it will be defined as a company resident in the United Kingdom for tax purposes. Under the U.K tax structure, the government taxes the global profits of companies that reside in the United Kingdom (that is companies that are headquartered in the United Kingdom) and for Non UK companies for the profits that they generate within the geographical boundary of the United Kingdom. However, for companies that pay taxes abroad, the government extends credit to them. The corporation tax is levied on all incomes from investment, trading and capital, less specific deductions. Any trading loss incurred by a company may be carried backwards for one year so that the tax can be set against profits made in that period. Alternatively, they can be carried forward for an indefinite period. Specifically, the UK tax system has a provision for the deduction of all interest payments from the profits before taxation. This is referred to as taxing the full return to equity as opposed to the full return to all the capital investment. The UK tax system therefore can be said to be an amalgamation source based and residence based systems.

Tax Band

In 2011- 2012, the standard corporation tax rate is 26%/ however, firms which make profits less than £ 300, 000 enjoy a reduced corporate tax rate of 20%. For companies with profits ranging between £300,000 and £1,500,000, the government applies a system of relief such that a 27.5 percent marginal tax rate is charged on profits over and above £300,000. The marginal tax rate has the effect of gradually increasing the average tax rate until it reaches the standard 26 percent. The tax authority has already laid down plans for reducing the standard tax rate to 25 percent in 2012/2013, 24 percent in 2013/2014 and finally to 23 percent by 2014/2015 (HM Revenue and customs 2011, p. 1).

Corporation Tax Rates 2011/2012

Comparison with the United States

Both the United States and UK have experienced a considerable decline in the income tax progressivity since the 1970s. Over the recent past, the income tax burden levied on top income groups in the two countries are much more identical with the average rate standing at 30 percent at the extreme. Unlike the UK which places major emphasis on residency, the U.S taxes all global incomes and any capital gains accruing to US citizens (green card holders and U.S residents). Furthermore, in the U.S gains from the investment are adversely categorized and taxed at the highest possible ordinary tax rate. They equally incur an added interest compounded over the period that particular investment has been held. In the UK interest from cash holdings is subject to income tax. Similarly, in the U.S income on cash holdings will be taxed but at ordinary rates of income (Morgan et al. 2009, p. 1).

The Relative Importance of Direct and Indirect Taxes in the United Kingdom

In the UK, direct taxes include corporation tax and income tax, imposed directly on the tax the payers through a specific process of assessment. Indirect taxes on the other hand comprise of Value Added Tax paid by individuals indirectly to the government. The consumer who bears the tax pays it to the retailer who in turn passes it over to the government (Michael 2004, p. 20).

There has been a major shift in UK taxation from direct to indirect taxation since the late 1980s. There was an initial increase in VAT to 15 percent from 8 percent in 1987, by 1991, it was increased to 17.5 percent. At the same time, the highest income tax rate fell to 40 percent from 60 percent in 1988, the basic income tax rate which was previously between 30 and 35 percent over the last decade dropped to 30-25 percent over the period 1985/1986 and 1988/1989. Furthermore, corporate tax dropped from 40 percent to 35 percent in 1986 (Williams 2009, p. 5). In 2010-11 period,

For the fiscal year 2010-11, a total of £ 446 billion was raised from taxation. The amount includes all taxes (vat and duties). National insurance contributions, income tax and capital gains accounted for 55.4 percent of the total revenue (247 billion), the contribution of VAT was worth 18.7 percent (83 billion) while corporate tax accounted for 9.4 percent of the total (42 billion). The number of registered taxpayers over the same period stood at 30.6 million (HM Revenue and Customs 2012, p. 2). Equally notable is the 2007-08 fiscal year in which direct taxes accounted for 45 percent of the total revenue collected (£ 204.6 billion), indirect taxes on the other hand accounted for 33 percent of the total revenue (£ 146.2 billion), contributions from national insurance amounted to £100.4 billion (22 percent of total revenue). It therefore seems easier for the UK government to change the indirect taxes as opposed to the direct taxes. In addition, indirect taxes are a useful tool for the government to manage the economy in the short run for instance through fiscal stimulus. They are equally useful when the government wants to control or regulate the consumption of particular products. By increasing the indirect taxes on such products, the government discourages certain behaviors considered undesirable or anti-social (U.S. Census Bureau 2012,p.2).

Direct tax equally has some importance, it can be used to develop certain desirable behavioral changes for instance it can be used to purchase a technology that is environmentally beneficial or undertake a research that will benefit the overall public. Equally, low corporate tax will attract foreign direct investment to the UK (Williams 2009, p. 3)

Revenue Generated by Each Tax Type as a Percentage of Total Government Expenditure in 2009-10 Fiscal Year in the UK and the U.S.A

For the fiscal year 2010-11, the HMRC collected revenue amounting to £468 billion. Over the same year if paid out 40 billion in payments and benefits.

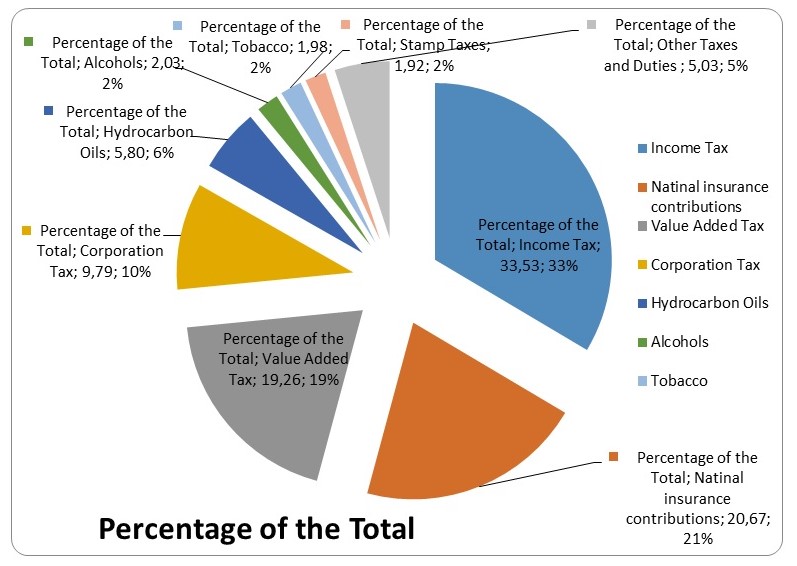

Figure1: UK revenue collections 2010-11

Calculations: UK figures as a percentage of the total revenue:

- Income tax= (157.2/468.9) * 100= 33.52 %

- National Insurance Contributions = (96.9/468.9)*100= 20.67 %

- VAT=(90.3/468.9) *100= 19.26 %

- Corporation Tax= (45.9/468.9)* 100= 9.76 %

- Hydrocarbon Oils = (27.2/ 468.9)* 100= 5.80 %

- Alcohols= (9.5/ 468.9)* 100= 2.03 %

- Tobacco= (9.3/ 468.9)* 100=1.98 %

- Stamp Taxes= (9/468.9)*100=2. 08 %

- Other Taxes and Duties= (23.6/468.9)*100= 5.03 %

Given the fact that some taxes which apply in the United States are not in the UK, we will only calculate and compare those taxes that are applied in both countries.

Calculations: the U.S. figures as a percentage of the total revenue:

- Income Taxes= (272,770,270/702,221,472) = 38.84

- Insurance Premiums= (15,768,805/702,221,472) = 2.25

- Tobacco Products= (16,781,991/702,221,472) =2. 39

Discussion

From the statistics computed, it is clear that the largest revenue source for the UK is which accounted for 33.53 percent of the total revenue collected in the fiscal year 20101-11. Second in the list is the national insurance contribution with a 20.67 percent, VAT 19.62 Percent, corporation tax at 9.79 percent, hydrocarbon oils 5.8 percent and lastly alcohol at 2.03 percent. When we compare it to the tax system of the united states, there are some observable similarities; income taxes in both countries contribute more than one third of the total revenue (U.S.A 38.84 percent and, U.K 33.52 percent). Similarly, taxes imposed to discourage the consumption of alcohol and tobacco products in the two countries, contribute approximately the same percentage of the total national revenue. In UK taxes on alcoholic beverages account for 2.03 percent of the total revenue while in the U.S. taxes on Tobacco products represent 2.39 percent of the total revenue. However, there is a major difference in the contribution of national insurance to the total revenue. In the United States, Insurance premiums contribute only 2.39 percent to the national revenue, in the United Kingdom on the hand the percent is significantly higher standing at 20.67 percent of the total revenue coming second after income tax.

Comparison between the Progressivity of Income Tax and Corporation Tax in UK and the United States

A progressive tax system is where the share of income an individual pays as taxes, rises with an increase in income. This results in a more equitable distribution of the post tax income (Piketty & Saez 2006, p. 5; Murphy 2008, p. 42).

From the above calculations, it is evident that the UK income taxes are progressive in their nature. This is supported by the fact that the mean tax rate measured as a percentage of the gross income is equally increasing. From the table it is equally evident that personal taxes in the UK are low, and this explains why the UK is a favorite destination for foreign capital. However the rate of progressivity is not enough, according to Murphy (2009, p. 212), the existing distribution of the tax burden in the United Kingdom does not match the definition of progressive taxation. He argues that though the low income individuals may be paying less or no income tax at all, they bear the highest rates of effective tax that include; council tax, tobacco and alcohol taxes in addition to value added tax.

On the other hand, the progressivity of the U.S tax system has declined from the 1960s relative to the U.K. for instance, during the 1960s approximately 70 percent of incomes from 0.01 percent of the high income earners was charged as tax compared to only 35 percent in 2005. Taxes for the middle income earners have remained relatively constant. The fall in progressively among individuals with high incomes is majorly due to a drop in corporate taxes in addition to the shift in the top income composition towards labor income and away from capital income (Kopzuk et al. 2006, 19). The table below indicates a historical comparison of rates for UK against U.S.A and France.

Notification of Income and Payment of Tax when in UK and U.S.A

Income Tax

In the United Kingdom, when an individual is engaged in trade and he is therefore required to pay income tax (IT), value added tax (VAT) or National Insurance Contributions (NIC), then it is his personal duty to notify HMRC within a specific time limit. From the first date of trading, the individual has up to three months to notify HMRC that he is trading; otherwise he could face a penalty of 100 pounds. In the UK a tax year starts on 6th April and ends on 5th April of the subsequent year, if an individual does not receive a tax return , he has until 5th October after the end of the tax year to notify HMRC that he is liable to tax.

In the U.S on the other hand, the individual bearing the tax liability is required to notify the secretary that he is liable for the tax payment. This is done by filling form 1040X or 1120X.

Corporation Tax

When a company or an organization is liable for corporation tax in the UK, they will receive a notice to deliver the companys tax return from HMRC. However, if they don’t receive it, the companys management has a duty to notify HMRC that the company is liable to pay tax. This must be done within a period of 12 months following the expiry of the corporation tax accounting period; otherwise the company is penalized (HM Treasury and BIS 2010, p.2; Auerbach 2006, p. 11).

Under the US tax system, all companies existing in any given tax year including those that are bankrupt are required by law to file their income tax returns whether or not they have a taxable income. They fill form 1120 to report their gains, incomes, deductions and credits. A company must submit its income tax return on the 15th day of the third month after the expiry of the short period (Internal Revenue Service Department of Treasury 2006, p. 6).

How the UK and the U.S have responded to Competitive Pressures

Because of the competitive pressures, the UK government has initiated policies that make Britain more open for business. The reform agenda was necessitated by the fact despite hosting the worlds known best businesses, too many of them were already leaving the UK specifically due to tax competitiveness. As a result, the government initiated a corporate tax reform aimed at making the system simpler, stable and more competitive resulting in conducive conditions for business investment (Keen et al. 2000, p. 50 ). UKs position in terms of corporate tax competitiveness was eroded when other countries reduced on their corporate tax rates more and faster than the UK. For example, in 1997, the UK had the tenth lowest tax rate among the 27 EU countries, but by 2010 it had slipped to the twentieth position (HM Treasury and BIS 2010, p. 2). It is as a result of this that the UK government developed a corporate reform roadmap aimed at creating the best corporate tax system in the G20. Notable reforms include:

Maintaining the tax base while reducing on the tax rates, this was intended to provide incentives to business with limited distortions. The corporate tax rate was reduced from 28 percent in 2010, to 26 percent in 2011, it has further dropped to 25 percent in 2012 and is expected to drop further to 24 percent in 2013. Taxation on small business rates fell from 21 percent in 2010 to 20 percent in 2011 and 2012 respectively (United Kingdom Budget 2011, p. 8). The tax system has equally been reformed to focus more on profits arising from UK activity in the determination of tax base rather than the global incomes (Klemm & McCrae 2002, p. 14). This in turn has made it more competitive by supporting UK jobs and investment. To a large extent therefore, it can be argued that the UK has responded to competitive pressures.

The United States has equally not been spared from the effects of competitive tax pressures. Although the country has maintained a relatively constant corporate tax since 2009 (35 percent), notable reforms have been undertaken. Event tax reforms in the U.S reduced the tax rates on capital income. In addition, from the year 2003 steps have been undertaken to minimize the problem of double taxing corporate incomes. This has been achieved by applying a significantly lower rate of 15 percent to capital gains and dividend income. Generally, the United States has opted for a relatively lower tax burden compared to other industrialized countries and it has chosen to rely more on personal income taxes as opposed to consumption taxes as its revenue source. However, worth noting is that in the area of corporate taxes the U.S still lags behind which threatens its ability to attract foreign capital which has become increasingly mobile. The corporate tax rate in the U.S is the second largest among the OECD countries (Economic Report of the President 2006, p. 110).

List of References

Adam, S & Brown, J 2011, A survey of the UK tax system, The Institute for Fiscal Studies, 2012. Web.

Atkinson, A 2006, The distribution of top incomes in the United Kingdom 1908-2000, Oxford: Oxford University Press.

Auerbach, A 2006, Who bears the corporate tax?, Cambridge: The MIT Press.

Clark, T & Dilnot, A 2002, Long term trends in British taxation and spending, Institute for Fiscal Studies, vol. 25, pp.1-17.

Clark, T & Dilnot, A 2002a, Long term trends in british taxation and spending, Institute for Fiscal Studies, vol. 26, pp.1-20.

Economic Report of the President 2006, The U.S. tax system in international perspective, Web.

HM Revenue and Customs 2012, Corporation tax rates, Web.

HM Treasury and BIS 2010, Corporate tax reform: Delivering a more competitive system, Web.

Internal Revenue Service Department of Treasury 2006, Corporations, Web.

IR20 2009, Residents and non-residents liability to tax in the united, Web.

Keen, M, Papapanagos, H & Shorrocks A 2000, Tax reform and progressivity, Economic Journal, vol. 110, pp. 50-69.

Klemm, A & McCrae, J 2002, Reform of corporation tax: A response to the government’s consultation document, Web.

Michael, P 2004, Individual income tax rates and shares, Statistics of Income Bulletin, Web.

Morgan,S 2009, International taxation: A comparison of the US and UK tax treatment of investment, Investment International, Web.

Murphy, R 2008, The road to progressive taxation public policy research, Compilation, Web.

Murphy,R 2009, Thinking for tomorrow, IPPR, Web.

Piketty, T & Saez, E 2006, How progressive is the U.S. federal tax system: A historical and international perspective, Journal of Economic Perspective, vol.21, no.1, pp.3-24.

U.S. Census Bureau 2012, 2010 annual survey of state governments tax collections, Web.

United Kingdom Budget 2011, United Kingdom Budget 2011, hmtreasury.gov.uk, Web.

Williams, D 2009, Direct taxes or indirect taxes? A consideration of merits of the approaches, KPMGs Tax Bussiness School, Web.