Introduction

Statement of the thesis

The decline in oil prices is likely to cause an increase in consumption, a decrease in inflation, and an increase in real GDP growth rate in the next few years. In recent times, oil prices have been falling and seem to stabilize at around 40 dollars a barrel.

This paper will examine factors determining the changes in oil price and how it affects the country’s economy, with a focus on the U.S. economy.

There are uncertain reasons regarding this recent steep fall in oil prices, such as temporary and permanent shifts in oil demand and supply, such as the entrance of the United States as a leading producer in the market.

We will further investigate how changes in oil prices affect a country’s GDP and its economy as a whole, considering selected economic indicators such as nominal and real interest rates, real GDP growth rate, real wages, and final consumption.

If the change in oil prices has a strong influence on the rate of inflation, there is a need to specify the actions that policy makers should consider in response to the changes.

Statement of the problem/ issues

The main problem is to find out whether there is a strong association between crude oil prices and other economic indicators, such as interest rates, final consumption, real GDP growth rate, and inflation rate.

If there is a strong correlation between oil prices and selected macroeconomic indicators, the government should consider an intervention to protect the economy from fluctuations in oil prices and the rate of inflation.

The decline in oil prices is likely to cause a decline in export demand because of reduced income from oil exporting countries. The decline in oil prices is also associated with a decline in investment in the oil & gas sub-sector (Baffes at al., 2015).

Reduction in investment in the sub-sector may have a small negative impact on aggregate demand. There is uncertainty on how long the low prices will last. It may prevent interest rates from dropping further when interest rates have a correlation with oil prices.

If the low prices are short-lived, any intervention from the government will cause a distortion that may last longer than expected.

Blinder & Rudd (2008) suggest that a rise in inflation raises concern in a similar manner to disinflation. Nelson (2004) discusses that the economic policies should not react to the changes in oil prices in a similar manner it had reacted in the past oil shocks.

Hypothesis

There are multiple graphical presentations in existing literature that portray that inflation and oil prices follow the same trend line.

This paper seeks to establish whether there is a strong correlation between changing oil prices and the selected macroeconomic indicators. It follows the first impression they give when one studies the graphical presentations.

We state the following hypotheses to assist in finding a solution to the strength of the influence of oil price changes to the economy.

H0: There is no strong correlation between changes in oil prices and selected macroeconomic indicators.

H1: There is a strong correlation between changes in oil prices and selected macroeconomic indicators.

The hypotheses are derived from the perception that inflation rates respond quickly to oil supply shocks. When historical data is plotted on graphs, the trend lines indicate that key economic indicators follow the same trend as that of oil prices.

However, some economic indicators tend to move in an opposite direction, such as real GDP and real interest rates.

The periods of oil shocks have been followed by periods of recession. Proponents claim it is the U.S. government’s response that caused the recessions (Blinder & Rudd, 2008). Opponents claim that the government’s response did not increase the intensity of the oil shocks.

They blame the delayed policy in response to the oil shocks (Nelson, 2004). Policy makers can determine the level of intervention to similar oil shocks by finding the strength of the influence of changing oil prices to key economic indicators. A disproportionate application of policy may intensify the effects of oil price changes.

Literature review and analysis of historical data

Effects of the 1970s oil embargo and other oil shocks on the level of the GDP and employment.

Oil prices are affected by the supply and demand of crude oil on the global market. In the 1970s, the supply of oil reduced when the OPEC countries reduced their oil production (Baffes et al., 2015). They also banned member states from selling oil to the U.S., and other countries that supported Israel in the Arab-Israel conflict.

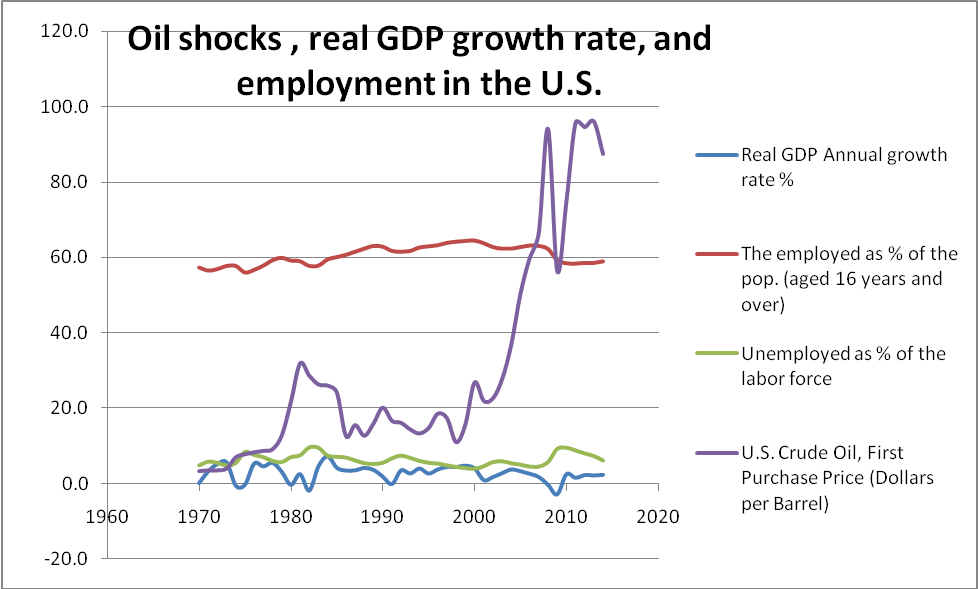

It was labelled as OPEC I, which saw the oil prices quadruple within a short period (Blinder & Rudd, 2008). OPEC II developed as a result of Iraq invading Iran in the late 1970s. At the time, the U.S. was more reliant on oil for energy than it is today. Figure 1, shown below, shows that a recession followed the periods of oil shocks.

Figure 1

Data sources: World Bank (2015), BEA (2015), and EIA (2015a).

Figure 1 shows that the real GDP annual growth rate and the trend of oil prices moved in opposite direction in the 1970s. According to the graph, there were recessions in 1970s, early 1980s, early 1990s, and towards 2010 (the 2008 financial crisis).

The Real GDP dropped to touch the 0% growth rate line when the purchase price of oil increased. The percentage of those who were unemployed also increased side by side with the increase in oil prices (see Appendix A for tables).

In the 1970s, the trend lines in the graph indicate that unemployment levels took similar turns as the trend line of oil prices. The graph also shows that the influence of the changes in oil prices weakened in the period that followed the mid 1990s.

Annual oil consumption in the U.S. over the last four decades

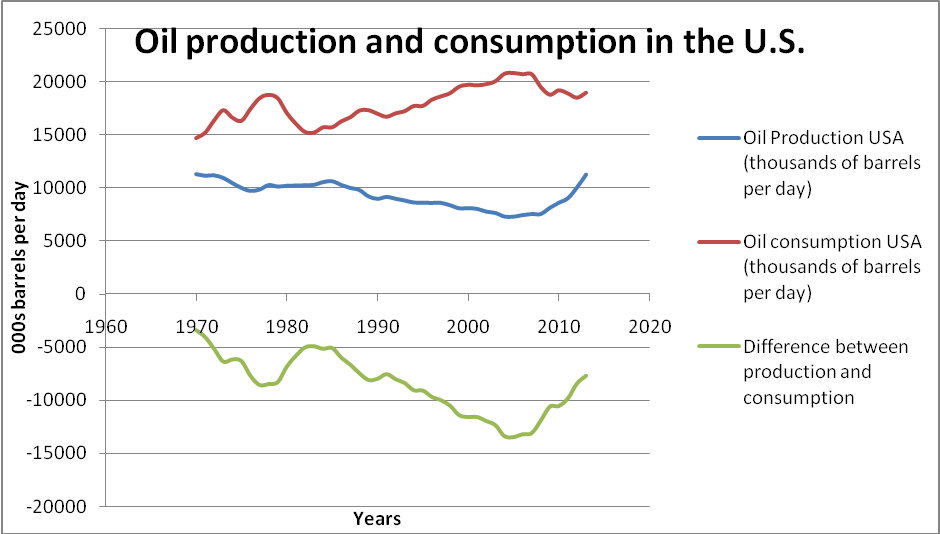

In the beginning of the study, we expected that the production of oil in the U.S. had increased while the consumption had declined. Figure 2 shows that the U.S. still needs to import crude oil.

However, the size of oil import that needs to be imported has declined to levels that are similar to those in the mid 1970s and mid 1980s. By the end of 2013, oil production was on a steep upward trend.

Figure 2

Data sources: EIA (2015b), and EIA (2015c)

From Figure 2, it can be seen that oil production in 2013 rose above the level it was in the 1980s. The difference between oil production and consumption also approached zero, which indicates a reduced need to import crude oil (see Appendix A for tables).

The reduced need to import reduces the demand for oil in the global oil market. It may also result in a further strengthening of the dollar against foreign currencies, as it creates a less supply of ‘petrodollars’ to the global market.

The effects of cost-push inflation and the phenomenon of stagflation arising from the oil shock of the 1970s

Based on the graphs, there is a strong indication that inflation rates rose during periods of higher oil prices. Blinder & Rudd (2008) discuss that the 1970s and 1980s experienced two periods of double-digit inflation rates, which were attributed to oil prices.

Blinder & Rudd (2008) mostly relied on trend lines to elaborate that the movement in oil shocks is similar to that derived from inflation rates.

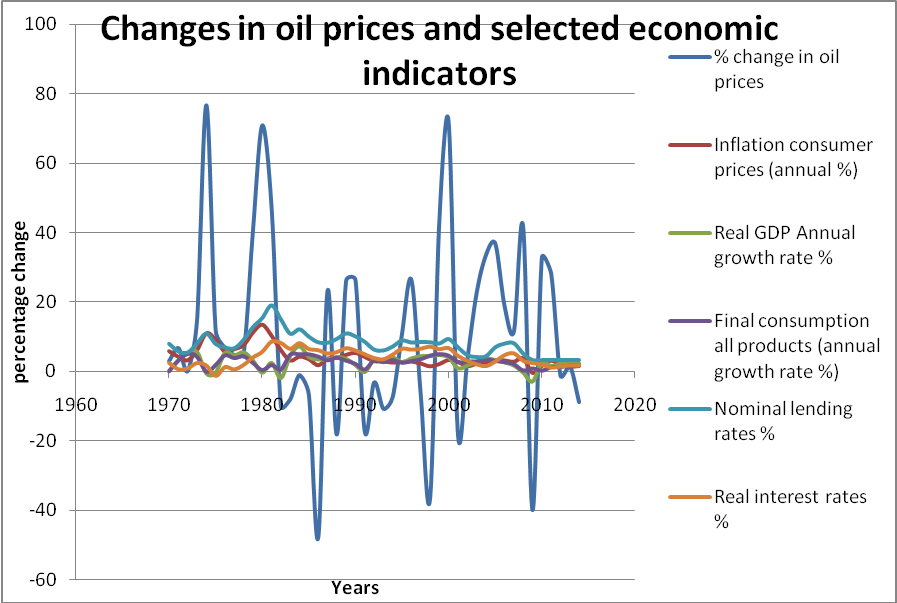

As it can be seen in Figure 3, inflation follows a similar trend to changes in oil prices. The periods with the highest inflation rate in the four decades include the 1973-1974 period and 1978-1980 period (Blinder & Rudd, 2008).

During the 1973-1974 period, inflation rate varied between 11.04% and 9.13%. During the 1978-1980 period, it varied between 7.65% and 13.51% (World Bank, 2015, see Appendix A for tables). There is a strong indication that inflation rates are influenced by changes in oil prices.

Inflation has never been higher than it was during the two periods over the forty-year period. Blinder & Rudd (2008) link the high inflation rates in the early 1970s to the increase in food prices, oil prices, and the removal of price controls during Nixon’s administration.

While higher food prices were linked to the shortage in food supply, it is visible that food prices are also affected by oil prices in the current oil supply shocks. Energy prices were the main source of inflation in the late 1970s (Blinder & Rudd, 2008).

Cashell & Labonte (2008) explain that energy prices may affect the prices of other products because it is a key input in the production of many other products.

Low inflation rate targets and low unemployment rates may be a challenging combination for policy makers (Nelson, 2004). The 1970s’ economic condition was known as stagflation. It is a term used to describe rising inflation rates and high unemployment rates occurring at the same time.

Cashell & Labonte (2008) explain that the belief that policy makers had on Phillips curve made them experience a dilemma in dealing with rising inflation levels in the 1970s. The Phillips curve predicts that inflation will rise and unemployment will fall in an inverse relationship.

An expansionary monetary policy increases demand, but it also stimulates inflation. The economy needs growth in demand to drive investment and economic growth. Nelson (2004) discusses that monetary policy was not viewed as an appropriate instrument to restore stability during the 1970s cost-push inflation.

Cashell & Labonte (2008) suggest that stagflation should not raise a lot of concern because the economy will return to its natural level of full employment, despite supply shocks.

The periods of high oil prices are also known to be the periods with the highest levels of inflation. However, in the last decade, the inflation rates appear not to respond with the same magnitude as the changes in oil prices. It may be an indication of an effective application of monetary and fiscal policies.

In 2008, oil prices changed because of a decline in demand derived from the global recession. The increase in oil prices, after 2008, can be seen as a retraction of the lost upward trend.

It may explain the reason for less volatility in inflation rates. In the last decade, there has been a decline in oil-intensity in energy production in the U.S.

Figure 3

Data sources: BP (2015), EIA (2015a), and World Bank (2015)

Figure 3 elaborates that the changes in the selected macroeconomic indicators do not match the volatility of oil price changes in magnitude. Nominal lending rates and inflation rates were more volatile to changes in the 1970s and 1980s than they have become in the last decade.

The figure elaborates that real GDP growth rate reduced each time there was an increase in oil prices. It is only in 2008 that real GDP growth rate fell, despite a fall in oil prices. The growth rate of final consumption also declined in a similar manner.

In the 1970s, it was expected that the reduction in employment levels would reduce the demand for oil. Reduction in demand would reduce the level of inflation (Blinder & Rudd, 2008).

Different views held that the rising oil prices only accounted for about a third of the inflation experienced in the U.S. (Blinder & Rudd, 2008).

Figure 3, shown above, may contribute to the argument because there is a big difference between the size of the percentage change in oil prices and the percentage change in key macroeconomic indicators. The main reason for the low impact in the U.S. is that local production cushioned against the effect of oil supply shocks.

The price of oil increased four times in the global markets, but the refiners’ acquisition cost increased by about 100% in the U.S. (Blinder & Rudd, 2008). In the future, as the economy turns to renewable energy alternatives, the effect of oil shocks may be reduced further.

Some authors blamed the government for the delay in using monetary policy to reduce demand for oil (Nelson, 2004). Blinder & Rudd (2008) discuss that the government should not be blamed because the inflationary pressures did not originate from its monetary policy.

Historical data also shows that the supply of money almost declined during the period (Nelson, 2004).

Cashell & Labonte (2008) discuss a research carried out by Bernanke and other authors that indicates that policy responses may make the effects of oil shocks to have a larger impact on prices. The change in oil prices has a small impact on overall price levels when there is no intervention.

The government is expected to overlook the effect of oil shocks when proposing policies. In response to Bernanke’s findings, some authors propose that it is unreasonable to withdraw economic policy when the economy is experiencing higher inflation levels (Cashell & Labonte, 2008).

Bernanke and his colleagues separated the effects of oil shocks on the economy using a simulated model. Opponents suggest that it is problematic to separate the effects of oil shocks from the effects of monetary policy in reality. It requires the government to respond, even when oil prices fall.

One of the limitations of using a contractionary monetary policy to contain inflation is that reducing the U.S. demand will not affect the demand of other countries. However, the U.S. contributes a lot to global demand, reducing its demand would have an impact on reducing global demand.

Another weakness of monetary policy is that there is a lag between application and effects, which may take time before they affect aggregate demand (Cashell & Labonte, 2008). The 1978-1980 oil supply shocks lasted a shorter period.

Using monetary policy, in trying to stabilize the economy, would have effects occurring in a period they are not needed. It is more appealing to allow the short-term market shocks to be restored through the market mechanism, back to the equilibrium price.

Oil prices have an impact on inflation when they are changing. Once they have adjusted and are stable, Cashell & Labonte (2008) explain that it should not be of concern to policy makers.

Higher oil prices have no effect on inflation, provided they are stable. Market forces will take the economy back to the natural rate of employment. The only challenge is that there are different levels of the natural rate of employment in different periods and countries.

The Current Oil Prices

Causes

There are a number of periods in which oil prices have fallen since the 1970s. Oil prices fell in 1985, 1990, 1998, 2001, and 2008 (Baffes et al., 2015). In 2008, the fall in oil prices was associated with the fall in demand as the world economy sank into recession (McCafferty, 2015).

In 1997-98, it was caused by the Asian economic crisis (Baffes et al., 2015). In all the oil shocks, the market was affected by either the supply of oil or its demand. The current sharp decline in oil prices is caused by increased supply. The other causes act through their effect on demand and supply.

In the historical periods, one of the causes of the fall in oil prices has been an increase in production. In 2014, the fall in oil prices responded to a similar cause. Prior to the fall in prices, there was an increase in oil supply, followed by an accumulation of oil reserves.

There has been an increase in production in the U.S. as shown in Figure 2. There has been an increase in oil supply since 2010 (McCafferty, 2015). In the global market, disruptions in supply only occurred in 2013 through the political instability in Libya and Iraq.

The difference between the falling prices in 2014-2015 and other periods is that the supply has not been cut by OPEC as it has been happening in similar situations. Saudi Arabia used to play a crucial role of reducing supply, which allows prices to stabilize.

In the recent period, Saudi Arabia intends to push back firms that supply oil from high production cost rigs into cutting their supply. Baffes et al. (2015) discusses the point as a change in OPEC objectives.

They have shifted from using oil prices to keep their market share to keeping their current production levels and relying on their competitiveness. Saudi Arabia holds the advantage of producing oil using one of the lowest costs in the global market.

In the U.S., some drilling firms have postponed production in high production cost rigs (McCafferty, 2015). The current increase in oil supply may last a longer period than previous oil shocks because of the presence of new producing countries that want to capture a larger market share.

Another reason is that the non-OPEC producers account for 58% of the global oil production, which may reduce the influence of OPEC. Baffes et al. (2015) predict that the lower oil prices will stabilize before the end of 2016.

The high prices that followed the 2008 recession were one of the drivers of an increase in investment in oil production. McCafferty (2015) explains that the high oil prices made high production cost oil rigs to become economically viable. An increase in oil rigs caused the supply of oil to increase.

The introduction of new technology in the U.S. for the extraction of oil and gas also increased supply in the U.S. In the 1980s, the venture into deep sea drilling and harsh climate environments caused an increase in supply in a similar manner (McCafferty, 2015).

The U.S. shale oil production has been able to increase global production levels by about 1% annually since 2011.

The demand for oil declined in the global market fell by about 0.8 million barrels per day while the U.S. oil supply increased by 0.9 million barrels per day (Baffes et al., 2015). It has resulted in increased supply and reduced demand.

The appreciation of the U.S. dollar against major currencies is cited as one of the contributing factors to falling oil prices. Baffes et al. (2015) explain that simulations indicate that a 10% appreciation in the USD will cut oil prices by between 3% and 10%.

The impact of an appreciating USD is felt through a loss in purchasing power from countries that use the dollar to engage in international trade.

Baffes et al. (2015) discuss that there was about a 10% appreciation of the USD in the last half of 2014, which may contribute to falling oil prices. A stronger dollar reduces the demand for oil in the global market through the loss of purchasing power.

Effects

The downward trend in oil prices may increase global economic growth in the next two years. According to the IMF, the recent fall in oil prices may result in the world economy growing by about 3.5% in 2015 and 3.7% in 2016 (McCafferty, 2015).

Baffes et al. (2015) discuss that models have been used to estimate that a 30% decrease in oil prices will result in about 0.4% to 0.9% decline in global inflation.

Oil prices affect the economy through three channels, which include input costs, changes in real income, and the response of policy makers (Baffes et al., 2015). These channels directly and indirectly affect other economic indicators.

In the UK, lower oil prices have been associated with a fall of inflation below targeted levels. In 2015, the inflation rate was 0.5% in January and 0.3% in February (McCafferty, 2015). Cheaper oil increases the purchasing power of workers through real wages.

As the prices of other products fall, workers will be able to purchase more commodities using the same level of nominal income (McCafferty, 2015). It may increase aggregate demand, which will stimulate increased production.

There are also negative effects of higher real wages. Blinder & Rudd (2008) discuss that higher real wages relative to productivity will put pressure on wage rates and reduce employment demand.

In the medium-term, high real wages will increase unemployment. In recent years, wages are considered to have absorbed most of the prices changes derived from oil shocks than it was in 1970s (Blinder & Rudd, 2008).

McCafferty (2015) supports the notion that lower oil prices does not translate into higher capital accumulation and higher productivity. Other factors have to be used to increase income levels.

According to McCafferty (2015), there is a lack of a model that elaborates how to set interest rates in response to sharply falling oil prices.

The lack of a clear level of interest rates may cause policy makers to avoid using interest rates in response to the current fall in oil prices. An inappropriate level of response may have adverse long-term effects on the economy.

The study by Bernanke and co-authors gives a finding almost similar to the simulation by the Bank of England, which suggests that lower oil prices have a very small impact on the level of GDP (McCafferty, 2015).

Bernanke and co-authors estimated that GDP would rise by 1.3% and inflation by 0.13% when oil prices rose by 10%, if there was no intervention from monetary policies (Cashell & Labonte, 2008). The Bank of England estimated that a 10-percent fall in oil prices would increase the GDP by 0.1% in two years (McCafferty, 2015).

These studies tend to indicate that the effect on oil prices on the GDP is minimal without the interference of government policies. Cashell & Labonte (2008), as well as Blinder & Rudd (2008), highlight the notion that the government’s effort in trying to control inflation from oil prices has been the source of recessions in the past.

Previously, Figure 3 has shown that the effect of oil prices fluctuations on economic indicators was small and is becoming smaller. It shows that government intervention should be minimal in response to oil shocks.

One of the reasons that the U.S. has become less sensitive to oil shocks is that the economy has become less oil-intensive than it was in the 1970s (Blinder & Rudd, 2008).

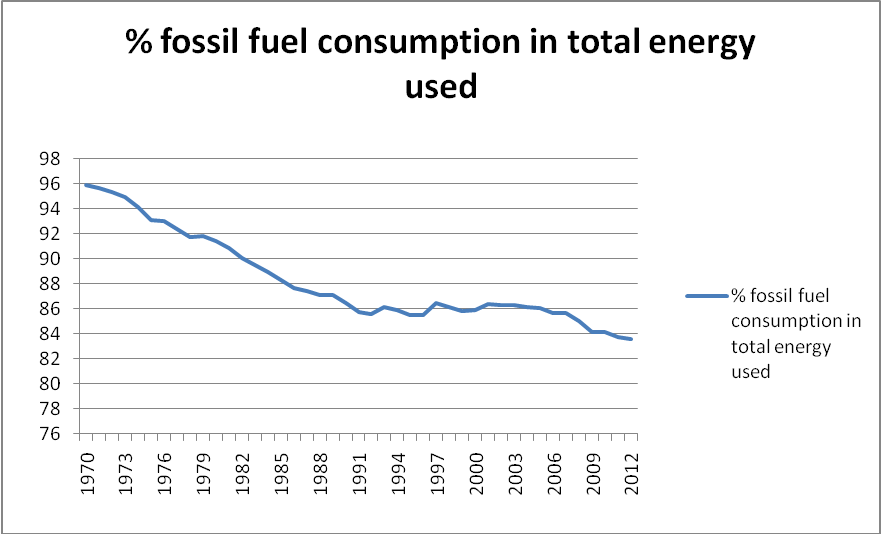

The U.S. has also reduced its reliance on imported oil through the years. Figure 4, shown below, shows that the reliance on oil for energy production has reduced as a percentage of energy needs.

Figure 4

Source of data: World Bank (2015)

A less percentage of the U.S.’s energy consumption is derived from oil. Baffes et al. (2015) discuss that the impact of falling oil prices may have an impact of varying magnitude on different countries depending on the intensity of oil consumption in a country.

In Asian countries, the fall in oil prices is weakening their currencies and causing an increase in capital outflows (Baffes et al., 2015). It is one of the ways oil shocks may affect financial markets.

Policy in response

The effect of the oil shocks has grown weaker in the last decade. According to Baffes et al. (2015), the effect of oil prices may end in 2016. Central banks do not need to respond to the fall in oil prices through a monetary policy because the phenomenon will be short-lived.

However, in the European countries, the rate of inflation was maintained at low levels, an expansionary monetary policy may be needed to maintain inflation closer to the targeted levels. Disinflation may not be preferred.

In countries such as Egypt, the lower oil prices provide countries, which usually support oil consumption through subsidies, to withdraw subsidies if it is part of their long-term goals (Baffes et al., 2015). In response to lower oil prices, the U.S. does not need to respond with a cut in the government expenditure.

Methodology

Explanation of theoretical model

The paper starts with an examination of the literature review of the causes and effects of oil shocks to the economy. There was examination of policies in response to changes in oil prices. In line with existing literature, the paper has used graphs for analysis.

The graphs were developed from historical data, which covers four decades on economic indicators. Percentages are used for most indicators because they allow a better comparison of effects than the use of absolute values.

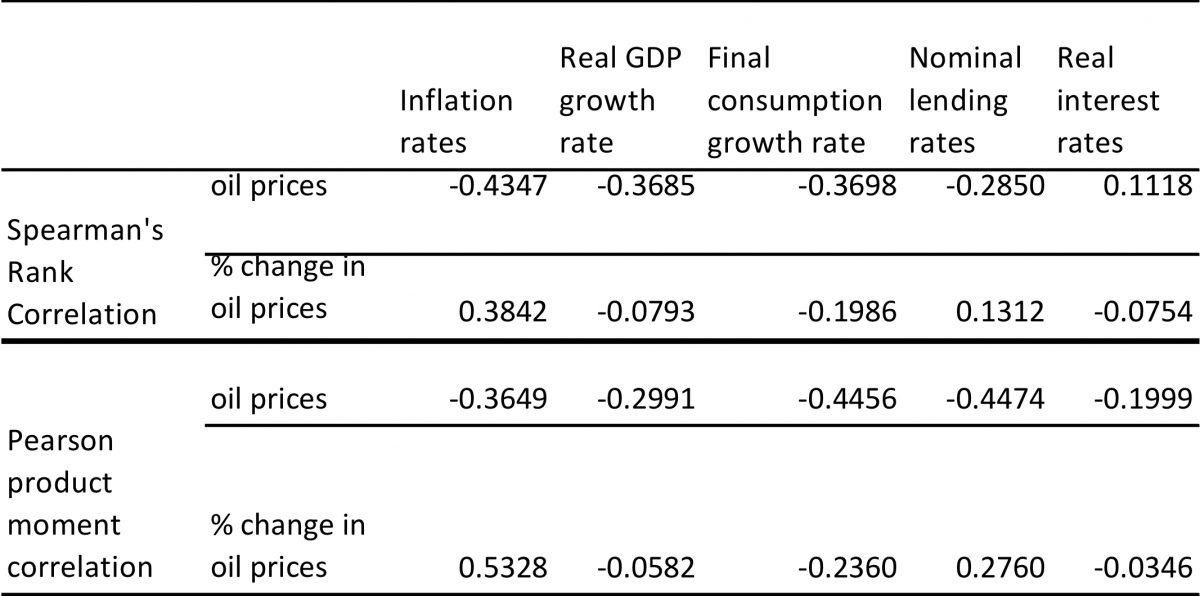

Spearman’s rank correlation has been applied in trying to find out whether there is a strong association between oil prices and other macroeconomic indicators. One of the reasons for applying the rank correlation is that the curves are non-linear. There is the presence of outliers.

Rank correlation has been used by Blinder & Rudd (2008) to analyze the effects of oil shocks to the U.S. economy. Pearson product moment correlation has been used by Baffes et al. (2015) in describing the association between changes in oil prices and macroeconomic indicators.

In this paper, the product moment correlation has been used to compare results from the rank correlation. Correlation is preferred because it is difficult to separate the effects of oil shocks from the effects of government policy.

Baffes et al. (2015) analyze trends in oil prices using correlation and finds out that only the core inflation rate may have a negative correlation with oil prices. Inflation derived from the CPI should have a positive correlation with changes in oil prices.

In line with the literature review, changes in oil prices should be used instead of oil prices to assess their impact on the economy. The results show that using absolute values in oil prices results in findings that are contradictory to existing literature.

Statistical analysis

In the results, the Spearman’s rank correlation indicates that there is a weak positive correlation between inflation and changes in oil prices over the forty-year period. However, the Pearson product moment correlation indicates that there is a strong relationship between changes in oil prices and the inflation rate.

The results conform with existing studies that inflation responds to changes in oil prices rather than higher oil prices. Cashell & Labonte (2008) and Baffes et al. (2015) suggest that once prices have stabilized, high oil prices have no impact on inflation.

Table 1

There are a few reasons for contradictory results when absolute prices are used. The reason for negative correlation is evident from the fact that the forty-year period is a long period, the highest inflation rates are in the 1970s and the highest oil prices appear after 2009.

It causes the rank correlation to be negative. Another reason for the negative correlation is the nominal oil prices. Result would be different if oil prices were chained to a base year. There is an accumulative inflation rate that makes oil prices in recent years higher than in the 1970s.

The result leads to the acceptance of the null hypothesis (H0) that there is no strong association between changes in oil prices and selected macroeconomic indicators. However, inflation rates show a strong positive correlation with changes in oil prices under the Pearson product moment correlation.

There is a weak negative correlation between changes in oil prices and real GDP growth rate, final consumption, and real interest rates. Changes in oil prices have a weak positive correlation with nominal lending rates.

Data collection

Data used in the paper was collected from government agencies’ databases and corporate databases.

The World Bank (2015) database provided a large group of data, in Excel format, from which data on real GDP growth rate, nominal lending rates, real interest rates, inflation rates, and annual growth rate of final consumption was obtained.

The EIA (2015a) provided data on the first purchase price of crude oil from 1970 to 2014. The EIA (2015b) and EIA (2015c) provided data on consumption and production of oil from 1980 to 2013.

The BP (2015) database filled the gap by providing data for oil production and consumption from 1970 to 1979. There was a negligible difference between data provided by EIA and BP databases on oil production and consumption.

The BP database worksheet also included data on oil prices, though it was not used in the analysis. Preference was given to the EIA historical data on oil prices. BEA (2015) provided data on the level of GDP.

Conclusion

Summary of the results

There is a weak relationship between changes in oil prices and key economic indicators. The weak correlation may be explained by the reduced impact of oil shocks in the last decade. In 2008 recession, changes in oil prices and changes in key economic indicators moved in a different direction than it was expected.

The effect is also reduced by the fact that the government has implemented policies that keep the nominal interest rates at a fixed lower level. It has also used an expansionary monetary policy that may overshadow the effects of increasing oil prices since 2009.

Existing theories indicate that only about a third of the effect of changing oil prices may be reflected on the macroeconomic indicators.

One of the limitations of the study is that it is difficult to separate the effects of changing oil prices from the effect of government policy using historical data. They are applied simultaneously and the effects are spread across different macroeconomic indicators, which have a second-wave of effects.

As a matter of fact, the correlation results only measure the extent to which macroeconomic indicators have a similar trend to changes in oil prices. Inflation rate is the macroeconomic indicator that appears to be greatly influenced by changes in oil prices.

Recommendations

- Policy makers do not need to respond to current changes in oil prices. One of the reasons is that the falling oil prices are expected to stabilize by the end of 2016. It makes the oil shock to be considered a short-term phenomenon. Monetary policy has time lags between application and effect, which may cause an unwanted effect in the long run. The literature review indicates that government policies may intensify the effect of an oil shock.

- It is an opportunity to implement fiscal policies that cut expenditure on oil subsidies in countries that relied on them. The contraction of fiscal policy should only be used when it is regarded as a long-term objective.

- The fall in oil prices may be followed by an increase in unemployment when there are higher real wages relative to productivity (Blinder & Rudd, 2008). It may cause a decline in the demand for labor. The government can ease its monetary policy by a small margin to contain rising real wages. It should be done in a timely manner to prevent the lagging effects.

References

Baffes, J., Kose, A., Ohnsorge, F., Stocker, M., Chen, D., Cosic, D., Gong, X., Huidrom, R., Vashakmadze, E., Zhang, J., & Zhao, T. (2015). Understanding the plunge in oil prices: Sources and implications. Global Economic Prospects. Web.

BEA. (2015). National data: gross domestic product. Web.

Blinder, A., & Rudd, J. (2008). The supply shock explanation of the great stagflation revisited. Web.

BP. (2015). BP statistical review of world energy June 2013. Web.

Cashell, B., & Labonte, M. (2008). Understanding stagflation and the risk of its recurrence. Web.

EIA. (2015a). Petroleum and other liquids: U.S. crude oil first purchase price (dollars per barrel). Web.

EIA. (2015b). Total petroleum consumption. Web.

EIA. (2015c). Total petroleum consumption. Web.

McCafferty, I. (2015). Oil price falls – what consequences for monetary policy? Web.

Nelson, E. (2004). The great inflation of the seventies: What really happened? Web.

World Bank. (2015). United States: World development indicators. Web.