Budgeting Tools Utilized by Both Government Types

Budgeting tools are usually used in the financial planning process. The budget serves the essential purpose of controlling and evaluating the use of sources and resources. Over the past decade, various governmental entities in the U.S. have used different budget approaches and formats. This is due to the advancement of budget philosophies to growth in the scope and complexity of operations in the government.

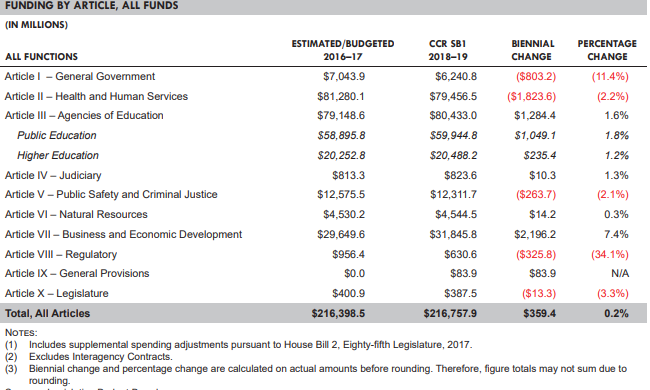

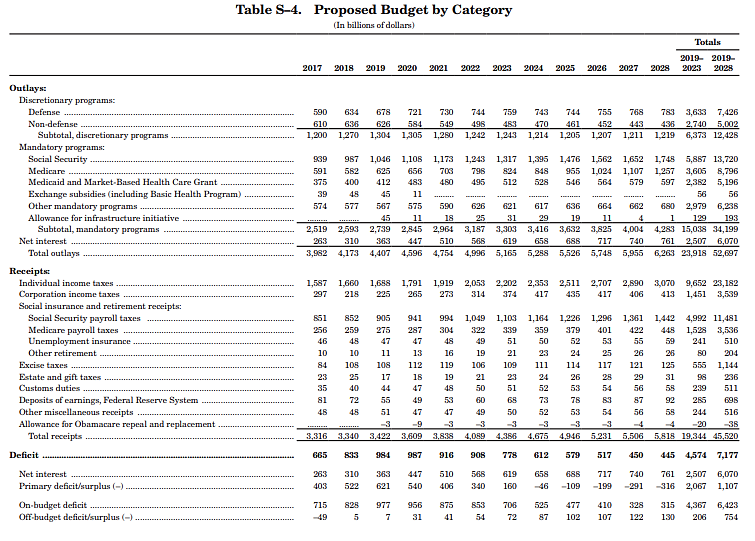

Presented below are figures showing budgets utilized by the state government, that is Texas State, and the federal government in the current fiscal year. Based on the Legislative Budget Board (2019), it is seen that the Texas State government employs the capital budgeting tool. This is because the financial decisions presented are for capital projects that impact public assets, and they include health, education, and water resources, among others. On the other hand, according to the Office of Management and Budget (2019), the financial decisions in the federal government are presented as outlays and receipts for the current or next fiscal year. Therefore, it can be said that the government utilizes an operating budgeting tool.

Impact of Market Inefficiencies on Both Government Types

In the case of market inefficiency, the state government will be more adversely impacted as compared to the federal government. The state government constitutes a sizeable fraction of the American economy. In the case of market inefficiencies, the state government is restricted in its ability to respond to economic shocks due to its limited institutional ability. Its limited institutional ability is brought about by the fact that it is required to operate on a balanced budget requirement, which is still affected even in the event of an inefficiency. Therefore, state governments can be regarded as much challenged as they have to make significant efforts to offset the unforeseen revenue shortfall.

On the other hand, the federal government can borrow funds in the face of market inefficiency to cover the revenue drop. This grants it more flexibility as it allows the federal government to increase spending for unprecedented economic purposes.

The Use of Rainy Day Funds by the State and Whether Or Not It Can Be Applied To the Federal Government

Rainy day funds are the monies put aside by the state governments from prior budget surpluses to cover future unexpected revenue deficits. State governments set aside these funds as are required to have a balanced budget. Contrary to the state government, the federal government lacks rainy-day funds. I believe that this should remain so. Balanced budget amendments and consequentially rainy day funds for the federal government is a popular political perception; nevertheless, the economics behind it is debatable.

This is because based on the Keynesian macroeconomic policy, the federal government has macroeconomic responsibilities; thus, it needs to be flexible to accommodate unforeseen expenditures. This means spending in hard times and saving in good times, for the overall sake of the economy. The revenue present on rainy day funds should not restrict these unforeseen expenditures. Moreover, according to the White House (2019), the U.S. government has run on a budget deficit since 1970, it will be irrational and impractical for the government to create a rainy day fund as it will have first to offset the multibillion-dollar debt.

The federal government has been successful in operating on budget deficits for decades, in the absence of a rainy day fund. However, it is essential to note that this is only achieved when the percentage GDP growth remains higher than the percentage increase in debt.

References

Legislative Budget Board. (2019). Summary of Conference Committee Report for Senate Bill 1: Appropriations for the 2018–19 Biennium. Web.

Office of Management and Budget. (2019). Efficient, effective, accountable an American budget. Web.

White House. (2019). Historical tables. Web.