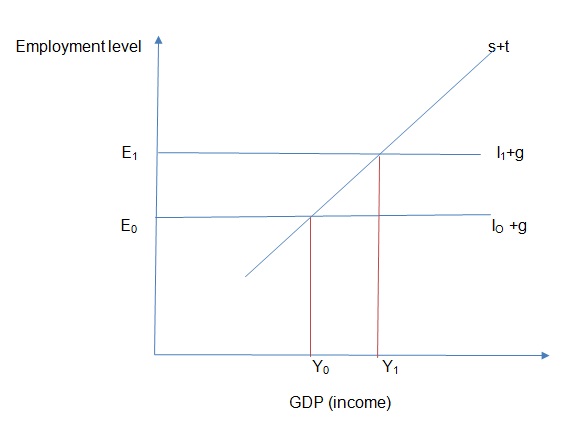

The effect of a reduction in government expenditures

Reduced levels of consumption government expenditure and investment in firms’, triggers cut backs in production, layoffs and leaves capital equipment lying idle. A reduction in government expenditure would adversely affect the economy since it would lead to massive unemployment and depression (Hall 15). The graph below highlights the interplay between government expenditure, investment and employment. Overall, reduction in investment and government spending from I1+g to IO+g will trigger a reduction in employment from E1 to E0.

“Rethinking Debt” by Jared Bernstein

The great misconception with regard to debt and borrowing culminated in the Great Recession. The last decade has been characterized by imprudent borrowing, ignoring totally their capability, or lack there of, to fulfil their financial obligations. This led to the bankruptcy of Lehman Brothers Investment Bank in September 2008. The global debt contagion arose leading to massive unemployment levels and unmanageable debt levels for countries like Greece. Knowledge of how to use debt as a beneficial and efficient tool is crucial for households, governments and financial markets.

Debt is an obligation or money owed by one party to another. Political leaders do not support deficit spending. A reduction in taxation levels since early 2000’s has led to an increase in the debt level of the country as a result of reduced revenue collection, and this has led to higher deficit spending. It is important to be clear on the intention of borrowing, that is, is it to invest or to consume? Borrowing for investment purposes is productive as they generate returns in the long run where as borrowing for consumption purpose does not generate economic gain.

Temporary borrowing does not significantly impact on the growth of debt since it is assimilated by economic expansion, but permanent borrowing adversely affects an economy as a result of increased deficit and debt growth. The most important thing to remember is the purpose for borrowing, the length of time taken to pay back and the mode of repayment. When the cost of borrowing is low as a result of recession, expansionary fiscal policies should be implemented to stimulate economic growth and cushion households from job loss. When the economy undergoes recession and household real income reduces, policy makers should employ expansionary fiscal policy since the private sector is diminishing (Greenwood, Hercowitz, and Huffman 410).

Minsky, an economist trained at Harvard argued that debt is principal to a functioning economy. Debt is a requisite tool for economic development. It is important to note that economic agents cannot sufficiently sustain themselves if they are not willing to borrow from the future to spend in the present. For an administration to repay its’ liabilities, it needs a rational reconsideration of the debt and its purpose in the economy.

“Finance without Financiers” by Gerald Epstein

The Global Financial Crisis of 2007-2010 forced European and American governments to invest vast amounts of money in financial institutions to avoid bankruptcy. According to David Gordon (1996), corporations’ productivity was on the decline as a result of employee oppression in terms of wages. Efficient and innovative workers were overlooked, further worsening the productivity of the firm. There has been a huge leap in financial profits in the past two decades so has the case been with regard to debt. Individuals at the helm of entities have huge salaries and bonuses and this has been the case even with a struggling economy. ‘Finance without financiers’ is critical in ensuring that there is efficient and effective allocation and utilization of resources in the economy (Gordon 120).

The state plays a crucial role in structuring and mobilizing finance for economic development. Government Sponsored Agencies (GSE’s) are imperative since they are an avenue through which the government can oversee the implementation of social goals. Community Development Financial Institutions (CDFI’s) are mandated to ensure that people and communities can access financial services. These institutions could perform much better if the government invested in them as this would make a substantial difference. Conversion of bankrupt organization in to state owned enterprises can jump start the economy by raising the levels of lending to households and economies. Sufficient social governance can only be attained if the systems in place ensure clarity and responsibility to all the stakeholders. The remuneration of employees in the finance sector, whether public or private has a direct link on the prosperity of ‘finance without financiers. It must be high enough to attract excellent talent. Stringent financial regulations must be put in place to ensure that the transition of a bank from bankrupt to public institution is successful.

Improved financial regulation is crucial, but not enough to attain the goals. Other techniques must be found to ensure that financial markets and institutions serve social purposes. The models of “finance without financiers” can be used to help strengthen the social productivity and efficiency of finance. It is the time to broaden and strengthen these institutions where they exist and new ones created where they do not exist for efficient and equitable economies.

Works cited

Bernstein, Jared. “Rethinking Debt.” Democracy: A Journal of Ideas, no. 23, 2012. Web.

Epstein, Gerald. “The David Gordon Memorial Lecture: Finance Without Financiers: Prospects for Radical Change in Financial Governance.” Review of Radical Political Economics, vol. 42, no. 23, 2010, pp. 293–306.

Gordon, J. What Is New-Keynesian Economics? Journal of Economic Literature. 28.3 (1990): 71-1115. Print.

Greenwood, J., Hercowitz, Z., and Huffman, W. Investment, Capacity Utilization and the Real Business Cycle. American Economic Review. 78 (1988): 402-417. Print.

Hall, E. Labor Supply and Aggregate Fluctuations. Carnegie-Rochester Conference Series on Public Policy. 12 (1980): 7-34. Print.