Government budgets are central policy documents prepared by a given country. They are used in the governing of the proposed revenues and expenditures. The budgets are based on the objectives the government intends to achieve in a fiscal year. The document is normally approved by the legislative body of a country and the head of government. The major objective of budgeting is to allocate and control resources.

In this paper, the author will provide a comparative analysis of government budgeting in Dubai and Thailand. To this end, a general review of government budgeting will be provided, together with a highlight of the consequences associated with continuous deficits and debts. The key macroeconomic variables in Dubai and Thailand will be provided, as well as the sources of revenue and expenditure in the two countries. Finally, the steps taken by the two governments in resolving budgetary problems will be analyzed.

A Review of Government Budgets

What a Government Budget Represents

Government budgeting employs artistic imagination and uses the available technical methods to create and improve the conditions and lives of the citizens. One of the major stakeholders in the budgeting process is the central government. However, the process also brings on board other agencies in the country. The agencies concerned are those that carry out different functions depending on the governing style adopted by a given country. The process varies widely from one country to the other. The variation depends on the cultural, political, and economic factors in the nation.

A national budget is a representation of the amount of revenue the government intends to collect and the expenditure to be incurred in a financial year. It is a contract between the state and the citizens. The document shows how the resources are brought together to fund the delivery of services required by the public. As such, the document should be clear and transparent for the purposes of accountability and trust by the general public. A sustainable and objective budget should adhere to the regulations and systems put in place. To develop a consistent and sustainable budget, other policy documents are required to estimate the needs and requirements of the citizens. The policies taken into consideration include strategic plans and financial trends monitoring reports. Others include land use and capital improvement plans.

Consequences of Continuous Budget Deficits and High Levels of National Debt

In most cases, government spending exceeds the amount of money available in the country. The result is a deficit or national debt. Governments use several strategies to cover for the national debt. One of these strategies includes borrowing. Hubbard explains three effects of a budgetary deficit on the country’s economy. There are both long-term and short-term effects that are detrimental to the growth of the economy. According to Hubbard, a cumulative increase in debt can lead to a rise in real interest rates. The rise is brought about by domestic borrowing by the government. Another effect of national debt is increased reliance on foreign savings. The net result is economic instability in the country. National debt also increases the tax burden in the country. In addition, it reduces capital formation and leads to a depressed economic growth. Consequently, the living standards of the citizens are negatively affected.

Values of Key Macroeconomic Variables in Dubai and Thailand

The economy of a country of a country is rated using the growth in its gross domestic product (GDP). The GDP uses a number of indicators. They entail, among others, consumer price indices and inflation rate. The variables define the economy of the country and its net worth.

Macroeconomic Variables in Dubai

Currently, Dubai’s economy is anchored on the tourism and real estate sectors. However, initially, the economy was pegged on the oil industry. According to the 2015 annual economic report by the United Arab Emirates Ministry of Economy, oil prices have been on a decline since 2014. For instance, between 2014 and 2015, the prices fell by about 60%. However, the negative growth had no major impacts on the GDP.

The inflation rate stood at 5.1% in 2013. The rate dropped to 4.2% in 2014. The figure was expected to decrease to 4.14% in 2015 (United Arab Emirates Ministry of Economy, 2015). The rate of unemployment as of 2014 stood at 11.5%. However, the debt index increased between 2000 and 2013. It stood at an average of $585 billion from 2000 to 2009. The figure rose to $780.6 billion in 2013. In 2014, it increased further to $798 billion. Between 2000 and 2014, Dubai went through an economic meltdown. However, the economy picked up due to the growth witnessed in the tourism and real estate sectors. Within the same period, private consumption rose by 3.1%. On its part, public investment grew by 9.9%, while private investment rose by 0.4%.

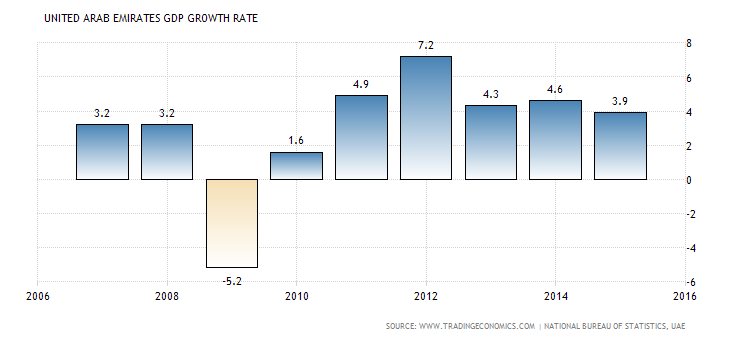

The figure below illustrates the growth of GDP in the United Arab Emirates between 2006 and 2014. The diagram also illustrates the projected growth between 2015 and 2016.

Macroeconomic Variables in Thailand

In 2006, Thailand’s economy grew by 3.2%. However, the figure dropped slightly to 2.9% in 2015. Like the case in Dubai, tourism plays a major role in the economy of Thailand. It is projected that the economic growth will rise to 4.0% in 2020. Between 2015 and 2016, the terms of trade fell from $115.3 billion to 112.4 billion. It is also noted that about 1% of the country’s population is unemployed. The figure dropped from 2.5% in the previous year due to the expansion of both the agricultural and non-agricultural sectors. The government has accumulated approximately $5.9 trillion in public debt. The figure is about 42.2% of the GDP.

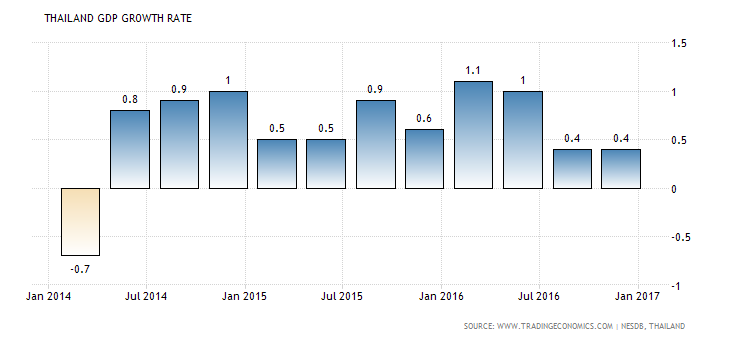

The figure below represents the growth in Thailand’s GDP between 2014 and 2017:

The Status of the Governments’ Budgets in Dubai and Thailand: 2012-2017

Sources of Revenue and Expenditure in Dubai and Thailand

In most countries, government revenue comes from tax. However, in Dubai, locals and expatriates are not subjected to income or sales tax. The government generates its revenue from corporate and indirect taxes. Other sources of revenue include fines, payments for services provided by the government, and oil. The revenue is expected to rise to11% in 2017. The increase is due to real economic growth brought about by principality, as well as the evolution and diversification of the services provided to the citizens by the government between 2012 and 2017. With regards to expenditure, the Dubai government will focus mostly on infrastructure and the provision of services to the people.

On its part, Thailand’s government depends more on taxes to raise revenue for its public budget. The tax regime is largely similar to that in Dubai. However, the major difference is that locals in Thailand pay taxes. In Thailand, borrowing is also commonly used to increase the revenue collected by the government. Between 2012 and 2017, government expenditure in the country has focused on infrastructure and provision of public services.

Measures put in Place to Solve Budgetary Problems in Dubai and Thailand

According to Kane, the government in Dubai has created a Supreme Fiscal Committee to enhance the efficacy of financial policies in the country. In addition, the government has managed to address the problem of budgetary deficits by emphasizing on the social aspects of the economy. The government is also encouraging private investment with the aim of increasing its revenue. In Thailand, public spending is a shared responsibility between the local and the central governments. There are laws that govern the use of locally collected revenue. Borrowing is also used to complement the government spending.

In both in both countries, there is a felt need to cut government spending and reduce borrowing with regards to the national budgets. In Thailand, the system of analyzing revenue and expenditure by the local government is seen as a way of reducing public expenditure. The central government also offers grants and subsidies to the locals to promote the national budget.

Conclusion

The budgetary process and funding vary from one country to the other. Taxes and borrowing are the major sources of funding in most countries. On its part, public expenditure revolves around the government’s development agenda. A budget is a tool used to run a country. It provides a roadmap on how to collect revenues and spend on public services.

References

Guess, G. (2015). Government budgeting: A practical guidebook. New York, NY: SUNY Press.

Hubbard, G. (2012). Consequences of government deficits and debt. International Journal of Central Banking, 8(1), 203-235.

Kane, F. (2015). Dubai avoids deficit in Dh41 billion budget for 2015.The National Business. Web.

Kosiyanon, L. (n.d). Budgetary spending behavior of local governments in Thailand: Some observations. Web.

National Economic and Social Development Board. (2017). NESDB economic report: Thai economic performance in Q4 and 2016 and outlook for 2017. Web.

Organization for Economic Co-operation and Development. (2014). OECD principles of budgetary governance. Web.

United Arab Emirates Ministry of Economy. (2015). The annual economic report 2015. Web.