Introduction

The determination of this research is to evaluate the enactment of construction corporations in the United Arab Emirates for the period of the pre and post worldwide eras of financial disaster, which is from 2006 to 2009. A percentage examination was directed based on an example of several corporations in the construction sector. A nonparametric examination, specifically the Wilcoxon matched-pairs contracted ratio examination, was implemented in order to observe if the intended ranks diverge amongst the pre-crisis and post-crisis eras.

The results reveal a negative actual and potential effect of the global financial crisis and the commercial sequence on the enactment of real estate corporations in the United Arab Emirates. There is a substantial reduction in the liquidness, effectiveness, influence, and commotion fractions after the financial disaster. The restrictions of the research spin around issues such as incomplete example magnitude, non-attainability of statistics for the aforementioned times, little limpidity regarding revealing a number of fiscal specifics and non-accessibility of annual manufacturing arithmetic means.

The local explosion in the United Arab Emirate appeared to be one of the most protruding subjects to lead the captions of the media for the previous more than a few years. This is primarily owing to an excess of essential assets for which the economy of the United Arab Emirates is renowned from one place to another in the whole world. An upsurge in construction value has taken the role of the most noticeable influence acting as a compound to the nation’s renown. The sensible strategies approved by the administration of the country consist of directing construction profits into emerging non-construction trade and industry subdivisions, inviting extraneous assets and funding numerous substructures, expansion and housing plans.

Despite these obviously reasonable compensations, the global financial crisis that has affected the worldwide economy almost seven years was successful in leaving its stain in a quickly developing country like the United Arab Emirates. Al-Masah Capital Limited conducted a research in 2011 that stated that the United Arab Emirates subsidized nearly sixty percent of the assets explosion in the Gulf Cooperation Council (GCC) nations, with Dubai on its own subsidizing up to forty-seven percent of the overall monetary funds among the Gulf Cooperation Council countries (GCC Real Estate par. 5). This impact rationalizes the dispute by Baker that “the central element in the financial crisis is the housing bubble. The real estate and construction sector, which emerged as the most attractive destinations for global investors during 2003-2007 was a sector severely affected by this financial blow” (Baker 73).

The Process of the Research

The economic theory of Minsky

Hyman Minsky has suggested a statement, which is most appropriate to a closed economy. He hypothesized that fiscal brittleness is a distinctive aspect of any capitalist economy (Wolfson, 2002). Great brittleness results in an advanced menace of a financial disaster. In order to simplify his investigation, Minsky outlines three methods that the corporations might select, rendering to their acceptance of menace. They are hedge finance, speculative finance, and Ponzi finance:

For hedge finance, income flows are expected to meet financial obligations in every period, including both the principal and the interest on loans. For speculative finance, a firm must roll over debt because income flows are expected only to cover interest costs. None of the principal is paid off. For Ponzi finance, expected income flows will not even cover interest cost, so the firm must borrow more or sell off assets simply to service its debt. The hope is that either the market value of assets or income will raise enough to pay off interest and principal. (Wolfson 395)

Fiscal brittleness levels transfer along with the commercial sequence. After a collapse, the corporations have lost a lot of funding and select only hedge, the harmless approach. As the economy develops and predictable incomes increase, the corporations usually are certain their ability to take on speculative funding. In this case, they are aware that the incomes will not be able to shield all the interest permanently. On the other hand, the corporations rely on their income to increase, and the credits will ultimately be refunded without many difficulties. More advances result in more asset, and the economy cultivates extra.

The Effects of the Crisis in the UAE

A research conducted in 2011 in the construction sector of the Gulf Cooperation Council countries quantified that charges and rentals have decreased by thirty-fifty percent from their heights, and an assessed three hundred and fifty billion dollars’ worth of production schemes have been postponed or annulled in the United Arab Emirates (Gibson 11).

In the course of the research, we have endorsed a number of causes for an interval in alteration of this reducing tendency. The leading issues observed the funds coming from extraneous depositors, the deterioration on immigrant inhabitants due to a reduction of expenditure, the financing of the technical hitches due to severe liquidness circumstances, the deteriorating customer assurance in the economy of the United Arab Emirates and most important inequities in mandate and source of housing units. The limpidity subject has detained massive consideration particularly after the financial disaster, as depositors are now in pursuit of precise and dependable material in advance of constructing asset choices. As a result, there are only eleven organizations in the construction segment at the moment that are registered in the Dubai Financial Market and three corporations in the Abu Dhabi Securities Exchange (Barthwal 204). The results maintain the information connected to the general deterioration in the presentation of this segment afterward the financial crisis (Barthwal 205).

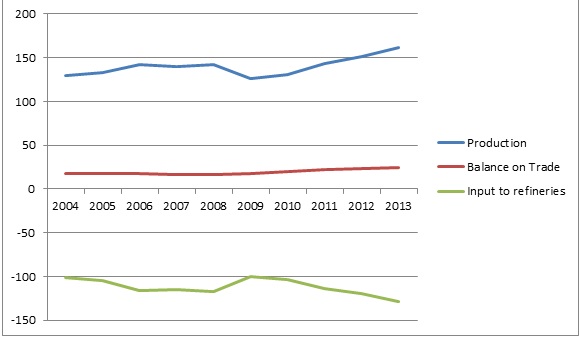

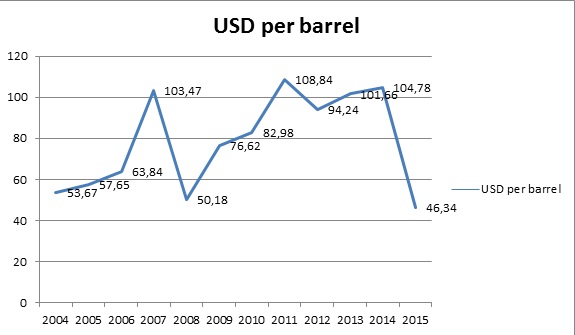

As the graph provided above shows, the financial crisis has taken its toll on the UAE economy, bringing its rates down significantly. Particularly, the issue regarding the inflation deserves to be brought up; as the graph displayed below shows, the inflation index has reached a rather significant mark, therefore, posing a serious threat to the financial well-being of the UAE organizations.

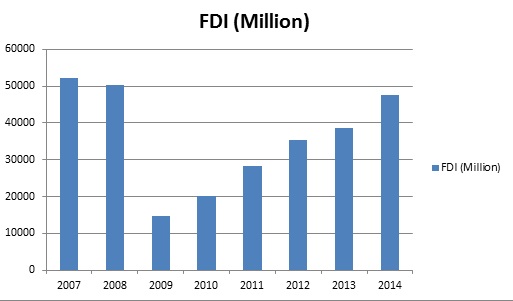

In addition, the recent drop in the foreign and local investments in the construction industry can be viewed as one of the harshest effects of the financial crisis. According to the chart below, the significance of boosting the investment rates in the construction industry in the UAE is huge at present; more to the point, the very existence of a range of corporations may hinge on the possibility for the increase of the above-mentioned factor.

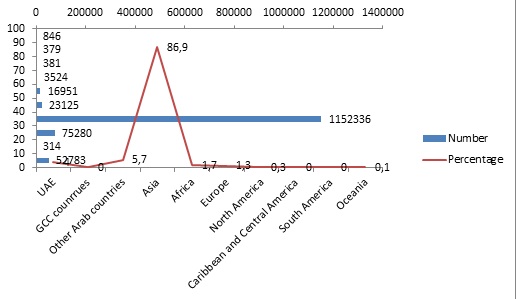

Last, but definitely not least, the reduction in the amount of migrant workforce can be viewed as an essential effect of the crisis on the construction industry development in the UAE. According to the graph provided above, the immigrant workforce market, though, being admittedly vast, does not have much diversity in it. The change mentioned above can be deemed as negative for the owners of construction companies, as they will have to pay extra to hire the UAE residents or outsource. However, the change in question may also boost the UAE economy by helping bring the rates of unemployment among the UAE citizens down.

Conclusions and Recommendations

The outcomes of the research disclose that there has been deterioration in the complete the liquidness shares; productivity shares; fiscal power shares and income shares of the organizations in the constructing sector after the global financial crisis. The deterioration in liquidness and productivity site has also been arbitrated as statistically noteworthy.

Recommendations that can be deliberated for the improvement of the presentation in this segment are the following: the segment should create a more reasonable housing system that will advance both transactions and income statistics for the corporations; moreover, the organizations have to benefit from the reduction in price of raw resources, particularly steel charges (Carlberg 75).

Works Cited

Baker, Donald. 2008. “The Housing Bubble and The Financial Crisis.” Real World Economics Review 46.1 (2008): 73-81. Print.

Barthwal, Randall. Microeconomic Analysis. New Delhi: New Age International, 2007. Print.

Carlberg, Conrad. Business Analysis with QuickBooks. Hoboken: Wiley, 2009. Print.

Crude Construction (Petroleum); Dubai Fathe Monthly Price – US Dollars per Barrel 2015. Web.

GCC Real Estate: Back on Growth Track? 2011. Web.

Gibson, Charles. Financial Reporting and Analysis. Boston: South-Western Cengage Learning, 2012. Print.

OPEC. Annual Statistical Bulletin. Vienna: OPEC, 2013. Print.

United Arab Emirates Foreign Direct Investment Forecast 2015. Web.

Wolfson, Martin H. “Minsky’s Theory of Financial Crises in a Global Context.” Journal of Economic Issues 36.2(2012): 393-400. Print.