Introduction

Financial inclusion is the process of making services provided by different sectors of the economy, especially the private sector, available to all businesses. This way, the system supports as many people as possible without biases. Financial inclusion aims to allow people of a particular economy to financially establish themselves, which helps raise the living standards in that current economy (Center For Financial Inclusion, 2018). The economic instability present in Nigeria presents a problem as their currency is debilitating to the other world currencies. It is also to be noted that despite the country being a large economy, the development rate is severely below what is expected (Financial Inclusion Insights, 2017). Analyzing the financial inclusion in Nigeria through a quantitative research method allows us to understand how financial technology companies can aid in developing their large economy. Financial technology companies integrate technology into finance to better deliver better services to consumers, allowing them to control their economic outcomes better. The drawbacks of financial inclusion are investigated, and financial technology firms are included to see how these drawbacks may be reduced. It is also to be noted that there is a significant gender gap in financial inclusion in Nigeria, which shall also be addressed in this paper.

Problem Statement

The paper aims to analyze the terms of financial inclusion in Nigeria and where the economy falls short. It seeks to look at how financial technology firms may aid in the weaknesses that evoke financial inclusions or lack thereof. It looks at the aspects of financial inclusion as a fundamental right for the citizens and why it is essential. Thus, the paper aims to analyze whether Nigeria’s economy is financially inclusive and exclusive and the detriments that come with such terms, and how this can be aided through financial technology firms.

Hypothesis and Objectives

It is assumed that Nigeria practices more financial exclusivity than inclusivity. There are barriers to financial inclusion, such as the lack of education in the financial sector and the lack of infrastructure to support financial inclusion fully.

The study’s objectives are to analyze the nature of financial inclusion in Nigeria and analyze the problems faced in the activity. It is also essential to look at factors to be considered to have financial inclusion and the benefits of the movement. The aim is to see how financial inclusion is vital in boosting the country’s economy and how this can be met through financial technology firms. Lastly, the objective is to look into how financial technology companies can supplement financial inclusion to bridge the disparity in Nigeria.

Financial Inclusion

To better understand the problem at hand, financial inclusion has to be examined. Its components and shortcomings, and advantages looked into financial inclusion in making financial services available to people across the economy. This is specific to minorities; the poor, women, and the disabled. It also includes providing these resources to businesses with low-income opportunities. Financial inclusion seeks to benefit the overall economy as it seems to gain from the boost of the minority economy. Due to the recent devaluation of the Nigerian currency, there has been an emergent need to promote investment. This is possible with a higher rate of financial inclusion as the rate of inflation is set to decrease, which might bring a corresponding increase in the rate of investment.

Aims of Financial Inclusion

Financial inclusion involves providing services such as mobile banking, insurance plans, money market firms, and microfinance policies. Over the years, Nigeria has managed to integrate a few financial inclusion policies (Kama & Adigun, 2016). These include microfinance banking and the rural banking program of 1977. The goal was to enable finance mobilization through saving in rural areas, encourage the growth of small businesses in the local government areas by providing credit, and encourage a modernized banking culture in a predominantly agricultural site, which eventually would promote organic solidarity.

The central bank developed a strategy to encourage financial inclusion. It involved using mobile banking, fostering a saving culture, creating a credit system and various financial products, introducing a microfinance policy, introducing non-interest banking, and insisting on an e-banking system that promoted a cashless policy.

Nigeria is classified as the biggest economy in Africa, with the highest-ranking gross domestic product, contributing to 14% of the continent’s gross domestic product (Ozili, 2020). The government stands to gain from financial inclusion as the availability of these services makes it possible for more economic activities. Hence, strengthening the economy, a few determinants of financial inclusion should be considered to isolate the disparity in Nigeria accurately.

Determinants of financial inclusion

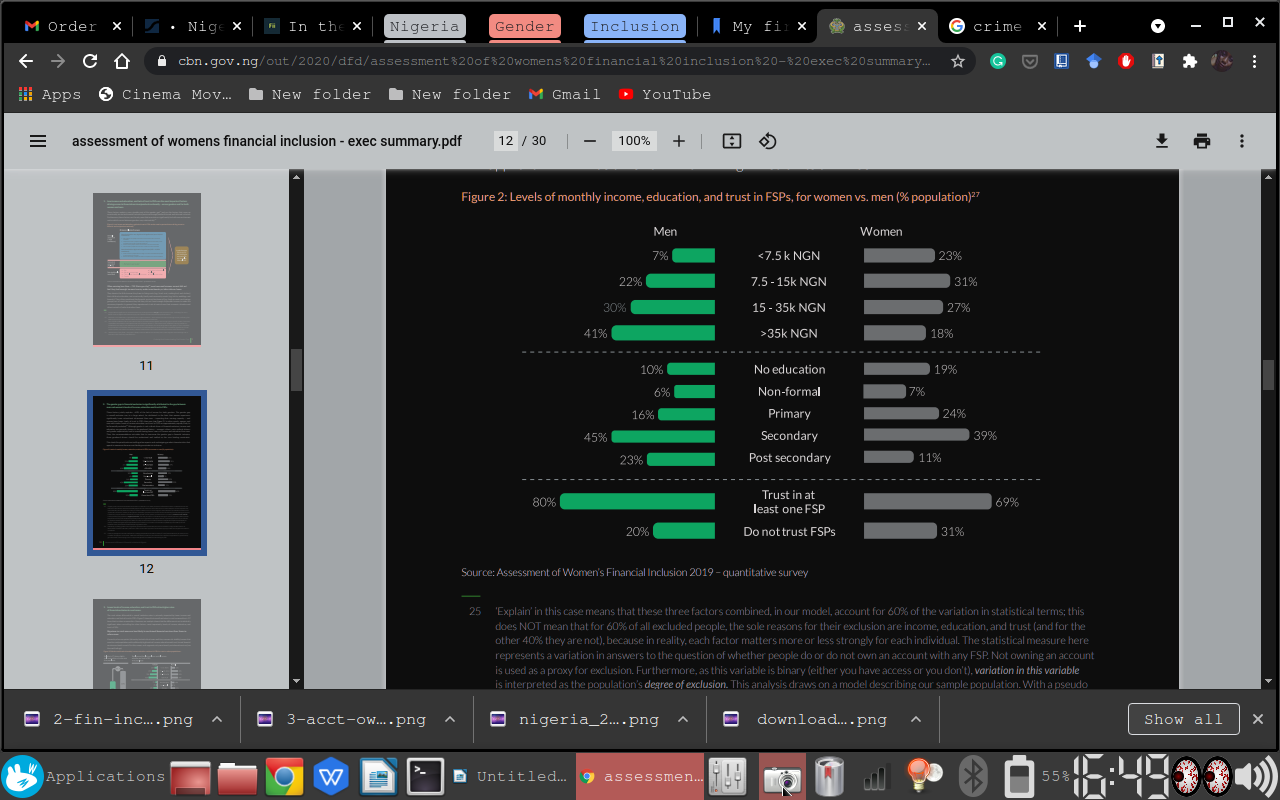

These factors include gender, socioeconomic such income, education, and age. Gender has been a significant determinant in financial inclusion in Nigeria. It has been evident that Nigeria is said to have a poverty rate of about 60%, with most low-income individuals being women. Despite the growing policies on banking and other financial services, the system still makes it easier for men to have financial inclusion than women. This financial exclusion based on gender creates a disparity and brings Nigeria back from economic dominance. Having a bank account was reduced to 18 years of age to encourage the opening of bank accounts and savings, thus increasing the inclusion rate through age (Abel et al., 2018). Education is essential as knowledge of financial patterns and how the market is manipulated is vital in determining how to invest your money. Income is also a factor as people of a higher income tend to be more financially inclusive as they are educated in ways that may make their money grow.

Shortcomings of Financial Inclusion

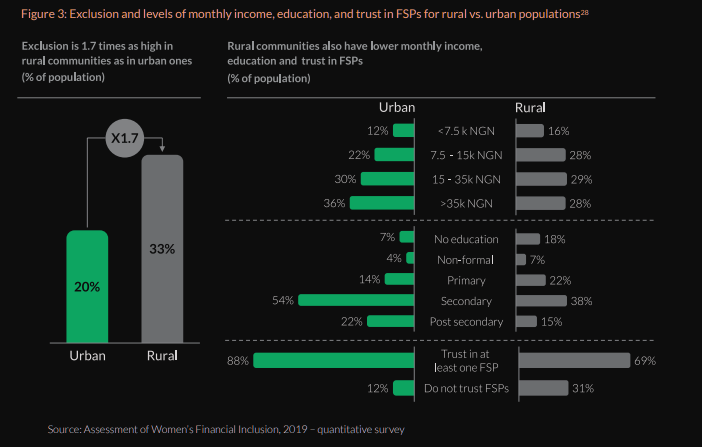

For Nigeria’s economy to vastly improve, financial inclusion must be prioritized to boost the living standards of the individuals to see an overall countereffect on the economy. The barriers to financial inclusion in Nigeria lie in the rural nature of most of its cities. Because of the high poverty rate, people lack the income to engage in financial inclusion services such as banking or insurance policies.

People are too busy struggling to make ends meet to focus on saving and making investments as they make too little to feed themselves. There is also a lack of financial literacy in most parts of Nigeria as the education system does not focus on that at a community level. There is a lack of knowledge about the inner workings of mobile money and a skepticism that is evoked from the miseducation of financial policies. This results in fewer people feeling the need to open a bank account or make investments as they lack knowledge of what is needed.

Financial Technology

Due to the progressive nature of society, financial inclusion has faced many barriers, and the need for innovation arose to help out with the disparity. Financial technology thus came up as an automated way of gaining financial inclusion. This is quickly done through mobile payments, crowdfunding platforms, online peer-to-peer lending, and automatic savings and investment applications. Financial technologies stand as a chance for redemption of the economy due to higher spending, thus raising the country’s economic activity. Given that Nigeria’s economy was crippled in the recession of 2017, there is a need for more investments and spending to reduce the rates of inflation, thus allowing the economy to recover. Thus, financial technology firms seem to be an opportunity for the economic development of the country and the development of financial knowledge for a long-term effect on the economy.

Importance of Financial Technology

These have been especially important as they prove to be a more reliable way to manage funds, as the user is in control of how their money is manipulated from their device. This brings about a certain level of trust in financial inclusion. The simplicity of financial technologies due to great user interfaces has also proved helpful as it is now easier to manipulate for a myriad of people, increasing financial inclusion. Mobile banking is a simple transaction that can be made through one’s phone. With the growing age of technology, everyone has a phone; hence everyone has access to the technology needed to become financially included; the operating costs are also reduced as a physical bank visit is more costly than a mobile money transaction, encouraging more users to opt for the cheaper alternative while still promoting financial inclusion. The apps also provide an expenditure invoice that estimates their monthly use and budget from that roughly. Financial technologies also make payment of bills easier due to the mobile nature of the software.

Financial technology companies are also crucial for businesses as they develop software and algorithms that calculate expenditure, profits, losses, savings, and gross income. Some Financial technology firms offer business loans for startup companies that allow them to grow and develop, with low-interest rates where they are allowed to give back and still promote financial inclusion.

Modes of financial technology

Through E-banking, cashless policies, and electronic payment systems, Nigeria has increased its financial inclusion. Due to the changed age policy, more people can get a credit card; thus, more people are allowed to start saving and spending with the support of financial technology firms. The central bank of Nigeria has granted licensees to many mobile money providers to encourage electronic means to source an income, thus increasing financial inclusion.

Mobile money transfers are encouraged for many services in Nigeria, such as bill payments, money transfers, airtime purchases, and shopping. This has increased the number of people involved in the economy, making Nigeria’s economy grow exponentially. There has been an encouragement for most banks in Nigeria to transition from the old banking system to the new ATM system. This will make banks, especially those in the rural areas, have more people open up accounts due to the curiosity about the behavior of technology as well as the apparent ease and life cost ATM transactions come with

Point-of-service transfers have also been vastly encouraged as they make work easier for bulky payments. These include ATMs and mobile banking points as well as Sacco branches and microfinance institutions. Loans have been easily accessible from the touch of a button, which has encouraged more financial inclusion through financial technology firms.

Shortcomings of Financial Technology

The drawbacks of financial technology firms are that the money is not as secure as it would be in physical locations. The crime rate in Nigeria is high, and it may be unsafe to have a point of service transfer as the technology is very malleable to robbery. There is also a lack of knowledge of the extensiveness of the existing technology due to the predominantly rural nature of Nigeria. Most people are used to the old school methods of money management; hence the investment in financial technology firms makes them apprehensive due to the nature of the transfers. Financial technology requires knowledge of technology and finance, both of which are greatly lacking in Nigeria and hence prove to be a problem during implementation. Financial technology is also restrictive in transactions as frequently, mobile banking or ATMs limit the amount transacted. this would make business owners have a disadvantage as it would still mean that there has to be reliance on physical banking; hence more would opt for cash transactions or banking rather than technological transactions

Data Collection

Data collection was done mainly by examining primary sources such as journals and articles on financial inclusion in Nigeria. There was also an analysis of the existing statistics given by the Central Bank of Nigeria. Existing statistical data from years ago to recent times as compared to establish a trend in financial inclusion. Factors considered were gender, income, employment rate, and the use of financial technology firms, with their distribution and education included. The living standards are also considered, with the set including; rural or urban.

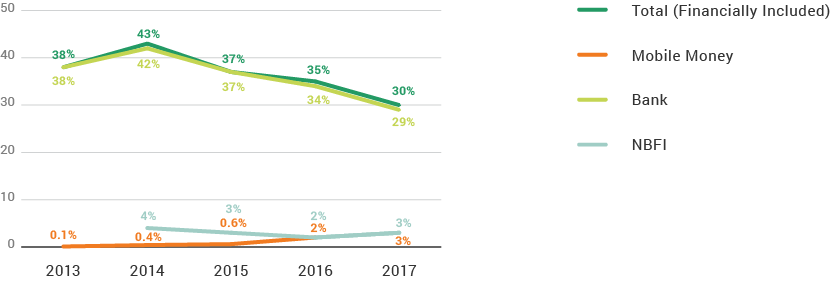

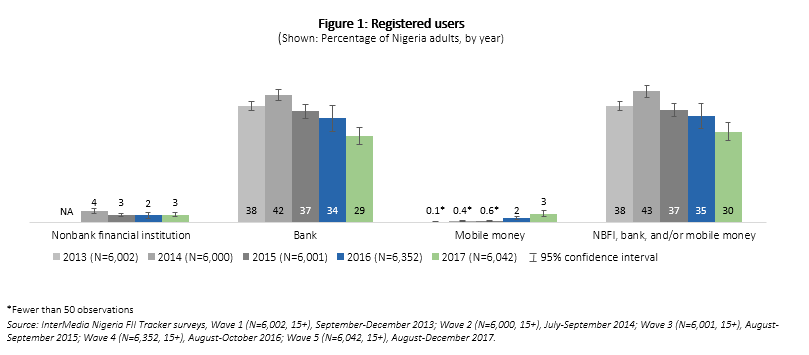

Nigeria’s financial inclusion has been declining despite the country’s efforts to engage in financial inclusion. There are several factors seen to affect this. The trend analysis looks into the past years’ financial inclusion rates based on the number of registered users in banking services juxtaposed to mobile money rates and e-banking rates. There has been a significant reduction in the number of banks registered adults over the years, which affects the financial technology spans.

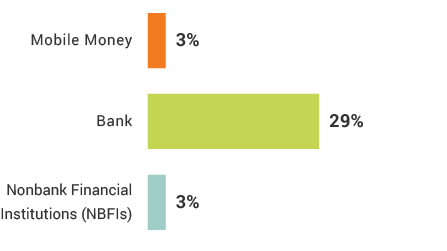

There is a more extensive use in the physical banks than the financial technology means (Financial Inclusion Insights, 2017). This equates to roughly 43% of the total population financially included, which is significantly lower than the expected rate, despite the efforts put forward

The rise in mobile money usage is not as high as it should be despite the myriads of services offered in Nigeria (Statista, 2016). This might be due to many reasons, but the rate is not rising despite the technological advancement

63% of Nigerians are employed, but half of that population owns a bank account. The majority of the bank owners are male, as females are left out of financial inclusion. 59% of these financially included adults save with their financial technology firms. Of this 59%, only 29% are fully immersed in mobile banking and other financial technology services (Central Bank of Nigeria, 2019). Despite the higher employment rate, half of the population that is employed earns significantly above minimum wage. Most of the high-earning individuals are men, followed by married women. Single women are a significantly large part of the financial exclusion in Nigeria.

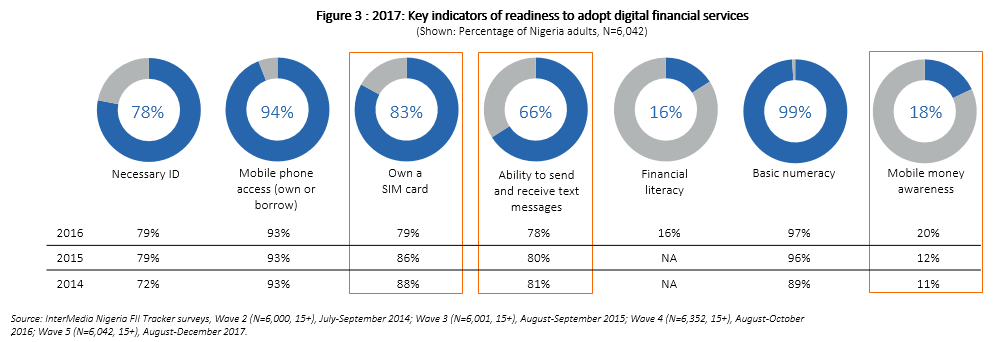

The majority of the population have a mobile phone that can access financial technology organizations and the numeral literacy needed to manage an account. Furthermore, most adults have the information needed to set themselves up with a financial technology organization; a bank account, mobile banking information, or Sacco (Statista, 2016). Only 18% of the population have mobile money awareness, while 16% have financial awareness in terms of financial technology.

From an educational perspective, more men are educated than women as the disparity is at 5%. women are more likely to be domesticated while men are more likely to be educated about financial issues.

Lastly, there is a significantly lower financial technology in rural areas than in urban areas (Central Bank of Nigeria, 2019). The majority of the population in the rural areas is predominantly female. There are also fewer service and financial services in rural areas, which contributes to the disparity between the rural and urban areas.

Data Analysis and Conclusions

The employment rate is higher in men than in women, which means that financial inclusion is higher in men. This is due to the societal barriers that exist only to allow men to be financially knowledgeable(Financial Inclusion Insights, 2017). Despite the averagely high employment rate, the income disparity is high between high earners and those below the minimum wage. Because most people earn either slightly more or significantly lower than minimum wage, the income does not support money management decisions. People are using the little they have to survive and consider investing in financial technology firms.

The education rate is higher in men than women, and women are encouraged to be more nurturing than hands-on in financial matters (Debadrita Sinclair, 2020). This means that a significant amount of the population will be financially excluded; thus, there will be less use for FinTech firms. There is also less awareness of financial security and the advantages that financial technology firms may impose on the economy.

The majority of individuals have access to the resources and the basic numeral literacy needed for financial inclusion, but fewer are educated on how financial inclusion is related to financial technology firms (Financial Inclusion Insights, 2017a). Likewise, the need for financial technology investment has not been put across as people still believe their traditional spending methods as more convenient. More users have access to mobile money transfer options, and fewer people are using bank services. Still, the number of mobile money users is not enough to guarantee a rise in financial inclusion in Nigeria. Fewer people own credit cards, and despite the higher use of online retail options since the start of 2020, there is still a significant reliance on bank transactions as opposed to financial technology transactions.

Despite the government’s efforts in financial inclusion, the distribution of financial technology firms in rural areas is significantly lower than that in urban areas. This is unfortunate as the majority of the population resides in rural areas. There is also a lack of trust in the security of the money invested in financial technology firms. This is a relatively new concept to a predominantly agricultural population that did not depend on technology for financial inclusion.

The availability and distance of the point-of-service terminals have also proven to be a challenge as not many people are aware of any other terminals other than ATMs. This is due to the domination of banks in financial inclusion services, overpowering the influence of Saccos and microfinance firms. Most people are also not aware of the benefits of such organizations and the business incentives gained from financial inclusion in financial technology.

Lastly, due to the receivership, the banks are a weak source of financial inclusion as they took hard hits to maintain the state of the economy. The over-dependence of banks for financial inclusion causes financial exclusion. The recession caused a rise in inflation rates, which caused a corresponding decline in the investment rates, bringing about a resulting devaluation of the currency (Financial Inclusion Insights, 2017). Due to the lack of investment in their currency, banks are losing more money, and it becomes riskier to keep money in bank accounts. The simplicity of the Know Your Customer method has been challenged by the biometric security methodology, which repels people from financial inclusion.

Recommendations

There should be efforts put across to motivate capacity building on the importance of financial intelligence. With the height of the age of innovation, a more significant part of the population should be educated on the importance of financial technology firms’ investment over traditional bank transactions (Kishori & Suraj, 2018). Likewise, the government should put less emphasis on the need for bank use and promote mobile and electronic transactions. The government should do this by providing more banking and mobile money agents all over the country. A particular emphasis has to be put on the rural areas over the urban areas as they greatly lack capacity building.

Informal financial services need to be improved to provide better traction for the functioning of financial inclusion. This means that the emphasis should be less on banks and more on services such as insurance, stock brokerage, and credit firms. The disparity in credit card usage over cash transactions is significant, and encouraging informal financial services may boost financial inclusion. The government should also encourage digital payment methods by adding government services such as registration for licenses and payment of taxes. This will encourage more users to partake in financial technology firms as the simplicity of processes may make people want to invest.

There should be legislation that considers social norms that hinder financial inclusion. These norms include the imposition of a nurturing role on women and religious practices that hinder the use of technological advancement (Debadrita Sinclair, 2020). The government should also encourage innovation by focusing on the financial technology infrastructure. This may be as simple as liaising with mobile network operators to promote mobile money and e-banking forms. Financial service providers should be given more space to operate and legislated to go into the deep rural areas, forcing financial inclusion.

There should be education on the advantage of financial technology firms in the business, attracting more people to invest. The knowledge of concepts such as microfinance, savings, insurance, and loans may help businesses grow, which may encourage more self-employment, raising the gap between high earners and minimum wage earners (Central Bank of Nigeria, 2019). Income inequality should also be considered in terms of gender. Women are seen to make significantly less than men, which brings about a massive gap in the overall economy.

References

Abel, S., Mutandwa, L., & Le Roux, P. (2018). A review of determinants of financial inclusion.International Journal of Economics and Financial Issues, 8(3), 1–8. Web.

Center For Financial Inclusion. (2018). Why financial inclusion matters. Web.

Central Bank of Nigeria. (2019). Women’s financial inclusion in Nigeria. Web.

Financial Inclusion Insights. (2017a). In the face of economic Headwinds, financial inclusion is declining in Nigeria · Financial inclusion insights from Kantar. Finclusion.org. Web.

Financial Inclusion Insights. (2017b). Nigeria · Financial inclusion insights from Kantar. Finclusion.org. Web.

Kama, U., & Adigun, M. (2016). Central Bank of Nigeria financial inclusion in Nigeria: Issues and challenges. Central Bank of Nigeria. Web.

Kishori, M., & Suraj, K. (2018). The study on financial inclusion in rural areas. International Journal of Research, 7(6), 40-26. Web.

Martell, J. (2018). Advantages (and disadvantages) of fintech-focused IoT. Medium. Web.

Ozili, P. K. (2020). Financial Inclusion in Nigeria: Determinants, challenges, and achievements.SSRN Electronic Journal. Web.

Sinclair, D. (2020).Assessing women’s financial inclusion in Nigeria. Dalberg. Web.

Statista. (2016). Nigeria: Number of bank customers 2016-2019. Statista. Web.