Decision-Making Process

The Cesim decision-making process outlines eight vital stages that teams should undertake throughout each round. They are designed to aid in decision-making before the beginning of any round (Figure 1). First, it is essential to analyze the results of the prior year or round. This primarily includes investigations of financial results, the performance of any competitors, and attributes that are controlling share prices within the market. Second, following the analysis, it is important to observe and gain an understanding of the market look of the current year. This is done in order to ascertain market and economic trends. Third, products that are operating within the market should be accounted for and adjustments should be considered and administered in the case that improvements in sales are necessary for the following round.

Fourth, the formulation of marketing decisions regarding all active products is necessary. Specific elements should be considered and can include price decisions, advertising, channel investments, and more. Fifth, a forecast of sales for the following year must be planned while recognizing the ongoing market outlook and results from previous years or rounds. Sixth, investments into R&D are made in order to directly influence better product creation and support cost and time efficiency in production. Seventh, decisions regarding terms of payment are created for the ongoing round and a reduction in days of accounts receivable is observed. This stage includes any adjustments made to the terms of payments. Eighth, budgets must be reviewed at appropriate intervals throughout the round and year. The eight stages provide a cohesive transition between tasks and correct adherence to the elements of each stage provides the company with positive results and overall efficient operations.

Overview

FRTech creates and distributes a variety of electronic products. The company values working as primary contact between a manufacturer and customer as a supplier, the creation of high-quality devices and segments, and reliable delivery times. The firm highlights three core strengths including design, development, and production competencies. Smart and innovative design allows FRTech to enter new markets and create a sustainable presence with a focus on the achieved quality and improving user experience. The development in the company’s facilities displays substantial design capabilities such as advanced 3D CAD modeling. FRTech specializes in the creation of custom parts for systems that customers require. Often the focus is on resisting tough environmental conditions or even the formulation of psychical security features. The company employs highly skilled engineers that are capable of meeting modern standards and demands. FRTech is open and has previously worked with clients regardless of their location and therefore upholds an international model for cooperation. Overall, FRTech presents operations that are highly specialized and require strong and cohesive relationships with partners, manufacturers, and clients.

Company Values

The company states that its goal is to “be an efficient expert on electromechanical products such as connectors, switches, and solenoids.” (Figure 2). This is because FRTech values having a status as a reliable and serious partner in both guidance and customer matters. The unique and specialized designs are also a reflection of this as the firm aims at meeting the existing needs of partners and clients. The company aims to establish itself as a reliable and stable supplier of specialty parts for a variety of products, as they have previously created elements for items such as hearing aids, control panels, and mobile devices. FRTech’s values can be summarized as reliable partnerships, clear and efficient customer communication channels, and innovative methods and products for niche markets and products.

Segments

The following report describes the analysis, adjustments, and results of rounds that were undertaken. The practice round had indicated an issue in time management. The allocation of figures in regard to market decision-making and the designing of products had taken a disproportionate amount of time in the round. This had caused customer care and R&D to receive insufficient attention and consultation. Essentially, the issue mainly stemmed from delayed access to figures and overall materials. This had caused current plans and budgets developed in the practice round to be in need of significant improvement. As such, earlier access would have likely resulted in better time allocation and familiarity with existing materials and processes. Despite this, the practice round was still extremely beneficial as it allowed individuals to familiarize themselves with the process of functions such as budgeting and product creation prior to participating in the actual rounds. A total of five rounds were conducted with a variety of outcomes emerging between the actualization of each segment.

Round 1

The initial round presented both familiar and novel challenges. While the practice round offered some understanding of the simulation processes and even relevant materials and resources, unknown factors began to emerge. The primary concern found in the round included the lack of budget parameters. Essentially, benchmarks for spending on facets such as advertising, channel investments, and R&D were not provided and there was no insight given in regard to market standards or averages. As such, certain budget selections were based on logical conclusions based on personal assumptions and minimums provided by the simulation. In the round following the first, this issue was largely solved as selected budgeting options of other students were shared among participants and this aided with the formulation of market averages. The early stage of the Cisem decision-making strategy dictated the early selection of objectives and the goals for the first round included becoming the dominant player within the market, upholding a high share price, achieving high profit, and limiting costs.

Market Outlook

The market outlook during the first round focused on four themes. First, there was expected growth in Asian markets. Second, demands in European regions would remain decent. Third, advertising and channel statements would contribute to decreased profits but be still vital to overall operations. Fourth, there is a heavy emphasis on having an accurate sales forecast. Overall, the outlook implied that demand would improve or remain satisfyingly stagnant while profitability would be unaffected by increased spending in advertising or channel investments.

Decisions

A marketing mix was implemented throughout the decision-making process according to the strategy highlighted prior. The first goal of the simulation round included becoming dominant players within the market on a worldwide level. In order to achieve this, a decision was made to introduce three unique mobile phone types. The diversification process was vital as Asian and European consumers had varied preferences in their devices and thus their purchasing habits. Overall, the strategy suggested products aimed at the European market should prioritize high-end household segments while Asian clients would see both high and low-end household segments promoted to them. The suits featured stylized designs including Classic, Avant-garde, and Sports devices. Each model was introduced to all the regions in which the firm operated but customization occurred in regard to the favorability of each model in each market. Additional versions of the products included the Sporty and Classicy models. All changes directly stemmed from customer responses and behaviors in relation to the existing products.

One mobile phone was initially introduced to the European market as predictors indicated a decent demand. Due to the expected growth in demand in the Asian market, two phones were simultaneously inserted into the sector. This was done in order to establish another value held by the company, innovation in the industry. The firm would be able to do so by predicting growth over the upcoming years and getting ahead of competitors. These decisions highlighted the potential issue of high costs at the onset of the firm’s operations. However, this initial spending may be beneficial in future rounds if the company is able to connect with customers and display innovation and industry leadership.

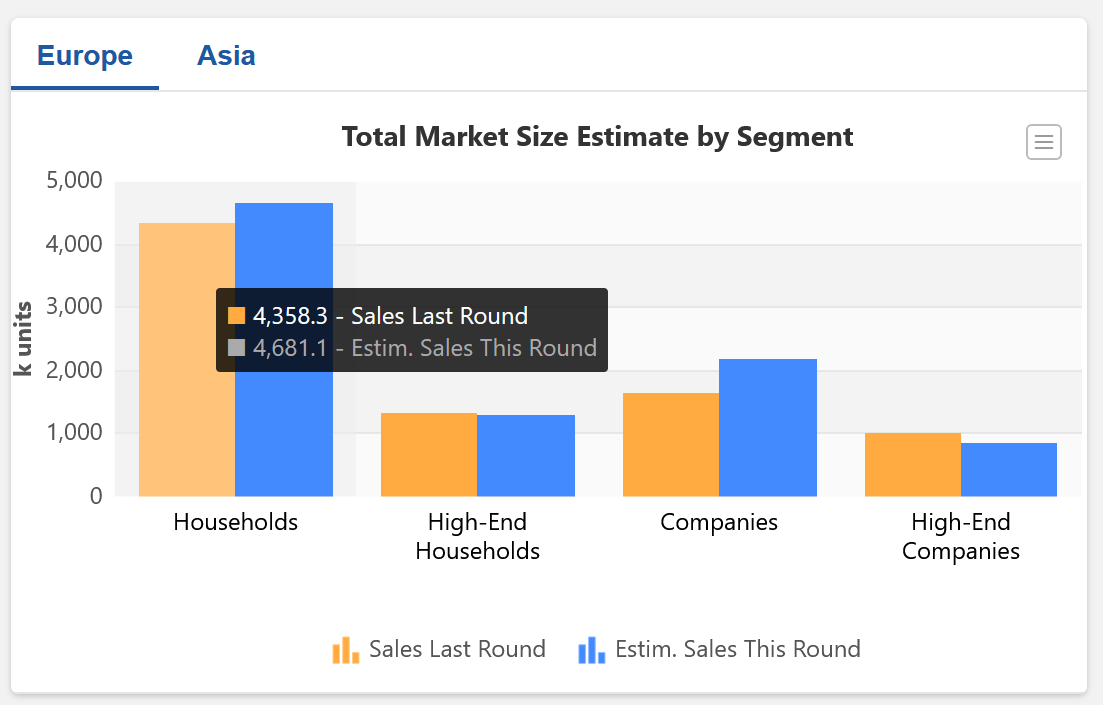

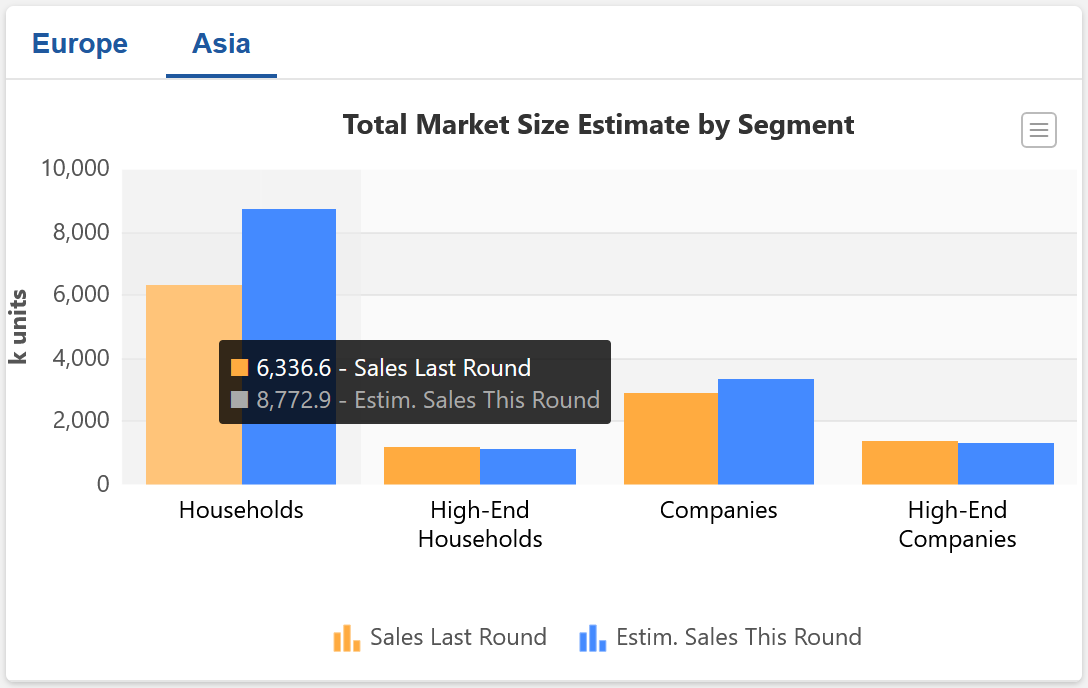

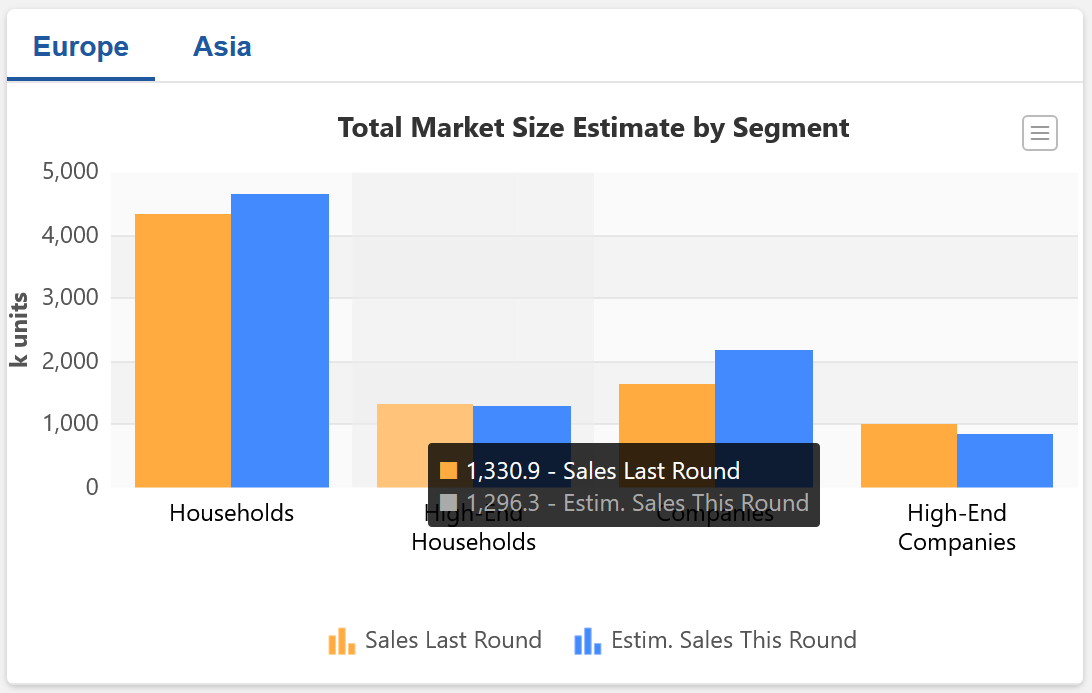

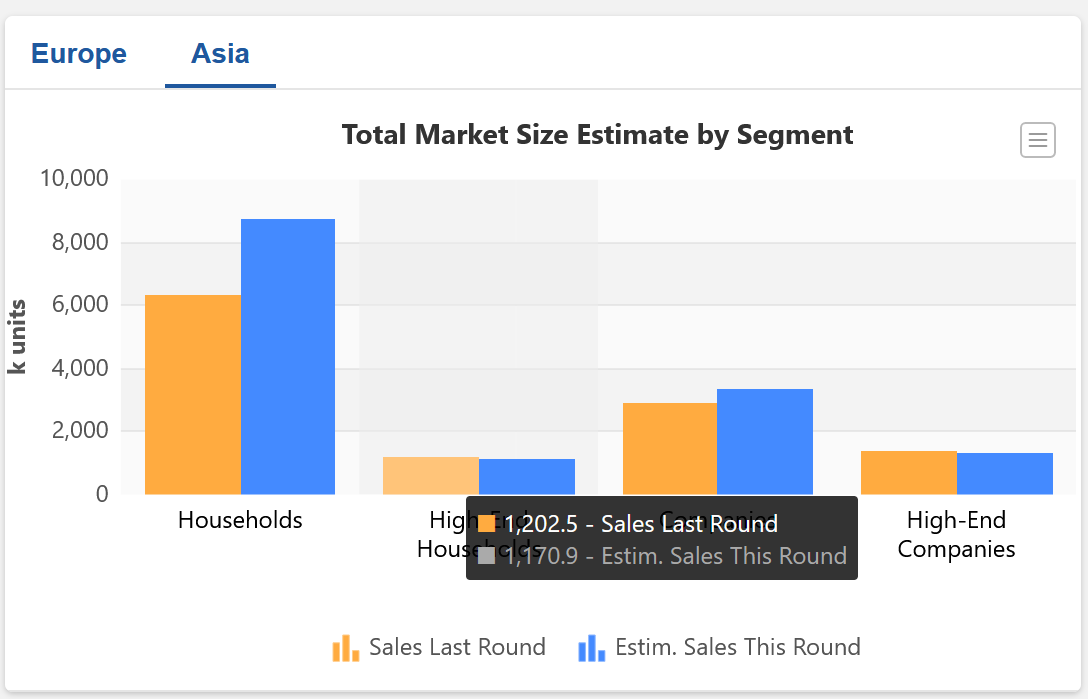

The previous round indicated that sales reached 4358 household sales in Europe and 6336 sales in Asia (Figures 3 & 4). The European market accounted for 1330 sales in high-end products while Asian markets made 1202 sales (Figures 5 & 6). This combined with the prediction for the upcoming round informed the decision to diversify product sales between the regions. Prices were set in accordance with the improved performance of the items listed, with Avant-Garde models performing better in Asia and Europe.

Results

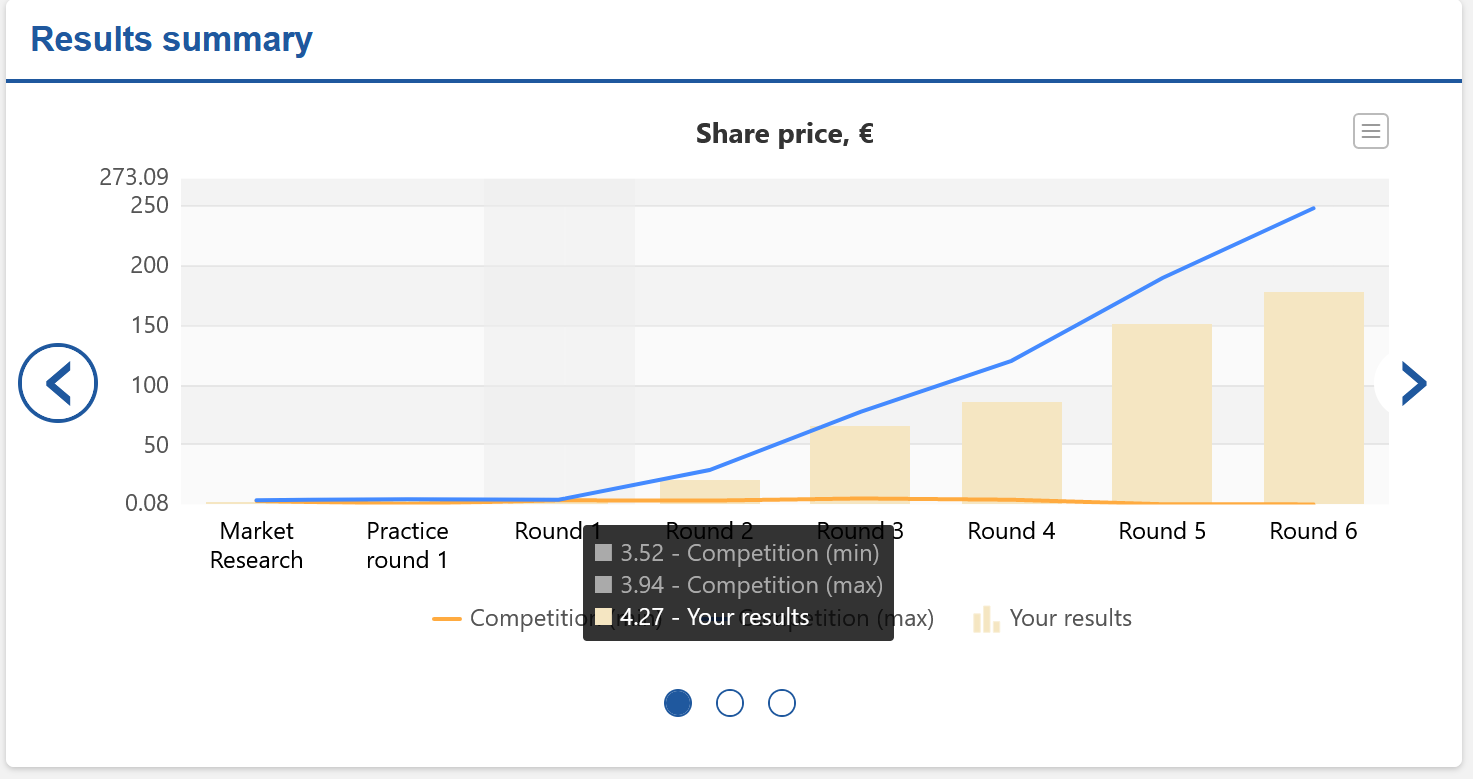

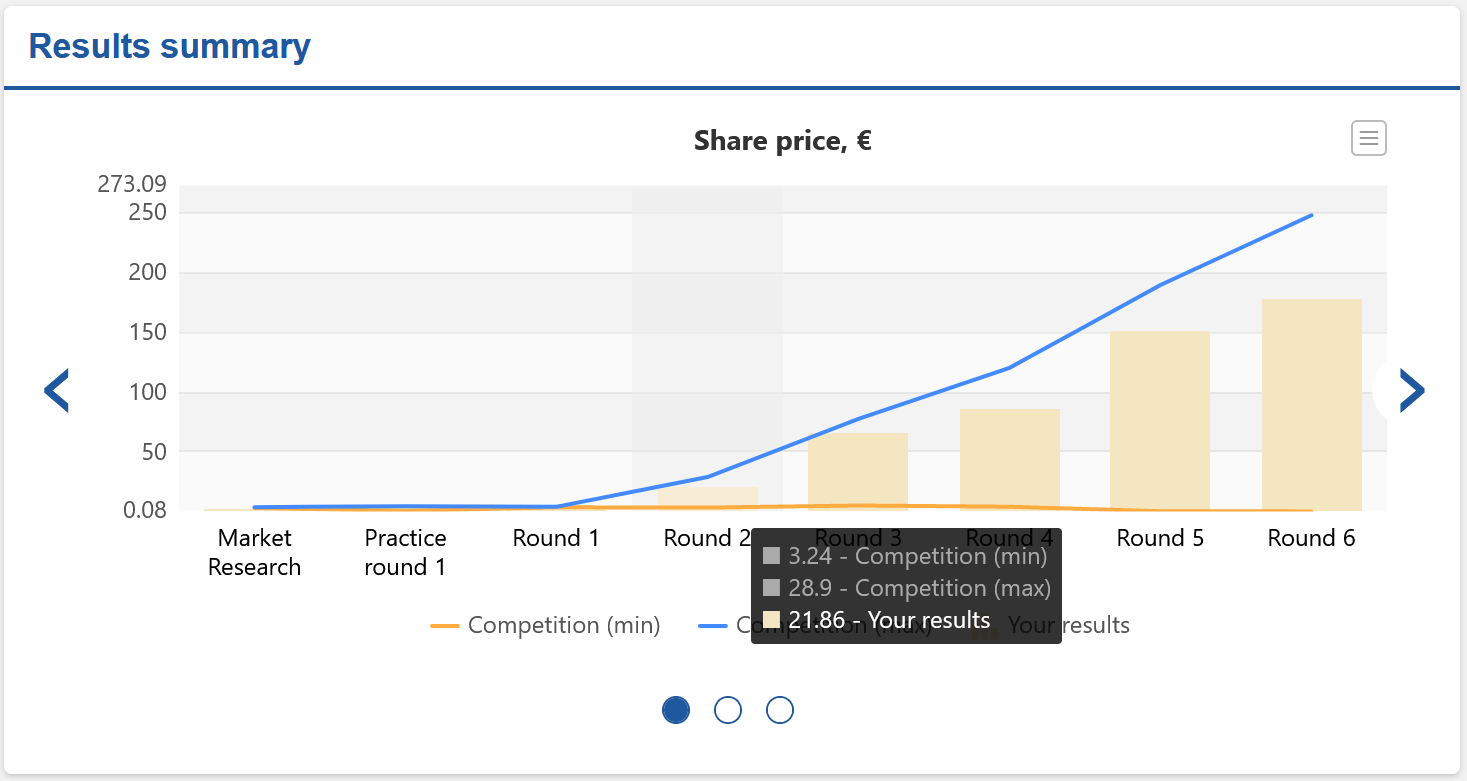

Unfortunately, the high costs at the start of the round resulted in quickly accumulating loans which created a problematic setting for the firm in the future. Despite this, the company was still able to position itself as a market leader. The share price reached 21.86 Euros in the first round which was lower than desired but not completely detrimental. The highest within the market amounted to 28.9 while the lowest was 3.24 Euros (Figure 7). As such, FRTech is placed in an adequate area above the average share price. However, these findings still indicated that the firm would require a better presentation for shareholders in order to entice improved investment. Currently, the prospects of increasing shareholder interest are low.

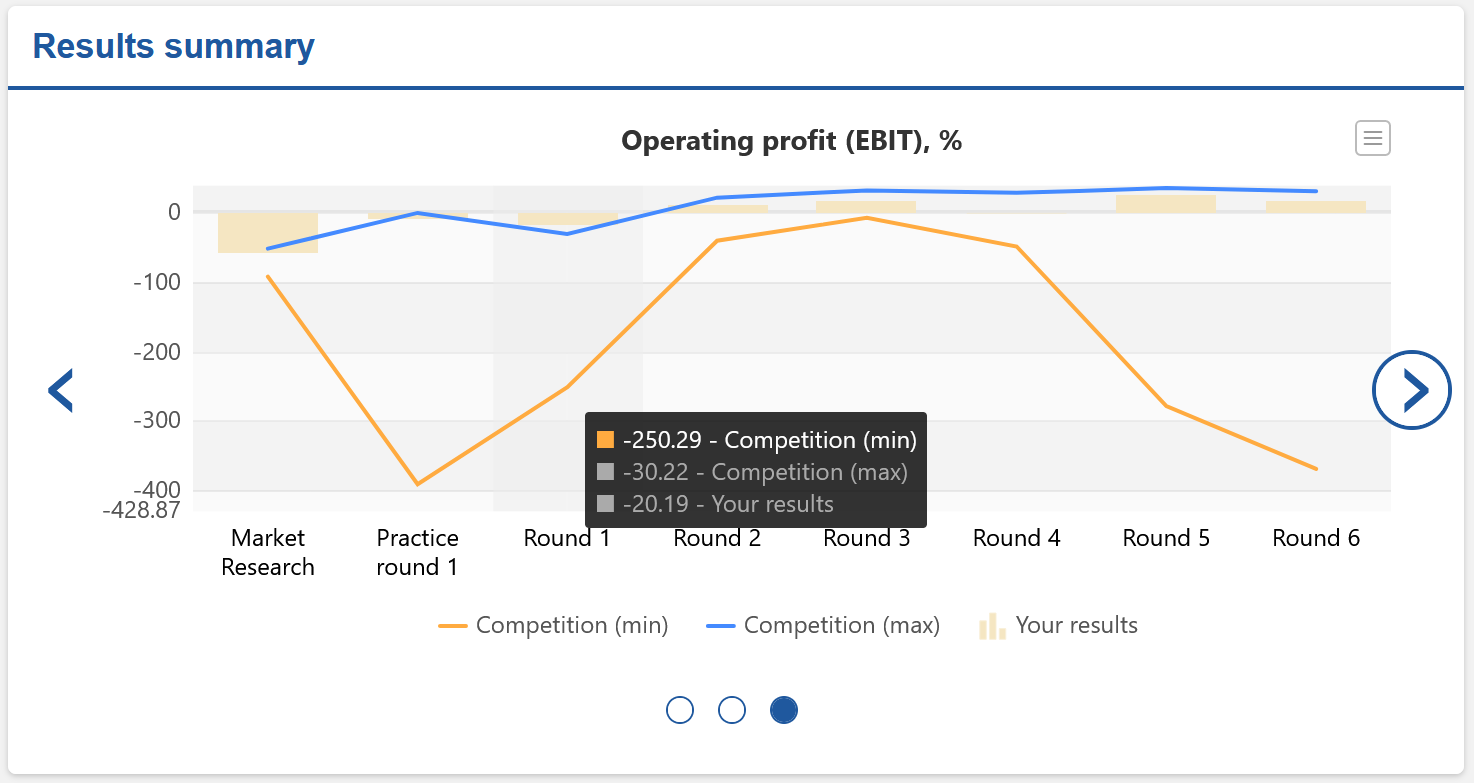

The gross profit was significantly more disappointing as the market maximum presented a rise of 60.76% while FRTech was only able to garner 42.77%. Operating profit was a concern as it had scored at -20.19% (Figure 8). Overall, the results indicated a high-risk investment into diversification and expansion strategies that did not allow for appropriate growth within the first round. As such, more efficient decisions must be made in the following rounds in order to counteract the excessive spending of the first round.

Round 2

The effects of the previous round were mostly ineffective or even harmful to FRTech. This was primarily due to the fact that accumulated loans were larger than expected and were not covered by profit margins. As such, the second round aimed at increasing customer sales and the interest of shareholders. Still, the market outlook has allowed for more diversification which is a FRTech focus and specialty. In the end, changes in price in a segment that is not price-sensitive resulted in decreased sales profit without enticing an increase in unit sales. Outside of that, the company had segmented itself as a third leader in almost all product sales in both markets which was a satisfying result but did indicate that future growth would be required.

Market Outlook

The market outlook differed from the first round. The main differences included the fact that Asian sales of household segments were likely to experience significant growth and become the biggest segment in the entire company. Additionally, price sensitivity could severely impact sales and overall profit. As such, it was important to observe customer reactions in relation to pricing and any changes in sales. Profit margins were expected to decrease throughout the round and design would impact demand in a prominent way. Decisions would need to account for the potential of growth but maintain product pricing. Similarly, fluctuations in demand for various models would have been accounted for. Because FRTech has a focus on customization and customer needs as a driving force in innovation, the firm would likely continue to pursue diversification and additional features.

Decisions

The predictions had assisted the decision that continued to prioritize household segments within the European and Asian markets. High investment in the first round did not result in the desired outcome and as such no new models were added to the sales strategy. However, the company did make motions to add features to the already existing devices. The main thought process behind this decision included making the products more appealing to consumers and shareholders by providing more features and better technology for a competitive price. The improvement of overall sales and increased shareholder investment were vital as the acquired capital could be used in order to pay off existing loans. All additional features were driven by preferences that customers displayed throughout the first round.

The Ansoff matrix which consists of four quadrants marked market penetration, product development, market development, and diversification was used within the decision-making process of this round. This is because all active products in the second round already had a presence within the market and counterpart competitive items. A decrease in price was conducted in the high-end household’s segment for the European market. However, this motion was likely irrelevant or even detrimental to the company as clients of high-end products are not as price sensitive as those that purchase low-end products. As a result, sales would not be affected but the loss of potential capital would occur. This action’s impact would also likely be compounded by the overall low-profit margins of the round.

Results

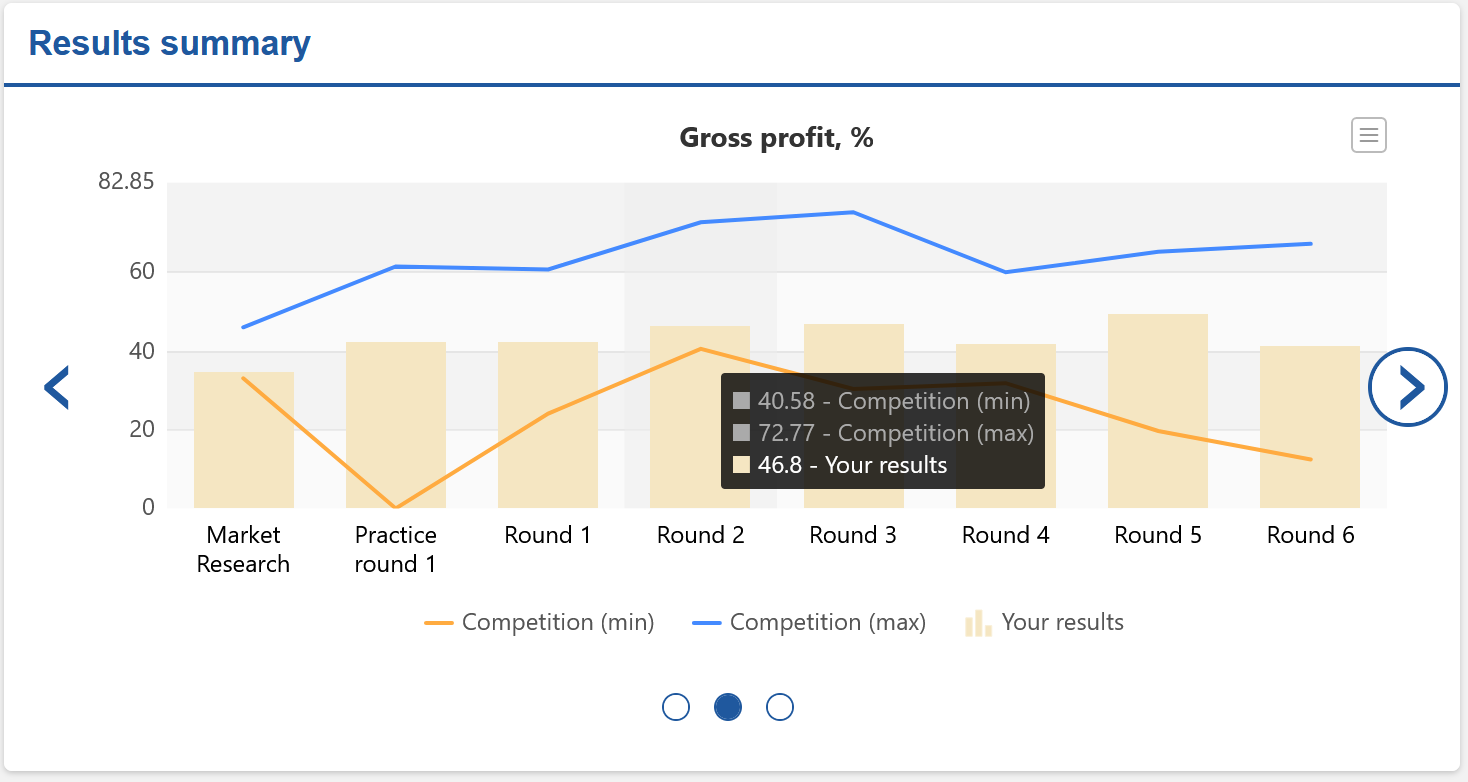

The share price after the second round had increased to 67.05 Euros which is considerable growth despite the numerous setbacks observed during the round. However, it still did not optimize the potential maximum share price of 77.59 but was still significantly higher than the minimum of 5.05 Euros (Figure 9). Gross profit was nearly stagnant, reaching only 46.8% (Figure 10). However, operating profit would finally improve and reach 13.24% which would qualify it as a non-loss. Despite this, the firm continued to lack the presence of shareholders who mainly avoided investment due to accumulating loans, low profit, low pricing, and increasingly high expenditure, especially when compared with firms that would spend more moderately. FRTech could potentially break out as a leader as it placed 3rd in market shares throughout almost all products and models.

Competitors

FRTech faced a number of competitors but had a satisfying position as the third-largest owner of market shares in practically all markets and product sectors. In fact, LinkTech and iOrange would be the only firms to place higher than FRTech in both the first and second rounds. There would also be active competition between the two brands as the first round was led by LinkTech while the second was led by iOrange in terms of the share price. Compared to these two companies, the growth observed by FRTech was incredibly stable and the firm would not lag behind the other two by a significant margin.

Market shares depicted an identical trend with LinkTech and iOrange having consistently the top two highest positions in all markets for both high and low-end products. FRTech would consistently take the third largest share with iWin following closely but never overtaking FRTech’s position except for the Asian household and company shares. Within the Asian market, Zela Tech would pose a significant threat as it had the third-largest shares in household and company shares in Asia. Overall, FRTech proved to be an immensely stable firm, especially in Europe. However, there is also potential for the firm to innovate products and continue to entice shareholders by providing superior products. It is possible that the Asian market does not require the specializations provided by the firm that is appreciated in the European sector. As such, FRTech would have to begin growing other strengths that meet the major demands of the Asian market in terms of household and company sales.