Global digital firm General Electric Company (GE) was founded on April 15, 1892. From aviation engines, power generation, and oil and gas production equipment to medical imaging, financing, and industrial products, GE produces a variety of goods and services. Its primary industries are aviation, energy, oil, gas. With $74,196 in revenue for the year of 2021, the business is ranked at six on the Fortune 500 under CEO Jeff Immelt’s direction (21 Annual Report, 2021, p.6). Product recalls at General Electric raise ethical and legal concerns, which harm the company’s long-term success by eroding consumer trust. General Electric faces fierce competition in every sector of the economy where it now operates. Although diversifying the company’s operations is bright, it increases the risk of overstretching its resources by restricting the attention it can give to each market sector.

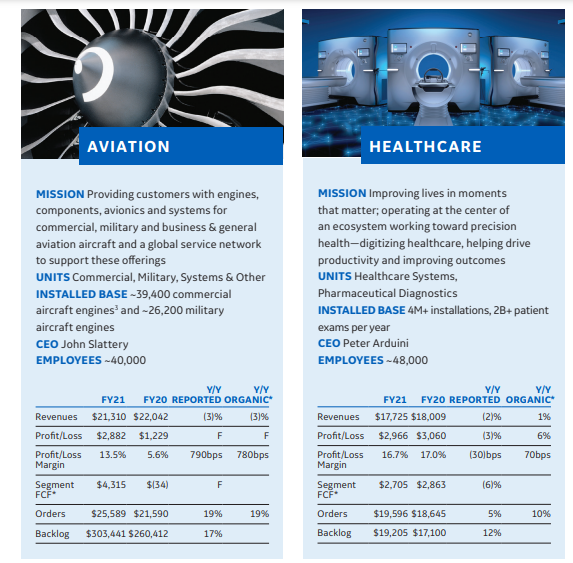

The four sectors of Power, Aviation, Healthcare, and Renewable Energy have taken center stage regarding how the corporation will maintain long-term profitability in the years to come. In the form of turbines and generators, the Power business of GE develops systems and solutions for generating electric power from sources like wind, oil, and gas (Direking, 2019). Even if this division is reported revenue for Q3 2019 was mere $3.9 billion, the $631 million quarterly loss is still preferred (Root, 2019, para. 5). Although the unit has already undergone top-down restructuring, it is still far from being considered a fixed unit because further work is being done to secure its success. The overall performance of all four sectors performed in the Table 1 below.

Table 1. GE’s 4 sector’s performance

The restructuring of GE’s portfolio came with a number of issues that the corporation ultimately neglected to solve, which resulted in subpar performance. There are numerous reasons why GE could not continue to produce quality results following restructuring. To start, the changeover process took longer than necessary, eventually extending over time and delaying the company’s entry into new industries. The overly optimistic statements made by GE management regarding the company’s future may be somewhat to blame for their tardy behavior.

General Electric must provide each business sector with the proper emphasis and attention as it moves forward. The firm should keep expanding through mergers and acquisitions. However, it is critical that these partnerships focus on the company’s current business divisions rather than spreading its resources too thinly over a wide range of product offerings. In order to continue reforming its organizational structure, General Electric should eliminate less lucrative business divisions and shift to a more industrial and technology division. The “Imagination at Work” campaign from General Electric should be kept up to promote its innovation and inform customers about the breadth of its offerings.

For the past 130 years, General Electric, a conglomerate corporation that takes on the most significant challenges globally, has consistently produced groundbreaking inventions. Undoubtedly, General Electric is among the world’s biggest and most prominent corporations. The company as a whole (General Energy) has demonstrated that through significant investments in research and development, it has established new business ventures like GE Health care and the union of GE Power and GE Renewable energy, which saw significant action in its wind energy turbine. There is still potential for GE Power to expand because electricity will always be needed, which is essential for economic progress.

References

Direking, D. (2019) General Electric’s 4 most profitable lines of business. Investopedia. Web.

Grant, R.M. (2018). Contemporary strategy analysis (10th ed.). Wiley.

Root, A. (2019) GE power is making strides, but it’s still the early innings. Barron’s. Web.

Roy, S., & Kemme, D. (2020). The run-up to the global financial crisis: A longer historical view of financial liberalization, capital inflows, and asset bubbles. International Review of Financial Analysis, 69, 1–27. Web.

21 Annual Report (Rep.). (2021). Web.