Strategic Planning

Current Performance and Mission

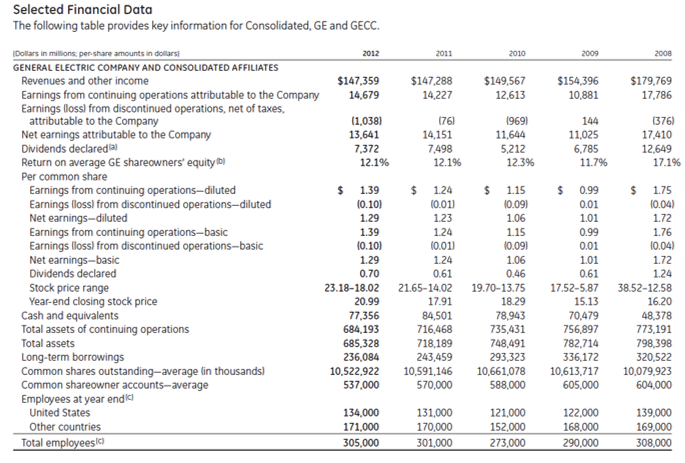

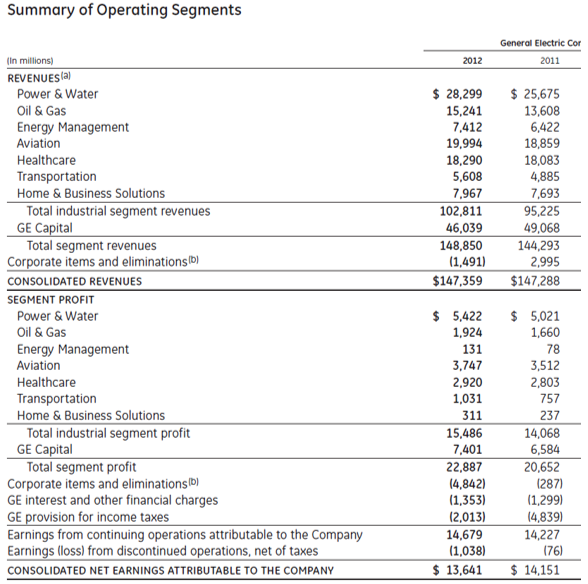

The case study at hand covers a period of the company’s performance up to the beginning of 2013. In 2012, General Electric managed to increase its segment profits to $22.9 billion (by 11%), $17.8 billion of which were generated from its operating activities. GE also returned $12.4 billion to investors paying dividends and stock buybacks thereby increasing stakeholder returns by 21%. The market cap of the organization grew by more than $30 billion. Thus, having over $100 billion of revenue at the beginning of 2013, the company had become the hugest and most prosperous infrastructure organization globally.

As far as the percentage of profit increase per business unit is concerned, it was distributed as follows (Hoffman 726-729):

- Power and Water: The volume increased by 8%. Deflection effects were offset due to stronger dollar and lower prices.

- Oil and Gas: 16% higher volume.

- Energy Management: 68% growth owing to increased prices.

- Aviation: 7% increase as a result of higher prices.

- Healthcare: 4% due to increased productivity.

- Transportation: 36% owing to higher prices and volume.

- Home and Business Solutions: 31% increase due to the offset of higher prices as a result of inflation.

- Capital: 12% growth owing to higher tax benefits and lower impairments.

As for the mission, GE does not provide any official mission statements on its website. Yet, in the “about” section, one can read that the company employs the best people and uses the best technologies to meet the hardest challenges looking for solutions in finance, health and home, and transportation.

Each website devoted to GE’s separate business units provides its mission statement (Hoffman 726-731):

- Power & Water: The unit claims that all employees work in collaboration with customers trying to foster progress, predict the energy needs of the future, and power a cleaner world through the use of advanced generation and delivery technologies.

- Oil & Gas: The unit positions itself as an unquestionable leader in advanced technologies in all industry segments and branches.

- Energy Management: The unit emphasizes the implementation of global team solutions to transmit, manage, distribute, converse, and optimize electrical power.

- Aviation: The unit claims to be the global leader in the production of jet engines of all sizes for both military and commercial aircraft as well as aircraft-derived engines for marine usage.

- Healthcare: The unit provides medical technologies of the new age, including medical diagnostics, information technologies, patient monitoring systems, etc.

- Transportation: The unit’s mission is to solve the toughest challenges in transportation across the globe by building equipment moving mining, marine, and rail industries.

- Home & Business Solutions: The unit sees its goal in delivering comfort, electrical protection, and convenience through the application of innovative technologies.

- GE Capital: The unit’s mission is to ensure the growth of customers’ capital by providing smart financial solutions.

EFAS Matrix

Table 3. EFAS Matrix.

IFAS Matrix

Table 4. IFAS Matrix.

Key Strategic Factors (SWOT Analysis)

Porter’s 5 Forces Analysis

5 Forces analysis reveals the following position of GE (Hoffman 723-732).:

- Industry rivalry or competition is medium since GE dominates numerous industries due to its diversification strategy, having only Siemens as a strong competitor.

- The threat of new entrants is low as the reputation, size, and position of GE makes it practically impossible for a new company to penetrate the market.

- The threat of substitute products is medium since customers always have a great number of options to choose from. GE must concentrate on its pricing policy and product features.

- The bargaining power of buyers is low as GE produces quality products at fair prices.

- The bargaining power of suppliers is low since GE buys huge volumes of products bringing their ability to bargain to a minimum.

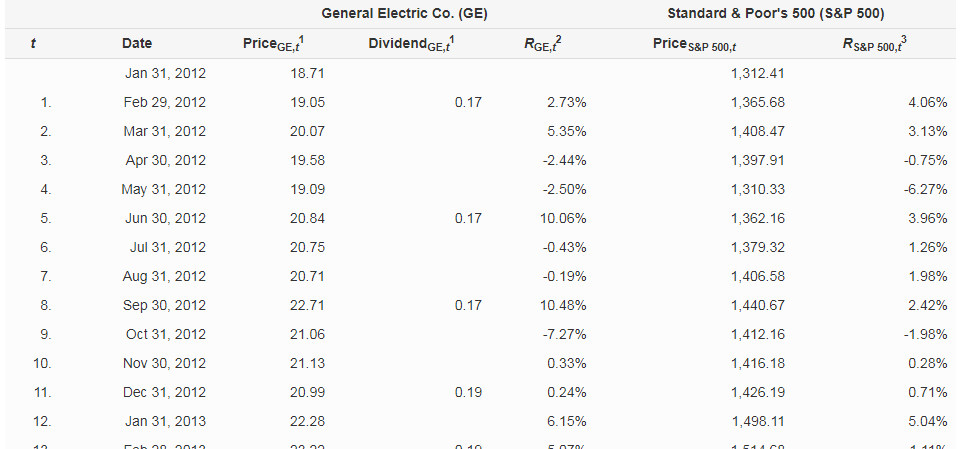

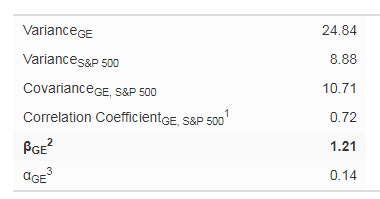

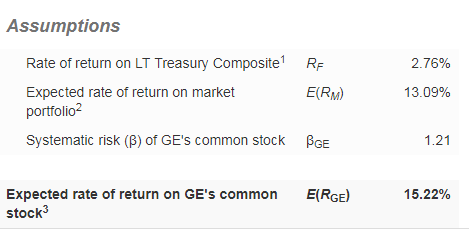

CAPM

Strategic Alternatives

GE can opt for several strategic alternatives. First and foremost, it can focus on customers in developing economies in all sectors, which will give it a competitive advantage. For gaining a competitive edge, it can also develop new technologies. Another option is to invest in process improvement in all its units (especially in emerging markets) to save money. Among all modern technologies, it would be reasonable to develop solar equipment, wind turbines, aircraft, communication, and other technologies. Yet, at the same time, GE should be ready for customers’ decreasing interest in this sector. GE can also rely on stockholders to widen profit margins, yet, their participation largely depends on the economic situation in the country.

GE can become the leader of the market of environmentally friendly technologies to be able to outperform competitors when the popularity of such equipment grows. However, it must take into account that this tendency is far from being steady.

The company can also pay down all pension obligations; yet, the results are unpredictable.

It would be effective to stick to the differentiation strategy and inventing products that are new and unique in all segments where GE currently operates.

The company can form partnerships with other organizations to combine strengths but it has no guarantee that it will not be let down.

It would be rather profitable to sell businesses that show poor performance and investing the obtained capital to core, successful units and acquire companies in the supply sector to ensure protections of delivery and mitigation of risks. At the same time, GE can invest in businesses with high growth rates and good potential/

Works Cited

“General Electric Co.” Stock Analysis on Net. Web.

Hoffman, Alan. General Electric, GE Capital and the Financial Crisis of 2008: The Best of the Worst in the Financial Sector? 2013. Web.