Introduction

The main objective of this report is to evaluate the formulation and implementation process of the strategy in the selected organisation and this paper will concentrate on EasyJet Plc. However, this report focuses on the background of the company, financial analysis, competitive advantage, strategic decision-making, influential current and previous strategies, external opportunities and threats, TOWS matrix, competitive environment, internal strengths and weaknesses, long-terms smart objectives, PESTEL, current competitive position or Porter’s Five Forces and so on. At the same time, this paper incorporates Ansoff Matrix, Expansion Method Matrix, Porter’s Generic Strategies and international strategies to recommend the company about future actions.

Company Background

EasyJet is a British aviation company started its journey in 1995 by incorporating to pose as a low-cost air transportation services within the home and abroad as an alternative to the high cost British national flagged carrier. At the very beginning, EasyJet started its operation introductory flights from London to other UK cities like Edinburgh and Glasgow with only two rented aircraft and contracted staff to test its business model. Now, the EasyJet carries the highest number of passengers than all other UK based airline with its operation in the 500 domestic and global routes covering Europe, US and some Asian destination with increasing satisfactory customer base.

EasyJet has introduced a point-to-point operational model that is to some particular extent of the diverse system in comparison to the most traditional airways hub while the transit passengers have to change their career but EasyJet has the opportunity to choose longer routes without transit. The company also listed in the LSE with symbol EZJ and evidenced itself as one of the FTSE 250 Indexed Company with the marvellous rise of its revenue generation (Easyjet, 2007). Beyond the global financial crisis of 2008, the company continues to keep its strong footprint in the aviation industry along with its almost 7000 well-defined human resources in the UK and Europe without any major shock at its share price in LSE.

Financial overview of EasyJet

According to the annual report 2010 of EasyJet, this company has experienced huge success such as total assets, net revenue, operating profit and profit for the year 2010 have been increased significantly from 2009; as a result, the return on equity increased by 3.1% from previous year. However, the following table demonstrates the data for EasyJet of previous four fiscal years –

Table 1: Financial Overview of EasyJet. Source: Self generated from EasyJet (2010) and EasyJet (2008).

Financial position of EasyJet and Ryanair

Table 2: Ratio analysis of EasyJet. Source: Self-generated.

On the other hand, the main competitor of EasyJet is Ryanair, which started its journey in 1985 with 25 employees but it has now 7000 employees with operation in 35 bases and 950+ routes (Snell, 2009)). It also offers low fare to the passengers; so, it can serve 66 million passengers each year in European markets (Ryanair, 2010). However, the subsequent two tables show the financial data for Ryanair of the last four fiscal years –

Table 3: Financial Overview of Ryanair. Source: Self-generated from Ryanair (2009) and Ryanair (2010).

Table 4: Ratio analysis of Ryanair. Source: Self-generated.

Strategic Decisions that Sustained its Competitive Advantage

In 2009, EasyJet operated in the European market considering four major strategic priorities, and in 2010, the company reaffirmed old strategies with some amendment. However, the key strategic decisions that created its competitive advantage are –

Safety

Annual report 2009 of EasyJet stated that the company gives the paramount importance on the safety of the customers by maintaining the highest standards of Safety in Europe because safety is the number one priority if this company. However, this company has already launched a new Safety Management System to ensure safety performance and safety compliance by the recommendation of European Commercial Aviation Safety Team to identifying and minimising the major risks of the company (EasyJet, 2009, p.10). Also, the management reported that Easyjet experienced no fatal accidents during the history of the company and Composite risk value (CRV) index demonstrated a steady development in this regard.

Turning Europe Orange

According to the annual report 2010, the management team of EasyJet has intended to expand its business all over Europe by selecting right routes at the right times to meet the demands of its large customer base. The leading airline EasyJet at London Gatwick, Milan, Malpensa and Geneva has already captured more than 6.5% share of the European market by serving about 45.20 million customers;

Business model

EasyJet has currently changed its business model to managing new route, slot, and seat system;

Short Haul destination

EasyJet provides numerous flights in 400 short-haul destinations, the minimum interval of flight in a short destination is only one hour, and it allows the airline to reduce the cost of serving customers during the flights;

Customer service

It provides outstanding customer service such as its strategy is to provide the best customer service performance in terms of punctuality, fresh food supply, issues less lost bags and smaller amount cancellations, and its success rate is almost 90% in this case.

Deliver low cost and maximise margins

According to the annual report 2009, deliver low cost and maximise margins are the fourth strategic priority of the company and it offers free tickets and other facilities frequently to uphold the image of its low fare (Allé & Schmitz, 2004). However, Johnson, Scholes & Whittington, (2005, p.840) stated that low fare strategy is the main reason behind the success of EasyJet and it targets those customers who are travelling in various destinations and much concerned about the fare;

Cost of operation

One of the main strategies of EasyJet is to control cost from all sector of its operation and the operating cost of this company is lower in Europe. However, the total cost per seat excluding fuel increased by 5.2% in 2010, but management showed no interest to boost the fare and continued to offer competitive fares to attract more customers (EasyJet, 2010, p.13);

Acquisition

The acquisition with GB Airways at the beginning of the year 2008 strengthen their financial resources and enhance its business opportunity as both companies have the mutual interest of resources and capabilities from designing to distribution (EasyJet, 2010).

SWOT analysis EasyJet

Strengths

- The brand name and existing reputation is one of the most significant strengths of Easyjet;

- The company possess advanced technological alignment including financial strength to support and remarkably increase its net profit margin under the concurrent recessionary economy,

- Easyjet is capable to counterbalance high fuel costs;

- The recent strategy to go for acquisition with GB Airways enhanced its operational growth and cost reduction

- It is present in the 37 of the top 50 European airports;

- It has been successfully operating almost 422 routes with 45 of the top 100 European routes;

- Skilled, trained, motivated, and experienced staff to bring passenger’s satisfaction is another key strength for the success for EasyJet occupying 672 cabin crew and 92 well-trained pilots;

- The uniqueness of its strategy like “Low fare, No frills” has been reinforcing its position with increasing sales and accounted enlarged total revenue up to 12%;

- With low fare but high-quality in-flight passenger’s services and provision of free flights and extra offers;

- The websites and online presence of the company always provide the latest information about its flights and including online booking.

Weaknesses

- According to the annual report, EasyJet paid comparatively high remuneration to their employees and directors and failed to cost-cutting under the recessionary economy;

- Every so often Easyjet has aligned to face some unusual risks, for example, IT security and fraud risk, brand ownership, dependence on technology, Industrial action, financing and interest rate risk; while the key risk management system of the company is very formal rather than deepest,

- Under the ongoing recessionary economy, many competitors of Easyjet, for instance, Ryanair and Aer Lingus generated privileged revenue than the EasyJet (Air Scoop, 2007).

Opportunities

- Easyjet has enough financial, technical and physical resources with enough capabilities and experience to increase its operation in the non-EU zone;

- Most of the customers are loyal as Easyjet has maintained a good relationship with its customer by providing exclusive service and the company has tremendous scopes to take the further expansion of its routes depending on satisfied customer base;

- Due to global financial crisis and Its consequential recessionary impact, the global airlines’ industry has demonstrated a rising trend to merge to reduce cost, Easyjet has such scope to commence suitable merger with its further service expansion plan.

Threats

- Under the present financial condition, the competitors are the main threat for Easyjet as the profit margins of other low-cost airways are increasing and the high-cost fuel operating airlines are rethinking to start their operation with low-cost fuel.

- Earning from tourism sector has decreased due to global financial crisis, for instance, the discretion of future expenditure of tourist has changed, as a result, the net profit of EasyJet Plc has adversely affected for the economic downturn and the company is not yet ready to counterattack the situation to recover it standard annual growth;

- The expansion rate in the non-EU zone of Easyjet is lower than its competitors which needed to be competitive;

- Some other external factors may become a threat for the Easyjet as a whole the industry like Swine Flu virus, and volcano those spread risk of a terrorist attack (Johansson, 2008).

Strategic Framework or TOWS Matrix

Figure 1: TOWS Strategic Framework for Easyjet. Source: Self-generated from Weihrich (2010).

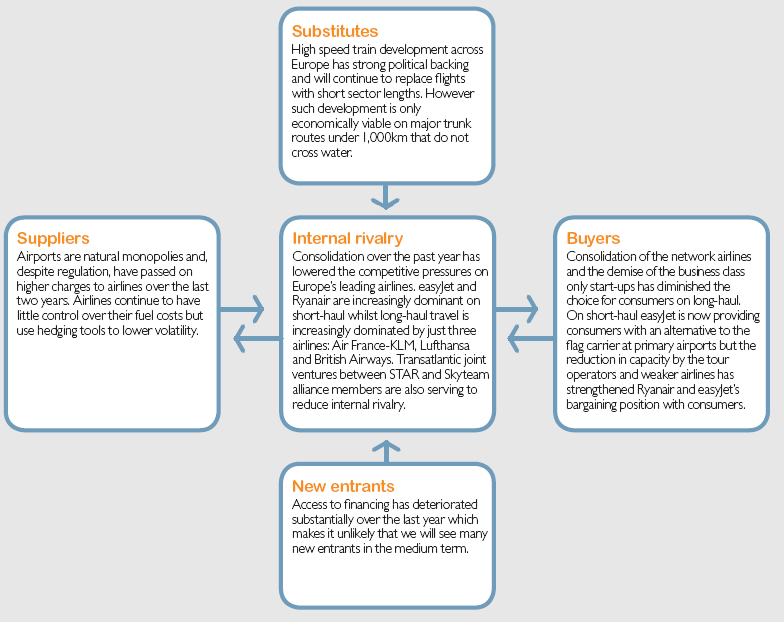

Current Competitive Position of EasyJet

Porter (2004) provided a strategic framework that illustrates five influential competitive factors of the industry; therefore, this report would analyze the current competitive position of EasyJet in light of Porter 5 forces.

Bargaining Power of Suppliers

According to the annual report 2008, the main suppliers of aircraft in the industry are Boeing and Airbus, but only prospective aircraft supplier of Easyjet is Boeing. However, the switching cost of one provider to another is enormous in this industry because different suppliers design the aircraft with different features, so, Easyjet has to train the technicalities and pilots again, which is the subject of huge cost. On the other hand, the local airports have little bargaining power due to unavailability of huge players though larger airports have imposed enormous charges on the airline companies.

Bargaining Power of Customers

The bargaining power of the customers are very high and there is no loyalty at all because they are aware of the high price and interested to gather knowledge about the offerings of other service providers. The competition among the airways of long haul route is nominal because of the acquisition of the network airlines but the scenario is different in short-haul airways due to presence of similar companies though Easyjet counted as passengers with a substitute of British Airways.

New Entrants

The obstacles to entering this market are large capital investment and constrained slot accessibility, which makes it far difficult for the new companies to find appropriate routes. On the other hand, the threat of new could be high if established airways could participate instantly at price war in existing LCC route and gain a competitive advantage though they have to follow the guidance of Restricted Flight Authorisations.

Threat of Substitutes

According to the annual report 2009, the threat of substitute products is high because super-speed trains and improvement of railway operation system across Europe may lower down the switching costs as this sector can replace air travel on short-haul. Also, Easyjet has experienced difficult financial position due to the global financial crisis as the customer purchasing power has reduced and influenced them to find out cheaper services.

Competitive Rivalry

The European aviation industry includes independent airlines (the budget sector), flag carriers, and franchises of chief airlines; here, Air France, Lufthansa, Virgin Express and British Airways are the major service provider in the long haul. However, the competition among the budget airlines is not too high as Easyjet and Ryanair are the mainstream players and both provide low-cost advantages along with similar services. Most importantly, these leading low-cost airlines have selected different routes for their travellers; as a result, Easyjet is a market leader where it operates.

However, Joint venture agreement has shortened the aggressive competitiveness on the continent’s principal airline businesses such as Joint ventures between STAR and Skyteam had reduced rivalry in the industry. According to the report of Mintel (2009), Airways like EasyJet the most efficient airlines for short-haul European travel asks lower price for its services than rivals’ offered price while leaders of long haul route Lufthansa, Air France, or British Airways offers high cost for similar services.

SMART Objectives of EasyJet

- EasyJet would like to boost its yearly profit by 15% within the next four years; therefore, it must reduce its operating costs by 8% each year from 2011 to 2014;

- EasyJet will increase the budget by 15% for research and development to reduce cost;

- Also, it will implement its new strategies within the next five years;

- It missions to boost the budget for promotional tools by 5% within 2013;

- Finally, Easyjet will start operation in 75 new routes in the different place within 2015; therefore, it will purchase few aircraft from Boeing by this time.

The PESTEL framework of EasyJet

Political factors

Johnson, Scholes & Whittington (2008) stated that political factors always influence the business environment, for instance, the foreign direct investment policy of the overseas government, unfriendly approach of the government of non-EU countries, instable political condition of a certain place, various factors related with tax exemption, tax policy, and entry requirements have influenced Easyjet’s operation. Also, many other factors may affect the company such as it has to face the risk of changes in the exchange rate because the UK joined the single European currency (EasyJet, 2010).

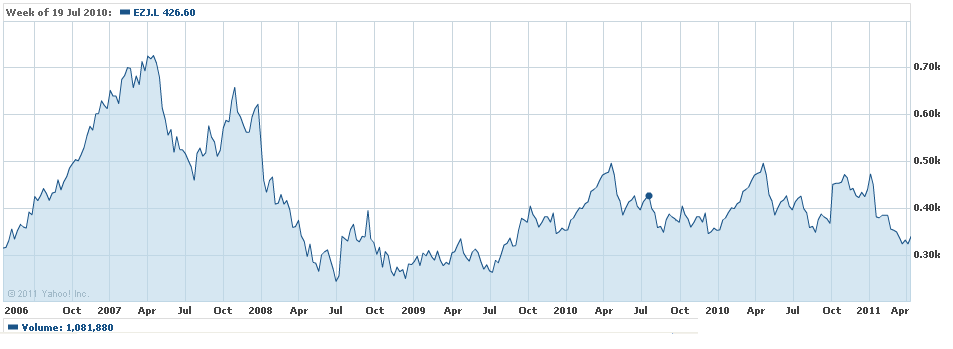

Economic factors

Rapid recovery from the global financial crisis changes the business environment, and change the purchasing power of middle-class people, and increase the interest in trade and tourism are the key success factors for Easyjet. However, EasyJet (2009) reported that it has an operation in 100 top routes along with 300 routes and it is in 37 number positions among the top fifty EU airlines. On the other hand, EasyJet (2010) pointed out some obstacles for the company such as volatility of oil and gasoline price, fluctuated international demand for Airways services, environmental pollution, and natural disaster and so on. However, the following basic chart shows that the share price of the company in London stock exchange has been decreasing from the FY2008 –

Socio-cultural factors

In 2009 and 2010, this company expended more than £33.8 million and £39.20 million respectively for Social security (Easyjet, 2010, p.69). To get better services from employees and follow best practice, this low-cost airline always ensures equal opportunities for all employees irrespective of ethnic group, race, gender groups, religious, political belief, or cultural background and so on. Therefore, Easyjet recruits employees based on candidate’s merit, future prospective and communication skills and good behaviour, for example, this company recruited about 6,666 people in 2009, among them 2193 employees were from overseas.

Technological factor

EasyJet uses advance technology in all aspects of operation such as technology plays a vital role to reduce fuel consumption, build communication with the employees and ensure satisfactory customer services. Also, this company is now operating about 25 A320 aircraft across the routes, as it would help the company to increase its profitability. Annual report 2010 provided some features of technology, such as, the website deals with eRes designs for seat purchases and reservations, RMS intends to yield management, AD OPT Technologies ensures pairings and roster optimiser, Agresso controls accounting system, AIMS handles operational information and team placements.

Environmental factor

EasyJet (2010, p.9) reported that aviation contributes more than 2% of global man-made greenhouse gas emissions; therefore, the employees and research team of EasyJet concentrate on the reduction of air pollution and keep the environmental concern in mind. The management of this company argued that all employees contribute to control pollution level, such as, the cabin crew gather waste materials for recycling, the higher authority communicate with politicians on global warming issues and with the suppliers to produce planes, which emits less carbon emission.

EasyJet estimated that it emitted above 4.51 tonnes of CO2 in 2010 and stated that this company gradually improved their worst position by taking effective policy and it reduced carbon emissions per passenger journey from 97.7kg to 96.9kg in 2010; however, it tries to produce eco-friendly Jet to reduce 50% carbon and 75% NOx emissions by next seven years.

Legal Factors

EasyJet always operates consistent with the UK rules and regulation, for instance, this company considered the Companies Act 1985 initially but now it is operating by the provision of Schedule 8 of the CA 2006 and the rule of Emissions Trading Scheme. However, this company has achieved profitable growth in European short-haul aviation by following the provision of the Civil Aviation Authority, and Regulation 3 of the Licensing of Air Carriers Regulations 1992; however, frequent change of aviation regulation to avoid the risk of terrorist attack has influenced on the business.

Recommendations to develop Strategic Activity of Easyjet

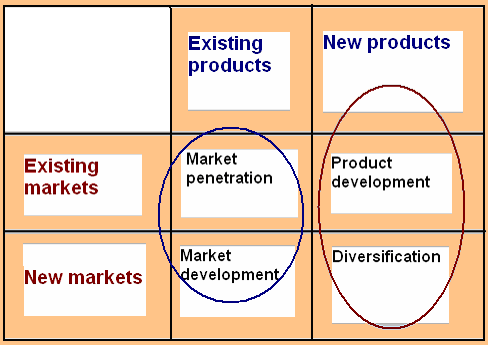

The purpose of this segment is to provide recommendations to develop its strategic activity to gain a sustainable competitive advantage and to increase the profit margins of the company. However, it is important for Easyjet to expand its business in more routes to sustain as a market leader by competing with the industry giants; therefore, the report suggests to focus particularly on the Ansoff Matrix, Expansion Method Matrix, Porter’s Generic Strategies, and so on.

Ansoff Matrix

EasyJet has already established its position as a market leader in the budget airline sector in European countries; therefore, it is easy for the company to expand its business by using Ansoff Matrix.

Market penetration

It would be an effective strategy while Easyjet will expand its operation in existing European routes. Annual report 2010 of this company expressed that its vision is to “Turn Europe Orange”, which indicates its eagerness to expand its business in the present operational area;

Market Development

This strategy indicates the development of the new market through current products and EasyJet is now focusing on new routes and it has already selected new routes extended its network to longer-range destinations, for example, Israel, Egypt and Turkey;

Product Development

Kotler & Armstrong (2006) stated that product development refers to develop a new product in the existing market and this strategy is not too effective for Easyjet though it can offer new services;

Diversification

Hitt, Ireland, & Hoskisson (2001) argued diversification refers to develop a new product for new markets to diversify the business. Therefore, Easyjet can expand its operation in developing countries by offering premium services to the new route.

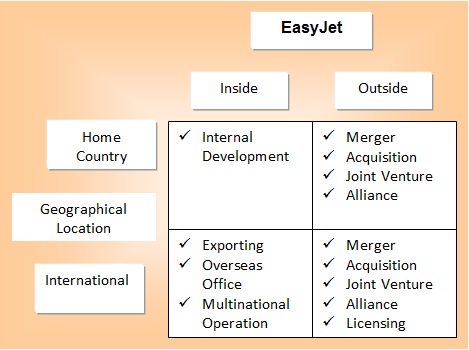

Lynch’s Expansion Method Matrix

Botten (2006, p.283) stated that It is the method by which the company will gain access the products and markets it has chosen from the Ansoff matrix; therefore, Easyjet can develop its market share both in the national and international market by implementing following methods such as a merger, Acquisition, Joint Venture, alliance, and so on. However, the following figure illustrates the expansion method –

Current Market

According to the Lynch (2007, p.853), Easyjet can expand its business in the existing market by two different strategies as it operated more than 400 routes with 175 aircraft in 27 countries, which demonstrates its success in the existing market. However, this airway also popular to the foreigner as more than 50% of its total passenger are originated from outside the UK; therefore, it should develop its capacity by merger with the competitive airlines to grabs more market share and reduce the competition.

New Market

At the same time, EasyJet can expand its business outside of the existing market, for instance, developing countries of Asia, Africa, or America are the potential market for EasyJet where it can start its operation by establishing subsidiaries or signing joint venture agreement with the local companies. However, acquisition of the local airlines is much easier than setting new operation, as it should require a huge investment to enter with a new operation, therefore, in 2008, this company completed the acquisition of London Gatwick-based airline “GB Airways” to enter the Southern European and North African amarket (EasyJet, 2010, p.7).

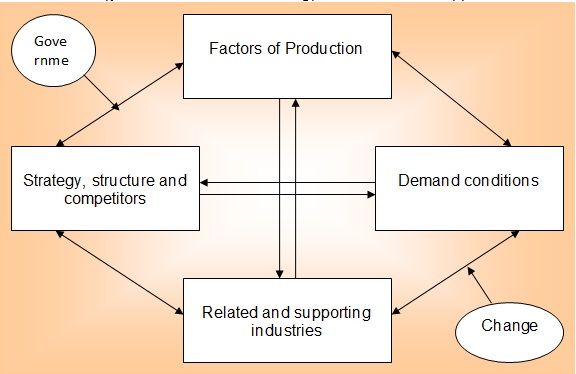

Porter’s Diamond Theory or International strategy

EasyJet has experienced enormous trouble due to volatile fuel price and customer rate in the global economic downturn; therefore, EasyJet has recently taken many actions to uphold market-leading position in short-haul in such economic position. However, EasyJet intends to follow market growth strategy by introducing its operation in 115 new routes; therefore, it should concentrate in few external and internal factors to be a leader in the new market though this company is operating with high confidence in 27 European countries.

- Mintel (2009) reported that the market demand is too high as customer want low-cost service in the ling haul routes;

- At the same time, it should consider demand conditions as there are many Airways in new routes those offer lowest price such as AirAsia is the market leader of Asian short-haul budget airways;

- Easyjet should try to enter related and supporting business like British Airways;

- Also, Easyjet should consider the strategy, structure and rivalry position.

Porter’s Generic Strategies

Cost Leadership Strategy

Easyjet has to spend huge fund for the remuneration purpose, as more than 65% of total employees of this company are a British citizen and rest 35% come from other European countries, which increase the operating costs. On the other hand, the volatility of fuel price creates a hindrance for the company as it influences to increase the operating costs and decreasing the profits, such as the oil price was US$135 a barrel in 2008. In this circumstance, EasyJet has to implement a cost leadership strategy and reduce operating costs by taking new initiatives, as it is a low fare and no-frills airlines.

Differential strategy

As the business model of airways industry is different from other industry, there is limited scope to follow this strategy though EasyJet would like to offer different facilities to the customer to ensure uniqueness among low fare and no-frills airlines in Europe.

Focus Strategy (Cost)

This strategy refers to focus on a narrower market segment through achieving cost advantages and easyJet can enter into the narrower segment of the market by offering a low price to attract cost-sensitive customers.

Focus Strategy (Differentiation)

This strategy would not be fruitful for Easyjet as it has limited scope to differentiate its service line; as a result, Easyjet should not drive to focus on this strategy to increase profit range.

Conclusion

The purpose of this report was to assess the formulation and implementation process of the strategy of the selected organisation, the success of these actions, and the strategic decision-making process to improve its position. To do so, this report provided a brief background of EasyJet including a summary of the current activity with its services range, financial position and strategic decisions that sustained its competitive advantage.

Also, this paper has concentrated on external opportunities and threats, internal strengths and weaknesses, competitive forces, current competitive position within its market, political, social, economical and environmental factors, the smart objective of the company and so on. However, this report recommended the company to develop its strategic activity to gain a sustainable competitive advantage by using some strategic frameworks like Ansoff matrix, Lynch’s Expansion Method Matrix, Porter’s Diamond Theory, and Porter’s Generic Strategies.

In the Ansoff Matrix segment, this paper recommended that market penetration and market development strategies are most useful for EasyJet because it has already branded as budget airlines in the industry. At the same time, the expansion method matrix provided a strategic solution to developing national and international market and suggested that merger or acquisition would be an effective strategy to expand its business with minimal costs.

However, the customers of the industry are very price sensitive; as a result, the main competitive advantage of EasyJet is cost-effective strategies, which enable the company to charge a low fare to the passengers. At the same time, its current strategies mainly concentrate on reducing the costs of operation and decreasing the price of the services.

EasyJet should address that low-cost fuel is the serious cause of environmental pollution but the use of high price fuel must affect the customer base; therefore, this company should sign an agreement with bio-fuel suppliers to purchase sustainable jet fuel (would be produced from waste) to resolve the dilemmas with low-cost fuel and restrain future challenges.

However, Wynn (2010) provided the example of British Airways by stating that BA agreement with two companies to produce more than 16.0 million gallons green jet fuel by processing and converting 500,000.0 tones of waste, which cover 10% of total needs; therefore EasyJet applied this strategy to be an eco-friendly company and compete with BA, Libra or other companies.

As the airline’s industry is highly competitive, EasyJet should focus on its fundamental service delivery and strategic change of the competitors to sustain as a market leader among low fare and no-frills airlines. EasyJet should incorporate the latest technology to create a strong customer base and reduce the effort for maintaining the operation system, such as it can use Yield Management System (YMS) to anticipate the behaviour of customers, Computer Reservation System (CRS) to introduce Navitaire’s Open Skies technology, and Enterprise Resource Planning System (ERP) to decrease financial month-end closing processing time.

In conclusion, Easyjet should consider the recommendation of this report to expand its business in 115 new routes, and earn more profits from outside of European markets by facing the challenge of the volatility of fuel price, adverse economic position, frequent change of aviation regulation, the threat of new entrants, high competition and so on.

Reference List

Allé, M. M. & Schmitz M. A. (2004) Séminaire d’elaboration d’un Business Plan. Web.

Botten, N. (2006) Management Accounting – Business Strategy. 4th ed. London: Butterworth-Heinemann.

David, F. (2008) Strategic Management: Concepts and Cases. 12th ed. London: Prentice Hall.

Easyjet (2008) Annual report 2008 of Easyjet. Web.

Easyjet (2009) Annual report 2009 of Easyjet. Web.

Easyjet (2010) Annual report 2010 of Easyjet. Web.

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2001) Strategic Management. 4th ed. South-Western Thomson Learning.

Johansson, J. K. (2008) Global Marketing. 4th ed. New Delhi: Tata McGraw- Hill Publishing Company Limited.

Johnson, G. Seholes, K. & Whittington, R. (2008) Exploring Corporate Strategy: Text & Cases. 8th ed. London: FT Prentice Hall.

Kotler, P. & Armstrong, G. (2006) Principles of Marketing. 11th ed. Prentice-Hall of India Private Limited.

Kotler, P. & Keller, K. L. (2006) Marketing Management. 11th ed. Prentice Hall.

Lynch, R. (2007) Corporate Strategy: Expansion Matrix, Pearson Education. Web.

Mintel (2009) Short-haul Airlines – UK – July 2009: Companies and Products. Web.

Mintel (2009) Short-haul Airlines – UK – July 2009: Market in Brief. Web.

Porter, E. M. (2004) A Model for Industry Analysis. Web.

Ryanair (2009)Annual report 2009 of Ryanair. Web.

Ryanair (2010) Annual report 2010 of Ryanair. Web.

Snell, J. D., (2009) Ryanair Holdings PLC (RYAAY). Web.

Weihrich H. (2010). The TOWS Matrix — A Tool for Situational Analysis. Web.

Yahoo Finance (2011) EasyJet plc (Public, LON:EZJ). Web.