Abstract

The study entails an analysis of cultural differences on the success or failure of mergers and acquisitions. In conducting the study, a case study involving one firm that has succeeded and one that had failed in its merger and acquisition process was evaluated. The two firms considered in the study included Cisco Systems Incorporation and Bay Networks. A comprehensive review of literature related to success or failure of mergers and acquisitions is conducted. The review considered the elements which result into emergence of cultural differences within the organization. The effects of cultural differences on communication in a merged entity ware reviewed.

The study also detailed the key cultural differences which result into either success or failure of mergers and acquisitions. Cultural assessment, cultural selection and cultural integration analysis and their contribution towards the success of mergers and acquisitions are also conducted with specific reference to the two firms considered in the study. The methodology used in undertaking the study was also evaluated.

This includes the research design and approaches used in conducting the study. The findings from the study were interpreted to ensure that entrepreneurs understand the importance of addressing cultural differences in the process of forming mergers and acquisitions. Finally, a conclusion and a set of recommendations were made to enable entrepreneurs improve their merger and acquisition process. The future research section entails areas which practitioners and scholars should considered conducting research.

Introduction

This chapter will first present the background information of the study with particular interest on the success or failure of mergers and failures. The statement of the problem which identifies a gap in mergers and acquisition with regard to existence of cultural differences between the merging organizations will be presented followed by the research objectives which will act as a guideline for the study. Moreover, the research question that delves on the cultural factors that influence the success and failures of the mergers will be presented. Finally, the chapter will present the scope and limitations of the study while giving the summary of the entire chapter.

This chapter is organized in a number of subsections. Sub section 1.2 presents a statement of the problem which identifies a gap in mergers and acquisition with regard to existence of cultural differences which is justified in subsection 1.3. The research objectives which act as a guideline for the study are outlined in subsection 1.4. This is followed by corresponding research questions in subsection 1.4. The significance of the study to the various stakeholders is outlined in subsection 1.6. The scope and limitation of the study are evaluated in subsection 1. 7. Finally, a summary of the entire chapter is given in subsection 1.8.

Background information

Over the past two decades, there has been a rampant change within Networking and Communication Devices Industry. This has been instigated by a number of factors such as increment in the intensity of competition. In addition, both individual and organizational customers are incorporating electronic commerce in executing their duties. Firms operating in this industry are increasingly formulating strategies on how to attain a high competitive advantage through acquisition of a large market share and increment in their profit levels (Sherman & Hart, 2006, p. 36). One of the strategies that they have incorporated includes formation of mergers and acquisition.

Merger entails integration of two or more firms whereby the selling firm’s assets and liabilities are absorbed into the purchasing entity. Despite a new entity being established, the purchasing firm mainly retains its original name. Alternatively, mergers can be defined as joining of two firms.

This mainly occurs via exchanging the shares. On the other hand, acquisition refers to purchasing another firm’s asset or the entire firm. As an operational strategy, firms in different economic sectors have been able to develop their financial stability. Due to the effectiveness of merger and acquisition strategy, both large and medium enterprises are integrating this concept in their strategic management processes (Sherman & Hart, 2006, p. 36).

According to Brodkin (2009, para. 1), numerous mergers and acquisitions were conducted in networking industry during 2009. Some of the companies that were involved in mergers and acquisition include Oracle, Dell Hewlett- Packard, International Business Machines and Cisco. Integration of e-commerce presents a potential of growth in mergers and acquisition. In conducting mergers and acquisition, understanding the existing organizational culture of the two parties is paramount (Alvesson, 2002, p.1). This arises from the fact that organizational culture plays a significant role towards the success or failure of mergers and acquisition.

According to Dwivedi (1995, p.9), organizational culture is defined as a system consisting of shared meaning amongst members of a given firm which distinguishes it from other organizations. A number of factors define organizational culture. These include values, norms, attitudes and beliefs. Despite operating in the same industry, there are differences that exist in relation to organizational culture. As a result, the success of mergers and acquisition is dependent on the effectiveness with which the existing cultural differences are managed.

This chapter is organized in a number of subsections. Sub section 1.2 presents a statement of the problem, which identifies a gap in mergers and acquisition with regard to existence of cultural differences, which is justified in subsection 1.3. The research objectives, which act as a guideline for the study, are outlined in subsection 1.4. This is followed by corresponding research questions in subsection 1.4. The significance of the study to the various stakeholders is outlined in subsection 1.6. The scope and limitation of the study are evaluated in subsection 1. 7. Finally, a summary of the entire chapter is given in subsection 1.8.

Problem statement

History has become somewhat of a critical arbitrator of the strategies used by companies to gain faster growth through mergers and acquisitions. The 1960s and 70s witnessed a style of management whereby organization were managed in the form of a conglomeration. Many companies assumed that the commercial and other business sectors could easily come together even when the two companies were totally unrelated and find success. Even in the absence of synergy between companies being acquired or those intending to form a merger nevertheless, there was still a lot of enthusiasm amongst companies to come together.

Empirical results however indicated that many firms in unrelated fields easily failed to gain momentum and work to greater success while a few managed to do so. For that reason, the problem statement ‘How dos organizational culture affects mergers and acquisitions In the UK Networking and Communication Devices Industry’

The reason why this paper focuses on one industry in one country is because of the fact that in 1990s, merger and acquisition trends shifted towards companies of related industries. Since unrelated companies needed different management and organization skills to run them. The strategic alliances will be investigated in this paper so that the current activities in the UK communication industry are used as evidence to explain why these strategies do not always succeed in achieving the goals hoped.

Justification

Formation of mergers and acquisition is aimed at increasing shareholders value. According to Chatterjee, Lubatkin, Schweiger and Wember (1990, p.1), numerous literature have been advanced in relation to the importance of mergers and acquisitions. Most of these literatures assert that attainment of the intended shareholder value is dependent on the compatibility of cultures between the two firms.

According to Stahl (2005, para. 1), cultural differences are considered as an obstacle towards the success of mergers and acquisition. Stahl further concurs with findings of studies conducted on mergers and acquisition which reveal that a considerable number of firms have failed to attain the intended integration benefits of mergers and acquisition due to existence of cultural differences. On the other hand, firms that have considered cultural factors in implementing mergers and acquisitions have been successful in attaining a high competitive advantage. Recklies (2001, p.1) opines that developing and sustaining a shared culture is vital in the success of mergers and acquisition.

Research Objectives

In conducting the study, a number of research objectives have been considered as:

- To identify the key cultural factors which lead to the success or failure of mergers and acquisition in Cisco System Incorporation and Bay Networks.

- To describe the nature of the cultural factors in which influenced mergers and acquisition performance of Cisco System Incorporation and Bay Networks.

- To explain the nature of the relationship between the cultural factors which improve mergers and acquisition success in Cisco System Inc and Bay Networks.

- To make practical recommendations on how to successfully implement key cultural factors on Cisco System Incorporation and Bay Networks. In order to improve future mergers and acquisition success.

Research Question

- How did cultural factors affect success of incorporation of mergers and acquisition in Cisco Incorporation?

Significance of the study

Through the study, management teams of firms intending to integrate mergers and acquisition in their strategic management will be able to develop sufficient knowledge of the importance of developing competency with regard to cultural differences. Developing an understanding of the existing cultural differences between organizations can result into effective management of mergers and acquisition. Gaining knowledge on the existing cultural differences will contribute towards efficiency in managing ambiguous and confusing issues relating to organizational culture that arises on daily operation of the firm. The resultant effect is that the firm will be able to attain the intended synergy.

The study will also aid management teams in appreciating the importance of values in analyzing organizational culture during formation of mergers and acquisitions. According to Roger (2000, p.3), some of the elements to be considered include the firm’s mission statement and its goals.

Addressing cultural differences can contribute towards the firm attaining a high competitive advantage. This arises from increased productivity since there will be harmony amongst the firm’s employees. By only considering firms which have a cultural fit in the process of implementing mergers and acquisitions, it will be possible form the merger to succeed. Higgs (n.d, para. 2) asserts that human capital is paramount in developing sustainable competitive advantage.

Evaluation of cultural differences in mergers will help in evaluating the extent to which firms can manage existing cultural differences. For example, it will be possible to determine the extent to which the employee can tolerate to either ambiguity or uncertainty. Appreciating the contribution of cultural differences towards the success or failure of mergers and acquisitions will contribute towards effective decision-making on whether to continue with the merger and acquisition deal or terminate it. If cultural fit exists, there is a high probability of the merger succeeding. According to Gertsen, Soderberg and Torp (1998, p.77), culture difference in organization can be classified as low, medium or high.

Through this classification, it the management is able to determine whether it is possible to manage the existing cultural differences by analyzing the associated degree. For example, if the percentage difference is less than 33%, it is considered as manageable. On the other hand, if it is 66%, it is considered being high. The study will also aid firms that have incorporated mergers and acquisition in their strategic management to develop programs aimed at conducting cultural integration upon completion of merger deal. One of the ways through which this can be achieved is incorporation of pre and post-merger intercultural training program.

In addition, it will be possible for the management team to deal with intercultural differences that arise in the course of operation. This will arise from formulation of a mutually accepted intercultural framework. According to Kwintessential (2010, para. 7) intercultural framework acts as a guideline for ensuring that post-merger synergy is attained. In addition, effects of cultural differences can be minimized by integration of cultural due diligence which entails a step by step process of conducting cultural assessment between the acquiring firm and the target (Thomas, 2000, p. 29).

Scope and Limitations

The analysis of this paper is aimed at investigating the impact of cultural differences in the success or failure of mergers and acquisitions in the Networking and Communication Devices Industry. This will be conducted by analyzing firms in the industry with specific reference to Cisco Systems and Bay Networks. Due to time and resource constraints, the research will be conducted on only a small group of respondents.

Summary

This chapter introduces the reader to the subject of study by offering succinct background information concerning the current activities in the business sector concerning mergers and acquisitions. The study is specifically about the UK communication industry. The statement of the problem gives the declaration on which the investigation would revolve around. Using research objectives, a researcher is able to design his/her research questions in such a manner as to realize the aim of the study.

The study is indicated to be significant to the managers and other this is because the success of mergers or their failure is determined by how they well or bad the management can deal with the cultural differences that exist between the two merging firms or engaged acquisitions. The next chapter entails a review of relevant literature.

Literature review

This chapter will first present literature on the general knowledge surrounding all aspects of mergers and acquisitions in modern business environment with emphasis on the role of corporate level strategy and the various level of culture. An analysis of the cultural differences in the organizations in combination with the cultural factors affecting mergers and acquisitions will also be discussed. In addition, the chapter will present the effects of cultural differences on communication in the resultant outfit and an evaluation of the linkage between organizational culture and acquisition. In tandem with the research objectives, a review of the cultural factors affecting mergers will be presented. More importantly, two case studies describing real life situations of failure and success on the effect of cultural differences on mergers will be presented. Finally, a summary of the chapter will be presented at the latter stages of this chapter.

The purpose of this chapter is to conduct a comprehensive review of relevant literature. This will enable the researcher to gain a comprehensive understanding of the various aspects related cultural differences in mergers and acquisition. The chapter is organized into a number of subsections. Subsection 2.1 entails an analysis of cultural differences in organization. The cultural factors affecting mergers and acquisitions are evaluated in subsection 2.2. Subsection 2.3 gives the effects of cultural differences on communication in the merged entity. The link between organization culture and acquisition is evaluated in subsection 2.4.

The various key cultural factors affecting success of merger and acquisition are evaluated in subsection 2.5. Hofstede theory is discussed on section 2.5.4. In order to illustrate the effect of cultural differences on the success of mergers and acquisition in real life situation, a case study of a success and failure is included in subsection 2.6.

Incorporating an effective corporate level strategy has become a priority among firms in different economic sectors due to increment in the intensity of competition. One of the corporate level strategies being considered by firms entails formation of mergers and acquisition. Over the past two decades, management of firms in different economic sectors have realized that incorporation of Mergers and Acquisition (M&A) in their strategic management processes is one of the ways through which they can be able to respond to the dynamic business environment (Bruner, 2004,p. 3). Stahl and Mendenhall (2005, p.3) assert that M&A are becoming popular in a firm’s effort to attain diversification and corporate growth. As a result, mergers and acquisition have become a competitive business activity. Bruner (2004, p.3) asserts that the concept of M& A is currently being characterized as aggressive change agents within the economy.

For mergers and acquisition to be successful, it is paramount for the management teams involved to consider integrating three main dimensions related to business strategy. These include process, context and content. These dimensions should be used in evaluating cultural differences existing amongst the firms. The ultimate effect will be success of the merger and acquisition (Saee, 2007, p. 8).

According to Vaara (2000, p. 81), there are three main levels of culture in relation to an organization. One of the levels entails artifacts, which includes the visible, audible and tangible results. The second level relates to values, which consist of the goals, philosophies, and standards, which are considered to be of intrinsic value to the organization. In the third level, this is where we have the study assumptions. These concepts result into emergence of differences in organizational culture.

Vaara (2000, p. 82) asserts that numerous failures in mergers and acquisitions over the past decade are because of cultural differences. Findings of studies conducted on mergers and acquisitions reveal that approximately 80% of all mergers and acquisitions formed do not attain their intended objective. On the other hand, approximately 50% of firms, which incorporate this concept, fail (Mohibullah, n.d, p. 2). One of the reasons associated to cause these failures relate to lack of cultural fit. According to Recklies (2001, p.1), failure of mergers may either occur during the pre-merger negotiation phase or post merger integration.

The purpose of this chapter is to conduct a comprehensive review of relevant literature. This will enable the researcher to gain a comprehensive understanding of the various aspects related cultural differences in mergers and acquisition. The chapter is organized into a number of subsections. Subsection 2.1 entails an analysis of cultural differences in organization. The cultural factors affecting mergers and acquisitions are evaluated in subsection 2.2. Subsection 2.3 gives the effects of cultural differences on communication in the merged entity. The link between organization culture and acquisition is evaluated in subsection 2.4.The various key cultural factors affecting success of merger and acquisition are evaluated in subsection 2.5. In order to illustrate the effect of cultural differences on the success of mergers and acquisition in real life situation, a case study of a success and failure is included in subsection 2.6.

Cultural differences

Cultural differences are one of the core issues that should be considered when considering integration of mergers and acquisition strategy. According to Mohibullah, cultural clash is one of the major factors that result into a failure of mergers and acquisitions. Findings of a study conducted by KPMG revealed that existence of cultural differences amongst firms is a key contributor towards failure of mergers (Gitelson et al, 2004, p. 1).

There is a strong direct correlation between how an organization deals with intercultural challenges in relation to mergers and acquisition and its performance. This mostly occurs in post-merger phase. This further affects the firms’ long-term failure or success (Kwintessential Limited, 2010, para. 5). However, the strength of the correlation with regard to cultural differences varies from one organization to another and from industry to industry.

In the process of conducting mergers and acquisition, it is important for the management team of the firm to evaluate the key cultural differences existing between the two organizations. This will aid in determining the probability of the merger succeeding. The initial stage of the strategy process entails identification of potential firm to consider in forming the mergers and acquisition. Effective evaluation of cultural differences among potential firms will ensure that only firms in which minimal cultural difference exist are considered.

In order to attain this effectively, the firm’s management team must consider the context of the potential firm by identifying the industry in which both firms operate (Saee, 2007, p. 8). To minimize the existing cultural differences, management team should consider firms operating within the same industry.

Identification of cultural differences will enable the firm to identify the content of the cultural differences. The ultimate effect is that the firm’s management team will be able to formulate the most effective strategy to deal with the differences. For example, if the existing cultural differences are minimal, the management team may consider integrating a harmonization strategy.

Cultural factors affecting mergers and acquisitions

According to Gitelson et al (2004, p. 1), culture clash translates into in-fighting and internal confusion. As a result, the firms involved experience inefficiencies and loss of time. Consideration of cultural differences in mergers and acquisition is vital in determining how a firm’s employees respond to the new firm formed. Culture clash is defined as the conflict, which arises from existence of differences with regard to company values, missions, styles, norms, attitudes, beliefs and philosophies.

Culture clash in a merger is made evident by a number of issues that include what is valued, treatment of employees, decision-making process, how to communicate and what is to be measured. It may also result from difference in opinion with regard to opinions and arguments related to the process to be undertaken in implementing new business strategy (Gitelson et al, 2004, p. 1). Mergers and acquisitions can also result into a change in orientation, character and nature of either merger partners.

Most of the researches conducted on merger and acquisition have failed to highlight the importance of harmonizing the cultural differences existing between organizations. However, harmonization of these issues presents a challenge to firms and may take a considerable number of years before the employees feel incorporated into the new entity. Effective harmonization of culture between firms plays a significant role in ensuring the success of the merger. Considering the intensity of cultural differences existing between the two partners, employees experience numerous challenges in the process of adjusting to post merger periods. A large proportion of the firm’s employees are concerned with loss of job and the consequent financial debt.

Gitelson et al (2004, p. 1) asserts that news of eminent merger affects the productivity of employees. This arises from the fact that employees will be preoccupied with how such a change will affect him or her. Such an organization change result into both the managers and line employees reducing their productivity with a margin of 15%. This arises from misinformation, rumors and worry. In addition, the merger may mean that the employees will be under a new management team that is quite distressing. Gitelson et al (2004, p. 6) postulates that formation of mergers and acquisitions results into the existing teams becoming ineffective. By establishing a merger and acquisition, the existing teams are disintegrated.

Coming under a new management coupled with new team members may hamper the freedom that existed in raising sensitive issues due to lack of trust in the new team. Mohibullah (n.d, p. 4), asserts that mergers and acquisition may result into loss of cooperation that existed in the individual firms prior to the merger. In addition, cultural differences may result into difficulty in attaining the intended synergy.

According to Kelly, Cook and Spitzer (2009, p. 9), synergies are paramount in the process of mergers and acquisition succeeding. A large number of firm’s management teams involved in mergers and acquisitions have realized that it is difficult for them to succeed in business without the necessary synergy (McGarvey, 1997, p. 6). However, if the management team does not deal with cultural differences, it will be difficult for the firm to attain the intended synergy. In addition, it will also be difficult to resolve conflicts that arise in the firm’s course of operation.

The degree of complexity in relation to mergers and acquisition is relatively high if the parties entering into a merger and acquisition relationship are from different countries or geographically separated due to existence of cross-cultural differences. Despite the firms involved in mergers and acquisition operating in the same industry, its employees may react to similar circumstances in a totally different manner. Therefore, it is paramount for firms involved in mergers and acquisition on a local or international scale to considerer the existence of these differences during the pre-merger and post-merger integration phase.

Effect of cultural differences on communication in a merged entity

Upon formation of a merger and acquisition, there is a high probability of existence of ambiguity in terms of communication. Ambiguity in an organization arises if there is no clear definition of a number of events. In addition, ambiguity may occur in the entire firm or amongst individuals. It also depends on cultural knowledge amongst the employees. Existence of ambiguity in a merged entity is directly associated with insufficient communication within the firm. Ambiguity can also be defined as lack of consistent information. Upon merging of two firms, the employees who were working independently are required to adapt to a new working environment.

This is emphasized by Gitelson et al (2004, p. 2) who asserts creation of a critical mass in relation to operational change is one of the contributors towards the success of mergers. Significant changes will be incurred in relation due to differences in work environment. On the firm becoming organized, there is a high probability that the expectations of the employees will be totally different.

Fost and Sullivan (2010, para. 3) are of the opinion that incorporation of an effective communication can result into minimization of the challenges associated with ambiguity. One of the ways through which management teams of firms can enhance success of mergers and acquisitions is by acknowledging the existence of the cultural differences and developing strategies on how to harmonize them. Communication is vital in minimizing resistance amongst the employees. Effective communication should be enhanced from top to the lower levels. It should be ensured that there is continuous communication during the entire transformation period. Young and Post are of the opinion that effective communication is the most important tool in managing change especially during establishment of mergers and acquisition.

Link between organization culture and acquisition

For mergers and acquisitions to be successful, it is important for there to be established a fit in the culture of the firms involved. One of the ways through which this can be attained is by ensuring that there are similarities in relation to the management style incorporated and the corporate culture adapted. This means that the firms involved must work towards integration so as to establish a homogeneous corporate culture. According to Gitelson et al (2004, p. 1), corporate culture is one of the key drivers which can result into the firm attaining superior performance. This arises from the fact that organization culture has an effect on issues related to customer satisfaction, innovation, organization flexibility, teamwork and quality of products and services that the firm deals with.

Key cultural factors that lead to the success or failure of M&A

In the process of integrating mergers and acquisition in the operation of a firm, management teams of firms pay more emphasis on issues related to legal, business factors and financial issues. Minimal consideration is given to cultural issues. The resultant effect is that the new entity experiences difficulties later in the future. With regard to existence of cultural differences, there are a number of factors that management teams of firms should consider in an effort to ensure successful cultural integration. These processes include cultural selection, cultural integration analysis and cultural assessment.

Cultural assessment

This is usually undertaken during the process of conducting the merger and acquisition due diligence process. Due diligence refers to paying more attention to employees’ or workforce priorities. According to Hewitt (2009, p. 2), due diligence should be considered in evaluating human capital issues. Employees of a firm intending to undertake a merger and acquisition are more concerned on the cultural fit (Albe, 2007, p. 6).

As a result, a considerable amount of time should be devoted to ensure that a comprehensive assessment of organization structure and human capital. While undertaking the cultural assessment of an organization, there is the need to take into account the products, values and the beliefs of the organization in question. This occurs approximately 30 days prior to finalization of the merger. For cultural assessment to be successful, the management team of the firm undertaking acquisition must consider a number of issues related to individual firms separately. Some of the issues to be assessed include the firm’s mission and vision statement, core values, goal and objectives, strategic intent and direction, integration policies, customer focus, employee empowerment, ability to respond to cope with new environment and cope with change.

Cultural integration analysis

Formation of mergers and acquisitions result into in-depth and extensive combination of strategies and structures between the firms involved. As a result, employees become uncertain with regard to corporate culture culminating into loss of trust amongst the employees. This means that there is a high probability of the intended value being destroyed. In order to prevent this, it is important for the management team of the firms involved to conduct a cultural integration analysis.

According to Mercer (2006, p. 1365), cultural integration is aimed at shaping a new culture through mutual absorbing and strengthening of the various cultural trait via effective communication. Alternatively, cultural integration is defined as the process of eliminating contradictions that arise from conflicts after formation of mergers and acquisition.

Through culture integration analysis, the acquiring firm is able to identify the existing cultural gaps and also opportunities presented for improvement. Culture integration is also referred to as cultural acculturation. A number of studies conducted on mergers and acquisitions have revealed that lack of congruence amongst organizational culture increases stress thus reducing their satisfaction and hence productivity. In addition, organizational cultural differences may also culminate into symbolic conflict. This entails where one group formed as a result of the merger breaches core team values.

This arises from the fact that organizations groups socialize in a given pattern. The resultant effect is that the employees are accustomed to specific values, ideas and practices. Mercer (2006, p. 1365) asserts that cultural differences may result into a strenuous relationship within the organization (Sarala, 2004, p. 147). This may limit transfer of knowledge within the organizations through the teams formed.

Mercer (2006, p. 1365) further asserts that there are four main modes of acculturation which can be integrated in mergers and acquisitions. These include assimilation, integration, separation and deculturation. Assimilation entails the culture of the merging firm totally replacing the culture of the merged firm. This means that the merged firm is totally absorbed by the merging enterprise. On the other hand, integration entail development of a hybrid culture that consists of the major related to the two firms. Culture integration is aimed at developing a strong culture by merging the two cultures (Dwivedi, 1995, p.9).

Separation involves keeping the culture of the two firms involved in the merger and acquisition distinct. In most cases, this mode of acculturation is incorporated if the employees of the firms involved (merged) refuse to accept culture of the other firm (merging). This mode is aimed at avoiding intense conflict amongst the parties involved. Deculturation often arises if employees of the emerging firms do not intend leave organizational values that they are conversant with. In addition, deculturation may also result if employees of the merged firm refuse to identify the culture of merging firms. The resultant effect is that psychological and the cultural bridge that is expected to be established amongst the different employees is broken. This culminates into organizational values and behaviors becoming chaotic.

There is a high probability of the firms involved in mergers and acquisition to have adopted different communication structure. This may result into cultural conflict within the new entity. Effective communication plays a significant role in ensuring that there is effective cultural integration. According to Mohibullah (n.d, p. 5), lack of effective communication in relation to merging firms is a problem since it may result into uncertainty, reduction in employee loyalty and reduction in trust. It is universally acknowledged that development of a high degree of trust in an organization results from incorporation of superior managerial beliefs, actions and philosophies. This serves in reducing transaction costs.

Cultural selection

This entails conducting a discussion with the management team of potential acquisition. Cultural selection entails identification of top performing employees. This enables the firm to make a decision on the employees to retain based on defined cultural criteria. The discussion enables the acquiring firm to identify potential leaders from the firm being acquired and their cultural matches. Lack of communicating to the top performing employees in time may result into their exit (Dwivedi (1995, p. 8).

The Hofstede theory

Hofstede did a great job studying culture and he developed dimensions that define the work related values in the context of national culture. These factors have been integrated into organizational culture since many companies that are successful have gone global (Hofstede, 2001, p. 12).

They use merger and acquisition as a strategy to expand into other countries. These factor include, power distance, individualism, masculinity, long term achievement and avoidance of uncertainty. From this, the Values Survey Model was devised and it’s a very useful model for use in the study of cultural difference in organizations and their impact. According to Hofstede, Culture is something that is collective yet in most cases intangible. It’s nonetheless, the concept that differentiates one particular group of people, an organization or a country from another (Hofstede, 2001, p. 12).

Hofstede asserts that culture is made up of two main elements, the internal and invisible aspects very the external elements that are very visible and in most cases described as practices. Latter Practices include things like courtesy in greeting, character of employees, and communication. Values on the other hand are virtues like honesty, responsibility, accountability and dedication.

Dimensions of Culture:

- Power distance: this in areas like UK where there is low power distance, there is minimal inequalities among the people. Organizations are decentralized in their operations and activities. The subordinates expect that the mangers would consult them and there are very little privilege and status symbols. Conversely, high power distance will be a description of a society that relies on few superiors who are very powerful. Organization is likely to b centralized and the subordinates are separated from the management by great margin in terms of salary, privileges and powers (Hofstede, 2001, p. 17).

- Individualism: the ties among people are loose and every individual is expected to take care of him/herself and his/her family. The UK organizations show that individualism is more important and they place very little emphasis on loyalty and protection. In the collectivist culture, employees would tend to expect a lot from the employers. Individualism, however, individual effort is more important to the success of the organization(Hofstede, 2001, p. 22).

- Masculinity: masculine organization like the UK communication industry, there is nothing like division of labour in that the more assertive roles are allocated to men. The success of the organizations is based on the academic prowess, competence and career achievement (Hofstede, 2001, p. 22). France on the other hand is conserved a feminine country and the organizations success is thought to stem from relationships, life skill and cooperation.

- Uncertainty avoidance: weak uncertainty in UK means that it does not perceive things that are not familiar to be dangerous as those with strong uncertainty. Such organizations seek to reduce the risk by rules to enhance order and coherence.

- Long-term goals: this deals with the virtues that are set to support future rewards. This is where personal adaptability is emphasised (Hofstede, 2001, p. 22). The investments include real estate investment and savings. The time for leisure is not very critical and soothing being bad or good depends on the circumstance.

With increasing need to expand globally, many people find themselves working with or in the management positions of organisations from different cultures. Hofstede is enthusiastic to stress on the fact that ‘dimensions’ are not a strict prescription or strategy to work out success but rather a mere concept. Their role is to equip the manager and workers with tools to analyse and help in understanding intercultural differences, For instance, when multinational companies build international teams to do a research.

Managing cultural differences in mergers and acquisitions

Case study 1: A case of success; Cisco System Incorporation

Cisco Systems was established in 1984 within information technology industry. The firm has been successful over the two decades it has been in operation. Due to effective management, the firm has incorporated the concept of internationalization enable it to become a global firm. This has also resulted from the high rate of industry growth. The expansion of the firm resulted into the firm expanding its product lines to include products such as network management software, diverse networking solutions, IP telephony, switching, wireless technology and routing, optical networking and website management tools. Growth of Cisco System into an international firm is associated with formulation and implementation of effective business strategy.

One of the operational strategies incorporated by the firm entails formation of mergers and acquisition. Through this strategy, the firm has been able to access new technologies. Adoption of the concept of formation of mergers and acquisitions by the firms was perceived as a major weakness by other firms in the high technology industry. Cisco’s System management team considered integration of merger and acquisition to be the most effective and efficient way of attaining competitive advantage (Cisco System Incorporation, 2004, p.3). One of the firm’s recent mergers entails Cisco System and Starent Networks at cost of $ 2.9 billion.

Incorporation of this strategy arises from consideration of forming mergers and acquisitions as the firm’s key growth strategy. Through this strategy, it is possible for the firm to attain a high level of customer satisfaction through innovation of next generation products. In line with this, the firm’s management team has developed an acquisition philosophy that entails consideration of acquisition as the key strategy in accessing scarce intellectual assets (Cisco System Incorporation, 2004, p. 4). In addition, formation of mergers and acquisition is considered by the firm’s management team as a key force in the process of identifying driving market transitions.

In conducting mergers and acquisition, the management team of Cisco System Incorporation is guided by three key objectives. These include employee retention, return on investment and new product development. The firm’s management team is committed at ensuring that it retains a large percentage of employees from the firm it acquires. This results from realization of the fact that unsatisfied employees will definitely leave the firm or if retained in the new firm they may result into inefficient performance of the firm. In order to eliminate occurrence of this, the firm’s management team has integrated a criterion with regard to cultural compatibility for all the firms it considers having a potential of being acquired (Paulson, 2001, p. 103).

The firm’s management team has developed this strategy upon realizing that it is a challenging task to make incompatible cultures cooperate to the extent that the all the employees of the acquired firms will be satisfied. In conducting its acquisition process, the firm ensures that it only considers firms that have similar cultures. The firm has often walked out of a merger and acquisition deal as a result of lack of cultural fit despite the financial terms being appealing (Jeffery, 2008, p. 8). According to the firm’s Chief Executive Officer (CEO), Cisco does not prefer acquiring other firms if it is sure that it will lay off all the acquired firm’s employees due to cultural differences.

Incorporation of employee retention objective has enabled Cisco System Incorporation to successfully manage cultural differences in the firms that it acquires. In order to minimize cultural differences, the firm’s management team ensures that one third of the top management positions in the new firm established after completion of merger and acquisition are set aside for employees from the acquired organization.

The firm’s employee retention as a strategy to eliminate cultural differences is also undertaken through incorporation of employee benefits (Pfeffer & Sutton, 2001, p. 8). One of the ways through which this is attained is by provision of stock options. Upon completing a merger and acquisition process, the firm’s management team ensures that it concerts the stock options of the acquired firm into its own stock. This provides a high potential of the acquired stock options appreciating. The resultant effect is that the firm’s employees execute their duties more seriously since they consider it as an opportunity for acquired stock options appreciating. In relation to employee retention, the firm’s management team has formulated a strategy that entails key employees of the acquired firm signing a non-compete whose duration is two years.

This is the time limit before these employees can leave the firm. In addition, this time is sufficient for the firm to develop another product. By limiting the employees from earning income from another firm in their industry, the firm is able to incorporate a sufficient culture amongst the employees. This results from the fact that a strong incentive amongst the employees to stay in the firm is developed. Through effective management of cultural differences that occur in mergers and acquisition, the firm’s Chief Executive Officer (CEO) asserts that the firm has been successful in retaining personnel. For example, Chambers, Cisco System CEO asserts that the firm witnessed minimal voluntary employee attrition in relation to the employee of the acquired firms at a rate of 6% in 1999 compared to the previous two years.

In its cultural integration process, Cisco System Incorporation management team ensures that in invests substantially in acquisition of integration resources in all its functional and corporate levels. Some of the issues considered by the firm’s management team in its cultural integration process include reward system, decision-making process and the organization structure.

Cisco System Incorporation has developed a comprehensive cultural integration process. The first step involves developing a lucid understanding of the mergers and acquisition rationale by all the parties involved. The management team also ensures that all parties understand the intended outcomes. Clarification of specific behaviors necessary for effective operation of the new entity is undertaken. The key drivers that are necessary for the success of the behavioral change are evaluated. In order to ensure that cultural differences are sufficiently dealt with, the firm’s management team ensures that change management is conducted.

In selecting a firm with which to enter into merger and acquisition, Cisco System Incorporation ensures that only firms with shared technological and business vision are considered. In addition, compatibility with regard to core values is also considered in an effort to ensure that culture differences are eliminated. This serves in developing an environment conducive for the success of the merged entity. The firm’s management team also conducts a comprehensive discussion with the top management team of the firm it intends to acquire. The objective of this discussion is to receive feedback related to the top performing employees. This enables the firm to formulate effective organizational culture strategies thus enhancing its capacity to retain employees of the acquired firm.

Case study 2: Case of failure; Bay Networks

In 1994, Synoptic Communications and Wellfleet Communications that were operating within the networking industry merged resulting into formation of Bay Networks. The objective of the merger was to form a strong player within the industry (Markoff, 1994, para. 1). Bay Networks have experienced a series of problems since its inception. One of the major challenges faced by the firm includes lag in developing and introducing new products.

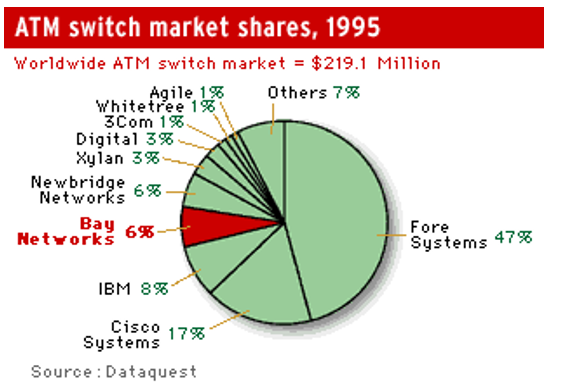

This has greatly cost the firm’s competitive advantage. For example, despite the firm venturing into production of Automated Teller Machine switches, it was overtaken by Cisco Systems Incorporation. Bay Networks was also overtaken by Fore System that ventured into this market at the same time with Bay Networks. Due to effective product development, Fore System managed to become the market leader. In addition, Cisco Systems attained a market share of 17% compared to Bay Networks that had a market share of 6% in 1995 as illustrated below.

The firm has not been able to market its products effectively. This results from difficulties in managing its sales force. According to Cnet (1996, p. 1), Bay Network’s management team was not able to integrate its sales force since the formation of the merger. According to Cnet (1996, p. 2), there were cultural differences between Synoptic and Wellfleet Communications in relation to motivation and management styles. This had a strong negative impact on the entire Bay Networks’ sales force. The firm experienced challenges in integrating direct and indirect distribution channels of the two firms. The resultant effect was the competition between the firm’s direct sales force and resellers.

The idea of establishing Bay Networks by merging Synoptic Communications and Wellfleet Communication was appealing on paper. However, the success of the new entity was limited by existence of differences in corporate cultures between the two firms. Wellfleet Communication’s management team was doubtful of the mergers’ success after considering the vast difference in corporate cultures.

In addition, the two firms had a large geographical divide in relation to location of their headquarters. Synoptic Communication was based in Santa Clara in California while Wellfleet Communication was based in Boston. According to Sadri & Lees (2001, p. 1), geographical separation culminates into a difference in corporate cultures amongst organizations. This results from the fact that employees develop different values forcing the organization to align its organizational culture in accordance with its immediate environment. Existence of geographical distance resulted into poor performance of Bay Networks.

On the other hand, Cisco System Incorporation minimizes cultural distance with regard to cultural differences that result from geographical distance. In order to undertake this, the firm’s management team gives priority to firms operating in networking industry that are located in Silicon Valley or those located close to its remote sites (Cisco System Incorporation, 2004, p. 5). In 1998, Bay Networks was acquired by Nortel at a cost of $ 9.1 billion (Weston & Heskett, 1998, para.2). Poor management of cultural differences is one of the factors that contributed towards failure of Bay Networks. Currently, Cisco Systems Incorporation continues to dominate the market.

Summary

From this chapter, the investigator gives the readers the literature that addresses concepts that are related to the merger and acquisition process in business. There is an extensive coverage of what the various aspects of business, organization culture and company management interacts to bring about the success or failure of a company. They include theories of culture, management factors and case studies of Cisco and bay networks. These are real companies in real business across the United Kingdom. They helped to give then background information of the business industry as it is today and the way mergers and acquisition have been impacted upon by organizational culture. The methodology chapter develops from this in a unique manner because it where the raw information will be collected. The chapter will help explain how data will be gathered for analysis.

Research Methodology

This chapter will present the research design utilized in conducting the study. In addition, the data collection techniques with emphasis on data coding will also be presented. The sampling techniques, sample size and selection of respondents are then presented before a justification of the sample population is offered. Moreover, the qualitative and quantitative methods of data analysis and ethical considerations will be presented in the latter stages of the chapter. Finally, presentation of the limitations encountered during the study followed by a brief summary of the study will be presented

The objective of this study was to conduct an in-depth analysis of the cultural factors that cause failures in mergers and acquisitions with specific reference to the Networking and Communication Devices Industry. The study was instigated by an increase in the number of mergers and acquisitions, which fail during pre or post merger phase. One of the major reasons, which contribute, to these failures is existence of cultural differences. In order to attain this, a number of objectives were formulated.

These include identification of the cultural factors, which contribute towards success of mergers and acquisition. In addition, the nature of the relationship between key cultural factors aimed at improving mergers and acquisitions in the Networking and Communication Devices Industry was determined. Through the analysis, it will be possible to make recommendations on how to implement cultural factors in the industry.

This chapter is structured in various subsections. Subsection 3.1 entails identification of the research design used in conducting the study. The method used in collecting data from the field is analyzed in subsection 3.2. In order to condense the raw data collected, the concept of data coding is evaluated in subsection 3.3. Due to the large size of the population, sampling technique is incorporated in selecting the respondents. Sampling, sample size and selection of respondents are considered in subsection 3.4 while justification of sample selection is illustrated in subsection 3.5. The method of data analysis and ethical consideration are outlined in subsections 3.6 and 3.7 respectively. The limitations of the research methodology are discussed in subsection 3.8. Finally, a summary of the chapter is given in subsection 3.9.

Research design

In order for a research study to attain the stipulated objectives, a well-defined research design should be incorporated (Saunders et al, 2009, p. 23). The research design acts as a framework, which guides the study. The resultant effect of incorporating research design is that the study becomes logical. According to Creswell (2003, p. 203), research can either be explanatory or descriptive. Explanatory research mainly deals with answering ‘why’ questions. This means that a well-defined causal relationship have to be established. Considering the nature of the research question of the study, this study is characterized as being explanatory. This is because it is aimed at evaluating why and how cultural differences have an effect on the success or failure of mergers and acquisition.

Consideration of a research design enables the study to be logical thus resulting into appropriate findings. Selection of the research design should ensure that it results into a high degree of accuracy in relation to the findings. The design adopted should be reflexive of the entire research process. According to Maxwell (2005, p. 2), a good research design is characterized as one in which all the components work harmoniously in promoting the findings of the study. On the other hand, a flawed research design results into failure. The research design adopted is dependent on whether the research questions considered is explanatory or descriptive.

There are two main research design incorporated by researchers in conducting a study. These include qualitative and quantitative research designs. Qualitative research design is also considered as being detailed which enables it to provide in-depth assessment of the issue under consideration. This arises from the fact that there is no definite procedure of conducting the study by utilizing this research design.

According to Thomas (2003, p.1), qualitative research design is defined as a multi-method of research which is interpretive in nature. In addition, qualitative research design is naturalistic in nature. This means that the researchers conduct a study on the subject matter by considering their natural setting. Qualitative research design gives the researcher capacity to utilize a wide range of empirical materials such as interviews, observation, personal experience and case study in collecting data. Maxwell (2005, p.3) postulates that qualitative research design entails a back and forth process of in relation to the various research design components.

This enables the researcher to effectively assess the objectives, research questions and methods. The research design selected must not only have a fit with its use but should also consider its environment.

In an effort to improve ease of interpretation of the research findings, the researcher integrated quantitative research design. According to Thomas (2003, p. 3) quantitative research design incorporates a number of statistical methods. This is made possible by use of numbers specific to the phenomenon under investigation. By interpreting the data, the researcher is able to make effective. Linking qualitative and quantitative research designs enabled the researcher to incorporate the concept of triangulation. Flick (2009, p. 26) opines that triangulation enables the researcher to effectively focus on the issue under consideration.

Data collection

According to Morse and Field (1995, p. 54) data collection is the process of obtaining useful information related to the phenomenon under investigation. In order to improve reliability of the data, it is important for the research to collect the most relevant data. Reliability in a study ensures that the results of the research are repeatable (Bryman & Bell, 2007, p. 40). The quality of data collected contributes towards an improving the decision making process by only focusing on relevant information. To ensure that the data collection process was organized; the researcher developed a data collection plan.

This resulted into elimination of subjective elements by clearly defining operational parameters for the study. The data collection plan was developed during the Plan-Do-Check-Act cycle. According to Morse and Field (1995, p. 53), PDCA provides a comprehensive framework for the researcher to develop a concrete understanding of the data collection and interpretation process culminating into improvement of the real process. Despite data collection planning process being time consuming, it is vital since it acts as guidance towards obtaining the correct data. In conducting the study, the researcher considered the field as the key source of data.

This enabled the researcher to obtain relevant data. Considering the fact that the study was aimed at analyzing how cultural factors affect mergers and acquisition in relation to firms within the Networking and Communication Devices Industry, data was collected from employees of Cisco Systems and Bay Networks. Prior to the actual data collection, the researcher conducted a reconnaissance to familiarize with how the firms operate. Through the preliminary research, the researcher is able to understand various issues such as language, practices, norms and social issues (Miller & Salkind, 2002, p. 45).

In order to improve reliability of the study, various methods of data collection were considered. According to Pearce and Axinn (2006, p. 28), incorporation of mixed methods of data collection culminates into production of high quality results. Both primary and secondary methods of data collection were utilized. Primary methods involved conduction of interviews and use of questionnaires.

The researcher made a decision to use semi-structured questionnaires to give the respondents a certain degree of freedom in answering the questions. According to Morse and Field (1995, p. 94), use of semi-structured questionnaires culminates into the researcher acquisition of all the required information. This means that the error of omission is eliminated to a certain degree. In addition, use of self-administered questionnaires enables the researcher to ask leading questions which easily help in getting the required answers from the respondents (Lancaster, 2005, p. 130). It was ensured that open and closed ended questionnaires were used.

The resultant effect is that the findings obtained were intense. In addition, close-ended questions based on yes or no were also incorporated. Use of yes and no questions were integrated where the researcher wanted to obtain specific information. Before administering the questionnaires to the respondents, the questions were reviewed to ensure that there is clarity and that any form of ambiguity is eliminated. By ensuring clarity, it was easy for the respondents to respond to the questions.

With regard to interviews, the researcher incorporated both face to face and telephone interviews. These were used in collecting data from those in the firm’s management level and the other lower level employees. Telephone interviews were considered to minimize the cost involved. An electronic voice recorder was used in collecting data obtained through telephone interview. An interview guide was also developed to ensure that the interview was well organized. Creswell (2003, p. 195), asserts that interview guide enables the researcher to emphasize on the topic under consideration during the actual process of conducting the interview. According to Longnecker (2008, p. 31), interviewing enables the researcher to understand the underlying reasons in relation to a certain individuals or a groups attitude or behavior.

Data coding

The data collected was assigned codes based on the responses. Data coding was considered to increase the ease of the data analysis process. Through data coding, the researcher was able to incorporate various statistical data analysis tools such as the Statistical Package for Social Sciences (SPSS) and Microsoft Excel (MS Excel). Incorporation of these data analysis tools arise from the fact that qualitative data is transformed into variables, which are easy for the two data analysis, tools to understand. To ensure effectiveness in the utilization of the SPSS, the various codes were developed into a matrix by considering the various responses.

This made it possible for the researcher to incorporate the Likert Scale. As a result, it was possible for the researcher to identify the attitudes of the respondents with regard cultural differences in mergers and acquisitions. Data coding also contributed towards significant reduction in the volume of data collected from the field. According to Longnecker (2008, p. 56) data reduction culminates into the data becoming sharp and focused through elimination of data which is not relevant.

Sampling, sample size and selection of respondents

Sampling and selection entails identification, choosing relevant data sources, which will be used in generating information (Bryman & Bell, 2007, p. 185). In order to integrate the concept of sampling, a target population was identified. This included all Cisco Systems and Bay Networks Incorporation employees. Sampling technique was incorporated from realization of the fact that it is not possible to collected data from all the employees.

The resultant effect is that the researcher was able to overcome time and cost constraints. Sampling technique enabled the researcher to select a sample population from the target population. Through sampling, all the parties in the sample population had the same probability of being selected hence eliminating bias. A sample population is defined as the total number of objects in a study, which have the same, and independent potential of being selected as the actual sample. From the sample population, a sample, which is the finite part of the statistical population, is selected.

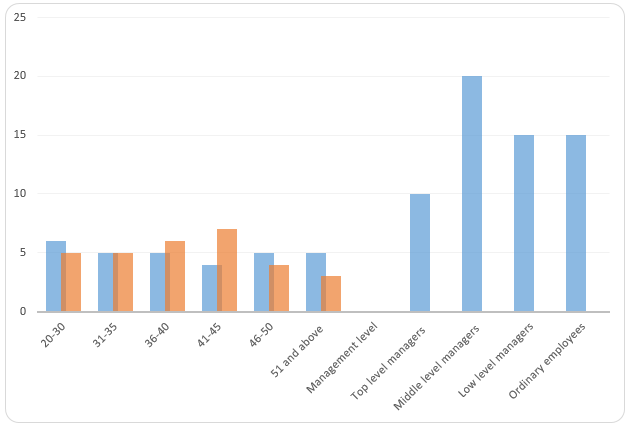

According to Kent (2007, p. 23), the respondents should have common characteristic to ensure that the feedback is related. The sample consisted of employees in the management level and other ordinary employees working in Cisco Systems and Bay Networks. This was attained through use of simple random sampling which made it is possible for the researcher to eliminate sampling bias. The selected sample is considered representative of the entire population.

The sample consisted of 60 respondents. Twenty-four of the respondents were selected from the management team. Twelve respondent managers were selected from each company. These respondents were from different management levels. Six of them were top managers while the other half was from the lower management levels. Thirty-six of the respondents were ordinary employees belonging to different department of the two firms. Eighteen of these respondents were selected from each company.

Justification of the sample selection

Consideration of both ordinary employees and those in management level as respondents was considered to gain understanding of their perception on how cultural differences affect their operation. In addition, those in management have the capacity of knowing how cultural differences affect performance of mergers and acquisitions. This is because they are charged with the responsibility of managing the new entity formed. On the other hand, ordinary level employees have concrete understanding on how cultural differences affect them in the process of executing their duties.

Data analysis

Grounded theory was integrated in analyzing the data collected. Grounded theory involves a research method in which the data collected is used in developing the theory relating to the phenomenon under study (Schwab, 2005, p. 83). According to Lincoln and Denzin (2003, p. 249), grounded theory is qualitative in nature and utilizes systematic procedures in an effort to develop theories related to a given phenomenon. This means that grounded theory enables the researcher to expand the on a given phenomenon by identifying various elements related to the subject under study.

In addition, grounded theory was important in conducting a research if the researcher intends to generate or explain a given situation. Through grounded theory, it will be possible for management teams to gain knowledge on how to conduct cultural fit analysis before implementing merger and acquisition decisions.

Ethical consideration

Consideration of ethics is an integral part of the research process no matter the nature of research (McBurney & White, 2009, p. 49). According to Gravetter & Forzano (2008, p. 97,) there are two main elements which should be considered when dealing with ethics. One of them entails responsibility to various individuals involved in the research (human and non-human). The second element involves being responsible to discipline of science.

This means that the researcher has to integrate honesty and accuracy in the reporting process. In conducting the research, the researcher ensured that voluntary consent in relation to the parties involved in the research was ensured. This was achieved by ensuring that the respondents had a legal capacity to give their consent on whether to participate in the research or not. There was no any element of force, duress, deceit, fraud, over-reaching, any form of intervention or ulterior for of coercion or constraint. As a result, the respondents had the capacity to pull out of the study as desired without any form of loss in relation to the benefits he or she was entitled. There was no any form of penalty associated with pulling out of the study.

It was also ensured that the respondents selected had comprehension and sufficient knowledge with regard to the subject matter of the research. This consideration ensured that the respondents had a capacity to fully participate in the research.

Before the actual study, the researcher ensured that the respondents were conversant with the nature, purpose and duration of the research. This was considered to increase the degree of confidence amongst the respondents. The respondents were made aware of the benefits associated with participating in the study as one of the outcomes. Additionally, any foreseeable discomfort and risks were made known to the respondents well in advance.

In order to increase freedom of respondents’ participation, the researcher ensured that a high degree of confidentiality was ensured. The need to protect confidentiality arises from the realization of the fact that qualitative research is conversational in nature and hence it is important for the researchers to maintain a well-defined boundary of what they tell the participants and what they are told. In addition, the researcher ensured that the concept of beneficence is incorporated. This contributed towards development of an environment conducive between the researcher and the respondents. The resultant effect of this is to make the interviewing session interactive (Johannison, 2006, p. 34).

In addition, creating an informed consent greatly contributes towards ensuring that there is a high level of respect during the process of conducting the research. Individual consent was presented to the researcher in understandable language. In conducting the research, the researcher obtained consent from the local authorities. This will be attained by approaching the management teams of the selected companies and explaining the objective of conducting the research.

Limitations

The study was limited in a number of ways. For instance, it was not possible for the study to consider all the employees as respondents due to resource scarcity in relation to time and financial constraints. This prompted the researcher to use sampling technique. It was assumed that the results obtained from the selected sample were representative of the cultural differences experienced in mergers and acquisitions. The study was also limited in that some of the respondents were not exhaustive in replying to the questions asked. This made the study challenging to the researcher.

Summary

The chapter gives the step through which the researcher when through to collect the data that was used in this study. The chapter covers all the aspects of data collection from the way the study was designed, data collected and the presented for analysis. As indicated, the qualitative and quantitative studies were both used in the study to enable extensive collection of data. The methods were also justified so that the conclusion could validate the study or be considered reliable. However, the chapter also highlights the limitations of the study process so that the reader can be able to understand that there could be errors and the reasons why. Ethical consideration paved the ways for study to process without damaging the people and business environment. Having collected all relevant information, the data was taken to nest chapter for analysis

Data Presentation and Analysis

This chapter will first present the demographic description of the respondents in the study with emphasis on their gender, management level and their respective age. Next, an analysis of the research questions and the factors leading to the success and failure of the organizations will be presented. An analysis of the cultural factors with regard to due diligence, communication style and nature of the cultural factors, which influence performance of mergers and acquisitions, will also be presented. Finally, an analysis of Individualistic versus collectivist culture of the entities and the summary of the chapter will be presented in the latter stages of the chapter.

There has been an increment in the rate at which firms are scanning the environment in order to identify potential partners to enter into merger and acquisitions with. Despite the increased integration of mergers and acquisition, their success is not guaranteed. However, success of mergers and acquisition depends on the effectiveness of its management. Some mergers, which have been formed, have been disappointing. On the other hand, some mergers such as those undertaken by firms such as British Petroleum, Cisco and General Electric have been successful.

According to Gertsen, Torp and Soderberg (2004, p. 76), mergers and acquisition result into a significant degree of disruption and transformational change within the organization. One of the issues of great concern relates to cultural differences. Culture is a key factor, which determines whether the merger will fail or succeed. Therefore, it is paramount for the management team to determine the most effective way of managing culture.

This chapter is organized into a number of sub- sections. Sub-section 4.1 entails a descriptive characteristic of the respondents. Some of the key characteristics considered include gender, age and employee rank and organization department. Sub-section 4.2 entails an analysis of the research questions used in conducting the study. The research questions are analyzed by identifying the various components. In sub-section 4.3, the various factors leading to success or failure of mergers and acquisition are analyzed. This is attained via identification of various factors. A summary of the chapter is given in subsection 4.4.

Primary and Secondary Data Presentation

In conducting the study, the researcher considered Cisco System Incorporation and Bay Networks employees. Diverse demographic data was evaluated in conducting the research. Demographic data was also utilized in conducting the study. This was attained by considering a number of demographic variables that included gender, management level and their respective age.

- Employee rank. Both employees in the management level and ordinary employees were considered. Selection of these respondents was considered because they experience cultural different issues related to cultural differences. The study took into consideration t the top, middle and lower level managers. Decision to consider different management levels arose from realization of the fact that their roles are different. As a result, a difference existed in relation to the effect of culture on their operation.

- Organization department. The study considered the different departments that exist within the two firms. The core objective was to determine how cultural differences affected performance of employees in various organizational departments.

- Age. The study took into consideration the age differences that exist amongst the respondents. Decision to incorporate age arose from need to determine the efficiency with which the employees can cope with the change, which results due to formation of mergers and acquisitions.

- Gender. Sixty percent of the respondents considered in the study were male employees while the rest forty percent were female. The table below gives an illustration of the demographic data considered in the research.

Questionnaire on the general demographic data

Table 1: The Questionnaire Results.

Rank in the department.

Department of Work.

Major Cultural Differences.

Primary and Secondary Data Analysis

In conducting the study, one research question was considered. This includes ‘How did cultural factors affect success of incorporation of mergers and acquisition in Cisco Incorporation and Bay Networks?’ In order to enhance the effectiveness of data analysis, a comprehensive analysis was conducted on the research question. This was achieved by breaking down the research question into a number of components. The various components considered are outlined below.

- Cultural factors leading to success or failure of mergers.

- Nature of the cultural factors that influence performance of mergers and acquisitions.

- Nature of the relationship between key cultural factors that result into improvement of mergers and acquisitions.

Primary Analyses

Quantitative Results

When the respondents were asked to respond to the 9 question that asked which factors resulted into the success or failure of mergers and acquisitions, they gave widely varied responses. A considerable percentage of the respondents mentioned a number of sub-cultural factors that were listed on the question number six. These factors included reasons that related to organizational values, to organizational customs, beliefs, traditions, the firm’s policies, to organizational objectives and to organizational behavior. The atmosphere that is generated by these factors has an effect on the mergers and acquisitions success.

Seventy percent of the respondents were of the opinion that success of mergers and acquisition is dependent on the effectiveness with which the firm appreciates value in an organization. The core objective of entering into mergers and acquisition is to attain synergy in the firms’ course of operation culminating into attainment of a high competitive advantage. These respondents were of the opinion that firm’s management teams do not conduct an evaluation of the existing values between the two firms to determine whether the merger will succeed or not. A significant proportion of the respondents cited differences in organizational philosophies as a major factor contributing towards the success or failure of mergers.

Difference in organizational goals was also cited as a key cultural factor affecting mergers and acquisitions. This arises from the fact that the management teams of the two firms’ have adopted diverse strategies with regard to attainment of the formulated goals and objectives.

Sixty percent of the respondents were of the opinion that differences in management style have an effect on the success or failure of mergers and acquisition. The leadership skills that a firm can adopt include autocratic, democratic or laissez faire. Democratic management style involves the employees in the decision making process. For example, some respondents from Bay Network asserted that they had the discretion to take their own approach towards attainment of the stipulated goals. On the other hand, autocratic management style tends to be authoritative in nature. Laissez faire leadership entails a situation where everyone is treated as being equal. If firms with different management styles enter into a merger and acquisition the probability of the merger failing is high. The table below gives an illustration of the varied responses in relation to mergers and acquisition.

Qualitative Results

The results of qualitative investigation were deciphered from the eighth question that sought to find the relationship between the main factors of cultural inconsistencies and similarities. These factors are critical in the determination of the success or failure of the mergers and acquisitions. The connection between the different cultures is what determines the compatibility of two different companies that are coming together to begin on a new path with same goals, same management style and try to work out with same strategies.

Due diligence