Introduction

This report is intended to investigate and assess the investment credibility and advantage of EasyJet Plc. To evaluate the report, EasyJet’s strategic movement has been compared with Ryanair and British Airways; therefore, the main aspirations of key stakeholders, mission and vision of EasyJet will be considered.

This report also intended to assess the EasyJet’s strategy, the external and internal environments, current strength, weakness, opportunities and threats, corporate social responsibility, organisational structures, financial data, competitors, ratio analysis to develop important evidence, which will be used to determine whether investment in the EasyJet’s equity is suggested.

Significant of Pension Funds

This report has been prepared for a client of the financial analysts company who is a Pension Funds. The objectives of Pension Funds intended to prospective investment that would be of most magnitude to the client. The basic intention of a pension fund is to invest and administer the subscriptions of the members of pension system in accordance with the general investment strategy.

The liable strategy is to expand the pension funds and invest them in such secured schemes without losing real value. In most recent time there are great significant of stock market downturn and caused millions dollar loses by the pension fund. Thus, the major two trend of pension fund is to investing in non volatile issues with stable growth and regularity in dividend payment rather than high capital gain.

Overview of EasyJet

In 1995, a British based airline EasyJet Airline Company Limited started its expedition with two leased flights from Boeing. Recently, the company operates almost 100 directions airports in 21 European and American. The EasyJet convoy consist of 75 own Boeing 737-700 aircraft including 84 leased crafts with 380 rotes.

In 2008, the company has generated pre-tax profits of £123m with a £12.9 million of costs coupled with the amalgamation of GB Airways. It has been evidenced to both the flexibility and quality of the EasyJet business model with its human resource has sustained to construct high growth in a tremendously challenging year of 2008 where the others were seriously shocked with recessionary impact.

Financial analysis of EasyJet

Before attempt to compare its financial condition, it should mention its own financial condition of 2008. From the annual report, 2008 of “EasyJet” findings at financial aspects has shown in following table. In this table, almost all financial factors have been integrated-

The above diagram has demonstrates that EasyJet’s revenue is increasing day to day, for example in 2008 its revenue was £ 2363 million, therefore, stockholders, and investors will be interested to invest in this recessionary period though its share price has decreasing.

Financial Comparison among EasyJet, British Airways and Ryanairs for 2008

EasyJet

EasyJet is the pioneer of European airlines industry network. It’s the second largest air company in Europe operates their network across more than 21 European countries. Their slogan is to afford care and convenience at a low cost with the aid of strong and experienced management team where engaged 6,107 employees put into practice the slogan of EasyJet. In September 2008, they launched 91 new routes around the world.

Though last fiscal year return on equity down by 6 percent but their total revenue increased by 31.5 percent (£2,363 million) in addition of 43.7 million new consumers (17.3 %). Another significant side, they deal with almost 25,260.12 million clients and out of them, more than half are out of UK. EasyJet holds their yearly growth rate 12.6 % efficiently.

British Airways

To facilitate most extensive international scheduled airline British Airways commence their business at Heathrow as their prime location. At this time, they work for vision London 2012. During fiscal year 2008, BA enlarges their income before tax 30.8 % that amounted £ 883 million indicates significant financial strengths. Their recent yearly revenue is £ 616 million and the growth rate is 12.6 %.

Ryanair

Another renowned European air transport provider Ryanair last year has initiated their business in the course of 201 new routes including three prime locations of UK- Bournemouth, Birmingham and Belfast and regarding this, they bought 30 new aircrafts. On behalf of their annual report 2008- their post tax profit margin is 18 percent, at the end of 2008 their reserve is € 2.2 billion. A significant record is that their revenue enlarged at € 481 million, 5,262 skilled and experienced employees work hard and soul to hold the par barrel price at € 130.

Assessing Performance & Corrective Adjustments

EasyJet: For future developments of the company, EasyJet always compare its competitive strengths with other major operations. From the investors presentation the following table has been presented:

In the above chart, the points are representing 1 is worst and 5 is best. Except values for money, EasyJet has clearly ahead in all other sectors. Its management efficiencies have surpassed all other major airlines. While British Airways was receiving fare on an international intra-European route of 180-200, EasyJet was fixed at 130 routs and now it has introduced 91 new routes; therefore, here is no gap between its competitors. From this chart, it can be said that still EasyJet holds the strong position in market.

Ryanair: It holds the highest position as its average point is 3.9. In order to ensure the quality and standards of Ryanair, a team of service audit manager has been formed to audit at least 650 flights, 8 destinations, and Ryanair is operating 74 aircrafts in 127 routs and has a confirmed order of B7C7. This audit team also inspects other six major competitors to set up the bench mark. A total of 14 stations are audited per year and close scrutiny is conducted over the passengers’ satisfaction. Corrective steps are taken always if any mistakes are found of opportunities. The gigantic equipments are relocated to other place, as opportunities are more.

British Airways: From the chart, it can be found that it is in medium position because the average point is three. In 2008, BA earned more than £8.7billion in revenue, 3.1% up on the previous year and among them 86.2% of this revenue came from passengers, while 7.0% from cargo and only 6.8% from other activities; moreover, it had 245 aircraft in service and it carried 805,000 tonnes of cargo to destinations in Europe, and all over the world.

Comparison among EasyJet, British Airways and Ryanair (5 years trend 2004 – 2008)

Concerning annul report and financial statement comparison among the chosen company “EasyJet” and two rivals, British Airways and Ryanair, is outlined bellow using a set of comparison tools. Amount used in this comparison griped from five years trend (2004-2008) available in the annual report and financial statement 2008.

Ratio Analysis

Make decision for an investment, tools of ratio analysis pull out its hand in identifying profitability, relation between current earnings and fluctuation of share price, amount of dividend, management of asset employment, competence of the company using current assets to pick up current liabilities and interest payment.

Sector Ratio Analysis: Specialty of a company evaluated through sector ratio analysis. Chosen company and its rival’s sector analysis have as a featured in following table-

Year-on-year Comparison of EasyJet’s Performance: Comparing performance of “EasyJet” by the side of its rivals is assessed in terms of profitability of the company. Calculation of profitability anchored in examination of financial data through out the last five years (2004 – 2008) of these three companies are discuss in following table-

Cash Flow Ratios: Cash flow ratios are the modes of evaluating competitive location of three air ways – EasyJet, British Airways, Ryanair. Calculation of the cash flow ratios are showed in following table. This comparison make possible anyone’s decision whether to invest or not and analysis existing financial array of a company.

Financial analysis

Recently the acquisition with GB airways and Global financial crisis has an adverse impact on EasyJet as stakeholder is not seeing any prospect and this is one of the major causes for price decreasing.

The Chart is representing the structure of EasyJet’s share price over the year (March 2008 to March 2009). It indicates the profitability and financial activities performance is decreasing, though September 2009 the activity was increasing. Shareholders aspiration includes enhancing the EasyJet environment for maximizing profitability and success.

In the figure showed the financial strength for last five years and from this figure it can be said that though, return on equity has decreased more than 31%, and share price fall in stock market but EasyJet still have financial strength to recover from share price in recession.

From the share price chart of these three companies, it can be said that in recession all are in down turns and in 2007 the market share price was in highest but now all are decreasing. In recession, tourism sector has seriously fall down, and share price is decreasing therefore, pension fund can be effective for risk management of the EasyJet.

SWOT analysis of EasyJet Plc

Environmental or PEST analysis of EasyJet

The EasyJet’s environmental condition is required to analyse by PEST analysis, to decide whether this pension fund will be effective for the EasyJet or not –

Political factors

Political situation always changes the business environment, increase or decreases the risk such as oil price has decreased for political chaos, which has adverse affect on the EasyJet’s operations. EasyJet Plc is bound to follow the rule sets by the ETS. In addition, recently UK has signed-up the in the single European currency, which have direct impact on its business for example EasyJet will face the changes of exchange rate. In order to face the challenges of Global financial downturn, it can consider the pension fund as an opportunity to raise share price.

Economic factors

From the annual report 2008 of EasyJet, it can be found that EasyJet in 37 number position among the top fifty EU airlines, which demonstrates its position and market segments. The annual report 2008 also mentions that its total revenue is increasing for example – in 2008, EasyJet’s total revenue was £2,362.8 million and in 2007 was £1,797.2 million but for recession, it may reduce this year. However, its operating profit has decreasing which may influence to take more loans from financial institutions, therefore, pension fund may play vital role.

Socio-cultural factors

Cultural, society, people, religion, friend etc have changes with the economic conditions as a result, their behaviour, attitude, and demand has a direct relationship with the business. Moreover, in Europe, America, there are lived people from different culture, race and religion and among them 40% are minorities of the total population may affect EasyJet’s business. It always gives the priority of employee’s safety and health; therefore, it has established the Safety Review Board. EasyJet employed 6,107 persons, and in 2009, more than 1,000 new employees have joined in easyJet either from GB Airways or from easy Tech and they have more flexible and efficient learning experience.

Technological factor

EasyJet’s strategy is to grow its fleet using the latest technology aircraft, while retiring older-aircraft typically within eight to ten years of delivery, therefore, from 2002, IT director had improved and delivered a series of programmes for technological-innovation, considerably enhancing the systems architecture and major business procedures. EasyJet invest largest money to imply the latest technology aircraft at the same time as retiring older aircrafts typically within seven-to-ten years of delivery. Since 2000, it is committed to decrease emissions of CO2 up to 22 percent within 2011.

Corporate governance of EasyJet

Nowadays many large organizations have been collapsed for not to follow the measures designed for expense of remuneration paid to the directors’ guided in the Companies Act, therefore, in current recessionary period maintained of corporate governance is essential ingredient for EasyJet Plc.

Role of the board

The Board comprised eight NED (including the Chairman) and other two Executive Directors and the Board is responsible conforming guidelines, previous plan approval and investment as well as divestment strategies. Hence, the corporate, audit, personnel committee, governance and nomination committee conducts the operations and self- evaluation for refining the strategies as well as to ensure long-term interests of the stockholders.

Independence of Directors

According to the various report and the London Stock exchange a majority of the directors and NED should be independent of the company, in addition, a committee configuration must be place in order to advance the responsibility of the selection of the executives, the salary of the directors as well as the audit procedure. EasyJet corporate responsibility offer to follow the rules of LSE, which mentioned that NED would be independent and they provide five situations when a director would be accountable for their activities.

Remuneration of Employees

Remuneration is the payment made to an individual for the services that he or she provided to the organisation. Director’s remuneration is a most energetic issue in the today’s business world. EasyJet should be designed for attracting and deriving the talent human resource for successful strategic implementation that focuses on base rate of pay, competitive compensation package over time, balance of gifts etc.

Potential Warnings to Investors

At the end of 2007, as well as in USA economic recession has a collision in major countries of the world. Concerning this, an investor has to aware of investing in any project of a company.

Economic down turn and high inflation rate discouraged the economic dependency on USA and move through China because of their low cost facilities. NBER reported in 2008 that percentage of trading activities of Australia and European countries shift through China dramatically, there also recruited Canada and Japan.

With the stepping up of China and the impact of depression most export – import areas are covered by China and partnership ratio of US vs. Europe has decreased. At present, China covered almost 23 percent of US foreign trade activities, and in Canada, this percentage is about 18. On behalf of pension fund, investing in one of these three airlines surrounds a high risk rather than any of China and Japan.

Future Cash Requirement

In order to establish new routes current working capital of EasyJet, British Airways and Ryanair are £ 505.2 million, £ 713 million and € 1.03 million respectively. Both of EasyJet and British Airways have the growth of 12.6 percent.

Annual reserve increased in 18 percent by £ 6 million of EasyJet where as this ratio is 8.74 percent and 30.50 percent for British Airways and Ryanair respectively. Aim of British Airways is to reduce their fuel costs at 20 percent and with in 2011 EasyJet determined to reserve £ 100 million. All of these three companies send a part of their earnings in environment segment as part of their corporate social responsibility.

Free Cash Flow Valuation

Free cash flow valuation is another approach that presents income statement and the balance sheet at an instance. Through out this approach it is easier for an investor will take investment decision because of the availability of per share data, retain earnings, total current assets and liabilities, interest and tax payments.

Income statement of EasyJet, British Airways and Ryanair For the year ended, 2008.

Balance sheet of EasyJet, British Airways and Ryanair For the year ended, 2008.

Explanation of “costs of goods sold and inventory”-

- Being a service company EasyJet needs to provide values necessary in traveling. On behalf of this arrangement, they ought to stock sufficient fuel, seat arrangement, fix-up flight schedules and network development, launch new routes etc. In short, factors those are involved in operating activities are the factors of cost of goods sold. As service company EasyJet’s cost of goods sold in income statement is £ 631.78 (in million) and this can be denote as the cost in arranging any fight in a year.

- “Figure 1102.6 which is PPE for non-current asset, as Inventory”- non-current asset of a company is varied with the change of time and with the change of customer demand. On the other hand, inventory is the stock of raw martial to operate business activities and make available product and services to the consumer. All of the aforesaid is the reason behind of figure – 1,102.6, which is PPE for non-current asset as “Inventory”.

Residual income valuation

With the aid of income statement and balance sheet residual income valuation of EasyJet is presented as bellow-

Calculation of “Net present value (NPV)” of EasyJet is given in following table-

Price Valuation

In Stock Market, these three companies price valuation shows following figure-

Aforesaid figure of these companies shows a strong stock market price valuation of British Airways. This figure also makes safe an investor’s venture.

Calculation of discounted cash flow for next 5 years for the company EasyJet:

Along with the question paper here also integrated an excel file. Based on a valuation model there provide a set of valuation factors since (2006 – 2010). Among these valuation factors cash flow before tax, tax rate, discounted factors, risk-free return, beta, market rate etc. are plotted for the aforementioned year and as for 2008 and 2009.

For NPV calculation, cash flow after tax (CFAT) is essential. On the other hand, calculation of CFAT requires cash flow before tax (CFBT) and tax rate or amount of tax. Therefore, amount of CFAT is as bellow-

Here,

- PV = Present value

- FV = Face value or CFAT

- i = Interest rate or discount factor = 24%= 0.24

- n = Number of year

Strategic analysis of EasyJet Plc

Strategic analysis is the application of organizational tools those are engaged decision-making, policy analysis, production, sales as well as advertising. In case of “EasyJet”, strategic analysis regard as four levels of the strategy, internal and external environment analysis. A diagnostic form of “EasyJet’s” strategic analysis is discuss as follows –

- The acquisition with GB Airways at the begging of year 2008, strengths their financial resources and enhances its business opportunity as they have mutual interest of resources and capabilities from designing to distribution.

- EasyJet’s services restrain low cost and highly efficient but have a strong financial existence.

- It wants to build them as a superior air network in Europe,

- Their utmost focus on customer demand and consequently they earned a strong customer position.

- Another point that makes “EasyJet” less defective is their network development.

- Not only build a strong network in aircraft industry nut also holds an efficient network performance.

- In winter, limit margin dilution for margin enhancement. To do this they continuous improve their revenue stream.

- EasyJet has established more than 60 head office around the world to reach their vision to reserve £ 100 million within 2011.

- The relationship with Airbus makes them efficient in fleet and ownership costs at low level.

- In 2008, they hold their average fuel price at $1,070 and for this when fuel price increase in 50% that had not any impact on per seat revenue at all,

- Through strengthened exchange rate of euro in 2008, “EasyJet” earned 11% greater than in 2007 in exchange of pound (£).

EasyJet’s strategy regarding diversification

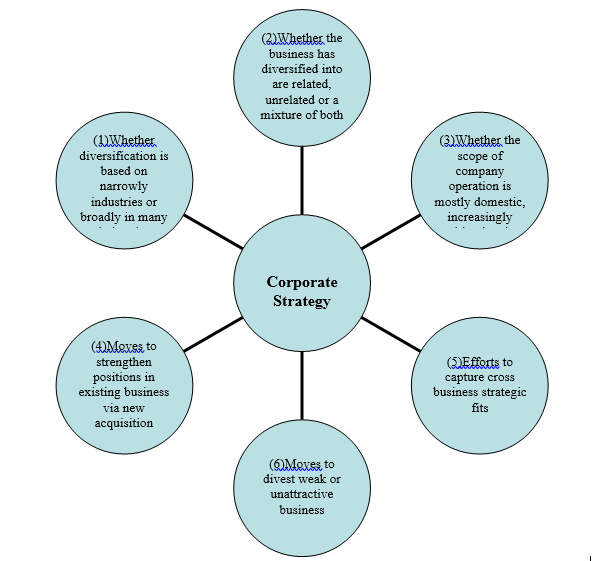

The strategy for diversification of EasyJet consist several factors and the important factors can be illustrated from the following figure:

- According to the first option of the graph whether diversification is based narrowly industries or broadly industries. EasyJet is based on airline service. Besides firming on airlines, it builds up associated business like food, traveling, tourism. The business is some how related as associated businesses are interrelated.

- As EasyJet diversifies into business with associated products, similar operating characteristic, common distribution channels or customers, or some other synergetic factors, it gains competitive advantage. Ryanair acquires fleet of several other aircrafts not acquires the whole company.

- The scope of the airline is in both domestic and internationalized. Major operations are conducted in Europe base countries. On the other hand, EasyJet is considering operating it flights in South Asia as large number of workers can be carried.

- Currently EasyJet has no intention to have acquisition another. It is trying to increase its operation in developed country like Bangladesh, Sri Lanka and Maldives

- As the product line is similar, it is tough to change. However, EasyJet is building its complementary services like hotel advantages, tourism facilities. Therefore, EasyJet will have an opportunistic option to increase this kind of business via sponsorship.

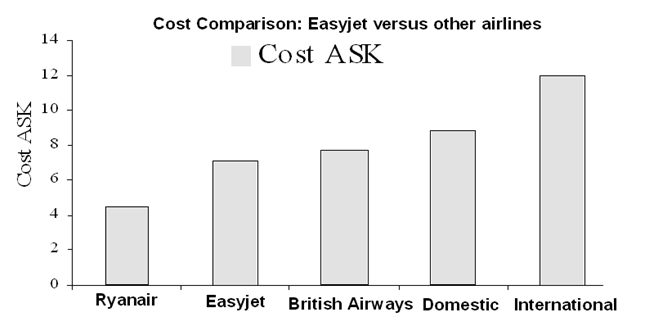

Strategic analysis of Ryanair

Ryanair pursues low cost strategy. While British Airways was receiving fare on an international intra-European route of 180-200, Ryanair was fixed at 50-80. Therefore, it is a huge gap between two airlines. From the following graph, this can be clarified:

Therefore, to survive in the market with low cost Ryanair pursues several strategies. These are given below:

- Ryanair uses no hub, therefore, the takeoff costs, additional customer expenses and meal costs as reduced,

- As it is using point-to-point the, time to go to destination, is reduced. The fuel, administrative and engine maintenance costs are declined,

- Secondary airports are used due to congestion in major airports as well as to save reachable time of the airports of customers. This policy is very popular to the customers,

- The airline advertises to convince its customer to believe that its plane is more time saver than using Buses, Trains and it is affordable.

Therefore, these are the external strategies are used to operate their activities. As the cost control method is implemented effectively the overall procedures has been conglomerated successfully.

Strategic analysis of British Airways

BA strategies are totally different to pursue its customers. Their main principle of British Airways has underlying in service and quality. The major undertaking strategies are given below.

- British Airways aimed to expand its service throughout the world and hence increase its seat capacity with large aircrafts. Therefore, it is getting the advantages of economic of scale and reduced the cost,

- E-ticket system is a competitive advantage for British Airways. British Airways wants all ticket should be sold via online. Therefore, customer can avail the advantages from anywhere in the world and administrative costs are reduced.

- Customer service is a distinctive competence for British Airways. It has established with 43000 square feet in area with capability to manage 300 call centers in India, which is best ever known.

- Market segmentation is another strong strategy to pursue. British Airways segmented its market into students, tourists, corporate and business group with state of art technology.

- To expand its brand recognition British Airways is creating its Brand awareness like in sports.

- Besides, transferring passengers, British Airways wants to boost its revenue by extending its business line with sky cargo. In the fiscal year, British Airways has transferred 947000 tonnes of cargo.

Future prospects of EasyJet: Future prospects of EasyJet centered on following areas-

- Boosts their financial strengths and efficiency in the course of low cost strategy, for instance, recent EasyJet’s financial capability grows 18%,

- Another focusing point is network development. They have continuing project to launch 100 new routes.

- With the addition of new routes, they also attentive in network performance.

- Increase gross margin or profit is an additional significant side. In 2008, their annual savings is almost £ 6 million and with in 2011 their target is to enlarge it in £ 100 million.

Make decision whether to invest or not

Ratio analysis of these three companies shows that compare to EasyJet and Ryanair British Airways holds a strong financial atmosphere. This aroma also has found in their sector analysis ratios, yearly performance comparison, cash flow valuation, cash flow ratios, profitability ratios, stock price valuation and in long-term income fluctuation.

Regarding all of aforesaid, it is better for a pension client investing in British Airways. In future, this investment would bring suitable output as their constraint. Another significant sight to mention that compare to other companies British Airways continues a flexible and sound share site.

Recommendation

In this economic down turn and high inflation period in operating business activities companies need to follow numerous common principles. With the aid of these, they could enable themselves to face recent economic ruins and easily shift their strategy whether call for. Common proposals for air companies are-

- It holds the flight prices resonance so that it would be possible to keep potential consumers.

- Reduce the carbon dioxide corrosion in air. Make their services environment responsive.

- EasyJet Plc can reduce expanses to overcome the global financial crisis and it should not cut the job of their employees.

- EasyJet has large contribution on economy; as a result, it should spend more money for advertising, promotion and R & D.

- Consider consumers’ demand first and pay attention in market segmentation that should reflect on both income level and age limit.

- EasyJet is powerful and aware safeguarding of brand name to sustain and develop current market share and operation.

- It should fix the wage and price of air ticket considering to the oil price and global economy.

- EasyJet should advertise to increase interest on travel within national and international place.

- It has focused on inter-organizational resource allocation and network development to facilitate easier communication.

- Make the journey safe and comfortable for all class of consumers.

Conclusion

As par requirement of the paper, investment analysis of EasyJet on behalf of a pension fund has integrated here along with comparison of two rivals- “British Airways and Ryan air”. Make a decision whether to invest or not this paper includes- brief description of ratio analysis, sector ratio analysis, yearly performance comparison, cash flow ratios, potential warnings to investors, cash requirement in future, valuation of free cash flow, valuation in residual income and valuation in pricing.

Concerning all of above and the global economic recession, a pension client would get valuable investing in British Airways because of their high profitability, retain earnings, inventory turn over, both income before and after taxes and interest rates as mentioned above. Though there have an economic downturn and its affect almost all major countries around the world but with the support of suitable strategies British Airways effectively faced this crisis.

Analyzing all of the financial data of the three airlines investment decision would better respectively as- British Airways, EasyJet, and, at last, Ryanair. British Airways has broader possibility of recessionary impact. Thus, investing in non volatile issues of EasyJet with stable growth and regularity in dividend payment would be wiser.

References

Attitude Travels, 2008, Low Cost No Frills Airlines in Europe. Web.

Besley, S. & Brigham, F. E., 2007, Essentials of Managerial Finance, 13th edition, Thomson South Western, Singapore. Web.

Bodie, Z. Kane, A. and Marcus A. J., 2005, Investments, 5th Edition, Tata McGraw-Hill publishing company limited, New Delhi. Web.

British Airways, British Airways Annual report 2007-2008. Web.

British Airways, British Airways Annual Report 2005-6. Web.

David, F., 2008, Strategic Management: Concepts and Cases, 12th edition, Prentice Hall. Web.

EasyJet Plc, 2006, Annual report 2006 of EasyJet. Web.

EasyJet airline company ltd., 2008, Charity. Web.

EasyJet Plc, Annual report of EasyJet Plc 2008. Web.

EasyJet Plc, Financial Statement of EasyJet Plc 2008. Web.

Finance.yahoo.com, 2009, Basic Charts Of EasyJet Plc. Web.

Finance.yahoo.com, 2009, Basic Charts Of EasyJet Plc. Web.

Griffin, R. W., 2006, Management, 8th Edition, Houghton Mifflin Company, Boston New York. Web.

Hitt, M. A., Ireland, R. D., Hoskisson, R. E., 2001, Strategic Management, 4th Edition, South-Western Thomson Learning, Singapore. Web.

Pandey, I. M., 2007, Financial Management, 9th Edition, Vikas publishing house PVT LTD, New Delhi. Web.

Ryanair Holdings, Annual report 2007 of Ryan air. Web.

Ryanair Holdings, Annual report 2008 of Ryan air. Web.

Ryanair Holdings, Ryan air Annual Report & Financial Statements 2005. Web.

Stoner, J. A. F., Freeman, R. E., Gilbert, D. R., 2006, Management, 6th Edition, Prentice-Hall of India Private Limited. Web.

Yahoo Finance, 2008, Basic Chart Get Basic Chart(s) for: Ryanair Holdings plc. Web.