History and Growth of GM

General Motors was founded at the beginning of the twentieth century and initially they were the manufacturer of Buick- a motorcar with an internal combustion of engine and horse-driven vehicles. They gradually developed more auto cars and in 1916, Alfred P. Sloan who led the company to an unprecedented growth over the years owned it. GM grew up into a huge global corporation despite all the tribulations it went through.

As GM is a gigantic conglomerate, it has several branches. GM has four organs for administration and reporting while GM North America (GMNA) had the largest sales. The GM maintained an overall percentage of 26 % to 28 % of all industries in this region.

However, its profits fell in 2005, which was due to lesser quantity of products and an unfavorable product mix and it was the result of plant closures, changes in product liability and other major impacts on net income. In Europe, GM (GME) faced continuous losses amounting to US$ 1.0 bn by 2004 due to continued negative price pressures and unfavorable exchange rates. GM in Asia Pacific (GMAP) had good sales, here with a very good position in China.

India and Thailand also yielded good earnings. GMAP showed very high net margin with about 10% in 2003 & 2004. GM in Latin America, Africa, and the Mid-east (GMLAAM) was unpredictable with losses in 2002 & 2003, mounting to profits in 2004. The net margin was higher in 2002, which fell to 0.4 % in 2003, which increased to 0.9% in 2004.

The GMAC was the financial subsidiary of GM, initially introduced to finance GM operations. This section had continuous profits and gradually it grew up into a global financial company, offering mortgages and insurances. The total revenues from the financing & insurance operations showed a gradual increase, which was 31000 million in 2004 and a net income of 2800 million in both 2003 & 2004 but however, there were also some losses in some other sectors.

The shares of GM and other American companies declined from 1990 to 2004, whereas shares of foreign companies rose and these led to restructuring. There was high competition and GM faced new challenges.

Strengths and Weaknesses of GM

The internal strengths of GM are market share, sales volume, performance of subsidiaries, labor force, financial strength, restructuring process and long experience, brand awareness in the US market, application of technology, and many other features. On the other hand, the external threats are Reduction of market share in the US market from 1990 to 2004, provision of North American Free Tread Agreement, operating expenses, excessive investment, and model of the cars, political factors, strategic decision, and stock performance.

Strengths

- Market Share: According to the annual report 2010 of GM, it has business operation in more than 157 countries and still has a significant share in global market. In addition, its current market position in North America zone is outstanding in terms of market share and volume of sales;

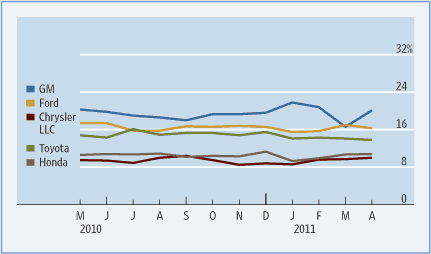

- Sales Volume: Wall Street Journal forecasted that General Motor is in the highest position considering the number of car sales because it has been sold 232,538 cars in the fiscal year 2010/11 while Ford Motor Company sold only 189,284 cars and Toyota Motor Sales USA Inc. sold 159,540 cars in this zone (WSJ, 2011). However, the following figure demonstrates the position of car manufactures in terms of car sales –

- Performance of Subsidiaries: It has many regional subsidiaries like GM Daewoo Auto & Technology, Shanghai General Motors, SAIC-GM-Wuling Automobile Co and many others subsidiaries those performance help to increase profit in consolidated financial statements.

- Labor force: GM has more than 209,000 efficient employees to operate the business in adverse economic condition and save the company from such position. However, most of the employees are higher educated in particular subject and their own field and they have innovative new idea to offer better services for the customers;

- Internal control: the management team follow local rules and regulations where it operates and it has own controlling system. However, it follows listing rules and other provisions of Sarbanes-Oxley Act of 2002 to control the business and avoid mismanagement and internal conflicts;

- Financial strength: GM Corporation is one of main player in the automobile industry, which has financial capabilities to compete with other car manufactures in national and international market by implementing its new business strategies in the present market place. According to the annual report 2010 of GM, its present key financial variables are –

Table 1: – Financial information of GM. Source: self generated from of GM (2010, p.47).

- Restructuring process: This company was become bankrupt due to the adverse impact of global financial crisis but it was successfully restructured by taking direct help from the government;

- Experience: As the company established in 1908, it has long experience to operate global market with strong brand image.

Weaknesses

Besides strong points, GM has many weak issues like –

- Decrease Market Share in the US market: From 1990 to 2004, GM lost a significant percentage of the US market share, such as, its market share fell about 35.5% to 27.3% while Toyota and Honda’s market share climbed by 18.3% to 26.2% in this zone;

- NAFTA: the competitors of international market particularly Toyota and Nissan have easily entered in the North American zone by taking facilities of NAFTA (North American Free Tread Agreement) and captured large market share;

- Operating expenses: the total costs and expenses of GM are increasing each year, for instance, this expanses were $130508 million in 2010, $62402 in 2009 and $170209 million in 2008, which shows gradual increase of this costs;

- Excessive Investment: The main requirement of huge investment, fixed costs, excessive cost for training and development of staff and capitalization are eligible to put greater pressure on any car manufacturer regarding GM. Those variables also create severe problems of over capacity by recession and lower sales revenue or under capacity for upturn;

- Model of the cars: Most of the car manufacturing companies change the model of the car frequently, but GM is not concentrate on this issue more seriously.

- Political factors: GM’s net selling market in the USA has been adversely affected since 1990 due to fluctuate economical and political situations. For this circumstance, the company is shifting its selling vision towards rising automotive car market of China, which offers lower profit margin than general projection.

- Strategic decision: Toyota, Honda and Nissan have taken measures to save the company from unusual events, for instance, these companies have introduced environmental friendly sport utility vehicles (SUVs) to increase profit margin;

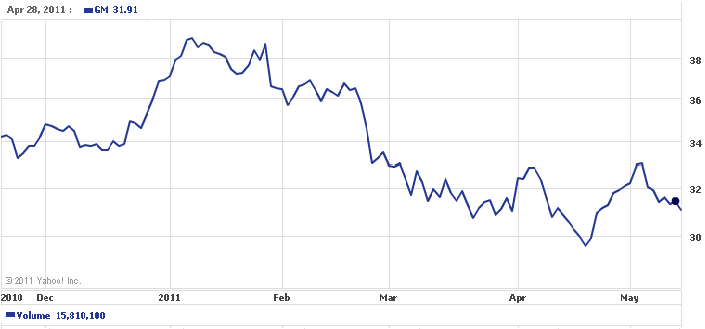

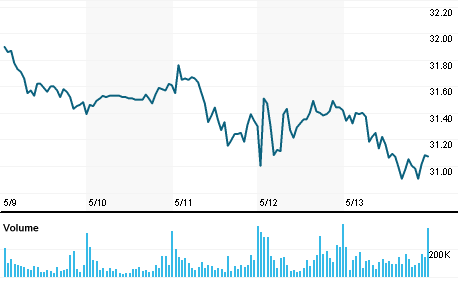

- Stock Performance: the performance of GM in Stock market is not satisfactory as this share price is decreasing day-by-day especially its share price decreased dramatically in April 2011 and the subsequent figure shows the position of GM in Stock market.

The External Environment of GM

Hitt, Ireland, & Hoskisson (2001) stated that the external environment of the company is depend on political, economical, social, and technological factors; therefore, this report will consider PEST analysis of GM-

- Political factors: General Motors (2010, p.29) reported that political unsteadiness in the Middle East and African countries could weaken the demand of cars and it must effect on the integrate market share of GM and annual financial performance. On the other hand, foreign direct investment policy in China, taxation policy of local and foreign countries, hostile attitude of the government of Nigeria and Venezuela, Israel- Palestine clash, and Iranian political environment influence the company both positively and negatively to operate the business.

- Economic factors: According to the report of Reuters (2011), GM experienced economic hardship due to the influence of bankruptcy in the fiscal year 2008 and 2009, but it enjoyed exceptional success in the year 2010, for instance, net income of GM was $6503 million, though the share price is decreasing at this moment (Reuters, 2011). However, Conklin (2005) projected $4.0 billion operating lose in 2005 due to high maintenance costs such as healthcare costs were $5.60 billion, which extremely higher than competitors’ expenses. However, Reuters (2011), forecasted that government provided fund from bailout bill to help the company to recover from recessionary impact, and the company started to gain its confidence and its share price would be in stable position in next three years.

- Socio- cultural factors: GM provides effort to build up efficiency level of the employees in order to offer quality products and services to the customers. As employees are the key assets of the company, GM provide high remuneration to them as they are responsible for research and design, increase quality of the products and improve sales rate; so, GM increases annual pension and healthcare funds for the staff as more than 679000 families depend on this funds (Ivey Management Services, 2005).

- Technological factors: The research team of GM is working hard to reduce petroleum consumption by introducing hybrid and electric technologies as Toyota and Honda have already captured a significant market share by developing environmental friendly products. At the same time, technological factors play vital role to introduce the vehicles with alternative fuels, and reduce oil and water consumption or launch next- generation hybrid power technology for gaining efficiency and ensure safety issues.

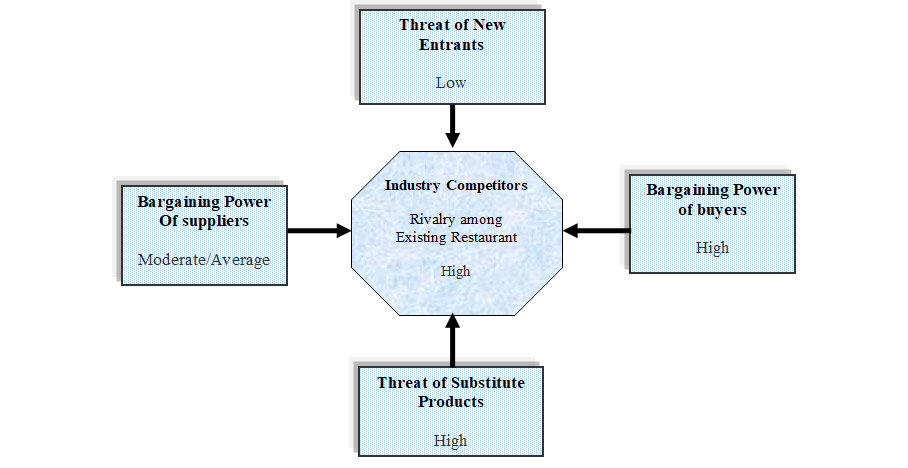

Porter’s five forces model analysis of GM

In order to discuss the competitive environment of GM, this report will focus on Porter’s five forces model –

- Threats from new entrants: According to the annual report of GM Corporation, the automobile companies had suffered intense competition in the local and international market for financial downturns, unstable fuel prices, and reduction of the employment rate. In addition, it is important to have strong financial condition with advance technological supports in order to enter this industry as new player. As a result, it is hard for the new companies to occupy the market share of General Motors but there is huge risk of competitive stress from newer domestic automakers of China and India because these new manufacturers are popular to the middle class target groups. At the same time, large automobiles like Toyota, Honda or other companies’ subsidiaries can captured the market of GM as its market share in the US market is decreasing;

- Bargaining power of suppliers: As per the annual report 2010 of General Motors, the main suppliers are raw materials suppliers, which supply steel, aluminum, oil, rubber, motor engine, resins, color, simple parts, engine, glass, copper, lead, systems, components, and other body parts of cars etc. Nevertheless, the bargaining power of these suppliers differs from nation to nation and the availability of the suppliers of particular products, such as, General Motors always clear the payment second month of the delivery due to avoid any misunderstanding in the supply chain management system.

- Bargaining power of buyers: Prior to the global financial meltdown, buyers were comparatively less influential factors to the automobiles industry because most of the customers of GM had concerned on quality rather than price of the products though the fact of this statement differed from one market place to another place. However, the bargaining power of buyers is now high because of the current pressure of global financial downturn, as the customers of new cars now like to purchase cars at lower price. In addition, this power of buyers helped the competitors of GM to increase their sales profit as most of the competitors offer lower price of the cars;

- Threats of substitute products: Besides competition with direct competitors, General Motors also suffered hard competition from some other substitute transportation system. As the demand of public transports like bus, railways system, and trams have provided huge facilities, the people take the advantage of public transport system in this economic condition;

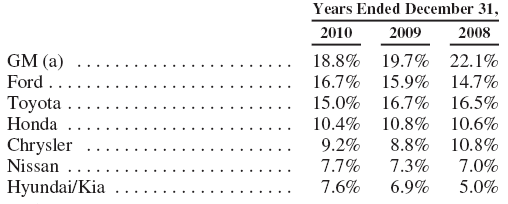

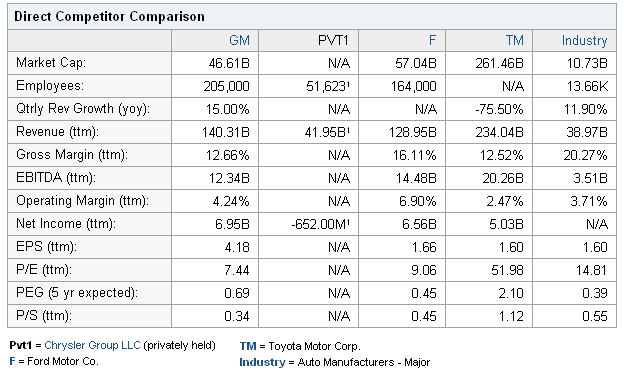

- Rivalry among existing firms: This Company has to compete with numerous direct and indirect auto manufacturers at both home and abroad, for instance, the key competitors of this company are Honda, Ford motors, Chrysler, Nissan, Mitsubishi, Land Rover, Toyota, BMW, etc. However, the rivalry among existing firms is extremely high as all companies change their strategies to expand its market share; therefore, market share in the US car and truck market of GM fell about 22.1% to 18.8% from 2008 to 2010 only for the intense competition. However, the following figure compares the position of GM with other direct competitors –

The external threats and opportunities of GM

Opportunities:

- Growth: This company has capability to perform strongly in existing market and enter new market with exclusive offer particularly EU market is potential for the company;

- Joint venture: Joint venture with local companies or large multinational companies can bring success for the company

- Hybrid cars: GM has scope to develop its hybrid technology, new vehicle styles and models for the target customers;

- International strategy: It should try to apply international strategy to enter highly populated regions enlisting India, China, and Russia to generate long- run return.

Threats:

- Recessionary Impact: It had been acted as the most vulnerable and dangerous factor of the General Motor company in terms of falling its certified dealership concerning 475 outlets among which 401 were linked with GMNA. In addition, it also generated stiff credit industry, disorder in the mortgage sector and fluctuated fuel rate for diminishing customer loyalty;

- Competition: Intense competition among the market players is one of the key threats for the company while competitors rapidly occupied large market share.

- Legal Litigation: Recently, legal litigation costs had increased as the company is responsible for environmental issues, employees and customer safety concerns, product quality, customers’ safety and other government policies;

- Fuel price: The volatility of fuel price decrease the demand of GM cars as the customer would like to purchase cars those require consumption rate of fuel is very low. However, the marketer of GM has already addressed this issue and this company is going to launch 19 FlexFuel vehicles in FY2011 with intent to capture 40 percent its total sales revenue;

- Compensation: Executive compensation committee has established considering the provisions of the ARRA (The American Recovery and Reinvestment Act of 2009) 2009 to maintain the remuneration system; however, it has many high-compensated employees, which become threat for the company at moment of financial crisis.

Strategy of GM

At around 2005, GM had been experiencing high losses. GM was also compelled to provide payment for retired employees and pensions. In addition, there was intense competition. Therefore, GM would have to take steps in order to overcome these difficulties. The earlier principles were best products, consumer focus, and unity, accept stretch targets and working rapidly. GM would now have to change its working strategies.

Among the US companies, which were the competitors of GM were The Big Three companies, Ford, Daimler-Chrysler and GM, which copied each others decisions involving models and prices which threatened continued profitability. On the other hand, foreign companies introduced newer models of cheaper improved products and they employed younger people & paid less salary to them.

The US companies strived to retain seniority distinctions, which hindered the innovation of new technologies. Many first time buyers preferred used cars but the older products of US Companies had poor performance, which created a bad impression in their minds. Consumers sometimes say that due to poor quality the US companies offered lesser prices. Repeated price and interest concessions led to customers waiting for the next sale.

Moreover, such programs served to decrease prices of used and new vehicles and consumers preferred cars that might have constant resale value. Thus, the US companies closed some of their plants. The US companies decreased prices from suppliers and enhanced the prices to the dealers, which led to reduced profits. The complexity and size of the huge companies like GM delayed changes in technological and corporate cultures.

Thus, the goals of GM were to increase shares by acting strategically. It would also have to introduce strategies to impress its customers. Thus, the company planned to undertake different corporate strategies.

GM’S Saturn Strategy

This project was that GM initiated a new branch in a new area with new employees. The Saturn vehicle was made especially different by providing it a plastic dent-free body. The sellers had fixed listed prices, for creating confidence to the customers of the company.

This produced high consumer satisfaction but the profits could not meet its expectations. The Saturn Strategy required distinctive features and new employees. This was expensive so GM decided to make Saturn just another simple brand, with engineering and marketing being shifted to GM’s centralized operations.

GM’s Strategy of Alliances

GM created alliances in several countries for expanding their business. They had an equity position with the Swedish manufacturer Saab, and also created joint venture with the Russian company for building SUVs for Russia. They had an alliance with Suzuki of Japan for producing engines for Suzuki vehicles. They also had remarkable alliance with Fiat, Daewoo and SAIC.

GM’s Fiat Strategy

GM had alliance with Fiat hoping to increase sales in Europe. Fiat hoped to increase sales of its luxury cars in the US. GM and Fiat reduced costs by sharing engines and platforms. They exchanged technologies. They also exchanged shares in each others companies. However, this alliance was disastrous. Fiat had decreasing sales and lesser profits. GM and Fiat worked individually and some Fiat shareholders argued GM was obliged to purchase the remaining 80% of Fiat. Finally, GM made an out-of-court settlement of $2 billion.

GM’s China Strategy

GM had a 50 per cent share with a Chinese auto manufacturer, SAIC. They had numerous competitors with about 200 carmakers, retaining a 40 percent market share. In addition, the government had interventionist policies, such as the foreign ownership of assembly factories should be limited to 50 per cent.

However, intellectual property was not protected resulting in models being copied and hence, threatening a decrease in prices. Moreover, GM faced risks that the joint venture might be dissolved or that the SAIC and others may turn into their global competitors; therefore, there were many challenges.

GM’s Daewoo Strategy

GM made an alliance for buying Daewoo assets forming GMDAT. This led GM to gain access to the market in Korea and also to provide low-cost cars for GM dealers worldwide. Initially, GM had a 33 per cent market share, which fell to 9.5 percent in 2004 and the situation was becoming tougher.

GM’S “Non-Market” Strategies

Governments made policies, which influenced automakers strategies. In some places, such as Canada, government provided free health care for the people thus decreasing the production costs and influencing plant location decisions.

For years, governments considered the automotive industry as a job creator, involving assembly operations and also dealers and suppliers. Therefore, the government provided significant financial assistance by which new plants or R & D facilities could be introduced. Hence, each automaker started requesting for financial assistance.

GM’s Healthcare and Pension Strategies

GM had numerous employees and thousands of families relied on it for pension funds. In 2005, the cost of healthcare amounted to $5.6 billion and GM was considering to reducing these huge healthcare obligations.

In 2005, GM thought to reduce benefits for retired UAW workers, but the UAW argued that this would be a breach of their contract. The union’s view was that before the union members chose to agree to reduce rises in their salaries expecting higher pension and health promises; thus, GM was legally and morally bound to the customer.

GM’S Environmental Strategy:

The governments were attempting to reduce gasoline consumption and emissions by increasing mileage for which they introduced regulations. Under the new regulations, sales were easier for Honda and Toyota than GM, which was compelled to sell smaller trucks at lower profit margins.

Automakers were thinking to alter the engines for enhancing gasoline mileage by using batteries or other electrical sources. GM introduced models, which relied on lead acid batteries and which it required charging. GM was also working for developing a six-cylinder diesel engine. Toyota and BMW was also working on new types of engines. GM and other automakers also considered fuel cells for producing electricity.

In fact, some countries signed the Kyoto Protocol, for decreasing carbon dioxide emissions while the US and some countries did not sign. However, GM voluntarily took measures to reduce carbon dioxide emissions monitoring its energy use and carbon dioxide emission launched a website.

Business Level Strategy of GM

The GM’s market share in the US fell from 35.5 per cent to 27.3 per cent. The global share of GM was 15 per cent in 2002, which was approximately 14.5 per cent in the following yrs. Thus, the consolidated net income rose by about 1 million from 2002 to 2004. The net margin from continuing operations was above 1 per cent throughout the 3 yrs.

An analysis of the financial data of global automakers would reveal the global position of GM. GM had the highest number of sales worldwide in 2004, but this does not mean an entire profit since the operating profit margin was -0.2% and the return on equity was -4.4%.

This indicates that the company is going through losses. On the other hand, Nissan and BMW had a high profit margin of about 9%, which means that the company is having high profits. Nissan had a return on equity of 20% also indicates the high profitability of the company. The Stock Change of GM was -38.6% whereas that of Nissan was about 228%. Hence, in comparison it appears that the position of GM is poor in the market.

In 2005, the CEO of GM intended to introduce new objectives. Following this, GM offered substantial discounts to attract consumers and lessen inventories. The CEO declared that the number of employees would be reduced to 25000., the CEO introduced a new strategy which included a) spending more on new vehicles, b)explaining the functions of each of GM’s eight brands; c) focusing more on lowering costs and improving quality; d) searching for ways to lessen the enormous healthcare costs.

GM planned to reduce healthcare costs in US. Nevertheless, this was not such a pressing matter for Canada due to differences in publicly funded healthcare systems. The CEO decided to be in charge of the GMNA. He made internal changes within the company by assigning the former chairman of the NA division and GMNA President to global product development and manufacturing and labor. The intention was to reinforce GM’s global focus.

The CEO also expressed a new strategy related to pricing, marketing and models of vehicles and said that if each product could be produced with more special features for attracting consumers it would be better.

For positioning the models uniquely so that customers can easily understand GM brought new strategies. Among the eight brands, Chevrolet and Cadillac would remain in the market and some models might be eliminated for lessening duplication. GM thought to use sticker prices, which would be much close to the original prices paid by customers to allow customers to compare prices of GM’S products with products of other companies.

GM also started new advertisements focusing the theme “Only GM” emphasizing safety features and in-vehicle communications service and electronic stability control and some other features.

The major problem faced by the company:

According to the case of Conklin (2005), the major problems faced by the company are-

Competition from Japanese automobiles: The foreign automakers particularly Japanese carmakers offer lower price for their new model quality cars those are concentrate on the environment friendly with low fuel consumption to the customer. Besides trucks and small car markets, these companies also penetrated the market of luxury vehicles with latest technology and these companies develop global networks to sales their products. However, GM is in number one position in terms of car sales but it is facing serious problem to sustain as a market leader in automotive industry from last three decades.

Competitors’ products: the competitors especially Toyota and Honda are manufacturing quality products and building strong brand image, which becomes one of most significant problems for GM.

Internal controlling system: the present management team is in under pressure due to the provision of previous rules as these rules create impeding to apply new technology and bring organizational change at the time of crisis.

Resale value: According to the report of Ivey Management Services, the government, rental service providers and many companies offer second hand cars at lower price; therefore, many potential customers purchase second hand cars instead of first hand cars of GM.

Customers’ respond: Most of the customers of GM stated that the value of this brand is higher than any other foreign company’s car and the quality also lower in terms of the price of the GM brand. Therefore, the customers would like to purchase competitors model as they get new car at lower price with similar or better features, which influence the market to reduce integrate sales of the company.

Restructuring process: In 2004, Wagoner in annual report of the company stated that GM should restructure its strategies in order to gain competitive advantages in future and it was a difficult task for the top management, as they had to take many decision going beyond existing culture of the company. For instance, it had twenty-seven different purchasing organizations but it is now performing as a single organization for global operation

The “Push” industry effect: Push strategy indicates that “pushing” the production through distribution channels to final consumers where the manufacturer directs all the marketing actions toward channel members for reminding them to carry out the production and to endorse those to final customers; however, GM followed these strategy and automatically reduced the market share.

The possible solutions/ alternatives for solving the problem:

Explanation of Scale: Each criterion was evaluated and given a score between 1 and 5, with 1 being very unfavorable and 5 being highly favorable

Alternative 1: Develop new product line

Annual report of GM stated that this company has focused on creating a strong business by introducing innovative products with excellent features; consequently, GM has already launched few models those can run by using alternative fuels consumption system (such as bio-diesel and ethanol blends) with other eco-friendly technologies (GM, 2010, p.12).

The purpose of this strategy is to increase the market share in the US market as the foreign companies penetrated the US market with these product lines; for example, Toyota became the market leader in the Hybrid and Plug-In Electric Vehicles while Honda is the major competitor of Toyota.

However, GM has already changed its objective related with the cost effective fuels issues and it has introduced 19 Flexmation considering these facts and added new features to operate with bio-fuels including E85 ethanol by the fiscal year 2012.

At the same time, GM (13) reported that new model hybrid electric vehicles would play vital role to change customer behaviour and increase sales revenue from the US and European car market; therefore, it would like to introduce Hydrogen Fuel Cell Technology, OnStar and Other Technologies in their new products.

Alternative 2: Restructuring Pricing Strategy

The marketer of GM should research on the market trends, external business environment, the effect of global financial crisis, demand, market competition and buyer behavior in order to restructuring its pricing strategy.

However, GM has long experience to operate business in national and international market as a major player but it lost its glorious market position due to higher competition and price war from Japanese companies. As a result, restructuring pricing strategy is one of the most essential criteria to sustain in competitive market while all competitors setting price considering customers’ purchasing power.

Alternative 3: Joint Venture and Acquisition strategy

The company can achieved competitive advantages by joint venturing with large automobiles to share their resource and capabilities to expand the business in outside of the US market.

Alternative 4: Combination of Alternative Strategy 1 and Strategy 2

Recommendation

This report recommended that Alternative strategy 4 is the best solution considering the evaluation criteria of decision-making process and this strategy would help the company to create brand image in global market including developing countries. Alternative strategy 4 only considers the new product development with exceptional features, but the company would never be able to capture large market share if the customers purchase the low price products of competitors. As a result, combination of pricing strategy with development of product line would be the most successful strategy to regain its market position in the US market and establish the company as market leader in global market.

Reference List

Conklin, D. C. (2005) General Motors: Acting Strategically. Ontario: Richard Ivey School of Business.

General Motors (2010) Annual Report 2010 of General Motors Company). Web.

Reuters (2011) General Motors Co (GM.N). Web.

WSJ. (2011) Sales and Share of Total Market by Manufacturer. Web.

Yahoo Finance (2011) Direct Competitor Comparison of General Motors Company (GM). Web.

Yahoo Finance (2011) General Motors Company (GM). Web.