Introduction

In data analysis, the study analysed data obtained from 439 participants, who are Chinese E-car consumers. The study employed Microsoft Excel in the analysis of frequencies and the presentation of data in pie charts and bar graphs.

Background Information

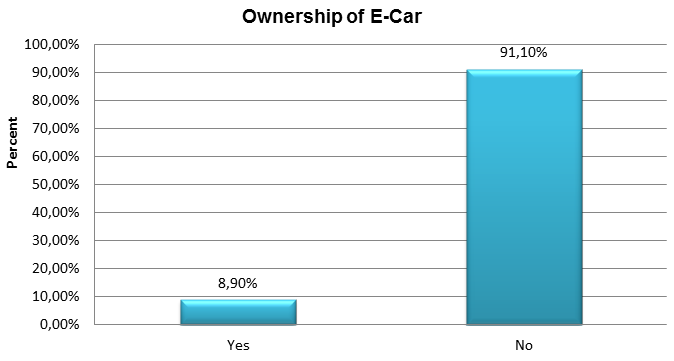

Do you own an E-car?

Figure 1 is a bar graph showing the distribution of respondents according to the ownership of the E-car. The figure shows that 8.9% of the respondents own E-car and the remaining 91.1% do not own E-car.

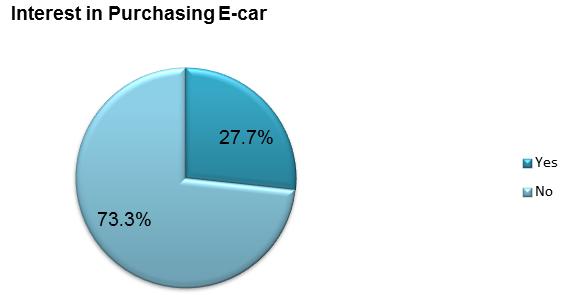

Are you interested in purchasing E-car?

Figure 2 is a pie chart displaying the proportion of respondents interested in purchasing E-car as 27.7% and those not interested in purchasing E-car as 73.3%.

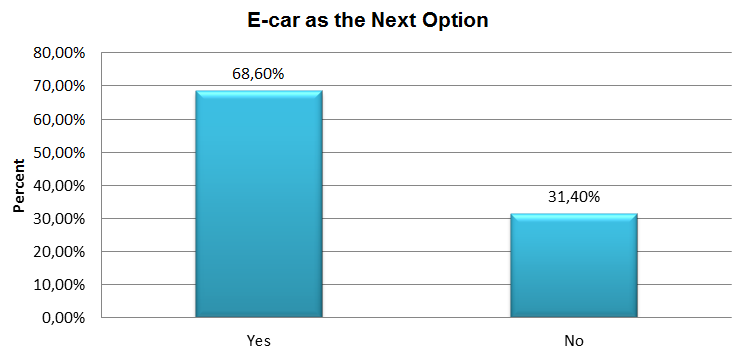

When you buy your next car, is E-car one of the options?

Figure 3 below shows that the proportion of respondents who would choose E-car as their next option is 68.6% whereas the proportion of respondents who would not choose E-car as their next car is 31.4%.

The First Hypothesis

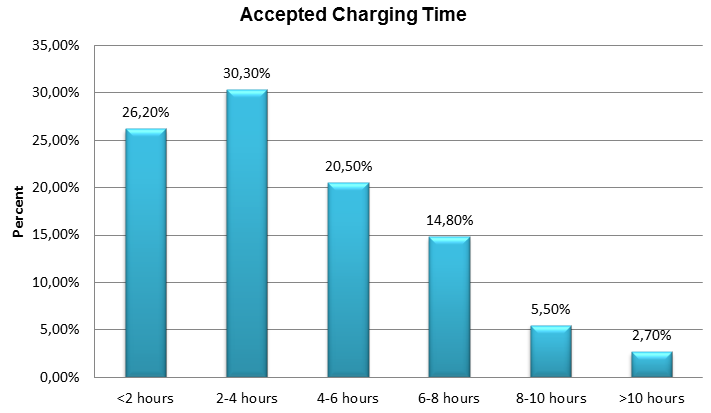

What time for the E-car charging can you accept?

The respondents provided diverse opinions regarding the charging time of E-car. Out of 439 respondents, 26.2% of respondents indicated that they accept charging period of less than 2 hours and 30.3% of respondents showed that they accept charging period of between 2 and 4 hours.

Moreover, 20.5% of respondents accept charging period of between 4 to 6 hours. The remaining portions of the respondents, 14.1%, 5.5%, and 2.7%, accept charging period of 6-8 hours, 8-10 hours, and more than 10 hours respectively.

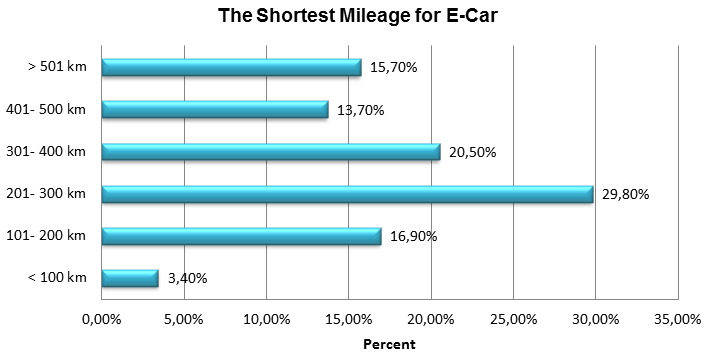

What is the shortest mileage for the E-car can you accept?

Figure 5 below indicates the distribution of responses regarding the shortest mileage that E-car can cover. From the figure, it is apparent that most respondents (29.8%) accept E-car that can cover between 201km and 300 km. Respondents who accept short mileages of less than 100 km and between 101 and 200 km constitute 3.4% and 16.9% respectively.

Respondents who require long mileages of 101-200 km, 301-400 km, 401-500 km, and more than 501 km constitute 20.5%, 13.7%, and 15.7% respectively.

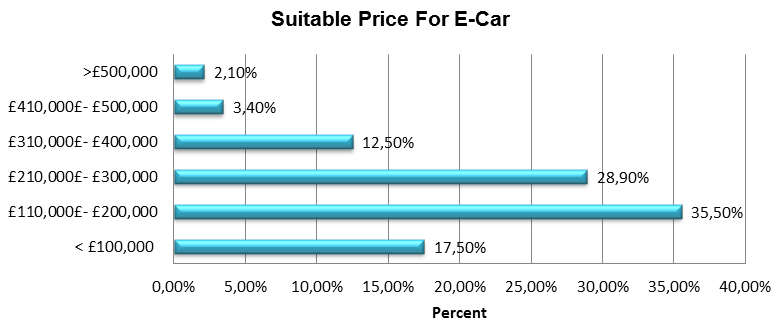

What price do you think is suitable for an average mid-range E-car like the BMW i3?

Figure 6 shows that most respondents (35.5%) think that the suitable price range for a mid-range E-car is between £110,000 and £200,000 while 28.9% of the respondents think that the suitable price range for a mid-range E-car is between £210,000 and £300,000.

Respondents who think that the suitable price range for a mid-range E-car is less than £100,000 constitute 17.5%. Moreover, 12.5%, 3.4%, and 2.1% of respondents think that the suitable price ranges for a mid-range E-car are £310,000-£400,000, £410,000-£500,000, and more than £500,000 correspondingly.

Brand Personality

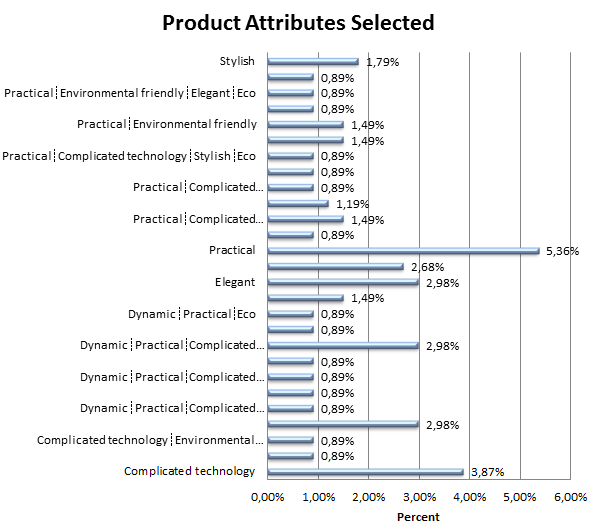

Which product attribute do you associate with the E-car?

To determine the level of awareness of BMWi3, the study asked the respondents about the attributes they associate with E-car. Figure 7 shows that most respondents (5.59%) selected practical as a tribute associated with E-car followed by 4.12% of respondents who selected stylish as an attribute associated with E-car.

Elegant and environmental friendly attributes received an equal review as both had 2.65% of customers who associated these attributes with E-car. Complicated technology (2.35%), dynamic (2.06%), eco (0.88%), and modern (1.18%) are other product attributes that respondents associated with E-car. However, some respondents (less than 0.3%) associated E-car with negative attributes such as slow, old-fashioned, and not stylish.

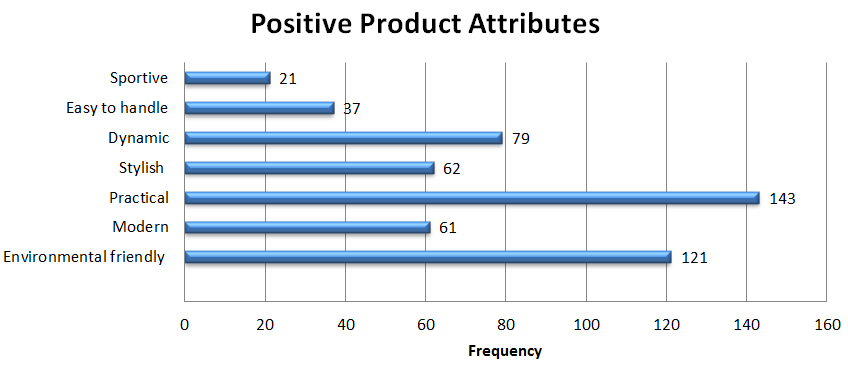

Figure 8 below indicates frequencies of positive attributed associated with E-car. Practical is a positive attribute that gained the most frequencies (143). Environmental friendly, dynamic, stylish, and modern attributes ranked second, third, fourth, and fifth with 121, 79, 62, and 61 frequencies respectively. Easy to handle and sportive are attributes that have the lowest frequencies of 37 and 21 respectively.

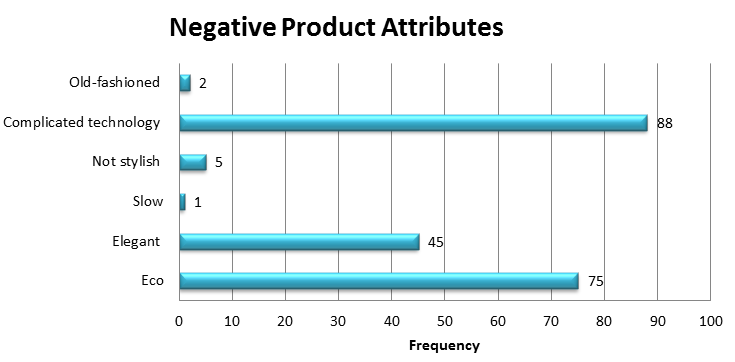

Figure 9 shows frequencies of negative product attributes associated with E-car. Complicated technology is a negative attribute that has the most frequencies (88) followed by eco attribute (75) and elegant attribute (45). Slow, old-fashioned, and not stylish are three negative attributes with 1, 2, and 5 frequencies respectively.

Product Associations

If you consider the BMWi3 as a status symbol, which attribute do you associate the most with it?

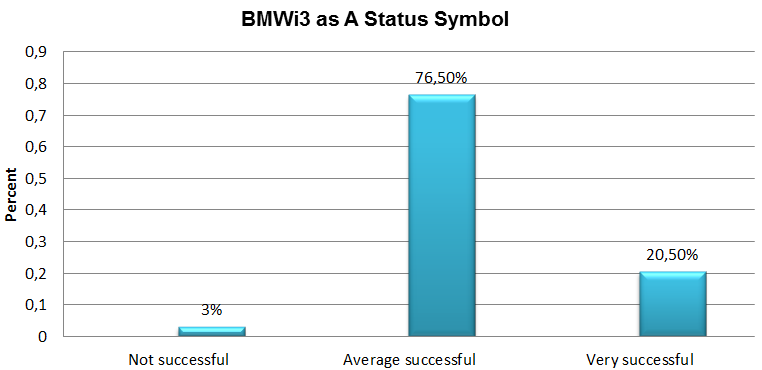

Figure 10 indicates how respondents rated BMWi3 as a status symbol among the Chinese E-car consumers. From the figure, it is apparent that over three-quarters of respondents (76.5%) consider BMWi3 a status symbol for people who have average lifestyles. Moreover, the figure shows that 20.5% and 3% of respondents consider BMWi3 as status symbol for very successful and not successful people respectively.

What personalities can you associate with BMWi3?

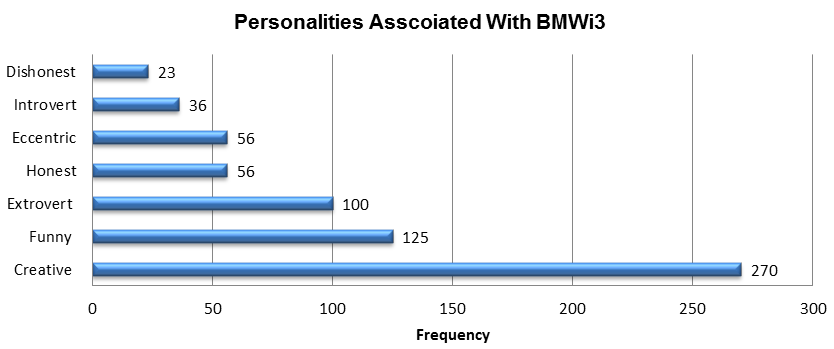

The question provided seven options of personalities, namely, creative, funny, extrovert, honest, eccentric, introvert, and dishonest, for the respondents to choose the ones that associate with BMWi3. From Figure 11, it is evident that creative personality has the most frequencies (270) followed by funny personality (125).

Extrovert and honest personalities have frequencies of 100 and 56 respectively. The above personalities are positive personalities that the brand strategy aims to associate with BMWi3. However, respondents associated BMWi3 with negative personalities such as eccentric (56), introvert (36), and dishonest (23).

The Second Hypothesis

Which added value of E-car such as BMWi do you perceive?

Table 1

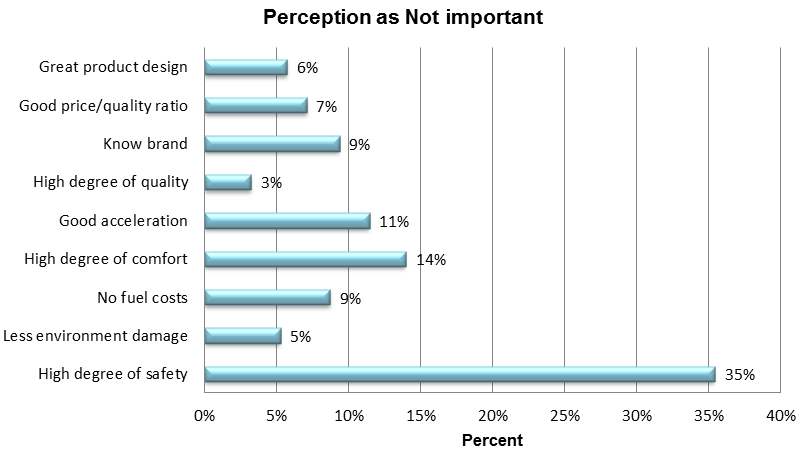

The figure above (Figure 12) shows that most respondents (35%) perceive the high degree of safety as unimportant added value to BMWi3. The figure also shows that 14%, 11%, 9%, and 9% of respondents rated high degree of comfort, good acceleration, know brand, and no fuels respectively as unimportant added values of BMWi3.

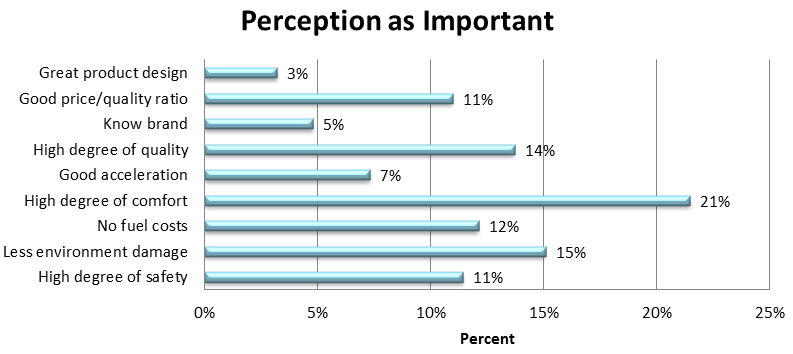

From Figure 14, 21% and 15% of respondents perceive high degree comfort and less environment damage as important added values of BMWi3. Good price/quality ratio and high degree of safety have equal ratings as 11% of respondents perceived them as important.

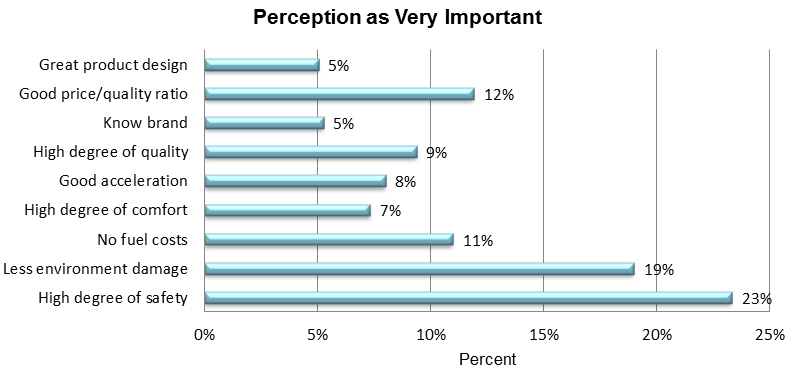

Most respondents perceive a high degree of safety (23%) and less environment damage (19%) as very important added values of BMWi3 (Figure 15). Moreover, the figure also shows that 12% and 11% of respondents perceive good price/quality ratio and no fuel costs as very important added values.

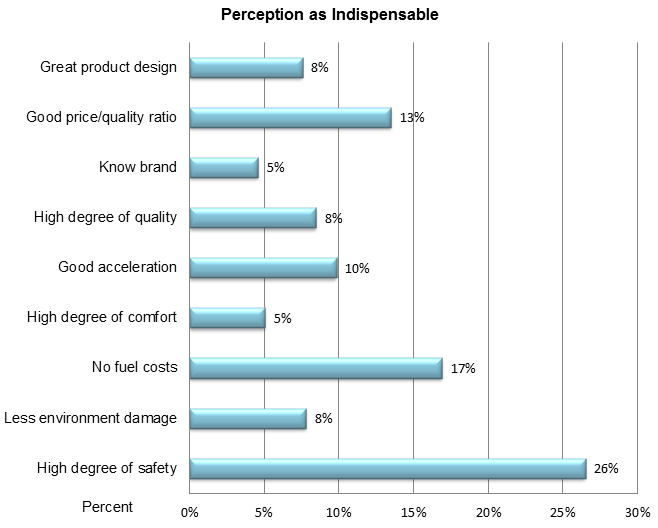

The figure below (Figure 15) indicates that most respondents (26%) perceive a high degree of safety as indispensable added value of BMWi3. Other added values that respondents perceive as indispensable are no fuel costs (17%), good price/quality ratio (13%), and good acceleration (10%).

The Third Hypothesis

Do you have trust in the expertise of BMW, a traditional engineer car manufacturer, in producing E-cars?

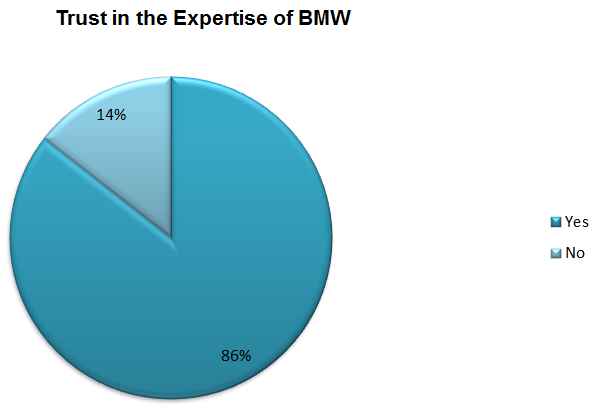

From the pie chart (Figure 16), it is apparent that 86% of the respondents trust in the expertise of BMW in producing E-cars while the remaining 14% do not trust in the expertise of BMW in producing E-cars.

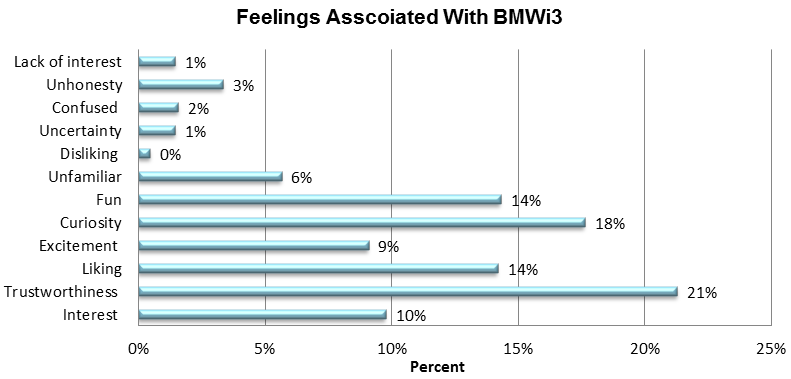

Which feelings do you have when you think of the brand BMWi?

From Figure 17, it is apparent that most respondents associate BMWi3 with positive feelings. Fun (14%), curiosity (18%), excitement (9%), liking (14%), trustworthiness (21%), and interest (10%) are all positive feelings that capture the brand strategy of BMW. In contrast, few respondents, namely, lack of interest (1%), unhonesty (3%), confused (2%), and uncertainty (1%), associated BMWi3 with negative feelings.

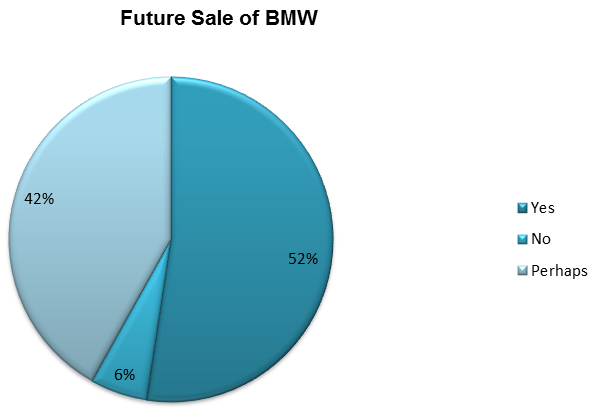

Do you think the BMWi will be successfully sold in the future?

The pie chart (Figure 18) indicates that 52% of respondents think that BMW would successfully be sold in future whereas 6% think that it would not be sold. Moreover, the figure shows that 42% of respondents are unsure whether BMW would be sold successfully or not.

The Fourth Hypothesis

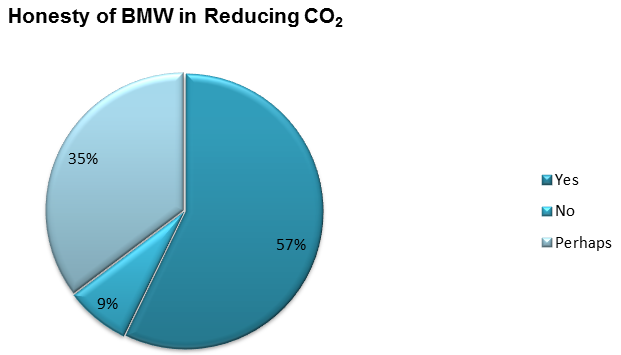

Do you believe that the BMW is honestly interested in reducing CO2 emissions to be environmental friendly?

The pie chart below (Figure 19) indicates that 57% of respondents believe that BMW is really honesty in manufacturing E-car to reduce CO2 emissions while 35% are unsure about the motive of BMWi3. Moreover, 8% of respondents hold that BMW has no intention of reducing CO2.

Which impression do you associate with the BMWi3?

Figure 20 indicates frequencies of impressions associated with the BMWi3. From the table, it is evident that 25.7% of respondents associate BMWi3 with eco-car while 19.4% of respondents associated it with trend. 14.1%, 1.03%, 9.1%, and 6.8% of respondents associated BMWi3 with business, family, sport, and luxury respectively. However, 14.6% of the respondents do not associate BMWi3 with anything.

Figure 20

Discussion

Background Information

The background data effectively describe purchasing behaviours of customers because they indicate ownership of E-car, interest in purchasing, and options for their car of choice. According to Creusen (2010), demographic attributes are central to the understanding of consumer behaviours because their ability to purchase certain products.

From the background information, the study infers that 8.9% of the respondents own E-car, 27.7% are interested in purchasing E-car in future, and 68.6% would consider purchasing E-car as their next car. Pavlou and Fygenson (2006) argue that change in consumer behaviour is a gradual process that is dependent on awareness.

Such a trend of increasing percentages indicates that there is an impending shift in the purchasing behaviour from normal cars to E-cars. Increased awareness of environmental problems caused by the use of fossil fuels has changed consumer attitudes and behaviours of Chinese consumers (Ivan & Penev 2012). In this view, the background information indicates that there is a progressive acceptance of E-car among the Chinese consumers.

The First Hypothesis

The first hypothesis is that the brand reputation of the BMWi electric cars is low among the majority of the Chinese consumers. Tan et al. (2014) concur that the reputation of E-cars in China is low due to inadequate awareness among potential consumers.

In testing this hypothesis, the study examined product information, brand personality, and brand associations as three main independent variables. These variables hold important data for analysis, which the study used in hypothesis testing.

Product Information

The analysis of data related to the product information shows that brand perception is relatively low among Chinese E-car consumers. The analysis shows that most respondents 77% can accept E-car with charging period of less than 6 hours while 23% of the respondents can accept E-car with charging period of greater than 6 hours.

Lebeau, Lebeau, Mairesse, Macharis, and Mierlo (2013) hold that consumers require E-car that charges within a short duration. Figure 4 illustrates the distribution of frequencies in the percentage form. From the figure, it is apparent that most respondents require E-car, which takes the shortest period possible to charge. However, BMWi3 takes approximately 6-8 hours to charge fully depending on the charging system (BMW: BMWi3 2015). In this view, only 23% of the respondents can accept a charging period of above 6 hours.

This acceptance level shows that the Chinese E-car market only targets 23% of the consumers in the automobile industry. A recent development in the E-car industry aims at reducing the charging period to improve the convenience of E-car (Song & Yang 2011). Additionally, the reduction of the cost of charging would enhance the cost-effectiveness of E-car (Li & Ouyang 2011).

Hence, the study recommends the reduction of the charging period and the cost to increase the consumers of E-car in the Chinese E-care market. Regarding the shortest mileage, 20.3% of respondents accept E-car that can cover less than 200 km whereas the remaining 79.7% can accept E-car than can cover over 200 km. When the battery is fully charged, E-car can cover a minimum distance of 160 km (BMW: BMWi3 2015).

In this case, 16.9% of the respondents accept the current model of BMW. In the aspect of a suitable price for a mid-range E-car, most respondents (82%) think that it costs less than £300,000. In this view, it evident that the product information is low among the Chinese consumers of E-cars because about 20% of them are aware of the BMWi3 features.

Comparative analysis indicates that 82% of respondents consider the price of BMWi3 to be less than £300,000. Hence, the study recommends BMW to manufacture affordable E-car because most respondents (35.5%) imagine the price range to be between £110,000 and £200,000.

Product Personality

Analysis of the product personality shows that there is still a low brand perception among Chinese E-car consumers. It is evident that the major attributes that respondents associated with E-car are practical, stylish, elegance, environmental friendly, complicated technology, dynamic, eco, and modern. Lebeau et al. (2013) assert that consumers of E-car prefer practical, dynamic, and environmental friendly attributes of BMWi3.

Low awareness is evident because a considerable number of potential consumers associate E-car with negative attributes such as complicated technology, elegant, old-fashioned, and not stylish. Sucky and Werner (2011) assert that BMW designed BMWi3 with the objective of not only reducing carbon dioxide emission, but also incorporating dynamic, practical, and modern features, which meet the unique needs of consumers in the automobile industry.

Jansson (2011) states that consumers consider eco attribute because they associate it with affordability and safety. Thus, the study recommends BMW to educate consumers to understand features of BMWi3 so that they can associate it with positive attributes.

Product Associations

Regarding product associations, most respondents (76.5%) associate BMWi3 with people who are averagely successful in life. In this view, the study infers that most respondents consider BMWi3 for people in the middle class. In the aspect of the impression, 25.7% of respondents consider BMWi3 as an eco-car.

Mingde and Yixiang (2010) hold that fuel cost is an attribute that consumers consider because they require economical cars. Extrovert, funny, and creative are the leading personalities that respondents associated with BMWi3. In this view, funny, eco, extrovert, creative, and trend are the leading attributes associated with BMWi3.

Egbue and Long (2012) argue that negative attributes are barriers that prevent the adoption of E-car in the automobile markets. Therefore, product information and brand personality support the hypothesis that brand information is relatively low among the Chinese consumers.

In this view, the study recommends that BMW needs to undertake extensive marketing for consumers to understand the importance of BMWi3 in the automobile industry and associate it with positive status symbols, impressions, and personalities.

The Second Hypothesis

The second hypothesis states that the number of people who are interested in BMWi electric vehicles is considerably small as consumer attitudes towards BMWi brand are low. The following question examines perceived importance of BMWi3 using a scale of 1 to 4, which indicate the importance of added values from ‘not important’ added value to ‘indispensable’ added value.

Table 1 shows the distribution of responses, which rate the importance of added values of BMWi3. Analysis of the distribution of perceptions of BMWi3 added values does not reveal any patterns or trends. Table 1 depicts that there is no apparent trend regarding how respondents perceive the importance of the added values of BMWi3. Almost the same proportions of respondents perceive added values as not important and indispensable.

For example, most respondents (35%) perceive high degree safety as an important while most respondents (26%) perceive high degree of safety as indispensable. Joshi and Mishra (2011) argue that enhanced awareness of E-car and pollution has made consumers perceive safety and less environmental damage as very important added values of BMWi3.

Random distribution of responses is indicative of a low interest in BMWi3 and negative perceptions. Therefore, BMW should undertake extensive marketing and consumer education so that consumers could develop interest in BMWi3 and dispel negative attitudes towards the brand.

The Third Hypothesis

The third hypothesis assumes that the majority of the aspiring BMWi consumers are concerned about the future of electric-supported BMWi vehicles because of low trust. The analysis supports the hypothesis that the majority of the aspiring BMWi consumers are concerned about the future of electric-supported BMWi vehicles because of low trust.

Although 86% of respondents believe in the expertise of BMW, 42% of the respondents doubt the future of BMWi3. The question aimed at establishing the nature of feelings that respondents associated with BMWi3. The responses from the respondents indicate that they have both negative and positive feelings.

Moreover, 13% and 6% of the respondents associated BMWi3 with negative feelings and unsuccessful sale in future respectively. Thus, the study recommends that BMW should build trust among the Chinese consumers by demonstrating and assuring them about the sustainability of BMWi3 in the automobile industry.

The Fourth Hypothesis

The fourth hypothesis states that the Chinese consumers cannot associate themselves with any of the BMWI marketing activities because BMW has not reinforced the BMWi brand. Consumer beliefs support the hypothesis that the Chinese consumers cannot associate themselves with any of the BMWI marketing activities because BMW has not reinforced the BMWi brand.

From the pie chart (Figure 20), it is evident that a significant proportion of respondents (8%) believe that BMW is not honest in its bid to reduce carbon dioxide emissions. Dodson (2012) avers that automakers normally adopt green technology as a marketing strategy. Additional 35% of the respondents are unsure whether BMW is honest or not in its objective of reducing carbon dioxide emission.

In this view, a third proportion of respondents, which is significant, are unsure about the intentions of BMW in manufacturing E-car. The negative impressions are against the brand strategy of portraying BMWi3 as a normal car in terms of consumption of energy and daily usage.

Fundamentally, eco is a negative attribute of BMWi3 while trend is a short-term brand image, and thus, are not in line with the brand strategy of BMW. Hence, BMW should reinforce its brand by providing relevant information to customers through customer care, and thus, enabling customers gain confidence in BMWi3.

Conclusion

BMW aims to transform consumer behaviours in the automobile industry by introducing green energy brand strategy. The strategy seeks to change consumer behaviours and make them purchase BMWi3, which is a brand of E-car.

However, the green energy brand strategy of BMW faces numerous challenges in the Chinese E-car markets. Evidently, consumer behaviours in the E-car industry are very dynamic in China. Understanding of the dynamics is imperative for BMW to influence consumer behaviours in the Chinese E-car markets.

The application of the utility theory, the hierarchy of effects model, and the consumer acquisition process model elucidate brand reputation, brand attitudes, sustainability, and the nature of associations. The analysis of the consumer behaviours using these theories indicates that the brand reputation of BMWi3 is low among the majority of the Chinese consumers.

Moreover, the analysis shows that most respondents have negative brand attitudes, believe that BMWi3 is unsustainable, and associate BMWi3 with negative impressions, personalities, and feelings. In this view, the study recommends BMW to improve its brand by transforming consumer behaviours for them to adopt green technology and become avid consumers of BMWi3 and related products.

The first recommendation is that BMW should educate consumers to understand features of BMWi3 and its importance in the automobile industry. The analysis of beliefs, attitudes, associations, and impressions indicate that most consumers do not understand BMWi3. The second recommendation is that BMW should shorten charging period and improve the cost-effectiveness of BMWi3 because a significant proportion of customers requires affordable eco-car.

Given that a considerable proportion of consumers do not trust, the third recommendation is that BMW should focus on building trust among the Chinese consumers by demonstrating and assuring them about the sustainability of BMWi3 in the automobile industry. As the fourth recommendation, BMW should reinforce its brand because a significant number of Chinese consumers do not want to associate with it.

References

BMW: BMWi32015. Web.

Creusen, H 2010, ‘The importance of product aspects in choice: The influence of demographic characteristics’, Journal of Consumer Marketing, vol. 27, no.1, pp. 26-34.

Dodson, B 2012, China fast forward: The technologies, green industries, and innovations driving the mainland’s future, John Wiley & Sons, London.

Egbue, O & Long, S 2012, ‘Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions’, Energy Policy, vol. 48, no. 2, pp. 717-729.

Ivan, C & Penev, A 2012, Chinese consumer attitudes towards the electric vehicle. Web.

Jansson, J 2011, ‘Consumer Eco-Innovation Adoption: Assessing Attitudinal Factors and perceived Product Characteristics’, Business Strategy and the Environment, vol. 20, no. 1, pp. 192-210.

Joshi, N & Mishra, P 2011, ‘Environmentally friendly car: A study of consumer awareness with special reference to Maharashtra State’, Information Management and Business Review, vol. 2, no. 2, pp. 92-98.

Lebeau, K, Lebeau, P, Mairesse, O, Macharis, C & Mierlo, J 2013, ‘Consumer attitudes towards battery electric vehicles: A large-scale survey’, International Journal of Electric and Hybrid Vehicles, vol. 5, no. 1, pp. 28-41.

Li, Z & Ouyang, M 2011, ‘The pricing of charging for electric vehicles in China: Dilemma and solution’, Energy, vol. 36, no. 9, pp. 5765-5778.

Mingde, C & Yixiang, X 2010, ‘Climate protection and motor vehicle regulations: Evaluation of motor vehicle regulations in China in the context of greenhouse gas management’, Natural Resources, vol. 34, no.3, pp. 266-274.

Pavlou, P & Fygenson, M 2006, ‘Understanding and predicting electronic commerce adoption: An extension of the theory of planned behaviour’, MIS Quarterly, vol. 30, no. 1, pp. 115–143.

Pisano, J & Duchemin, S 2013, How services can help BMW’s new electric brand to reach sufficient target audience to make business sense. Web.

Song, Y & Yang, Y 2011, ‘Recent situation and development trend of electric vehicle battery’, Power System and Technology, vol. 4, no. 3, pp. 1-7.

Sucky, E & Werner, J 2011, Mobility in a globalised world: Economics, engineering, informatics, logistics, and urban planning, University of Bamberg Press, Bamberg.

Tan, Q, Wang, M, Deng, Y, Yang, H, Rao, R & Zhang, X 2014, ‘The cultivation of electric vehicles market in China: Dilemma and solution’, Sustainability, vol. 6, no. 1, pp. 5493-5511.