Executive Summary

Vera Bradley is an American Handbags and Leather accessories company that focuses on the manufacture and sale of luggage bags, women handbags, and accessories. This industry is a multi-billion dollar business, which was estimated at $96 billion in 2013 (Han, Nunes, and Dreze 3). The largest markets for the handbag and leather accessories in terms of total industry sales include the United States with 36%, Europe with 21%, Japan with 16%, and China with 11% of industry sales (Han, Nunes, and Dreze 12).

Vera Bradley operates in a highly competitive environment where other highly successful handbags and leather accessories makers include Coach, Michael Kors, and Kate Spade in the United States, Louis Vuitton, Gucci, Hermes, and Cartier in the international market. The company sells its products through various channels such as indirect department store and specialty retailer channels (Vera Bradley 5).

Options

In its initial years, Vera Bradley focused solely on the production and sale of duffel bags, handbags, and sports bags (Vera Bradley 4). However, by 2014, the company had made significant strides towards diversification where it sold a wide range of products, including luggage bags, wallets, purses, jewelry, cell phones and computer covers, a wide variety of bags, lunch sacks, scarves, baby clothing, and beach accessories among other products (Vera Bradley 5).

Strategic Issues

The key strategic issues concerning the company focus on expanding to new markets without the necessary capability in terms of distribution to serve its market. Such a strategy has led to many shortages and delays of its products in its specialty stores.

The other central strategy relates to the adoption of online platforms as important mechanisms for selling its products. Lastly, slow automations and implementation of technologies led to slow production and hence the slow growth that the company has experienced in the last few years.

Implementable Recommendation and Justification

The construction of large warehouses and the automation of operations have allowed the company to increase its efficiency. Further, the adoption of eCommerce, the company has opened a new platform where it can access new customers across the world.

Industry and Competitive Analysis

Market Size:

- The Handbags and Leather Accessories is a global market that is worth $96 billion

- There is a growing demand for affordable luxury handbags and leather accessories

- Vera Bradley has 96 full-price retail stores, 29 factory outlets in the USA, and seven full-price retail stores in Japan

- The company is one of the most successful small retailers in this industry with annual revenues of $5 million

Degree of Product Differentiation

Vera Bradley operates in an industry that has a very little differentiation of products between competitors. However, at the beginning, the company was inspired by the desire to make duffel and luggage bags that were not available in the market.

The company initially focused on making high quality and stylish products to serve the gap in the market that was not served at the time (Vera Bradley 6). The company has also been successful through its product sale approaches where it has collaborated with other major retail outlets such as Wal-Mart among others in the United States and across the world.

For instance, the company’s products are sold in over 3100 indirect specialty retail stores throughout the world. The company has also focused on the sale of high quality products, yet at affordable price as compared to other products of the same type by its competitors.

Product Innovation

Vera Bradley is a company that was born out of the founder’s desire to make groundbreaking and fashionable handbags and leather accessories for its customers. As such, the company has established a brand loyalty and identity around its products, which include:

- High-quality duffel bags

- High-quality ladies’ handbags

- Computer and phone cover accessories

- Eyewear products

- Highly appealing store designs

- Customized designs for customers

- Signature patterns in its products

Vertical Integration

Vera Bradley is a highly vertically integrated company since it is involved in all areas of production in its activities. The company has its own factories, distribution channels, as well as its retail stores across the United States and Japan (Vera Bradley 4). However, the company’s products are also sold in specialty retailers that are not owned by the company.

PESTEL Analysis

Political Factors

Vera Bradley has its headquarters, its major operations, and market in the United States. As such, it has to adhere to the regulations and laws that govern the employment of its workforce in the United States. Secondly, the company has operations in overseas countries such as Japan. Hence, it has to ensure that its activities are above board to protect itself from any political backlash.

Economic Factors

The company has experienced an increased growth in its affordable luxury products category, especially since the 2007/2008 financial crisis. During the economic downturn of the time, an industry wide shift from expensive luxury products to affordable luxury products was witnessed to ensure that the industry continued to grow unlike other sectors that experienced a significant drop in sales.

In the recent past, the company has experienced increased competition. It has seen a drop in its sales in 2015 as compared to 2014. For instance, in the first quarter of 2015, the company achieved revenue of $101.1 million as compared to $112.2 million in the same quarter in 2014.

This finding was a drop of $11.1 million (Vera Bradley 32). Increased prices of leather products in the world have led to reduced profit margins for the company’s products. High taxes for luxury products in Japan have led to high operational costs in the country where Vera Bradley has seven outlets.

Social Factors

Brand loyalty among customers of luxury leather products is a key factor for competitiveness in the industry (Beard 449). Further, since fashion and leather goods have a central function in showing the socio-economic class, they are essential products among consumers.

Hence, a company that provides products that meet clients’ desires is better placed to succeed. Vera Bradley has been able to meet the client’s demands by positioning itself as high-end-affordable products maker.

Technological Factors

Technology is an important factor of success in any company in the 21st century. In line with the desire for effectiveness and efficiency of its activities, Vera Bradley has invested in new ERP systems and supply chain systems to ensure efficiency and effectiveness in its activities. The company has also incorporated eCommerce as part of its strategy to expand its reach of customers.

Environmental Factors

The luxury industry of leather products and related fashions involves the use of leather products. Consequently, it cannot avoid environmental impact. As part of the company’s desire to ensure that it is environmentally friendly, Vera Bradley is involved in various charity activities across the United States. For instance, the company has so far donated more than $50 million towards different initiatives such as cancer research among others (Vera Bradley 45).

Legal Factors

The company works in a highly regulated sector. Hence, it must adhere to all laws and policies that exist. The company must adhere to fair competition requirements, labor laws, and taxation laws among others in the industry.

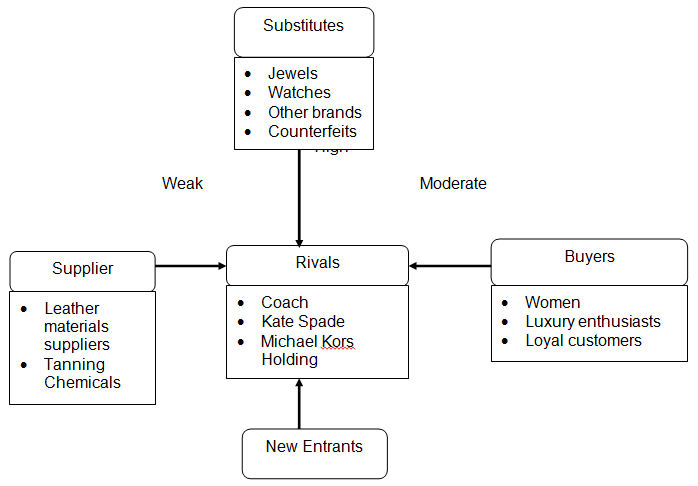

Figure1: Five Forces Analysis

Bargaining Power of Supplier

In the luxury goods industry, companies place a lot of emphasis on quality of the raw materials since such resources have a significant influence on the outcome of the final product. To ensure the quality of raw materials, major luxury goods companies have become vertically integrated by setting up their leather product farms and units (Moore, Doherty, and Doyle 139).

However, Vera Bradley focuses on establishing long-term and reliable working relationships with raw material suppliers. However, leather suppliers are not well organized to reach the final consumer since they do not sell final products (Han, Nunes, and Dreze 12). Hence, they are solely dependent on the luxury goods makers. As such, suppliers have a low bargaining power over Vera Bradley.

Threat of Substitute Goods

The use of luxury leather goods is a self-indulgence driven consumption. As such, it can be replaced by any good or service that addresses the self-gratification and pampering desires of an individual. Substitutes come from other products in the accessories segment.

However, substitutes may include other categories of goods such as watches, jewelry, and apparel among others (Han, Nunes, and Dreze 15). Following the financial crisis of 2007/2008, many luxury goods consumers greatly cut their expenditure of expensive products and opted for quality but affordable magnificent goods.

Other consumers are opting for luxury goods rentals where they rent a given product instead of buying to have a feel of luxury with no intention of owning the product. This plan is a significant threat to the luxury products market. Counterfeits pose the greatest threat to the luxury products goods industry.

Threats of New Entrants

The luxury goods industry is characterized by entry of many new players. In most cases, the only approach that new companies use is endorsement of the products by a celebrity n order to attract new customers (Doole and Lowe 21). However, building a recognizable brand is a long process.

Many luxury goods consumers are loyal to their brands that they perceive to deliver quality and high status at the same time. As such, while the entry of new entrants is easy, establishing a luxury brand identity and acceptance among consumers takes a lot of time. Accordingly, the threat of new entrants is considered very low in the luxury leather goods industry.

Bargaining Power of Buyers

In the luxury goods category, the brand loyalty of individual consumers towards specific brands is a key determinant of which parties or customers have the most influence (Doole and Lowe 36). For instance, most high-end specialty stores such as Saks Fifth Avenue, Harrods, Selfridges, and Neiman Marcus among others have their powerful channels and brands.

In this case, luxury brands or new entrants can access a wide customer base of luxury products. However, in the established brands of luxury leather goods, loyalty is majorly directly related to the brand. If specialty stores do not stock such brands, their image among customers is weakened (Moore, Doherty, and Doyle 142). In developing countries, specialty stores hold a higher bargaining power since they are essential in allowing luxury brands reach the market since the luxury product makers may not have established their operations.

At the individual level, many customers have emotional attachments to their brands. Hence, they have a moderate bargaining power (Teece 174). However, since no individual customer exerts a significant wallet-share, such clients have moderate influence on luxury products.

Rivalry among Competitors

The luxury leather goods industry is highly fragmented at the brand level since numerous brands are differentiated in terms of size, heritage, positioning, and design. Many brands are managed at the individual companies to ensure that they can safeguard their brand DNA and creativity. In most cases, brands have a specific customer base target for their products (Han, Nunes, and Dreze 14).

In addition, despite switching costs being very low for customer, brand loyalty plays an important role in ensure that customers do not switch to other brands. As such, due to loyalty, there is moderate rivalry between brands since players in the industry often seek to serve different and niche customer segment.

Driving Forces Analysis

Several forces drive the success of Vera Bradley in its luxury leather goods business. Firstly, the company has various products that have ensured that it has a strong brand followership. In terms of product innovation, the company has managed to come up with the following products:

- Customized handbags for ladies

- Customized duffel bags

- Signature quilted bags

Lifestyle Branding

Vera Bradley is known for its unique patterns in its customized products that meet the various customer demands and unique lifestyle needs. From luggage bags to handbags, the company understands the customers’ demands since it is actively engaged with the clients in designing new products.

The company serves a wide range of customers’ young girls, college students, young professionals, teens, mothers, and grandmothers. As such, the company has created a niche market for its products by serving the different lifestyle demands of its customers across board.

Demand for Affordable Luxury

The recent economic recession exposed risks of providing only high-end expensive products to customers. More and more people are demanding affordable luxury products. This move is a major driving force in the luxury leather products in the world. Vera Bradley focuses on making affordable yet luxurious products that serve this growing marketing segment.

Key Success Factors

Product

Vera Bradley’s customized pattern designs and high quality leather products have put it as one of the most recognizable luxury brands in the United States. This situation has allowed the company to establish a niche market for its products, which is also evident through the increased customer loyalty in the United States and across the world.

Innovation

The company’s ‘Signature’ quilted luggage bags and handbags among other products demonstrate the company’s innovativeness, which has allowed it to remain successful in the highly competitive market of luxury products.

Employees

The company believes that its employees are the most essential resource. The company has therefore embarked on various programs that are specifically designed towards ensuring that employees are happy and motivated to work.

Distribution

The company has one of the most elaborate distribution channels that allow it to reach its customers in the United States and the world. For instance, the company’s products are distributed across more than 3300 specialty stores in the United States. Further, the business has close to full-price retail stores, at least 30 factory outlets in the USA, and around 10 full-price retail stores in Japan (Vera Bradley 4).

Globalization

In response to the growing needs of a globalized world, the company is in the process of expanding to other markets outside the United States. For instance, the company already has established seven full-price retail stores in Japan. It also has agreements with specialty stores outside the United States to ensure that it can sell its products in countries where it has not established its operations.

Internal Analysis

Financial Analysis

The following is the financial statement of Vera Bradley in the last five years:

Revenues

From 2010 to 2012, the revenues of Vera Bradley rose significantly. However, in the following 2014 and 2014, the company has seen its revenue reduce slightly.

Gross Profit Margin

Gross Profit Margin= (Net Revenue-Cost of Sales)/ Net Revenue. The gross profit margin of Vera Bradley shows that the company is in a good financial health.

Net Revenue Growth Rate

Net revenue growth rate refers to the percentage gain or loss in net revenue over a specified duration. For Vera Bradley, the company’s net revenue growth rate now stands at -4.13% down from 25.31% in 2011.

Current Ratio

Current ratio indicates a company’s ability to pay short-term (5-year) obligations. Vera Bradley’s current ratio is 4.25, which indicates that it is in a strong position to pay its short-term obligations

Return on Assets

Return on assets indicates the level of profitability in terms of how much a company earns from its property. Currently, the return on assets for Vera Bradley stands at 0.1. This figure is very low.

Overall Profitability

The company achieved its highest profits in 2012. However, since then, it has seen its profitability decline gradually.

Resources and Capabilities Analysis (VIRN(E)):

The above table shows that Vera Bradley had some advantages in some areas. However, not all the areas of capabilities were analysed. The company has a highly creative team that ensures it has its unique identity. Further, it has a strong brand, which gives it a competitive advantage.

Weighted Competitive Strength Analysis:

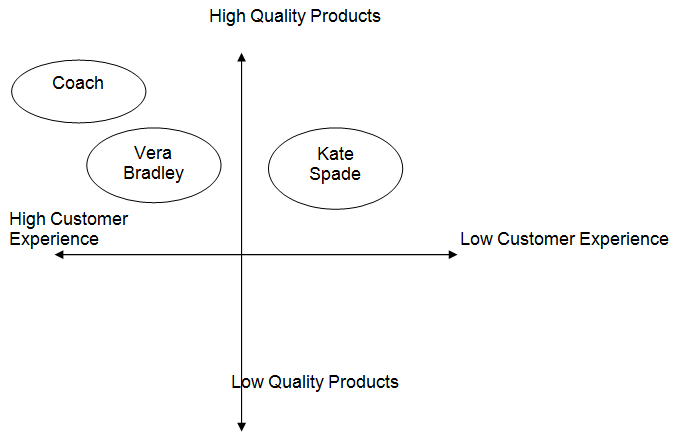

The above table shows that Vera Bradley did not have advantage in all areas that were measured. The company offered the best customer experience among its competitions. However, in terms of product diversification, Coach Inc. was ahead. In terms of price, it matched unfavorably against Coach and Kate Spade.

Figure2: Strategic Group Map

Current strategy

The company’s strategy is focused on three key areas, which are distribution strategy, sales strategy, and personal selling. In the first strategy, Vera Bradley understands that distribution is one of the major factors of business success.

As such, it has focused on ensuring that it has an elaborate and working distribution channel that is backed by regional warehouses for forward distribution. On sales strategy, the company is keen on ensuring that its products are accessible through various channels such as specialty stores, company-owned retail stores, and eCommerce.

Lastly, the company is keen on expanding its company-owned stores to reach many customers and reduce overheads that are evident in its specialty warehouses.

SWOT Analysis

Works Cited

Beard, Nathaniel. “The branding of ethical fashion and the consumer: a luxury niche or mass-market reality?.” Fashion Theory 12.4(2008): 447-467. Print

Moore, Christopher, Anne Doherty, and Stephen Doyle. “Flagship stores as a market entry method: the perspective of luxury fashion retailing.” European Journal of Marketing 44.1/2(2010): 139-161. Print.

Vera Bradley. 2015 Annual Report, Company Annual Report. Roanake: Vera Bradley, 2015. Print.

Teece, David. “Business models, business strategy and innovation.” Long range planning 43.2(2010): 172-194. Print.

Doole, Isobel, and Robin Lowe. International marketing strategy: analysis, development and implementation, Boston, MA: Cengage Learning, 2008. Print.

Han, Young, Joseph Nunes, and Xavier Drèze. “Signaling status with luxury goods: The role of brand prominence.” International Retail and Marketing Review 9.1(2013): 1-22. Print.