Summary

The herd behavior is common in developed and emerging economies. However, herd behavior is more pronounced in emerging economies because of the lack of reliable information regarding the market. There are so many uncertainties involved that investors are wary of the way they interpret information. As a result, they rely on the recommendation of experts and at the same time monitor the activities of other investors. Afterward, they make rational and irrational decisions based on the actions of others. They disregard the results of their own research efforts and rely on the fact that a greater number of investors did the same thing and therefore conformity to a certain group action can provide assurance of sound investment.

Herd behavior may be a common phenomenon in financial markets but it can be argued that the negative effect can easily destabilize an emerging economy. It is therefore important to put up measures to mitigate the impact of herd behavior. There is a need for transparency in governments. Investors must be assured that economic data coming from the government were never manipulated to paint a rosy picture of the economic climate. At the same time, trading barriers must be in place in order to automatically shut off trading activities if the presence of herd behavior is detected.

Introduction

The stock market will never be free from herd behavior which is the tendency of investors to follow the impulsive buying and selling of others (Wang, 2008, p.1). This is an instinctive behavior common in many organisms. It is based on the idea that there is strength in numbers (Lao & Singh, 2010, p.2). Thus, it is a common tendency in every market that deals in stocks, regardless if the said market is located in France, Germany, China, India, the United Kingdom or the United States. Herding is evident in developed financial markets as well as in those in the emerging financial markets. However, it can be argued that herd behavior is more pronounced in emerging markets as compared to the more developed markets of highly industrialized regions found in the West.

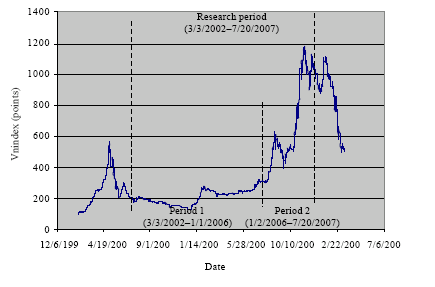

The herd behavior observed in emerging markets follows the same cause and effect patterns. Nevertheless, there are major differences. One of the often highlighted causes of herd behavior in emerging markets is the absence of reliable data that are needed to make accurate predictions regarding the growth and decline of a particular company. There is also a pronounced absence of data with regards to the overall behavior of the emerging market making it difficult to figure out cycles of robust growth and sharp corrections in the said market. A closer examination of the Vietnamese Stock Index from its date of establishment in 2002 until 2008 revealed that there are significant fluctuations (see Fig.1). The fluctuations can be linked to uncertainty in emerging markets such as in Vietnam.

Information is the lifeblood of investing. Investors must have access to reliable information in order to develop an efficient decision-making process. Investors must rely on publicly available information to make decisions. From this point forward, investors must conduct research in order to verify the information and determine how to invest in such a way that a competitive advantage can be created.

It is important to determine if there is indeed the existence of the herding phenomenon wherein investors simply jump on a bandwagon and disregard the use of conventional marketing analysis tools to make accurate decisions. Once a confirmation has been made regarding the existence of a herding phenomenon among investors, then it is time to figure out the various reasons why herd behavior is inevitable especially in emerging markets.

It is also important to find out the effect of herd behavior. An overview of the mechanisms involved in financial markets suggests that this particular behavior guarantees instability. An unpredictable financial market with too many sharp twists and turns can never induce investor confidence. It is therefore important to negate the impact of herd behavior. A careful analysis of the problem is the first step in developing a cure but in order to implement a long-lasting solution, it requires the help of various stakeholders from policymakers, market regulators, business leaders and investors.

Herd Behavior

In theory, investors are guided by the principle of maximizing profits using rational means (Demirer, Gubo, & Kutan, 2007, p.2). But there are times when it is difficult to follow an investor’s own assessment of the situation. As a consequence, investors rely on their ability to mimic the actions of others. It can be a desperate attempt to counteract the effect of a major crisis. It must be reiterated that the herd instinct is very much evident among animals that live together as a group. The herd instinct is a survival instinct based on the idea that there is strength in numbers. It is also based on the idea that two heads are better than one and therefore a significant number of people deciding to buy a commodity can never be wrong all at the same time.

A thousand people desiring after one thing makes the object of their pursuit highly valuable. In other words, human beings are not supposed to pursue something that has no value. But what if the behavior is not based on a rational analysis of available information? In this case, decisions are made based on instinct and do not reflect the actual value of the stock or the overall performance of a particular financial market. In other words, stock can be overpriced and at the same time, it can be undervalued. The sudden upsurge in the market can create a bubble that can be beneficial for a short period of time but the long-term effect can be disastrous. A negative outflow of capital investment can easily lead to a financial crisis.

In theory, herd behavior is not expected when it comes to institutional investors. They have “immense resources and professional teams to gather and analyze information and make trading decisions based on specialized knowledge” (Shyu & Sun, 2010, p. 2). Nevertheless, herd behavior is still evident especially when it comes to extraordinary developments in the market.

Herding when it comes to the financial markets is defined as the tendency to mimic the decisions made by other investors (My & Truong, 2011, p. 51). This type of behavior is made evident in an environment characterized by high uncertainty (My & Truong, 2011). In emerging markets, there is high market uncertainty. There is therefore a logical explanation why analysts probing the intricacies of herding behavior have observed this particular phenomenon in emerging markets. Here is a clear explanation as to why emerging markets are prone to herd behavior:

Herding is stronger in emerging markets than developed ones. This finding is not altogether surprising. Investors in emerging markets often find it too difficult or expensive to gather and collect the information, required to conduct fundamental analysis, whereas observing and imitating other investors’ decisions is relatively easy and cheap. Herding of this speculative nature is, therefore, more common in emerging markets (Wang, 2008, p.1).

The herd behavior is usually the direct result of overdependence on exports. Investors seek advice from experts and many of them blindly follow what they have to have heard regarding a particular scenario (Lai & Lau, 2004). In an ideal situation, investors are supposed to work hard with regard to the research aspect of their jobs. But once again, it is easier to rely on the work of others. It is easier to listen to what experts are saying regarding a particular market trend.

It is also important to point out that one feature of herd behavior is the speed at which decisions are made. The rapid decision-making process can be attributed to the fact that in “human society, people who communicate regularly with one another think similarly” (Lai & Lau, 2004, p.1). In other words, investors in a given area are aware of the same thing and they process the same type of information. Thus, it is easier for them to recognize a pattern, especially when it comes to the increasing price of a stock or the rapid devaluation of the same.

One of the best examples of herd behavior in the context of financial markets is the crash that occurred on Wall Street on October 19, 1987 (Lai & Lau, 2004). In the said event the Dow Jones Industrial Average fell sharply in a matter of seven hours. But what makes this event important to this discussion is that the stock market rebounded the following day as if nothing had happened. Investors later revealed that they reacted to each other during these crashes rather than “responding to hard economic news” (Lai & Lau, 2004, p.1). This piece of information is evidence that when herd behavior is evident, investors are not relying on a scientific assessment of economic information but simply reacting to the behavior of analysts and other investors.

Herding behavior is directly linked to information that can be obtained by analysts and investors. Investors and stakeholders decide based on the quality of information that they have access to. But they also make decisions based on the unavailability of relevant information. It has to be made clear that information used for decision-making purposes is public. Information regarding a particular stock must be public or else the investor can be charged with insider trading. Nevertheless, investors develop their “private information” by conducting their own research regarding a company (Bikhchandani & Sharma, 2000, p.6).

It is through the course of research that investors discover something that made them decide to buy or sell a particular stock. It is the lack of access to this “private information” that forces other investors to follow closely the actions of other investors. Although they have no way of knowing what the other person is thinking they can always follow what he is doing. The lack of access to quality information can create insecurity in the decision-making process. This is exacerbated by the presence of public information that may require a verification process before investors can be certain of the quality of the said information.

Consider for instance the economic data released by the government. In an emerging market, there is a possibility that the government doctored the economic data (Bikhchandani & Sharma, 2000, p.5). Thus, there is a great deal of uncertainty. If one compares the situation to a developed economy the investors are less certain of their position. They needed assurance from other investors and analysts regarding the correct assessment of the financial market in that particular emerging market. They will begin to monitor the actions of others because that is the only way for them to indirectly determine if they know something that is not obvious to others. It can therefore be argued that uncertainty can be reduced if public information can be trusted. Uncertainty can also be reduced if the government in question is more transparent with regard to the information describing the true state of the economy.

The herd behavior is usually associated with foreign investors (Ornelas & Alemanni, 2008, p.2). They can easily bring instability to a particular emerging market the moment they begin to act like a herd when it comes to the entry and exit of capital. It may be a reaction to news about the economy and other factors but just the same it can easily create a crisis. It is important to point out that there are three generalized scenarios wherein herd behavior is usually present. The first one is linked to the period described as high trading (Economou, Kostakis & Philippas, 2010, p.12). The second one is characterized by low trading (Economou, Kostakis & Philippas, 2010, p.12). The other one is characterized by market volatility (Economou, Kostakis & Philippas, 2010, p.12). It is easy to understand why investors tend to exhibit behavior during these times. Herd behavior provides false assurance regarding the future performance of a particular stock.

Cause and Effect

The specific mechanism that creates herd behavior is similar to the factors that are present prior to the creation of a bubble. The first thing that happens is that investors speculate and as a result, the price of a commodity is pushed higher and higher. Stock prices increases and at the same time, it creates its own success story. Investors are attracted to this kind of information. At this point news travel by word of mouth and more people are sucked into the false idea that a particular stock is more valuable than it really is. Thus, there is a need to interrupt the positive feedback to provide a more accurate picture of the market but if there is none then it can easily produce a speculative bubble (Lai & Lau, 2004). The advice of experts and other professionals played a significant role in changing the perspective of investors and made it easier for them to make a decision to buy or sell even if the information that they possess does not warrant such actions (My & Truong, 2011, p.52).

In the case of the Vietnamese stock market, the tendency for herding behavior is intensified due to the following conditions: 1) weak reporting requirements; 2) poor regulations; and 3) low accounting standards (My & Truong, 2011, p.52). In addition, another common feature of emerging markets is “the absence of historical equity market data that are informative of future asset returns” (Calvo & Mendoza, 1997, p.4). It must also be pointed out that the main motives in herd behavior are: a) imperfect information; b) concern of reputation; and c) compensation structures.

Investors must also be wary of analyst recommendations (Loh & Stulz, 2011, p.1). It is important to consider the conclusions provided by analysts but it is much better if a particular investor personally verifies information regarding a downgrade or a bleak outlook. It is also important to consider that a recommendation coming from reputed analysts can trigger market volatility.

There is a great incentive to prevent the occurrence of herd behavior in financial markets. The 1987 Wall Street crash was attributed to this phenomenon (Lai & Lau, 2004). According to another report, “The herd behavior that existed in the South Korean market may have eventually contributed to economic instability there, culminating in the Asian financial crisis of 1997 (Wang, 2008, p.1).

Here is another reason why herding behavior must be opposed: “In the asset pricing context, herding may cause stock prices to deviate from their fundamental values. As a result investors are forced to trade at inefficient prices” (My & Truong, 2011, p.52).

Investors and herd behavior can singlehandedly weaken an emerging economy (see Table.1). Although herd behavior must be made non-existent in the global financial world there is an urgent need to develop strategies to prevent herd behavior in emerging markets. A financial crisis can easily cripple the economy. It is of great importance for various stakeholders to come together and develop strategies to prevent herd behavior in emerging markets. Consider for instance the following information regarding the ability of investors to transfer foreign investment from one country to the next requires a clear set of regulations.

Table 1: The effect of a financial crisis in an emerging market

Mitigating Impact

The ideal solution calls for a mechanism that can create appropriate feedback for the investors. The expected effect will help warn investors that there is a trend that is building towards a speculative bubble. Based on the negative outcome of herd behavior investors will find it prudent to heed such warnings. The only problem is that there is no way to develop such measures without creating a highly regulated system. Although financial markets can be regulated there can be no laws that can compel investors to report everything that they have done.

It is the nature of a free-market economy that enables the creation of financial markets. It is the principles of free enterprise that enable competition. As a result investors can make money through buying and selling of stocks. Without this capability, a financial market is impossible. However, the same principles that allow for growth and financial breakthroughs are the same principles that call for the absence of central control. In the absence of a centralized controlling authority, investors and various stakeholders are given the freedom to do what they believe is for the best interest of many people.

It is difficult to go against herding because the investors are merely doing what they perceive to be the best action that will produce the greatest benefit for their clients. It is quite a different story if investors willingly participate in a scheme that defrauds their clients and other stakeholders. If it can be proven that the actions that resulted in herding behavior were a calculated approach then they can be reprimanded and punished severely if they broke the rules.

However, in most cases, herd behavior is not a direct transgression of investment rules. At the same time, it must be pointed out that “the behavior of funds is complex and cannot be explained by simplistic rules” (Borensztein & Gellos, 2000, p.4). Nevertheless, there are certain practices in the market that requires more extensive investigation. Authorities must look into practices employed by investors such as positive feedback trading, a system of buying and selling stocks characterized by the following actions: “buying those assets whose prices have been rising and selling assets whose prices have been falling … this behavior can be the result of extrapolative price expectations, collateral or margin calls, dynamic hedging, or other strategies that prescribe automatic selling or buying in reaction to price movements” “Borensztein & Gellos, 2000, p.6). This system of buying and selling can be lucrative and therefore a tempting proposition. Ideally, it must not be used but investors can arrive at the same conclusion regardless of the tools used for assessing the financial market.

It is therefore extremely difficult to monitor the activities of investors in order to stop herd behavior. Investors can easily explain that they simply acted on the information available to them. Nevertheless, more stringent measures must be in place in order to increase investor confidence that a particular emerging market is not going to cave in from uncertainty.

According to one report, the 1994 Mexican financial crisis resulted in the clamor for capital controls, taxes and other barriers to asset trading (Calvo & Mendoza, 1997, p.1). However, it will not take long to realize that capital controls can be controversial and difficult to implement without risking the integrity of the whole financial market. However, other control measures can be adopted from other financial markets. In the New York Stock Exchange “there are automatic trading halts that go into effect when stock prices fluctuate too much within a single trading session” (Calvo & Mendoza, 1997, p.1). This is a model that can be used by stock markets in emerging economies. They can provide effective feedback to investors informing them that possible herd behavior is in effect. At the same time, it provides a way to stop investors from destabilizing the market and create a chain-reaction of events that can lead to irrational decisions that they will soon regret.

As mentioned earlier, the existence of government interference can be viewed as controversial in a free market enterprise. The move to provide more stringent measures regarding the trade-in stocks may not be popular but it is justified. Consider for instance the negative impact of a significant capital outflow as a result of a mere rumor. In the case of the Mexican financial market, researchers were able to discover that capital outflows as a result of herd behavior can reach as high as $15 billion. There is no need to elaborate on the fact that this type of capital outflow can easily destabilize the economy.

Conclusion

It is important to develop strategies that can help mitigate the impact of herd behavior. Nevertheless, it must be made clear that regulating the stock market is a double-edged sword. It can help prevent anomalies but at the same time, it can create an environment that is unattractive to investors. International investors demand the freedom to move in and out of a particular emerging market considering the fact their particular economies are volatile as compared to developed markets. On the other hand, international investors must realize that by playing by the rules they help develop an emerging economy so that it can reach maturity and stability. One of the best examples of effective controls is the use of a trading barrier that halts transactions whenever a rapid decline in the sales of stocks has been detected within a single day. It may not be a perfect mechanism for control but at least it can send feedback to investors that the present valuation of the market is not based on sound economic fundamentals but herd behavior.

References

Bikhchandani, S., & Sharma, S. (2000). Herd behavior in financial markets: a review. Web.

Borensztein, E., & Gelos, R. (2000). A panic-prone pack: the behavior of emerging market mutual funds. Web.

Calvo, G., & Mendoza, G. (1997). Rational herd behavior and the globalization of securities markets. Web.

Demirer, R., Gubo, D., & Kutan, A. (2007). An analysis of cross-country herd behavior in stock markets: a regional perspective. Web.

Economou, F., Kostakis, A., & Philippas, N. (2010). An examination of herd behavior in four Mediterranean stock markets. Web.

Lai, M., & Lau, S. (2004). Herd behavior and market stress: the case of Malaysia. Web.

Lao P., & Singh, H. (2010). Herding behavior in the Chinese and Indian market. Web.

Loh, R., & Stulz, R. (2011). When are analyst recommendation changes influential? Web.

My, T., & Truong, H. (2011). Herding behavior in an emerging market: empirical evidence from Vietnam. Web.

Ornelas, J., & Alemanni, B. (2008). Herding behavior by equity foreign investors on emerging markets. Web.

Shyu, J., & Sun, H. (2010). Do institutional investors herd in emerging markets: evidence from the Taiwan stock market. Web.

Wang, D. (2008). Herd behavior in stock markets: variable and cyclical. Web.