Background

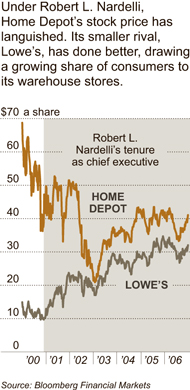

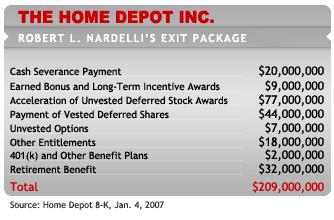

In the case surrounding the former CEO of the Home Depot the stock prices fell up to 8% under his six year tenure and during the same years he received more than $240 million as his compensation package. However the Robert Nardelli resigned 1st January 2007 but not before taking an exit package that was worth approximately $210 million dollars. Such a huge exit package was however made possible thanks to his employment agreement policy with the Home Depot Company which Robert entered into when he was hired by the company in the year 2000.

This form of employment contract with the company is a binding legal agreement that is very difficult if not impossible for the company to break or even revoke and it is very common in very many other corporations. On the other hand the employment agreements clearly spell out what a chief executive officer will eventually receive as his compensation package and it also at times guarantees payment regardless of the executive’s performance. James R. And Chris W. (2007).

In the case of Robert Nardelli among his other benefits his employment contract called for his annual salary of approximately 41.5 million dollars, an annual bonus of approximately $3 million dollars, an annual stock option grant that is approximately 450,000 shares as well as a grant of his deferred stock units that was corresponding to 750,000 shares the stock and this was regardless of his performance in the company. On the other hand his employment contract also predetermined how much compensation he would eventually receive in any possible termination scenario before the end of his working tenure.

In Nardalli’s case of his recent resignation a part of his employment agreement stated that he would receive $20 million dollars in cash severance and the agreement also called for an accelerated vesting of options and the differed stock awards which he received throughout his employment in the Home Depots Company. The 40% of his $210 million dollars in his exit package or even the $84 million was for the reason that there was an acceleration vesting in the options as well as the stock awards.

A large part of this amount also consists of the annual compensation that was guaranteed by his contract. To make the matters worse he received a stock options grant during the brief market slide that was shortly after the 2001 terrorist attacks in America and this however broke the company’s regular pattern of the issuing options. By granting the stock options during a period of a temporary decline in the stock prices can further result into a windfall profit that is unrelated to the company’s performance.

The Home Depot Company further revealed that the American securities and exchanges commission initiated an informal which is related to the past stock option grants. The backdated stock options from the year 1981 to the year 2000 resulted in the $200 million in the overstated earnings. The backdating that ended in the year that Robert became the chief executive officer of the Home Depot company even though an internal review further concluded that there was no wrongdoing by the board of directors or even the current management but it does not clearly state who was responsible. Michael B. (2007).

The ethical problem

Ethical norms are the moral standards that help us judge good from bad or right from wrong and living morally. They involve articulating the good habits or character that we should have, the consequences of our behavior on us and others and the duties that we are supposed to follow. It is very unethical, for the Home Made Company to provide the former chief executive officer with the severance parachutes.

This is because he failed to maintain the growth that the company had previously experienced and this pointed to his huge salary as a sign that he was meant to bring in new innovation to the company so as to help maintain its historical growth. It is however unethical when an individual is paid a hefty salary or even a severely parachuted compensation package and they do not bring in any positive results to the company.

This means that the former chief executive officer was paid for the work which he did not even perform since after his employment the company’s growth declined and it also failed to maintain the substantial historical growth. Robert Nardelli was also very unethical since he was a very blunt and critical manager who turned off his employees and his compensation package that earned the investors fury. In the year 2006, a lot of questions were mounting concerning his leadership and he then directed the company’s board of directors to skip the company annual meeting which was unethical.

He also forbid the shareholders from speaking more than one minute by using very large digital timers. His unethical behavior in the meeting with the shareholders as well as the showdown over his compensation package further caused the board of directors to oust him in January 2007. Even though his compensation was based on his employment contract and it was compliant to the laws rules and regulations it was ethical that his compensation be based on his performance since he was employed by the company.

It was also unethical for him not to answer the shareholders questions but rather evade them so that they can then become informed on issues which pertain the company’s operations. Therefore, he concealed very crucial information that was needful to the shareholders and he also did not act in a transparent manner and therefore he lost confidence with the shareholders as well as the public.

It is also unethical that the company paid its stock holders less in returns after seeing an increase in revenue and profit. This is because the corporation should not only use the stakeholders to basically maximize the company’s profits but the corporation should understand that the company’s relationship with the shareholders is highly based on the moral, normative as well as commitment.

It is also very unethical that Nardelli went to the previous shareholders annual meeting as the only board member present and he did not even give a speech as he also refused to answer questions from the stakeholders. This highly frustrated the 50 or even more shareholders who had shown up for the meeting and this prompted the relational shareholders to urge the company to re-evaluate its strategy on the management team performance.

It is also notable that Nardelli replaced several executives in the company with his former colleagues as he also implemented the top-down management. This move was very unethical since there were no proper rules or even procedures that were used by him in recruiting his former employees. Similarly, his recruitments meant that some of the employees in the Home Depots Corporation had to either lose their jobs or be transferred to other departments without their consent.

The theoretical approach

Edward Freeman’s Stakeholder theory

The stakeholders theory by Edward freeman identifies and also models the groups which are the stakeholders of a company and it also describes and recommends the methods by which the company’s management can give due regard to the interests of such groups.

Since the shareholders of the Home Depot are the owners of the company the corporation therefore has to put their needs first so as to increases the value for them. In the stated case the shareholders needs have not been put first and their opinions are not relevant in any way according to the former CEO of the company who did not give them any opportunity to ask him any questions.

It is very important that the company converts the investors, employees and suppliers inputs into salable outputs that the consumers buy thereby returning some capital benefit to the company. According to this theory the Home Depot Corporation should address the needs of the investors, the suppliers, the consumers and also the employees. On the other hand, according to this theory the company management should know that it has a fiduciary responsibility to its stakeholders and that the corporation is a very important tool for immortality that was not displayed in Robert Nardellis case.

The corporation according to this theory in addressing the issue ought to instigate on the doctrine of the fair contracts whereby the principles of entry as well as exit are clearly defined according to the general acceptable ethical standards. Secondly the corporation should have the principle of governance whereby there are set rules of the game which have been set by the unanimous consent which did not happen in Roberts case. Donaldson, T. & Preston, L. (1995).

On the other hand the corporation should also apply the principle of externalities where whereby if in any case the affected want the contract can be renegotiated. In the case of the former CEO of the corporation Robert Nardellis since the shareholders were the ones who had been highly affected by the compensation package his contract could have been renegotiated.

Adam smith’s theory of moral sentiments

Smith more specifically divided his theory into two moral systems and they were:

- The categories of nature of morality which included the prudence, propriety and benevolence.

- The categories of the motive of morality which include reason, self-love and also sentiment.

In relation to the case involving the hefty compensation package of Robert Nardelli the theory of moral sentiments asserts that there are some principles in his nature that interested him in the fortunes of other people. The compensation package rendered him a lot of happiness that was very necessary to him even though he did not derive anything from it except the pleasure of just seeing it. Bonar, J. (1926).

According to this theory Robert did not have any immediate experience of what the other people thought or felt about the pay and therefore no idea can be formed in the manner in which he was affected. Since the theory claims that man is not capable of forming the moral judgments beyond a limited sphere of activities that are centered on his personal interest Robert was not able to form any moral judgment on the compensation issue. Morrow, G. (1923).

The business response

First and foremost, the corporation should be highly committed to the ethical relationships which exist between the shareholders and the corporation irrespective of their expected benefits. This will however make the shareholders gain more confidence in the company’s management since there will be a lot of transparency.

Secondly, the corporation in response to the issue need to create as well as sustain the relationships that exist between the company the stakeholders and they should further be based on the mutual trust and also corporation. This will make the corporation have competitive advantage over its competitors. Berman, Wicks, Kotha, Jones. (1999). Thirdly, in addressing the issue the corporation should however make a strategic commitment to mortality and thus ethical principles will be applied in the company’s operations.

On the other hand the company should also shape its strategies around certain moral obligations so as not to have a repeat of the Robert Nardellis case. The corporation should also beware that its decisions highly affect the outcomes of the stakeholders such as in the case that is being discussed. The corporation should also not ignore or even abridge the claims that the shareholders are of very instrumental value to the corporation by simply honoring them as this does not serve the strategic interests of the company.

The company should also know that the interests of the shareholders form the basis or the foundation of the company’s corporate strategy which represents what the shareholders is as well as what they stand for. Berman, Wicks, Kotha, Jones. (1999). In responding to the issue the corporation should also understand that the company’s relationships with the shareholders is highly based on the moral, normative commitment other than on a sole desire to use the stakeholders to basically maximize the company’s profits.

On the other hand, in responding to the issue the corporation should have a strategic change in its operations especially when it comes to the compensation of the CEOs such that they should be compensated as per their performance in the company.

The corporation should also converts the investors, employees and suppliers inputs into salable outputs that the consumers buy thereby returning some capital benefit to the company. On the other hand, the company should have employment agreements which clearly spell out what a chief executive officer will eventually receive as his compensation package and it should also at times guarantee payment based on the executive’s performance.

References

Bonar, J. (1926): The Theory of Moral Sentiments by Adam Smith, Journal of Philosophical Studies, vol. 1.

Morrow, G. (1923) The Ethical and Economic Theories of Adam Smith: A study in the social philosophy of the 18th century, Cornell Studies in Philosophy, no. 13.

Berman, Wicks, Kotha, Jones. (1999): The Intrinsic Stakeholder Commitment. Academy of Management Journal; Vol. 42 Issue 5) using earlier work of Edward Freeman is a Normative Approach.

Michael B. (2007): Embattled Chief Executive Resigns at Home Depot. New York.

Donaldson, T. & Preston, L. (1995): The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review, v 20.

James R. And Chris W. (2007): Nardelli out at Home Depot. USA today.