Introduction

Everybody wants to own a decent house at an affordable price that too in a place adjutant to their office, schools and hospitals. No doubt, superior quality with reasonably priced housing offers secure and stable family lives. Any one would be happier, healthier, and richer when one has affordable decorous homes proximate to healthcare, schools and transport links.

Superior and affordable housing can perk up one’s social, economic and environmental well-being. It assists to foster superior communities that can draw skilled workers and investment. During the sustained economic stability and growth phase in UK, more than million people were able to own their own house thanks to the lesser mortgage rates.

However, UK house price have plummeted by more than 20 percent from the highest price it enjoyed in August 2007 during 2008. There are many reasons that can be attributed for this sudden fall in house prices. This research essay analyzes the changes in house price in UK over the last two years and predicts what is likely to happen to the market over the next year or two.

Analysis

In economy, there is always co-relationship between consumer spending and house pricing. According to Attanasio et al, house prices do not have direct independent impact in explaining consumption behaviour whereas Campbell and Cocco is of the opinion that they play a larger role. Quigley and Schiller find empirical evidence of a housing wealth impact without having regard to common factors where as Aron and Muellbauer is of the opinion that a major portion of the earlier correlation was responsible for variation in common casual factor. (UK Budget 2008: P.162). In rising house prices scenario, house owners may have a feeling of pride due to increase in their networth substantially and hence will be spending more on consumption.

It is to be remembered when UK experiencing a fall in house prices, it fosters a negative impetus thereby causing house prices to keep declining. When house prices are declining, it creates a negative sentiment towards purchasing a house as it makes investor to follow wait and watch approach. During recent recession, UK witnessed a sharp decline in interest rates. In such scenario, those who wish to avail a variable mortgage for purchasing a house seems to be more fascinating for residential purpose than renting.

House price data released by Halifax during January 2009 indicates that UK house price have plummeted by more than 20 percent from the highest price it enjoyed in August 2007. It has been predicted that UK housing market is anticipated to fall by a minimum of 15 percent during the ensuing 2 years. This decline is going to be increased by 25 percent in the near future despite of the fact that UK is going to organise the 2012 Olympics. As per the Royal Institute of Chartered Surveyors (RICS), the UK’S current housing market is witnessing a meltdown on countrywide basis. In the last three decades, house prices are declining at lighting speed in U.K.

According to British Bankers Association (BBA), there has been a sharp decline in the quantum of mortgages sanctioned in July 2007 for the purchase of houses to 17772 as against 64,015 which is equivalent to decline of 72%. Further, there was a decline of 50 percent in the loans for equity withdrawals as has been borrowed by homeowners to spend on housing. Due to this, the overall quantum of mortgage loans outstanding has fallen by £35 billion.

Likewise, the supply of housing loan also witnessed a sharp decline as it plummeted from 159,599 houses in June 2007 to£116,699 houses in 2009. There has also been sharp downfall in mortgage contracts due to tightening lending criteria. There has been increase in the remortgaging due to deep interest rate cuts despite of the fact in some cases penalties have been levied in case of remortgaging. One another reason for the decline in the house prices in UK is the disinterest shown by the ailing mortgage banks which are reluctant to lend to new mortgage loan to customers and this has made the prospective home buyers have to pump in at least one-fourth of purchase price as equity.

Due to recent mortgage crisis, lending to housing has been tightened as it requires a minimum of 25% by way of deposits. Further, salary eligibility has also been considerably increased and this has led to less demand for houses in UK. This has forced the house price in UK to drop further by 20 percent.

UK has been an attractive investment centre for the OPEC nations as it witnessed massive petro dollars investment in UK housing sector in the past. Due to crash in oil prices in 2008, there has been decline in the influx of petro dollars from Middle East and this has been cited as one of the reason for the downfall in housing price in UK. (Walavat 2009)

Crash in house prices varies from place to place in UK. On overall basis, the house price fell by 15.6% in North, 17.5 % in the South in the 12 months period ending March 2009. Northern Ireland witnessed a massive crash in house price of 30% year on year basis whereas Wales reported 8.2% cross and Scotland reported about 12.5%. (Hickman 2009).

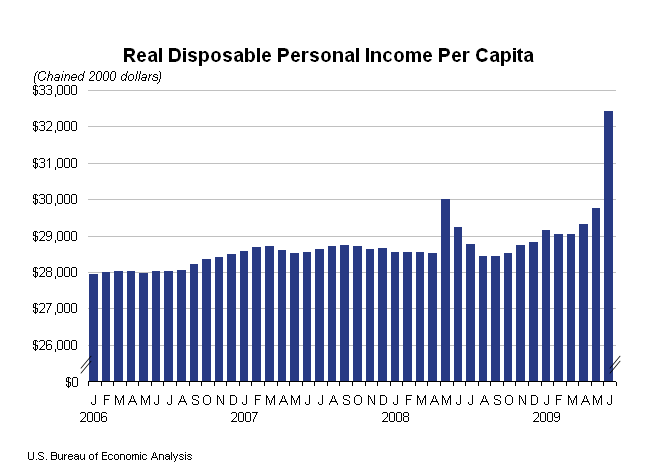

Real disposable income in UK was £ 28,000 in January 2006. It has increased to £ 32000 in June, 2009. There is an increase of 14% in disposal income of UK citizens. However, due to abnormal increase in unemployment due to global recession, the fall in income of individuals led to fall in housing prices.

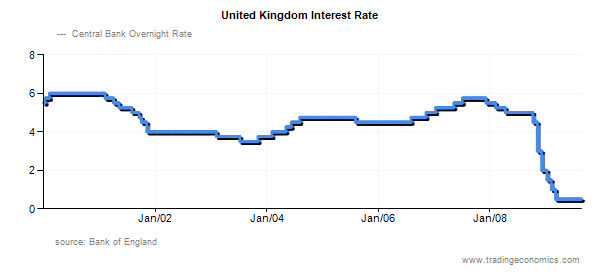

The interest rates touched the peak of 5.75% in September 2007 now has fallen and remained at 0.50% at August 2009. This has created direct impact on the housing market as lending has become unprofitable due to low interest rates that exist in UK from March 2009 to till date.

Table 1:Trend in All house prices in UK.

Housing Demand

An increase in the real income levels of consumers may push the house prices to upwards. Likewise, if there is a substantial increase in the substitute products, then the demand for the original products will increase. For instance, if rental rates are being increased, consumers started to plan to have own house rather than renting it out. Likewise demand for housing will also be affected when there is a transformation in the consumer’s penchant towards owning a home.

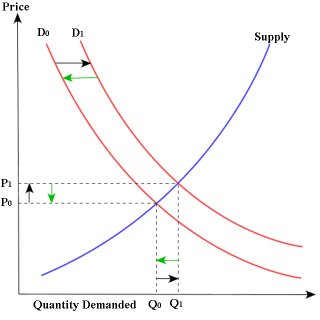

When the demand for housing in UK moves back , the quantum of house demanded declines back to Qo – but housing is being impacted by sticky prices and hence , housing prices only declines slowly to Po.

According to RICS, there has increase in the number of unsold houses which is a ten-year high. Since 1989, the number of unsold houses has reached to alarming rates in 2008. Due to heavy stock pile of unsold houses, the purchasers are negotiating with sellers for heavy discounts in the house prices. Further, as per RICS, the fall in the house price is moderate in Wales and London is at modest pace whereas there were sharp fall in house prices in Humberside, Yorkshire and East Angila. There has been a decline in demand for the houses in general in UK due to tighter lending parameters and due to prevalence of uncertainty of economic scenarios.

Construction industry has warned the UK government that there will be loss of thousands of jobs in construction industry unless there has been intervention by government in the form interest rates cuts.

The recession in the housing market in UK has already affected many companies engaged in the construction activities. For instance, Bovis’s was down by £ 12 million in revenues by the year end 2008 and it has sold less 193 homes in 2008 as compared to its previous year.

In the housing crash that occurred between 1989 and 1992, construction workers were able to get jobs in commercial property market. However, during this current recession, both housing and commercial property sector were badly affected and hence there was a sharp job loss in the construction industry in UK. In anticipation of a severe year’s trading ahead, Bovis has reduced its borrowing to just £ 44 million, connoting gearing at an historic low of just 6 %. (Gilmore and Rossiter 2008).

As per RICS , since 2003 , the rental market in UK is witnessing a decline which is proving to be disastrous to landlords as it may compel tenants to force landlords to ask not only for deflationary remission in rents but also to compel for freeze on rents. The house owners have no other option except to accept the request as they may incur capital loss if they try to dispose their assets in the falling markets. Hence, the buy to let housing investors will be probably losing a great sum of money on each property every month till they prolong to hold such loss making investments.

The demand for the houses for rent by Eastern European Union workers are also diminishing as these workers are deciding to migrate back to their home nations in the event of ever increasing recession in UK. These developments have added more fuel to fire to the buy to let investors as they now burning their fingers by investing in the housing market in UK. (Walayat 2009).

There have been two-fold increase in house prices in UK in factual parlance in the last ten years. The present mean cost of houses is in excess of £210,000 which is higher by 8 times of the average salary drawn by an UK citizen. This has resulted in more complexities for young generation and families who wish to purchase the houses for their own purpose. Though construction of more houses is the need of the hour to gear up for long run affordability forces, more support is required to assist younger generation and families over the next few years. Since 1997, there has been more focus on enhancing the eminence of social housing as it is obligatory on the part of UK government to build up more reasonably priced houses both to buy and to rent, by taking into account the ever increasing requirements of family housing. Housing associations, the private sector and the local officials will have now fresh chances to construct and administer new homes also.

The last decade has witnessed doubling of prices of houses and if UK government neglect the increasing need for more houses, it will result in broadening of wealth inequality, aggravated objectives and damage to our economy.

Interest Rates

For determining the mortgage rates, the cost of borrowing the money and the capacity to repay the loans plays a vital role. As increase in interest rates may make the repayment of mortgages to become more costly and the chances of home loan repayment default becomes more possible. It is to be remembered that there were high levels of interest’s rates during the earlier house price decline both in 1973 and in the early 1990’s. The chances of further interest rates decline in the future may assist to stabilise a declining housing market but the UK government Monetary Policy committee’s capability to announce interest rate cuts may be diluted if inflation augments. Further, the real effect a reduction in base interest rates has on household’s capability to repay mortgage payments rests on the degree to which such mortgage bankers pass on the reduction to loan takers especially for interest –only or new fixed rate mortgage loans. It is to be recalled the majority of lenders have not passed on the interest rate cuts to their fixed rate deals in various instance whenever Bank of England announced a cut in the base interest rates.

Future Initiatives

UK’s Prime Minister recently revealed UK government initiatives for offering of thirty lakhs new house by 2020 that offer homes to needy residents which mirror the varied requirements of all of UK’s residential districts. It is to be noted that the housing stock is increasing by 1.85 million per annum, the quantum of houses that being offered for those who are living alone is estimated to nurture at 2.23 million per annum. UK government is having plans to deliver about 20 lakhs houses by 2016 and 30 lakhs houses by 2020: UK government is estimating that housing provision will increase over period towards the 2.4 millions per annum mark in 2016. By taking this into account, UK is planning to deliver about two million new homes by 2016 and progressing at around 2.40 million houses per year over the succeeding forty-eight months and to offer an additional million new homes before the end of2020. To fulfil this objective, the Housing Corporation of UK is investing about £2.3 billion to offer about 6,301 homes in tiny villages and cities through its 2006 to 2008 plans. (Budget 2008).

In UK, the rural areas consist of more than half of local boards with the uppermost home price to income percentage. Besides, about 12.5 % of houses in rural provinces are social homes for rental purposes as contrasted to 21% in urban provinces. In spite of higher average incomes than compared to urban households, roughly about 32.1% of country families have rental revenues of not more than 61% of the English median. In UK, Rural district officials get a fair allocation of reasonable housing investment. Unfortunately, majority of the outlay goes into the town provinces rather than to rural areas. It is imperative that regional and local deliverance agencies engross with country communities and people to recognise “rural reasonably priced homes” requirements and act in association with distribute houses where they are required in top priority. (Budget 2008).

Currently, in UK, buyers are being recommended to avail an equity loan of up to one-fourth of the price of property which can be availed from any one of the four participating lenders. However, UK government is of the view that existing housing products are not adequately supple especially for the new home buyers. Moreover, UK government do aware that this scheme is not presently flexible enough. Hence, it has been decided by the UK government that from 23 July 2008 onwards, it will be extending a “new 17.51% Government Equity Loan product”, which home buyers will be able to employ in combination with a credit from any lending institution. (Budget 2008).

It is to be observed that when consumers purchase homes they are in general making one of the major fiscal choices of their lives. Though owning a house can offer many advantages, there are also perils affiliated to it. These comprise the major perils like sudden decline in house prices, increase in interest rates or discontinuance of flow of income as a member of the household may become unemployed or might die in middle tenure of the loan. For instance, at the very high end to cover some of these risks, financial insurance can be available by house purchasers. (Budget 2008).

Future Expectation

Housing Market depression and UK Mortgage Banks

Northern Rock bank was worst affected due to housing market turmoil and prospects of its survival were blemishing. UK’s biggest mortgage bank, Halifax is also in red and it was on the edge of collapse during September 2008. Another mortgage bank namely HBOS is also in financial trouble. During the middle of the 2008, the share price of HBOS dwindled over 95% and it is clearly demonstrating how severity is the present bearish nature of UK’s housing market. Once considered to be premier stock, now HBOS stocks are being quoted less than penny. As the result of government intervention, HBOS stock has been further diluted.

Correction Measures

UK government started to worry over the increasing of bankrupts among banks in UK as the house prices started to fall in September 2008. UK government has introduced more correction measures to set the falling banking sector. It has introduced a ban on the short selling of financial stocks. It has nationalised the ailing banks like Bingley and Bradford and it has introduced a massive interest rate cuts during October 2008. UK government also announced unprecedented housing bailout packages of £500 billion to help the ailing UK’s mortgage banks.

UK financial markets witnessed intense volatility and there had been daily movements as great as 10% which was never witnessed in UK’s economy since the 1987 Financial Crash.

Adequate measures have already been initiated by the Bank of England to ease tensions both in financial and economic markets in UK by announcing interest rates cuts and quantitative easing.

Further, Bank of England announced an interest rate cut to the tune of 1.5% during November 2008. UK government also announced VAT cutting budget in an effort to motivate consumers to spend more.

The Royal Institution of Chartered Surveyors is of the view that during June 2009, there has been an increase of 0.10% of increase in the housing price in UK. RICS claims that residential property market seems to have found a ground now perhaps on temporary basis.

However , due to continued threat of jobs losses for the balance period in 2009 and as banks are setting high obstacles for mortgage borrowers by framing high eligibility criteria , there seems to no immediate transformation from the recession in housing market.

Labour government has reduced the capital gain taxes from 40% to 18% to augment the investment in residential housing sector. This move by the UK government is expected to kindle the investments in housing sector.

Strong reasons why Housing Market would not fall

After joining as EU member, there had been large inflow of migrants around 800.000 individuals to UK from neighbouring Accession States which would make the UK as a busy housing market in Europe in the ensuing years. Further, due to recession in UK’s housing market, there has been slowdown in the construction of new houses. Critics argue that as such, this demand may be in excess of the supply in the years ahead in UK. As such, the prices of houses are expected to soar sharply in the near future. Economists are of the view that fundamental of UK’s economy is more robust as UK economy is able to perform moderately than other nations in mainland Europe.

To resurrect the UK’s housing market, UK government announced various bailout packages like cutting the interest rates straight from five percent to just 2 percent and pumping out £ 600 billion as bailout packages which are aimed to resurrect the falling housing market in UK. This would help the UK banking especially mortgage banks to resume its normal lending policies and to support the UK’s economy especially UK’s housing market. According to “British Bankers Association (BBA)”, there has been a fall of 73% in the number of mortgage approval which declined from 64020 to 17,775 in July 2007 alone. Likewise, loans to equity withdrawals which have been considered as a fundamental to UK’s consumer bonanza has declined by 50%.as home owners have availed loans against equity to spend. The overall impact of this is that the quantum of mortgage loans outstanding has shrivelled by around £35.1 billion as against a steady mortgage which would have needed an escalation of at least £25 billion over the analogues period.

This has an impact on average value of loan sanctioned for the purchase of houses which pinnacled at £ 160,000 in June 2007, and now has been hovering around just £ 117,000. This denotes a high deflationary trend in housing markets in UK. Since, there has been tightening of lending policies by mortgages banks, the demand for houses have gone down as obtaining a credit for the purchase of houses has become scarce.

The changes in Housing Market of UK within the Last Decade

Long-term Housing Price Forecast for UK

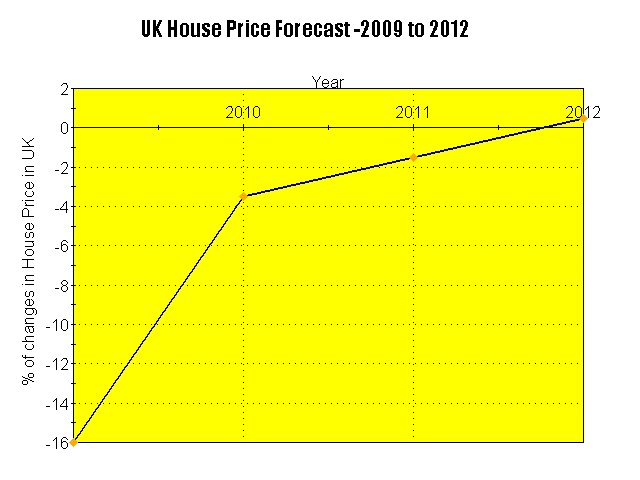

It is predicted that mean housing price in UK is expected to reach £ 3, 00,100 in the next decade. This connotes that fall in housing prices in UK is a temporary phenomenon. The opponent of this prediction should realize that mean price of houses in UK had fallen by more than 15% in a year in 1992 and at that time no one would have predicted that mean home prices would increase to 200% in the ensuing decade? Hence, it is estimated that present housing price decline is expected to move upwards in the year 2012.

According to National Housing Federation research study, despite of down turn in housing markets, house prices in UK is expected to rise by at least 25% in the five years to come and is expected to reach £ 274,700 with in five years from 2009. The research conducted by Oxford economists predicts that house prices will decline in 2009 and will start to recover in 2010 and then aggressively increase in 2011.

The above research paper states that house prices in UK will augment by:

- In 2011 by 5.3%

- In 2012 by 9.2 %

- In 2013 by 9.3%

Conclusion

The housing market in UK is having a considerable effect on the UK economy as about 80% of households are held by private sector. In Europe, UK is the leading nation in home ownership and housing plays a greatest structure of wealth in the UK.

It is obvious that the UK housing market prolongs to witness the damage of depressed market status. The present credit crisis prolongs to shatter the faith in the financial market. The Chartered Surveyors were of gloomy about the housing price expectations in UK since 1998 and however, it is not expecting a great fall in housing prices as UK underlying economic structure remains strong and the UK labour market remains vibrant.

From the table 1, it is evident that house prices have increased steadily till the first quarter 2008. From the second quarter of 2008, the house prices have started to decline and as of 2nd quarter 2009, there were decline in house prices in UK by 11.7%

However, UK government has taken initiatives to correct the housing market in UK by cutting the interest rates straight from five percent to just 2 percent and pumping out £ 600 billion as bailout packages which are aimed to resurrect the falling housing market in UK. However, during 2012, housing prices will regain and will be quoting at prime rates thereon as per the estimates shown in the Fig 2. The study by National Housing Federation research also reveals that housing price decline is only a temporary phenomenon. No doubt, the fall in housing prices in UK is a temporary phenomenon and it is the right time for the investors to invest in housing sector to reap huge benefits later on.

List of References

- Budget (2008). Great Britain. HM Treasury. Housing and Private Consumption in the UK. London: TSO.

- Gilmore Grainne & Rooiter James. (2008). House Price Downturn Worst since Slump of 1990’s, Surveys Report. [Online]

- Hickman Martin (2009) House Prices Up but “Too Early” to Call End to Crash. The Independent [online]

- Walayat Nadeem (2009) UK Housing Market Crash and Depression Forecast 2007 to 2012 [online] Web.