Introduction

Digital banking has enabled unrestricted and secure access to accounts anytime, anywhere for customers on their computers, tablets, and smartphones. Customers can now make simple and secure transactions, including checking account balances or getting statements online from the convenience of their gadgets. However, the rise of online banking has brought unintended consequences such as identity theft, credit card fraud, spamming, phishing, and other related cybercrimes. The paper evaluates a con article on ‘The impact of cybercrime on e-banking.’ It analyzes and discusses cyber threats’ impact on online banking and the need to improve security measures.

Review

The study by Chevers seeks to propose a research model that evaluates cybercrime in e-banking to inform future imperial research on the context. It mainly focuses on business-to-consumer (B2C) e-commerce, with particular attention to electronic banking. Electronic banking or e-backing is the use of the internet as a remote delivery channel for banking services via the internet. E-banking is the main mode of transactions for most online business transactions, such as online flight booking, e-commerce purchases, and banking. Nevertheless, users do not fully trust online banking for fear of losing personal information or becoming victims of cybercriminals.

According to the study, people aged 60 years and above suffer the most losses, with 55,043 reported cases, losing a total of $339,474,918. Generally, people have little confidence in the technology despite the security improvements of digital banking and trust services. Other research has also evaluated the awareness and habits of digital banking users and established they lack knowledge of the possible attacks on these digital platforms. Therefore, losses attributed to cybercrime in e-banking are expected to rise as more people gain access to computers and the internet.

Based on Chevers’s literature review, common cybercrime risks and threats include work-at-home frauds, web cloning or online lottery, loan scams, hacking, identity theft, phishing, and retail-based fraud schemes. However, the study focuses on phishing, identity theft, and hacking because they mainly affect financial institutions like insurance companies, banks, and credit unions.

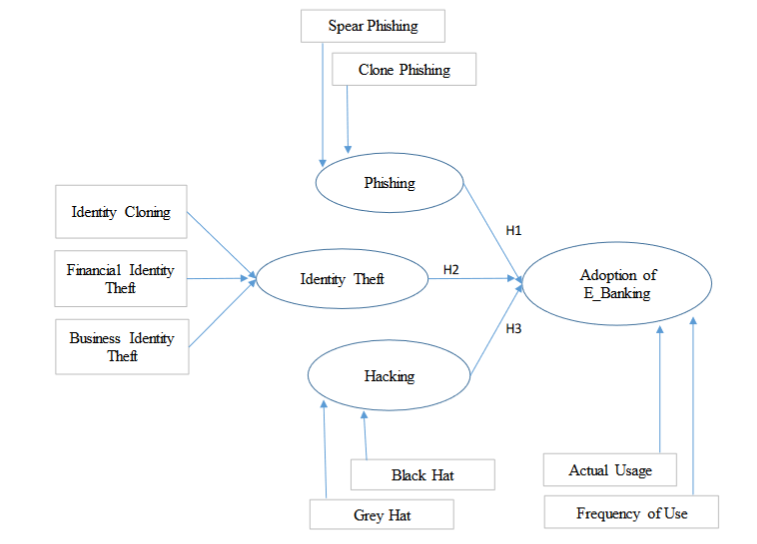

Therefore, the author modeled his research technology acceptance model to combat identity theft, hacking, and phishing. The resulting research model comprises three independent variables (identity theft, hacking, and phishing) and one dependent variable (e-banking), as shown in figure 1.

The study aims to conduct quantitative research requiring a survey to test three hypotheses. The hypothesis includes:

- H1: Phishing will have a negative impact on the adoption of electronic banking.

- H2: Identity theft will have a negative impact on the adoption of electronic banking.

- H3: Hacking will have a negative impact on the adoption of electronic banking.

The study is yet to validate the hypotheses. In the end, the author shall publish the findings on which cybercrime has the greatest impact on e-banking.

Critique of the Paper

Based on the topic and analysis of the content, one would expect the author to develop a model that would be used to test the hypothesis. It is possible to conclude the author is trying to draw attention to elements of modern threats to e-banking rather than proposing a model. Furthermore, the author needed to provide an abstract description of the research model, including how it will use the variables to produce outcomes. For instance, it would help if the author provided details on how the model in figure 1 works.

Reflection

The paper gives a big picture of e-banking security threats and presents a complete view of the security landscape. More broadly, it draws readers’ attention to the fact that e-banking should be an end-to-end solution. By investigating cybercrime in e-banking from a user perspective through a survey, the author’s effort has resulted in the need to address issues associated with contemporary digital and mobile banking. For instance, the elderly are at risk of cybercrime involving identity theft, hacking, or phishing due to limited knowledge.

Besides, there is a need to define a new set of evaluation criteria for the complete assessment of e-banking security. Banks, e-commerce, and other businesses that accept online transactions also need to embark on extensive campaigns to sensitize their customers and raise general awareness on security issues on e-banking platforms.

Conclusion

E-banking has become an essential part of the banking system and a popular mode of transaction for most people. However, customers must keep vigilant to protect their accounts from cybercriminals. The study users three independent variables (identity theft, hacking, and phishing) and one independent variable (e-banking) to develop a research model for future researchers. However, the study had shortcomings, such as insufficient details on the model and the unclear goal of the research.

Nonetheless, the study raises critical concerns about the need to reevaluate the security of e-banking from the users’ perspective. The statistics suggesting the elderly have become the main victims of cyber criminals on e-banking platforms indicate the need to raise awareness for the users. Besides, the paper provides a basis for future research on the issues with contemporary digital and mobile banking.

References

D. Chevers, “The impact of cybercrime on e-banking: A proposed,” in International Conference on Information Resources Management (CONF-IRM), 2019.

W. Wodo, D. Stygar and P. Błaskiewicz, “Security Issues of Electronic and Mobile Banking,” in Proceedings of the 18th International Conference on Security and Cryptography (SECRYPT 2021), 2021. 10.5220/0010466606310638.