Introduction

The Gulf Cooperation Council (GCC) has six member countries. The countries are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. These economies have developed as promising markets. Bahrain has many foreign investors; the remaining five countries are not so much popular among the foreign investors (Balaz and Londarev 510; Neaime 235). The long run examination demonstrates that aside from Bahrain, there is no proof of a long run connection between the oil costs and securities exchanges in the GCC nations. The GCC offers a market that is dissimilar to the markets of the developed countries and other emerging markets because the GCC separates from the entire equity market of the world and is highly affected by the local political instabilities in the region. An investor gets access to have foreign ownership of stock in Saudi Arabia if and only if he invests in mutual funds.

This is different in Bahrain, Qatar and Kuwait, where a foreign investor gets access to own stock without having to invest in mutual funds. There is always a constant flow of capital in and out of the GCC markets (Neaime 236; Ciner 205). This capital flow is not responsible for speculative attacks like in the emerging markets across the world. Speculative attacks occur in the GCC if there is over-heating in the domestic market. Because there are restrictions on the foreign ownership of stock, there is a limited flow of capital in the GCC market. The turnover of capital inflow is higher in Saudi Arabia and Kuwait. This is because there are many publicly traded companies present. The publicly traded companies have an effect on the stock market. These companies include real estate companies, banks, construction companies and communication companies. These companies are responsible for the volatility in the market (Balaz and Londarev 512).

Kingdom of Saudi Arabia

The Kingdom of Saudi Arabia is the leading in production and exportation of oil in the world and this makes it be an important member of the Group of Twenty (G20) countries (Cologni and Manera 860). Actually, the Kingdom of Saudi Arabia is the only OPEC country in the G20. Moreover, Saudi Arabia has the largest economy among the countries in the Middle East. The other members of the G20 have more stable international financial markets as compared to the Kingdom of Saudi Arabia. However, of late, the Kingdom of Saudi Arabia has amassed enough revenue from the oil business to strengthen its international financial market (Ciner 205). The Kingdom’s authority is completely aware of the obligations intrinsic in being a superpower on the planet oil market. They comprehend the immediate effect of high and unstable oil costs on world monetary development. The high cost of oil is not, obviously, the main issue upsetting the world economy and thwarting development, yet it constitutes one of the essential elements that add to insecurity on the planet’s economy. In this way, as an individual from the G20, encouraging the sound development of the world economy constitutes the foundation of Saudi Arabia’s oil approach (Balaz and Londarev 510).

It has turned into a standard practice for Saudi government’s policy-makers to demonstrate occasionally the imprint or a particular reach for what they consider ‘a sensible or reasonable cost’ for a barrel of raw petroleum. The Saudi practice is uncommon, as oil costs are controlled for particular arrangement goals. Cost is an element of supply and demand (Cologni and Manera 860; Ciner 205). The obligation of Saudi Arabia, the world’s pre-famous oil power, and swing maker, is to keep up the supply-demand equalization. The part of swing maker has given the Kingdom impressive impact in the oil market (Neaime 236). Actually, oil value dependability and the upkeep of sensible costs lie at the heart of Saudi Arabia’s oil approach.

The Kingdom’s administration perceives that rising rough costs could wreck worldwide financial recuperation and leads the best approach to steep decline and that short-run pick up from high oil costs balances by decreased deals later on (Cologni and Manera 862). Saudi Arabia delivered 13.3 for every penny of worldwide oil in 2012, and at present has a normal creation limit of 10 million barrels for every day. With its assumed 2 million or more barrels for each day of extra limit (out of an assumed 6 million barrels for every day of OPEC aggregate extra limit), it is resolved to hold its part as the world’s swing maker and the political and business sector impact that this gives (Ciner 205; Neaime 236).

The Kingdom’s initiative additionally demonstrated some worry about the impact of high oil costs on future oil utilization and the likelihood that high oil costs could prompt ‘interest annihilation’ (Cologni and Manera 865). This could, thus, result in a lasting movement on the interest bend toward lower interest, leaving the significant oil delivering nations, particularly Saudi Arabia, with impressive ‘unmoving overabundance limit’. To a great degree low oil costs, then again, influence the development capability of the creating nations and the stream of venture to the business, which would at last undermine oil supply security, with negative effect on the hobbies of both creating and devouring nations. A few authorities of the Kingdom have contended that $100 a barrel would be a “reasonable” cost for rough. In fact, Saudi value targets, which lie in a band around $100 per barrel, are not out of line with the hobbies of numerous mechanical nations (Balaz and Londarev 514; Cologni and Manera 868).

Bahraini

For the Bahraini securities business sector vacillation and oil value instability, the short run analysis revealed slight hints of high connection between the variables over the period under study, for instance, 2009 and 2010. The variables had a lag of 8 to 16 days. Over the long run, the variables had a lag of 128 days and the results revealed that there is a high relationship between the two variables (Cologni and Manera 870). Considering the Bahraini economy, the outcomes are to some degree in line, as Bahrain is an administration-based economy, with immaterial dependence on hydrocarbon trade (Neaime 236). Notwithstanding this, Bahraini securities exchange is moderately open to global speculators, and has been making a decent attempt over the past decade to create itself as the portal to the Middle East for western speculator (Ciner 207). With this framework of capital markets and economy, the oil value fluctuations are negative since the worldwide economies shift to the Bahraini economy. This aims at lessening the global venture portfolios or exchange to more secure securities. This assists with the comprehension that any value unpredictability in oil markets would affect the Bahraini Stock Market with a short slack of 4 to 8 days, yet that impact ceases to exist over that slack, and the enduring effect of that persists over the long run (Neaime 237; Cologni and Manera 870).

Kuwait

Kuwait is one of the biggest oil makers in the region, just behind Saudi Arabia. In regards to the capital markets sector, it has as of late freed to pull in outside speculators (Cologni and Manera 872). The correlation between Kuwait securities exchange changes and oil value vacillations are limited in the short run. This correlation is high in the end when the oil value is highly fluctuating. This perception of no short run lead slack relationship is reasonable, since it has been just the later past when Kuwait opened up its capital markets to outside portfolio directors who may be touchy to worldwide oil stuns (Neaime 238). The long haul impact of oil value stuns transmits through the macroeconomic channels of the entire economy straightening out to oil value stuns, since Kuwait as Saudi Arabia is intensely subject to oil trade (Cologni and Manera 871).

Oman

Oman is one of the most special economies in the district. It has in the course of the most recent decade kept up a level of no national obligation with sensibly estimated sovereign trust having exposures internationally. Contrasted with its partners in the GCC, the oil creation of the nation is lesser. However, lately it has found much oil holds and the oil riches have definitely expanded. Oman has avoided the worldwide financial specialists as far as securities exchanges (Neaime 238). There is confirmation of a high connection between the variables amid the short run period at stopped interims between the 2007 and 2009 oil cost downslide. Likewise, there is a high relationship as time goes on. This prompts the argument that the oil value stuns do not have a current relationship to money markets unpredictability in Oman, which is a discerning contention, attributable to low base of global speculators (Balaz and Londarev 514).

Qatar

Qatar economy has seen a sensational development in the previous decade upheld by oil and gas trade incomes. Qatar occupies part of the main 3 nations as indicated by GDP per capita, though it is an exceedingly subordinate economy on hydrocarbon. Oil and gas represent about half of GDP deciphered into around 85% of fare income and 70% of government incomes (Cologni and Manera 872). There are slight hints of high connection between oil value instability and the securities business sector costs in the short keep running between March and April 2009. There is an immediate relationship of oil unpredictability and the share trading system instability. There is a high connection between the variables over the long run. The economy goes by the substantial dependence on the hydrocarbon sector (Ciner 208).

he United Arab Emirates

The United Arab Emirates is one of the innovative cases of hydrocarbon development based changes. In the previous 3 decades, UAE has changed itself from a ruined desert state to a standout amongst the most financially stable states in the Middle East (Neaime 238). Over the previous decades, the UAE has effectively changed it economy to decrease reliance on hydrocarbon area. Only 25% of the GDP depends on oil and gas as indicated by late results (Cologni and Manera 873). The UAE’s Economy albeit dependent on oil to a quarter of its GDP suffered in the late oil value crisis of 2008, which harmonized with the world monetary stoppage. Out of the 7 part states, Dubai was the most exceedingly hit. It was an economy principally in light of service industry. It endured radically coming to a close sovereign default state before relying on Abu Dhabi, which are its neighbor and a part of the UAE (Cologni and Manera 874).

Literature review

Production of oil

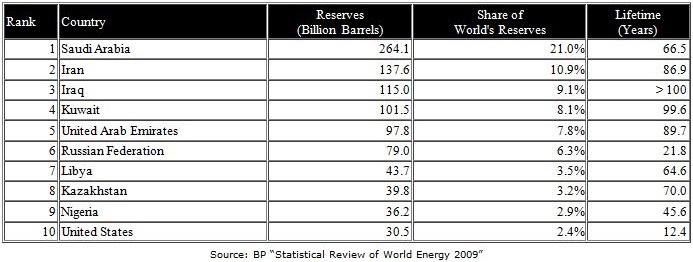

Notwithstanding being honored with enormous oil and gas stores, the GCC or if nothing else some of its part states will most likely come up short on its valuable dark gold in one period. While general gas stores appear to be still copious as reserves-to-creation proportion surpasses 100 years, we ought to remember that the reserves are not just as spread through the area (Ciner 208). Bahrain, for instance, will suffer unavoidable exhaustion in somewhat more than two decades. However, in spite of their firm duty to enhancement, the GCC economies are yet handing-off intensely on their hydrocarbon generation division. The Middle East oil creation and stores assume an urgent part in the worldwide economy (Neaime 238). Just as imperative, the GCC states have the potential and capacity to put enormous money related assets into oil and gas investigation and generation, taking care of the ever-bigger demand for petroleum and petrochemicals of economies on the ascent, for example, China and India (Ciner 207).

GCC states together created 24 percent of the world’s aggregate raw petroleum generation in 2013, with Saudi Arabia ahead of the pack, pumping 11. 5 million barrels for each day as per the British petroleum (BP) statistical review of world energy report in 2014. Likewise, a large portion of the world’s demonstrated oil stores are situated in the Middle East (47.9%) trailed by South and Central America (19.5 percent) and North America (13.6 percent) (Ciner 208). All the more accurately, the GCC states control around 30 for every penny of the world’s raw petroleum stores and that without a doubt adds to the relative worldwide significance of the Gulf petroleum division. Saudi Arabia alone holds around 16 percent of worldwide oil saves while other GCC states additionally hold huge unrefined stores: Kuwait 6 percent, UAE 5.8 percent, Qatar 1.5 percent and Oman 0.3 for each penny (Balaz and Londarev 510; Neaime 239).

The Gulf Region nations, overall, have about 54% and 40% of the world’s routine oil and gas demonstrated stores, and substantial extra measures of unproved and unfamiliar stores. In 2010, the Gulf Region produced more than 25.2 million barrels of oil for every day, and 44.6 billion cubic feet of normal gas every day, representing more than 30% of the world’s oil generation, 15% of gas creation, and 32% of Liquefied Natural Gas (LNG) trades (Cologni and Manera 860). As indicated by the international energy outlook projections, the world’s vitality utilization anticipates expanding by more than half by 2030, a normal increment of 1.6% per year (Ciner 205). Oil, gas and coal will keep on supplying a great part of the vitality utilized around the world. Worldwide interest for fluid energies is required to develop by just 1.0% per annum over this period, and the aggregate offer will decay from 34% (in 2008) to 29% (in 2035). We anticipate that that will meet the world’s developing vitality request, the Gulf Region’s offer of world oil creation will increment above 30% as Iraq comes back to full generation in the coming years (Neaime 238).

This will meet the world’s developing vitality request, the Gulf Region’s offer of world oil generation will increment above 30% as Iraq comes back to full creation in the coming years. Worldwide interest for characteristic gas has ascended at a rate considerably more prominent than that of raw petroleum, encountering a normal increment sought after of 2.7% every year over the 1973-2010 periods contrasted with 0.9% for unrefined petroleum over the same period (Neaime 238). Common gas utilization worldwide is determined to keep expanding at a normal rate of 1.6% every year up to 2035, as contrasted and a proceeding with 1.0% every year for fluid powers (Ciner 206). The gas’ development industry in the Gulf Region itself will keep on being tremendous, because of the quickly developing force prerequisite of the GCC populace and expanding substitution of gas as an essential fuel for force era around the globe because of lower expense of normal gas on a proportionate premise, effectiveness contemplations, and natural contemplations (Cologni and Manera 874).

Notwithstanding higher oil generation and fares, the effect of lower oil costs are obviously adding to financial weights in various GCC nations, as per market analysts. Spending plans in the GCC stay underweight, with net outside resources in Saudi Arabia and Bahrain declining strongly since the beginning of the year, and forcefully lower oil incomes in Oman and Kuwait in the first quarter of 2015 (Ciner 207). Talk about diminishing state sponsorships has expanded. Oman and Bahrain remain the most helpless regarding their financial plans in the present low oil value environment. Experts said bigger economies, for example, Saudi Arabia and the UAE have generously amassed stores to help pad the effect of lower oil costs, and can keep up moderately expansionary financial approaches in the close term, however confronted with monetary strains a large portion of these nations are underweight to diminish spending (Cologni and Manera 874).

As a component of financial solidification endeavors Kuwait, Oman, and Abu Dhabi have decreased a few appropriations on fuel and utilities, and the UAE Ministry of Energy is liable to prescribe further diminishments in fuel sponsorships in the UAE going ahead. Bahrain has thought about cutting nourishment and different dies down and supplanting these with money presents to nationals, while Oman has proposed forcing duties on exile settlements and brought common gas costs up in an offer to spare cash (Ciner 208). Kuwait aims to record a deficiency without precedent for over decade, however once more; generous stores imply that spending increases. In Saudi Arabia, official information demonstrated the monetary allowance recorded a shortfall of – 2.3 for every penny of GDP in 2014, the first spending plan deficiency in over 10 years (Neaime 239). Examiners anticipate that the monetary allowance deficiency will extend to just shy of 12 for every penny of GDP this year, on lower oil incomes and moderately high use. Oman and Bahrain are relied upon to run the biggest monetary shortfalls in the GCC this year, keeping in mind that the financial plans can be financed; these nations are confronting the most weight to support spending (Balaz and Londarev 515).

The researchers have resuscitated the levelheaded discussions on the impacts of oil value changes on the financial development of hydrocarbon economies. The reason may be the huge relationship between oil cost and times of retreat if one can see monetarily, the oil sending out nations incorporate with the worldwide economy and have a major effect on the world’s biggest economies that are subject to oil. In this way, any worldwide emergency has a major impact on their economies (Cologni and Manera 876). A progression of money related emergencies in the most recent three decades has apparent results of the impact of oil value vacillations on financial improvement. As oil costs vacillate over a long run, oil trade nations confront high salary unpredictability at a residential level.

It recommends that oil exporters have a high proportion of a sparing to GDP in light of the fact that there are risks that salary stuns (Neaime 239) might unfavorably influence them. This high instability affects resultants preparatory strive to make sizable reserve funds however generally low venture. There could be the reasons – e.g. demographics and low assimilation limit – for high sparing and low venture rates. Legislatures of oil sending out nations need to confront a few monetary difficulties when there is a high unpredictability of oil costs in the universal market in this manner forces profoundly dubious fare incomes (Cologni and Manera 877). In view of this contention, repeatedly the inquiry emerges that how much this legislature need to spare out of oil income, the amount to spend on infrastructural ventures, and the amount to devour out of it (Ciner 209).

Similarly important is the gas generation in the Middle East locale. The US Energy Information Administration’s (EIA) international energy Outlook 2013 report expresses that four noteworthy normal gas makers in the Middle East together represented 85 percent of the regular gas delivered in the Middle East in 2010. In the interim, Middle East is additionally the biggest holder of gas stores (40-43.2 percent relying upon source) (Ciner 208; Neaime 235). Qatar is unquestionably the GCC pioneer in the gas area as the Peninsula holds around 13.4 percent of worldwide characteristic gas stores, holding a third place on the planet directly after Iran with 18.2 percent and Russia’s 16.8 percent. The open deliberation, whether the GCC nations ought to differentiate and create elective vitality sources is progressing.

The International Monetary Fund (IMF) evaluates that the GCC nations have taken after a large portion of the standard approaches that advance more enhanced economies, including changes to enhance the business atmosphere, the advancement of the household foundation, budgetary developing, and upgrades in instruction. Nevertheless, the accomplishment to date has been restricted. It is not astute to accept that in the end the economy changes and adjusts to another circumstance when the primary thing it produces is existent. The monetary writing is loaded with cases in which the economy has fallen because of exhaustion of normal assets (Balaz and Londarev 510; Neaime 235).

There are enormous move costs (for example, a human capital concentrated on a part no more beneficial) that require a tremendous part from an open approach. Most of the nations in the area depend vigorously on the oil division. In spite of the last’s endeavors decade, oil keeps on ruling the GCC area’s fares, representing almost 70% of all stock fares. What’s more, the amount to expend alongside these fundamental inquiries, policymakers need to go to few issues like smooth utilization, cushioning so as to fit organization of oil value instability cradle load of investment funds as safety oriented courses of action, and most critical is to guarantee enough commitment towards GDP by enhanced areas if common assets are expendable. Actually at whatever point in future hydrocarbon income will come up short on stock, the government ought to put more in non-oil segment commercial ventures and advance differentiated improvement (Ciner 208).

The surplus in the present record adjusts effortlessly advances infrastructural ventures and feasible development of GDP because of the abnormal state of funds. Despite the fact that worldwide oil value stuns are sudden and capricious, in this way, causes a more prominent effect on endogenous financial variables for oil trading economies depending principally on oil incomes. In this way, the high vulnerability in oil value development, and thus in oil incomes impel the GCC nations to spare many of their oil incomes for preparatory purposes (Neaime 239; Ciner 205). There are no shocks in the late British Petroleum report, which gives insights relating to principle vitality assets. The report, which is a principle reference in this field, affirms that Saudi Arabia is the top oil maker and exporter, dislodging Russia from postposition, with the normal Saudi petroleum generation coming to 11.5 million barrels a day in 2013.

Absolutely, Saudi Arabia has been and still is; the greatest exporter of raw petroleum yet what is new is that it is currently likewise the greatest producer (Cologni and Manera 878). More comprehensively, the Gulf Cooperation Council (GCC) states together delivered 24 for every penny of the world’s aggregate unrefined petroleum generation in 2013. There is nothing huge about this except for on top of that, it is trusted that Saudi Arabia can possibly improve its oil generation when important. The capacity of Saudi Arabia to remunerate worldwide oil markets was evident unmistakably amid the previous couple of years when oil trades from Libya and Syria emerged on and because of the Western blacklist of Iranian oil (Balaz and Londarev 510; Neaime 235).

The reality of the situation is that the GCC states have the craving, the potential and the capacity to put colossal measures of cash in oil generation. This is viewed as essential in light of the rising worldwide monetary development and the ensuing ascent popular for petroleum and petrochemicals, particularly by the world’s greatest economies, for example, those of the US, China and India. It suffices to bring up that the GCC states control 36 for every penny of the world’s sovereign riches and along these lines have the ability to upgrade the level of petroleum generation. Concerning oil reserves, Venezuela and not Saudi Arabia has the biggest unrefined petroleum holds, with 17.7 for every penny of the worldwide stores contrasted with Saudi’s 15.8 for each penny (Neaime 240; Neaime 240). Indeed, even along these lines, Venezuela is down in the rundown of oil makers because it delivers just 2.6 million barrels a day, 3.3 for each penny of worldwide oil generation and much lower than Saudi Arabia’s 11m barrels (Ciner 210). What is sure is the presence of such enormous oil saves that it is superfluous to investigate for any more.

While Saudi Arabia and Kuwait hold the “record” of most inadequately enhanced economies, in a few expresses the commitment of non-hydrocarbon GDP to the general GDP has altogether expanded in the course of recent decades; territorial collaboration is required. Chipping away at making local financial reconciliation inside of the GCC is a reality that would encourage the move (Neaime 242). Non-vitality divisions could profit by this broadened basic business sector and higher interest. UAE (and quite Dubai) is model in monetary broadening, speaking to a sample to follow in creating approaches of expansion running from the lessening of pay bills, spread of free zones, occupation and instructive activities, support of business and solid budgetary frameworks (Cunado and Garcia 70). Qatar has likewise gained critical ground in the previous decade, with a noteworthy piece of the non-hydrocarbon income originating from speculation salary, which comprises of exchange of benefits from open undertakings, and represented 16.9% of the GDP and just about 44% of aggregate incomes in 2013-14. Furthermore, Qatar with its little populace holds hearty stores of gas that would keep going for a few eras – an extravagance others do not have (Neaime 242; Ciner 209).

Revenue of oil

In spite of the fact that the GCC nations have seen a drop in the offer of oil incomes to the genuine GDP, they have had constrained accomplishment in broadening the income base significantly. The vast majority of the financial broadening arrangements started in the GCC nations. The financial expansion suffers from business open doors for the nearby populations, instead of their long run monetary attainability and desirability (Neaime 242). The GCC nations remain profoundly reliant on hydrocarbon incomes, making them powerless to changes in worldwide vitality request and costs (Ciner 208). After the worldwide financial meltdown, the GCC economies have reliably beaten their worldwide associates, developing by around 24.0% over the five-year period to 2013, bolstered by vigorous oil incomes (Neaime 242). Sanctions against Iran dissents in Libya and Nigeria, late aggressor action and the developing interest from the developing economies have all served to support oil costs at raised levels (Cunado and Garcia 71). Oil costs saw an increment from $62 per barrel in 2009 to about $105 a barrel in 2013, helping the inlet economies to produce high monetary surpluses. Then again, the moderately stable oil costs in 2013 have brought about a slowdown in the GCC economies from the earlier years (Balaz and Londarev 516; Neaime 243).

Hydrocarbon incomes in a larger part of the GCC nations represent near 60% of the aggregate incomes. The individual income contribution from Saudi Arabia and Kuwait are 90% and 93% respectively. This is interesting with other asset rich economies, for example, Norway, where incomes from oil represent pretty much 30% of government incomes (Cunado and Garcia 70; Neaime 242). A special case to this is the emirate of Dubai, some piece of the UAE, where oil division incomes frame just a little extent of the emirate’s income, with the rest originating from areas, for example, transportation, tourism and others. Financial specialists in the area trust that Dubai, which has moderately littler oil stores, has been in the bleeding edge of monetary enhancement. The Dubai sample is a benchmark to settle monetary and social conditions and enhance monetary development; however, there is a sure level of alert as the last budgetary emergency drove the emirate near default (Balaz and Londarev 517).

Looking at the budgetary income patterns, it can be unmistakably seen that separated from Qatar and the UAE, the commitment of non-oil open income is far lower in different states. As far as general incomes, Qatar has enlisted a twofold digit development of 19% every year throughout the most recent five years, a long way in front of others, mirroring an in number ascent in both hydrocarbon and non-hydrocarbon divisions (Cunado and Garcia 74; Neaime 242). Qatar’s income pattern is additionally one of a kind as in the nation figured out how to maintain a strategic distance from the huge drop in hydrocarbon incomes that affected other GCC nations because of the long haul nature of its gas contracts, rather than spot costs for oil applicable for other country’s hydrocarbon incomes. In any case, the offer of hydrocarbon income to the aggregate wage for Qatar has stayed reliable at around 60% for the 5-year period under audit. For the money related year 2014-15, the Qatari government anticipates that aggregate incomes will reach about QAR 225.7 billion. The aggregate incomes for the budgetary year 2013-14 remained at QAR 346.6 billion, much higher than the initially planned level of QAR218 billion. It ought to be remembered that the greater part of the GCC governments are moderate in anticipating their incomes, accepting lower oil costs (Balaz and Londarev 516).

Fluid Nitrogen Gas generation in Qatar is normal to stay at current levels because of the willful ban on gas generation from the North Field. The ban, at first booked to end in 2008, expects to last until the end of 2016 after a few expansions. Nevertheless, Qatar’s financial income still anticipates that would surpass spending plan use, giving agreeable monetary headroom (Neaime 244; Cunado and Garcia 73). Qatar has likewise outpaced other GCC nations as far as non-hydrocarbon division development, posting an 18% CAGR in the course of the most recent five years. A noteworthy piece of the non-hydrocarbon income originates from speculation salary, which comprises of exchange of benefits from open endeavors (counting Qatar Petroleum’s subsidiaries), and represented around 16.9% of the Gross domestic product and right around 44% of aggregate incomes in the monetary year 2013-14. Custom obligations and corporate pay duty compensate for whatever is left of the non-hydrocarbon government income.

The administration’s long haul target is to back its budgetary operations through non-hydrocarbon income by 2020 (Ciner 205). In accordance with this vision, Qatar is focusing on financial broadening and has allotted noteworthy capital towards the advancement of the foundation, wellbeing, and training. Appraisal of the general financial circumstance in the UAE entangles by the absence of consistency amongst the seven emirates that frame the UAE (Cunado and Garcia 75). Abu Dhabi is the overwhelming emirate, having the most astounding hydrocarbon reserves and producing more than half of the GDP in the UAE. The commitment of hydrocarbon income to the aggregate income remained at around 63.8% in 2013 much lower contrasted with Kuwait and Saudi Arabia. In parallel, the non-oil economy has likewise been picking up quality and anticipates extending by more than 4% every year throughout the following couple of years on the back of Dubai’s solid non-oil development and enhancement endeavors by Abu Dhabi (Balaz and Londarev 517).

Objectives, scope and coverage

The primary target of this paper was to inspect the effects of unpredictability in oil costs in the GCC economies. Not at all like past studies that utilized low-recurrence information (yearly, quarterly, or month to month), this study utilized week by week information, which can all the more sufficiently catch the connection between oil and stock costs in the region (Cunado and Garcia 75). The study did not utilize day-by-day information, keeping in mind the end goal to maintain a strategic distance from time contrast issues with the universal markets. The stock markets usually close the business on Thursdays and Fridays in the GCC nations, while the created and universal oil markets close the trade on Saturdays and Sundays. Notice additionally that, on the regular open days, the GCC markets close just before the US stock and goods markets open. In like manner, the study utilized week-by-week information and picked Tuesday as the weekday for all variables in light of the fact that it falls amidst the three normal exchanging days for all business sectors (Cunado and Garcia 75).

Normally, the data utilized as a part of every different analysis originate before the end of 2005, and therefore they missed the stupendous varieties that have happened in the GCC and oil markets in the course of the most recent three years. The period for this study accordingly starts from June 2012 to October 2014 for the six GCC countries and the world securities exchange as measured by the MSCI (Morgan Stanley Capital International) business records. Securities exchange files are in the MSCI database. For oil, the study utilized the week after week Brent spot cost acquired from the Energy Information Administration (EIA). The Brent oil costs are the reference costs for unrefined petroleum, including oil delivered by the GCC nations. All costs are in US dollars (Balaz and Londarev 515; Ciner 205).

Hypothesis, methodology and data requirement

The methodology is the process of instructing the ways to do the research. It is, therefore, convenient for conducting the research and for analyzing the research questions. The process of methodology insists that much care accompanies the kinds and nature of procedures to stick to in accomplishing a given set of procedures or an objective (Zhang 2382). The purpose of this research proposal is to create a room for further research that will assess the relationship between the employees’ pay and their level of performance. Consequently, the research study is exploratory. Exploratory research studies provide researchers an opportunity to assess areas that have not been extensively researched (Zhang 2382). Therefore, engaging in exploratory studies contributes to the development of additional knowledge on the issue or phenomenon under investigation. Testing the stipulated hypotheses will achieve this goal. The integration of a comprehensive research methodology helps to undertake the research study.

Quantitative and Qualitative Approach

Quantitative research approach refers to the use of statistical techniques, mathematical methods and calculation techniques for data analysis (Zhang 2383). The quantitative methodology aims at utilizing mathematical and statistical theories and models to analyze the data. The quantitative method validates the hypotheses and conclusions that stem from the qualitative methodology. The scientific procedures and processes of the quantitative methodology encompass deriving models and theories; designing instruments for data gathering; controlling the variables empirically and analyzing data using models.

The qualitative approach is mostly concerned with the human motives and the reasons behind such motives (Zhang 2382). The main questions that come with qualitative approach are ‘why?’ and ‘how?’ in addition to ‘what?’, ‘where?’ and ‘when?’ Concerning this, a researcher utilizing the qualitative approach will tend to use smaller samples rather than larger samples. Qualitative approach strictly generates only information that applies to the designated case study; any additional information is guessed. Upon drawing the hypotheses from a qualitative approach, they go through a test using the quantitative approach.

Advantages and disadvantages of primary research

Primary research is relevant for categorizing the observations or variables, examining the variables and generating statistical representations to analyze the observations. A researcher who utilizes the primary research design has a predetermined knowledge of what to expect. In addition, the researcher employs data collection instruments like questionnaires or other relevant data collection equipment. The kind of data handled through primary research is mainly in numerical or statistical format. A strong feature of the primary research is that it is the most efficient design to test hypotheses. Its limitation is overlooking the relevant details of the variables or observations (Zhang 2385; Cunado and Garcia 73).

On the other hand, primary research does not give a full detail in terms of the description of the research process. Unlike qualitative research, the researcher has no idea of what results to expect because he/she mainly relies on observations. Primary research approach consumes a lot of time and demands many resources in terms of money and expertise (Zhang 2385).

Population and Sampling

There are two popularly used procedures for sampling. The sampling procedures include prospect sampling and non-prospect sampling. In a probability sampling procedure, the samples are representative of the population. This is because all the entries have a chance of selection. On the other hand, items in the non-probability sampling do not have an equal chance. In this scenario, not all the items in the population have equal chances of selection. The primary target of this paper was to inspect the effects of unpredictability in oil costs in the GCC economies. Not at all like past studies that utilized low-recurrence information (yearly, quarterly, or month to month), this study utilized week by week information, which can all the more sufficiently catch the connection between oil and stock costs in the region.

The study did not utilize day-by-day information, keeping in mind the end goal to maintain a strategic distance from time contrast issues with the universal markets. The stock markets usually close the business on Thursdays and Fridays in the GCC nations, while the created and universal oil markets close the trade on Saturdays and Sundays. Notice additionally that, on the regular open days, the GCC markets close just before the US stock and goods markets open. In like manner, the study utilized week-by-week information and picked Tuesday as the weekday for all variables in light of the fact that it falls amidst the three normal exchanging days for all business sectors (Zhang 2388; Cunado and Garcia 75).

Normally, the data utilized as a part of every different analysis originate before the end of 2005, and therefore they missed the stupendous varieties that have happened in the GCC and oil markets in the course of the most recent three years. The period for this study accordingly starts from June 2012 to October 2014 for the six GCC countries and the world securities exchange as measured by the MSCI (Morgan Stanley Capital International) business records. Securities exchange files are in the MSCI database. For oil, the study utilized the week after week Brent spot cost acquired from the Energy Information Administration (EIA). The Brent oil costs are the reference costs for unrefined petroleum, including oil delivered by the GCC nations. All costs are in US dollars.

Reliability and validity

The validity of the data represents the data integrity and it connotes that the data is accurate and much consistent. The validity of the data is a descriptive evaluation of the association between actions and interpretations and empirical evidence deduced from the data (Zhang 2382). Reliability of the data is the outcome of a series of actions, which commence with the proper explanation of the issues to be resolved. This may push on to a clear recognition of the yardsticks concerned. It contains the target samples under investigations, the proper sampling strategy and the sampling methods to be employed (Zhang 2386; Cunado and Garcia 70). Reliability of the data suffers from four main challenges. These are the respondents having insufficient knowledge on the area of the research, the mental or physical shape of the respondents at the time of data collection, biases in observation by the researcher, and error in making observations.

Limitations of the study

There have been a considerable measure of concerns on extra-budgetary costs of gathering of the information, paying little mind to whether the accumulated information is truly genuine or not and whether there may be an unequivocal conclusion when translating and breaking down the information. What’s more, a few representatives were hesitant to offer some data that was private and perilous in the hands of their rivals. This represented an extraordinary test in the examination as the specialist needed to take more time to discover to gather the essential data.

Data tabulation and analysis

This section covers the analysis of the data, presentation and interpretation. The analysis of the results utilized the statistical tools of regression and correlation analysis.

Data analysis

The primary objective of this paper was to inspect the effects of unpredictability in oil costs in the GCC economies. Not at all like past studies that utilized low-recurrence information (yearly, quarterly, or month to month), this study utilized week by week information, which can all the more sufficiently catch the connection between oil and stock costs in the region. The study did not utilize day-by-day information, keeping in mind the end goal to maintain a strategic distance from time contrast issues with the universal markets. The stock markets usually close the business on Thursdays and Fridays in the GCC nations, while the created and universal oil markets close the trade on Saturdays and Sundays. Notice additionally that, on the regular open days, the GCC markets close just before the US stock and goods markets open. In like manner, the study utilized week-by-week information and picked Tuesday as the weekday for all variables in light of the fact that it falls amidst the three normal exchanging days for all business sectors.

Normally, the data utilized as a part of every different analysis originate before the end of 2005, and therefore they missed the stupendous varieties that have happened in the GCC and oil markets in the course of the most recent three years. The period for this study accordingly starts from June 2012 to October 2014 for the six GCC countries and the world securities exchange as measured by the MSCI (Morgan Stanley Capital International) business records. Securities exchange files are in the MSCI database. For oil, the study utilized the week after week Brent spot cost acquired from the Energy Information Administration (EIA). The Brent oil costs are the reference costs for unrefined petroleum, including oil delivered by the GCC nations. All costs are in US dollars.

Figure 5.1 portrays the authentic time-ways of the log costs of raw petroleum and stocks in the GCC nations. Their developments are extensively characteristic of the long haul conditions that may exist between them. In like manner, standard unit root tests are helpful for looking at the stationary properties of the series. Both the ADF (Augmented Dickey-Fuller) and PP (Phillips-Perron) tests depend on the invalid theory of a unit root, while the KPSS (Kwaitowski-Phillips-Schmidt-Shin) test considers the invalidity of no unit root. The outcomes are in Table 4.1 below. Every one of the arrangement has all the earmarks of being integrated order, which is a standard result in the writing for this kind of series.

The outcomes showed in Table 5.1 are instrumental in inspecting the long run conditions between the variables and the series in the first distinction when considering the transient linkages. Table 5.2 gives the summary of the statistical properties of the series.

Contrasted with the World market, the GCC securities exchanges have higher instability, but not automatically significant yields. Kuwait has the most elevated week-by-week returns and then Oman and Qatar. Saudi Arabia encounters the most elevated risk and then Qatar and the UAE in that order. Largely, oil value changes are more unstable than all GCC securities exchange returns over the period under study. Skewness is negative as a rule and the JB (Jarque-Bera) test measurement firmly rejects the null hypothesis of normality, with the exception of Kuwait. The second panel reports the genuine connections among the GCC markets, MSCI list, and oil revenue. As should be obvious, cross-market connections of GCC stock and oil returns are not high, but rather they are higher than the relationships between oil value fluctuations and MSCI. Bahrain and Kuwait are two nations showing a negative relationship with oil value fluctuations. The connections between the GCC markets and the world business sector are low and negative, with the exception of Oman and Saudi Arabia. This is a characteristic of the way that the GCC securities exchanges separate from the world business sector and those worldwide investors can in any case get significant advantages by including monetary resources from the Gulf area to their universally broadened portfolios.

Short term analysis

This segment presents the fleeting linkages between oil value changes and securities exchange returns utilizing the first logarithmic contrasts. First, an examination with a worldwide resource-evaluating model researches the sensitivities of the GCC stock market revenue of oil cost and world business sector changes, and after that perform a Granger causality test to analyze the cause-effect relationship.

Returns in the GCC securities exchanges, oil value changes, and world business sector sensitivities

The worldwide multifaceted model that inspects whether the GCC securities exchanges are responsive to oil cost and world business fluctuation is as below:

Where rit represents the week-by-week stock returns, for a country denoted by i. roilt represents the oil prices. msciit represents the week-by-week return on the world business sector. The returns are distributed normally with a zero average and a restrictive variance represented by a standard GARCH (1, 1) process. The model utilizes the QML (Quasi-Maximum Likelihood) strategy. Table 5.3 provides the summarized results.

The coefficients for the series of the world returns are insignificant aside from Saudi Arabia. This demonstrates that the GCC securities exchanges differ from the world business sector, which is reliable with the investigation in light of the correlations. In addition, the coefficients of the oil value fluctuations are non-negative and factually significant for Qatar, Saudi Arabia, and the UAE. This implies that securities exchanges in these nations move together with oil value fluctuations. There is, however, no transient relationship between oil value changes and stock returns in Bahrain, Kuwait and Oman. The proposed model appears to fit the information acceptably since the ARCH and GARCH coefficients are significant as a rule. The results further reveal that the restrictive unpredictability does not change acutely since the ARCH coefficients are generally little in size. By complexity, it has a tendency to vary systematically after some time due to the substantial GARCH coefficients. A granger causality test normally tests the short-term relationship between the variables. The results are in Table 5.4 below.

The Granger causality test examines the flow of short-run connections between oil value changes and stock returns in the GCC nations. Since a few variables and additionally their respective impacts are extremely delicate to the chosen number of lags in the examination, the study chose to actualize this test for different lags. Table 5.4 above reports the outcomes acquired. The outcomes demonstrate that, in the short-run oil value stuns Granger-cause fluctuations in the securities exchange returns in Qatar, the UAE, and to some degree in Saudi Arabia (5%) and Bahrain (10%). They verify those of the past table in that the GCC securities exchanges correlate with the price changes on the world’s oil market. There is likewise proof of causality from the world securities exchange to oil costs.

Results of the cointegration test

The results of the cointegration test the of unit root variables suggest that a direct mix of them produces a stationary variable and that some long-run balance connection binds the variables together. To test for cointegration for every nation under study, there was a regression analysis of the logarithm form of the securities market price on the logarithm form of the oil cost and a constant. There was then a test of the generated residual series from the regression analysis using the Augmented Dickey-Fuller test, Phillips-Perron test, and Johansen. These measurable tests depend on the invalid theory of no cointegration. The outcomes are in Table 4.5. The generated residual series are non-stationary, with the exception of Bahrain. In this manner, just the Bahraini securities exchange has all the earmarks of cointegrating with oil costs. Estimation of the long-run relationship between Brent oil costs and securities exchange costs in Bahrain creates the accompanying cointegrating mathematical statement as indicated by which an increment in oil costs of 10% prompts an uptick in the Bahraini securities exchange of 4.19%.

6.0 Conclusion

This paper augments the comprehension of the linkages between the volatility oil costs and the economies of the GCC nations. Since these nations are real world players in the energy sector, their securities exchanges are prone to be defenseless to the impact from oil value fluctuations. The study tested for both short run and long run conditions. In regards to the short run investigation, solid positive correlations between oil price volatility and the securities exchanges are in Qatar, the UAE, and to some degree Saudi Arabia. Weak correlations are for Bahrain and Oman, yet no short run connections between oil costs and the Kuwaiti securities exchange. Nevertheless, the survey outcomes show that when causality exists, it largely keeps running from oil costs to securities exchanges.

The long run examination demonstrates that aside from Bahrain, there is no proof of a long run connection between the oil costs and securities exchanges in the GCC nations. In the Bahraini analysis, the relationship between oil value and securities exchange is direct and the heading of long-run causality keeps running from oil cost to securities exchange. The GCC offers a market that is dissimilar to the markets of the developed countries and other emerging markets because the GCC separates from the entire equity market of the world and is highly affected by the local political instabilities in the region. An investor gets foreign ownership of stock in Saudi Arabia if and only if he invests in mutual funds.

The results of the investigation should be of incredible enthusiasm to analysts, controllers, and business sector members. Specifically, the GCC nations as policymakers in OPEC ought to watch out for the impacts of oil value volatility for the individual economies and securities exchanges. For financial specialists, the huge connections between oil costs and securities exchanges infer some level of consistency in the GCC stock exchanges. The study’s discoveries offer a few streets for future examination. To start with, the connection between oil prices and securities exchanges in the GCC nations can be required to shift to the other financial divisions of the economy. A sectoral investigation of this connection would be enlightening. In addition, proof from worldwide equity markets is relevant to look at the strength of the discoveries. Moreover, the approach connected in this study is important to inspect the impacts of other products that come from the energy sector, for example, gas and other petroleum-related items. At last, additional research could outline causality in the oil and thee securities market in the GCC nations and in other oil trading nations.

Works Cited

Balaz, Peter and Andrej Londarev. “Oil and its Position in the Process of Globalization of the World Economy.” Politicka Ekonomie. 54.4 (2006): 508-528. Web.

Ciner, Cetin. “Energy Shocks and Financial Markets: Nonlinear Linkages.” Studies in Non-Linear Dynamics and Econometrics. 5.1 (2001): 203-212. Web.

Cologni, Alessandro and Matteo Manera. “Oil Prices, Inflation and Interest Rates in a Structural Cointegrated VAR Model for the G-7 Countries.” Energy Economics. 30.1 (2008): 856-888. Web.

Cunado, Juncal and Fernando Garcia. “Oil Prices, Economic Activity and Inflation: Evidence for Some Asian Countries.” Quarterly Review of Economics and Finance. 45.1 (2005): 65-83. Web.

Neaime, Simon. “Financial Market Integration and Macroeconomic Volatility in the MENA Region: an Empirical Investigation.” Review of Middle East Economics and Finance. 3.1 (2005): 231-253. Web.

Zhang, Dayong. “Oil Shock and Economic Growth in Japan: A Nonlinear Approach.” Energy Economics. 30.2 (2008): 2374-2390. Web.