Introduction

The declining international oil price has had a significant socio-economic and political impact on all the six Gulf Cooperation Council (GCC) member states. According to Amineh (2017), since June 2014, the international oil price per barrel has plummeted by over 70%. The impact is that the region lost over $ 360 billion in revenue in 2015 alone (Cambanis & Hanna, 2017). The GCC member states heavily rely on the sale of hydrocarbons in the international market to fund their budget. Although countries such as the United Arab Emirates and Qatar have tried to diversify their economies, oil and gas remain their primary source of revenue. El-Katiri (2016) says that the petro-states of the Arab Gulf are now faced with a new reality that they had not anticipated would come that early. Most of them had been developing strategies to ensure that their economy would remain stable in the post-oil era. Hellyer (2016) says that geopolitical realities such as the Arab Spring and the instability in some of the regional states such as Iraq and Yemen have complicated the problem further.

Most of these countries are faced with immense budget shortfalls, but they feel they have to be responsible for their citizens as it has been the case in the past. Many are moving with speed to curb public spending as a way of managing the reduced inflow of revenues. According to Behnassi and McGlade (2017), GCC countries are considering cutting subsidies that they have been granting their people for many years. In the plan, these states are considering an introduction of taxes such as value-added tax to increase sources of revenue. Others are exploring untapped resources to help reduce the budget deficit that is imminent due to falling prices. The paper explored the socio-economic and political impact of falling international oil prices on the spending of GCC member states. The research focused on answering the following research question:

What role has lower oil prices since 2014 played in social and economic spending in the Gulf Cooperation Council?

Literature Review

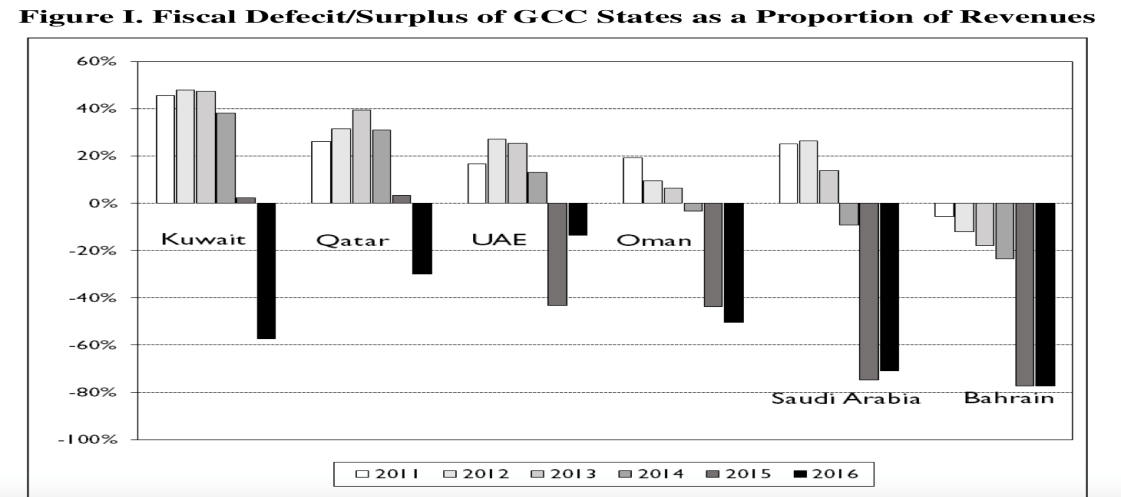

According to Cherif and Hasanov (2014), the GCC countries hold over 30% of the proven world’s oil reserves. In 2014, the region’s oil production and sale stood at 32.3% of the total global production, with Saudi Arabia in the lead at 15.7%. Claessens (2014) says that these countries have enjoyed a relatively long period of stable international oil prices until 2014. Although the constant drop in the oil price was a common occurrence, it never lasted as long as it has been over the past three years. Koltai and Muspratt (2016) say that when global oil prices started falling, most of the leading oil producers, especially the GCC countries, expected that it was a regular problem that would not last long. However, it is clear that the problem may last for a very long time, but it is not yet clear how long exactly. Heydarian (2014) says that what is now evident is that GCC countries and other top oil producers around the world can no longer rely on hydrocarbons as the only source of revenues for the economy. The international oil prices have dropped by over 70%, and that means the countries which heavily rely on this commodity to fund their economy are going to face serious problems in the near future. Some of these countries are now faced with a budget deficit after struggling for so long to withstand the dwindling revenues, as shown in figure 1 below:

As shown in the figure above, the economic impact of the falling international price is clear. Kuwait and Qatar were able to withstand the pressure of the falling oil price in 2014 and 2015 by maintaining a budget surplus. The United Arab Emirates started feeling the impact in 2015. Oman and the Kingdom of Saudi Arabia were affected the same year that the international oil price dropped. Bahrain, on the other hand, was already operating on a budget deficit and the fall in oil prices only worsened their situation. By 2016, all these countries were running on a budget deficit (Devarajan & Mottaghi, 2016). The problem may be wished away easily as it is not yet clear when global prices will go up once again.

The governments of these six countries have focused on coming with a solution to current economic problems. According to Colombo (2014), one of the proposals that are gaining public support as a means of raising alternative revenues in various countries within GCC is imposing high fines on individuals and companies breaking the law. However, Lester (2016) says that revenues generated through fines are negligible compared with the lost income caused by the reduced global oil price. The government cannot rely on such initiatives to get enough money to fund various social and developmental activities. One of the measures that all six governments have considered is the elimination of subsidies extended to many companies in the country (World Bank, 2014). In these six countries, the national governments have been spending a lot to subsidize the cost of production as a way of cushioning the people against high prices, especially of essential commodities such as foodstuffs, clothing, and education. The decreased source of revenue is forcing these governments to consider such drastic measures. Ulrichsen (2016) says that GCC countries have always avoided the introduction of value-added tax (V.A.T) to manage products’ prices in the local economy. However, the tough economic situation in the countries may force them to introduce this tax as a way of generating additional revenues to support government functions. It is important to note that the introduction of taxes may not be an easy initiative to implement. The regional governments, especially the Kingdom of Saudi Arabia and the United Arab Emirates, have considered a diversification of the economy as a means of solving the problem.

According to Mottaghi and Devarajan (2014), the falling oil price since mid-2014 has played a critical role in changing the regional socio-political environment. Most of the people in these countries have become used to a lifestyle where the national government subsidizes most of the basic products (Guastella & Menghi, 2016). However, that is set to change as the subsidies may be eliminated. In the Kingdom of Saudi Arabia, elaborate plans are already in place to cut down government expenses on subsidies and to introduce taxes. Living cost is, therefore, expected to be higher than it is currently. Callen, Cherif, Hasanov, Hegazy, and Khandelwal (2014) say that making citizens pay for these basic needs may not be a problem to many, specifically for those who understand the true impact of the reduced international oil price.

The problem is the rate at which these changes have to be implemented. In less than four years, there is going to be a major shift, from subsidized products in the market to taxed commodities (Altomonte & Ferrara, 2014). It may not be easy for people to deal with the sudden increase in product prices within such a short period. Many may be forced to change their lifestyles completely. It is important to appreciate the fact that some of these people are also affected directly by the reduction of global oil prices. Many companies in Saudi Arabia, the United Arab Emirates, and other GCC countries have opted to downsize as a means of dealing with the reduced flow of income (World Bank, 2015). The locals have felt the impact of the lay-offs as some of them are now jobless. Others have been forced to deal with reduced salaries as a better alternative to losing a job.

According to Ramady and Mahdi (2015), the political atmosphere is expected to change as the government plans to introduce taxes and eliminate subsidies that the locals have been enjoying for a very long time. In Kuwait, the lawmakers have vowed to reject any attempt to introduce the value-added tax in the country. Ulrichsen (2014) says that these politicians are championing the interest of the people. Although people understand that the fall in global oil prices has affected the government’s revenues, they are not ready to deal with the sudden increase in the cost of living. They feel that the government has a responsibility to its people to find alternative sources of revenue to meet its current needs (International Monetary Fund, 2014). The government must use creative means of revenue generation other than having to tax its people. It may not be easy to do that. The next chapter focuses on the methodology of this study.

Methodology

The declining global oil price and its impact on leading petroleum-producing countries, especially in the GCC, have attracted the attention of many researchers. It was important to collect data in this study to inform the findings and conclusion. It would have been good if primary data were to be collected from a sample of respondents. However, the time available for the study was very short, and it was not possible to do that. As such, the study wholly relied on data collected from secondary sources. Information was obtained from books, journal articles, and reliable online sources. These sources were selected with care to ensure that information obtained is trustworthy. For the journals, only peer-reviewed articles were selected. For the websites, the study relied on organizations with authority such as the World Bank, the International Monetary Fund, the World Trade Organization, and various United States governmental departments. Books used in the study were carefully selected to ensure that they capture the topic of this study precisely. Top news agencies such as the New York Times also helped in understanding the nature and magnitude of the problem. The findings from these sources were discussed, and they formed the basis of the conclusion made. The next section focuses on the findings made from the sources.

Findings

The findings obtained from the secondary data sources in this study show that the declining international oil price has had a serious socio-political and economic impact on GCC countries. When the problem started in mid-2014, many stakeholders in the oil and gas sector, including the government, expected that it would not last long. Many economists predicted that the decline would not continue for more than four or five months (Al-Mawali, 2015). They based their analysis on the past trends and the forces responsible for the current problem. However, it is now three and a half years since the problem started and it is not yet clear when it will be addressed. Currently, most of the GCC countries are struggling to finance their budget. It is important to look at the specific economic, social, and political implications of this problem.

Economic Impact

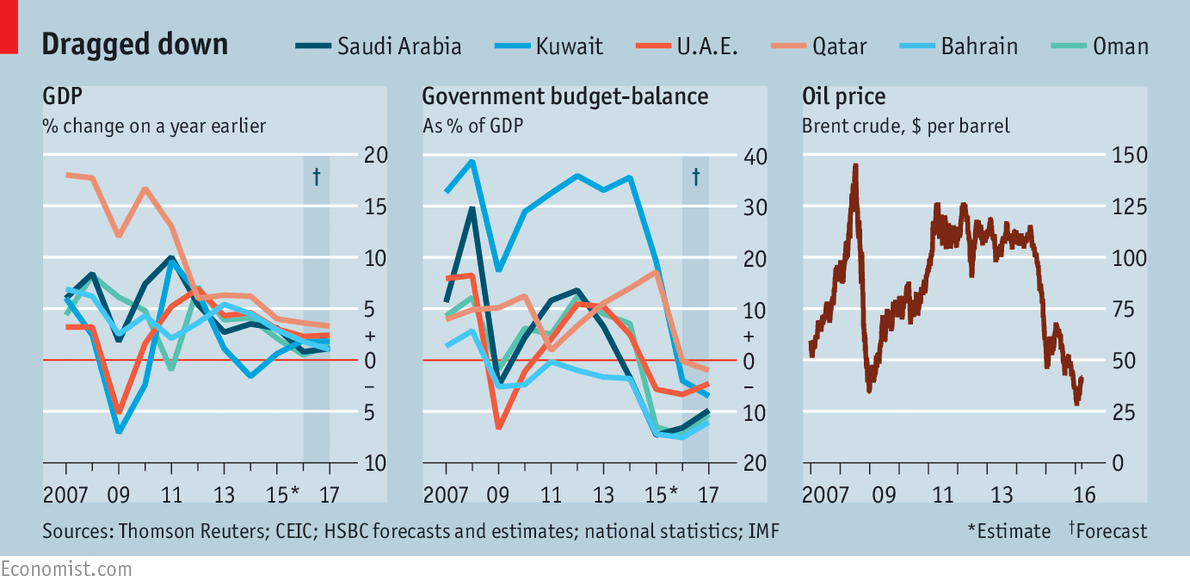

The GCC member states are currently struggling to find ways of dealing with the unprecedented drop in global oil prices, which is their main source of revenue. Wiseman (2014) says that the economic implications have been dire, and some may even experience economic recession if preventive measures taken fail to yield the desired results. Figure 2 below shows economic statistics on the impact of the declining international price of oil on GCC member states:

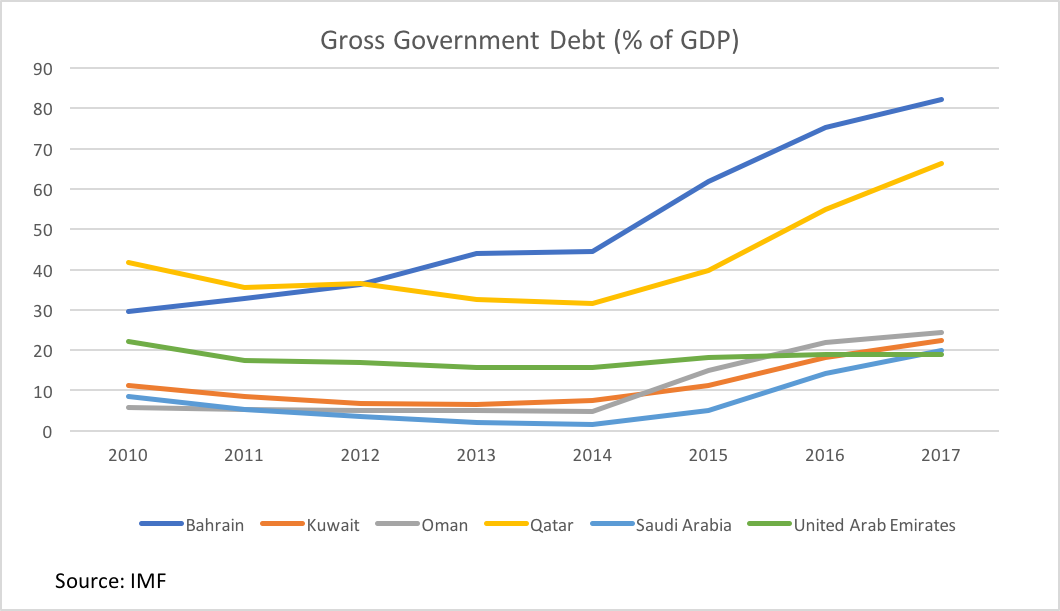

The figure above shows that the GDP growth rate of all the GCC member countries has been affected by the sustained drop in the global oil price. The governments’ budget balance as a percentage of the GDP is also affected significantly. Although Kuwait has demonstrated some resilience, it is clear that it is not immune to these challenges. As the oil price per barrel continues to drop, each of these countries is finding it increasingly difficult to have a balanced budget. Ulrichsen (2016) argues that GCC member states have no option but to resort to government borrowing to finance the budget. Figure 3 below shows the increasing gross government debt, as stated by O’Hanlon and Steinberg (2017), in the six GCC member states:

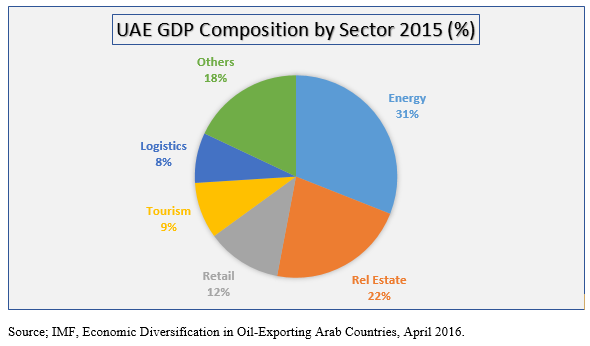

The graph shows that Kuwait, Qatar, the Kingdom of Saudi Arabia, and the United Arab Emirates experienced a reduction in gross government debt from 2011 to 2014. Each of these governments was able to finance the budgets without having to rely on external donors. Oman also had no significant problems in funding its budget. It is only Bahrain that had a consistent increase in government debt, though that seemed to change between 2013 and 2014. However, when the region was hit by the falling oil prices, everything changed. All the countries started borrowing to finance their budget. Qatar and Bahrain were the most affected countries regarding the sudden increase in government debt. The United Arab Emirates, Saudi Arabia, Kuwait, and Bahrain have tried to put to check their excessive borrowing, especially from international financial institutions such as IMF, the World Bank, or foreign countries (Shahid & Ahmed, 2014). However, the reduced revenues may threaten the sustainability of the economies. Some countries have tried to diversify their economies to help them deal with the current shock of the dropping oil price. Figure 4 below shows the level of diversity of the United Arab Emirates’ economy.

The massive investment and effort put in place by the United Arab Emirates’ government to diversify the economy has born fruits. As shown in the figure above, although the energy sector is still the largest as a percentage of GDP, it has been reduced to 31% of the country’s source of revenue. It means that currently only 31% of the economy of the country is affected by the reduced global oil price if the ripple effect of this problem is not taken into account. The real estate sector has been growing steadily, and it currently accounts for 22% of the country’s GDP. Other important sectors of the economy include the retail, logistics, and tourism.

Socio-political Impact

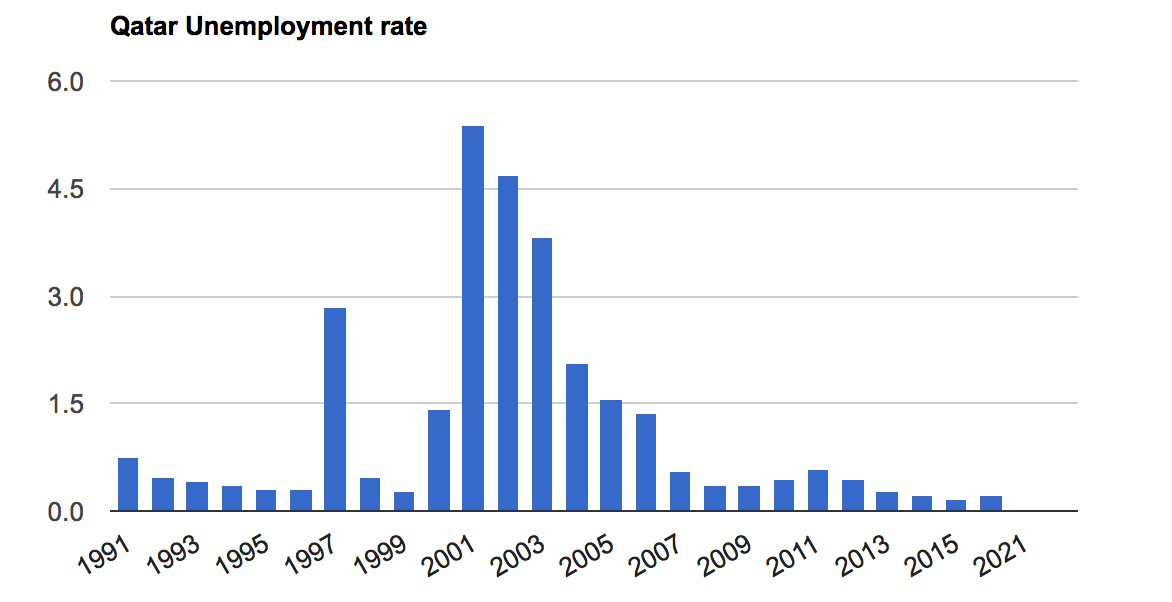

The socio-political environment of these six countries has also been affected by the ongoing problem. Devarajan and Mottaghi (2015) say that one of the major social problems is the loss of a job to many people who were working in the oil and gas industry and related sectors. Many oil companies have been forced to reduce the number of their employees because of the need to reduce expenses. Some of the regional countries like Qatar and Kuwait have made tremendous steps in reducing unemployment rates since 2001, but the gains may be rolled back if the problem persists, as shown in figure 5 below:

Pay-cut is another social issue that is becoming common in the region as companies struggle to deal with the reduced flow of revenue. The hospitality and transport sectors are some of the worst affected industries because of their relationship with the oil and gas sector. Azoury and Bournois (2014) say that living standards of many people may change as their source of income is disrupted. Some of the luxuries which have been available for the middle class may only be available to the rich. These socio-economic problems may lead to political problems. The GCC countries were not affected by the Arab Spring. It may be attributed to the comfort that these governments have created for their people through the elimination of taxes and introduction of subsidies. The current trend may force these governments to drop these benefits, and it is unpredictable how such a move may affect the political landscape of the region. The current peace and stability in the GCC member states may not be guaranteed. At the moment, the Kingdom of Saudi Arabia is one of the regional powers in the Middle East because of its strong economy and military might. However, these political privileges may be eliminated if the economy is destabilized by the reduced international oil price.

Conclusion

The findings of this paper demonstrate that the declining international oil price have a serious economic, social, and political impact on the GCC member states. The ability of these governments to spend heavily on programs such as subsidizing basic needs may be compromised. Most of these governments have come to appreciate that their purchasing power has been reduced by the current problem. Most of these governments funded various projects using the proceeds from the sale of hydrocarbons. With the reduced revenues from these products, the GCC governments have been forced to eliminate some of the subsidies and mega projects considered less important to the countries’ socio-economic and political growth. It is feared that the reduced government expenditure (especially on subsidies and other projects, which are socially important) may affect the political atmosphere in the region. The interpreted data in the analysis section show that people may blame their governments for the increased cost of living. The regional political stability may be affected.

References

Al-Mawali, N. (2015). Intra-Gulf Cooperation Council: Saudi Arabia effect. Journal of Economic Integration, 30(3), 532-552.

Altomonte, C., & Ferrara, M. (2014). The economic and political aftermath of the Arab spring: Perspectives from Middle East and North African countries. Cheltenham, UK: Edward Elgar.

Amineh, M. P. (2017). Geopolitical economy of energy and environment: China and the European Union. Leiden, Netherlands: Brill.

Azoury, N., & Bournois, F. (2014). Crisis, globalization and governance: How to draw lessons. Newcastle upon Tyne, UK: Cambridge Scholars Publishing.

Behnassi, M., & McGlade, K. (2017). Environmental change and human security in Africa and the Middle East. Cham, Switzerland: Springer.

Callen, T., Cherif, R., Hasanov, F., Hegazy, A., & Khandelwal, P. (2014). Economic diversification in the GCC: Past, present, and future. New York, NY: International Monetary Fund.

Cambanis, T., & Hanna, M. (2017). Arab politics beyond the uprisings: Experiments in an era of resurgent authoritarianism. New York, NY: Century Foundation Press.

Cherif, R., & Hasanov, F. (2014). Soaring of the gulf falcons. Washington, DC: International Monetary Fund.

Claessens, S. (2014). Financial crises: Causes, consequences, and policy responses. Washington, DC: International Monetary Fund.

Colombo, S. (2014). Bridging the gulf: EU-GCC relations at a crossroads. Roma, Italy: Edizioni Nuova Cultura.

Devarajan, S., & Mottaghi, L. (2015). Towards a new social contract. Washington, DC: International Bank for Reconstruction and Development.

Devarajan, S., & Mottaghi, L. (2016). Middle East and North Africa economic monitor April 2016: Syria, reconstruction for peace. Washington, DC: The World Bank.

El-Katiri, L. (2016). Vulnerability, resilience, and reform: The GCC and the oil price crisis 2014–2016. New York, NY: Columbia University Press.

Farnham, C. (2016). Beyond the consent of the governed. New York, NY: Page Publishing.

Gengler, J., & Lambert, A. (2016). Renegotiating the ruling bargain: Selling fiscal reform in the GCC. The Middle East Journal, 70(2), 321-329.

Guastella, A., & Menghi, A. (2016). GCC market overview and economic outlook 2017: A challenging transformation ahead to achieve desirable growth. Milano, Italy: Value Partners Management Consulting.

Hellyer, H. A. (2016). A revolution undone: Egypt’s road beyond revolt. New York, NY: Oxford University Press.

Heydarian, R. J. (2014). How capitalism failed the Arab world: The economic roots and precarious future of Middle East uprisings. London, UK: Zed Books.

International Monetary Fund. (2014). World economic outlook October 2014: Legacies, clouds, uncertainties. Washington, DC: International Monetary Fund

Koltai, S., & Muspratt, M. (2016). Peace through entrepreneurship: Investing in a startup culture for security and development. Washington, DC: Brookings Institution Press.

Lester, L. (2016). Energy relations and policy making in Asia. Singapore, Singapore: Springer Singapore.

Mottaghi, L., & Devarajan, S. (2014). Harnessing the global recovery: A tough road ahead. Washington, DC: World Bank.

O’Hanlon, M., & Steinberg, J. (2017). A glass half full: Rebalance, reassurance, and resolve in the U.S.-China strategic relationship. Washington, DC: Brookings Institution Press.

Ozdemir, S. (2017). Handbook of research on sociopolitical factors impacting economic growth in Islamic nations. New York, NY: IGI Global.

Ramady, A., & Mahdi, W. (2015). OPEC in a shale oil world: Where to next. Cham, Switzerland: Springer.

Shahid, A., & Ahmed, M. (2014). Environmental cost and face of agriculture in the Gulf Cooperation Council countries: Fostering agriculture in the context of climate change. London, UK: McMillan.

Ulrichsen, K. (2014). Qatar and the Arab spring. Oxford, UK: Oxford University Press.

Ulrichsen, K. (2016). The politics of economic reform in Arab gulf states. Houston, TX: Rice University Press.

Wiseman, A. W. (2014). Education for a knowledge society in Arabian Gulf Countries. Bradford, UK: Emerald Group Publishing Limited.

World Bank. (2014). Global economic prospects, volume 8, January 2014: Coping with policy normalization in high-income countries. Washington, DC: The World Bank.

World Bank. (2015). Global economic prospects, January 2015: Having fiscal space and using it. Washington, DC: The World Bank.