Introduction

The economy of the United Arab Emirates (UAE) is the second largest in the Gulf Cooperation Council (GCC). It is also one of the rapidly growing economies in the world. In the last four decades, the economy has transformed from a poor country that depended on fishing, agriculture, and herding to a modern economy that boast of high per capita income and trade surplus (Nyarko, 2011, pp. 3-78).

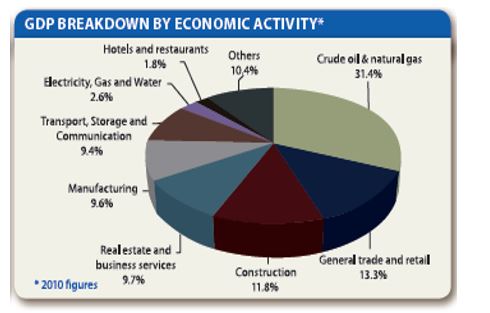

The main industries that contribute to economic growth in UAE include tourism, oil, services, construction, and manufacturing. UAE’s economy is highly integrated with the world economy, thereby making it susceptible to exogenous shocks. This paper examines the impact of the recent global financial crisis on UAE’s employment, banking, real estate, and tourism sector.

UAE’s Economy In Terms of GDP

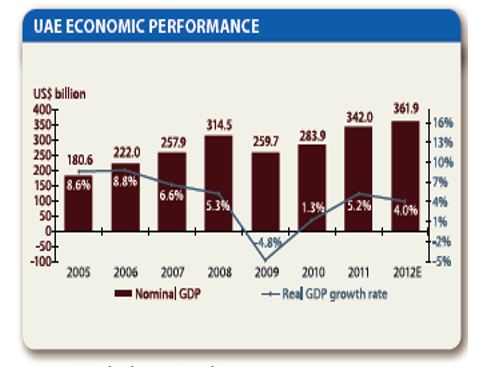

Prior to the global financial crisis, which began in 2007, the UAE enjoyed rapid growth in its gross domestic product (GDP). Figure 1 (in the appendix) shows the country’s GDP growth rate from 2005 to 2012. From 2003 to 2006, the country’s GDP grew at an average rate of 7% (Zaki & Rao, 2011, pp. 304-320).

This rapid growth was underpinned by strong economic activity, high domestic consumption, and increased earnings from oil exports. From 2005 to 2008, the country’s nominal GDP expanded at a CAGR of 21.9% due to high earnings in the tourism, oil, and real estate sector.

The impact of the global financial crisis was realized from the second half of 2008. The UAE was severely affected by the crisis due to its openness to international trade, as well as, its reliance on tourism and oil exports. In particular, economic growth was adversely affected due to fluctuations in oil prices and reduction in aggregate demand in the countries that import UAE’s products (Nyarko, 2011, pp. 3-78).

The decline in economic growth was reflected in the significant reduction in the country’s GDP. According to figure 1, GDP reduced from 6.6% in 2007 to 5.3% in 2008. This decline was attributed to significant reduction in oil prices, as well as, reduction in oil production in the country.

In 2009, the country recorded its lowest GDP growth rate in the last five years. Concisely its GDP contracted by -4.8% (Bank Audi, 2013). The factors that accounted for the decline include the reduction in revenue from oil by approximately 32% (Nyarko, 2011, pp. 3-78). According to figure 2 (in the appendix), consumption, which is the third largest component of UAE’s GDP, reduced significantly as unemployment rate increased and expatriates and foreign investors left the country.

In 2010, the government implemented an expansionary fiscal policy, which involved heavy investment in non-oil industries. The resulting increase in aggregate demand led to a GDP growth rate of 1.3% in 2010. In 2011, the GDP grew by 4.9% due to increased oil production and high oil prices. The government expects increased public expenditure, recovery of the real estate sector, increased tourist arrival, and high oil prices to spur economic growth in 2013.

Impact on the Employment Sector

UAE has always maintained one of the lowest unemployment rates in the world. Table 1 (in the appendix) shows the country’s unemployment rate between 2003 and 2011. From 2003 to 2007 when the global financial crisis began, the UAE had an average unemployment rate of 2.81%.

However, the unemployment rate began to rise in 2008 due to the financial crisis. Concisely, most companies in major industries such as banking, construction, and tourism made huge losses during the crisis period. Consequently, they reduced their workforce in order to avoid escalation of labor costs (Toledo, 2013, pp. 39-53).

Additionally, most companies were reluctant to create new jobs in 2008 because they were not sure of when domestic and global aggregate demand would rebound. Concisely, most firms chose to postpone their plans to make new investments in order to avoid losses. Moreover, some companies left the country due to its unstable macroeconomic environment. Consequently, unemployment rate rose from 3.1% in 2007 to 4% in 2008.

The unemployment rate has remained above 4% since the beginning of the financial crisis. In 2009, the unemployment rate was high among the youth who were below 25years. This is because most companies focused on employing experienced personnel rather than fresh graduates from colleges or universities.

Most companies preferred to employ experienced people in order to save on training costs. During the crisis, the government focused on investing in the non-oil sectors and rescuing troubled private sector firms, thereby limiting its ability to create jobs in the public sector (Toledo, 2013, pp. 39-53).

This led to an increase in unemployment rate among the locals who prefer to work for the government rather than the private sector. In particular, the unemployment rate among the nationals rose to 20.8% in 2011, whereas only 3.2% of the expats in the labor force were unemployed (Toledo, 2013, pp. 39-53). Nonetheless, the UAE is one of the few countries that have managed to maintain their unemployment rate below 5% after the financial crisis.

Impact on the Banking Sector

The country’s banking sector is highly integrated with the world’s financial markets. This facilitated the transmission of the adverse effects of the global financial crisis to UAE’s banking sector (Sercu, 2009, p. 75). Prior to the crisis, the banking sector of UAE enjoyed high growth by all measures.

For instance, between 2005 and 2007, the uptake of new loans grew at an annual rate of 30% (Brunnermeier, 2009, pp. 77-100). Similarly, deposits grew at a high rate of 27%. However, the profitability and growth of the sector reduced substantially in 2009 due to the following factors.

First, banks and clients had limited access to wholesale funding. UAE’s banks could not obtain funding from the traditional markets such as the USA and the UK to lend to their customers. This was because most western banks had financial troubles. Lack of wholesale funding led to high interest rates, thereby discouraging the uptake of new loans and increasing the default rate on existing loans. Second, the decline in real estate prices discouraged investors from launching new investments in the industry.

Several investors withdrew or deferred the loan contracts, which they had entered in order to fund real estate projects. Additionally, the public opted to save rather than to purchase new houses. Consequently, there was a severe reduction in the demand for mortgages. Third, the general decline in economic performance reduced borrowers’ ability to repay their loans. Thus, the number of non-performing loans increased during the crisis period. Finally, liquidity reduced as banks rationed credit in order to avoid making losses.

Impact on the Real Estate Sector

The real estate sector was also affected negatively during the crisis. In 2009, the number of new real estate projects that were launched in major regions such as Dubai and Abu Dhabi reduced tremendously. Similarly, the demand for new houses reduced due to limited availability of credit (Brunnermeier, 2009, pp. 77-100).

Lack of investor confidence led to capital flight from the economy. This led to the reduction in the number of new housing units that were built in 2009. Overall, the growth of the real estate industry declined by, nearly 15% in 2009. In response to this decline, the government injected $33 billion in the banking sector to fund real estate projects. Consequently, growth in the industry rebound to approximately 1.6% in 2010.

The real estate sector had not yet fully recovered by 2012. For instance, in Dubai and Abu Dhabi, new housing units had lost 56% and 45% of their value respectively between 2008 and 2012 (Hassan & El-Maghraby, 2011). Additionally, the country had an excess supply of nearly 65,000 units by 2012. This surplus reflects the inability of the demand for houses to rebound to its pre-crisis level.

Impact in the Tourism Sector

The impact of the financial crisis was mainly felt in 2009 in the tourism sector. At the domestic level, demand for tourism products reduced because citizens focused on saving their income by cutting on leisure expenditure.

The number of foreign tourists also reduced dramatically due to the economic downturn. This is because nearly 80% of the country’s foreign tourists are usually business executives (Nyarko, 2011, pp. 3-78). Additionally, UAE’s tourism sector has traditionally been positioned as a luxury market, thereby discouraging tourist arrival during the crisis.

The supply of new hotel rooms also reduced due to high construction costs. Moreover, the hotel occupancy rate in major cities such as Dubai was less than 75%. Consequently, most hotels made losses. Moreover, most firms in the sector had to reduce their labor force in order to remain profitable.

Nonetheless, the industry’s growth rebound in 2010 with hotel occupancy increasing by nearly 14% (Hassan & El-Maghraby, 2011). This growth was underpinned by the increase in competition in the airline industry that led to a reduction in air tickets to UAE’s major tourist destinations such as Dubai and Abu Dhabi.

In 2011, the industry continued to experience strong growth. However, the growth was underpinned by external positive shocks rather than improvements in UAE’s macroeconomic fundamentals. In particular, the 2011 political unrest in the Arab Spring led to the diversion of demand from major markets such as Egypt and Tunisia to the UAE. Overall, the tourism industry is one of the few UAE’s sectors that have fully recovered from the effects of the recent global financial crisis.

Conclusion

The United Arab Emirates was adversely affected by the recent global financial crisis. The effects were mainly felt in 2009 when the country’s GDP contracted by -4.8%. The main sectors that were adversely affected included employment, banking, real estate, and tourism.

The government responded to the crisis by diversifying the economy. This involved increased public investments in non-oil industries. Consequently, the tourism and banking sectors have rebound. Nonetheless, growth in the real estate industry is still very low and unemployment among locals continues to rise.

Appendix

Table 1: UAE’s Unemployment rate.

References

Bank Audi. (2013). UAE economic report. Web.

Brunnermeier, M. (2009). Deciphering the liquidity and credit crunch in 2007-2008. Journal of Economic Perspectives, 23(1), 77-100.

Hassan, F., & El-Maghraby, M. (2011). UAE real estate sector. Web.

Nyarko, Y. (2011). The United Arab Emirates: Some lessons in economic development. New York, NY: UNU-WIDER.

Sercu, P. (2009). International finance: Theory into practice. New York, NY: McGraw-Hill.

Toledo, H. (2013). The political economy of emiratization in the UAE. Journal of Economic Studies, 40(1), 39-53.

Zaki, E., & Rao, B. (2011). Assessing probabilities of financial distress of banks in UAE. International Journal of Managerial Finance, 7(3), 304-320.