Introduction

In the application of conceptual framework, standard setters have come up to many standards. The despite its importance, conceptual framework has received relatively little attention in the setting standards of financial reporting standard-setters. Thus, in making measurement decisions, standard-setters focus on applying the definitions of financial statement elements and the qualitative characteristics of accounting information in the context of the objective of financial reporting. Application of those concepts has resulted in a variety of measurement bases being used to measure financial statement amounts. These include historical cost, amortized historical cost, fair value, and value in use, among others.

The basis of preparing the generally accepted accounting standards emanates from financial accounting standards board concepts and statements that are known to create conceptual framework. This conceptual framework that is used in preparing financial accounting reporting standard as come under criticism from various academician and professionals. Concepts and statements that are used in coming up with financial statements include concepts of prudence, consistence, matching and accrues basis. Before we explore the critic point of view lets look at how this accounting concepts are framed.

The accounting concept are highlighted as follows objectives of financial reporting by business enterprises this explain the goals and aim preparation of financial statement or accounting report going to describe main uses as creditors and shareholders. It does not define other stakeholders who are most crucial. They go a head to classify users into present and potential with assumptions that these users have reasonable knowledge of accounting and they understand business and economic situations prevailing at the country and at time of reporting.

For the analyst, the conceptual framework is an important building block in understanding information provided by financial statements. The conceptual framework delineates the characteristics accounting information must possess to be useful in investment and other economic decisions.

It further defines objectives of financial reporting as to be used in making in decisions about investments giving of credit and when to sell the share. It also assumes that it will help them as assess the timing and uncertainty of cash flow in an organization.

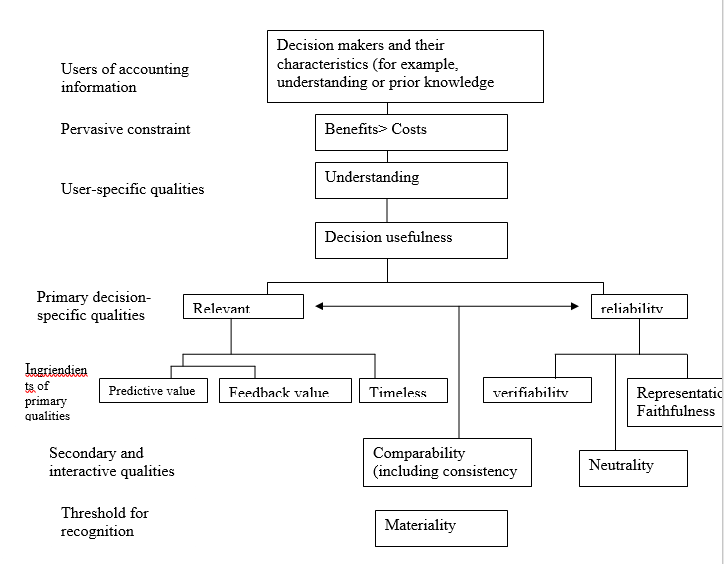

A hierarchy of accounting qualities source figure 1 of FASB concepts statement no 2. Qualitative characteristics of Accounting information.(adapted from White G. I, Sondhi A. C. and Fried D.)

Statement of financial Accounting Concepts (SFAC) 1, sets forth the objectives of financial reporting. While statement of Financial Accounting Concepts (SFAC) is concerned with the Qualitative characteristics of Accounting Information.

Qualitative characteristics of Accounting Information. Analysts’ concern with the qualitative characteristics of accounting information derives from the need for information that facilitates comparison of firms using alternative reporting methods and is useful for decision-making. Although some of these characteristics are self-evident, others require some explanation. We start with relevance and reliability, key characteristics from the analyst point of view.

Relevance is defined as the capacity of information to make a difference in a decision. In practice, of course, the relevance of information depends on the decision maker. To a technical analyst, all financial data are relevant. For fundamental analysts, the relevance of information varies with the method of analysis.

Timeliness is an important aspect of relevance. Information loses value rapidly in the financial world. Market prices are predicated on estimates of the future; data on the past are helpful in making projections. But as time passes and the future becomes the present, past, past data become increasingly irrelevant.

Reliability is encompasses verifiability, representational faithfulness, and neutrality. The first two elements are concerned with whether financial data have been measured accurately and whether they are what they purpo0rt to be. Data without these characteristics cannot be relied on in making investment decisions.

Neutrality is concerned with whether financial statement data are biased. FASB proposals are frequently the object of complaints that companies will be adversely affected by the new standard. The principle of neutrality states that the board should consider only the relevance and reliability of the data, not any possible economic impact.

Unfortunately, relevance and reliability tend to be opposing qualities. For example, the audit process improves the reliability of data, but at the cost of timeliness. For that reason, financial statement users have generally not supported the auditing of quarterly data, believing that the time delay does not compensate for any improved data quality.

Relevance and reliability also clash strongly in a number of accounting areas. Market value data investments may be highly relevant but may be accurate only to a limited extent. Yet historical cost, although highly reliable, may have little relevance. It is old argument as to whether it is better to be “precisely wrong” or “approximately right.”

Analysts have generally opted for approximately right. They have supported the disclosure of supplementary data in such areas as natural resources off balance sheet financing and segment data. Auditors and prepares, more concerned with reliability, have often opposed the inclusion of less reliable data in the financial statements.

Consistency and comparability are also key characteristics of accounting information from the analyst perspective. Consistency refers to use of the same accounting principles over time. A broader term, comparability, refers to comparisons among companies. Consistency is affected by new account standards and voluntary changes in accounting principles and estimates. Accounting changes hinder the comparison of operating results between periods when the accounting principles used to measure those results differ. As the transition provisions of new accounting standards vary, it for such changes. For voluntary changes the effect of the change is generally disclosed only for the year of the change.

Comparability is a pervasive problem in financial analysis. Companies are free to choose among different accounting methods and estimates in a variety of areas, making comparisons of different enterprises difficult or impossible. Although the FASB has narrowed these differences somewhat in recent years, new types of transactions create new sources of non-comparability. Even when accounting differences do not exist, however, comparability may be missing because of real differences between the firms.

Worldwide accounting standards setting decisions relate to conceptual framework especially that of measurement. Therefore, conceptual framework helps standard setters to set standards this is based on the measurement concept. The accounting framework lack rules on the measurements. As accounting, concepts that are used assist in decision making to accounting setters. With the emergence of international accounting reporting convergence due to internal expansion of business , International Accounting Standards Board and Financial Accounting Standards Board are working together to improve conceptual frameworks for accounting setting.

Accounting for Managers

Accounting for managers entails corporate social responsibility. Corporate social responsibility is the duty and moral obligation of corporate to other stakeholders. Corporate social responsibility refers to moral rights and wrongs of any business transaction or decisions. The moral responsibility of corporate depends on the nature of business and the individuals involved. Business organizations have adopted various ethical policies because they believe in showing the neighborhood their moral responsibility and in the process they have increased their sales.

Corporate social responsibility like any other concept is to be discussed broad terms. The concept of corporate social responsibility has been in existence since 1953 when it was introduced in American corporations. Its basic premises of ethical obligation have made managers and shareholders to own self interest in business transactions. Any manager who incurs business transactions will consider and address the needs of the society. Corporate social responsibility revolves around four basic theories which include social contract theory, social justice theory, rights theory and deontological theory.

Social contract theory: There exists a series of explicit and implicit contracts between individuals, organizations, and institutions forming central tenet of social contract theory. Tenet of social contract theory assumes social contracts evolve around an environment of trust and harmony. Corporations enter contracts with the society to receive resources and societal acceptance to operate in exchange for harmony.

Social Justice Theory: Social justice theory, examines the fairness in distribution of societal goods and services. Social justice theory argues that a fair society are considered, by of distribution of social goods. Corporate managers, have a responsibility in ensuring these goods have been appropriately being distributed in society.

Rights theory: Rights theory deals with the rights of various members of the society, including basic human rights and property rights. Corporate managers should not interfere with property rights and human rights of members of the society. Shareholders of a corporation who have certain property rights should not affect human rights of employees, local community members, and other stakeholders.

Deontological theory: Deontological theory assumes that everybody has a moral duty to treat everyone else with respect, including listening and considering their needs. This belief is for everyone, including corporate managers, shareholders and other stakeholder. Corporate social responsibility gives reasons why managers should work towards sustainable development.

Importance of social responsibility

Social responsibility is important as it takes care of accounting part of social activities to other stakeholders. Traditional accounting standard only caters for accounting for one or two stakeholders. The inclusion of social responsibility accounting setting will help in reducing the companies costs of trying to make decisions on how to account for them.

References

Barth, M. E. 2004. “Fair Values and Financial Statement Volatility”, in The Market Discipline Across Countries and Industries, Edited by Claudio Borio, William Curt Hunter, George G. Kaufman, and Kostas Tsatsaronis. Cambridge, MA: MIT Press.

Barth M.E. (2006); Standard-Setters, Measurement Issues and the Relevance of Research Graduate School of Business Stanford University and International Accounting Standards Board.

Landsman, W. R. 2005. “Fair Value Accounting for Financial Instruments: Some Implications for Bank Regulation.” Working paper. University of North Carolina, Chapel Hill.

Storey, R. K., and S. Storey. 1998. “The Framework of Financial Accounting Concepts and standards.” FASB: Norwalk, CT.

International Accounting standards Board. 2006. Preliminary Views on an Improved Conceptual Framework for Financial Reporting: The Objective of Financial Reporting and the Qualitative Characteristics of Decision-Useful Financial Reporting Information. London, UK.

Financial Accounting standards Board. 2006. Statement of Financial Accounting standards No. 157: Fair Value Measurements. Norwalk, CT.