Introduction

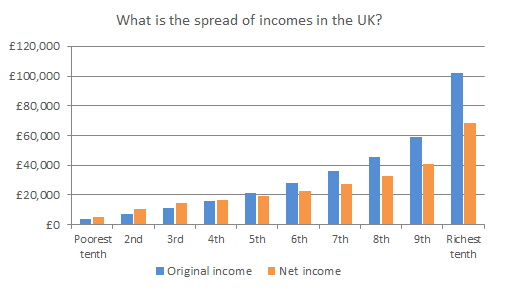

It is difficult to ignore the scale of income inequality in the United Kingdom (U.K) because it is among the highest in the industrialized world (Atkinson 2015). Low-income people have an income of £8,468, which is ten times less than that of the rich (£79,042) (The Equality Trust 2015). The graph below shows the scale of income inequality in the country.

The graph above shows that the level of income inequality is at its highest at the top of the income scale. Concisely, groups with the 9th highest incomes make only 60% of what people at the top level of the socioeconomic hierarchy make (The Equality Trust 2015). The level of income inequality is also higher if we analyze the original incomes as opposed to the net income. The poorest 10% of the population has an income of £3738, while their peers at the top level of the socioeconomic ladder have an income of £102,366 (The Equality Trust 2015).

These statistics show that the original income of the poor is 27 times smaller than the original income of the rich. In May 2014, the Office for National Statistics Data revealed that the top 1% earners in the U.K had the same amount of wealth as the total 53% of the country’s population (The Equality Trust 2015). During the same period, the Sunday Times reported that the richest 1% of the population had doubled their wealth in the last five years alone (Atkinson 2015).

Based on the income inequality problem in the U.K, the Green Party (2014) revealed that the poorest 20% of the population in the U.K are worse off than their counterparts in other western European countries, including Germany, Austria, France, and Sweden. The same political organization compared the living standards of the poorest 20% of U.K citizens and found out that they are similar to many Eastern European countries, including the Czech Republic and Slovenia (Green Party 2014).

Indeed, compared to other Organisation for Economic Cooperation and Development (OECD) countries, the U.K has among the highest income inequalities. For example, a sample of 30 countries from this union, including the United States (U.S), Australia, Canada, Netherlands, Denmark, Norway, and Germany (among other countries) revealed that the U.K was among the fifth most unequal countries in the OECD (in terms of income inequality) (The Equality Trust 2015). Compared to other European countries, experts also rated it as the second most unequal country in the continent (Atkinson 2015).

Different experts have proposed different solutions to solve the income inequality problem in the U.K. Most of these solutions have been political. For example, the UK labor party recently revealed that if it were elected to office, it would impose a 50% income tax for the top earners in the country. While this proposal is plausible, it raises a question regarding whether it is prudent to reduce income inequality through taxes and transfers. It also brings attention to the concept of optimal taxation. This paper exploits this issue in-depth in lieu of the concepts of efficiency and resource distribution. It also explores the possible consequences of taxing the top earners at a higher rate than other groups of taxpayers. However, before delving into these details, it is pertinent to understand the concept of optimal taxation as it applies to this study.

Optimal Taxation

The concept of optimal taxation emerges within a theoretical framework, which presupposes that a country’s taxation system should strive to improve the welfare of its citizens, subject to certain constraints (Salanié 2011). Economists often evaluate a country’s tax system on two fronts – efficiency and equity. Tax efficiency usually excludes ethical and normative arguments because it narrowly focuses on resource allocation issues (Boadway 2012). Resource distribution emerges within the purview of social and economic equity. For a long time, economists have highlighted the consequences of not reflecting specific value judgments on a country’s tax system (Salanié 2011), but they do not always say which value system should guide a country’s taxation model.

The optimal taxation model also treats the social planner as a utilitarian. Here, the concept of the optimal tax suggests that the tax system should be efficient and free from distortion. In the context of this study, distortions arise through income inequalities. Comprehensively, the concept of optimal tax strives to maximize social welfare within a given revenue requirement (Boadway 2012). Based on this understanding, the optimal tax theory often helps governments to make decisions regarding whether to use income tax or commodity tax to maximize social welfare. For commodity taxes, it explains whether governments should tax different commodities, or defines how progressive a tax system should be (Boadway 2012).

Generally, the concept of optimal tax engages different tenets of the tax system to maximize social welfare in a country. Politicians have often used the concept of optimal tax to support, or oppose, the imposition of high taxes for the rich. Some of their arguments for the proposal appear below

Reasons for Increasing Taxes for the Rich

The arguments proposed by the U.K labor party to increase the tax rate for the rich are not exclusive to the British political space alone; democrats in the U.S also hold the same view (Cohen 2015). Some experts have supported the same sentiments by saying that the government could raise more revenue by increasing the tax rate for this small group without affecting other income groups (Bermann 2014). They hold this belief because of statistics, which show the rapid increase in wealth among the top earners over the past decade. Indeed, this paper has already shown that the wealthiest 1% of the British population have doubled their income in the past five years.

Experts believe adjustments in income tax have not put up with this change because the rich still make more money than the government collects in tax (Thorndike & Ventry 2002). Many people also hold the belief that taxing the rich would not necessarily affect their lifestyles as they have more than enough money to finance their basic and secondary needs. However, the same assumption would not be true for the middle class because slight variations in income tax could significantly affect their lifestyles.

People have different ideas about equity and efficiency as it relates to the design of the U.K tax system. While the labor party may perceive increased taxation of the rich as one form of promoting equity and efficiency in the tax system, there are little disagreements among pundits that doing so could create distortions in the market and the economy at large (Thorndike & Ventry 2002). However, at the same time, many researchers argue that income inequality, which stems from ineffective tax systems, could cause economic decline (Atkinson 2015). The same is also true when there are progressive tax systems in a country because they could promote economic growth. Supporters of the labor party often argue that certain types of taxes for the rich could promote economic growth in the U.K. For example, an increase in estate tax for the rich could promote economic growth because it would increase the value of property that the rich would want to leave to their heirs (Thoma 2015).

Proponents of the proposal by the labor party to increase taxes for the rich also support their arguments from an ethical perspective by saying that, meritocracy, which is the bedrock of capitalism, has given the rich an unfair advantage over other people, who could be equally as hardworking, or innovative, as they are (Cohen 2015). For example, children from wealthy families often have the benefit of gaining access to good education and have valuable social or business networks that would allow them to advance in their careers. Such advantages elevate them above their peers, but unjustifiably so because they have nothing over their competitors except being born into wealthy families.

Since research also shows that inefficiencies in the U.K capitalistic system prevent workers from getting fair wages, proponents of proposals by the labor party to increase taxes for the rich have also argued that doing so would correct this imbalance and reclaim income that should have flown to workers in the first place (Thoma 2015). These are some of the most compelling arguments advanced by proponents of the labor party. However, some people do not support their view because they believe that increasing taxes for the rich, to more than 50%, would not yield the desired reduction in income inequality as supporters of the labor party claim (Sowell 2013; Badel 2015). Their views appear below

Increasing Tax for Top Earners would not reduce Income Inequality

As shown above, some experts believe that taxing the wealthy would promote economic growth (Thoma 2015). The concept of optimal taxation also supports this argument because it promotes the argument that poor taxation policies cause distortions in the market, which leads us farther away from the efficient allocation of resources (Salanié 2011). Proponents of this view also believe that economic growth is suppressed in this regard (Boadway 2012).

There are few disagreements that taxes cause distortions, but as Thoma (2015) argues, efforts to minimize such distortions should not override our quest to promote equity and fairness in the tax system. One view that has often characterized arguments that are unfavorable to tax increases is the penalization of creativity, innovation, and job creation, which many people attribute to economic growth (Sowell 2013). In line with this view, taxation discourages the wealthy from using these tools to create more wealth because they would be doing so at their expense and for the benefit of the government, or by extension, for the benefit of people who rely on the government.

Based on the above assertion, some researchers argue that increasing the rate of taxation for top earners would not have the desired effect of reducing income inequality (Sowell 2013; Badel 2015). For example, a paper from Brookings Economic Studies shows that increasing the tax burden for the rich would have a small or a negligent effect on reducing income inequality (Burke 2015). The research was championed by a fellow at the University, William Gale, who tested the hypothesis.

Using a model from the Urban-Brookings tax policy center, he tested whether significant gains in the reduction of income inequality could be found if the government increased the rate of income tax for the rich by 50%. Since the study was conducted in America, the researchers found that increasing the tax burden by this margin would mean an additional $6,464 in taxes owed to the government by some of these “wealthy” households (Burke 2015). However, the taxes owed to the government would further increase to $110,968 for households of the richest 1% of the population (Burke 2015). The study also found that the tax burden for the “extremely wealthy households (top 0.1% of households) would increase by more than $500,000 (Burke 2015).

To understand the effect of these tax increases on the income inequality gap, the researchers used the Gini coefficient (a measure of income inequalities between the rich and poor). Experts have used this measure to reveal the income gap inequalities among wealthy countries (Burke 2015). For example, using the tool, they found that Sweden had the lowest level of income inequality in the world (The Equality Trust 2015).

Nonetheless, using the Gini coefficient in their study revealed that taxing the top earners had a trivial effect on the level of income inequality in a country. Stated differently, they found that taxing the top earners in the country had no effect on income inequality (Burke 2015). They also found out that there would be insignificant changes in income inequality if the government evenly distributed the extra taxes to the lowest 20% of the population (Burke 2015). However, the move would increase the income level of this demographic (Badel, 2015). Statistics showed that such a move would increase the income of the poorest 20% of the population by $1,760 (Burke 2015).

Although Brookings Economic Studies reported insignificant changes in income inequality, they suggested that there could be a noble reason for increasing the tax burden of top earners. For example, they found out that tax increases could increase government revenue, which would also increase the resource pool for improving welfare services in the country (Burke 2015). Therefore, although they did not find evidence to support economic mobility through tax increases, they found out that the strategy could yield substantial benefits to most people in low-income groups.

Another argument advanced by some observers to disapprove of the proposal by the labor party stems from the fact that the rich already pay the highest taxes in the U.K. Indeed, statistics show that the top earners in the U.K already pay the highest taxes in the country. In fact, statistics from Mendick and Holehouse (2014) show that the rich already contribute 27% of the country’s income tax revenue. This percentage has increased from 22% in 2000 to 27% in 2014 (Mendick & Holehouse 2014).

The same statistic reveals that the top 3,000 earners in the country contribute £2.6 million to the national kitty (Mendick & Holehouse 2014). This finding shows that the income tax system of the U.K relies on top earners for most of its income tax revenue. In this regard, it would be unjustifiable to tax rich people, while they are already the highest contributors to income tax in the country. While this finding does not mean that the rich are not subject to further taxation from the government, it shows that they contribute their fair share of money to the income tax kitty. Relative to this finding, Atkinson (2015) argues that the top earners are not rich because they are manipulating the system, but because they take more risk, are more skilled, and work harder than the rest of the population.

Possible Consequences of Increasing Taxes for Top Earners

As shown in this paper, experts have divided opinions regarding the effects of taxing top earners. While some of them believe it would reduce income inequality in the U.K, others believe it would lead to a further decline in economic growth in the country (Sowell 2013; Badel 2015). People who hold this view believe that the nature of the global business space could aid a massive outflow of capital from the UK to other markets that do not heavily tax the rich (Thorndike & Ventry 2002).

They also believe that imposing a higher tax burden on the top income earners could discourage most of them from engaging in further economic activity because they would be “working for the government” (Sowell 2013; Badel 2015). With a lack of personal payoff, some of the proponents of this view argue that the rich would not be motivated to work hard because a huge proportion of their income would only go to the government (Thorndike & Ventry 2002). A separate group of observers believes that increasing taxes for the top earners would lead to increased tax evasion by the rich as they would look for creative ways of evading tax (Thorndike & Ventry 2002). Therefore cases of tax evasion could increase. Nonetheless, a different group of observers believes that an increase in taxes could reduce income equality through the fair and equitable distribution of wealth in society.

Conclusion

This paper has explored different arguments that support or oppose the increase of income tax for top earners in the U.K. Both arguments are plausible, but each of them has its merits and demerits. While increasing the tax burden on the rich could seem to reduce income inequalities on the surface, decades of research have shown that this is not always the case. Alternative measures could be more effective in reducing income inequality.

For example, reducing the number of tax loopholes that the top income earners could use to evade tax would be a workable measure of reducing income tax inequalities. Therefore, a more effective solution to addressing income inequality is improving the efficiency of tax collection and possibly looking for ways to include more people in the tax bracket. Such an approach would be more acceptable to both the rich and the poor because it would be less “punitive” as opposed to taxing top earners who already contribute more than their fair share to the national government. Such an approach would align with the principle of optimal taxation, which strives to increase efficiency in the market. Stated differently, such a theory does not promote “excessive” taxation because it would minimize the distortions that would arise from the same action.

Comprehensively, although the proposal to raise income tax for the rich may seem plausible, evidence from this research shows that the proposal would not solve income inequality in the U.K. In any case, it appears like a populist move which politicians have used to gather political support. For example, politicians have used such divides to create rifts between employers and employees and the rich and the poor. However, economically, increasing taxes for one group of taxpayers would not significantly reduce income inequality between the rich and the poor.

References

Atkinson, A 2015, Inequality, Harvard University Press, Cambridge. Web.

Badel, A 2015, Higher Taxes for Top Earners: Can They Really Increase Revenue. 2016. Web.

Bermann, J 2014, Raising Taxes on the Rich Would Reduce Income Inequality: Larry Summers. Web.

Boadway, R 2012, From Optimal Tax Theory to Tax Policy: Retrospective and Prospective Views, MIT Press, Cambridge. Web.

Burke, A 2015, New research shows raising the top income tax rate won’t reduce inequality. Web.

Cohen, P 2015, What Could Raising Taxes on the 1% Do? Surprising Amounts. Web.

Diamond, P & Saez, E 2011, ‘The Case for a Progressive Tax: From Basic Research to Policy Recommendations’, Journal of Economic Perspectives, vol. 25, no. 4, pp. 165-190. Web.

Green Party 2014, Taxing Wealth: The Green Party’s proposal for a Wealth Tax on the top 1%. Web.

Mendick, R & Holehouse, M 2014, How top 3,000 earners pay more tax than bottom 9 million. Web.

Salanié, B 2011, The Economics of Taxation, MIT Press, Cambridge. Web.

Sowell, T 2013, Trickle Down Theory and Tax Cuts for the Rich, Hoover Press, New York. Web.

The Equality Trust 2015, The Scale of Economic Inequality in the UK. Web.

Thoma, M 2015, Taxing the Wealthy Promotes Economic Growth. Web.

Thorndike, J & Ventry, D 2002, Tax Justice: The Ongoing Debate, The Urban Institute, New York. Web.