Executive Summary

The Canadian industrial growth has been phenomenal. With the growth of Canadian industries, exports have been on a hectic pace. All produce has to be at some point in time be packaged before delivery and because of the rise in industrial output, the packaging industry in Canada has been doing well. The desired effect of packaging is to enhance transportability, protection of the product during transit and shelf life, and serve to differentiate products. Be it in the automotive, aero, plastics, textile and garments, dry flow materials, or the food

sector, packaging consumption is driven by changes in consumer demand for convenience and portability. Therefore, the growth in packaging will remain in line with the population growth, which is estimated to be around 3% per annum. According to Euromonitor, in Canada, the presence of large, US and foreign-based manufacturers makes up the bulk of competitors, with Alcan; one of the few large domestic packaging companies, along with CCL Industries Inc, Norampac, Cascades, and Atlantic Packaging making a significant presence in the Canadian packaging industry (Euromonitor, 2008).

Expenditures on packaging products vary in comparison to the volume of shipments. Therefore, it is also critical to analyze the kind of industries that care for quality packaging and why. This paper attempts to provide an overview of the packaging products used by Canadian manufacturing industries in the automotive, aero, food, textiles, plastics, and dry flow materials sector and why. The product value can straight away be ascertained as one of the reasons for the high-valued and quality packaging of these products.

Literature Review

Fluctuations in demand, in the price level, in consumers’ preferences, in regulations, and development of new technologies, affect packaging. It is because of this that since 1992, there has been a substitution of plastic and corrugated cardboard packaging products for metal and glass boxes and containers.

Since 1996, when the manufacturing industries experienced a 2.6% increase in the value of their shipments, they began using plastic containers and packaging materials such as corrugated boxes, metal cans, set-up, and folding boxes, and glass containers. In 1996, Canadian manufacturing industries spent 7.2 billion dollars on containers and packaging products, when there was an increase in consumption of containers by 11.6% over the previous year.

This was due to the low-interest rates, a weak Canadian dollar, a strong demand in North America, and a healthy construction sector that led to an increase in the demand for Canadian industrial and packaging products. The increase in the consumption of containers can be explained almost entirely by the rise in the consumption of plastic and corrugated cardboard packaging products.

Not surprisingly, about 56% of expenditures for containers and other packaging products in 1996 were consumed by the Food and Beverage Industries. While the Food industries spent Canadian $2,688 million on containers, the Beverages industries spent Canadian $1,341 million.

The year 1996 was conspicuous for the increased spending by the Chemical and Chemical Products Industries, which increased their expenditures on packaging by about 75 million dollars (almost 10%). However, during the same period, two industries that spent less on containers and packaging products were the Textile Products Industries and Clothing Industries. This was due to the decline in demand for Canadian textile and clothing products during the few years between 1990 and 1996. , which have seen a decrease in their packaging products during this period. This result can be explained by the decrease in shipments for these two industries (Saint-Pierre, 2002).

Analysis of Industries

The Canadian automotive industry produces light-duty vehicles like cars, vans, SUVs, and pickup trucks, and heavy-duty vehicles like trucks, buses, and military vehicles. Apart from these, the industry is also known for its production of a wide range of spare parts and systems used in those vehicles.

To complement its manufacturing activities, the industry has a well-developed vehicle dealer network, an aftermarket organization that supplies replacement parts and accessories, and a world-class distribution system and service providers, which makes the Canadian automotive industry highly vibrant. And because the nation offers a good work environment for workers and employers, many multinational car manufacturers have established their production units there. Among them, the names Toyota, Honda, Ford, DaimlerChrysler, and General Motors are conspicuous. Over the years, the consumption of these cars has increased domestically and in exports:

- In 1983, the production of Canadian light vehicles was 1.55 million units, about 14% of North American production; Canada produced about two cars for every light truck produced in that country.

- In 2002, Canadian light vehicle assembly rose to 2.6 million units, which was 16% of total NAFTA production. However, the volume of light truck production has grown to almost equal that of passenger cars; a change from 1983.

- In 2002, Canada produced over 2 598 656 vehicles, and today, the Canadian automotive industry is the eighth largest in the world.

- The Canadian auto industry, while manufacturing motor vehicles, employed 51 000 people to produce 2.6 million vehicles in 2002. The total shipment of finished units was worth $62.1 billion of which 90% of production value came from exports.

- Because many key high-volume models are sourced in Canada, reinvestment opportunities have been very attractive, especially in infrastructure development. Vehicular production has increased over the years and also new state-of-the-art process technologies are introduced for enhancing features on new models.

- In the heavy-duty vehicular sector, there were 27 relatively low-volume assembly plants producing heavy-duty vehicles, commercial trucks, and conversions in 2002. These plants together produced 30 800 vehicles, from which shipments generated $3.7 billion. Of this, 85% of production value came from exports.

- In the motor vehicle body and trailer sector, shipment brought in $2.7 billion annually, of which, over 35% of production value came from exports.

- In addition to the above, Canadian automotive manufacturers also produced systems and spare parts for their vehicles. Canada has always attracted automotive manufacturers here because of their world-competitive process technologies, and cost-competitiveness. The industry had 98 100 workers in their rolls who produced vehicles which when shipped generated Canadian $32.7 billion in revenue, of which, 60% of the production went to exports (ic.gc.ca, 2003).

Market Analysis and Recommendation

Despite globalization and the emergence of China, India, Brazil, and Mexico as favored destinations for car manufacturers, Canada continues to be well patronized by major automotive manufacturers. In the context of auto business in Canada in the coming years, it will continue to draw manufacturers because of its strong and competitive process technology and infrastructure:

Vehicle assemblers have increasingly delegated systems development to Tier I companies. With the proximity of major Canadian parts makers to Detroit product design centers close, there is the added advantage of facilitating concurrent engineering development work so necessary in enhancing new features for new vehicles. Also, Canadian R&D activities are supported by attractive R&D tax credits (ic.gc.ca, 2003).

Therefore, for the industrial packaging industries in Canada, the market trend will continue to grow steadily and safely, making it an attractive and profitable proposition.

The Canadian Aerospace industry is looking good. In 2003, Bonnie Brown, the Member of Parliament for Oakville, announced on behalf of Allan Rock, Minister of Industry that Canadian $871,875 was to be invested in the development of an innovative integrated manufacturing system that will enable Futuretek-Bathurst Tool Inc. to expand into a full aerospace support services company. The investment, funded through Technology Partnerships Canada, under the Aerospace and Defense Supplier Development Initiative, was aimed at helping small and medium-sized enterprises in the aerospace and defense sector develop and incorporate world-class business and manufacturing practices and technologies.

As seen in the automotive industry sector, Canada invests heavily in R&D with the idea to remain a strong supplier of components and technology to manufacturing companies abroad and in the country. Countries like China and India are among the most-favored countries for manufacturers globally because of their cheap labor, well-educated workforce, liberalized tax benefits from the governments, and abundant raw material supplies. Canada may not be able to compete against these countries in these fields and thus has to improve its innovative capacity and technology to compete and sustain its economical growth.

In the words of Ms. Brown, “The investment of $871,875 million will provide a significant contribution in building Canada’s innovative capacity for the future, not just for Canadian companies, but for exports as well. Fostering world-class capabilities is critical in its success.”

Futuretek-Bathurst Tool Inc., a provider of engineering and manufacturing services to the aerospace and related industries, could develop with this investment, a quick-response integrated manufacturing system necessary for it to establish itself as a source of rapid prototyping and engineering services for value-added aerospace components.

Edward Szukalo, Vice-President of Futuretek-Bathurst Tool Inc. said that the company could then provide a greater range of cost-effective engineering services, particularly in the early-stage and prototyping phases of new product development. Technology Partnerships Canada’s critical investment in this research and development was expected to promote innovation, commercialization, sustainable development, and increased private sector investment while enhancing the quality of life of all Canadians (ITO, 2003).

In 2005, Federal Industry Minister David L. Emerson welcomed recommendations in developing a coordinated future for the Canadian aerospace industry, which accounted for some $21 billion in annual sales.

The importance of aerospace is critical in understanding the importance of revenue it generates for the industry and nation. Aerospace is a huge industry that generates millions of jobs globally. It is in this context that David L. Emerson stressed the need to strengthen the infrastructure in Canada. In a meeting held on the border of strengthening the nation’s aerospace strategic framework, a collaborative 20-year vision, including performance goals, and critical enablers of the sector’s long-term success were discussed.

Canada rank’s among the top five aerospace nations; the Bombardier C-series aircraft are today competing with Boeing and Airbus Industries in certain categories, and Canada is a top-tier original equipment manufacturer with proven expertise in technology development. The province of Quebec is home to many aerospace leaders, and Canadian industrialists seek to build on its existing capacity and continue to be a key player in the industry’s growth (Industry Canada, 2005).

Bombardier is looking good to capture a major share of a certain market segment for commercial airliners globally.

In the recent Aerospace Fair at Farnborough, UK, Bombardier vied with the likes of Airbus Industries and Boeing Industries to capture the 100-149-seat commercial market. During the fair, a Letter of Interest (LOI) was signed by Lufthansa Airlines for the purchase of up to 60 aircraft from Bombardier. Likewise, many other airlines showed keen interest in Bombardier’s new C-series of aircraft to be manufactured from their base in Quebec.

What is of interest to packaging industries is that Bombardier is made from parts supplied from various parts of the globe; While it has decided to locate the final assembly location for the C-series aircraft at Mirabel in the greater Montréal area, the manufacture of the aircraft’s aft fuselage and cockpit will take place at their Saint-Laurent facility, near the new product development center, Bombardier’s Belfast facility, a center of excellence for composite manufacturing, will be home to the design and manufacture of the C-Series aircraft wings. Bombardier will however retain their Chinese base for the manufacture of their standard Bombardier aircraft fuselage.

This just goes to show that the Canadian Aerospace industry is on the verge of take-off and the market is extremely healthy and profitable.

This is indeed good news for the industrial packaging industries in Canada.

Bombardier’s revenues for the fiscal year ended Jan. 31, 2008, were $17.5 billion US, and the five-abreast C-Series aircraft, designed to meet the growing needs of the 100- to 149-seat commercial aircraft market category, will touch an estimated 6,300 aircrafts; more than $250 billion US revenue over the next 20 years. This is good news for the company and its stakeholders (Bombardier, 2008).

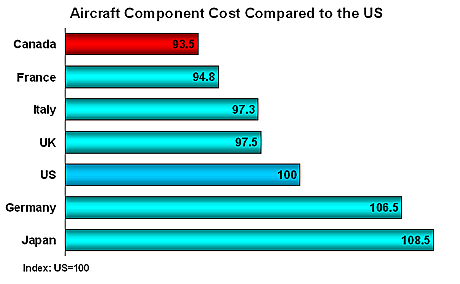

Among other places in Canada, the city of Ontario requires special mention. With a huge network of more than 350 Ontario aerospace firms focused on systems and equipment, Ontario provides a wide range of aerospace/aviation design, manufacturing, and product support for global aerospace industries. Aircraft component costs in Canada are amongst the lowest globally. The following index provides a fair estimation of where the Canadian component cost is in comparison to other aerospace-component producing countries.

What’s more, the skilled Ontario workforce and supportive government climate have positioned Ontario firms to take on new breaking projects such as the USA – led joint strike fighter (JSF or F-35), the Airbus A-380 aircraft, and the Canadian maritime helicopter project (Ontario, 2007).

Market Analysis and Recommendation

There is no denying the fact that the Canadian Aerospace industry is poised for tremendous growth. With their aerospace centers in Quebec and Ontario, the Canadian government is going full steam ahead to provide the industry with the investment required to meet global aerospace needs, be it in spares production or aircraft manufacture. The industry is so huge that there is ample scope for expansion and this spells well for the packaging industry.

The Canadian Plastics industry dates back by more than a century. The advent of petrochemical-based polymers started in the 1930s, and by the 1960s, the commercial plastic products industry was ready to enter the high-growth phase. Plastics are used by virtually every end-use segment of the economy. The unique attributes of plastics led to the creation of new products such that, many plastic products have displaced paper, glass, and metal from traditional applications. Of the three different and major product lines in Canada, 34 percent of shipments are packaging, 26 percent are for construction, and 18 percent are for automotive components.

The market for plastic and plastic products was so high that, in 2007 about 2 630 establishments in Canada processed synthetic resins into plastic products. This generated shipments valued at $19.7 billion. With growth comes opportunities and because of the popularity in this sector, employment opportunities rose, giving more jobs to the nationals. The following Table 1 shows the growth and market potential for plastic and plastic products in Canada:

Industry Canada estimates.

The plastics processing industry accounts for 4.2 percent of the nation’s manufacturing gross domestic product (GDP) and 5.3 percent of total manufacturing employment. While the plastics industry has grown faster than other manufacturing industries, the table above gives a clear indication that of late the plastic industry has been on the decline. In terms of exports, the industry has declined, so too has the revenue from shipments. Establishments have been reduced leading to a drop in employment. The trend does not look encouraging for the industrial packaging industries and therefore should not be considered for higher growth potential for packaging industrialists.

One reason that can be attributed to lower or reduced exports could be due to high transportation costs which preclude direct export to distant markets. This becomes a barrier for Canadian companies to expand their product market. In cases such as these, most companies seek joint ventures, acquisitions, or alliance opportunities in other countries to expand their business. In such cases, the packaging industry will have a limited role in the logistical movement of goods (Margeson, 2008).

Market Analysis and Recommendation

This is an industry that does not favor the industrial packaging industry. With the decline in the exports and establishments, it does not augur well for future investment plans either.

The Canadian Textiles and Garments industry also did not farewell. The Canadian apparel market valued at $10,382 million in 2005 was a distinct decline of 0.6 percent from the previous year. The year-to-year decline came about due to reduced domestic shipments. It crashed to $3,386.2 million in 2005, a year-to-year decline of 12.6 percent, while imports, continued their relentless increase, rising 6.5 percent to $6,995.8 million in the one year. Ever since China and India began their exports of textiles and garments abroad, they flooded the markets with cheap products. This affected the domestic market heavily and textile and garment producers found it hard to compete with them, leading to a drop in sales and revenue. The following Table 2 shows the difference in exports and imports and the shipment decline:

From the above table one can see that except for a few exceptions, domestic shipments of apparel have been descending. In contrast, imports have been exhibiting year-to-year increases since 1997. Thus, Canadian apparel manufacturers continue to lose market share to offshore suppliers. The domestic shipment also took a beating, making the industry vulnerable. For the industrial packaging industries, this is not a welcome sign and thus the textiles and garments industry needs to be invigorated to stop its demise.

According to Statistics Canada, there were 2,150 establishments in the Canadian apparel industry in 2005 which gave employment opportunities to about 69,911 workers. The effort raised $5,594 million in terms of shipment of apparel, of which, not surprisingly, some 39.5 percent went to the U.S.A.

The Canadian apparel industry account for 1.2 percent of the country’s manufacturing Gross Domestic Product; 1.2 percent through investment and 4.5 percent through employment. The 10th largest manufacturing sector in Canada, the apparel industry needs to be restructured to exploit export opportunities and compete with imports.

With Canada’s apparel exports are in serious decline, what was once seen to be a year-to-year increase has somersaulted to end in year-to-year declines.

However, efforts are on to stem this tide and bring the industry back on the rail. Voicing concern over the state of affairs of the textile and garment industry in the country, Eileen Melnick McCarthy, Director, Communications, Canadian Apparel Federation, said that the textile and garment industry remains an important source of employment for highly skilled professions and entry-level workers, who account for the majority of sewing machine operators and other production-related jobs. If this trend continues, the industry will be forced to shut shop and this could have a disastrous effect on the Canadian economy. Apparel is manufactured in all provinces and territories, with Quebec accounting for 55 percent of the total production, with significant contributions coming from Ontario, Manitoba, and British Columbia, she ended (Industry Canada: Apparel, 2008).

Market Analysis and Recommendation

This industry does not favor the industrial packaging industry. With the decline in exports and drastic decline in domestic shipments, the packaging industry does not stand to gain much, except for those who are associated with the surviving establishments. Unless there is a turnaround, the textiles and garment industry will face a severe resource crunch and cease to exist.

The Canadian Food industry is a booming industry. The Government of Canada to enhance production surplus has decided to provide organic farmers with financial and technological assistance to tap into new and locally-based markets. The Government has always supported the organic industry to meet and overcome the growing needs of consumers for organic products. In continuation of government policy to support such activities, the Federal Agriculture Minister, Gerry Ritz announced that his government had released A$258,100 in investment to benefit farmers, consumers, and the environment.

With the demand for organic foods increasing globally, there is a need to meet the demand and increase organic food production. The Government is committed to supporting our farmers as they seize these new market opportunities, said the Minister.

The funding for the project, ‘Growing up Organic,’ is being provided to the Canadian Organic Growers Inc. (COG) through Agriculture and Agri-Food Canada’s national Advancing Canadian Agriculture and Agri-Food Program (ACAAF).

‘This initiative will make sure that the network of government-farmers-industry buoyant and continue the trend for demand and growth of the agricultural sector, leading to a vibrant future for organic farming in Canada,’ added Laura Telford, Executive Director of COG.

While organic farming promotes the sustainable health and productivity of the ecosystem; the soil, plants, animals, and people; it does increase revenue and food stock so vital for human existence, apart from protecting the environment. Organic foods are farmed using environmentally sustainable production methods like soil regeneration and water conservation.

Also, the project will help organic farmers tap the domestic markets such as child care facilities, hospitals, and schools, and encourage the transition of conventional farming to organic practices.

The project is also expected to develop regional organic value chains, including producer cooperatives and the infrastructure needed to support local distribution and storage. This will provide farmers with a high value, secure market and at the same time provide consumers with regionally grown organic food. Local distribution of foods will reduce transportation costs and greenhouse gas emissions, benefiting the ecosystem. With reduced production costs, food will become cheaper yet remain hygienic.

While the Government’s initiative to provide more support to organic farmers remains constant, the ACAAF program, which began in 2004, with the support of the Agriculture and Agri-Food Canada, has provided more than $7.2 million to 74 organic projects in Canada till now (Agriculture and Agri-Food Canada, 2008).

References

Étienne Saint-Pierre: Overview of packaging products used by Canadian manufacturing industries, 2002. Web.

Euromonitor, 2008, Packaging Industry in Canada. Web.

ic.ga.ca: Canada’s Automotive Industry 2003. Web.

Industrial Technologies Office, ITO, 2003. Web.

Government of Canada Supports Development of Advanced Prototyping and Engineering Services for the Aerospace Industry. Web.

Industry Canada 2005: The Canadian Aerospace Partnership Articulates a 20-Year Vision for Canadian Aerospace. Web.

Bombardier: Press Release, 2008, Bombardier Launches C-Series Aircraft Program. Web.

Ontario: Ontario’s Dynamic Aerospace Industry, 2007. Web.

Industry Canada: NAICS 3261 Plastic Products Industry (Total). Web.

Margeson, John, 2008, Industry Canada: Canadian Plastics Products Industry. Web.

Industry Canada: Canadian Apparel, 2008. Web.

Agriculture and Agri-Food Canada, 2008, GOVERNMENT OF CANADA INVESTS OVER $258K IN ORGANIC FARMING. Web.