Introduction

The recent wave of globalization has transformed business operations on global scale. International businesses have been compelled to modify their products and services as well as management strategies to enable them meet the needs of this modern generation. As such, the banking industry has not been spared at all.

For instance, unlike the traditional trend when banks only concentrated in offering commercial services, modern banking calls for diversification of services to include investment, insurance and pension plans, underwriting securities and portfolio management. On the same note, although Citibank enjoys enormous branch network globally, it has been equally trapped in this mayhem.

As a result, the bank has put in place strategies to improve its international presence by expanding into emerging markets. On the same note, product diversification has also been employed by the bank as one of the expansion strategies.

Citibank prides itself in the history of international banking for being the oldest operator to venture in international marketing (Deloitte, 2006, p. 14). The company was established in New York way back in 1812. However, it began its international operations in 1902 having been elevated to position of the largest bank in United States banking industry (Cleveland & Huertas, 1985, p. 112).

It commenced its initial international presence by investing in Asian markets in countries like Manila and Shanghai (Zweig & Wriston, 1995, pp. 74-82). The expansion was rapid and heightened by major acquisitions of already established banks such as International Banking Corporation in 1918 and other subsequent mergers with Farmer’s loan and trust company. Hence, by 1929, Citibank had already assumed sterling position in international banking (Cleveland & Huertas, 1985, p. 112).

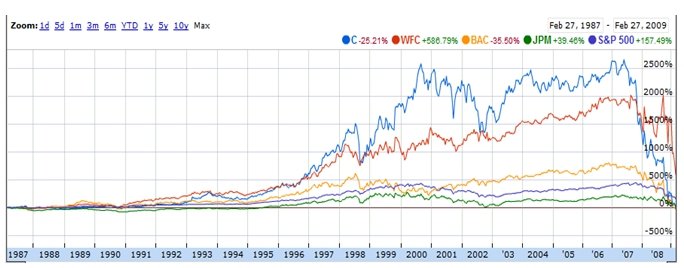

It is imperative to mention that Citibank operated under different names until 1980s when it adopted its current name (Zweig & Wriston, 1995, pp. 74). Moreover, in 1998, it started operating under Citigroup Inc. and it is under this umbrella that the bank has grown to be a giant player in international banking. It has always remained ahead of competition as illustrated in the figure below (Grosse, 2003, p. 24).

Definitely, the path to Citibank’s success has not been easy. However, the road ahead is not smooth at all as international banking sector becomes more complex due to numerous globalization challenges and opportunities (Ammann, Gemes & Lenzhofer, 2010, p. 4).

The effects of globalization which have been more pronounced in the 21st century have attracted new challenges for businesses since they have to keep up with the trend to avoid being redundant in the contemporary banking world (Hufner, Metzger & Reichenstein, 2000, p. 66).

The latest technology in the banking sector has facilitated identification of new market segments, development of customized services as well as opportunities for capturing new markets (Kim, 2010, p. 46). However, the same technological innovation has attracted its own share of management challenges (Kim, 2010, p. 48). Citibank is not an exception in the sense that despite its success stories in the past, the new era might bring devastating outcomes.

It is against this background that this insightful analysis was conducted with an aim of establishing challenges of international banking in 21st century. Moreover, this paper provides the much needed business plan guidelines that may enable Citibank to survive amidst myriad of challenges likely to be faced international banking.

Study method

To facilitate the success of this case study, data was collected from credible secondary sources which included authentic websites, books, financial magazines and reputable financial consulting companies’ reports and the justification of each source is explained below.

- Euromoney –this is very resourceful for this case study because of its long standing reputation in financial publications focusing on the banking industry

- Datamonitor- is a company that specializes in businesses analysis in six key industry sectors such as health, technology, automotive, energy, consumer markets and financial services

- Wall street journal and financial news magazine are also reputable for their objectivity in business reporting.

- Emerald and Ebsco Host online databases provide recent peer reviewed articles on all subjects and hence they are very relevant in this case study.

- World Bank and OECD journal (financial markets trends) are very relevant for this case study because these reports cover diverse global issues.

- Booz & company, a leading consulting firm on management issues with a high reputation in financial analysis.

- Citibank is also very insightful especially the Investment research and analysis section which provides current reports about the organization performs across all regions.

Organizational Analysis – Citibank products and Services

Citibank operates under the wide umbrella of a giant financial services company known as Citigroup (Grosse, 2003, p, 16). The company offers consumer and corporate banking services via wide network of over 1,700 branches which are spread worldwide in over 100 countries (Datamonitor. 2004, p. 4).

These branches are interlinked via strong electronic system and ATMs as well as the World Wide Web. The company is headquartered in New York. It is further subdivided into sub brands such as Citicorp Investment services, Citiphone Banking and CitiTerm life insurance to facilitate smooth delivery of wide array of services. Citibank mostly concentrates on banking, lending and investment services.

It serves wide range of clientele ranging from individual consumers, institutional and individual investors, large corporations and governments to small businesses (Datamonitor. 2004, p. 6). In order to facilitate delivery of the above services, the company has streamlined its operation under three major sectors namely personal finance, small business and corporate/institutional sector.

However, most of these products and services tend to overlap across the different sectors. For instance, insurance and credit cards are available across the three sectors.

As highlighted above, Citibank is rigorously branded and each of the brands offers wide range of selected products and services. The Citicorp investment services offers basic banking accounts and investment services such as mortgages and asset management. The banking accounts are further subdivided into savings, checking and college savings categories. Checking accounts are very flexible and they offer different rates depending on the average balance under each category.

Therefore, customers have an opportunity to select a checking account within their reach (Grosse, 2003, p, 16). Similarly, the savings account also varies in terms of interest earned and Citibank encourages their customers to maintain large balance by paying attractive interests to big savers. The college savings account allows parents to deposit money for their children until they reach college level of education whereby the amount is paid in installments (Datamonitor. 2004, p. 4).

On the same note, CitiTerm Life insurance specializes in business and personal insurance while CitiPhone Banking enables its consumers to access banking services via phones (Datamonitor. 2004, p. 4). However, Citibank card division is much diversified and offers quite a number of credit card solutions to businesses and individuals.

This credit card services is one of the Citibank’s strongest point and they have diversified them to incorporate each and every need of their diverse customer base. The card services falls under three subcategories namely college, value and reward cards. The most popular are value cards since they offer low interest rate of 11.24 % (Datamonitor. 2004, p. 6).

On the other hand, reward cards charge slightly higher interest rate of 14.24% but it has numerous benefits to consumers through the various reward schemes that are earned depending on frequency of usage. The college cards category offers students wide range of credit cards to choose from such as Citi Dividend Platinum and Citi Platinum Select. Each of the cards attracts myriad of benefits and opportunities to users (Citi, 2011b, par.4).

Consequently, Citibank has realized significant role of internet to business and by so doing they have embraced online banking services whereby consumers are able to access wide range of their services without the need for physical contact (Datamonitor. 2004, p. 4). Through their effective website, Citibank.com, consumers are able to apply for various Citi Cards, open and access accounts among other functions (Datamonitor. 2004, p. 4).

As mentioned above, Citibank originated in the United States. Besides operating in the U.S, domestic market its presence is greatly felt in other parts with most of its operations being concentrated in Asia markets such as china, Hong Kong, India, Japan, Singapore and Philippines (Gkoutzini, 2005, p.23). In addition, it has several branches in Europe. Latin America, Middle East and Africa and also its growth vision is to expand in emerging markets in these regions (Citi, 2011b, par.5).

International Market Analysis

The fact that Citibank presence is felt in over 100 countries indicates that it enjoys a wide market share in international banking. However, a SWOT analysis is necessary to portray the extent to which its strengths, weakness, opportunities and threats affect its business operations within the international market.

Strengths

Citibank operations in over 100 countries has given the organization a competitive edge in global arena and also cushioned it against huge losses in case of financial turmoil in any of its representative region (Datamonitor. 2004, p. 6). In addition, Citibank has undue advantage over its rivals because of its huge capital base under the umbrella of Citigroup.

Hence management at Citibank is capable of taking huge investment risks (Datamonitor. 2004, p. 8). Similarly, Citibank innovative product offering has enabled it to remain ahead of its competitors because specifically tailored products attract large number of consumers (Citi, 2011b, par. 3).

Weaknesses

Recently, Citigroup, the umbrella under which Citibank operates, has been accused of wrongful practices leading to severe tarnishing of its brand. This negative perception is likely to drift away investors especially from its investment services since they fear negative outcome from the ongoing law suit (Bianco & Timmons, 2002, p. 38).

Similarly, Citibank needs to expand its online presence beyond United States in order to compliment physical branch operations worldwide (Bianco & Timmons, 2002, p. 42). Past failures in website branding has also cost the organization whereby it relentlessly attempted to sell the company under a different online brand name (Timmons, 2002, par, 8).

Opportunities

Citibank interest in emerging markets has enabled it to become a pioneer in highly profitable but risky markets such as Moscow and this has given it a strategic positioning advantage (Dennis, 2010, par. 6). However, the Chinese market which is on a fast lane towards becoming fully liberalized presents the best opportunity for Citibank although it is yet to make any significant impact in this market largely due to tight government regulations (Busch, 2009, p. 86).

In spite of the increasing tendency towards online shopping, credit card holders are still reluctant to provide their card details to online vendors (Mullineux & Murinde, 2003, p. 70). Therefore, in order to encourage usage of its credit cards for online transactions, Citibank has come up with Click Citi option that enables one to pay online without keying in confidential card details (Citi, 2011b, par. 12).

Threats

Economic instability following the 2007 financial crisis in the United States has created uncertainties among investors thus negatively affecting financial institutions (Busch, 2009, p. 86). This has lead to fluctuation in foreign exchange rates. As such, Citibank, being a global financial institution, is likely to be hard hit by this fluctuation. Interest rates have also dived thus impacting Citibank profits negatively.

For instance, foreign exchange fluctuations in Argentina and Brazil led to substantial losses at Citibank (Datamonitor. 2004, p. 8). In addition, over the recent years, market conditions have not been conducive and the deteriorating financial performance is indeed clear evidence.

To make matters worse, strict regulations in consumer banking industry are hurting banks negatively (Gkoutzini, 2005, p. 8). For instance, regulations put a cap on the amount of interests that loans are supposed to earn of which failure to comply might attract far reaching consequences (Mullineux & Murinde, 2003, p. 74).

Foreign entry in emerging markets

In spite of the above challenges, the future looks bright for Citibank if it takes the big leap towards investing in emerging markets in Asia and Middle East. According to Wilkinson (2011, par, 12), Citibank has embarked on massive recruitment drive to hire managers for the new branches that are yet to be opened in Asia and Middle East. Other banks such as Barclays, HSBC, Goldman Sachs and JP Morga have also followed similar trend in preparation for new expansion to Asia-Pacific region.

These two markets are quite promising due to recent discovery of potential benefits in Islamic banking (Divanna, 2007, p. 66). In addition, although these regions are also experiencing spill over effects of financial crisis, there is still some possibility of rebound and subsequent growth. Therefore, reaching out for these customers might prove to be profitable in the near future (Weldon, 1998, p. 46).

However, Citibank has to be a bit cautious even as it enters these markets via private banking brand and introduce investment services on a later date (Wilkinson, 2011, par, 8). According to Yuksel (2010, p. 24), private banking services are highly resilient and are able to withstand economic turmoil as evidenced in continued profitability of private banks amidst current economic downturn.

International Challenges

Volatility of emerging markets

As epitomized above, emerging markets present the best opportunity for Citibank to invest during this period of economic downturn. According to Citi (2011a, par 6), emerging markets offer greater potential for growth as compared to advanced economies. According to Dennis (2011, p. 5), emerging markets refer to developing countries that are experiencing above average economic growth rate which is fueled by rapid infrastructural development and large populations that provide cheap labor.

Economists’ forecasts indicate that emerging markets will recover from economic down turn faster than core economies in the current year (Citigroup Inc. 2011, par, 5). A recent survey by International monetary Fund highlighted a huge disparity between core economies and emerging markets growth rate whereby in 2001 they grew by 2.2% and 6.4% respectively (Dennis, 2011, par, 8).

Therefore, markets such as Central Eastern Europe, Middle East and Africa will present the best opportunity for Citibank to invest. Nevertheless, emerging markets should be approached with caution because they are deemed to be very volatile (Jaffer, 2004, p. 8).

Mikdashi (2001, p. 112) underscores that although past political instability and lack of transparency in emerging markets is slowly fading away especially in large markers like China and India, caution is still needed while venturing in these markets. Therefore, prior research is necessary to determine the volatility risk. This implies that investment managers will have an uphill task establishing whether any venture in emerging markets has potential for profitability or not.

Operational Inefficiency due to limited technology in emerging markets

Operations in emerging markets especially in Africa will be greatly hindered by too much paper work that reduces efficiency (Clacher et al., 2006, p. 112). This may be due to limitations in technological advancement which has been a persistent problem in African emerging markets.

Clacher et al. (2006, p. 112) further underscore that paper transactions are very costly and also tend to expose banks to transactional errors and deliberate frauds. Moreover, due to lags in settlement of cheques and drafts business liquidity is highly constrained leading to increased operation risks.

Human resource management challenges in highly technological era

Over the recent years, employees have been regarded as the most important asset for organizational growth and success (Smith, 2007, p. 130). In banking industry, employees are equally important due to the fact that it is a service industry whereby customers have very high expectations.

A cursory look at the new trend of online banking might despise the role of employees in service delivery. Nonetheless, Gkoutzini (2005, p. 8) expounds that they are still critical in facilitating online banking success. According to Citigroup Inc. (2011, par, 5), online consumers have very high expectations and unmet expectations may lead to organizational failure unlike in traditional banking whereby customers can blame an employee.

Therefore, the challenge today is how to keep the IT staff on their toes so that they can be more vigilant to avoid service failure. In addition, these employees need to be extra vigilant to protect customers from internet fraud. Otherwise, Citibank might end up losing considerable market share (Gkoutzini, 2005, p. 8)

International Business Strategy (Planning): Investment plan for emerging markets

In spite of high volatile nature of emerging markets, it is imperative to note that benefits outweigh possible risks if the business plan outlined below can be adopted. Furthermore, neither the core economies nor emerging markets can guarantee 100% return on investment if the recent debt crisis in Europe is anything to go by (The Committee on the Global Financial System, 2010, p.6).

To begin with, pooled investment strategy is the best due to minimal risks involved. Citibank bank can merger with existing financial services provider in these emerging marketing and run a joint mutual fund entity (Gkoutzini, 2005, p. 8).

Moreover, Citibank investment division might consider investing in Exchange Traded Fund which is usually invested via international brokerage service. The latter is another option of pooled investment. However, it is crucial to mention that the latter move is rather risky due to the high volatile nature of stock markets.

Introduce modern banking where absent

Citibank has recorded success in implementation of modern banking equipments to facilitate transactions in core and some emerging economies (Citigroup Inc. 2011, par, 5). The same strategy can be adopted in emerging markets where such services are absent.

However, great care should be taken to avoid locking out significant clientele who may be unable to use modern technological equipments (Gkoutzini, 2005, p. 8). Most importantly, security concerns should be taken into consideration while adopting modern internet banking (Gkoutzini, 2005, p. 12). Needless to say, such a strategy will facilitate business operations by increasing efficiency and subsequent reduction in transaction errors and fraud.

Integrate human asset with technology

In this era of globalization, technology will play significant role in business operations and performance (Citigroup Inc., 2011, par, 5). According to Deloitte (2006, p. 14), banks should strive to reconnect with their customers through a combination of technology and personal service (The Committee on the Global Financial System, 2010, p.6). This implies that employees are still significant in spite of the major shift towards online banking.

Although technology is the main resources for performance optimization, full implementation will require huge capital base (Busch, 2009, p. 86). To reduce cost, banks should consider entering into global partnerships on technology in an attempt to reduce initial costs (Gkoutzini, 2005, p. 8).

As epitomized above, employees can either make or break online service delivery process, therefore, it is important for human resources managers to ensure that employees are motivated to carry out their duties effectively. According to Walker (2001, p. 102), employee motivation is anything from compensation to non-monetary benefits that makes employees loyal towards fulfilling organizational goals.

Conclusion

In a nutshell, Citibank is obviously a pace setter in international banking. Data collected during this analysis indicate that the bank is headed for notable success owing to its wide capital base and diverse network across the globe. However, some weaknesses still persist. Most of these weaknesses are mainly external in nature.

As a critical example, it is imperative to note that businesses today are operating in a highly competitive world due to globalization which has also attracted myriad of challenges for international businesses operations. As such, Citibank interest in emerging markets appears to be an excellent initiative.

However, this giant financial institution ought to approach such a move with extra caution owing to the high volatile nature of these markets. Most importantly, the management at Citibank has to come to the realization that employees are indeed potential assets. Better marketing strategies should be adopted to integrate latest technological platform in order to boost online marketing and banking.

References

Ammann, C., Gemes, A & Lenzhofer, A. 2010. Private Banking: After the Perfect Storm, Booz&Co. Web.

Bianco, A & Timmons, H. 2002. Crisis at Citi, Business Week. Web.

Busch, A. 2009. Banking regulation and globalization. New York: Oxford University Press.

Citi 2011a. Emerging market growth forecast for 2011. Web.

Citi. 2009. Major and emerging markets agent bank reviews. Web.

Citi. 2011b. Our product expertise. Web.

Citigroup Inc. 2011. Citi Private Bank Identifies 2011 Investment Themes. Web.

Clacher, I. et al. 2006. Challenges facing banking in emerging markets: A case study of the Tanzanian national payments systems. Journal of Financial Regulation and Compliance, 14(1, 112 – 118.

Cleveland, H. B. & Huertas, T. F. 1985. Citibank, 1812-1970. Cambridge, Mass.: Harvard University Press.

Datamonitor. 2004. Citibank, N.A. Swot analysis. Web.

Deloitte. 2006. Global banking industry outlook, growth solutions in changing world. Web.

Dennis, G. 2011. Emerging market earnings: Holding up well, Citi. Web.

Divanna, J. A. 2007. Middle Eastern Wealth Management. London: VRL KnowledgeBank Limit.

Gkoutzini, A. 2005. International Trade in Banking Services and the Role of the WTO: Discussing the Legal Framework and Policy Objectives of the General Agreement on Trade in Services and the Current State of Play in the Doha Round of Trade Negotiations. International Lawyer, 39 (4), 877-915.

Grosse, R. 2003. The Challenges of Globalization for Emerging Market Firms. Latin American Business Review, 4(4), 12-32.

Hufner, K., Metzger, M. & Reichenstein, B. 2000. Challenges for international organizations in the 21st century: essays in honor of Klaus Hüfner. New York, NY: Palgrave Macmillan.

Jaffer, S. 2004. Islamic asset management: forming the future for Shari’a-compliant investment strategies. London: Euromoney Books.

Kim, S. 2010. International banking in the New Era: Post-Crisis Challenges and opportunities. Bingley: Emerald Publishing Group.

Mikdashi, Z. (ed.). 2001. Financial Intermediation in the 21st Century. New York, NY: Palgrave Macmillan.

Mullineux, A. W. & Murinde, V. 2003. Handbook of international banking. Cheltenham, U.K.: Edward Elgar.

Smith, A. D. 2009. Internet retail banking: A competitive analysis in an increasingly financially troubled environment. Information Management & Computer Security, 17(2), 127 – 150.

The Committee on the Global Financial System (CGFS). 2010. Long-term issues in international banking: new report by the Committee on the Global Financial System. Web.

Timmons, H, et al. 2002. Citi’s Sleepless Nights: The Bank Faces Lawsuits, Fines, and Closer Scrutiny,Business Week. Web.

Walker, G. A. 2001. International banking regulation: law, policy, and practice. London: Kluwer Law International.

Weldon, L. 1998. Private banking: a global perspective. Cambridge: Gresham.

Wilkinson, T. L. 2011. Managers hire for emerging markets, financial news. Web.

Yuksel, U. 2010. A Risky Mode Of Foreign Market Entry: International Portfolio Investments. Journal of Business & Economics Research, 8(8), 22-32.

Zweig, P. L., & Wriston, W. 1995. Citibank, and the Rise and fall of American Financial Supremacy. New York, NY: Crown.