Executive summary

This project management is about introducing a financial company to be listed on the stock exchange. The project was envisaged by the directors of the financial company, to achieve this, there are several consecutive actions that the company will have to undertake in the project management process. These steps necessary in the implementation process include; project commencement through stakeholders meeting, legal and statutory requirements, project budget and cost estimation, share registration, engagement of financial advisors, formal request to be listed in the stock exchange, and initial public offer.

Introduction

For a company to increase its capital, it is usually necessary for the company to be listed on the stock exchange. This is usually a long process that involves several parties that have an interest in the company in question. It is therefore mandatory for the company to employ strategic methods to achieve its goals. This can be done through a project management process that outlines steps of achieving the goal within a given period.

This analysis will address the major steps involved in the transition process; the company in question is a financial company that needs to be on the list of stock exchange companies. The major advantage that creates the need for this process is essential to attract buyers of the company’s shares which will, in turn, increase the ownership of the company and also increase the capital of the company as a result of the share sale.

Business needs

The major objective of making the financial company in this case appears in the stock exchange is to;

- To be able to attract more capital to the company and in the process increase its financial capability. This objective is in line with the company’s mission and vision of expanding its business to other regions.

- To create employment for the people of Saudi Arabia and also increase utilization of the country’s human resources.

- To meet the ever-increasing demand in the financial company through the provision of loans and financial needs for its clientele.

- To increase the government revenues through the provision of taxes generated by the company.

Project description

Scope of the project

The introduction of this financial company into the stock exchange will involve several steps that are imperative in the execution process. The entire process aims at increasing the size of the business by making it listed on the stock exchange. Since the company deals with financial issues to the public, making it listed in the stock exchange will lead to an increase in revenues. The company and its stakeholders will benefit from increased revenues and also increased size of the company. To the public, this will allow them to own the company through the purchase of the company’s shares. The government will benefit from the increased taxes as a result of improved business in the company.

Business objectives: Reasons for undertaking the project

Justification of the project

- Increasing the magnitude of the company through increased ownership of the company and increased capital as a result of funds from the purchase of shares.

- There will be an increase in job opportunities as a result of the increased size of the business.

- Utilization of skilled labor in Saudi Arabia will be increased as a result of employment creation that will result from the increased business activity.

- Stakeholders and shareholders will be certain to receive increased revenues as a result of external funding of the company.

Project deliverables

Project deliverables of any project are its output; it includes the output of every project activity undertaken. Project deliverables are used to track the successes and progress of a project. In this project the deliverables are:

- Trading license from the Stock exchange authorities.

- Share certificates for every shareholder

- Audit and Company share reports.

- Increased Capital funds.

- Stock exchange regulatory agreements and reports

- Company legal reports and financial advisor reports

- IPO (Initial Public Offer) share placement reports

Roles and project stakeholders

The various parties and stakeholders have an important role in project implementation as outlined below:

Risk assessment: Any constraints or risks

Risks are part of any project implementation process, the result of risks are usually fatal and can curtail the progress of the project implementation process. Risks usually result to poor implementation of the project, late implementation of the project and even failure of the entire project. A planned mitigation process is thus imperative for the entire project to be successful. In order for the project implementation process to be successful, it will be essential for the team to classify risks into various categories depending on the likelihood of the risks occurrences. The most likely risks to the list classified risks can be categorized as highly likely, most likely, less likely.

Highly likely have a above 50% chances of occurrence, most likely have less than 50 % chances of occurrence while less likely have less than 10 % chance of occurrence. The table below succinctly provides a list of risks that the financial company faces in the implementation process.

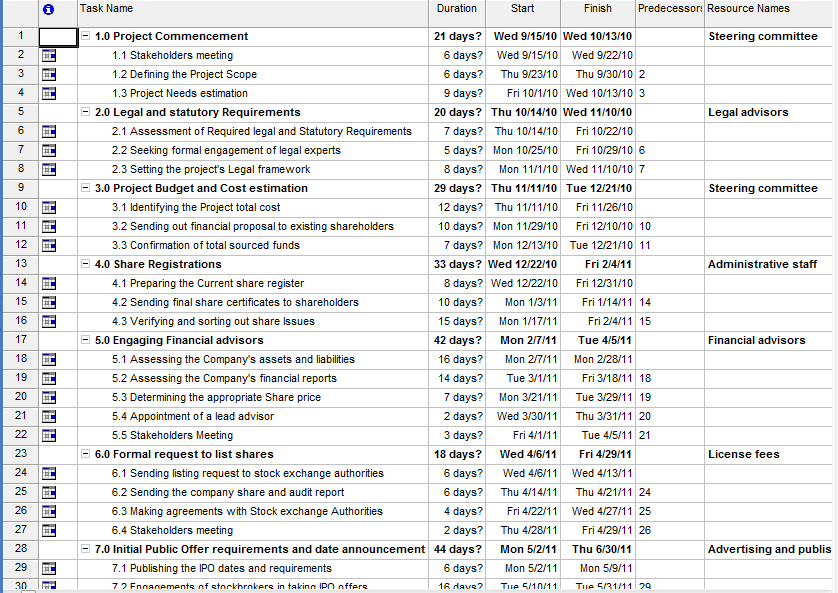

Project Activity: The activity list

Project Commencement

This is the stage where the project begins with a meeting of the board of directors of the financial company, to determine the scale of the project. Within this stage, they make decisions on project management and implementation of the project. The boards of directors as representatives of the shareholders are the main stakeholders and they envisage the project scope and goals of the project. At this stage it is important to estimate the financial resources to be used in the project; funds are needed for project undertaking.

Legal and statutory requirements

The process of seeking placement in the stock exchange involves a lot of parties. Thus about the business undertaking of the financial company, business laws set by relevant authorities must be adhered to. Legal requirements that need to be adhered to include: stock trading laws, capitalization, and disclosure laws. These laws and other laws need to be assessed by the company’s lawyers to ensure that they are adhered to before seeking a stock trading license.

All legal and statutory requirements for licensing will be determined by the legal advisors hired by the company, they will also draw up a legal framework to be followed in the project. The legal advisors also act as advisors to all project stakeholders and as a result advising on all activities to ensure that no contravention of the laws is conducted.

Project Budget and Cost estimation

The process of budgeting and allocating costs is n important factor that determines if the project completion is a success or not. This process involves identifying the cost of the project and seeking funds to finance the project. The process of budgeting is conducted by the steering committee and they must correctly identify and allocate costs for the project since lack of funds might deter the project’s success. Most of the financial resources will be sourced from the existing shareholders because they are responsible for all the company’s activities and they are the eventual beneficiaries of the listing of the company.

After sourcing funds from shareholders, the steering committee will meet to confirm the total sourced funds and compare them with the project budget. If the sourced funds fall short they could go back to the shareholders for more funding or seek loans from funding agencies. They might also engage interested investors in the process of funding the project in exchange for a stake in the company.

Share Registrations

The activity of share registrations is an internal company activity meant to take stock of the existing shares and the number of shareholders in the company. This process is critical since it is used to determine the company’s share capital and to sort out issues concerning share certificates held by shareholders. The process of share registrations is conducted by the administrative staff and all uncollected share certificates are mailed to shareholders. This process ensures that all certificates issued out remain valid in connection to new certificates yet to be issued and that shareholders become aware of the number of the shares they hold before listing the company into the stock exchange.

Engaging financial advisors

After the identification of all existing shareholders, the company will engage financial advisors in the task of determining the company’s preparedness for listing. The financial advisors will undertake the task of determining all the company’s assets and liabilities to ensure they meet the threshold required by the relevant authorities. They will also assess the company’s financial position by analyzing their recent financial reports; all these activities are important in determining the appropriate share price to be used in the listing.

The share price determined by the financial advisors shows the financial position and attractiveness of the company’s performance for the public. After the determination of a share price, a project lead advisor will be appointed to proceed with the project to the end. At the end of this stage will be a stakeholder meeting for them to be briefed on the progress of the project and for the steering committee to give a go-ahead.

Formal request to list shares

The project lead advisor upon completion of the determination of a share price will send a listing request to the stock exchange authorities for a license. For the stock exchange authorities to grant a license, the company will send the company’s audit and financial reports. Once the reports are verified by the stock exchange authorities they will draw up license agreements and will be signed by both parties awaiting determination of the Initial Public Offer (IPO) date. Finally, a stakeholders meeting will be held to determine the dates for the IPO and planning on how IPO will be carried out.

Initial Public Offer requirements and date announcements

Once the IPO dates have been set, stakeholders will engage advertising firms to announce the IPO dates officially.

Appointed stockbrokers will also be called on to participate in sensitizing the public of the IPO share offer and to take applications of interested investors in the IPO. This stage is very critical because all the shares offered by the financial company must be applied for by investors for a successful listing in the stock exchange. The offering of the IPO share application is usually for a limited period and once the closing date is approached no offers are accepted. All applications will be processed against shares offered for placement by the company before the formal launch of the IPO.

IPO formal launch

This stage involves the announcement of the IPO placement results to the public. The IPO placement results are published for the public and all successful and rejected applicants are informed of their application. At this stage in case of oversubscription of the share offer, the rejected oversubscribed offers will be refunded to the respective investors within a specified time frame. All other issues concerning the share placement will be sorted out by the respective brokers on behalf of the investors.

Project conclusion

This is the last activity in the project; at this stage, the IPO date set earlier will be marked by the commencement of trading of the company’s share. The activity involves ringing the bell to commence trading of the shares at the IPO price set earlier. Once the trading of the shares goes live, the steering committee will meet to assess the success and failures of the project and prepare a report for all stakeholders. Finally, a meeting of all stakeholders will be held where they will be presented the opportunity to air their views of the project.

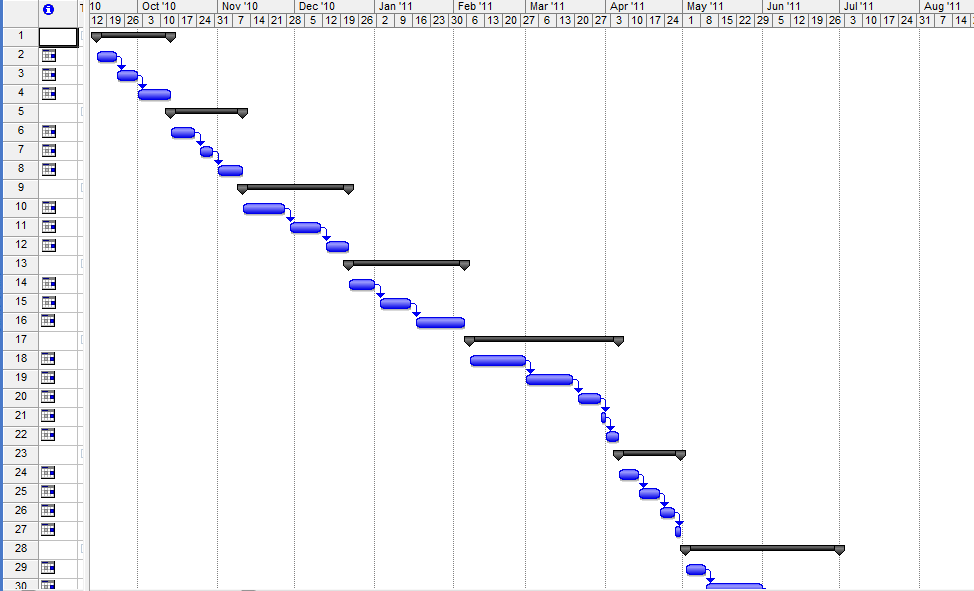

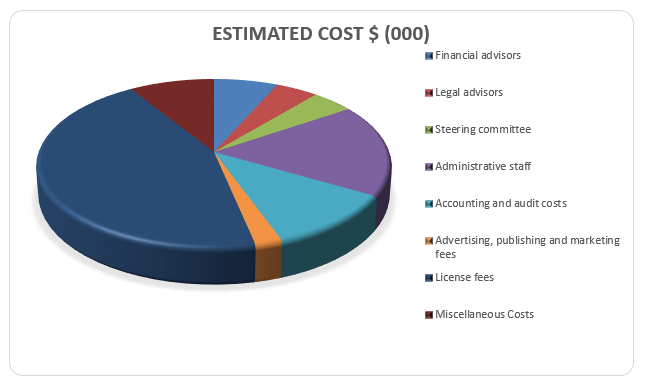

Resource requirements

The Process of listing in the stock exchange will involve a lot of parties and experts; resources need to be set aside for the various project tasks as outlined below.

- Financial advisors

- Legal advisors

- Steering committee

- Administrative staff

- Accounting and audit costs

- Advertising, publishing and marketing fees

- License fees

- Miscellaneous Costs

Event analysis & diagram charts

Project Cost Analysis

Project controls and risk management

This magnitude project requires a well-resolved risk control and mitigation plan that will ensure that the process is risk-free. This financial company that aims to be listed in the stock exchange has the following controls and risk management in place.

- Constant meetings that involve stakeholders to ensure that the process is under control. This meeting will be scheduled quarterly to enhance the implementation process

- Reports that indicate the progress of the implementation process will be required to ensure that the process continues as planned. The reports analyses the risks, challenges, and management or milestones achieved in the course of the execution process.

- Risk management plan. This plan will be done to ensure that the project lead advisor is in control of the project and in a position to address issues that may escalate the occurrence of the risk. To improve on the efficiency of the control plan, it will be necessary to have a weekly report that addresses issues that develop in the course of the implementation process. The management of the mitigation process will be included in the project charter.

- Management of communication process. To increase the efficiency of the implementation process, it is necessary for the management and the steering committee together with the project lead advisor to create a communication protocol concerning issues that develop in the process of project implementation. The protocol will ensure that questions raised and developed in the process of implementation are addressed by the right people at the right time. For this case, the project lead advisor will be a link between the steering committee and the stakeholders. The project leader will thus be responsible for the communication process; this will make the concerned parties informed on the project implementation process.

Authorizations

Authorization of the project requires levels of authority necessary for the implementation process. It is necessary to have authorization in the course of the implementation process since any changes and variations of deliverables can be addressed. The following parties will be responsible for the authorization of the project.

The project plan Statement will be approved by:

- The Project lead advisor

- The Project Steering committee

- The Project Sponsor/ owner

Project Changes will be approved by:

- The Project Owner

- The stakeholders

- The financial company managers

Project deliverables will be approved by:

- The Project Owner/sponsor

- The Steering committee

- The Key Stakeholders

Conclusion

This analysis has explicitly demonstrated with the aid of the project management software (Ms. Projects) how the financial company will be introduced into the stock exchange. The benefits of introducing the company into the stock exchange will increase its capital which means that the company will be financially stronger than it was initially. The other benefit that will result from the process is the fact that the company will grow in size and be able to offer loans and other financial assistance to other firms, this means therefore that the company will benefit other companies and people.

The government is also another major gainer in the implementation process of this project; this is because the taxes that the company will accrue will result in to increase in government earnings. The entire process has a risk and control management process that will ensure that the implementation process is done without any major obstacles.