Facts You Did Not Know

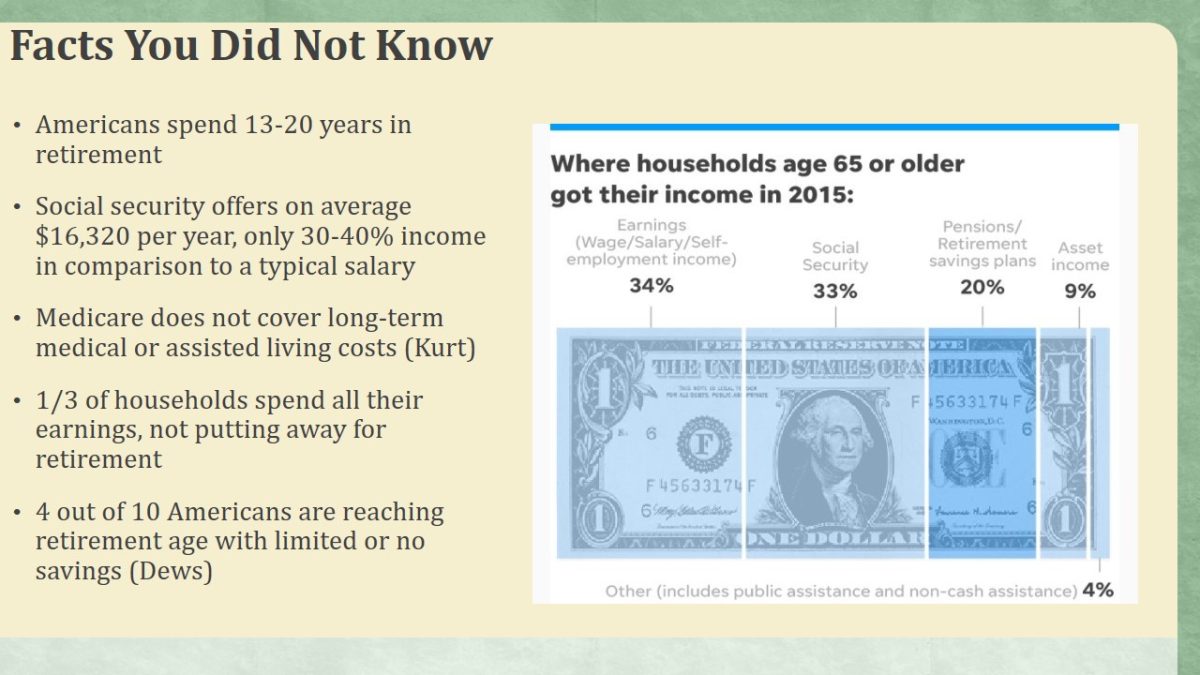

- Americans spend 13-20 years in retirement.

- Social security offers on average $16,320 per year, only 30-40% income in comparison to a typical salary.

- Medicare does not cover long-term medical or assisted living costs (Kurt).

- 1/3 of households spend all their earnings, not putting away for retirement.

- 4 out of 10 Americans are reaching retirement age with limited or no savings (Dews).

The facts on this slide are just some of the worrisome statistics about retirement in the United States. For many people, retirement is a time to dedicate to travel and activities they always wanted. Others want to lead a peaceful, healthy life. However, it can quickly become a period of worry and stress. Many Americans do not realize the significant loss of income that comes with retirement and how a lack of preparation can be detrimental.

Significance

- Credible resources with up-to-date information.

- Inadequate preparation leads to poverty.

- The process of investing for retirement is long-term and complex.

- Financial and legal challenges require understanding the system.

- Strategies to begin your path to retirement.

A variety of credible resources and platforms were analyzed to compile the most accurate and up-to-date information on the topic of investing for retirement. Retirement funding consists of using a variety of resources to ensure income is diversified. The complex process requires understanding, and specific steps are developed to ensure you are on track with your savings. This presentation will educate about the strategies that can be taken to start investing for retirement to guarantee a stable future. I will discuss strategies for determining the amount that needs to be saved, which resources to use, and financial details of asset allocation.

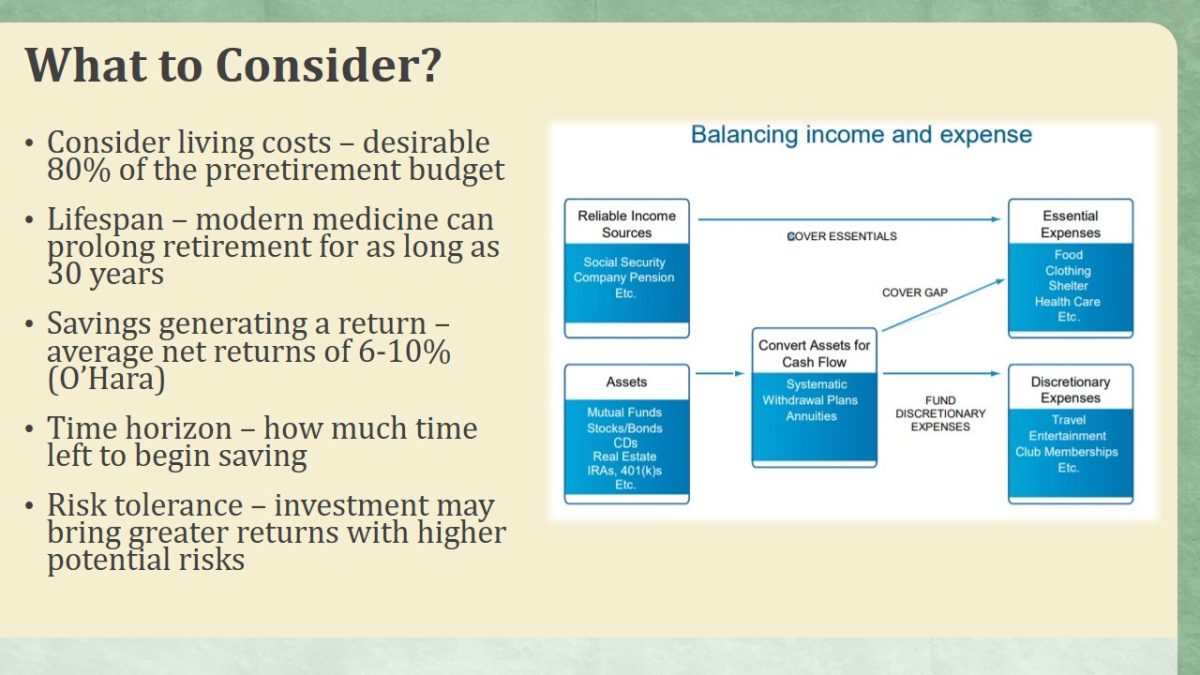

What to Consider?

- Consider living costs – desirable 80% of the preretirement budget.

- Lifespan – modern medicine can prolong retirement for as long as 30 years.

- Savings generating a return – average net returns of 6-10% (O’Hara).

- Time horizon – how much time left to begin saving.

- Risk tolerance – investment may bring greater returns with higher potential risks.

Retirement investment is based on using this combination of factors to determine the best plan for an individual. Everything comes down to simple mathematics of balancing income and expenses. Therefore, the steps taken to ensure a stable retirement depends on current saving and investment strategies match lifestyle choices in the future. However, retirees usually do not require 100% of preretirement income since many expenses are reduced, including the need to save for major purchases and income tax.

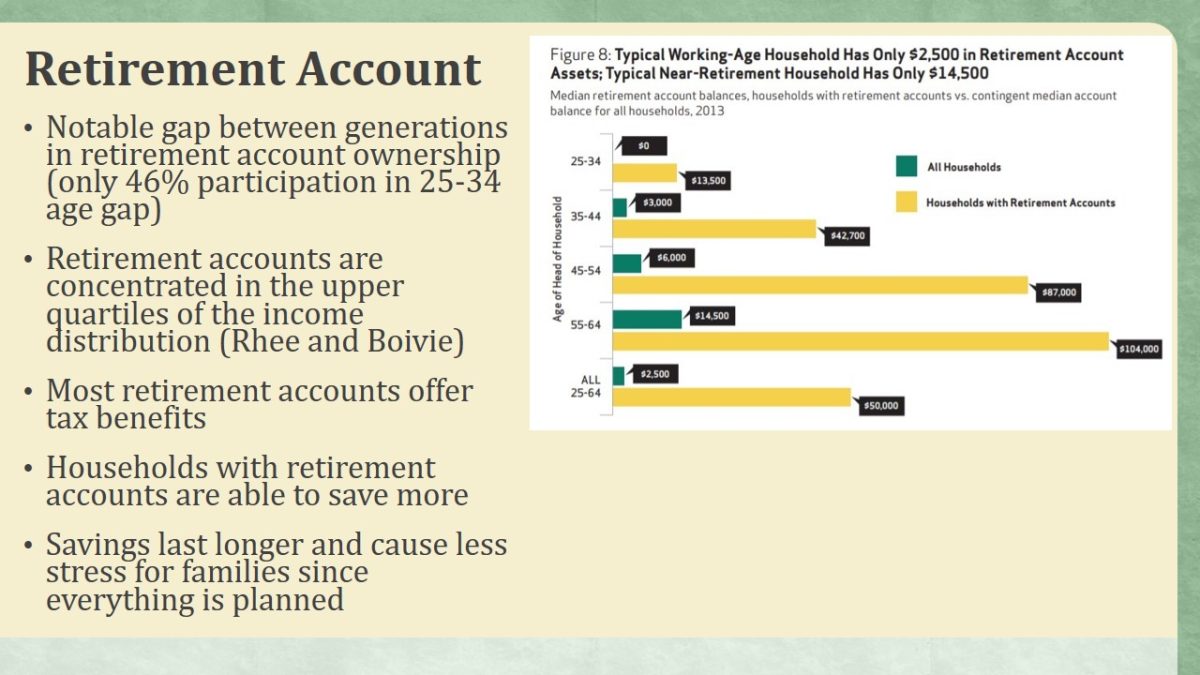

Retirement Account

- Notable gap between generations in retirement account ownership (only 46% participation in 25-34 age gap).

- Retirement accounts are concentrated in the upper quartiles of the income distribution (Rhee and Boivie).

- Most retirement accounts offer tax benefits.

- Households with retirement accounts are able to save more.

- Savings last longer and cause less stress for families since everything is planned.

Unfortunately, trends suggest a much lower prevalence of retirement accounts in new generations. That is understandable since a retirement account can consume a significant portion of earnings. However, it is worrisome since, as seen in the chart, the amount saved is unsustainable for retirement. A retirement account is necessary to secure financial future, especially in a time of low Social Security and decreasing popularity of workplace pension.

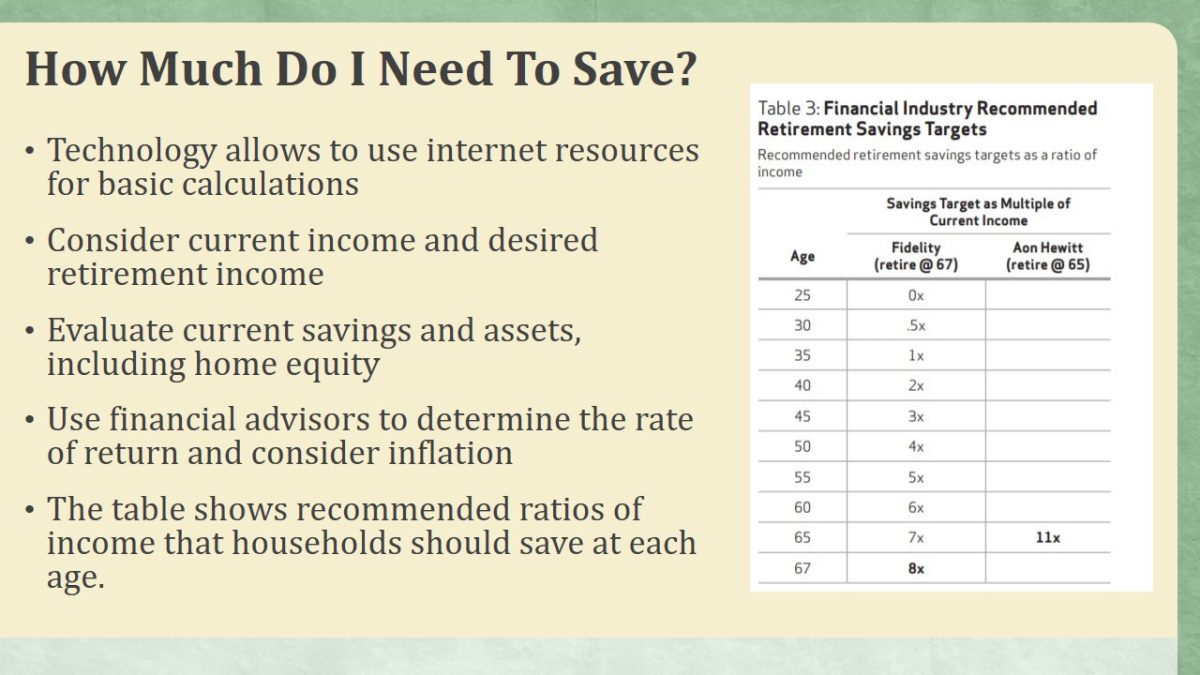

How Much Do I Need To Save?

- Technology allows to use internet resources for basic calculations.

- Consider current income and desired retirement income.

- Evaluate current savings and assets, including home equity.

- Use financial advisors to determine the rate of return and consider inflation.

- The table shows recommended ratios of income that households should save at each age.

One of the most critical steps in calculating retirement plans should be to consider inflation. Over decades, one’s saving may devalue significantly in terms of simple purchasing power. An annual retirement income of $40,000 results in $3,300 per month. With an average Social Security benefit of $1,300, it leaves approximately $2,000 one must fund (or $24,000 annually). With an estimated 6% return on investment, a retiree should save approximately $400,000 nest egg before tax and inflation.

Investment

- Key to a secure retirement is to invest safe assets.

- Investment produces compounded interest over the years until your retirement and after.

- Many retirement-focused investments offer tax incentives.

- A competently diversified portfolio is more profitable than all-cash savings accounts, able to overcome inflation.

Investing for retirement implies not just planning out future savings, but properly directing assets into long-term investments which will be producing money through compounded interest. A critical part of retirement accounts discussed here is that they have tax incentives which through competent financial planning can result in little to no tax collected at withdrawal once retirement age is reached. When considering large sums needed for retirement, inflation and tax are detrimental forces which can cause significant losses that proper investment can defer (“”Preparing Your Savings for Retirement”).

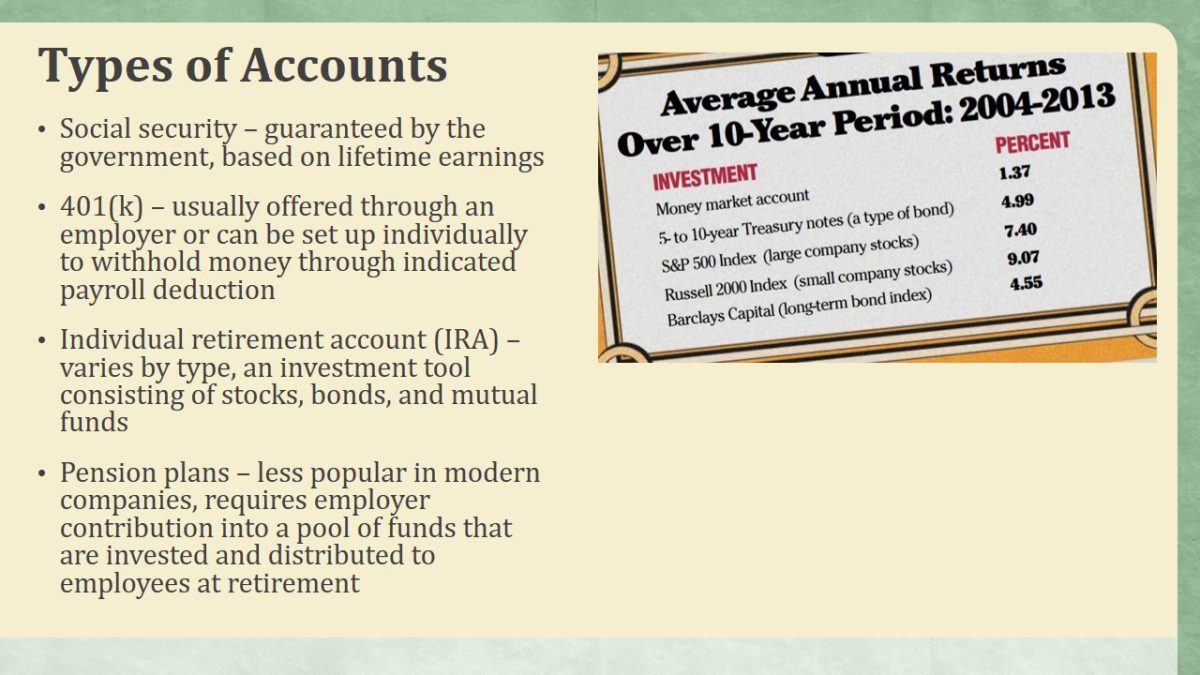

Types of Accounts

- Social security – guaranteed by the government, based on lifetime earnings.

- 401(k) – usually offered through an employer or can be set up individually to withhold money through indicated payroll deduction.

- Individual retirement account (IRA) – varies by type, an investment tool consisting of stocks, bonds, and mutual funds.

- Pension plans – less popular in modern companies, requires employer contribution into a pool of funds that are invested and distributed to employees at retirement.

There is a wide variety of federal, employee, and private retirement account options. Each carries a certain amount of risk and return as well. The table highlights the average returns on investments based on these accounts. As evident, there is a significant difference between money market accounts such 401k and stocks that are part of the IRA.

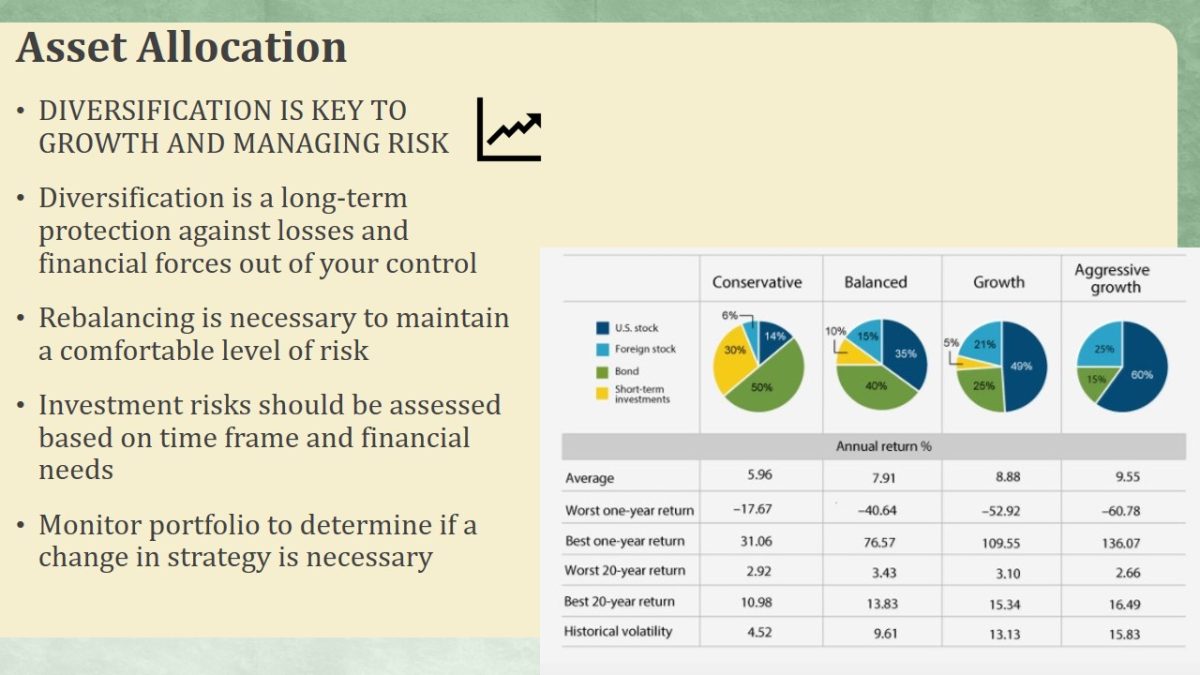

Asset Allocation

- Diversification is Key to growth and managing risk.

- Diversification is a long-term protection against losses and financial forces out of your control.

- Rebalancing is necessary to maintain a comfortable level of risk.

- Investment risks should be assessed based on time frame and financial needs.

- Monitor portfolio to determine if a change in strategy is necessary.

When a portfolio is created, one becomes a factual investor even if you are not doing any stock trading and relying on professionals. Despite its seemingly complex nature, it is necessary to monitor investments to stay within comfortable bounds of risk. Diversification is critical to protecting from unexpected financial forces which may derail a high-risk investment. It is recommended that no more than 5% of the portfolio consist of a specific stock or bond (“The Guide to Diversification”).

Shifting from Saving to Spending

- Asset allocation in retirement helps to ensure funds for prolonged prosperity.

- Portfolio withdrawals should be gradual, with consideration of expenses and tax.

- More households than ever are choosing to save a portion of retirement income.

- Rigid spending plan protects from crises.

- Avoid spending all your money within the first few years.

It is absolutely critical to realize that entering retirement does not indicate that one should stop saving and investing into the future. Even certain accounts that require the withdrawal of funds (specific types of IRAs) set a deadline at 70 years of age. Rebalancing the portfolio remains a valid option considering the prolonged lifespan and increased costs of health care. Strict spending plans protect the boundaries of financial security for retirees who purchase non-essentials.

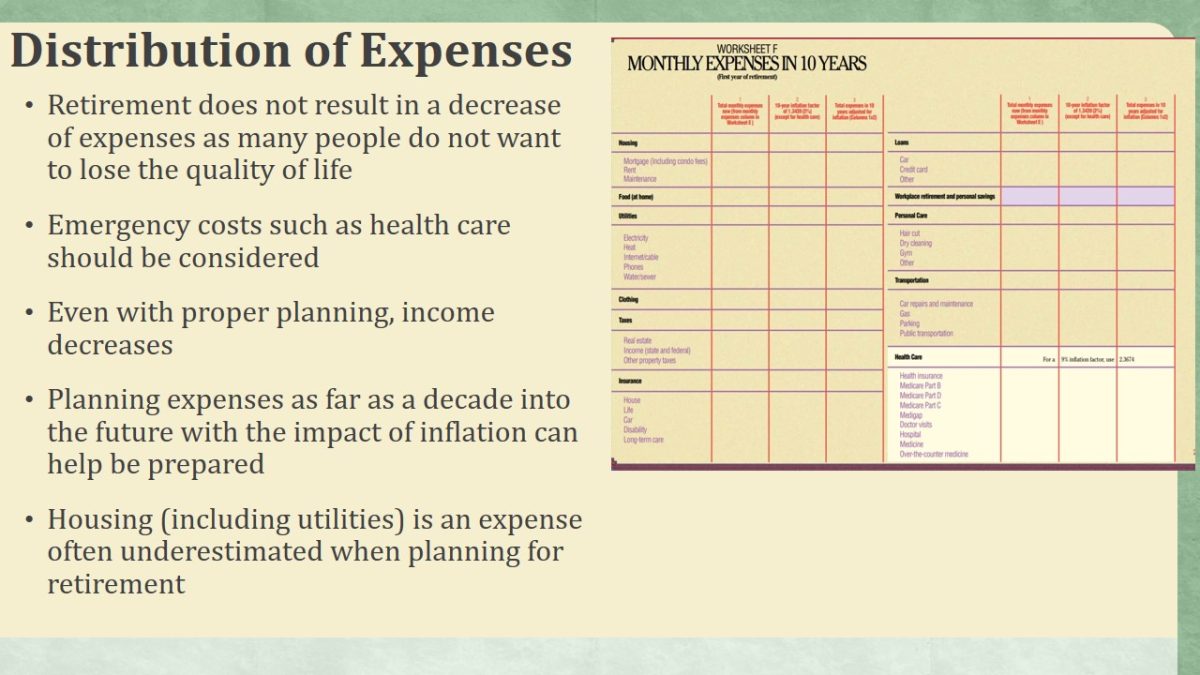

Distribution of Expenses

- Retirement does not result in a decrease of expenses as many people do not want to lose the quality of life.

- Emergency costs such as health care should be considered.

- Even with proper planning, income decreases.

- Planning expenses as far as a decade into the future with the impact of inflation can help be prepared.

- Housing (including utilities) is an expense often underestimated when planning for retirement.

The chart you see in this slide is an example of the extensive planning of expenses that needs to be done once retirement is underway. While it is difficult to predict prices, inflation, and financial conditions at a young age, once retirement starts, it is possible to plan such things out. Realistically, with many American families lacking competent retirement savings, such plans will be necessary to maintain an adequate quality of life as seniors.

Estate Planning

- Power of attorney and wills should be documented.

- A trust can be incorporated into a financial plan.

- Life insurance and estate plan can help the family after one’s death.

- A clear outline of beneficiaries helps avoid legal battles.

- Each aspect of estate planning requires separate professional expertise.

Unfortunately, with the age of retirement, death is something that should be considered even if one has excellent health. Estate planning consists of various legal and financial technicalities which require the guidance of professionals to ensure one’s wishes on the disbursement of the estate (including the investment portfolio) are fulfilled after passing. Many would like to ensure the financial well-being of their spouses and children which makes estate planning the final and necessary step in the estate planning process.

Conclusion

- Start saving as soon as possible!

- Consider financial factors and risks.

- Diversify portfolio of investment.

- Calculate income vs. expense ratios.

- Plan asset allocation to ensure long-term stability.

- Retirement plan is a guarantee for the future.

Using all the information in this presentation, you can begin to start saving for retirement today. Even though the prospect of the future is ambiguous, especially in terms of finances, it is a necessary step that everyone needs to take. Taking into account all relevant financial factors and risks, a competent and profitable portfolio can be developed which will address all relevant needs in the future. Use careful planning and asset allocation that would guarantee long-term stability. Do not leave your future up to chance, start investing for retirement today!

Works Cited

Dews, Fred. “10 Facts About Social Security and Retirement Saving.” Brookings. 2015. Web.

Kurt, Daniel. “6 Surprising Facts About Retirement.” Investopedia. 2017. Web.

O’Hara, Carolyn. “How Much Money Do I Need To Retire.” AARP, 2015. Web.

“Preparing Your Savings for Retirement.” Fidelity, n.d. Web.

Rhee, Nari, and Ilana Boivie. “The Continuing Retirement Savings Crisis.” National Institute on Retirement Security. 2015. Web.

“The Guide to Diversification.” Fidelity. 2017. Web.