Introduction

The scope of financial management includes a wide variety of problems and objectives associated with planning, organizing, directing, and controlling financial resources. These activities include investment decision-making through capital budgeting, raising finance from different resources, and dividend decisions (Brigham & Houston, 2021). The cost of equity valuation is of extreme importance for financial management, as it helps to make adequate decisions concerning capital investments (Brigham & Houston, 2021). Cost of equity calculation is an important part of estimating the cost of capital and performing equity and enterprise valuations (Brigham & Houston, 2021). The capital asset pricing model (CAPM) is the most preferred way of equity valuation (Moyo and Mache, 2018). However, the prevalence of the method is difficult to explain, as it provides similar results in comparison with other methods of evaluating the cost of equity (Moyo and Mache, 2018).

The present paper aims at addressing the problem of selecting the methods for equity valuation using a mixed-method approach. First, it tests the hypothesis that utilization of CAPM provides a higher level of satisfaction with the results by utilizing ANOVA. Second, the paper identifies the benefits of using CAPM for equity valuation in comparison with other methods using qualitative analysis of semi-structured interviews. The results are expected to provide a significant contribution to the current body of research.

Literature Review

Overview

The present section of the report aims at providing a review of the current body of knowledge concerning CAPM and equity valuation. First, an explanation of CAPM is provided, and its utilization for different purposes is discussed. Second, alternative equity valuation models are briefly introduced. Third, the validity of all models is compared. Finally, a synthesis of all the information is provided, and the gap in the literature is identified.

Capital Asset Pricing Model and Its Use

CAPM is one of the most widespread models for evaluating the cost of equity. The model evaluates the discount rate using the formula below:

r = rf + β + EMPR

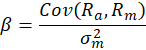

In the formula above, rf is the risk-free rate, β is the beta value of the stock, and EMRP is the equity market risk premium (Kolesnichenko et al., 2017). The formula is closely connected to the portfolio theory by H. M. Markowitz, under which all risks are divided into systematic and specific (Kolesnichenko et al., 2017). The β coefficient in the formula can be calculated using the regression analysis of action return (Ra) and the average market return (Rm) (Kolesnichenko et al., 2017). According to Kolesnichenko et al. (2017), for convenience purposes, β can be calculated the following way):

Where:

Cov(Ra, Rm) are the covariance of action return and average market return; σ2f is the variance of the average market return.

CAPM is utilized for a wide range of research purposes. Boyer et al. (2017) utilized the method for estimating the cost of equity in emerging markets. The results revealed that calculating the cost of equity is a challenging task when speaking of the emerging markets, as risk-free rate, beta, and the equity risk premium can be difficult to estimate (Boyer et al., 2017). Thus, the cost of equity and the value of equity may vary significantly depending on the estimations, which implies that the utilization of CAPM is questionable in this case. Kolesnichenko et al. (2017) utilized CAPM to measure the cost of equity in the conditions of economic instability in emerging markets using the example of Russia. The results revealed that CAPM is applicable for the purpose; however, there are considerable concerns when estimating the basic elements of the model (Kolesnichenko et al., 2017). Additionally, Kolesnichenko et al. (2017) propose that other methods, such as the dividend discount and cash flow, can be used. Thus, while the utilization of the CAPM model is possible, its benefits in comparison with other methods are unclear.

Salvi et al. (2020) utilized CAPM to assess if intellectual capital disclosure affected the cost of equity capital. The results of the research revealed that the disclosure of intellectual capital had a significant negative impact on the cost of equity (Salvi et al., 2020). At the same time, CAPM was found adequate for the purpose of the study despite its drawbacks and limitations. Ahmed et al. (2019) used CAPM to understand how the corporate social and environmental practices affected the cost of equity, which is crucial for investment decision-making. The results of the analysis revealed that high engagement in social and environmental practices helped users to make useful decisions, which decrease risks and resulted in higher equity valuation (Ahmed, 2019). The CAPM approach was found adequate for achieving the purpose of the study.

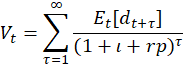

The CAPM model is also utilized for valuating equity, as the cost of equity is a vital part of such assessments. Henriksen andSørensen (2017) state that one of the common approaches to equity valuation is to use the CAPM “to estimate the expected return on equity, and then assume that the cost of equity is equal to the estimated expected return on equity” (p. 56). The model assumes that the essential parts of the model (risk-free rate, beta, and EMPR) are constants. If these assumptions are made, the standard equity valuation model can be written the following way:

In summary, the CAPM model is used for a wide variety of purposes. The approach has been validated by numerous researchers and financial managers. However, the utilization of CAPM is limited by the difficulty of estimating its basic components. Additionally, the benefits of its utilization in comparison with other methods are unclear.

Alternatives Methods for Equity Valuation

There are numerous alternatives to the CAPM-based model for equity valuation. Pinto (2020) discusses four types of equity valuation models. The first type of equity valuation is based on present value or discounted cash flow. These models estimate the future benefits of purchasing the security by calculating the intrinsic value of the security (Pinto, 2020). Two common examples of such approaches are dividend discount models and free-cash-flow-to-equity models (Pinto, 2020). Such approaches are associated with a wide variety of problems with assumptions. For instance, the dividend discount models assume that the growth of dividends is constant and they are the only form of income for the shareholders (Moyo& Mache, 2018). Market multiple models are also commonly used to evaluate equity. These approaches evaluate the intrinsic value of common shares using a price multiple for some fundamental variable (Pinto, 2020). The common examples of the approach are P/E (price-to-equity) and P/S (price-to-sales) ratios. Utilization of such approaches is associated with biases, as the forecasts of the share prices are based on comparison with other firms (Sehgal & Pandey, 2010). However, such approaches are still associated with consistent results (Moyo& Mache, 2018; Pinto, 2020; Sehgal & Pandey, 2010).

Equity can also be evaluated using enterprise value. The common form of such valuation is the enterprise value divided by the value of a fundamental variable. One of the common examples of using this approach is dividing earnings before interest (EBIT) and tax by capital employed, which can be calculated by subtracting current liabilities from total assets (Pinto, 2020). Finally, asset-based valuation approaches can be used for equity valuation. This method assumes that the value of a firm is equal to the sum of the value of its business assets. These types of methods evaluate equity by subtracting the value of preferred shares and liabilities from the estimated value of assets (Pinto, 2020). The book value of assets is usually modified to increase the accuracy of estimates (Pinto, 2020). Thus, there are numerous approaches to equity valuation validated by research and practice.

Validity of Methods

There is a large body of evidence confirming the validity of all the methods of equity valuation discussed in the previous section of the literature review. Moyo and Mache (2018) assessed the validity of the eight most popular methods for equity valuation to compare the results. The study included CAPM, two dividend discount models, a P/E multiple models, two P/B (price to book value) models, a residual income model, and the Ohlson and Juettner-Nauroth model. The results revealed that the majority of methods generate similar results to those of CAPM (Moyo& Mache, 2018). However, variants of the P/E and P/B approaches provide slightly higher estimates (Moyo& Mache, 2018). However, the utilization of these methods is valid if applied consistently between all the valuations, as all of the valuations are affected by the stability of the companies’ income and financial position (Moyo& Mache, 2018). Thus, there are no problems with the validity of any of the described methods for equity valuation.

Synthesis, Knowledge Gap, and Problem Statement

CAPM is the most commonly used model by financial managers and researchers for equity valuation. The method is associated with several difficult estimations that can be difficult to make in unstable economies. There are numerous alternatives to the CAPM approaches validated by solid evidence. Even though estimations may provide different values when compared to each other, they can all be used if implemented consistently. Moreover, the deviation in the accuracy of valuation is comparatively low.

Financial managers should be provided with clear benefits of every valuation method to select the most appropriate. The literature review revealed a significant gap in the current body of knowledge. In particular, current literature cannot explain the reason for CAPM being a preferred method for equity valuation in the majority of cases. In other words, the central problem is that current research cannot provide the criteria for selecting the CAPM method over others.

Proposed Methods

The present paper proposes to use a two-level approach to close the gap in knowledge. First, it tests the hypothesis that CAPM gives higher satisfaction to the user in comparison with other methods. Second, the study proposes to use thematic analysis of semi-structured interviews with experts that utilize diverse methods for equity valuation to deduct the reasons for preferring CAPM over other models.

Sampling

Since the purpose of the proposed research is to identify the benefits of the CAPM approach as seen by its users, the population under analysis are financial managers that engaged in equity valuation during the past three years worldwide. A simple random sampling method is preferred, as it gives every item of the population an even chance to be included in the study (Ghauri et al., 2020). The method helps to reduce the biases, and the researcher does not need to have prior knowledge of the population to conduct the study(Ghauri et al., 2020). According to the sample size calculator created by Qualtrics (2020), a sample of at least 385 respondents is recommended to achieve a confidence level of 95% with a 5% margin of error. As for the qualitative part of the research, ten semi-structured interviews will be conducted with respondents of diverse backgrounds.

Measures and Procedures

The level of satisfaction with the equity valuation model will be measured using a self-created questionnaire consisting of five Likert scale questions, as suggested by Cirera and Muzi (2016). After the sampling procedure, the potential respondents will be contacted using email to obtain informed consent and ask them to complete the survey designed to measure the level of satisfaction with the model of equity valuation they prefer. After that, interviews will be conducted using Zoom or other video-conference services preferred by the respondent.

Data Analysis

The quantitative data will be analyzed using a one-way analysis of variance (ANOVA). According to Ghauri et al. (2020), this method is appropriate to analyze if there is a statistical difference in the means of two or more unrelated groups. As for the qualitative part, a thematic analysis will be used to identify the benefits of using CAMP in comparison with other equity valuation methods.

Conclusion

The present paper provided a review of current literature concerning the CAPM method for equity valuation. The literature revealed that CAPM is the preferred method for equity valuation among scholars and researchers for no apparent reason. Therefore, financial managers do not have the confirmed benefits of utilizing CAPM over numerous alternatives. The present paper proposes a mixed-method approach for solving the identified problem. The synthesized results of the ANOVA analysis of the survey and thematic analysis of semi-structured interviews are expected to close the identified knowledge gap.

References

Ahmed, A. H., Eliwa, Y., & Power, D. M. (2019). The impact of corporate social and environmental practices on the cost of equity capital: UK evidence. International Journal of Accounting & Information Management.

Brigham, E. F., & Houston, J. F. (2021). Fundamentals of financial management. Cengage Learning.

Boyer, B., Lim, R., & Lyons, B. (2017). Estimating the cost of equity in emerging markets: A case study. American Journal of Management, 17(2), 58-64.

Ghauri, P., Grønhaug, K., & Strange, R. (2020). Research methods in business studies (5th ed.). Cambridge University Press.

Henriksen, A. B., &Sørensen, M. D. (2017). Epstein-Zin-based equity valuation. Web.

Kolesnichenko, E. A., Sutyagin, V. Y., Radyukova, Y. Y., Smagina, V. V., &Yakunina, I. N. (2017). Valuation cost of equity capital in the conditions of economic instability in emerging markets (by the example of Russia). In Russia and the European Union (pp. 383-391). Springer, Cham.

Moyo, V., & Mache, F. (2018). Inferring the cost of equity: Does the CAPM consistently outperform the income and multiples, valuation models? Journal of Applied Business Research (JABR), 34(3), 519-532.

Pinto, J. E. (2020). Equity asset valuation. John Wiley & Sons.

Qualtrics. (2020). Sample size calculator. Web.

Salvi, A., Vitolla, F., Raimo, N., Rubino, M., &Petruzzella, F. (2020). Does intellectual capital disclosure affect the cost of equity capital? An empirical analysis in the integrated reporting context. Journal of Intellectual Capital, 21(6), 985-1007.

Sehgal, S., & Pandey, A. (2010). Equity valuation using price multiples: evidence from India. Asian Academy of Management Journal of Accounting and Finance, 6(1), 89-108.