Executive Summary

This paper strives to investigate changes in the value of FDI inflows in the Mexican automotive sector from 2012 to 2016. Data were obtained from Statista and analyzed using SPSS software (version 23), Tableau, and Microsoft Excel. Using these techniques, descriptive and inferential data analysis techniques were employed to understand the relationship between the independent variable (time) and the dependent variable (FDI). The descriptive methods employed were frequencies, mean, median, and standard of deviation, while the inferential analysis was conducted using the one-sample T-test (comparison of means). Broadly, it is established that there has been a significant decline in FDI inflows in the Mexican automotive market within the period under analysis. This finding contradicts those of previous research, which suggests a general increase in FDI inflows to the Mexican automotive sector.

Introduction

Background

Due to the openness of its economy, Mexico is one of the highest recipients of foreign direct investments (FDIs) in the developing world (U.S. Department of Commerce 2017). Multiple reasons explain why this is so but researchers have pointed out that a good business environment, rising number of skilled laborers, macroeconomic stability, and its proximity to the United States largely explain the high FDIs in the North American nation (Yamazaki, Abo & Juhn 2013; Castillo et al. 2013; Pavlinek 2018; Buckley & Clegg 2016). The automobile sector is one of the biggest recipients of FDIs in Mexico. Indeed, it is one of the country’s most important sectors because it accounts for about 3.8% of its gross national product and 21% of the country’s manufacturing processes (Price Waterhouse Coopers Mexico 2013).

FDI inflows in the Mexican automobile sector are subject to change because of uncertainties in the global macroeconomic environment, differences in economic policies between Mexico and the US (which is the country’s biggest FDI source), increased competition from alternative investment destinations, and changes in business realignment among investors (United Nations Economic Commission for Latin America and the Caribbean 2018). Consequently, there is a need to understand the trend in FDI flows in the country’s automotive sector. This paper explores changes in the value of foreign direct investments in the Mexican automotive sector between 2012 and 2016. Data will be obtained from Statista.com and analyzed using the SPSS technique, Microsoft Excel, and Tableau.

Importance of Topic and Gaps

FDI inflows are considered strong catalysts for economic growth (Ailincă 2016). Countries that receive high FDIs often benefit from the creation of new employment opportunities, expansion of productive capacities, and infrastructure growth (among others) (Gómez-Mera et al. 2014; Ye 2014; Lall & Narula 2013). An analysis of changes in FDI inflows in the Mexican automotive sector is an important topic because it provides multinational companies (MNCs) with information regarding different aspects of business performance, which are relevant to countries or enterprises wishing to venture into Mexico or its automotive industry. Indeed, by analyzing the findings of this report, they would better understand the different elements of industry performance underlying the sector such as the ease of doing business, trade and exchange liberalization, the nature of private sector development, availability of infrastructure for growth among other factors (Peng 2016).

The gap that exists in the literature is the lack of a sectoral review of FDI inflows in Mexico because many studies have generalized their analysis to the entire country. Therefore, few researchers have explored the performance of each sector of the Mexican economy, relative to FDI inflows. This paper fills this research gap by specifically focusing on the Mexican automotive industry. The analysis is contextualized within 2012 and 2016 to provide an updated understanding of the same.

Objectives and Structure of Report

As outlined above, this study aims to investigate changes in the value of FDI inflows in the Mexican automotive sector from 2012 to 2016. Four objectives guide this review. They are outlined as follows:

- To estimate the degree of change of FDI inflows in the Mexican automotive sector from 2012 to 2016

- To analyze the trend in FDI inflows in the Mexican automotive sector between 2012 and 2016

- To predict the future trend of FDI inflows in the Mexican automotive sector after 2016

- To find out whether there have been drastic changes in the FDI value of the Mexican automotive sector between 2012 and 2016

The research questions are as follows:

- What is the average change of FDI inflows in the Mexican automotive sector?

- Have FDI inflows in the Mexican automotive sector increased or decreased from 2012 to 2016?

- Will the rate of FDI inflows, increase or decrease after the year 2016?

- Have there been drastic changes in the value of FDI inflows in the Mexican automotive sector?

Based on the above research questions, the hypotheses of the study appear below.

Research Question 1

- Hypothesis 1 (H1): The average rate of FDI change in the Mexican automotive sector is within a five-percentile range

- Hypothesis 2 (H2): The average rate of FDI change in the Mexican automotive sector is not within a five-percentile range

- Null Hypothesis (H0): There is a neutral FDI change in the Mexican automotive

Research Question 2

- Hypothesis 1 (H1): FDI inflows in the Mexican automotive sector have increased from 2012 to 2016

- Hypothesis 2 (H2): FDI inflows in the Mexican automotive sector have decreased from 2012 to 2016

- Null Hypothesis (H0): FDI inflows in the Mexican automotive sector has neither increased nor decreased from 2012 to 2016

Research Question 3

- Hypothesis 1 (H1): The rate of FDI inflows in the Mexican automotive sector will increase after 2016

- Hypothesis 2 (H2): The rate of FDI inflows in the Mexican automotive sector will decrease after 2016

- Null Hypothesis (H0): The rate of FDI inflows in the Mexican automotive sector will not increase or decrease after 2016

Research Question 4

- Hypothesis 1 (H1): There have been drastic changes in the value of FDI inflows in the Mexican automotive sector?

- Hypothesis 2 (H2): There have been no drastic changes in the value of FDI inflows in the Mexican automotive sector?

- Null Hypothesis (H0): There have been neutral changes in the value of FDI inflows in the Mexican automotive sector?

Based on the above research objectives, this report has five key sections. The first one is the introduction part, which provides background and justification for the research topic/idea. The second section is the literature review part, which contains an analysis of empirical and conceptual evidence concerning the research topic. The third section is the methodology part, which outlines the research methods used to answer the questions. The fourth part contains the findings of the research as descriptive and inferential data. The last part is the conclusion section, which reflects the preliminary findings and data trends.

Literature Review

Critical Overview of Conceptual International Business Literature

As highlighted in the introduction section of this paper, changes in foreign direct investments often cause significant variations in economic activity within different economic sectors. Stemming from this view, most of the conceptual pieces of literature on this topic have analyzed FDIs in the Mexican automotive industry by comparing it with other industries (Yamazaki, Abo & Juhn 2013; Castillo et al. 2013; Pavlinek 2018; Buckley & Clegg 2016). Recent studies have focused on understanding the impact of America’s foreign trade policies on FDI flows in the South American nation (Center for Automotive Research 2017; Nishino 2017). Most of these works of the literature suggest that the stronger the performance of the global economy, the higher the FDI flows, and the slower the pace of economic recovery, the lower the rate of FDI flow. Similarly, a decline in FDI inflows within a country would mean a slowdown in some of its economic sectors (Center for Automotive Research 2017; Nishino 2017). Particularly, this statement is true in many emerging economies, such as Mexico, India, and Brazil, which depend on strong FDI inflows to support their economic sectors and create jobs for their people (Ibrahim & Muthusamy 2014).

Critical Overview of Empirical Literature

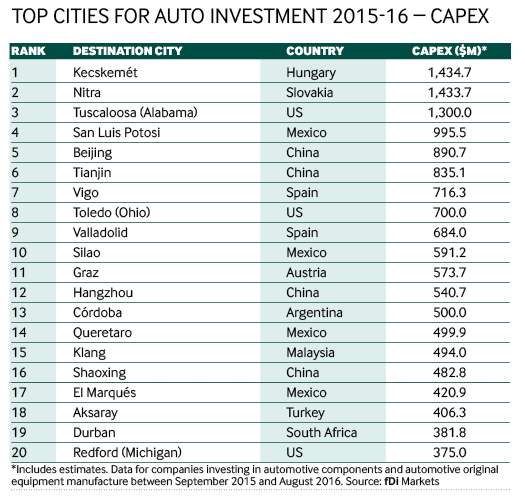

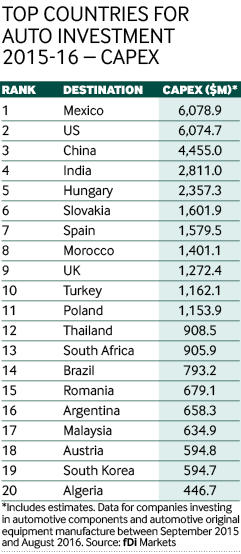

In the past few years, Mexico has made a name for itself as a leading global economic hub, buoyed by a growing middle class, availability of skilled labor, and an improved infrastructure to support production (Deloitte 2015). These competencies have helped it to create a reputation of being an integrated global manufacturing sector. Consequently, it has attracted the attention of different types of investors from nations such as Japan, Germany, and Spain (Deloitte 2015; Shehadi 2016). As an auto industry powerhouse, FDI inflows have helped Mexico to attract huge capital investments, and build an efficient supply chain management system that has not only allowed it to manufacture cars but also support a vibrant auto parts industry. The cities of Saltillo and San Luis Potosi in Mexico are the highest recipients of FDIs in the Mexican automotive sector (Tecma Group 2015; Shehadi 2016). KIA and Hyundai are only a few companies that have setup up production and manufacturing plants in these cities through investments that are worth more than $400 million (Tecma Group 2015). Figure 1 below shows that Mexico is among the top five most attractive cities in the world for FDI in the auto industry.

According to the diagram above, Mexico is ranked among the top countries for auto investments. Figure 2 below shows that it leads the US and China in terms of attractiveness, while South Korea and Algeria assume positions 19 and 20 on the list (respectively).

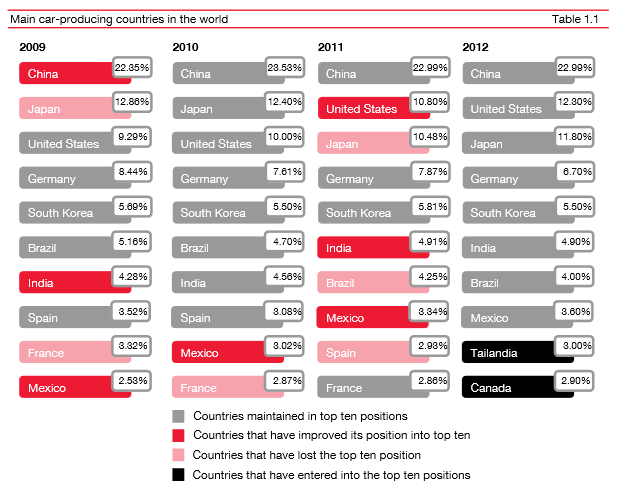

The competitiveness of Mexico’s automotive industry is also supported by an excerpt from a report by the Price Waterhouse Coopers Mexico (2013), which shows that the North American nation has consistently been among the top ten main car-producing nations of the world. Figure 3 below highlights this fact by showing that between 2009 and 2012 the company has been in the top ten slots of the main car-producing countries in the world.

The North American Free Trade Agreement (NAFTA) treaty has been highlighted in several reports as having a key impact on the FDI flows in the Mexican automotive sector (Center for Automotive Research 2017; Nishino 2017). Particularly, new changes to this agreement by the Trump-led administration has attracted the attention of researchers who are investigating how these changes will affect FDI inflows in the automotive sector (EYGM Limited 2017).

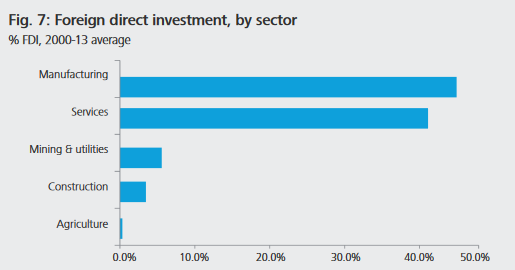

A report by Deloitte (2015) shows that the competitiveness of the Mexican automotive sector is likely to increase in the future, thereby further attracting more FDI investments. This statement partly stems from the huge FDI allocations that the manufacturing sector receives, relative to other sectors of the economy. Figure 4 below highlights this fact.

Most of the strategies adopted by foreign direct investors in Mexico can be summarised into three groups. The first one is the creation of continental production systems to improve the efficiency and competitiveness of their operations. This strategic approach is often adopted by US multinationals, which are experiencing increased competition from Asian companies (United Nations Economic Commission for Latin America and the Caribbean 2018). The second strategy is the expansion of a market presence in Mexico through the acquisition of private assets (United Nations Economic Commission for Latin America and the Caribbean 2018). American multinationals operating in Mexico also commonly pursue this FDI mode (United Nations Economic Commission for Latin America and the Caribbean 2018). Lastly, foreign direct investors establish a new market presence in the country by stretching their outreach to areas that they previously never operated (United Nations Economic Commission for Latin America and the Caribbean 2018).

Conceptual Framework

The international production theory will form the main conceptual framework for this review. It presupposes that the quest by foreign investors to venture into new markets is a product of a balance between the advantages of initiating production in the home country and abroad (Dunning 2014; Cantwell 2015; Turolla 2013). This theory is selected for this review because studies have shown that most of the FDI inflows to Mexico are from investors who are looking for production, manufacturing, and supply chain efficiencies (Galvin, Goracinova & Wolfe 2014; Wójtowicz & Rachwał 2014; Villareal & Fergusson 2017; Pavlínek 2017). Therefore, comparing the advantages and disadvantages of producing in their home countries vs. Mexico comes to focus. The international production theory will help to make sense of such complexes.

Methodology

Data Collection Strategy

The data collection strategy was hinged on seeking and analyzing secondary information obtained from the Statistics Portal (2018). It was essential to use published research data because the research topic is regional and government publications or industry reports are periodically updated with this type of information. The data sources and variables developed are explained in the section below.

Data Sources and Variables

As highlighted above, the data analyzed in this study were sourced from the Statistics Portal (2018). It related to FDI inflows in the Mexican automotive sectors from 2012 to 2016. Information was obtained in its raw form and filtered using Microsoft Excel (2010) and the SPSS software. The FDI inflow was quantified as a percentage – it formed one variable in the study. The other one was time. It stretched from 2012 to 2016.

Data Analysis Strategy

The data were analyzed using descriptive and inferential techniques borrowed from the statistical packages for the social sciences (SPSS) – version 23, Microsoft Excel 2013, and Tableau. These statistical assessment techniques were applied in this review because they are user-friendly and have strong descriptive-analytical capabilities (Shankar & Braj 2016; Hinton & McMurray 2017; Heck, Thomas & Tabata 2013). The descriptive methods used were frequency tables, bar charts, means, and standard of deviation. Inferential analysis was done using the one-sample T-test technique. The findings are highlighted below.

Data Analysis

Descriptive Data Findings

Figure 5 below shows the output for the FDI inflows for the Mexican automotive industry between 2012 and 2016.

According to the graph above, the year on year FDI growth rate in the Mexican automotive sector for 2012, 2013, 2014, 2015, and 2016 were 37.9%, 31.3%, 33.3%, 19.9%, and -19.2%. These statistics mean that the FDI inflows into the Mexican automotive sector have declined since 2012. Based on this finding alone, it is possible to deduce that the hypothesis H2 for the first research question, which states, “The average rate of FDI change in the Mexican automotive sector is not within a five-percentile range” is true because the decline is more than 10%. Hypothesis H2 is also true for the second research question. It states, “FDI inflows in the Mexican automotive sector have decreased from 2012 to 2016.” This finding is hinged on the fact that the FDI inflow for 2012 was 37.9% and in 2016 it was -19.2%.

Based on this change in numbers, it is possible to predict that the rate of FDI inflow in post-2016 will increase because, in 2016, the value was too low and in 2017, there has been a significant increase in attention for the Mexican automotive industry as explained by Deloitte (2015). This statement implies that the first hypothesis for the third research question, which states, “The rate of FDI inflows will increase post-2016” is true. The first hypothesis for the fourth research question, which states, “There have been drastic changes in the value of FDI inflows in the Mexican automotive sector” is also true. This affirmation stems from the drastic change in FDI inflows, which happened between 2015 and 2016 (19.9% to 19.2%).

The SPSS findings revealed that the mean of the analyzed data was pegged at 12.20. This figure implies that the decrease in FDI for the period under study was about 12%. The median number was 12 and the standard deviation was.837, meaning that the data was generally consistent. These findings are highlighted in table 1 and 2 below.

Table 1. Statistics (Source: Developed by the Author of the Report).

Table 2. Frequencies (Source: Developed by the Author of the Report).

Preliminary Results for Inference

The inferential analysis was done using the one-sample t-test (mean testing). The results appear in tables 3 and 4 below.

Table 3. One-Sample Statistics (Source: Developed by the Author of the Report).

Table 4. One-Sample Test (Source: Developed by the Author of the Report).

Based on the findings above, the equation we could deduce appears below.

t(4)=0.535, p =.621. In other words, the mean was not correlated with the test value 12.

Findings and Conclusion

According to the findings generated in this study, there has been a significant decrease in FDI inflows for the Mexican automotive industry between 2012 and 2016 because of the drastic change in the percentage that happened between 2015 and 2016 where FDI inflows dropped by 200%. The conceptual framework for this study is the international production theory. When analyzed in the context of these findings, it could be deduced that Mexico has lost its competitive advantage in the automotive sector to other countries and that is why there has been a significant decline in FDI investments within the industry. Stated differently, it could be assumed that the host countries for international investors are providing better returns than the Mexican automotive market. This finding contradicts those of previous researchers, such as Deloitte 2015, which suggests a general increase in FDI inflows to the Mexican automotive sector.

Reference List

Ailincă, AG 2016, ‘Trend analysis of worldwide FDI flows in the context of promoting sustainable development and national interest’, Economica, vol. 12, no. 5, pp. 238-250.

Buckley, P & Clegg, J 2016, Multinational enterprises in less developed countries, Springer, New York, NY.

Cantwell, J (ed) 2015, The eclectic paradigm, Palgrave Macmillan, London.

Castillo, N, Ochoa, A, Márquez, B & Cervantes, L 2013, Competitiveness’ key factors: the organization’s internal resources, its heterogeneous distribution and its difficulty to imitate them, Lulu.com, New York, NY.

Center for Automotive Research 2017, NAFTA briefing: trade benefits to the automotive industry and potential consequences of withdrawal from the agreement. Web.

Deloitte 2015, Competitiveness: catching the next wave – Mexico. Web.

Dunning, J 2014, Explaining international production, Routledge, London.

EYGM Limited 2017, USA new government: implications for the Mexican automotive industry. Web.

Galvin, P, Goracinova, E & Wolfe, D 2014, Recent trends in manufacturing innovation policy for the automotive sector: a survey of the US, Mexico, EU, Germany, and Spain. Web.

Gómez-Mera, L, Kenyon, T, Margalit, Y, Reis, YG & Varela, G 2014, New voices in investment: a survey of investors from emerging countries, World Bank Publications, London.

Heck, R, Thomas, S & Tabata, L 2013, Multilevel and longitudinal modeling with IBM SPSS, 2nd edn, Routledge, London.

Hinton, P & McMurray, I 2017, Presenting your data with SPSS explained, Taylor & Francis, London.

Ibrahim, S & Muthusamy, A 2014, ‘Role of foreign direct investment (FDI) in India’s economic development-an analysis’, Journal of International Relations and Foreign Policy, vol. 2, no. 2, pp. 101-113.

Lall, S & Narula, R 2013, Understanding FDI-assisted economic development, Routledge, London.

Nishino, K 2017, NAFTA renegotiations – implications for the automotive industry. Web.

Pavlínek, P 2017, Dependent growth: foreign investment and the development of the automotive industry in East-Central Europe, Springer, Cham.

Pavlinek, P 2018, ‘Global production networks, foreign direct investment, and supplier linkages in the integrated peripheries of the automotive industry’, Journal of Economic geography, vol. 94, no. 2, pp. 41-165.

Peng, M 2016, Global business, Cengage Learning, London.

Price Waterhouse Coopers Mexico 2013, Doing business in Mexico automotive industry. Web.

Shankar, AH & Braj, B 2016, Statistics for social sciences (with SPSS applications), PHI Learning Pvt. Ltd., London.

Shehadi, S 2016, Mexico leads automotive FDI ranking. Web.

The Statistics Portal 2018, Change in the value of foreign direct investment (FDI) in the automotive industry in Mexico from 2012 to 2016. Web.

Tecma Group 2015, Foreign investment in the Mexican automotive sector keeps on rolling in. Web.

Turolla, FA 2013, ‘Towards a theory of international production of infrastructure services’, Internext, vol. 8, no.1, pp. 17-30.

United Nations Economic Commission for Latin America and the Caribbean 2018, Mexico is region’s second largest recipient of foreign direct investment. Web.

U.S. Department of Commerce 2017, Mexico – 1-openness to and restriction on foreign investment. Web.

Villareal, MA & Fergusson, IF 2017, The North American free trade agreement (NAFTA) (CRS report r42965), Congressional Research Service, Washington, D.C.

Wójtowicz, M & Rachwał, T 2014, Globalization and new centers of automotive manufacturing – the case of Brazil, Mexico, and Central Europe. Web.

Yamazaki, K, Abo, T & Juhn, J 2013, Hybrid factories in Latin America: Japanese management transferred, Springer, New York, NY.

Ye, M 2014, Diasporas and foreign direct investment in China and India, Cambridge University Press, London.