Abstract

Artificial Intelligence (AI) means the modern wide variety of computer applications that have notable machine learning capabilities hence depicting that of human intelligence. The stock market refers to trading platforms where buying and selling of shares can be undertaken by investors.

By use of AI, there is a possibility to monitor the trading patterns and predict how markets can be shaped in the future. Many companies such as Kavout and Epoque have embraced the use of AI in their stock trading paraphernalia. Through artificial intelligence, companies have been advantaged to improve their returns on investment.

There is a possibility that in the future, AI will empower stock markers further. For instance, due to the current rise of globalization, AI will take all the advanced patterns of cloud computing to give a better analysis of stock management models, investment processes, and fast data speed when it comes to buying and selling of shares.

Introduction

Artificial Intelligence (AI) is a wide-range category in computing that is effective in developing smart machines that can undertake tasks that may be human intelligence oriented (Patel et al., 2021). AI enables machines to think humanly, rationally, and act humanly and rationally too. Stock markets refer to where people and institutional investment firms come together to transact in shares in a given public venue.

Today, buying and selling of shares exist as electronic marketplace places. Thus, it is important to report on how AI is responsible for enabling machines and equipment used in stock market paraphernalia. AI uses modern microservices architecture and can be subject to cloud software. This paper presents a report on how AI affects stock markets.

Artificial Intelligence Effects on Stock Market

AI can be termed as one of the key components that will shape the future of stock trading. For instance, the use of robotic instruments to analyze a wide variety of data points and implement fine trades is evident as a result of AI (Sushma & Tarun, 2020). Therefore, the optimal price, the analysis predicts markets that have significant accuracy in stock mathematics.

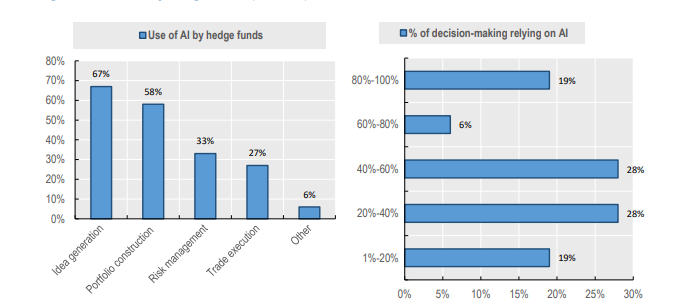

Similarly, by the use of AI-centric machines in stock trading, trading companies prevent the risk of giving higher returns. Many companies have embraced AI in trade execution by 27% and decision making, as seen in figure 1 below (Xie & Akiyama, 2021). Thus, as a result of globalization, AI has been able to penetrate the stock markets in all countries hence effective in stock markets.

Machine Learning as a Booster in the Subject

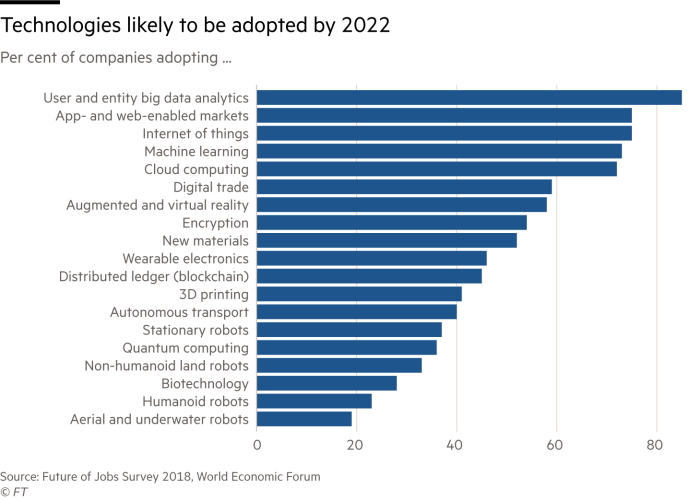

Machine learning is developing at a fast pace, and financial firms are not left behind in adopting the new applications. Antony Antenucci, the vice president of Intelenet Global Services supports the idea that the increased intelligence in cloud computing has advanced many sections of stock markets (Sharma & Kaushik, 2017).

Antenucci explains that some companies, such as Wall Street realized they could increase their business functions through the use of AI. He says, “they could effectively crunch millions upon millions of data points in real-time and capture information that current statistical models couldn’t” (Patel et al., 2021). Therefore, it means that companies around the world can utilize the new trends to enable smarter trading patterns in the stock market and other fields.

Efficacy of Adopting Machine Learning Technology

By adopting the use of AI, stock markets have been made efficient in buying and selling shares. End-to-end machine learning under the umbrella of AI has given a chance to have quality and quantity data science that can be used in analysis during stock trading (Sharma & Kaushik, 2017).

For example, AI information and expertise power have led to the formulation of investment strategies. That is possible by developing a smart asset allocation system using comprehensive learning to forecast the assets of a given portfolio within the stock market (Sushma & Tarun, 2020). Therefore, embracing artificial intelligence in stock trading ensures that stock trading businesses can have a concrete transactions that are supported by the latest trends in cloud computing.

Nowadays, proprietary investment technology can combine AI with an active exchange-traded fund (ETF). The above is possible by processing and accumulating data generated from various sources such as social media, news journals, and financial statement pages (Sushma & Tarun, 2020).

Globally, companies can now systemize the trading patterns and investment process to understand the markets and how to manage such companies as it a trend in stock market business, as seen in figure 1 below (Umer et al., 2019). Using the elements highlighted in the paragraph, a business person interested in opening a stock trading firm would utilize the information to determine their starting points.

Examples of Stock Companies that have Adopted Artificial Intelligence

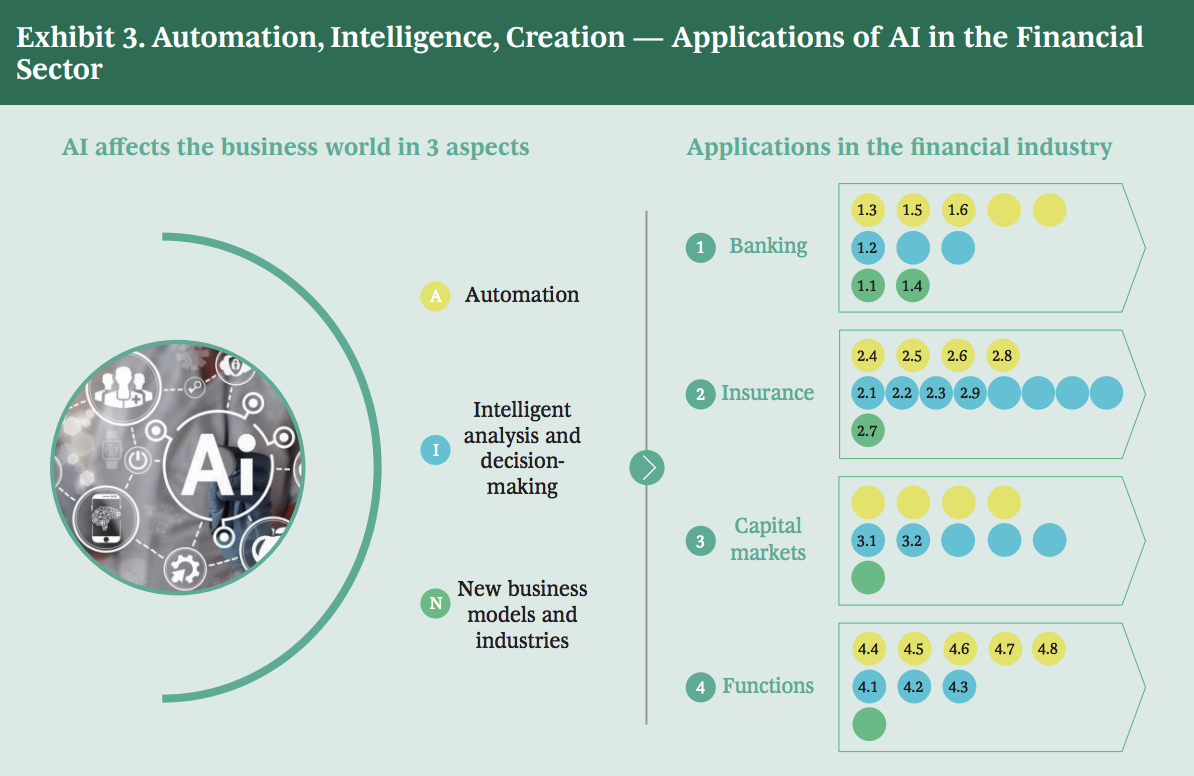

Companies around the world have adopted the use of AI as one way to ease their trading paraphernalia. For example, Trading Technologies in Chicago acquired Neurensic and developed an AI platform that is capable of identifying complex trading data on a massive scale. The multiple markets that the company indulges in have been able to execute stock elements in time (Thomas, 2021). Additionally, by combining machine learning with cloud-based processing, the firm has enabled its customers to have a comprehensive assessment. Therefore, as shown in figure 2, many firms are embracing AI in to boost their business.

Another example is Kavout, based in Seattle, which has a ‘K Score’ product of the AI helping in processing massive complex stock data (Bajunaid & Meccawy, 2017). The product on the platform runs a raft of forecasting models to initiate stock-ranking ratings in the market. Due to the utilization of AI, the company can recommend daily top stocks by use of pattern recognition tech power and price predicting elements. All the models of portfolios for the two companies highlighted above are enhanced by AI algorithms (Patel et al., 2021).

Therefore, the information above shows how AI has affected the stock market in the world. Artificial intelligence is useful in analyzing potential trades in the stock market. Epoque, a company based in Switzerland, has fully automated AI transactions in three categories referred to as engines (Thomas, 2021). First, there is a strategy engine that observes and offers analysis of trades. The second is an older engine that is tasked with developing orders and undertaking operational activities. Lastly, there is the logical engine that can handle running orders and utilizes AI to improve the speed of the performance.

Impact on the Stock Market

The current trend in the current stock market experience has taken the industry to another level. Companies nowadays have adopted more complex computing skills powered by AI. Infinite Alpha, a stock company, uses AI to enable crypto asset trading. Therefore, the firm can offer protection to investors by utilizing advanced authentication and encryption and other digital modules (Thomas, 2021). In this case, using the AI-geared intuitive dashboard, the users can access their account and see the transactions and also the balances and stock histories concerning their trade.

Generally, it shows that AI can be segmented further into various categories that can be deployed independently to provide the desired work programmed in stock market companies (Bajunaid & Meccawy, 2017). Thus, stock markets with AI are more advanced than the old-fashioned monolithic applications that were less capable compared to the cloud-based architecture used today.

Drawbacks of Artificial Intelligence Might Have on Stock Markets

Reduced Benefits Due to Cyber Issues

Applications powered by AI might change many factions of stock markets as this happens. First, due to the speed of analysis, forecasts, and investment issues, investors may find in the future that medium-term benefits will be below the expectations of the competitive base set by other stock trading firms (Sushma & Tarun, 2020).

Therefore, there might be a push for the businesses to return to old ways of getting a financial adviser who will be suggesting the portfolio mix in stock trading due to the uncertainty of machine learning in the stock market. It is important to note that due to cyber issues, AI has been at risk of letting computer technicians with ill-fated intentions hack data, which can lead to loss of resources (Umer et al., 2019). Due to the power of microservices architecture, the stock markets might be overweighed by cybercrime to establish anti-phishing attacks that may yield to the collapse of investment.

The decline in Portfolio Payoff

When using AI, there is a high possibility that portfolio payoff may decline. When excluding microcaps, 62% of the payoff may go down hence disappearing returns (Xie & Akiyama, 2021). That means stocks can be difficult to trade as they might have negligible market capitalizations. When excluding non-rated firms, it might be 68% lower and 80% for distressed firms around credit cap elements (Xie & Akiyama, 2021). According to research, machine learning in stock markets may only be profitable when there is high investor sentiment and low market liquidity, among other factors. Therefore, despite AI’s powerful rise in stock trading, the subject has drawbacks on the same.

Cross-sectional Return receptibility

Artificial Intelligence may not solve everything in the stock market. It can only be valuable for real-time business, risk control, and established firms. The reason is that machine learning specializes in stock picking rather than industry rotation. Strategies that seek to maximize the next-level economic cycles may be unable to move funds equally in the industry (Sharma & Kaushik, 2017). Therefore, it is important to note that machine learning in stock markets may face the challenge of cross-sectional return receptibility hence making stock to be difficult to arbitrage in investment areas.

Conclusion

Artificial Intelligence in the stock market has played a key role in advancing the trading of shares. Through AI, investors can create strategies that can help analyze complex trading data and investment sequences. Stock market companies such as Kavout and Epoque have been boosted after adopting machine learning in their stock trading business. There are challenges of AI in the subject as they may have cross-sectional return forecast made hard to actualize by the investors. Additionally, the rise of cybercrime raises concern over many issues as some financial data might be manipulated.

Recommendations

Due to the continued embracing of AI in the stock market, it is important for modern-day companies to have machine learning power in their business. By 2025, stock markets shall be at a point where the business shall be conducted more efficiently than it is now. The following list shows recommendations for the report. The recommendations can be useful if utilized in the right way.

- Industries should embrace the use of AI as it ensures effective transaction and analysis of complex data

- The use of AI should be scrutinized keenly to avoid liabilities such as loss of resources such as money invested

- It is important to have modern microservices in stock computing as it shows the history and can forecast the future.

References

Bajunaid, W., & Meccawy, M. (2017). How to utilize big data for business intelligence in the stock market. International Journal of Computer Applications, 166(9), 13-16. Web.

Patel, A., Patel, D., & Yadav, S. (2021). Prediction of the stock market using artificial intelligence. SSRN Electronic Journal, 5(11), 3. Web.

Sharma, S., & Kaushik, B. (2017). Quantitative analysis of stock market prediction for accurate investment decisions in the future. Journal Of Artificial Intelligence, 11(1), 48-54. Web.

Sushma Jaiswal, & Tarun Jaiswal. (2020). Review on machine learning techniques for stock-market forecasting. Artificial Intelligence Evolution, 9(2), 34-47. Web.

Thomas, M. (2021). How AI trading technology is making stock market investors smarter. Built-In. Web.

Umer, M., Awais, M., & Muzammul, M. (2019). Stock market prediction using machine learning (ML)algorithms. ADCAIJ: Advances in Distributed Computing and Artificial Intelligence Journal, 8(4), 97-116. Web.

Xie, F., & Akiyama, E. (2021). How price limits affect the behaviors of a market with differences in the speed of information acquisition: An approach with the artificial market (An agent-based model for financial market). Transactions Of the Japanese Society for Artificial Intelligence, 36(5), 1-8. Web.