In simple terms, Islamic banking is a banking system that functions according to the guidelines laid down by the Shariah (Islamic law). “Islamic banking is banking based on Islamic law (Shariah). It follows the Shariah, called fiqh muamalat (Islamic rules on transactions). The rules and practices of fiqh muamalat were incorporated from the Quran, the Sunnah and other secondary sources of Islamic law” (Banking Info par.1).

There are two basic principles on which the whole Islamic banking is based on. The first one is that in a partnership firm if the partners are ready to share the profits they should be ready to share the losses as well. In Islamic terms, this principle is called Mudharabah. The second principle prohibits the account holders to either pay or receive interest (Riba) on money borrowed or lent respectively. The Islamic banks also follow these principles in their own transactions.

One might think that if no interest is to be given or taken then how the Islamic banking functions. Well, for this problem there is a solution in the Islamic banking system that the borrower can pay an amount (as agreed upon by the two parties) to the lender as a benefit.

Now, since the Islamic banking is based on the Shariah, all the transactions are bound to follow the Islamic moral codes of conduct. As such, there is a prohibition to investments or doing businesses engaged in intoxicating products such as alcohol, games such as gambling and foods such as pork.

Historical context of islamic banking

The past of Islamic banking may be better understood if it is explained in two different parts; first, when there was only the idea of an interest-free banking and second, when the idea was conceived into being by some private inventiveness is some nations and by the government initiative in some others.

The earlier scholars (in 1950s) promoted the idea of interest free banking and called it the Islamic banking system. The ensuing two decades witnessed further interest among people towards this kind of banking.

The advent of 1970s witnessed the participation of institutions in this sector. “Conference of the Finance Ministers of the Islamic Countries was held. The involvement of institutions and government led to the application of theory to practice and resulted in the establishment of the Islamic banks” (Hannan par. 10). Owing to the efforts of the conference attendees, Islamic Development Bank (IDB) came into being in the year 1975.

‘The Islamic Banker’ claims that, “The first model of Islamic banking system came into picture in 1963 in Egypt. Ahmad Al Najjar was the chief founder of this bank and the key features were profit sharing on the non-interest based philosophy of the Islamic Shariah” (The Islamic Banker par. 3). Also, “In 1974, the Organization of Islamic Countries (OIC) had established the first Islamic bank called the Islamic Development Bank (IDB).

The basic business model of this bank was based on providing financial assistance and support on profit sharing basis” (The Islamic Banker par. 3). It further claims that, “By the end of 1970, several Islamic banking systems had been established throughout the Muslim world, including the first private commercial bank in Dubai (1975), the Bahrain Islamic Bank (1979) and the Faisal Islamic Bank of Sudan (1977)” (The Islamic Banker par. 4).

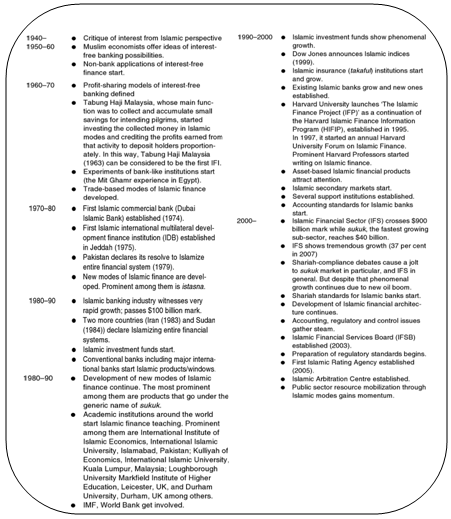

Table 1: Brief history of Islamic banking

Source: www.shariah-fortune.com

Table 2: Detailed history of Islamic banking, Source: (Ariff and Munawar 75).

The basis of islamic banking and its organs

As mentioned earlier in the paper, Islamic banking is based on the principles laid down in the Shariah. The two main pillars of Islamic banking are profit sharing and taking or giving no interest. The process is very simple that a person deposits his/her money in an Islamic bank and the bank in turn gives an assurance of returning the money when required.

The depositor can withdraw his/her money from the bank whenever required (within the working hours of the bank). But since nowadays there are ATMs all over, money can be withdrawn whenever required. In lieu of offering services to their clients, Islamic banks charge a certain amount as fee and if the bank considers it feasible the depositors may be offered gift (Hibah) as well. Following are the different organs of Islamic banking:

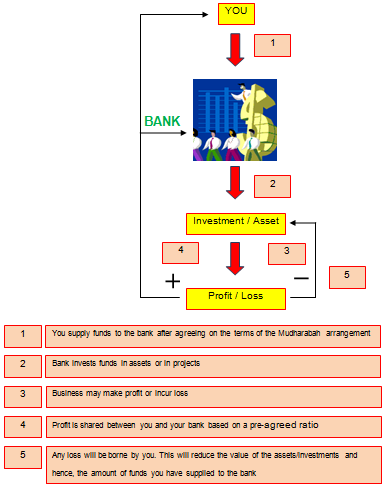

Mudharabah or the profit sharing system. Mudharabah is basically a banking system that involves sharing of profit between two entities. In these two entities, one is the bank and the other may be either an investor or a borrower. There are two ways in which the transaction is carried out.

In the first method, the bank acts as an entrepreneur and accepts investment from an investor. In the second method, the bank acts as a lender and lends money to a borrower. In both the cases, the ratio of profit sharing is fixed prior to the commencement of the banking relation or transaction. “Losses suffered shall be borne by the capital provider” (Banking Info p. 6). Following is a flow chart that depicts the Mudharabah or the profit sharing system followed by Islamic banks:

Figure 1: Functioning of Islamic banks

Source: www.bankinginfo.com

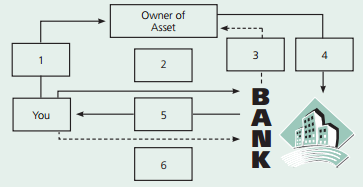

Deferred payment sale system or Bai’ Bithaman Ajil (BBA). Under this system, the buyer of any goods sells the goods and then pays the seller the amount including a pre-decided profit margin. This amount may be paid either as a total amount or in instalments, whatever has been agreed upon. The actual practice is that an entity identifies the goods to be purchased and the bank is requested for a BBA (Bai’ Bithaman Ajil) or deferred payment sale.

The entity assures the bank to buy back the goods from the bank at an increased value. The bank in turn buys the goods and pays the seller. Now the bank is the owner of the goods. Reasonable profit (as agreed upon with the entity) is added to the cost of the goods and the goods are then sold to the entity. Now the entity is the owner of those goods and pays the bank in instalments within a stipulated time frame. Following is a flow chart of the deferred payment sale system followed by Islamic banks:

Figure 2: Deferred payment sale system

Source: www.bankinginfo.com

Murabahah or the cost plus system. We have seen that in BBA, the price at which the bank sells the goods to the entity is inclusive of a mutually pre-decided profit margin. But according to the Murabahah system, the seller (bank) has to make the buyer aware of the actual cost of the goods and the profit added to the cost. This has to be done at the time of making the agreement.

Musyarakah or the joint venture system. The Musyarakah system deals with the partnerships or joint ventures. Joint ventures are done in order to make profit but there are times when the joint venture has to face losses. In joint ventures, the parties involved invest in some proportion. The profits in a joint venture need not be shared according to this proportion but the profit sharing proportion can be different and pre-decided. On the contrary, in case of losses, the losses have to borne by the parties involves according to the proportion of their investments.

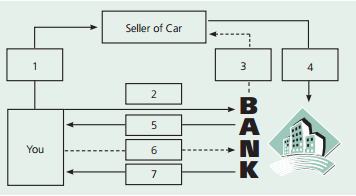

Ijarah Thumma Bai’ or hire purchase system. The Ijarah Thumma Bai’ system usually refers to consumer goods financing, vehicles more commonly. This system involves two different contracts; Ijarah and Bai’. The Ijarah contract is for leasing and renting and the Bai’ contract is for purchasing. Following is a flow chart that depicts the system of Ijarah Thumma Bai’:

Figure 3: Ijarah Thumma Bai’ system

Source: www.bankinginfo.com

Wakalah or the power of attorney system. The Wakalah system refers to an agency of any product or service in which the agency charges a pre-decided fee for the services being rendered. The agency acts as an agent of the principal party for performing explicit jobs.

Qard or interest free loan. The Qard system refers to the loan given by any lender for a specific duration to the borrower without any interest being charged. The borrower has to repay the loan amount within the specified time frame. Even though there is no interest levied in this kind of ending, the borrower can pay to the lender any amount of his/her will but there is no compulsion.

Hibah or the gift system. In Hibah system, any entity that has been benefitted from another person or a body may pay to that person or body any amount as a token of gratitude.

The following table depicts the principles followed by some of the major countries where Islamic banks function:

Table 3: Islamic banking principles in different countries.

Legal and illegal banking practices based in islamic banking

Except Sudan, Iran and Malaysia, there are no other countries where Islamic banks have legal cover. “In general, legislative needs for Islamic banking can be minimized by legislating the Shariah principles and the Shariah restrictions for contracts while leaving practical details for adjudication by the courts” (Tahir p. 8).

Tahir further suggests that, “Registration requirements associated with agreements need to be simplified as the associated costs may impede lease financing. There is also need for special legal cover in order to facilitate and implement Musharakah (partnership) agreements by Islamic banks” (Tahir p. 8).

Since the Islamic banking system is governed by the Shariah, the framework is different from the non-Islamic or conventional banks. Since the Islamic banks follow the no-interest policy, the documentation of financial instruments is totally different and as such they cannot be compatible with the non-Islamic banks.

The need of the hour is that the governments of countries where Islamic banks are functioning should come out with some legal cover for the Islamic banks in order to make the Islamic banks more sustainable. Only then the Islamic banks will be able to function worldwide. But as a matter of fact, Islamic banks have improved their standards during the years.

Anees Sultan claims that, “Investments into some Islamic funds are not always 100 percent ‘Islamic’. Some of the terms under which some funds operate state that interest income shall constitute less than a certain percentage of total income, but some interest income is accepted” (Sultan par. 6).

One might wonder that if interest is prohibited in Islam, how such instances are occurring. The board members of the Shariah are paid compensation for favouring judgements (Sultan par. 7). “Also consider the word Sukuk – now used to describe Islamic structured bonds. The word itself has nothing Islamic or religious about it; it is simply Arabic for a promissory note. Likewise, both Murabah and Takaful are just Arabic nouns for various commercial or social activities” (Sultan par. 7).

Another action of the Islamic banks that raise eyebrows is their dealings with the commercial or conventional banks. There are some conventional banks that have started Islamic banking branches and in these branches, conventional banking products as well as Islamic banking products are being offered. Now how can one believe that the transactions in such banks would be interest-free?

Comparison of islamic banking and conventional banking

In some countries, due to the cosmopolitan nature, there are Islamic banks as well conventional banks. These banks perform all the financial transactions as may be expected from a financial institution. The Islamic Financial Institutions support the world economy by providing all the required services. The basic concept of Islamic banks and conventional banks is the same.

Both are engaged in providing their customers banking products such as saving and current accounts, fund transfer, safety lockers, international trading, etc. Islamic banks don’t have any objection in performing such tasks because they are not against the Shariah. The main difference between Islamic banks and conventional banks exists in the manner in which funds are mobilized in Islamic banks and conventional banks. By mobilizing funds it is meant the investments and loan disbursements.

For the purpose of comparison of conventional banking system and Islamic banking system, we have considered the following two banks: Faysal Bank as the conventional bank and Meezan Bank as the Islamic bank.

Faysal Bank

First let us know about Faysal Bank. “Faysal Bank Limited was incorporated in Pakistan on October 3, 1994, as a public limited company under the Companies Ordinance, 1984” (Faysal Bank). The bank is presently engaged in commercial activities and banking products such as deposit accounts, vehicle loans, loans on property, etc.

Vision of Faysal Bank: “Excellence in all that we do” (Faysal Bank).

Mission of Faysal Bank: “Achieve leadership in providing financial services in chosen markets through innovation” (Faysal Bank).

Meezan Bank

Talking of Meezan Bank, “Meezan bank Limited, a publicly listed company, is the first and largest Islamic Bank in Pakistan and one of the fastest growing banks in the history of banking sector of the country” (Meezan Bank).

Vision of Meezan Bank: “Establish Islamic banking as banking of first choice to facilitate the implementation of an equitable economic system, providing a strong foundation for establishing a fair and just society for mankind” (Meezan Bank).

Mission of Meezan Bank: “To be a premier Islamic bank, offering a one-stop for innovative value-added products and services to our customers within the bounds of Shariah, while optimizing the stakeholders’ value through an organizational culture…” (Meezan Bank).

In order to compare the products of both the banks, the following table will be helpful:

Table 4: Banking instruments of Meezan Bank and Faysal Bank

Source: www.scribd.com

Now we shall study these different instruments separately.

Current accounts:

This kind of account is generally for business owners. They may deposit or withdraw amount as many times as they want. But a certain charge is levied on the transactions. Let us now compare the current accounts of the two banks in question:

Table 5: Current account features of Meezan Bank and Faysal Bank

Savings account:

Unlike current account, saving account can be opened by individuals and not business organizations. Saving bank offers some interest or profit to the account holder. This kind of account is the most preferred one by people of all genders and age groups because of its simplicity and easy access. Let us now understand the various features of different kinds of saving accounts being offered by the two banks:

Table 6: Saving account features of Meezan Bank and Faysal Bank

Consumer Financing:

As the name suggests this kind of financing is for customers who want to purchase some consumer goods. Such goods may include vehicle loan, credit cards, etc. Let us now understand the salient features of this kind of banking instrument in both the banks:

Table 7: Salient features of saving account of Meezan Bank and Faysal Bank

The table below will further make us understand the differences between conventional banks and Islamic banks:

Table 8: Salient features of conventional banks and Islamic banks

Source: www.scribd.com

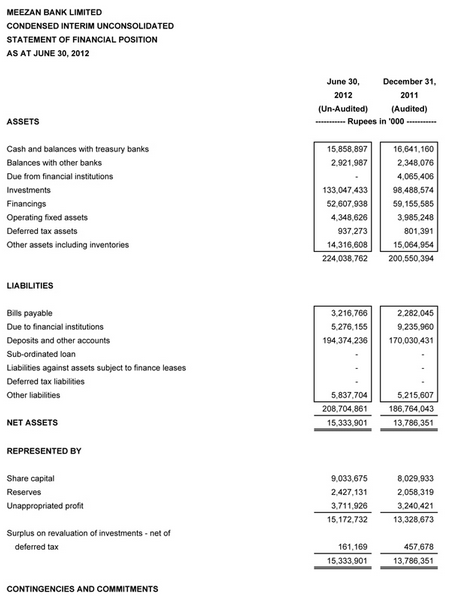

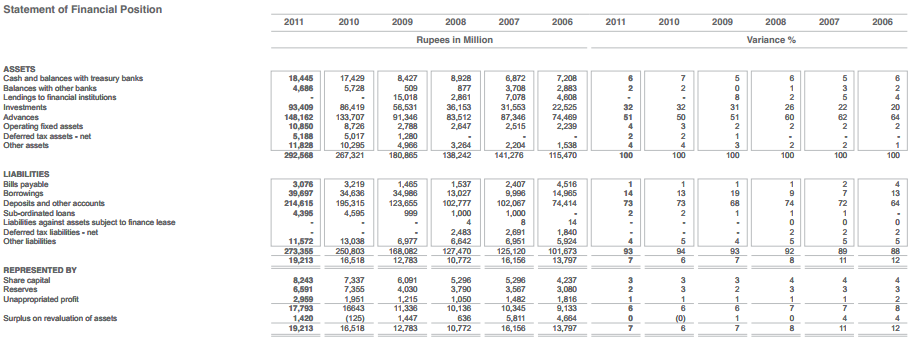

In addition to the aforementioned points, the statement of the financial positions of Meezan Bank and Faysal Bank are at Appendices 1 and 2 respectively.

Instruments of islamic banking

Deposits

Islamic banks as well as conventional banks accept deposits but the difference is in the manner of return on the deposits. While in conventional banking system, the return on deposits is predetermined, in Islamic banks it is according to the Musharaka and/or Mudaraba system. The return on deposits in Islamic banking system is not fixed.

Another difference between these two banking systems is that while in conventional banking system the risk is borne by the bank, in Islamic banking system, the risk and reward are both shared by the bank and the investor. In conventional banking, since the return on deposits is predetermined, any excess benefit out of the deposits is for the bank. However, there is a similarity between the two kinds of banking system that for long term deposits the return is higher and for short term deposits, the return is lower.

Investments & Financing

Both the conventional and Islamic banking systems offer loans or credits to business organizations. This is done in order to gain some profit out of the credit facility being provided. But there is a difference in the terms and conditions of financing in both these kinds of banking systems.

Conventional banks disburse loans at a predetermined rate of interest but since the interest is involved, the Islamic banks cannot do so. But it’s not that the Islamic banks don’t offer loans. They do offer loans but then there is no interest factor; the loans are interest free (Qarz-e-Hasna). In Islamic banks loans are given under the profit sharing system.

Overdrafts and Credit cards

In conventional banking system, the customers are allowed to withdraw cash from their overdraft account or the credit cards. Credit cards may be used either for purchasing goods or for withdrawing cash. The conventional banks charge interest on the amount used under these two schemes. On the other hand, in Islamic banks there is no credit card.

The customers of Islamic banks are offered debit cards whereby they can purchase goods or withdraw cash provided there is sufficient credit balance in their accounts. However, Islamic banks do offer credit but that is under the Murabaha system wherein although there is no interest factor but profit margin is added to the amount to be returned. In case of default by the customers to repay the credit availed, conventional banks charge extra amount (penalty) whereas in Islamic banks this is not the case.

The defaulters have to make another agreement with the conventional banks for the repayment of the overdue amount with penalty but in Islamic banks this is not possible. In Islamic banks, even if there is any defaulter, the bank cannot charge any excess amount other than the original amount that was utilized by the customer. The only thing that Islamic banks can do in such cases is to blacklist the defaulter and abstain from lending any further credit facility to that particular customer.

Leasing

Leasing is a banking instrument wherein the Lessee is allowed to use the facility or product for a predetermined rent. The ownership in such cases may or may not be transferred to the lessee. In Islamic banking system, this is done under the Ijara system. Under Ijara, the ownership is not transferred to the lessee unless the lease term is completed. In Islamic banking system there are certain rules pertaining to Ijara that the banks have to abide by.

Firstly, the rent is applicable only after the lessee gets custody of the asset. Secondly, in case of default in rent payment, the banks cannot charge any extra rent but a penalty may be imposed. This penalty cannot be kept by the banks as their profit but it has to be given to some charity. Thirdly, in case there is any major repair required or is going on the banks cannot claim the rent. And lastly, in case of lost of asset, the Islamic banks cannot claim the remaining instalments. It means that the Islamic banks have to bear the ownership risks.

Agriculture loans

Agriculture loan is of two kinds; short-term and long-term. Short term agriculture loans are required by farmers in order to purchase seeds, fertilizers, etc. The long-term agriculture loans are meant for expansion, purchase of irrigation equipments, etc. It is a usual practice of farmers to return the loan amount once their crops are sold. The conventional banks charge some predetermined interest on the extended loan facility.

In Islamic banks, there are different systems for different purposes. For purchasing seeds, fertilizers, banks offer credit to farmers in return of the crops. This is called the Bai Salam system wherein the farmers have to give the agreed quantity of crops to the banks in lieu of the credit facility availed by them.

The Murabaha system is for extending credit facility for the purchase of irrigation equipments. For expansion or purchase of further land, the Musharaka and Mudaraba systems come into effect. But in order to avail all these facilities from an Islamic bank, the farmers have to convince the bankers on the viability and profitability of their farming venture.

Housing finance

Housing finance is the best form of financing for any financial institution whether it is a conventional bank or an Islamic bank. But as mentioned earlier, there is a difference in the terms and conditions of financing in both the banking systems.

In conventional banking system, housing loan is offered on a predetermined interest rate whereas in Islamic banks the housing finance is offered according to the reducing Musharaka system. Under the reducing Musharaka system, the house to be financed is purchased by the bank and the customer as joint owners. The bank then offers its share in the property to the customer for a predetermined rent.

The share amount of the bank is segmented into small amounts and the customer has to pay this amount along with the rent to the bank as instalments. As the customer keeps on paying the instalments, his/her share or stake in the house keeps on increasing while that of the bank keeps on decreasing. When the last instalment is also cleared by the customer, the bank has no claim over the house and the ownership of the house is transferred to the customer.

The good thing (beneficial for the customer) in house financing according to the reducing Musharaka system is that if by chance there is any devaluation of the property, the customer doesn’t have to bear the brunt alone. The bank will also share the loss according to its share in investment.

Advantages and disadvantages of islamic banking

The following table depicts the advantages and disadvantages of Islamic banking:

Table 9: Advantages and disadvantages of Islamic banking

Economic crisis and islamic banking

The economic crisis has turned out to be disastrous for the financial sector. Banks have started to abstain from lending. This has increased the borrowing rate. “The value of bonds issued worldwide against mortgages, for example, crashed from $1.9 billion for the year to $500 million in the year 2008”. (Hassan par. 3). The third world countries were the most affected since they had drawn inspiration from the idea of free market.

This situation was mostly limited to the conventional banking sector. The Islamic banking sector was not affected much. The reason was that Islamic banks function on a partnership basis with their customers. “The Islamic economic and financial system is based on a set of values, ideals and morals, such as honesty, credibility, transparency, clear evidence, facilitation, co-operation, complementarities and solidarity” (Hassan p. 4).

Such moral conducts provide protection, constancy and protection to the parties involved in the transactions. Also, as per the Shariah, taking or giving interest is not allowed. Also businesses such as gambling are prohibited. All such factors have made the Islamic banking system a reliable source for making financial transactions.

“Beginning in 1998 and 1999, the bank failure rate began to climb again, with a failure rate accelerating in 2008, 2009, and 2012. In 2008, 25 banks were closed. This number jumped to 140 bank failures in 2009” (Amran p. 8).

The following two tables will further make us understand the effect of the financial crisis on Islamic banks and conventional banks:

Table 10: Capital Adequacy Ratio (CAR) of Islamic banks before and during the financial crisis

Source: www.businessperspectives.org

Table 11: Capital Adequacy Ratio (CAR) of conventional banks before and during the financial crisis

Source: www.businessperspectives.org

From the aforementioned tables it may be concluded that the Islamic banks performed better than their conventional counterparts before as well as after the crisis. After analyzing the different ratios it makes us understand that the Islamic banks had greater profitability as compared to the conventional banks.

Islamic banking is the solution to economic problems

If all the banks follow the guidelines of the Shariah, financial crisis can never happen. For example if the conventional banking sector adopts the risk-sharing system of the Islamic banks, there would never be any problem because then the banks will take great care while investing the funds.

Likewise the Islamic banks, the conventional banks will also do proper survey before investing anywhere. By investing also means lending money to borrowers. Before lending money to such borrowers, the banks will do a thorough viability study and only after being convinced of the profitability they will offer the financing of the project.

“Islamic banks act as venture capital firms collecting people’s wealth and investing it in the economy, then distributing the profits amongst depositors. Islamic banks act as investment partners for those who need money to do business”. (Hassan p. 4).

“The collapse of leading Wall Street Institutions, notably Lehman Brothers, should encourage economists worldwide to focus on Islamic banking and finance as an alternative model” (Amran p. 9).

The success of Islamic banks can be understood from the fact that the number of such banks is increasing incessantly and the amount they are dealing in is touching the skies. “Furthermore, Islamic banking provides a viable alternative to conventional banking and is less cycle prone. The spread of Islamic finance into western markets demonstrates that it is now being treated seriously by regulators and finance ministers” (Amran p. 12).

The growth of Islamic banks can be gauged by Thomas Grose’s statement that, “London now is home to 25 companies offering some form of Islamic financing. BLME is the largest of five wholly Sharia-compliant banks operating in Britain. The first, the Islamic Bank of Britain, opened in 2004, and the number is expected to double within five years” (Grose par. 4). The Islamic banking has become popular because people have started understanding that only Islamic banking system can save them from the severe financial crisis in future.

Mr. Adnan Ahmed Yousi, who is the CEO of Albaraka Group, Bahrain, claimed that “Islamic banks do not rely on bonds or stocks, and are not involved in the buying and selling of debt unlike most conventional banks…Islamic banking is distinguished by the fact that it is prohibited from buying debts under Islamic Sharia law” (as cited by Al-Hamzani par. 3).

This is the reason that Islamic banks are unaffected to a great extent by the global economic crisis. So it is advisable for the conventional banks to follow the banking systems of Islamic banks and avoid further and future risks.

Network of islamic banks around the world

Following is a consolidated list of the main Islamic banks in different countries around the world:

Table 12: Islamic Banks in various nations

Source: www.listofbanksin.com

Challenges and problems being faced by islamic banks

Majority of the Islamic banks are located in Muslim countries. The non-Muslim world is not much aware about Islamic banks and their principles. The Islamic banks are bound by the guidelines of the Shariah law. As such, they have to work according to the Musharaka and Mudaraba systems. It has been observed that the Islamic banks face problems in their functions and the bankers owe these problems to the following reasons:

There is a shortage of serious and genuine people who want to do business. People take loans from Islamic banks for the sake of it. Due to the lenient rules of repayment, people approach such banks for loans and advances. There are numerous instances wherein people have taken loan from Islamic banks and haven’t returned because they are aware of the loop holes that no penalty can be levied on them.

Within the bank, there is a shortfall of well trained professionals who are well versed with the Islamic banking system. Each one of us wants to do the best in life and so do the banking professionals. Even though Islamic banks are doing well, their business is not at par with the volume of business handled by the conventional banks.

And since size does matters, the fresh banking professionals prefer the conventional banks rather than the Islamic banks. They are worried about their profession and future promotions. Secondly, Islamic banking needs professionals who are well aware of the nature of business in their banks. There is a dearth of such professionals. Young graduates do not see any future in the Islamic banking sector. It needs a lot of moral and religious understanding on the part of the employees of Islamic banks.

It is very ironic to state that due to the vast advancements in science and technology, young students have ample opportunities that are more lucrative and challenging than being an Islamic bank professional. The professionals of Islamic banks are required to have a greater perspective of the banking industry; Islamic in particular, and at the same time, they have to have a proper understanding of their customers and their projects.

There are only limited banking instruments with the Islamic banking professionals that they can offer to the customers. It is a human tendency to go to shops where there is a large variety of things that they want to purchase. Similarly, when a person wants to do banking, he/she will like to have more options to choose from.

According to the Shariah guidelines, forward booking of currency is not allowed. So there is always a risk of currency fluctuation. Under such circumstances, the exporters are at a loss and the foreign importers are the beneficiaries. Suppose for example an exporter takes order for a particular item at $100 per piece.

During the time of finalization of the order, the currency exchange rate is say $1 = Rs.50. It means that the exporter has agreed on a rate of Rs.5000 per piece. But due to the currency rate fluctuation, the rate may come down to say $1= Rs.45. It means that the exporter has to sell goods at a loss of Rs.500 per piece. This issue sometimes forces business people to opt for the conventional banking system.

It’s a normal practice by exporters that as soon as their goods are loaded, they approach their respective banks for bill discounting. In conventional banking, bill discounting is preferred because the banks get good commission and sometimes interest as well on the amount discounted. On the contrary, Islamic banks are bound by the Shariah guidelines and though they are allowed to do bill discounting, they cannot charge any interest and moreover, the charges are also very nominal.

In spite of the fact that Islamic banking system has been prevalent for more than 35 years now, majority of the people are unaware of the basic principles of Islamic banking or what exactly Islamic banking is. If the Islamic banks want to prosper, it is very crucial for them to spread awareness among the people about Islamic banking. It is an added portfolio for the Islamic banks to teach each and every new customer about the principles of Islamic banking.

Islamic banks are not fully established and are still in the learning and experiencing phase. It is a common practice in Islamic banks to use the short term deposits of their customers for long term financing. This is done because the banking professional are under the impression that certain short term deposits won’t be withdrawn, even on maturity. This belief of theirs sometimes backfires when some of these short term deposits are withdrawn.

In such circumstances, the bank has funds problem and as per the banking culture, it has to borrow from some other bank for a couple of days. The banks those are ready to transfer funds don’t do it as a courtesy or a friendly gesture. They charge a certain amount of interest. Here the problem arises for the Islamic banks since they are bound by the guidelines of the Shariah law and can neither pay interest nor take interest.

As mentioned above, most of the Islamic banks do not have the variety of instruments that conventional banks have. Due to the advancement in technology and science, conventional banks have gone far ahead in bringing innovative products for their valued customers.

Islamic banks, on the other hand, are banking on the same old banking instruments or products. Moreover, most of the Islamic banks do not have their own research and development department so that they may devise new products. This hampers the progress of Islamic banks to a great extent.

In today’s world, advertisement is a must for any product’s success. But ironically, Islamic banks do not do much of advertising and avoid the media to a great extent. Actually, the world should know what Islamic banking is about and for this advertisement or the media are the best options.

Recommendations

It’s not impossible to have solutions for all the problems mentioned above. It’s just a little understanding and initiative that is required. It has to be accepted that the working conditions for Islamic banks will never be the same in Muslim and non-Muslim countries. It’s not that these problems are faced by all the Islamic banks. The Islamic banks in Muslim countries such as the Kingdom of Saudi Arabia, United Arab Emirates, Qatar, etc, are doing quite well.

It’s only the newer ones in non-Muslim countries that are facing the major problems. Since the Islamic banks follow the values of Islam in their banking operations, they should also be humble and extend help to the new Islamic banks. At least they can provide feedback, experienced professionals etc. So that the newcomers are not stuck and may perform better and come up to the expectations of the principles of Islamic banking.

It should be the endeavour of the International Islamic Banking Organization, the Islamic Development Bank, and other Islamic banks governing agencies to put more efforts and professionals in the research and development field. I am sure experts on Islam religion must have been employed by such organizations but such experts should have a vast and broad mindset and identify new products for the masses.

According to Dr. Salah Al-Shalhoub, head of the Centre of Banking Studies and Islamic Finance (CBSIF), the trend of Islamic banking is changing and “The Islamic banking system, which used to design products on purely Islamic basis, began to expand these products to meet requirements of customers who felt more secured about their investments, not only in terms of finance but also from the Shariah perspective” (as cited in Arab News par. 9).

It’s true but more efforts are required. Like regarding the problem being faced by the Islamic banks due to the bill discounting and booking of foreign currency, the governing bodies can devise some way to overcome the problem. This way they will be able to attract more and genuine customers because as such Islamic banking system is an excellent one and people will prefer Islamic banking if their requirements are met.

The Islamic banks, on their part, should hire more professional people who are experts in banks and have the knowledge of the principles of Islamic banking as well. Customer service is very important in any service organization. Customer service doesn’t only mean welcoming the customers and offering them a glass of cold water. The Islamic banking professional should go out of the way and explain to their customers what Islamic banking is all about and how they will be benefitted.

The Islamic banks should rely on the media and should have a separate budget for advertisement. After all, this is a kind of business and businesses prosper due to advertisement. This way, two purposes will be served. Firstly, the advertisement will spread the awareness of Islamic banking and secondly the bank’s popularity will grow.

People will come to know about the specialities of Islamic banking system and will automatically be attracted towards doing business with such banks. Even if initially the business people hesitate to come due to the strict guidelines regarding various products and instruments, at least the banks can garner many customers for their saving bank accounts. Nowadays even children want to open their saving accounts.

Gradually, as there will be more innovative products and the banks will have better professionals, it is beyond doubt that Islamic banks won’t succeed. The future of Islamic banks is very bright.

Conclusion

It has been only 37 years since Islamic banks have come into the banking scenario and as compared to the conventional banks, they are quite new. As such, it is quite early to decide whether or not Islamic banking industry is a success or not. Looking at the response and feedback that Islamic banks are getting from foreign countries that are non-Muslim it may be understood that the even though slow yet there is some progress.

The popularity is increasing gradually. Moreover, the world economists have been quite impressed by the performance of Islamic banks during and after the economic crisis. There have been symposiums and conferences to discuss this issue. The number of Islamic banks in non-Muslim countries is increasing gradually and it is estimated that within the next five odd years, the number will double.

There are certain drawbacks of Islamic banks but these are due to the strict guidelines of the Sharia. But if we look at these drawbacks from the Sarah’s point of view, it will be understood that it is actually for the good of the masses. Sharia law doesn’t want to harm anyone due to its principles. Islam doesn’t allow earning money from money.

The only ways of earning allowed in Islam through business are trading, manufacturing, and service oriented jobs. There are restrictions to such businesses also. Certain things cannot be dealt with such as gambling, pork, intoxicating items, etc. If we think optimistically, such guidelines are better for the society as a whole because all malpractices can be avoided by such guidelines.

Children learn what they see. If we start following the same path as the Islamic banks and abstain from all those things that are banned according to Sharia law, our future generation is sure to become a decent and civilized and God-fearing one. Then our earth will be a better place to live in.

Works Cited

Al-Hamzani, Mohammed. 2008. Islamic Banks Unaffected by Global Financial Crisis. Web.

Amran, Muhamad. n.d. Prospects for Islamic Banking after the World Economic Crisis. Web.

Arab News. 2012. Symposium Explores Prospects of Islamic Banking. Web.

Ariff, Mohamed, and I. Munawar. The Foundations of Islamic Banking, Cheltenham, United Kingdom: Edgar Elgar Publishing, 2011. Print.

Banking Info. 2009, Your Guide on Basic Concepts and Principles of Islamic Banking. Web.

Faysal Bank. Faysal Bank. Web.

Grose, Thomas. 2008. The Rise of Islamic Banking in a Time of Economic Crisis. Web.

Hassan, Abul. 2009. The Global Financial Crisis and Islamic Banking. Web.

Meezan Bank. Meezan Bank. Web.

Sultan, Anees. 2008. As Islamic Banking Grows, so does the Need for Standards. Web.

Tahir, Sayyid. Current Issues in the Practice of Islamic Banking. Web.

The Islamic Banker. Islamic Banking and Economics. Web.

Appendix 1

Statement of financial position of Meezan Bank

Source: www.meezanbank.com

Appendix 2

Statement of financial position of Faysal Bank

Source: www.faysalbank.com