Literature review

Lu and Ramamurthy (2011) acknowledged that information technology was a great contributor to the organization’s agility. In other words, the greater a company invested in information technology, the more agile the company would be. The authors also pointed out that information is not always advantageous since sometimes it could be a hindrance or an impediment to a company’s agility. They proposed and theorized this greatly observed but fewer studies scenario and they looked at the specific factors that led to the likelihood for IT being an impediment or an enabler of agility in an organization.

The authors argued that a company required to develop superior firm-wide capabilities in information technology in order to succeed in the management of the information technology resources for it to realize its agility. The authors refined the conceptualization and measured the companies’ capabilities in information technology in different dimensions including the information technology infrastructure adopted, the companies’ spanning capabilities with reference to information technology and its proactive stance in accordance with information technology.

The authors then conducted a matched-pair field survey of information technology systems in one hundred and twenty-eight organizations to study empirically, the relationship between a company’s information technology capability and its agility. The results suggested that there was a positive relationship between agility and the organization’s IT capability.

In a separate study by McLaren, Head, Yuan, and Chan (2011), argued that for firms to successfully compete in a highly dynamic marketplace, companies had to adapt and align their information technology systems and strategies frequently. The authors of the paper were addressing some of the issues not previously addressed in the existing literature and this included the need for an approach that is finer-grained. This approach would be useful for the assessment of the specific areas of misfit between the organization’s information systems capabilities and its competitive strategies.

Tallon, Kraemer, and Gurbaxani (2000) were responding to some of the issues on the profitability of IT. The full impact of information technology has not been accounted for since some of the benefits may be intangible. Some firms have attempted to measure the profitability using economic analysis but this only gives estimates and cuts off a large portion of the benefits from IT.

This led the authors to adopt an inclusive approach in order to value IT. A comprehensive approach was also used. The authors, therefore, adopted a model that was used to determine the impact of information technology on the vital business ventures within the corporations. The payoffs from IT were measured in the form of the practices within the business and the corporate objectives.

The research survey was conducted on three hundred and four business executives from around the globe. The data was analyzed and the conclusions confirmed that the corporate goals of the companies determined the level of payoff from information technology. This meant that the more emphasis on goals are revolved around IT, the greater the payoff. The results also indicated that management practices determined the level of pay off derived from IT in the firm or business. Such practices as strategic alignment and investing in IT-led businesses to earn more.

In the recent past, a number of electronic market systems have come up and are being used in the corporate market. These systems were meant to make the firms improve the effectiveness of their transactions. Various industries have adopted the electronic market system successfully. However, in other areas, the system has not managed to work or has failed to extend to other industries as earlier expected due to its slow pace. This simply indicates barriers exist and this has hindered the success of this venture (Lee & Clark, 1996).

Lee and Clark (1996) were attempting to analyze the reasons for the failure of the electronic systems to be adopted successfully. The authors selected four such cases-two of which had successfully adopted the electronic market system and two of which did not. The economic benefits were analyzed to determine the success of integrating information technology into the market. This system was meant to increase efficiency and to reduce some of the costs that may be incurred during transactions.

The research question was to determine the barriers that hinder the full adoption of the electronic market system. This was done by assessing the resistance and the financial risks of adoption. The authors provided suggestions on the implementation of the electronic system in the market. This article was interesting since I could learn that the electronic market system may be used to reduce costs and to increase the efficiency in a company.

Hypotheses being tested

The research question for the study to be conducted would be to determine the effects of the level of Information Technology adoption on the performance levels in terms of payoffs. The different levels of adoption of information technology by the different companies would be assessed to determine if its effect on the payoff from IT is related to the level of adoption. There is one hypothesis for this research question and both the null and the alternative hypotheses are as follows:

H1: The level of adoption of Information Technology determines the performance levels in corporations in terms of payoffs.

H0: The level of adoption of Information Technology does not determine the performance levels in corporations in terms of payoffs.

How these hypotheses are related to previous research

This hypothesis is meant to assess whether the adoption of information technology or information systems into an organization would lead to an increase of payoffs that may be in terms of profitability or performance. Previous research indicates that there is an impact of information technology on the vital business ventures within the organizations.

Tallon, Kraemer, and Gurbaxani (2000) conducted a research survey on three hundred and four business executives from around the globe and analyzed the data. Their conclusions suggested that the corporate goals of the companies determined the level of payoff from information technology. This meant that the more emphasis on goals are revolved around IT, the greater the payoff. The results also indicated that management practices determined the level of pay off derived from IT in the firm or business. Such practices as strategic alignment and investing in IT-led businesses to earn more profit and advance in their businesses.

Moderating and mediating variables

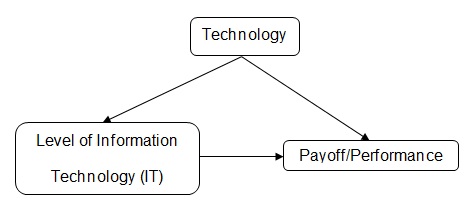

In the hypothesis chosen and from the hypotheses from the previous research, there is no use of the moderating variables. However, there is the use of a mediating (mediator) variable. The mediator variable explains the relationship that exists between two other variables. From the hypothesis in the current study, the mediator variable is technology. It can be concluded that the relationship between all of the variables in the researches done is a technology that is basically information technology.

In the current study, the fact that the level of adoption of IT determines the performance levels in corporations in terms of payoffs shows that there is an effect of technology in the performance of an organization. In the other literature that has been used, technology is the center point and forms the relationship between the dependent and independent variables. It is because of technology that the advancements in terms of profitability or performance are made possible. Companies that embrace technology have a high chance of being successful.

Conceptual framework

Operationalization of the variables

The hypothesis in this research would require the determination of the effects of the level of Information Technology adoption to the performance levels in terms of payoffs. In this hypothesis, the independent variable is the level of information technology adoption in different corporations. This variable is controlled or manipulated by the experimenter. The different levels of information technology adoptions will be assessed to determine its effects on the performance of the corporations in terms of the payoff from IT.

The dependent variable would then be the performance levels in the firms. This would be determined by looking at the payoffs received from Information Technology. This variable is observed or measured for variation and it is assumed that it is a result of the variation of the independent variable. The mediator variable is a technology and its effect would be assessed to determine its effect on the performance of the organizations in terms of payoff (performance).

References

Lee, H., & Clark, T. (1996). Impact of electronic marketplace on transaction cost and market structure. International Journal of Electronic Commerce, 1(1), 127-149.

Lu, Y., & Ramamurthy, k. (2011). Understanding the link between information technology capabilities and organizational agility: An empirical examination. Management Information Systems Quarterly, 36(4), 931-954.

McLaren, T., Head, M., Yuan, Y., & Chan, Y. (2011). A multilevel model for measuring fit between a firm’s competitive strategies and information systems capabilities. Management Information Systems Quarterly, 35(4), 909-929.

Tallon, P., Kraemer, K., & Gurbaxani, V. (2000). Executives’ perspective of the business value of information technology: A process-oriented approach. Journal of Management Information Systems, 16(4), 102-105.