Introduction

The aftermath of the 2011 Tohoku earthquake, which impacted the eastern half of Japan, resulted in $309B in property and business losses, with major companies such as Panasonic, Toyota, and Sony impacted due to various parts of their supply line (manufacturing and delivery facilities) been located within the Tohoku region (Chandler, 2012: 26).

Not only that, many local businesses and enterprises were of course adversely impacted as well creating a subsequent boom in short to mid term loan requests in order for such companies to avoid bankruptcy (Westervelt, 2011: 19). Based on this, the problems that need to be addressed as a result of this crisis are threefold: the first is the need to implement some form of reconstruction, the second is to address the issue of the sheer amount of business loan requests to local lenders and the last is the need to keep markets calm and not cause undue negative speculation which could result in unstable market conditions. All of these factors boils down to what the Japanese central bank could possibly do to handle this particular crisis and what would be the inevitable effects on the Japanese money market and foreign exchange market.

Possible Solution

One possible solution to this issue takes the form of the central bank emulating what it did immediately after the 1995 Kobe earthquake in which it created a 500 billion yen loan program which targeted various banks and lenders within the affected region of the disaster (Neely, 2011: 303).

Articles released a month after the earthquake disaster indicated that the central bank was planning a 2 trillion Yen (roughly $186 billion) infusion into the economy in order to both ease market concerns and address the issue of providing sufficient loans for businesses within the affected area of the disaster. The inherent problem with this strategy is that this will increase the value of the yen which would subsequently hurt exports within the country as well as cripple the recovery efforts that will need to be undertaken within Japan’s eastern region.

Analysis of Money Markets

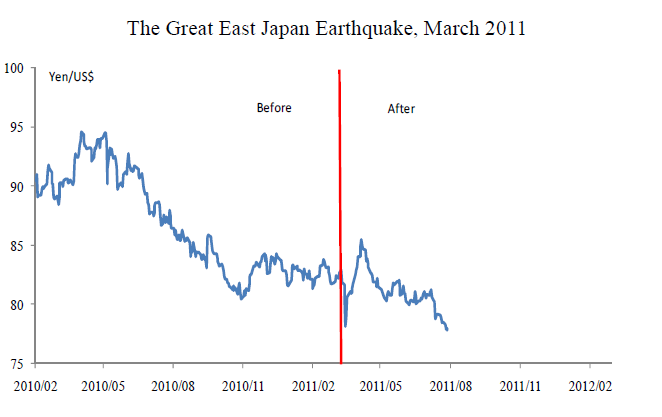

What you have to understand is that immediately after the 2011 Tohoku earthquake the Yen actually strengthened instead of weakened, as seen in the chart indicated above. The reason behind this can be connected to several reasons: the first being the fact that “historically” the Japanese Yen has been a currency with low interest rates, as such; investors have tended to use it as funding currency wherein they borrow Yen and subsequently invest it in other markets where the overall interest rates are better (Fisher, 2012: 76 – 78).

The end result of such actions was that when the disaster impacted Japan (resulting in a drop in currency values) various investors actually unwound their overseas investments and bought Yen as a method of covering their pending debt repayments to creditors.

When combined with the second reason behind the currency value increase, which was an infusion from the central bank of $186 billion, this would of course result in a higher currency value. Do note though that this is not the result the Bank of Japan is looking for since it is a potentially disastrous solution in the long term given the fact that the overall value of Japanese exports would increase.

Thus, it is likely that the central bank would engage in a Yen-selling maneuver that would subsequently shore up the Nikkei index while at the same time free up sufficient liquidity for the local industrial base affected by the disaster. Such a tactic may have already been implemented as seen in the case of the graph shown above wherein the value of the Japanese Yen nose dived almost immediately after its sudden rise which is indicative of a certain degree of intervention from the central bank of Japan.

How this Policy may affect the Australian Economy

Initially, there would be some adverse effects once the central bank of Japan infuses the economy with a loan package designed to assist the businesses affected by the earthquake. The price of imports from Japan would definitely increase, as such, companies within Australia that depend on certain technological products from Japan (i.e. motherboards, circuits, processors etc.) would undoubtedly be affected resulting in a price increase of certain tech based goods within the country.

Once the central bank implements its Yen-selling maneuver it is likely though that currency markets and exports would stabilize and return to normal as the value of the Yen decreases. Another factor that should be taken into consideration is how such a policy will affect Australian exports into Japan. An analysis of the Australian export market reveals that a large percentage of exports from Australia to Japan come in the form of coal, steel and other such products normally utilized in industrial processes.

When the 2011 earthquake hit there the demand for raw material exports suddenly plummeted as the businesses that normally ordered them were affected by the disaster. Through the implementation of the aforementioned policy indicated above, it is likely that exports of raw materials will increase which would result in subsequent gains for the Australian economy.

Reference List

Chandler, C 2012, ‘Japan one year later’, Time International (South Pacific Edition), 179, 10, p. 26, MasterFILE Premier, EBSCOhost, Web.

Fisher, D 2012, ‘Earthquake-proof profits’, Forbes, 189, 4, pp. 76-78, Business Source Premier, EBSCOhost, Web.

Neely, CJ 2011, ‘A Foreign Exchange Intervention in an Era of Restraint’, Review (00149187), 93, 5, p. 303, MasterFILE Premier, EBSCOhost, Web.

Westervelt, R 2011, ‘Industry Assesses Quake Impacts. (cover story)’, Chemical Week, 173, 13, p. 19, MasterFILE Premier, EBSCOhost, Web.