Introduction

Jones Blair is a private company that has specialized in making and advertising different architectural paint. The Company uses “Jones” for branding reasons. In addition to paint, the company deals with sundries such as rollers and brushes produced by other companies (Herman, 2003). Since 2004, the company has accrued a profit of 1.14 million dollars from its total sales of 12 million dollars. Over the last decade, the company’s growth in sales approximates at 4 percent yearly. Consequently, the authority has made key decisions for the company to introduce the latest commercial marketing efforts. This script thus provides a summary of the company’s strengths, weaknesses, threats, as well as opportunities (SWOT analysis).

Strengths

The company maintains its margins despite the increased expenses resulting from factors such as hiking costs of the research, as well as development. Secondly, they lead in offering reduced prices for the paint in their area of specialty (Herman, 2003). Significantly, the company has many outlets for its products. However, external premium retail purchasers only deal with the products of this company. The majority of its outlets with purchases exceeding over 50,000 US Dollars carry the John Blair line.

The company produces goods, as well as services of improved quality. The presence of proficient sales representatives that personally know the individual customers provide support for the company. (McCaffery, 2004). The company’s long-term market has matured to approximately two percent of its entire sales. Sources have designated that, the company produces distinctive lumberyards, as well as paint stores making it the most common patronized in the region. In addition, the company has markets in key businesses, as well as financial centers such as “Dallas Fort Worth” (DFW).

Weaknesses

The company faces many challenges in deploying commercial marketing efforts in the available markets for architectural paint coatings. This implies that the corporate marketing efforts would explore new markets for the company’s products. As a result, the company’s sales would increase and would result in its growth (McCaffery, 2004). In addition, their sales representatives have been participating in coordinating cooperative advertising programs with the company’s competitors. As a result, the majority of their competitors accrue more sales over them. In addition, the requirement that forces them to trim down the release of volatile compounds poses a challenge to the company.

The requirements that it should comply with W/EAP have resulted in squat profit margins. This compliance means that the company would incur extra costs inform of the acquisition of an additional workforce. Consequently, the company’s expenses would hike, therefore, the squat profit margins. Consequently, the company would serve a small proportion of clients thus the minimized sales volume. Additionally, the company’s high charges for their products decrease in DFW sales, and the lack of the company’s awareness is a threat to its revenues. The company should amplify its output and simultaneously sell its products at fair prices. This would create favorable competition with their competitors. In addition, the creation of new accounts does not bring a significant change. The company has failed to bring changes in the paint gallonage. Concisely, there is a lack of awareness of the company’s opportunities among the potential citizens, as well as hiking prices in the paint service area, especially at DFW.

The company experiences external threats from its myriad competitors. These competitors offer low prices compared to the company of interest. Consequently, the company spends enormously on advertisements in counter-attacking these competitors. The majority of the retailers are devoid of sufficient knowledge for the products of Jones Blair Company. However, the substitutes that guarantee a long life span influence the demands of the company’s products. Concisely, the regulations of the “Volatile Organic Compounds” (VOC) contribute significantly to the company’s sales volume (Mor Barak, 2010).

Opportunities

The available opportunities for this company constitute approximately 300 outlets. These retailers mainly dominate the rural areas. For instance, there are the DIY painters who firstly choose a retail outlet then later a brand of the paint. In addition, there are pro-painters who frequently buy and look for quality, durable, as well as easily cleanable paints. Concisely, these retailers provide an available market. As a result, venturing in these opportunities translates to substantial sundry growth thus the sales volume increase (Mor Barak, 2010).

The financial analysis

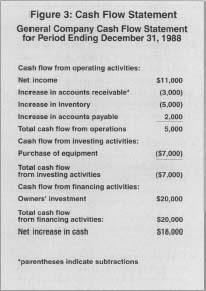

Currently, Jones Blair Company faces inimitable financial challenges, which need solutions for purposes of enhancing its profitability. The company’s market position has become low because of the immense merchandising efforts of companies such as Kmart, and Sears. This implies that the company’s net return has eventually decreased. The current approximated sales for this company consist of 15% of the entire $80 million net value of the market. Significantly, the company’s net revenue is at equilibrium with the company’s expenditure thus the break-even in its operations. Consequently, the company’s goal of realizing supernormal profits is hard to achieve. This circumstance translates to the company’s slow rate in its profit growth. Below is a cash inflow statement as of December 1998.

Conclusion

In conclusion, this document has highlighted several opportunities that the Jones. Blair Company should exploit in an effort to enhance its growth. For instance, there are many potential customers in rural areas. It has been described that the company is deficient potential customers. However, it has credited the company for its success, for instance, the company’s survival under both the myriad external and internal constraints. Moreover, it has emphasized the increment of the company’s popularity in increasing the sales volume, as well as its substantial growth.

References

Herman, E. (2003).The Dallas-fort worth Jobbank.Jamak.Dallas, CN: fabrication, INC. Publishers.

McCaffery, P. (2004).The higher education manager’s handbook: effective leadership and management. Alberta, CN: Routledge publishers.

Mor Barak, M. (2010). Managing diversity: towards a globally inclusive workplace. Thousand Oaks, CN: Sage publishers.