Introduction

Financial statements are key instruments for the right decision-making of businesses. They aid in the computation of key ratios that help in critically analyzing and forecasting a business’ future (Allee & Yohn 2009). Financial management ability is a key component for the success of every venture and is based on the ability to prepare and use the information contained in the financial statements (Ormiston & Fraser 2013). JWS, a supplies retail firm dealing with equipment and supplies in the construction industry has financial management shortcomings. This report analyzes the financial statement of JWS to address key shortcomings and provide a financial-based approach to the shortcomings through a review of the literature. The report uses trend analysis to analyze the company’s performance between 2013 and 2015.

Debt Reduction Plan

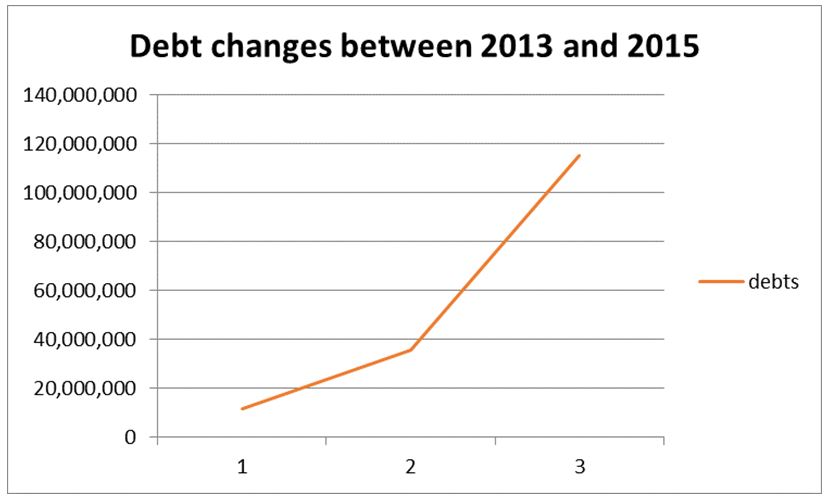

A business that deals with numerous clients hardly operates without debts. It is paramount for the management to manage the extent of debts to avoid jeopardizing the business’ cash flow. Two main approaches can be used to ensure that debts do go overboard, which are reducing expenses or increasing the income to meet the increasing expenses (Weygandt, Kieso, & Kimmel 2005). Asset sales can be used to settle overdue debts. The figure below shows the trend of debts between the 2013 and 2015 financial years.

Sale of Fixed Assets

Fixed assets help in running the business though some may be obsolete. The redundant assets of no economic value are better disposed of. Selling such assets is important in helping a firm to settle its debts. The company’s debts increased from £11,868,000 in 2013 to £115,207,000 in 2015 which was a 9.71% increase. A large proportion of this debt is a bank overdraft that ought to have been paid within a short time. Selling part of the store (20%) can be used to generate money to finance the company’s operations to avoid further borrowing. The £7,994,000 raised from the sale of fixed assets should be used to pay debts. The payment of creditors and loans will reduce the interest payable.

Reduction in Stock and Improving Stock

A company’s stock ties to its operating capital. However, the degree of tying depends on the rate of stock turnover. Slow-moving stock is disadvantageous to firms with less capital (McLaney & Atrill 2005) as it challenges the maintenance of adequate stock and working capital. Improving stock allows a company to trade with fast-moving stock by having a stock control system (Maynard 2013). Stock control systems enable firms to know the products to stock most and when to stock them. The company has had its stock increase from 2013 through to 2015. Therefore, the amount of cash held in the form of stock is high. To decrease the amount of stock held to raise cash, the company ought to improve its stock turnover by selling more stock through a reduction of the days that surplus stock is sold (from 157 to 80 days). This move will raise approximately £19,778,000 to be used in increasing operating capital because some of it will be used for the repayment of creditors.

Collect from Overdue Debtors and Improve Credit Control

Business operations are unpredictable at times and where cash deficits arise credit becomes unavoidable. According to Lantto and Sahlström (2009), credit cash can be used where the operating capital has fallen below the minimum such that a business may lose profits due to a lack of stock. The amount owed rose from £10,596,000 to £51,240,000 from 2013 through 2015. In 2015, the stock days, debtors’ days, and creditors’ days were 157, 156, and 134, respectively. It took the company 157 days to sell a stock, 156 days to receive cash from debtors, and 134 days to pay its creditors. The company should reduce the days that its debtors take to settle their dues from 156 to 80 days to be able to pay its creditors. This move reduces the receivables from £51,240,000 to £23,605,000 between 2015/16, which will also help the company to avoid bank overdrafts. Overdue debtors cause a company to seek alternative sources of finances at a cost that is avoidable by managing the stock levels and debt repayment period. Fewer stock days result in lower costs in terms of storage and handling expenses.

Repayment of Overdue Creditors

Suppliers play an important role in making a business successful. Suppliers’ reliability depends on their relationships with businesses, which are founded on the ability of businesses to pay them on the agreed dates without failure. Overdue credit supplies may attract interest. The company’s precarious financial position forces it to sell part of its assets or borrow to pay the suppliers. The proceeds from the sale can settle the debts thus avoiding interest on loans. The reduction of creditors’ days from 156 to 80 (from £31,387,000 to £16,822,000) between 2015/16 will enable the company to pay its creditors promptly thus avoiding the costs of overdue creditors. Interest tax expenses will reduce thereby increasing the cash at hand.

Profit Improvement Plan

The profitability of a trading firm relies on the efficient management of supplies and sales by minimizing the costs of handling them (Fridson & Alvarez 2011). To improve profits margins, the administrative expenses have to be reduced. These expenses have been on the rise, which has continuously reduced the reported profits. Profits were reduced in the first year because of inflation and an increase in the cost of supplies. Expenses should be reduced by maintaining a constant wage rate and avoiding any salary increments. The distribution expenses should be reduced by 20% to increase the profits realized from sales.

Effect of Store Disposal on Sales Revenue and Cost

Store disposal can in the short-term lead to a decrease in sales. However, alternative ways of selling to the target customers are viable, for example creating an online store (using the latest online retailing technology) where customers can preview the supplies they want and make orders. Consequently, the floor space occupied will reduce and lower the floor area rent. The strategic location of stores close to clients who order particular commodities and disposal of stores that report low sales are other viable options. Customers can also be served by centralised stores, which will maintain the firm’s distribution costs and eliminate paying rent on unproductive stores. The sale of stores, however, has reduced the sales by a great margin. The sale of some stores led to a decrease in sales from £119,666,000 to £107,699,000 between 2015 and 2016.

Sales Growth/Price Increase

The profit and loss accounts of JWS Building Supplies Ltd show that the company was a profitable enterprise as it recorded positive operating and net profits. However, the payment of dividends resulted in negative retained earnings for the company. The sales revenue decreased by 10% from 2015 to 2016 due to the closure of some stores. The contributory factor was the company’s expansion that occurred after Andrew Sandwell took over as the managing director. The sales increase was coupled with a more than proportionate increase in operating expenses, which might have resulted from the large geographical dispersion of the business units as well as the lack of experience of the operations director. As a result, the profit before tax declined from £949,000 to £4842,000 from 2015 to 2016. The tax remains constant, and the revenue increase is small.

Renegotiation of Purchase Price with Suppliers

Supply is an important factor in cost determination and price setting. The ability of a firm to negotiate for better terms of sales with its supplier is vital in determining the profitability of any venture (Dyson 2007). JWS can renegotiate the terms of purchases from its suppliers and look for better terms that will increase its credit days’ limits beyond the customers’ repayment period. This kind of arrangement helps the company avoid the cost of short-term borrowing to repay its suppliers. Negotiating for lower prices for supplies also leads to more profits.

Further Operating Cost Reduction

Operating costs are major causes of success or failure in firms (McLaney & Atrill 2008). The ability to contain and minimize these costs is a major catapult to business success. The costs regularly incurred such as deliveries, salaries, electricity and customer support can be minimised by being innovative and adopting the right technology. To reduce handling costs, the company can operate an online store where bulky products are ordered and shipped to the customers’ premises directly from the supplier. Stores with a limited number of customers can be closed down to avoid the cost of operating the shops. The salaries paid to the workers can be computed based on sales to ensure that the company does not incur losses on paying huge salaries even when it is making losses. The distribution and administrative costs are reduced by 20% in 2015/16, which is positive due to the low cost of operations.

Interest Cost Savings

The expense due to interest rose from 56% to 78% between 2013 and 2015. The increase resulted from the bank loan taken for business expansion. The overall effect of the increase in interest expense was to decrease the net profit of the company. Future expansion using loan financing implies that the company may not generate sufficient returns to cover its increasing interest expenses. The interest coverage ratio decreased from 76.1 times in 2013 to 1.1 times in 2015. The decrease was attributed to the decrease in operating profits and the increase in interest expenses. A decline in the interest coverage ratio may cause a company not to meet its interest expenses from operating profits in the future, hence reporting operating losses. By avoiding borrowing, the company can avoid the cost of borrowed money translating to an income. The total interest payable in 2015 is £6,240,000, which is sufficient to cater for dividends and tax.

Reorganization Cost

The reorganization of the company will be costly because some employees will be allocated duties according to their qualifications and competencies. The closure of stores with low sales will lead to the loss of jobs. Redundant assets need to be disposed of at low prices, which will cause losses to the company. Written off bad debts amount to £3million, the stock sold below the original cost amount to £1million, redundancy costs are equal to £3 million. These costs are absorbed by the company, which causes a major financial problem as indicated on the balance sheet.

Dividend Policy

The company pays dividends even when it incurs losses. Dividends should be paid only when profits are realized after all deductions have been made including the settlement of a large proportion of current liabilities. The company needs to stop paying dividends while undergoing financial difficulties and resume the payment of dividends once the company has finished settling its short-term and medium-term debts.

Capital Structure

The company’s capital structure is highly affected by liabilities as the total liabilities are £119,107,000 while the total assets are £127,808,000 for the year 2015, which shows that a larger part of the company is financed by borrowed money. The current assets are less than the current liabilities in the same year indicating that unless the company sells assets or borrows, it cannot meet its obligations of settling its debts. Firms should have more current assets than liabilities to be able to meet cash demands without resorting to borrowing or selling current assets (Albrecht et al. 2011).

Summary of Financial Results

The company reported £349,000, £3,389,000 and £3,361,000 profit after tax in the years 2015, 2016 and 2017 respectively (see Appendix). In 2016, there was a great decline in the profit, which can be attributed to the increase in the administrative expenses and distribution costs. To reverse the trend, the two costs should be reduced greatly by employing the latest technology in administration and the most efficient distribution methods.

Management Structure

The appointment of the operations director based on friendship with the managing director and the appointment of a marketing director who is not conversant with the operations of a construction company could be the main reasons for the working capital management inefficiencies. The implication of deteriorating working capital ratios is that the company will fall into cash flow problems in the future. The company should employ an operations director with vast financial management expertise to help the company to make the right decisions on matters regarding finance acquisition, utilization and repayment. The board ought to take into consideration the expertise of those appointed to head various departments and their remuneration to avoid incurring costs with minimal gains.

Sensitivity Analysis

The liquidity position of enterprises is best explained by the current and quick ratio. The current ratio of JWS Building Supplies Ltd was 0.75 in 2013 but reduced to 0.7 in 2015 indicating a decline in liquidity. Similarly, the quick ratio decreased from 0.75 in 2015 to 0.67 in 2016. The low liquidity ratios show that the company has a cash flow deficiency. The weak cash flow situation deteriorated further in 2015, which was probably due to the employment of a finance director with no formal training in accounts. The current liabilities of the company decreased from £117,907,000 in 2015 to £60,151,000 in 2016. The gearing ratio decreased significantly from 963% in 2015 to 172% in 2018. The decreased gearing resulted from the decrease in bank loans and bank overdrafts. The increase in the company’s debt is a major threat to the suppliers and lenders as the company can be liquidated.

Executive Summary

Every firm should have a sound financial management system. JWS projections assume that the growth of the company will be exponential. The statements below indicate how key items change concerning changes in certain components. By the year 2018, the company will be making substantial profits and have improved liquidity.

Profit and Loss Accounts Projection

The assumptions made are that revenue will decrease between 2015/16 by 10% then increase cumulatively by 3%. The cost of sales will decrease by 10% then increase by 2% in 2017 and 2018. Administration costs will decrease by 20% because workers’ salaries are constant and some employees will be dismissed with the sale of some stores. The expenses are expected to increase in 2018 because of distribution costs from high sales. The company will stop paying dividends for the next three years until it repays all its debts. Interest payable and receivable will be assumed to be equal to those of the previous years (2013 and 2014 respectively).

Balance Sheet Projections

The sale of assets due to reorganization reduces the value of assets from 8,701,000 in 2015 to 5,312,000 in 2016. The assets are expected to increase during reorganization because new assets will be acquired. As revenue becomes positive, the profit will increase thereby raising the retained earnings. If reinvested, the profit will increase the balances.

Cash Flow Summary

The cash flow closing balance is negative because there was borrowing instead of cash deposits. The cash flow was 82,620,000 in 2015 but is expected to decline to 22,551,000 in 2018 due to the assumption that revenues will increase year after year (See Appendix for detailed information).

References

Albrecht, W., Stice, J., Stice, E. & Swain, M 2010, Accounting: principles and applications, 11th edn, South-Western, Thomson, Cengage Learning.

Allee, K. D. & Yohn. T. L 2009, “The demand for financial statements in an unregulated environment: an examination of the production and use of financial statements by privately held small businesses,” The Accounting Review vol.84 no.1, pp. 1-25.

Dyson, J 2007, Accounting for non-accounting students, 7th edn, New York, Prentice Hall.

Fridson, M. S. & Alvarez, F 2011, Financial statement analysis: a practitioner’s guide, Wiley, Hoboken.

Lantto, A‐M. & Sahlström, P 2009, “Impact of international financial reporting standard adoption on key financial ratios,” Accounting & Finance vol. 49 no.2, pp. 341-361.

Maynard, J 2013, Financial accounting, reporting, and analysis Oxford University Press, Oxford.

McLaney, E. & Atrill, P 2005, Accounting: an Introduction, 3rd edn, Prentice Hall, Harlow.

McLaney, E. & Atrill, P 2008, Accounting: an Introduction, 4th edn, Prentice Hall, Harlow.

Ormiston, A. & Fraser, L. M 2013, Understanding financial statements, Pearson Education, New York.

Weygandt, J., Kieso, D. & Kimmel, P 2005, Accounting principles, 7th edn, John Wiley & Sons, New Jersey.